Henri Matisse Flowers 1907

In his CNN townhall last night, Trump left nothing standing of his hostile interviewer. While CNN’s handpicked audience applauded him throughout. They handed him the stage and he took it. All of it.

This was the best answer on the war in Ukraine. Home run pic.twitter.com/vJnE8xpiOz

— MAGS (@TAftermath2020) May 11, 2023

Nancy Mace

"This could be the most corrupt scheme in American politics." pic.twitter.com/fj5FNmRAWz

— MAGA War Room (@MAGAIncWarRoom) May 10, 2023

Ed Dowd

300,000 Excess Deaths from the Jab 'And We Think We're Low' – Ed Dowd

"I would love to see excess mortality start to trend back towards normal. Unfortunately, it's not," lamented Blackrock portfolio manager @DowdEdward.

"In the group that I follow – which is undeniable – Group… pic.twitter.com/JZJhPuKJ3D

— The Vigilant Fox 🦊 (@VigilantFox) May 10, 2023

German farmers

Webb

https://twitter.com/i/status/1656544051833782273

Overpopulation

In May 2009, a small group of billionaires gathered in secret to discuss how their enormous collective wealth could be used to solve the problem of "overpopulation".

Present at this highly secretive meeting were, among others: David Rockefeller, Bill Gates, Warren Buffett and… pic.twitter.com/K9WNwSCcyC

— Wide Awake Media (@wideawake_media) May 10, 2023

McLuhan

In 1977, media prophet Marshall McLuhan discussed CIA and FBI surveillance, and then spun it into one of the most mind-bending comments on identity in the digital age I've ever heard. pic.twitter.com/gDWVJa4Anh

— Benjamin Carlson (@bfcarlson) May 10, 2023

https://twitter.com/WinRussiawill/status/1656363220972765184

Watters

We’ve now entered impeachment territory. This is the biggest political bribery scandal in American history and it has national security consequences. The Biden family’s been untouchable because they are the system. The FBI and the CIA are in on it- this is how the system works.… pic.twitter.com/vddPR2vCli

— Jesse Watters (@JesseBWatters) May 11, 2023

• House GOP Identifies 9 Biden Family Members Who Received Foreign Money (NYP)

House Oversight Committee Chairman James Comer identified nine members of President Biden’s family Wednesday who allegedly received foreign income after teasing the bombshell for weeks. “Since you asked, I’ll tell you,” Comer (R-Ky.) told a rapt room of reporters at the Capitol after laying out new bank record evidence showing first son Hunter Biden received $1 million from a corrupt Romanian businessman while his dad was vice president. “Joe Biden’s son [Hunter], Joe Biden’s brother [James], Joe Biden’s brother’s wife [Sara], Hunter Biden’s girlfriend or Beau Biden’s widow [Hallie], however, you want to write that, Hunter Biden’s ex-wife [Kathleen Buhle], Hunter Biden’s current wife [Melissa Cohen], and three children of the president’s son and the president’s brother,” Comer said.

The chairman seemed to indicate that only one of Biden’s grandchildren and two of his brother’s children got the foreign funds. “We’re talking about grandchil — a grandchild,” Comer said at the press conference. “That’s odd, most people that work hard every day’s grandchild doesn’t get a wire from a foreign national.” James Biden has three children, including daughter Caroline, who pleaded guilty in 2018 to making over $100,000 in charges on a stolen credit card. Emails from Hunter’s abandoned laptop show Caroline turned up her nose at an $85,000 job offer that would have allowed her to serve her probationary period near her beloved cousin in California. Caroline’s siblings are James Biden Jr. and Nicholas Biden. The president’s other brother, Frank Biden, has two children, but Comer did not mention him and it’s unclear why Frank’s daughters, who reportedly work for NBC and as a nurse practitioner, would be involved.

A Comer aide told The Post it is possible that additional Biden relatives received foreign money. Bank records indicate $80,000 transferred from Romanian businessman Gabriel Popoviciu from 2015 to 2017 went to accounts identified only by the name “Biden,” for example — and a March memo from the committee indicated $70,000 from Chinese company CEFC China Energy did as well. Hunter Biden and first brother James Biden were well-known for years for seeking millions from nations including China, Mexico, Romania, Russia and Ukraine — but the involvement of other family members was only more recently alleged by Comer. The Oversight Committee issued a memo on Wednesday morning saying that Hallie Biden appears to have received $10,000 in early 2017 from Popoviciu — before receiving another $25,000 later that year as part of Hunter and James Biden’s partnership with CEFC China Energy.

More power than Congress?

• FBI Refuses To Give Congress File Alleging Biden Took Bribes As VP (NYP)

The FBI has refused to give Congress an informant file alleging that President Biden took bribes while he was vice president, The Post has learned — setting up a possible showdown over access to the information. House Oversight Committee Chairman James Comer (R-Ky.) issued a legally binding subpoena last week requiring the FBI to turn over the file by noon Wednesday, but the bureau instead replied with a six-page letter raising various objections. “Information from confidential human sources is unverified and, by definition, incomplete,” wrote FBI acting assistant director for congressional affairs Christopher Dunham, who also argued that informant reports must also be kept private to protect sources.

“As is clear from the name itself, confidentiality is definitional to the FBI’s Confidential Human Source program,” Dunham wrote. “Confidential human sources often provide information to the FBI at great risk to themselves and their loved ones. The information they provide also can create significant risks to others who may be referenced in their reporting.” The FBI official concluded: “We … hope this helps you understand that keeping this kind of source information free from the perception or reality of improper influence — and preventing the redirection of this information for non-law enforcement or non-intelligence uses — is necessary for the FBI’s effective execution of our law enforcement and national security responsibilities.”

Comer slammed the FBI’s stonewalling, but he did not immediately announce further steps to acquire the document. Congress has the power to apply financial pressure to agencies and can also use litigation to enforce its orders or attempt to shame officials through contempt votes. “It’s clear from the FBI’s response that the unclassified record the Oversight Committee subpoenaed exists, but they are refusing to provide it to the Committee,” Comer said. [..] The document subpoenaed by the Oversight Committee is an FD-023 informant report that was created or modified in June 2020-months before Biden won the presidency.

In a letter to Attorney General Merrick Garland and FBI Director Christopher Wray, Comer and Grassley wrote last week, “We have received legally protected and highly credible unclassified whistleblower disclosures.” “Based on those disclosures,” the Republicans wrote, “it has come to our attention that the Department of Justice (DOJ) and the Federal Bureau of Investigation (FBI) possess an unclassified FD-1023 form that describes an alleged criminal scheme involving then-Vice President Biden and a foreign national relating to the exchange of money for policy decisions.”

“If you say he’s [Putin] a war criminal, it’s going to be a lot tougher to make a deal to make this thing stopped..”

• Trump Says He Would Meet With Putin To Settle Ukrainian Conflict (TASS)

Former US President Donald Trump said he would meet with Russian President Vladimir Putin and his Ukrainian counterpart Vladimir Zelensky to end the conflict in Ukraine. “I don’t think in terms of winning and losing. I think in terms of getting it settled so we stop killing all these people,” he said during a CNN’s town hall program. Trump explained that if he was president, he would resolve the conflict within 24 hours. “Russians and Ukrainians, I want them to stop dying,” the politician said. “And I’ll have that done in 24 hours.”

Trump added that he considered Putin to be very smart. However, in former US president’s opinion, “Putin made a mistake” by launching the special military operation. He also pointed out that it was not the time to consider the Russian president a war criminal. “If you say he’s [Putin] a war criminal, it’s going to be a lot tougher to make a deal to make this thing stopped,” Trump said. He also added that it was something that “should be discussed later.”.

Trump

https://twitter.com/i/status/1656538428534652928

“I don’t think in terms of winning and losing.” “I think in terms of getting it settled so we stop killing all these people..”

• Trump Wants Both Ukrainians And Russians To ‘Stop Dying’ (RT)

Former US President Donald Trump has refused to say whether he favors a particular side in the Russia-Ukraine conflict, stating he would rather focus on ending the bloodshed altogether. Speaking for a CNN town hall in New Hampshire on Wednesday, Trump also insisted that Washington was giving too much ammunition to Kiev. Asked by CNN’s Kaitlan Collins if he wants “Ukraine to win this war,” Trump, who is campaigning for a second term in office, replied: “I don’t think in terms of winning and losing.” “I think in terms of getting it settled so we stop killing all these people and breaking down this country,” the former president said.

When pressed by Collins on the matter, Trump added: “They are dying, Russians and Ukrainians. I want them to stop dying.” He criticized the amount of military aid provided to Kiev by the Pentagon. “We don’t have ammunition for ourselves [and yet] we’re giving away so much,” he said. Trump also said he wanted Europe to “put up more money” for Ukraine and “equalize” its financial assistance compared to aid provided by Washington. Trump insisted that he would “have that war settled in one day” if he was president, promising to meet with presidents Vladimir Putin of Russia and Vladimir Zelensky of Ukraine if he gets elected in 2024.

Trump CNN

Powerful moment:

CNN: "Do you want Ukraine to win this war?"

Trump: "I don’t think about it in terms of winning and losing, I think in terms of getting it settled so we stop killing all these people."

*Massive audience applause*

The people want peace.pic.twitter.com/Y62bhwPhX7

— Kim Dotcom (@KimDotcom) May 11, 2023

Plenty offers. But they need to include China.

• Lula Offers To Act As Go-Between To End Ukraine Conflict At G7 Summit (TASS)

Brazilian President Luiz Inacio Lula da Silva said on Tuesday that he plans to offer Brasilia’s services as a mediator for settling the Ukrainian conflict on the sidelines of the G7 summit, which is slated to be held in Hiroshima, Japan, later this month. Addressing a joint news conference with Dutch Prime Minister Mark Rutte, the Brazilian leader said, “The continuation of the war will only cause more deaths. So, we must find someone who would be able to discuss peace, and Brazil is ready for that.” Lula said that, prior to his relevant negotiations with Rutte, he had already discussed the issue with the Chinese president and the British prime minister, and that he would raise it with the president of Indonesia and many other leaders with whom he plans to meet at the G7 summit.

According to the Brazilian president, the situation in Ukraine, energy, battling climate change, economic development and the fight against unemployment are certain to be on the agenda of the G7 meeting in Hiroshima on May 20-21. “We have received multiple requests for bilateral meetings, and I am confident that the Ukrainian issue will be raised at every such meeting,” Lula added. And every side involved in the conflict has its arguments, he believes. While Ukraine is bound to resist what he called the unacceptable occupation of its territory, the EU has its arguments in favor of the decisions it has made, and Brazil and other countries have their reasons for trying to reach a compromise, the Brazilian leader said. Lula recalled that his country had condemned “the Russian military invasion” in a UN vote.

“Now is the time for diplomacy, not for war,” he emphasized. Earlier, Lula called Russia a guarantor of a long-lasting global peace and proposed developing a new international format for a potential dialogue between Moscow and Kiev, saying that he stands ready to mediate any direct negotiations between Russian President Vladimir Putin and his Ukrainian counterpart, Vladimir Zelensky.

“Stop providing military aid to Ukraine and Ukraine [will] have to surrender in a few days.”

• Borrell Says He Knows How To Stop Ukraine Conflict ‘Immediately’ (RT)

The conflict between Moscow and Kiev that has been dragging on for more than a year can be ended in just several says, EU foreign policy chief Josep Borrell admitted on Spanish broadcaster La Sexta on Wednesday. It all depends on Western military supplies to Kiev, he claimed. “I know how to end the war immediately,” Borrell told La Sexta’s El Intermedio show. “Stop providing military aid to Ukraine and Ukraine [will] have to surrender in a few days. That’s it, the war is over.” the EU top diplomat presumed aloud. Borrell then said that it is not the outcome the EU and other Western nations would like to see. The bloc’s foreign-policy chief claimed that an immediate end to the conflict on such terms would see Ukraine “occupied” and “turned into a puppet country” that is “deprived of its freedoms.”

“Is this how we want the war to end?” he asked rhetorically. Borrell then blamed the continued hostilities on Moscow, saying that Russia has repeatedly insisted it would not stop until all the goals of its military campaign in Ukraine are achieved. He also criticized the peace efforts by China and Brazil, claiming these are detached from reality. “Everyone, who says they want peace should then say … ‘I want Russia to withdraw from Ukraine,” Brussels’ foreign-policy chief maintained, adding that he has little understanding for anyone thinking otherwise. “Those, who say: ‘I want peace and the best thing to achieve it is for the Europeans to cease helping Ukraine’ … frankly, I do not know what world they live in,” he said. Kiev promptly reacted to Borrell’s words, accusing him of having the “wrong emphasis” in his speech.

Withdrawal of Western military aid “could certainly not end the conflict immediately,” President Vladimir Zelensky’s aide Mikhail Podoliak said on Twitter. It would only lead to further escalation as hostilities would spill over to “other territories,” he claimed, without elaborating on his statement. Borrell’s words came less than a day after UN Secretary General Antonio Guterres also expressed his skepticism about Brazil and China’s peace efforts. Any mediation efforts would be in vain for now since both parties to the conflict are “fully involved” in the ongoing war, he told Spain’s El Pais on Tuesday.

The Kremlin said in late April it supported international efforts aimed at finding a peaceful solution to the conflict but still maintained that its goals in the conflict should be achieved. Russian President Vladimir Putin cited the need to protect the people of Donbass, as well as Kiev’s failure to implement the 2014-2015 Minsk peace accords, as reasons for launching Russia’s operation against Ukrainian forces in February 2022. He also said Russia was seeking the “demilitarization” and “denazification” of Ukraine. Moscow has also accused Kiev of making any potential talks senseless since Ukraine is demanding Russia surrender all the territories that joined it following referendums, including the most recent, in autumn 2022.

“Maria Zakharova earlier slammed NATO’s statements about Ukraine’s possible future accession as short-sighted and simply dangerous.”

• Ukraine’s NATO Accession Does Not Depend On Stoltenberg – Borrell (TASS)

A decision on Ukraine’s possible accession to NATO will be made by the bloc’s member states and not by its Secretary General Jens Stoltenberg, the European Union’s High Representative for Foreign Affairs and Security Policy Josep Borrell said in an interview with the La Sexta TV channel on Wednesday. According to him, Ukraine’s NATO membership “does not depend on the NATO secretary general but the NATO countries.” The EU’s top diplomat also emphasized that the issue “is not under consideration” at the moment. Stoltenberg pointed out earlier that NATO’s doors remained open to Ukraine. He also claimed that all of the bloc’s member states supported Ukraine’s accession but, in his words, it will only be possible to substantially discuss the matter after the conflict is over. Russian Foreign Ministry Spokeswoman Maria Zakharova earlier slammed NATO’s statements about Ukraine’s possible future accession as short-sighted and simply dangerous.

“The ultimate goal is to demilitarize NATO as a whole rather than just Ukraine, and so far, it appears to be working brilliantly.”

• Bold Gambits On The West Asian Chessboard (Pepe Escobar)

The collective west appears to lack a decisive leader, with the Hegemon currently being “led” by a senile president who is remote-controlled by a pack of polished-faced warmongers. The situation has devolved to the point where the much-hyped “Ukrainian counter-offensive” may actually be the prelude to a NATO humiliation that will make Afghanistan look like Disneyland in the Hindu Kush. Arguably there may be some similarities between Russia-NATO now and Turkiye-Russia before March 2020: both sides are betting on some crucial military breakthrough on the battlefield before sitting at the negotiating table. The US is desperate for it: even the 20th century ‘Oracle’ Henry Kissinger is now saying that with China involved, there will be negotiations before the end of 2023. Despite the urgency of the situation, Moscow does not appear to be in a hurry.

Its key military strategy, as seen in Bakhmut and Artemyovsk, is to use a combination of the snail technique and the mincing machine. The ultimate goal is to demilitarize NATO as a whole rather than just Ukraine, and so far, it appears to be working brilliantly. Russia is in it for the long haul, anticipating that one day the collective west will have an “Eureka!” moment and realize it is time to abandon the race. Now let’s assume, by some divine intervention, that negotiations would start in a few months, with China involved. Moscow – and Beijing – both know they simply cannot trust anything the Hegemon says or signs. Moreover, the crucial US tactical victory has already been conclusive: Russia sanctioned, demonized and separated from Europe, and the EU cemented as a de-industrialized, inconsequential lowly vassal.

Presupposing there is a negotiated peace, it will arguably resemble a Syria 2.0, with a massive “Idlib” equivalent right on Russia’s door, which is something entirely unacceptable to Moscow. In practice, we will have Banderista terror outfits – the Slav version of ISIS – free to roam across the Russian Federation in car bombing and kamikaze drone sprees. The Hegemon will be able to switch the proxy war on and off at will, just as it continues to do in Syria, Iraq, and Afghanistan with its terror cells. The Security Council in Moscow knows very well, based on the Minsk farce acknowledged even by former German Chancellor Angela Merkel, that this will be Minsk on steroids: the Kiev regime, or rather the post-Zelensky regime will continue to be weaponized to death with brand new NATO gimmicks. But then the other option – where there is nothing to negotiate – is equally ominous: a Forever War.

“We can only hope that America will elect a president in 2024 who will finally end NATO’s deadly world tour.”

• NATO ‘s Great New Idea: ‘Let’s Start A War With China!’ (Ron Paul)

NATO’s post-Cold War history is that of an organization far past its “sell-by” date. Desperate for a mission after the end of the Warsaw Pact, NATO in the late 1990s decided that it would become the muscle behind the militarization of “human rights” under the Clinton Administration. Gone was the “threat of global communism” which was used to justify NATO’s 40-year run, so NATO re-imagined itself as a band of armed Atlanticist superheroes. Wherever there was an “injustice” (as defined by Washington’s neocons), NATO was ready with guns and bombs. The US military-industrial complex could not have been happier. All the Beltway think tanks they lavishly fund finally hit on a sure winner to keep the money pipeline flowing. It was always about money, not security.

The test run for NATO as human rights superheroes was Yugoslavia in 1999. To everybody but NATO and its neocon handlers in DC and many European capitals, it was a horrific, unjustified disaster. Seventy-eight days of bombing a country that did not threaten NATO left many hundreds of civilians dead, the infrastructure destroyed, and a legacy of uranium-tipped ammunition to poison the landscape for generations to come. Just last week tennis legend Novak Djokovic recalled what it felt like to flee his grandfather’s home in the middle of the night as NATO bombs fell and destroyed it. What a horror! Then NATO got behind the overthrow of the Gaddafi government in Libya. The corporate press regurgitated the neocon lies that bombing the country, killing its people, and overthrowing its government would solve all of Libya’s human rights problems.

As could be predicted, NATO bombs did not solve Libya’s problems but made everything worse. Chaos, civil war, terrorism, slave markets, crushing poverty – no wonder Hillary Clinton, Obama, and the neocons don’t want to talk about Libya these days. After a series of failures longer than we have space for here, DC-controlled NATO in 2014 decided to go all-in and target Russia itself for “regime change.” First step was overthrowing the democratically elected Ukrainian government, which Victoria Nuland and the rest of the neocons took care of. Next was the eight years of massive NATO military assistance to Ukraine’s coup government with the intent of fighting Russia. Finally, it was the 2022 rejection of Russia’s request to negotiate a European security agreement that would prevent NATO armies circling its border.

Despite the mainstream media and US government propaganda, NATO has been about as successful in Ukraine as it was in Libya. Hundreds of billions of dollars have been flushed away, with massive corruption documented by journalists like Seymour Hersh and others. The only difference this time is that NATO’s target – Russia – has nuclear weapons and views this proxy war as vital to its very existence. So now despite its legacy of failure, NATO has decided to start a conflict with China, perhaps to take attention off its disaster in Ukraine. Last week NATO announced that it will open its first-ever Asia office in Japan. What next, NATO membership for Taiwan? Will Taiwan willingly serve as NATO’s newest “Ukraine” – sacrificing itself to China in the name of blundering NATO’s seemingly endless appetite for conflict? We can only hope that America will elect a president in 2024 who will finally end NATO’s deadly world tour.

“For President Tayyip Erdogan, extending the deal is a signal to the West that Turkey can be trusted. As a result, the government will do everything in its power to preserve the grain initiative..”

• Grain Deal To Be Extended Taking Into Account Russia’s Interests – Turkey (TASS)

The grain deal is expected to be extended at the talks that started on Wednesday in Istanbul, taking into account Russia’s objections, a source in Ankara close to the talks told TASS. “There is information that the agreement will be extended beyond May 18. That’s why I’m talking about it as a fact. And there are expectations that the export of Russian products will be a part of it,” the source said. According to the source, extending the grain deal is a crucial issue for the Turkish leadership in the run-up to the elections and they will do everything in their power to make it happen. “For President Tayyip Erdogan, extending the deal is a signal to the West that Turkey can be trusted. As a result, the government will do everything in its power to preserve the grain initiative,” the source said.

On July 22, 2022, a package of documents on the supply of food and fertilizers to the international market was signed in Istanbul. Initially, the agreements were concluded for 120 days. On March 18, 2023, Russia announced the extension of the initiative for 60 days. The Russian Foreign Ministry noted that a further extension of the deal would depend on the reconnection of the Russian Agricultural Bank to the SWIFT system and the lifting of a number of restrictions on supplies, insurance and the use of ports. The Turkish side earlier said that the Turkish state bank Ziraat may be ready to carry out operations to pay for Russian grain and fertilizers. The negotiations between Russia, Ukraine, Turkey, and the UN on the extension of the grain deal and the implementation of the Russian part of the agreement on the supply of grain and fertilizers will last two days in Istanbul, with May 11 expected to be the key day of the negotiations.

Well-known recipe

• US To Create ‘Free Syria Army’ Of Terrorists Against Damascus – Lavrov (TASS)

The United States has set about creating a “Free Syria Army,” consisting of terrorists and militants, to serve as a tool against the legitimate government in Damascus, Russian Foreign Minister Sergey Lavrov said on Wednesday. “It’s no longer enough for the US to support the self-proclaimed Kurdish regions beyond the Euphrates River and flood the illegal armed units that they have formed with weapons,” the Russian foreign minister pointed out during four-party talks on Syria with his counterparts from Syria, Turkey and Iran. “According to our data, the Americans have started to create the so-called Free Syria Army near the Syrian city of Raqqa, engaging local Arab tribes, along with militants from ISIL (the former name of the Islamic State terror group, which is outlawed in Russia – TASS) and other terrorist organizations.

The goal is clear: to use these militants against Syria’s legitimate authorities in order to destabilize the situation in the country,” Lavrov noted. Lavrov emphasized that the Russian and Syrian militaries had recently discussed the issue, agreeing on a model of joint actions in that field. “I hope that all planned steps will be successfully implemented,” the top Russian diplomat added. According to him, Moscow believes that “blatant foreign interference in the region’s affairs is unacceptable, particularly when it involves military force;” and in this case, it is about “deploying foreign military units to Syrian soil.”

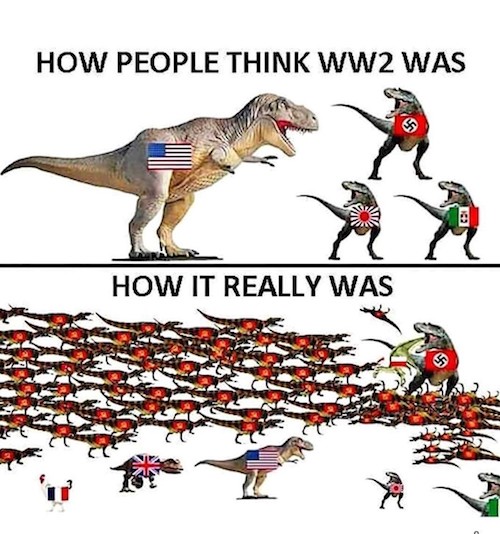

Because 450,000 Americans died vs 28 million Russians.

• Young Americans Don’t Understand History Of WWII – Kremlin (RT)

Younger generations of Americans no longer remember who fought against whom in World War II, and even middle-aged citizens are ignorant of the recent past, Kremlin spokesman Dmitry Peskov has claimed. Speaking to journalists on Wednesday, President Vladimir Putin’s press secretary said the lack of understanding of history among Americans was not merely “forgetfulness” but a “pernicious line” and warned of the consequences of such ignorance. “Not knowing the horrors of the past, not knowing who saved the world from the brown plague (fascism), means that soon in America there will be a generation that will be unable to soberly assess its present and its future,” Peskov said.

He noted that Russia, on the other hand, continues to do everything it can to keep the memory of the heroism of the Soviet people alive and make sure younger generations are aware of the true details of the war. Peskov also noted the presence of the leaders of former Soviet republics at the May 9 Victory Day parade in Moscow, suggesting that this demonstrated the political and social will of those countries to protect this history. “We will bring these truths to the people of the world, so that those who want to, can study the real facts [of WWII]” he said. His comments came after White House Press Secretary Karine Jean-Pierre attempted on Tuesday to describe Russia as analogous to Adolf Hitler’s Germany, and claimed that the “US and allied forces” were the ones who secured victory in WWII. Jean-Pierre also accused Vladimir Putin of having “promised only more violence” during his address at the May 9 parade in Moscow.

In his speech in Red Square, the Russian president denounced the “disgusting, criminal and deadly” ideology of Western supremacy and the globalists who “pit people against each other, split societies, provoke bloody conflicts and coups, sow hatred, Russophobia and aggressive nationalism, destroy traditional family values that make human a human.” Putin also claimed that the West had forgotten what “the insane ambitions of the Nazis led to” and who was responsible for defeating “this monstrous, total evil.” The Soviet Union did the lion’s share of the fighting in Europe, at the cost of 8.7 million soldiers and up to 20 million civilian lives. Victory Day marks the day on which the remnants of the Nazi regime officially signed their unconditional surrender to the USSR and Allied forces at the end of World War II. Although the document was signed in Berlin on May 8, due to different time zones, Russia has historically celebrated the event on May 9.

Zakharova

Russia MFA Spokeswoman Zakharova: "President of the European Commission Ursula Von der Leyen is a representative of European revanchists and seeks simply to take revenge on our country for her Nazi ancestors and the crushing defeat that they suffered 78 years ago." pic.twitter.com/lfoGsl2hP3

— COMBATE |🇵🇷 (@upholdreality) May 10, 2023

Start small.

• Liechtenstein To Accept Bitcoin For Payments To State (RT)

The government of Liechtenstein is considering accepting Bitcoin as payment for state services, the micro-state’s Prime Minister Daniel Risch told Handelsblatt on Sunday. Risch, who is also Liechtenstein’s finance minister, said that a “Bitcoin payment option is coming.” The official didn’t specify what particular services will become available for payment in the digital currency, or when the announced payment method would become available. Any crypto received will be immediately exchanged for Swiss francs, Liechtenstein’s national currency, Risch said. Although crypto is too volatile to entrust portions of the country’s multi-billion-dollar annual savings, that assessment could change, he added. Bitcoin would not, however, be accorded the same legal status as the franc. Liechtenstein is a German-speaking microstate located in the Alps between Austria and Switzerland. It is the world’s sixth smallest nation, with a population of under 39,000 people.

In 2019, the principality became one of the first places in the world to pass dedicated crypto regulations with The Liechtenstein Blockchain Act. Only two nations in the world have currently approved Bitcoin as legal tender – El Salvador and the Central African Republic. However, it was reported last month that the CAR has reversed this decision. There are still no uniform international laws that regulate cryptocurrencies, which are notorious for their high volatility. The most popular crypto, Bitcoin, was worth a fraction of a cent when it was launched in 2009 and shot up to nearly $69,000 per coin in November 2021. The rate has mostly been on a downward spiral since then, with the decline triggered by fraud allegations, government lawsuits and investigations, and general global economic instability. Bitcoin currently trades at nearly $28,000 per coin.

Are we to believe they do not know this?

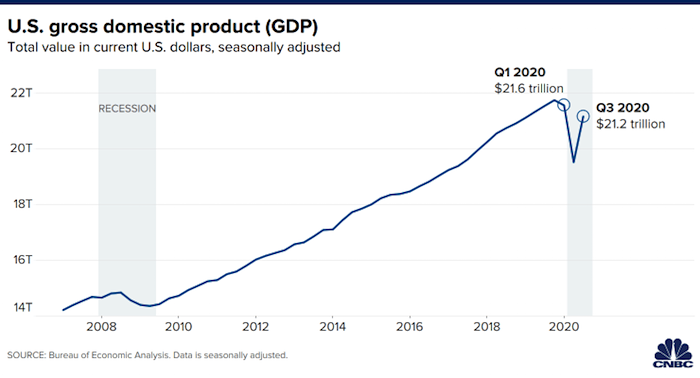

• Net Zero Grid Batteries Alone Would Bankrupt America (Rucker)

Science and policy analyst David Wojick calculated that just the batteries needed to back up wind and solar electricity generation in a “net zero” USA would cost $23 trillion — America’s entire 2021 gross domestic product (GDP) — and probably many times that. Energy and technology consultant Thomas Tanton found that battery backup to replace current U.S. fossil fuel electricity — and convert vehicles, furnaces, water heaters, and stoves to electricity — would cost at least $29 trillion in initial outlays. Trillions more would be needed to cover financing, repairs, maintenance, replacements, burying broken and worn out non-recyclable equipment, and building systems strong enough to survive hurricanes.

Professional engineer Ken Gregory determined that grid-backup battery costs could reach $290 trillion (12.6 times the USA’s 2021 GDP), based on actual 2019 and 2020 hourly intermittent electricity generation data, rather than annual average data utilized in the other studies. None of these estimates includes the costs of turbines, panels, transmission lines, or transformers. Energy analyst Francis Menton estimated that New York’s plan to procure 24,000 megawatt-hours of battery storage would provide only 0.2% of what the state would actually need as backup. But even that would require 300,000 Tesla Long Range 80-kilowatt-hour battery modules — before New York mandates electric automobiles and home heating and cooking systems.

Each of those modules weighs over 1,000 pounds and holds 6,000 individual lithium-ion cells. Each one contains 25 pounds of lithium, 60 pounds of nickel; 44 pounds of manganese; 30 pounds of cobalt; 200 pounds of copper; and over 550 pounds of aluminum, steel, graphite, plastics, and other materials, energy analyst Ron Stein reports. To manufacture each module, we must mine 30,000 pounds of cobalt ore (much of it with child labor in the Congo), 5,000 pounds of nickel ore, and 25,000 pounds of copper ore, plus inject and extract 25,000 pounds of brine to get the lithium. Backing up New York’s peak summertime electricity needs for just 45 minutes (those 300,000 battery modules) would require 3,750 tons of lithium, 9,000 tons of nickel, 6,600 tons of manganese, 4,500 tons of cobalt, 30,000 tons of copper, and 82,500 tons of other materials.

Together, we’d need to mine more than seventy-five million tons of ores for those New York grid-backup batteries — after removing at least as much overlying rock to get to the ore bodies. Backing up California’s currently planned wind and solar electricity generation would require nearly 310,000,000 long-range modules. Imagine the batteries, materials, and ores that we’d need for the entire USA — or world!

True cost

The True Cost of Electric Cars Batteries

Source: California Insiderhttps://t.co/58nByDjFlU pic.twitter.com/smTiiB3AJb— Wittgenstein (@backtolife_2023) May 10, 2023

“Julian has spent much of his time in isolation, is often heavily sedated and has been denied medical treatment for a variety of physical ailments. He is routinely denied access to his lawyers. He has lost a lot of weight, suffered a minor stroke, spent time in the prison hospital wing — which prisoners call the hell wing — because he is suicidal, been placed in prolonged solitary confinement, observed banging his head against the wall and hallucinating.”

• Julian Assange – A Fight We Must Not Lose (Chris Hedges)

The detention and persecution of Julian Assange eviscerates all pretense of the rule of law and the rights of a free press. The illegalities, embraced by the Ecuadorian, British, Swedish and U.S. governments are ominous. They presage a world where the internal workings, abuses, corruption, lies and crimes, especially war crimes, carried out by corporate states and the global ruling elite, will be masked from the public. They presage a world where those with the courage and integrity to expose the misuse of power will be hunted down, tortured, subjected to sham trials and given lifetime prison terms in solitary confinement. They presage an Orwellian dystopia where news is replaced with propaganda, trivia and entertainment.

The legal lynching of Julian, I fear, marks the official beginning of the corporate totalitarianism that will define our lives. Under what law did Ecuadorian President Lenin Moreno capriciously terminate Julian’s rights of asylum as a political refugee? Under what law did Moreno authorize British police to enter the Ecuadorian embassy — diplomatically sanctioned sovereign territory — to arrest a naturalized citizen of Ecuador? Under what law did former President Donald Trump criminalize journalism and demand the extradition of Julian, who is not a U.S. citizen and whose news organization is not based in the United States? Under what law did the C.I.A. violate attorney-client privilege, surveil and record all of Julian’s conversations both digital and verbal with his lawyers and plot to kidnap him from the embassy and assassinate him?

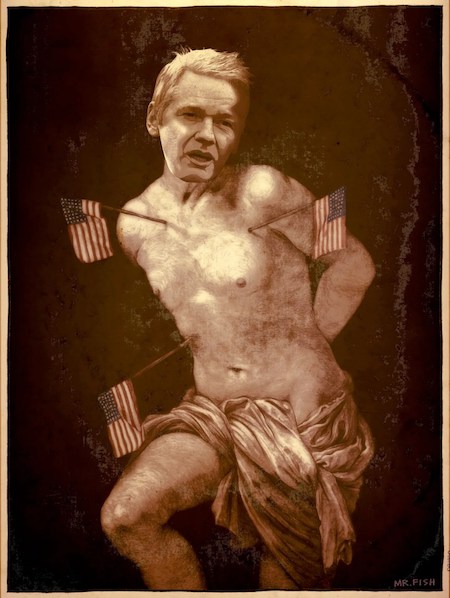

And Our Flags Are Still There – By Mr. Fish.

The corporate state eviscerates enshrined rights by judicial fiat. This is how we have the right to privacy, with no privacy. This is how we have “free” elections funded by corporate money, covered by a compliant corporate media and under iron corporate control. This is how we have a legislative process in which corporate lobbyists write the legislation and corporate-indentured politicians vote it into law. This is how we have the right to due process with no due process. This is how we have a government — whose fundamental responsibility is to protect citizens — that orders and carries out the assassination of its own citizens, such as the Muslim cleric Anwar al-Awlaki and his 16-year-old son. This is how we have a press which is legally permitted to publish classified information and our generation’s most important publisher sitting in solitary confinement in a high security prison awaiting extradition to the United States.

The psychological torture of Julian — documented by the United Nations special rapporteur on torture, Nils Melzer — mirrors the breaking of the dissident Winston Smith in George Orwell’s novel 1984. The Gestapo broke bones. The East German Stasi broke souls. We, too, have refined the cruder forms of torture to destroy souls as well as bodies. It is more effective. This is what they are doing to Julian, steadily degrading his physical and psychological health. It is a slow-motion execution. This is by design. Julian has spent much of his time in isolation, is often heavily sedated and has been denied medical treatment for a variety of physical ailments. He is routinely denied access to his lawyers. He has lost a lot of weight, suffered a minor stroke, spent time in the prison hospital wing — which prisoners call the hell wing — because he is suicidal, been placed in prolonged solitary confinement, observed banging his head against the wall and hallucinating. Our version of Orwell’s dreaded Room 101.

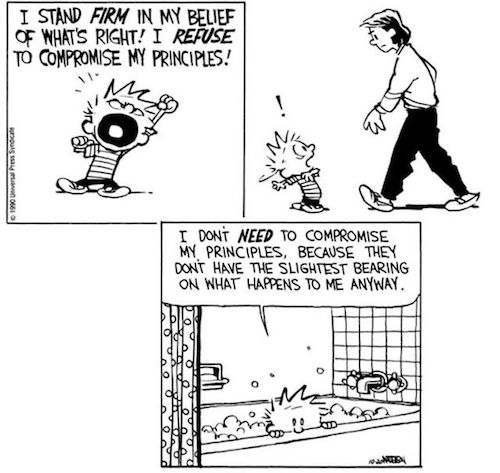

Cold Outside

Comedy can be a powerful remedy for the cultural insantity pic.twitter.com/frUVrLXB1D

— Glenn Diesen (@Glenn_Diesen) May 10, 2023

Vet

https://twitter.com/i/status/1656281389346480128

Pigeon loop

— Nature is Amazing ☘️ (@AMAZlNGNATURE) May 9, 2023

Mola mola

The Mola mola, also known as the ocean sunfish, is the heaviest known bony fish in the world. The largest recorded specimen measured 3.3 m (10 ft 10 in) in length and weighed 2,300 kg (5,100 lb).pic.twitter.com/BUYehfOuN4

— Wonder of Science (@wonderofscience) May 10, 2023

Support the Automatic Earth in virustime with Paypal, Bitcoin and Patreon.