Fred Lyon Land’s End San Francisco 1953

It’s like the mob rules the world.

• Global Inequality Much Worse Than Previously Thought (Ind.)

The gap between rich and poor across the globe is even wider than we currently think, according to a new analysis. Official estimates of inequality only take into account the money that the tax man sees, according to a recent paper by economists, Annette Alstadsæter, Niels Johannesen and Gabriel Zucman. But recent leaks of vast caches of documents from secretive jurisdictions such as Panama and Switzerland have given a more accurate picture of the sheer scale of global tax evasion – most of it carried out by very wealthy people. The three economists have used this trove of data to make a new assessment of the true wealth of the planet’s richest people, and thus a potentially more accurate measure of just how much richer they are than those at the bottom.

Until now, most assessments of wealth have relied on random tax audits, which do not pick up hidden offshore assets. This would not impact measurements global inequality if the poor dodged paying their dues as much as the rich did. In fact the rich evade many multiples more than the poor, according to Alstadsæter, Johannesen and Zucman. They studied three sets of documents: the Panama Papers, leaked from a Central American law firm which helped people set up tax haven companies; the Swiss Leaks, which revealed the dealings of HSBC’s Swiss subsidiary; and Scandinavian tax records, which give an unusually detailed picture of the income of citizens of that region. By combining the data sets they were able to make an estimate of the true size and scope of tax evasion, and thus inequality.

They found the wealthiest 0.01% in Norway, Sweden and Denmark evaded 30% of their personal taxes on average, compared to just 3% in the total population. In Norway, which has particularly detailed data, the super-rich, ie the top 0.1% of the wealth pyramid, are 30% wealthier than previously thought, when their hidden offshore assets are taken into account. This means they actually own 10% of all wealth, not the 8% previously thought. The authors posit that the scale of tax evasion is likely to be even worse in many other countries which have far less stringent tax disclosure rules. Only when we can truly assess how much personal wealth is stashed offshore will the scale of global equality be known, the economists say.

It’s also where this won’t last. You CAN go to far.

• The US Is Where the Rich Are the Richest (BBG)

It’s an excellent time to be rich, especially in the U.S. Around the world, the number of millionaires and billionaires is surging right along with the value of their holdings. Even as economic growth has slowed, the rich have managed to gain a larger slice of the world’s wealth. Globally, almost 18 million households control more than $1 million in wealth, according to a new report from the Boston Consulting Group. These rich folk represent just 1% of the world’s population, but they hold 45% of the world’s $166.5 trillion in wealth. They will control more than half the world’s wealth by 2021, BCG said. Rising inequality is of course no surprise. Reams of data have shown that in recent decades the rich have been taking ever-larger shares of wealth and income—especially in the U.S., where corporate profits are nearing records while wages for the workforce remain stagnant.

In fact, while global inequality is simply accelerating, in America it’s gone into overdrive. The share of income going to the top 1% in the U.S. has more than doubled in the last 35 years, after dropping in the decades after World War II (when the rich were taxed at high double-digit rates). The tide shifted in the 1980s under Republican President Ronald Reagan, a decade when “trickle-down economics” saw tax rates for the rich fall, union membership shrink, and stock markets spike. Now, those policies and their progeny have helped put 63% of America’s private wealth in the hands of U.S. millionaires and billionaires, BCG said. By 2021, their share of the nation’s wealth will rise to an estimated 70%. The world’s wealth “gained momentum” last year, BCG concluded, rising 5.3% globally from 2015 to 2016.

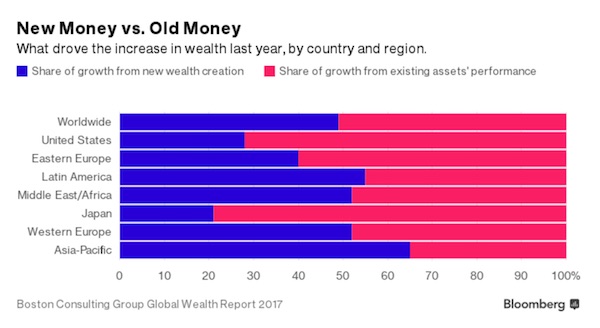

The firm expects growth to accelerate to about 6% annually for the next five years, in both the U.S. and globally. But a lot of that can again be attributed to the rich. The wealth held by everyone else is just barely growing. Where is all this wealth coming from? The sources are slightly different in the U.S. compared with the rest of the world. Globally, about half of new wealth comes from existing financial assets—rising stock prices or yields on bonds and bank deposits—held predominately by the already well-off. The rest of the world’s new wealth comes from what BCG classifies as “new wealth creation,” from people saving money they’ve earned through labor or entrepreneurship. In the U.S., the creation of “new” wealth is a minor factor, making up just 28% of the nation’s wealth increase last year. It’s even lower in Japan, at 21%. In the rest of the Asia Pacific region, meanwhile, two-thirds of the rise is driven by new wealth creation.

Whenever you see “rising pension wealth” anywhere these days, feel free to laugh out loud.

• UK Wealth Gap Rises As Home Ownership Falls (G.)

A fall in home ownership is fuelling the return of rising wealth inequality across Britain, it has emerged. Booming house prices in the run-up to the financial crisis had led to a decade-long fall in the uneven distribution of the country’s wealth. However, comprehensive new analysis of the UK’s wealth divisions has now found that the trend has gone into reverse. The study by the Resolution Foundation thinktank found that just a tenth of adults own around half of the nation’s wealth. The top 1% own 14% of the total. It warned that even this figure may be an underestimate because of the difficulties in calculating the assets of the super-rich. By contrast, 15% of adults in Britain have either no share of the nation’s record £11.1 trillion of wealth, or have negative wealth. The study found that wealth is distributed far less evenly than earnings or household income.

The thinktank measured wealth inequality using the “Gini coefficient”, with 0 being perfect wealth equality and 1 representing a society where a single person has it all. Wealth inequality was almost twice as high as earnings inequality. Despite the perception that wealth inequality has been rising for decades, the research found that the inequality of net financial and property wealth fell steadily between 1995 and 2005, with the Gini coefficient falling from 0.71 to 0.64. The fall was driven by high and rising home ownership, with more households benefiting from the pre-crisis property price boom. As a result, the proportion of property wealth owned by the bottom four-fifths of adults grew from 35% in 1995 to 40% in 2005.

However, home ownership has been falling steadily since the mid-2000s, with the wealth held by the bottom four-fifths of the population dipping as a result. Since the financial crisis, home ownership among the least wealthy 50% of the population has fallen by about 12%. Meanwhile, it has risen by 1% for the wealthiest tenth. The shift in property ownership further towards the richest has contributed to the widening of wealth inequality. Including private pensions, the Gini coefficient rose from 0.67 to 0.69 from 2006-08 to 2012-14. Total wealth across Britain, which includes private pensions, property, financial and physical wealth, rose in the wake of the financial crisis from £9.9tn in 2006-08 to £11.1tn in 2012-14. This has been fuelled by rising pension wealth. [..] Private pensions account for 40% of the wealth total – the largest share at £4.5tn.

Add this to all the other issues. A gutted society.

• UK Debt Bubble Returns Millions To Days Of 2008 Crash (G.)

Charities and financial advisers are calling on the government to use the Queen’s speech to address the “bubble” of unmanageable debt that households are rapidly accumulating. Unsecured consumer credit – including credit cards, car loans and payday loans – is this year expected to hit levels not seen since the 2008 financial crash. There has been concern in the Bank of England that consumer spending is being underpinned by debt, amid comparisons to the run-up to the financial crash. In addition, figures published last week show inflation reached a four-year high in May, meaning shopping is getting increasingly expensive, further intensifying the squeeze on household budgets.

Debt advisers are urging the government to make good on fulfil a promise in the Conservative manifesto to introduce a scheme where those in serious debt are protected by law from further interest, charges and enforcement action for up to six weeks. Many campaigners would like to see this extended further, to up to a year. “It would be excellent if the government in the Queen’s speech committed to helping households who are struggling with debt. It really is one of the great problems of the time that politicians have to grapple with,” said Peter Tutton, head of policy at debt charity StepChange. “We are seeing more and more households struggling just to make basic ends meet – to pay their rent, to pay their council tax, to pay their gas bill. We would like to see the government say, ‘we need to do something about this’.”

The charity estimates that 2.9 million people in the UK are experiencing severe financial debt in the aftermath of the recession. One reason is that many who lost their jobs found new jobs that were less well paid. Sara Williams, the author of Debt Camel, a blog advising on money problems, said: “The recent large increases in consumer credit … look alarming to debt advisers – very much like a bubble building up.”

I still want to see who paid for all this. It’s too fast and furious to be spontaneous.

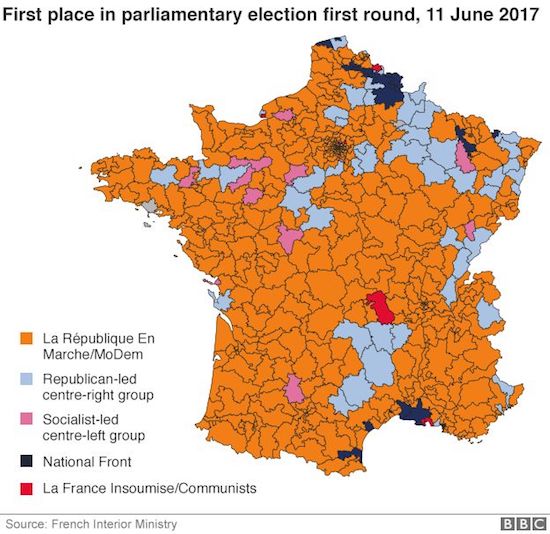

• Macron Set To Dynamite Parties That Have Dominated For Half A Century (AFP)

French voters went to the polls on Sunday for parliamentary elections set to hand a landslide victory to the centrist party of President Emmanuel Macron which would complete his stunning reset of national politics. The new assembly is due to be transformed with a new generation of lawmakers – younger, more female and more ethnically diverse – winning seats in the afterglow of Macron’s success in presidential elections last month. The scale of the change is forecast to be so large that some observers have compared the overhaul to 1958, the start of the present presidential system, or even the post-war rebirth of French democracy in 1945. It is also entirely unexpected: Macron was unknown three years ago and initially given little chance of emerging as president, but he and his 15-month-old Republic on the Move (REM) party have tapped into widespread desire for change.

“It’s like a science fiction movie for me,” REM candidate Beatrice Failles, a weapons inspector, writer and community activist, told AFP this week during campaigning in Paris. REM and its allies are forecast to win 400-470 seats in the 577-strong parliament, one of the biggest majorities post-war that would give the pro-EU Macron a free hand to implement his business-friendly programme. Sunday’s voting is the decisive second round of the election after a first round last weekend which was topped by REM. If confirmed, the victory will come at the expense of France’s traditional parties, the rightwing Republicans and Socialists, but also the far-right National Front which faces major disappointment. The Socialists are set to be the biggest victim of voters’ desire to reject establishment figures associated with years of high unemployment, terror attacks and lost national confidence.

Pollsters predict the party faces financial ruin with its strength in parliament falling from nearly 300 seats to around 20 after their five years in power under president Francois Hollande. The main concern for observers and critics is the likely absence of any political counterweight to Macron, leading some to forecast that opposition could be led through street protests or in the media. “Desperately seeking an opposition,” said the front page of Le Parisien newspaper on Saturday. [..] In the first round, REM won 32% of the total number of votes cast, but this represented only about 15% of the total number of registered voters. Around half of REM’s candidates are virtual unknowns drawn from diverse fields of academia, business or local activism. They include a mathematician, a bullfighter and a former Rwandan orphan. “You could take a goat and give it Macron’s endorsement and it would have good chance of being elected,” political analyst Christophe Barbier joked recently.

Brexit negotiations will be insane. Multiple governments will fall over this.

• Secret Plot To Oust Theresa May If She Fails To Deliver ‘Hard’ Brexit (Tel.)

Theresa May will face a “stalking horse” challenge to topple her as Prime Minister if she waters down Brexit, senior Tories have warned. Leading Eurosceptic MPs have told The Telegraph they are prepared to mount an immediate leadership challenge if Mrs May deviates from her original plan. The revelation comes after a torrid week for the Prime Minister in which she faced fierce criticism for her handling of the Grenfell Tower catastrophe. Conservative MPs – including Cabinet ministers – have concluded that Mrs May cannot lead them into the next election and they are now discussing when she could go. Eurosceptic MPs have warned that any attempt to keep Britain in the customs union and single market or any leeway for the European Court of Justice to retain an oversight function will trigger an “overnight” coup.

The plot has been likened to Sir Anthony Meyer’s 1989 challenge against Margaret Thatcher. One influential former minister said: “If we had a strong signal that she were backsliding I think she would be in major difficulty. The point is she is not a unifying figure any more. She has really hacked off the parliamentary party for obvious reasons. So I’m afraid to say there is no goodwill towards her.” They added: “What we would do is to put up a candidate to run against her, a stalking horse. You can imagine who would do it. It would be a rerun of the Margaret Thatcher scenario, with Anthony Meyer. Of course Meyer had no chance at all, but she lost support and she was gone. Bear in mind that she was a hell of a lot more popular than the current Prime Minister.” Another former minister said: “If she weakened on Brexit, the world would fall in… all hell would break loose.”

Hubris. England.

• Arrogance: The Greeks Had A Word For It (G.)

“I’m not absolutely certain of my facts, but I rather fancy it’s Shakespeare – or, if not, it’s some equally brainy lad – who says that it’s always just when a chappie is feeling particularly top-hole, and more than usually braced with things in general that Fate sneaks up behind him with a bit of lead piping.” So says the immortal Bertie Wooster at the start of the PG Wodehouse story Jeeves and the Unbidden Guest, and it is fairly certain that the hapless hero, in introducing his “fairly rummy” anecdote, is raking back through his sketchily absorbed education to reach for the word “hubris”, a word inherited from those brainy lads, the Greeks.

In the past week of political turmoil, “hubris” is a word that has been exercised rather more than usual. So have other Greek words, most notably “chaos” (the inchoate matter out of which the universe was formed, according to the poet Hesiod). And “crisis”, which began life meaning “a picking apart” or “a separation”; also a bringing to trial, or a moment of judgment. Though whether a universe will be formed from the current chaos, whether a judgment or a moment of clear-eyed seeing will drop neatly out of our present crisis, remains very much to be seen.

Bertie Wooster’s definition of hubris is a perfectly good one as far as our rather limited modern usage of the word goes. The lead piping came for the Tories, first in the shape of an exit poll on election night and, since then, perhaps in their slow, shocked and wholly inadequate reaction to the catastrophe at Grenfell Tower. But hubris, like chaos and crisis, began with a rather different meaning. For the Greeks, it did not simply signal that pride goes before a fall but, rather, something stronger and more morally freighted. Hubris described an act intentionally designed to dishonour its victim. Hubris was something expressly calculated to cause shame to the weak. Hubris was tinged with violence. Hubris was excessive and brutal.

The first of many. I know I’ve said that before, but these things can be hidden, until they cannot.

• Illinois Finances In ‘Massive Crisis Mode’ (AP)

It’s a new low, even for a state that’s seen its financial situation grow increasingly desperate amid a standoff between the Democrat-led Legislature and Republican Gov. Bruce Rauner. Illinois already has $15 billion in overdue bills and the lowest credit rating of any state, and some ratings agencies have warned they will downgrade the rating to “junk” if there’s no budget before the next fiscal year begins July 1. Rauner on Thursday said he was calling lawmakers back to Springfield for a special session, after the Legislature adjourned May 31 without approving a state spending plan — the third straight year lawmakers have been unable to agree on a budget. Legislators are due at the Capitol on Wednesday, and Rauner said the session will continue through June 30 or until the two sides have a deal.

Lawmakers from both parties have acknowledged Illinois needs to raise taxes to make up for revenue lost when a previous tax hike expired, leaving the state on pace to take in $6 billion less than it is spending this year — even without a budget. Rauner, a former businessman who is seeking a second term in 2018, wants Democrats to approve changes he says are needed to improve Illinois’ long-term financial health before he’ll support a tax increase. Among them are term limits for lawmakers, a four-year property tax freeze and new workers’ compensation laws that would reduce costs for employers. Democrats say they’re willing to approve some items on Rauner’s list, but that what he’s demanding keeps changing or goes too far and would hurt working families. Senate Democrats also note that they approved a $37 billion budget with $3 billion in cuts and an income tax increase in May. The House has not taken up that plan.

In the absence of a budget, funding has been reduced or eliminated in areas such as social services and higher education. Many vendors have gone months without being paid. And increasingly, they’re filing lawsuits to try to get paid. The courts already have ruled in favor of state workers who want paychecks, as well as lottery winners whose payouts were put on hold. Transit agencies have sued, as has a coalition of social service agencies, including one that’s run by Rauner’s wife. Health care plans that administer the state’s Medicaid program also asked a federal judge to order Mendoza’s office to immediately pay $2 billion in unpaid bills. They argued that access to health care for the poor and other vulnerable groups was impaired or “at grave risk” because the state wasn’t paying providers, causing them to leave the program.

Judge Joan Lefkow ruled June 7 that Illinois isn’t complying with a previous agreement to pay the bills and gave attorneys for the providers and the state until Tuesday to work out a level of payment. Mendoza says whatever that amount will be, it will likely put Illinois at the point where 100% of revenues must be paid to one of the office’s “core priorities,” such as those required by court order. And if this lawsuit doesn’t do it, the next court ruling against the state will. Then, she’s not sure what will happen, other than more damage. “Once the money’s gone, the money’s gone, and I can’t print it,” Mendoza said.

A very useful concept. Reference to Minsky would be in order, though.

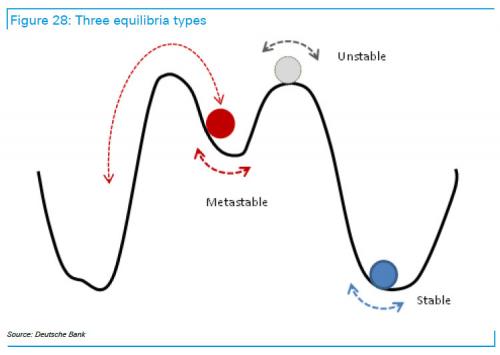

Big changes threaten to explode not when uncertainty begins to rise, but when it is withdrawn. Excessive determinism is almost always the biggest enemy of stability. This seeming contradiction is behind the concept of metastability which captures the mode of market functioning in the last years. Imagine you have to balance a long stick on your finger. By placing it vertically on your fingertip, the stick could fall either left or right from its initial position because standing upright is unstable. However, in trying to keep the stick vertical, you instinctively (and randomly) wiggle your finger. The added randomness (noise) acts as a stabilizer of an otherwise unstable equilibrium. So long as the noise is administered carefully, the stick remains vertical, or metastable. The withdrawal of noise becomes destabilizing.

In general, there are three types of equilibria to distinguish: stable, unstable and metastable. The bottom of the valley is stable; top of the hill is unstable; a dimple at the top of the hill is metastable. Metastability is what seems stable, but is not – a stable waiting for something to happen. Avalanche is a good example of metastability to keep in mind – a totally innocuous event can trigger a cataclysmic event (e.g. a skier’s scream, or simply continued snowfall until the snow cover is so massive that its own weight triggers an avalanche). Complacency is a source of metastability. It has a moral hazard inscribed into it. Complacency encourages bad behavior and penalizing dissent – there is a negative carry for not joining the crowd, which further reinforces bad behavior.

This is the source of the positive feedback that triggers occasional anxiety attacks, which, although episodic, have the potential to create liquidity problems. Complacency arises either when everyone agrees with everyone else or when no one agrees with anyone. In these situations, which capture the two modes of recent market trading, current and the QE period, the markets become calm and volatility selling and carry strategies define the trading landscape. But, calm makes us worry, and persistent worrying causes fear, and fear tends to be reinforcing. Persistence of low volatility causes misallocation of capital. This is how complacency leads to buildup of risk – it is the avalanche waiting to happen. For a given level of uncertainty, on the risk/reward curve investors settle at a point that corresponds to their risk limits. This position is determined by the volatility cone on the risk frontier, its width commensurate with volatility.

Insanely positive still.

• Young Greeks Can’t Name EU Achievements (K.)

An 84% majority of Greeks aged between 16-25 say that peace is the most important result of the country’s membership in the EU, according to an upcoming survey, which also found that 24% are unable to name three or more achievements of the 28-member club. The online survey, which will be published in full on Wednesday, was conducted by pro-European think tank To Diktio (The Network) with the help of MAD TV on a sample of 1,173 high-school and university students using a multiple-choice questionnaire. Asked if they think that Greece’s membership of the 28-member bloc improves their daily life, just over 37% gave a negative answer.

Whereas most of those who took part in the poll said they are in favor of closer European integration, only a minority said they consider the establishment of welfare states a significant contribution of the EU process. Meanwhile, 86% agreed it is “very significant” that they can travel, live, study or work freely across the EU, while 72% said it is positive that “we have a common strong currency which makes our transactions easier.” Finally, 83% said that the union can play a key role in “protecting fundamental rights regardless of gender, race, religion, disability or age.” Greece joined the EEC, the predecessor of today’s EU, in 1981.

Just to add the proper insult, the picture below comes from Yuan Yang on Twitter: “Five min into this international property fair & I’ve already been offered to emigrate to the UK, Australia & get my kids into school in US”.

While Syrians kids face abuse, Greece offers passports and ‘Easy Living’ to wealthy Chinese. Mankind has fully lost its compass.

• Abandoned and Abused: Syrian Refugee Children On Greek Detention Island (G.)

Rasha went missing late afternoon last Saturday. Her peers describe hanging out as normal with the 20-year-old Syrian in the Greek refugee detention camp. Then she vanished. Last Tuesday her friend Amira, 15, received a flurry of images on her phone. Rasha was lying naked in bed with a man. Superimposed upon his head were grotesque cartoon faces and an accompanying message from the anonymous caller: “I promise I will kidnap you also.” This was far from being the first threat that the teenage refugee from the Syrian city of Qamishli has received since arriving on the Aegean island of Chios six months ago. Existence in the razor-wire-fenced detention centre, a former factory known as Vial, deep within the island’s mountainous interior, is fraught for a child hoping for a fresh start in Europe, preferably the UK.

Fellow refugees intimidate her routinely. “Men say they will attack me, they try and trap us by saying don’t go to Souda [another refugee camp on the island] or go into the town. They say: ‘If I see you there, I will attack you. I will kidnap you and kill you.’” Amira is among scores of unaccompanied minors on Chios who are eligible to claim asylum in the UK under the so-called Dubs amendment. A year ago the UK government announced it would urgently offer sanctuary to a sizeable proportion of Europe’s vulnerable child refugees, a figure widely understood to be about 3,000 minors until, in February, the Home Office unexpectedly stopped the scheme after helping just 480, one child for every 130,000 UK residents. Not a single unaccompanied minor has been transferred from Greece to the UK under the Dubs scheme.

On Tuesday the last chance to reopen Dubs will be heard in the high court in London, a legal challenge that describes the Home Office’s premature closure of Dubs as unlawful and “seriously defective”. The three-day hearing holds potentially profound ramifications for Chios, which is separated by a slim strip of water from Turkey, so close that Amira can see its summer homes and factories from the island’s coast. Beyond lie the borders with Syria and Iraq from where each day people board a motley flotilla of rubber boats and dinghies to attempt the short but perilous crossing to Europe’s gateway. What those that successfully make the crossing quickly encounter could hardly be further from their aspirations of a civilised and safe world. The child refugees of Chios describe being stabbed by local people, police beatings, attacks by the far right, knife fights among drunken adult asylum seekers, and sleepless nights in flimsy tents on pebble beaches.