Claude Monet O Rio (The River) 1881

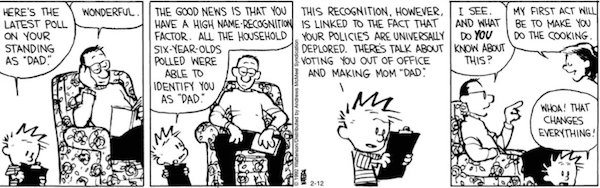

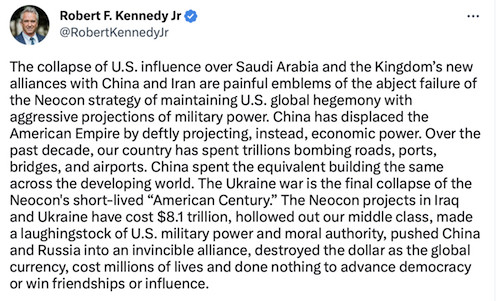

RFK

The Democratic National Committee is rigging the primary. Here's how. pic.twitter.com/2t0fk4L7w8

— Robert F. Kennedy Jr (@RobertKennedyJr) September 11, 2023

Trump 9/11

https://twitter.com/i/status/1701280839533838398

https://twitter.com/i/status/1701253565702938885

Isaacson

Here's my conversation with @WalterIsaacson, author of the new biography on @elonmusk and one of the greatest biographers ever, having written incredible books on Einstein, Steve Jobs, Leonardo da Vinci, Jennifer Doudna, Benjamin Franklin, and many others. Outline of our… pic.twitter.com/k0YJ0RooQi

— Lex Fridman (@lexfridman) September 10, 2023

“A judge in Pennsylvania has ruled that former President Trump has ‘presidential immunity’ and cannot be sued over statements he made about 2020 election fraud.”

He’s directly threatening Europe now:

“..the millions of Ukrainian refugees now residing in foreign nations. They have generally “behaved well,” but if the hosts “drive these people into a corner,” the end result will not be “a good story” for Europe..”

• Zelensky ‘Senses’ Weakening Western Support (RT)

If Western nations do not maintain their assistance to Kiev, they could face defeats at the ballot box and trouble from the millions of Ukrainian refugees they host, President Vladimir Zelensky has warned. In an interview with The Economist, Zelensky complained about weakening support from senior Western officials, which he claimed to have seen in their eyes during meetings. “I see that he or she is not here, not with us” contrary to spoken assurances, he said, according to the interview published on Sunday. According to Zelensky, failure to support Ukraine amounts to siding with Russia in the conflict, which escalated into open hostilities in February 2022. “If partners do not help us, it means they will help Russia to win,” he stated.

Zelensky believes that Western voters will not forgive their leaders if they “lose Ukraine.” Further trouble may also come from the millions of Ukrainian refugees now residing in foreign nations. They have generally “behaved well,” but if the hosts “drive these people into a corner,” the end result will not be “a good story” for Europe, the president added. The Ukrainian leader said he is “morally” ready for a long war with Russia, but this will require the country to switch to a “totally militarized economy.” He added that now is “a bad moment” for peace talks with Russia, due to the lackluster battlefield progress over the three months of Kiev’s summer ‘counteroffensive’. Moscow has estimated Ukrainian losses during the push at over 66,000 troops and 7,600 heavy weapons.

The Economist noted that the Zelensky government had built up expectations for the offensive, but now he is “carefully adjusting his message to reality.” The Ukrainian president also appeared to take credit for the drone attacks deep inside Russian territory, which Kiev formally refuses to claim as its own. Explaining his strategy, he said public support for the Russian government will fall “because our drones will land.”In a “long war,” Moscow will lose regardless of how the Russians feel because the Russian economy will fail, he added. The Russian government expects the economy to grow by 2.5% or more in 2023. Recent forecasts by the World Bank and the IMF have upgraded their predictions for Russia due to strong industrial production and higher-than-expected energy revenues.

Moon of Alabama noticed it too.

“I have seen such threats from low ranking individuals of the fascist Bandera fringe. They spoke of terrorism they would unleash in the West should it end its support for Ukraine. That the Ukrainian president now reinforces such threats shows how deeply he immersed himself in that mindset..”

• Zelensky Threatens To Terrorize Europe (MoA)

The Economist published another interview with the Ukrainian President Vladimir Zelenski. It includes his usual unrealistic platitudes about not ending the war until Russia has completely pulled back. Speaking with an English language media he didn’t miss to mention the ever misunderstood story about Chamberlain’s move in Munich: “Tapping loudly on the table, Mr Zelensky rejects outright the idea of compromise with Vladimir Putin. War will continue for “as long as Russia remains on Ukrainian territory”, he says. A negotiated deal would not be permanent. The Russian president has a habit of creating “frozen conflicts” on Russia’s borders (in Georgia, for example), not as ends in themselves but because his goal is to “restore the Soviet Union”. Those who choose to talk to the man in the Kremlin are “tricking themselves”, much like the Western leaders who signed an agreement with Adolf Hitler at Munich in 1938 only to watch him invade Czechoslovakia. “The mistake is not diplomacy. The mistake is diplomacy with Putin. He negotiates only with himself.”

In 1938 Chamberlain had no other choice but to give in on Czechoslovakia. Britain was not ready for war and the parts Hitler wanted to annex from Czechoslovakia had undeniably a largely German population: “He contended that Sudeten German grievances were justified and believed that Hitler’s intentions were limited”. Zelenski goes on to threaten, in rather unthankful fashion, those countries which have delivered aid to Ukraine but may want to cut their losses: “Curtailing aid to Ukraine will only prolong the war, Mr Zelensky argues. And it would create risks for the West in its own backyard. There is no way of predicting how the millions of Ukrainian refugees in European countries would react to their country being abandoned. Ukrainians have generally “behaved well” and are “very grateful” to those who sheltered them. They will not forget that generosity. But it would not be a “good story” for Europe if it were to “drive these people into a corner”.

I have seen such threats from low ranking individuals of the fascist Bandera fringe. They spoke of terrorism they would unleash in the West should it end its support for Ukraine. That the Ukrainian president now reinforces such threats shows how deeply he immersed himself in that mindset. A previous Economist story shows that Ukraine has already set up the necessary infrastructure to wage a terrorist campaign: “In modern Ukraine, assassinations date back to at least 2015, when its domestic security service (SBU) created a new body after Russia had seized Crimea and the eastern Donbas region. The elite fifth counter-intelligence directorate started life as a saboteur force in response to the invasion. It later came to focus on what is euphemistically called “wet work”.

“Valentin Nalivaychenko, who headed the SBU at the time, says the switch came about when Ukraine’s then leaders decided that a policy of imprisoning collaborators was not enough. Prisons were overflowing, but few were deterred. “We reluctantly came to the conclusion that we needed to eliminate terrorists,” he says. A former officer of the directorate describes it in similar terms. “We needed to bring war to them.” In 2015 and 2016 the directorate was linked to the assassinations of key Russian-backed commanders in the Donbas; Mikhail Tolstykh, aka “Givi”, killed in a rocket attack; Arsen Pavlov, aka “Motorola”, blown up in a lift; Alexander Zakharchenko, blown up in a restaurant.

Intelligence insiders say the SBU’s fifth directorate is playing a central role in counter-Russia operations. From there it is just a short step towards total war: “Meanwhile, a long war of attrition would mean a fork in the road for Ukraine. The country would lose even more people, both on the front lines and to emigration. It would require a “totally militarised economy”. The government would have to put that prospect to its citizens, Mr Zelensky says, without specifying how; a new social contract could not be the decision of one person. Almost 19 months into the war, the president says he is “morally” ready for the switch. But he will only broach the idea with his people if the weakness in the eyes of his Western backers becomes a “trend”. Has that moment come? No, not yet, he says. “Thank God.” Does Zelenski know of any country with a totally militarized economy that survived? I have yet to hear of one.

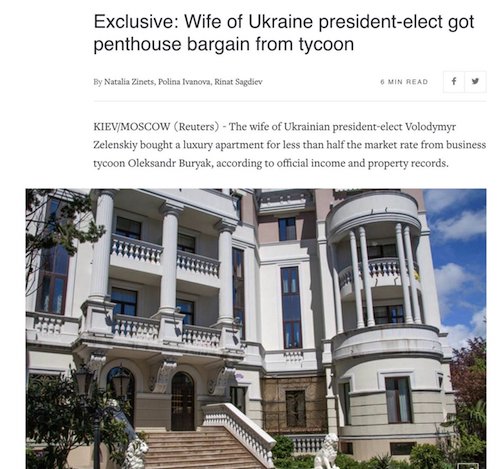

“..78% of Ukrainian adults see Zelensky as “directly responsible” for Kiev’s corruption problem..”

“..only 18% of Ukrainian adults disagreed with the statement that Zelensky bears responsibility…”

And we hand him tens of billions.

• Ukrainians Blame Zelensky For Corruption – Poll (RT)

The vast majority of Ukrainians believe that President Vladimir Zelensky is at fault for widespread corruption in the country’s government and military, a new study has revealed. The poll, released on Monday, found that 78% of Ukrainian adults see Zelensky as “directly responsible” for Kiev’s corruption problem. It was conducted by the Ilko Kucheriv Democratic Initiatives Charitable Foundation and the Kiev International Institute of Sociology. Prior to the launch of Russia’s military offensive in February 2022, Ukraine consistently ranked among the world’s most corrupt nations, but it was touted as a bastion of freedom and democracy as the US and its NATO allies rallied public support for massive aid to Kiev. However, Ukrainian corruption remains a concern and could hinder the country’s bid to join the European Union, an unidentified Western diplomat told Politico on Monday.

Ukraine is a “very corrupt country,” the diplomat said, adding that Zelensky’s plan to use the Security Service of Ukraine (SBU) to prosecute graft cases could “send the wrong message.” Upon landing in Kiev for a surprise visit on Monday, German Foreign Minister Annalena Baerbock reportedly said Ukraine needed to step up its efforts to fight corruption. The Ukrainian poll was conducted from July 3 to July 17 in face-to-face interviews with thousands of citizens across the country. There were no major differences in findings based on region or socioeconomic factors. Respondents aged 60 and older took a harsher view, with 81% saying Zelensky was responsible for government corruption. The rate was 70% in the youngest segment, ages 17 to 29. Overall, only 18% of Ukrainian adults disagreed with the statement that Zelensky bears responsibility.

Documents obtained by the International Association of Investigative Journalists in 2021 showed that Zelensky and his business partners set up offshore companies to purchase lavish properties in central London. Zelensky transferred his stake in one of the companies to an aide just before he was elected president in 2019. Supporters of former Ukrainian president Petro Poroshenko accused Zelensky and his associates of using their offshore accounts to evade taxes. Zelensky has purged officials in his government for alleged corruption, including an embezzlement scheme involving humanitarian aid. Just this month, he sacked Defense Minister Aleksey Reznikov, who came under fire earlier this year over purchases of military rations at inflated prices. However, the new defense chief, Rustem Umerov, is reportedly under investigation for alleged crimes in his previous job.

If everyone’s corrupt, who investigates?

• EU Believes Ukraine Is ‘A Very Corrupt Country’ – Politico (RT)

Widespread corruption in Ukraine could hamper Kiev’s bid for EU membership, a western European diplomat told Politico on Monday. He said Ukrainian President Vladimir Zelensky’s efforts to tackle the problem have also alarmed Brussels. Ukraine applied for membership in the European Union last February, and was formally granted candidate status four months later. Although European Commission President Ursula von der Leyen is expected to address the issue of enlargement during her state of the union speech on Wednesday, and EU Council President Charles Michel has vowed to admit all candidate nations by 2030, Ukraine’s bid could be hamstrung by rampant corruption. Ukraine is a “very corrupt country,”an anonymous western European diplomat told Politico.

“We want to give a positive signal to Ukraine but things such as this proposal to give more power to [Ukraine’s] intelligence [services] over corruption can send the wrong message.” The proposal in question was raised by Zelensky last month. Following a purge of allegedly corrupt officials at the Ukrainian Ministry of Defense, Zelensky announced that he would task the Security Service of Ukraine (SBU) with probing and prosecuting corruption cases, taking investigative power away from the country’s multiple anti-graft agencies. The SBU reports solely to Zelensky. Representatives of Ukraine’s existing anti-corruption agencies told Politico last month that by making the SBU the only body allowed to investigate these cases, Zelensky is essentially giving himself the power to decide which corrupt officials to prosecute and which ones to shield.

There is precedent for these fears, the head of the Anti-Corruption Action Center (ACAC), Vitaly Shabunin, said. Oleg Tatarov, the deputy head of Zelensky’s office, was under investigation by the National Anti-Corruption Bureau of Ukraine (NABU) last year, when the case was unexpectedly transferred to the SBU. “It was buried there,”Shabunin said. “Now [Zelensky’s] office wants to make that into practice.” Ukraine has for years been ranked as one of the most corrupt countries in the world. According to Transparency International’s Corruption Perception Index, as of 2022, the country ranked 116th out of 180. Aside from corruption concerns, disputes between Ukraine and European nations over agriculture could also hold up Kiev’s membership bid. Ukrainian farmers could undercut their European counterparts with cheap grain exports, meaning that the EU will likely have to reform its Common Agricultural Policy if Ukraine is to be admitted, Politico noted.

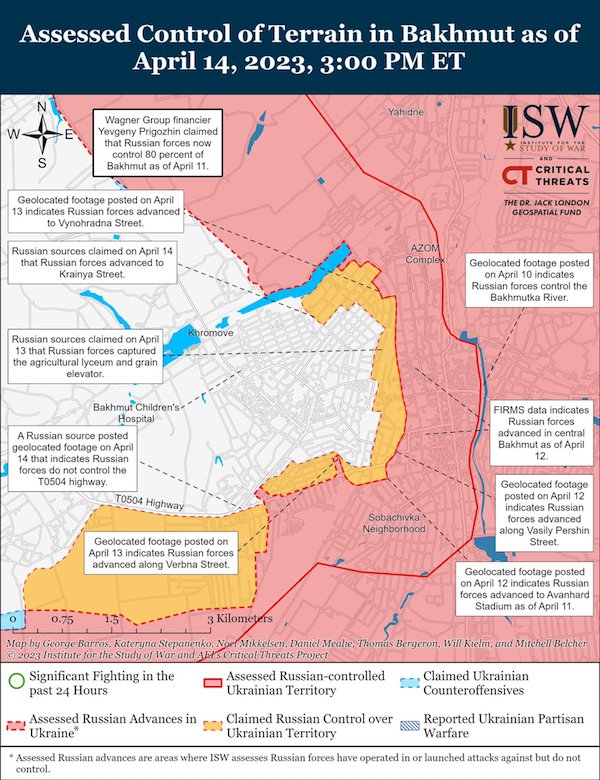

“..Russia controlled more land last month than it did at the beginning of the counteroffensive..” But Blinken said Ukraine reclaimed 50%.

• Blinken Contradicts Ukraine On Peace Negotiations (RT)

US Secretary of State Antony Blinken has claimed that the Ukrainian government will agree to peace talks with Russia if Moscow offers to negotiate first. Ukrainian leaders have argued otherwise, however, and insist that peace “needs to be won on the battlefield.” “Thus far, we see no indication that [Russian President] Vladimir Putin has any interest in meaningful diplomacy,” Blinken told ABC News on Sunday. “If he does, I think the Ukrainians will be the first to engage, and we’ll be right behind them,” he added. Blinken and other top American officials have long insisted that the Ukrainian government will decide when to seek peace with Russia, and that the US will continue to supply Kiev with weapons until that time comes.

Ukraine agreed in principle to a Turkish-mediated peace deal in April 2022, but walked away from the agreement after a visit to Kiev by then-British prime minister Boris Johnson. Ukrainian President Vladimir Zelensky has since issued a decree forbidding any negotiations with Putin’s government, as well as repeatedly vowing to take back the territories of Donetsk, Lugansk, Kherson, Zaporozhye, and Crimea – the latter of which voted to join Russia in 2014 – by force. Retaking this land, however, has proven costly for Kiev. More than three months into its long-awaited summer counteroffensive, the Ukrainian military has lost more than 66,000 troops and 7,600 pieces of heavy weaponry, according to the latest figures from the Russian Defense Ministry.

In exchange, Kiev’s forces have only managed to reclaim a handful of villages near Zaporozhye, while Russia controlled more land last month than it did at the beginning of the counteroffensive, according to the Washington Post. Nevertheless, Ukrainian Foreign Minister Dmitry Kuleba declared last week that the conflict “cannot be ended by simply bringing belligerent parties to the table for negotiations.” “It needs to be won on the battlefield for Russia to become serious about negotiating peace,”Kuleba added. Russia maintains that it is open to a diplomatic solution to the conflict, but that any peace deal would have to take into account the “new territorial reality” – that Donetsk, Lugansk, Kherson, Zaporozhye, and Crimea will never be ceded back to Ukraine. Furthermore, Russian Foreign Minister Sergey Lavrov has said negotiations would be held “not with Zelensky, who is a puppet in the hands of the West, but directly with his masters.”

“..if anyone is treasonous, it is those who call me such. Please tell them that very clearly.”

• Elon Musk Responds To Ukraine ‘Treason’ Claims (RT)

American tech billionaire Elon Musk has responded to criticism over his refusal to help enable a Ukrainian drone attack on Russian naval forces in Crimea by pointing out that he’s a citizen of only the US and isn’t obliged to fight for Kiev. “I am a citizen of the United States and have only that passport,” Musk said on Monday in a post on his X (formerly Twitter) social media platform. “No matter what happens, I will fight for and die in America.” He added that in light of the fact that the US Congress hasn’t declared war on Russia, “if anyone is treasonous, it is those who call me such. Please tell them that very clearly.”

At issue is Musk’s decision last year to prevent his Starlink satellite network from being used to guide Ukrainian naval drones for an attack against the Russian Black Sea Fleet on the Crimean coast. When news of Musk’s refusal came to light last week, US media outlets suggested that he had been traitorous, and Ukrainian presidential aide Mikhail Podoliak accused him of “committing evil and encouraging evil.” The Tesla CEO and SpaceX founder gave Ukraine free use of more than 20,000 Starlink terminals after Russia launched its military offensive against Kiev in February 2022. His aim was to keep Ukrainians from losing internet access and communications capabilities amid the conflict.

However, Musk expressed concern about his network being used for offensive purposes and potentially playing part in triggering a wider conflict. He therefore refused Kiev’s pleas to extend the country’s Starlink coverage all the way to Sevastopol. “If I had agreed to their request, then SpaceX would be explicitly complicit in a major act of war and conflict escalation.” CNN host Jake Tapper argued on Sunday that Musk had “effectively sabotaged” an American ally, and he asked US Secretary of State Antony Blinken whether the “capricious billionaire” should therefore face “repercussions.” Blinken declined to condemn Musk and pointed out that Starlink had been a vital tool for Ukraine’s defense.

..”straightforward and honest Brussels bosses” who “told all Russians directly and without beating around the bush: you are second-class people for us.”

• Medvedev Advocates Suspending Diplomatic Relations With EU (TASS)

Russian Security Council Deputy Chairman Dmitry Medvedev has called for suspending diplomatic relations with the EU in response to the EU decision to bar Russian citizens from entering the EU with everyday personal items, calling it a spit in the face of every Russian. “What should we do about it? Certainly not impose tit-for-tat retaliatory restrictions on EU citizens. We are not racists, in contrast to many leaders of those countries whose relatives served in the SS (Schutzstaffel, the notorious paramilitary organization under Germany’s Nazi regime – TASS). Moreover, those [Europeans] who travel here usually have a love and appreciation for Russia. It would be better just to suspend diplomatic relations with the EU for a while.

And to call our diplomatic personnel home,” Medvedev suggested, commenting on the European Commission’s clarification on the EU’s ban on importing automobiles, smartphones, suitcases and shampoo, among an entire range of items, into the EU from Russia, even for strictly personal use. Medvedev mockingly “praised” the EU leaders, calling them “straightforward and honest Brussels bosses” who “told all Russians directly and without beating around the bush: you are second-class people for us.” And the EU’s decision is clearly not meant as just punishment for what Brussels sees as the “criminal and aggressive regime in the Kremlin.” Rather, “this is a spit in the face of every citizen of Russia,” Medvedev emphasized. In suggesting measures to suspend Moscow’s diplomatic relations with the EU, Medvedev noted that only such a move could make Brussels officials truly afraid, “because embassies are [traditionally] evacuated before certain very specific events.”

“Who knows what else these ‘orcs’ from that immense ‘Mordor’ are capable of?” Medvedev asked sarcastically, using a common derogatory slur used in the West to refer to Russia and Russians, equating them to the goblin-like humanoid creatures in J.R.R. Tolkien’s fantasy novel “The Lord of the Rings.” The European Commission’s clarification dated September 8 bans the import from Russia to the EU of goods listed in Annex 21 to EU Regulation No. 833/2014, regardless of the purpose of their use and the duration of stay in the EU, including cars with less than 10 seats. The EC emphasized that it does not matter whether the vehicles are being used for private or commercial purposes. The list contains a wide range of all sorts of items from cellular telephones and audio and video recording devices, to suitcases, hold-alls, articles of clothing, toothpaste, shampoo and other hygiene products.

“Goods that are classified as prohibited – even shampoo and toilet paper – should be confiscated..”

“..at least “they have not banned [Russian nationals] from wearing pants when crossing the border.”

• Russian Customs Chief Accuses EU Of ‘Total Lawlessness’ (RT)

Russia’s interim customs chief has blasted the European Commission’s instruction to EU member states to confiscate personal possessions of arriving Russian tourists. “How do we take the European Commission’s ban on traveling by personal car or with smart phones? Well, it’s utter nonsense,”Ruslan Davydov told journalists on Monday on the sidelines of an economic forum in the city of Vladivostok. The EU slapped wide-ranging sanctions on trade with Russia over the Ukraine conflict. Last Friday, however, Brussels explained that the restrictions should also apply to items for personal use brought by tourists crossing the bloc’s border. Goods that are classified as prohibited – even shampoo and toilet paper – should be confiscated, according to the clarification. The European Commission urged “EU operators [to] identify, assess, and understand the possible risks of sanctions circumvention” when conducting customs checks.

Davydov branded the decision as “total lawlessness” that defies the normal logic of customs controls. Moscow has little influence on the policies, since the EU broke all cooperation with Russia, he noted. “The way they regulate customs procedures on their soil can only invoke regret and incomprehension,” he added. But at least “they have not banned [Russian nationals] from wearing pants when crossing the border.”=The official assured that the Federal Customs Service, which he heads, shall not adopt a similar policy regarding tourists arriving from the EU. The Russian embassy in Helsinki urged citizens on Sunday not to travel to Finland in cars with Russian license plates, citing the risk of seizure stemming from the new guidelines.

Lula opens the door and closes it at the same time. Putin as Schrödinger’s president: “..the decision [on a possible arrest] is within the power of the judiciary, not my government..”

• Brazilian Court To Decide About Putin If He Attends G20 Summit – Lula (TASS)

The issue of Russian President Vladimir Putin’s arrest during his visit to the G20 summit in Brazil in 2024 will be considered by the country’s court taking into account the arrest warrant issued for the Russian leader by the International Criminal Court (ICC), the country’s president Luiz Inacio Lula da Silva said. “If Putin decides to attend [next year’s summit], the decision [on a possible arrest] is within the power of the judiciary, not my government,” Reuters quoted the politician as saying. On September 9, in an interview with the Indian TV channel Firstpost, Lula da Silva said that as long as he was president of Brazil, “he [Putin] will not be arrested without the authorization of the authorities.” At the same time, Reuters pointed out the president questioned Brazil’s membership in the ICC. He recalled that neither Russia, China nor the US are members of the organization.

According to the leader, such agreements harm developing countries. On March 17, the ICC issued arrest warrants for Russian President Vladimir Putin and Russian Presidential Commissioner for Children’s Rights Maria Lvova-Belova, alleging that they were responsible for the unlawful deportation of Ukrainian children. It could theoretically be executed if the Russian leader arrives in one of the countries that recognize the ICC’s jurisdiction. Moscow has rejected such accusations, calling “the very phrasing of the question” outrageous and pointing out that Russia does not recognize the jurisdiction of the ICC, so its decisions are null and void for Russia.

“Sergei Skripal, the original target and survivor of the Novichok attack allegations in the official narrative, must never be allowed to testify publicly..”

• Lies And Pretence In New London Novichok Hearing (Helmer)

In a London courtroom last week, lawyers for the British government and the presiding judge, Lord Anthony Hughes (lead image, centre), revealed they will resist the efforts of the Dawn Sturgess family to obtain a multi-million pound settlement in compensation for what they claim, and the government says, was her death five years ago from Novichok poisoning by Russian state agents. Secrecy is the key, not only to the big money claim, but to the government’s aim to defeat it and at the same time preserve the official story that the Kremlin ordered and carried out the chemical warfare attack in England in 2018.

Lord Hughes is defending the government’s effort to keep secret enough of the evidence in the case to block Adam Straw KC and Michael Mansfield KC, the Sturgess family lawyers, from demonstrating that the British security services should have known in advance – and did know enough — to have protected Sturgess from the Russian cause of her death. Their argument has been that for this negligence a very large sum of money should be paid to Sturgess’s heirs, to Rowley, and to the lawyers. The judge, the government, and the lawyers have agreed, however, there is one secret they must all keep. Sergei Skripal, the original target and survivor of the Novichok attack allegations in the official narrative, must never be allowed to testify publicly to what he knows.

To cover this up, Straw, Mansfield, and a lawyer representing the British press lied in court last week, claiming they want “open justice” from the secret services and the police. According to Jude Bunting KC representing the media, “open justice is about avoiding ill-informed speculation about proceedings and, insofar as material is in the public domain because of assertion, or even because of state-sponsored [Russian] misinformation, that is all the more reason for disclosing that material in open rather than in closed.” Hughes claimed to be seeking the same openness. “One of the difficulties of this inquiry and this case…is that everybody popularly supposes that they know the answer. They may or may not be right, but the purpose of the inquiry is to find out.” Hughes was pretending.

Paul Craig Roberts. “The gun charge is just a way of getting rid of the real charges..”

• The Gun Charge Against Hunter Is the Way of Covering Up the Real Issues (PCR)

Conservatives and Republicans are gleeful that the DOJ has been forced off its sweetheart gun charge deal for Hunter and might now have to bring a felony gun charge. The conservatives and Republicans do not realize that the gun charge is the least serious or important of the charges and that by making the gun charge the issue the real issues, which are threats to Joe Biden, don’t get a day in court. The gun charge is just a way of getting rid of the real charges. Moreover, if Hunter is convicted, something a Democrat jury is unlikely to do, and doesn’t get a suspended sentence, Joe will pardon him.

The conservatives and Republicans don’t understand that they and President Trump, not the Bidens, are the prosecutors’ target. We now have a black quota-hire Fulton County prosecutor adding US Senators and Trump lawyers to her racketeering indictment. The ridiculous indictment is so broadly framed that anyone who expressed doubt about the election is covered by the indictment. When you give power over law to people who see law only as a weapon with which to get enemies, you destroy the rule of law. That’s what the dumbshit white liberals have done.

“..But the question is whether such requests are evidence of a crime…”

• The “Why Not” Culture: The Georgia Final Report Should Worry Us All (Turley)

With the release of the special grand jury final report in Georgia, the nation finally was able to see what foreperson Emily Kohrs last February was giggling about in interviews. Call it the “Why not?” report. Back then, when Kohrs was asked if there were recommended charges, she chuckled and said, “Can you imagine doing this for eight months and not coming out with a whole list of recommended indictments? It’s not a short list. It’s not.’” In addition to nodding at an expected Trump indictment, she added, “There may be some names on that list that you wouldn’t expect.” After all, why not? The final product did not disappoint. The members recommended 39 people for prosecution, including Sen. Lindsey Graham (R-S.C.) and former Sens. Kelly Loeffler (R-Ga.) and David Perdue (R-Ga.).

They also included lawyers who argued for recounts or investigations into alleged election fraud. While the report expressly claims that the Fulton County District Attorney’s office did not create the list, it was the office of Fani Willis that presented the law, the evidence and potential targets to the special grand jury. During that process, these members concluded that politicians voicing support for the former president and his allegations could be criminally charged for doing so. The news that Willis did not indict Graham and others infuriated many on the left. Liberal websites were inundated with comments like “I want all the enablers charged, tried, and given long sentences as traitors to our country” and asking why the list did not include Senators Grassley, Cruz, Lee and “147 current and former members of the House, just to name a few.”

[..] The question is when advocacy or inquiries or negotiations become criminal acts. Willis’s first grand jury clearly believed that senators who called for recounts or Raffensperger’s resignation should go to prison. The comparison between their recommendations and the eventual indictment does not clearly answer how such acts are distinguishable as crimes. The same lack of limiting principle is evident in the new theory being pushed by various experts under the 14th Amendment to bar Trump from ballots on the grounds that he “engaged in insurrection or rebellion” or gave “aid or comfort to the enemies thereof.” Beyond the tendentious claim that the Jan. 6 riot was an actual insurrection, they also maintain that the provision is self-executing, requiring no vote of Congress for secretaries of state to bar Trump from next year’s ballots.

Even though Trump has not been charged, let alone convicted, of insurrection (or even incitement), these advocates believe that he can be removed from the ballot because of his election claims, his inflammatory rhetoric and his delay in calling for supporters to leave the Capitol. This is one of the most dangerous legal theories to arise in decades. This week, Democratic Arizona Secretary of State Adrian Fontes aptly described the claimed right to disqualify as a “radical” measure that would “encompass every elected office in our government — state, local, federal, and so forth.” Indeed, Democrats have called for barring not just Trump but 120 Republicans in Congress from running for office.

As with the Georgia special grand jury, the question is “Why not?” If the standard is “giving aid or comfort” to insurrectionists, then why not throw hundreds of other Republicans who supported the challenge to certification on Jan. 6 off the ballot? And while we’re at it, why not bar every lawyer who helped file claims of voting fraud from ever running for office? They all gave aid or comfort with their actions. By this reasoning, Rep. Jamie Raskin (D-Md.) and other Democrats could have been barred from ballots for opposing Trump’s certification in 2016 without any basis, along with leaders such as Hillary Clinton, who continued to call the election “stolen” for years. In 2016, there were also violent riots in Washington opposing Trump’s inauguration, thanks in no small part to such rhetoric. We can then have different candidates of both parties removed from ballots in every state.

“Mr. Gaetz pushed through an agreement that the process to remove and replace the Speaker of the House could be activated by one vote. Mr. Gaetz reiterated last week that he means business. He’s the one vote.”

• The Mills of the Gods (Jim Kunstler)

Do you think that more than half of the US public may be getting a little irked with “Joe Biden’s” lawfare elf, AG Merrick Garland, as he rolls one innocent J-6 protester after another into decades of hard-time for strolling through the US Capitol building — while the special counsels assigned to only a few of the Biden family crimes play hide-the-salami with due process? For all their cheap talk about “our democracy,” it’s a little scary to see what Democratic Party lawyers actually think of the legal system that is supposed to allow a society based on liberty to function fairly. Court filings last week indicate that Special Counsel David Weiss is about to indict Hunter Biden on that gun charge they have used as the joker in a three-card Monte game for going on five years.

Last time, they ran the game before Delaware federal judge Maryellen Noreika, she detected a teeny-weeny, sneaky clause in the plea agreement to a watered-down gun charge that would have granted immunity to Hunter B from any other past wrongdoing, including, of course, the entire alleged Biden family racketeering operation that had the First Son acting as prime broker and bag-man for tens of millions of dollars in bribes from foreign actors in countries less than friendly to US interests, funneled into any number of Biden family shell corporations. Judge Noreika nixed the plea agreement. Now, Mr. Weiss’s crew seems to be saying that the immunity clause is still tied to any plea deal answering a forthcoming September 29 indictment.

The move would appear to be timed to exactly the moment that a House impeachment committee would begin its inquiry into the Biden family’s moneygrubbing activities. In ordinary House committee hearings, DOJ officials like to use the excuse of “an ongoing investigation” to demur from answering questions. Merrick Garland has done this dozens of times. Will they now try to upgrade that to “an ongoing prosecution?” Could that move lead to a constitutional impasse, requiring the Supreme Court to rule? Or does a House impeachment panel enjoy special privileges of inquiry? It also appears that Rep. Matt Gaetz (R-FLA) intends to force the issue of opening an impeachment ASAP against “Joe Biden.” In last January’s maneuvering to seat a new Republican House majority, Mr. Gaetz pushed through an agreement that the process to remove and replace the Speaker of the House could be activated by one vote. Mr. Gaetz reiterated last week that he means business. He’s the one vote.

The argument that Republicans should leave hands-off “Joe Biden” so they can run against the feeble old grifter in 2024 is preposterous because there is no way that the “JB” can possibly run for reelection under any circumstances. It’s just another trip being laid on the American public — and one that illustrates how tragic and dangerous is the absence of an honest news media for challenging such insolent gambits. The President can barely totter into a room now without making some embarrassing pratfall or gaffe. He couldn’t possibly survive a debate, especially with all the new records of his crimes unearthed since the last time around in 2020 when he pretended to know nothing about his son’s business dealings.

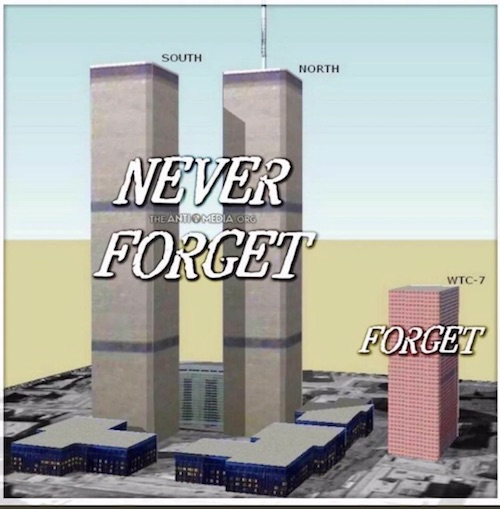

“..it is pretty clear who is responsible for 9/11 and why. Many Americans today understand what really happened..”

“It is paradoxical that President Trump is in the dock for questioning an election, while Dick Cheney and the neoconservatives, and the whore media that covered up for them, never faced a single charge.”

• 9/11 After 22 Years (Paul Craig Roberts)

Today is the 22nd Anniversary of the attack on the World Trade Center and Pentagon known as 9/11. A generation of 22-year olds has grown up after 9/11, and the event probably means nothing to them. They learn that it was an attack on America like the Japanese attack on Pearl Harbor, and 9/11 disappears into history. It is unlikely that anyone under 40 is much concerned with 9/11. A 40-year old today would have been 18 in 2001 and would likely dismiss 9/11 concerns as conspiracy theory. Today’s youth are more likely to be marching in support of sexual perversion than wondering about the source and purpose of the 9/11 attack.

Over the years I have reported the mounting evidence provided by scientists and by architect Richard Gage’s Architects and Engineers for 9/11 Truth until the organization he created removed him at the request of the government, effectively destroying the organization. But for me the proof that 9/11 was an inside job has always been that no one in government and security agencies was ever held accountable for the worst humiliation ever inflicted on an alleged “superpower.” Instead, it took a year before the White House even agreed to an official coverup with the 9/11 Commission, another in the long line of commissions like the Warren Commission that validates the official story. If a few young Saudi Arabians had actually defeated the entire national security apparatus of the United States, the White House would have been screaming, and heads would have rolled.

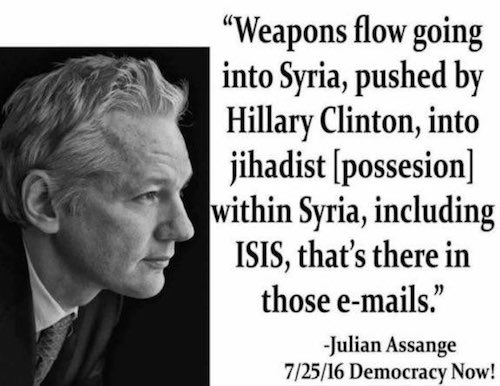

The neoconservatives had just called for a “new Pearl Harbor” so they could launch their wars of destruction of Israel’s enemies in the Middle East. They immediately blamed 9/11 on “Muslim terrorists” and began their invasions that halted only when Russia blocked the neoconservatives’ overthrow of Syria. So it is pretty clear who is responsible for 9/11 and why. Many Americans today understand what really happened, but the government will never admit it. It takes decades for the truth to come out, and by then everyone affected by the event is dead, and the event becomes ancient history. It is paradoxical that President Trump is in the dock for questioning an election, while Dick Cheney and the neoconservatives, and the whore media that covered up for them, never faced a single charge.

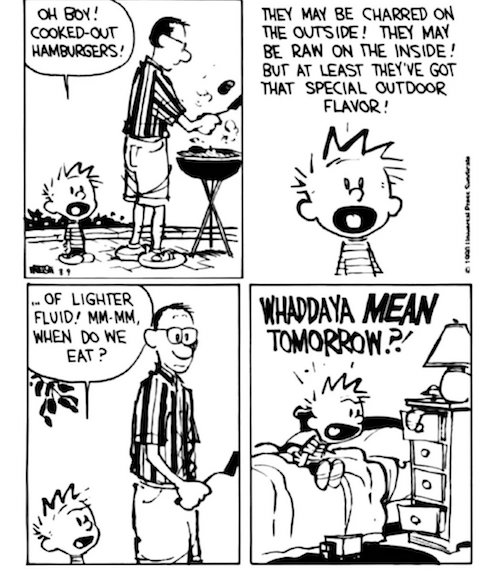

Great Depression

https://twitter.com/i/status/1701337655886102874

Smile

https://twitter.com/i/status/1701205047835521236

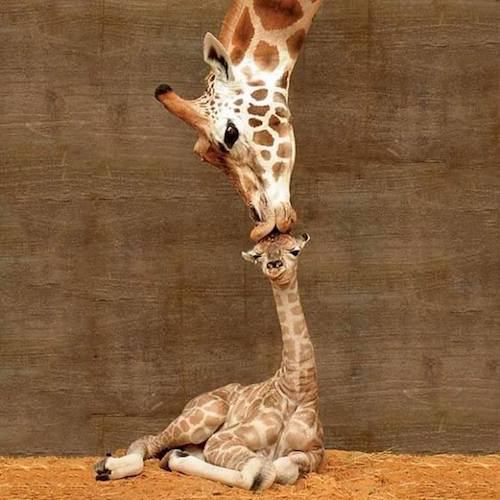

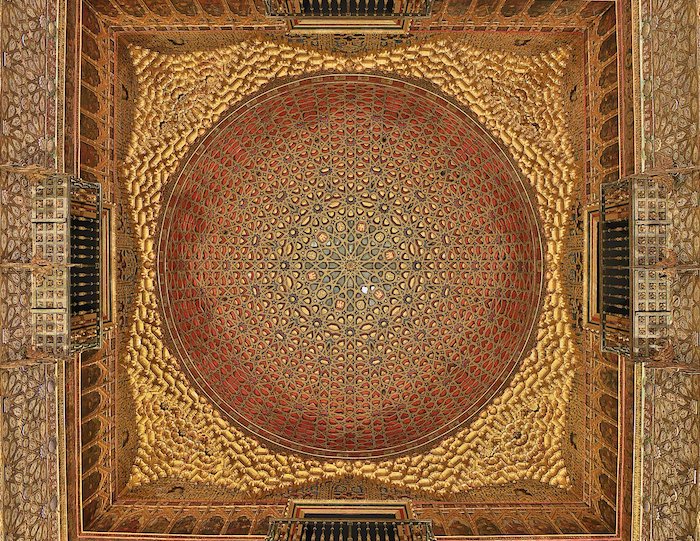

Left my heart

I left my heart here pic.twitter.com/qeRO00fVni

— Enezator (@Enezator) September 11, 2023

Support the Automatic Earth in wartime with Paypal, Bitcoin and Patreon.