Tesla Studios Engineering class, Wanganui Technical College, New Zealand Sep 26 1916

Today, we give you another little gem from Nelson Lebo, our dear friend in Wanganui, New Zealand, who equates the inertia in debt (economy) with that of heat (climate), a smart idea that makes a lot of – explanatory – sense. But first, here’s a picture of Nicole and I back in April 2012 (that’s a kitten named Billy T I’m holding in my arms) at the Lebo home that Nelson restored from basically a bare skeleton and which he talks about in this article, in Castle Cliff, one on New Zealand’s poorest neighborhoods. The house is right by a beach with black volcanic sand and – I kid you not – a local seal slash resident beachmaster who was keeping watch lying on top of these huge pieces of eucalyptus driftwood.

Here’s Nelson:

Nelson Lebo: Today is the winter solstice in the southern hemisphere – “the shortest day of the year.” This weekend marks the time of year when hours of daylight are shortest and hours of darkness are longest. For a home like ours that is powered mostly by sunlight energy, this is not good news. But every cloud has a silver lining. Here’s what I mean.

Although the end of June marks the time when hours of daylight are shortest, it is not necessarily the coldest time of year – that comes later. In other words, as June turns to July and temperatures drop on average, the days actually get longer. This may sound counterintuitive: more sun but colder. What’s up with that?

It all has to do with lag time, or what may also be called thermal momentum or seasonal inertia. Put simply, there is a delay in the system between energy input (amount of sunlight) and how we experience that energy (air temperature).

Most of the seasonal delay is influenced by large bodies of water: oceans, seas, very big lakes. These large bodies of water are the thermal mass of the planet – they absorb heat slowly and release it slowly. Sunlight energy is loaded into the world’s waters only for it to be released at a later date.

On a very large scale, most climate scientists say that much of the excess heat energy that the Earth is currently absorbing is going into the world’s oceans. They refer to oceans as “heat sinks.” The major concern with this situation is that the ‘sinks’ will become ‘sources’ in the future. In other words, the chickens (massive amounts of heat energy) will come home to roost (wreak havoc on us with extreme weather events).

While this energy is being stored in the oceans everything appears to us to be OK. It is a lot like running up a large debt. I suspect there were few complaints in Wanganui, New Zealand, while council was running up our current debt while holding rates artificially low. Only now do we hear complaints.

This is the same strategy that U.S. President Bush (the second) used with the Iraq War. He did not tax Americans to pay for the war, but put it on the national credit card. There were few complaints at the time, but now after a trillion dollars we hear complaints about the “unsustainable levels of federal debt” in America.

Similarly, climate scientists continue to warn of “unsustainable levels of carbon debt,” but I suspect more and more people will echo them in the future, especially because another and perhaps more ominous delay is also built into the climate system.

Once fossil fuels are burned the carbon dioxide remains in the atmosphere for decades causing more and more warming. Many scientists say that even if we stopped burning all coal, oil and gas today that we would continue to experience the effects for the better part of most Wanganui Chronicle readers’ lifetimes.

In the same way, even if WDC balanced the city’s budget next year we will all still be paying for debts racked up in the past and the accrued interest for years to come.

OK, now for the silver lining … for our house anyway. Heading into July and through August, as temperatures remain low, the increasing minutes of sunlight every day make our solar home that much warmer. Additionally, we use a ‘delay system’ inside our home to capture the daytime warmth and release it at night.

This delay is, of course, thermal mass and it acts just like the Tasman Sea outside our front door: absorbing heat slowly when it is in abundance and releasing it slowly when it is in deficit.

Understanding complex systems and their associated delays, oscillations, changes and feedback loops helps us to ‘see’ into the future and plan accordingly. This way of seeing the world is called “systems thinking,” and is at the heart of eco-design. It has helped us design and renovate an inefficient old villa into a low-energy eco-home, and it has the potential for humanity to come to grips with global climate change and unsustainable debt.

Human beings are notoriously bad at looking toward the future and planning ahead. Systems thinking is a tool to help us all look toward an increasingly volatile and indebted future, ask if it is the future we want for our children, and then decide whether we have the courage to do anything about it today.

Update: Nelson sent me a picture of Billy T. and her little sister:

• Global Drag Threatens Worst US Export Performance In 60 Years (Wiley)

Ever since an über-strong U.S. dollar crushed the export sector in the mid-1980s, the U.S. economy hasn’t looked quite the same. Exports picked up towards the end of the decade, helped along by the G-7’s historic 1985 powwow at New York’s Plaza Hotel, which led to a coordinated effort to slam back the dollar. Nonetheless, some export industries never fully recovered. Fast forward to the present, and export performance may soon be as noteworthy as it was 30 years ago. Risks to the global economy (and exports) include turmoil in oil-producing nations, credit markets that are teetering in China and comatose in Europe, and the backside of Japan’s April sales tax hike. Worse still, export growth already lags behind every one of the past ten expansions, even the 1980s, thanks to a drop in the first quarter:

The chart shows that exports are no longer distinct from other parts of the economy (nearly all of them) that haven’t measured up to a “normal,” credit-infused, post-World War 2 business cycle. Together with emerging global risks, it begs the question of whether sagging exports can drag the U.S. into recession. We think it’s too early to make that call [..] Nonetheless, export performance bears watching, and especially as the first quarter’s result mirrored a big drop in corporate profits. Falling export volumes surely contributed to the weak profits result. Moreover, profits are an excellent leading indicator, as shown below:

Should exports and profits weaken further, that would cause us to reevaluate risks in both financial markets and the economy. Extra chart (free) Some readers may prefer this version of the export chart, with each cycle labeled:

Read more …

“The sooner and more predictably the Fed exits its extraordinary monetary accommodation, the sooner businesses can get back to business and labor can get back to work.”

• The Asset-Rich, Income-Poor Economy (WSJ)

“Balance-sheet wealth is sustainable only when it comes from earned success, not government fiat,” is the ugly truth that former Fed governor Kevin Warsh (amazing what truths come out after their terms are up) and hedge fund billionaire Stan Druckenmiller.

Economist Richard Koo diagnosed Japan’s crash in the early 1990s and subsequent two decades of economic malaise as a “balance-sheet recession.” That conclusion wasn’t lost on the Federal Reserve during the financial crisis of 2008-09. The Fed engineered an emergency response to craft what can best be described as a balance-sheet recovery. At its policy meeting earlier this week, the Fed made clear that it’s scarred, if no longer scared, by the crisis. Extraordinarily loose monetary policy will continue in force. While the Fed’s monthly asset purchases will decline, short-term interest rates will remain pinned near zero. And long-term rates need not move higher—the Fed assures us—even with improving inflation dynamics, credit markets priced-for-perfection, and stock prices at record levels. The aggregate wealth of U.S. households, including stocks and real-estate holdings, just hit a new high of $81.8 trillion.

That’s more than $26 trillion in wealth added since 2009. No wonder most on Wall Street applaud the Fed’s unrelenting balance-sheet recovery strategy. It’s great news for those households and businesses with large asset holdings, high risk tolerances and easy access to credit. Yet it provides little solace for families and small businesses that must rely on their income statements to pay the bills. About half of American households do not own any stocks and more than one-third don’t own a residence. Never mind the retirees who are straining to make the most of their golden years on bond returns. The Fed’s extraordinary tools are far more potent in goosing balance-sheet wealth than spurring real income growth. The most recent employment report reveals the troubling story for Main Street. While 217,000 jobs were created in May, incomes for most Americans remain under stress, with only modest improvements in hours worked and average hourly earnings.

It’s taken a full 76 months for the number of people working to get back to its previous peak, a discomfiting postwar record. Unfortunately, during the same period the U.S. working-age population increased by more than 15 million people. That’s why the share of the working-age population out of work is now at a 36-year high. There are now more Americans on disability insurance than are working in construction and education, combined. Meanwhile, corporate chieftains rationally choose financial engineering—debt-financed share buybacks, for example—over capital investment in property, plants and equipment. Financial markets reward shareholder activism. Institutional investors extend their risk parameters to beat their benchmarks. And retail investors belatedly participate in the rising asset-price environment. All of this lifts balance-sheet wealth, at least for a while. But real economic growth—averaging just a bit above 2% for the fifth year in a row—remains sorely lacking. [..]

Balance-sheet wealth is sustainable only when it comes from earned success, not government fiat. Wealth creation comes from strong, sustainable growth that turns a proper mix of labor, capital and know-how into productivity, productivity into labor income, income into savings, savings into capital, capital into investment, and investment into asset appreciation. The country needs an exit from the 2% growth trap. There are no short-cuts through Fed-engineered balance-sheet wealth creation. The sooner and more predictably the Fed exits its extraordinary monetary accommodation, the sooner businesses can get back to business and labor can get back to work.

Read more …

“Each of the last five great merger waves on record” – going back more than 125 years – “ended with a precipitous decline in equity prices”

• Stocks Are ‘Dangerously Overvalued,’ M&A Deals Suggest (MarketWatch)

Here’s one sign a significant stock market decline might occur sooner rather than later: the rapid acceleration of recent merger and acquisition activity. This past week saw news of another big deal, led by medical-device maker Medtronic’s announcement of its $43 billion bid to acquire rival Covidien. At the current pace, M&A deals could reach $3.51 trillion this year, the most since 2007, according to data provider Dealogic. It wasn’t a fluke that a surge in M&A activity coincided with that year’s market top, according to Matthew Rhodes-Kropf, a professor at Harvard Business School and an expert in the field. “Each of the last five great merger waves on record” – going back more than 125 years – “ended with a precipitous decline in equity prices”, he says.

Some experts have found that merger activity surges when stocks are richly priced, at least in part because companies can use their inflated shares to pursue acquisitions. “The marked increase in recent M&A activity is one more piece of evidence that the market is dangerously overvalued,” says Dennis Mueller, an emeritus economics professor at the University of Vienna in Austria who has studied M&A cycles in the U.S. as well as overseas. Of course, shareholders of the company being acquired rarely complain, since the acquisition price usually represents a huge premium. Covidien’s stock this past week surged as much as 29%, compared with where it closed the prior week, for example.

Does the recent M&A boom mean you should immediately get out of stocks? Not necessarily, since the volume of M&A activity isn’t an exact market-timing tool. Mueller says it’s possible that the market is at the beginning of a long M&A boom that could last a few more years. Rhodes-Kropf agrees that the recent M&A surge doesn’t necessarily mean a bear market is imminent. “Everyone tends to call the bubble too soon,” he says, adding that his hunch is that this merger trend could very well last a while longer.

Read more …

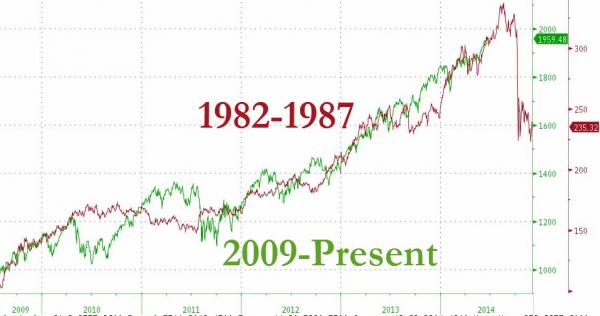

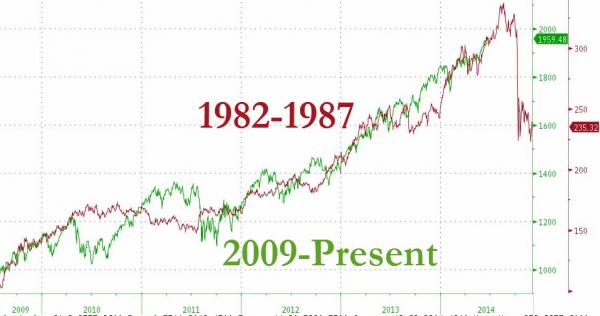

• It’s Never Different This Time – 1987 or 2014 (Zero Hedge)

While the price analogs of the last few year’s exuberance in US equity markets are enough to worry all but the most systemically bullish “believer”; we suspect the following article from the LA Times In the Spring of 1987 will raise a few hairs on the back of the neck of perpetually optimistic extrapolator…

It’s never different this time..

“One of the largest bullish factors is burgeoning worldwide liquidity, thanks to expansive monetary policies by central banks. That has helped fuel a surge of foreign investing that could propel US stocks higher, regardless of what happens to the American economy, some analysts say… Low interest rates also help stocks by making Treasury securities, certificates of deposit and other interest-paying investments less attractive. The sluggish economy, meanwhile, keeps the Federal Reserve from driving up interest rates and prevents inflation from overheating… Also, the sluggish economy–by keeping manufacturing rates low–discourages money from flowing out of financial assets into such investments as factories and machinery.”

– LA Times, March 8, 1987; a few months before the October 1987 crash

Read that again!!

Never different.

Read more …

I’ve said this often about people just like Yellen, especially Bernanke. And I’ve always been hesitant to declare them incompetent; they have access to far more data than we do, and they have tons of smart people working for them.

• Janet Yellen: Either Lying or Incompetent (Phoenix)

Janet Yellen just cemented her status as the third member of the unholy triumvirate of Fed Presidents: Greenspan, Bernanke, and now Yellen. Greenspan was so afraid of deflation that he hired Bernanke (an alleged deflation expert) in the early 2000s. Between the two of them, they created bubbles in virtually every asset class on the planet. Deflation did hit for a total 12-14 months (late 2007-early 2009). It was enough to terrify Bernanke to the point that he spent well over $3 trillion (an amount larger than all but a handful of countries’ GDPs), cut interest rates to zero (punishing savers) and generally destroyed the US economy… all in the quest of propping up a few crony capitalist banks that were sitting on several hundred trillion dollars’ worth of derivatives trades. Yellen took over the Fed in early 2014 and has since proven herself to be just as misguided or dishonest as Bernanke was. Among other things…

• She claims there are no signs of stocks being overvalued, despite the fact that by virtually every metric in existence the market is SEVERELY overvalued.

• She first claimed inflation was too low, and now claims that rising prices are just “noise” while meat prices hit record highs, gas prices hit their highest levels since 2008, home prices are as unaffordable as they were in 2005-2006, healthcare costs are up double digits and energy prices are rising.

It’s an astounding series of comments, coming from the woman in charge of US monetary policy. What’s even more astounding is that it appears Yellen actually believes this stuff, which indicates that she either A) doesn’t read the news or look at price charts for items or B) has no idea how to interpret data or C) is a liar. This is the same story we had with Bernanke and Greenspan, both of whom oversaw epic meltdowns in the financial system. Yellen will be no different.

Read more …

” … the more they print, the more inequality there is, the weaker the economy will become”

• Marc Faber: Fed Policies Have Been A ‘Catastrophe’ (CNBC)

The Federal Reserve [announced] another $10 billion worth of tapering on Wednesday, reducing the size of its monthly asset purchase program to $35 billion, from $85 billion at the height of the program. And though the hyper inflation many warned would be a consequence of its stimulative policies has not yet reared its head, Fed skeptics like Marc Faber still have strong words for the central bank. “It’s a catastrophe,” Faber said Tuesday on CNBC’s “Futures Now.” “What the Fed has done is to lift asset prices, and the cost of living. In the meantime, as the cost of living increases, are higher than the wage increases, the typical American household income is going down in real terms.”

Faber, editor of the “Gloom, Boom & Doom Report,” consequently believes that rising American inequality is a result of the Fed’s actions. “So the Fed is boosting asset prices. It leads to less affordability, people can’t buy their homes anymore in the lower income group. Except, of course, the well-to-do people, they can buy homes because their asset prices have gone up and they own the assets,” Faber said. “And so the more they print, the more inequality there is, the weaker the economy will become.”

Read more …

• The Shortest Economics Textbook Ever (Zero Hedge)

1. 95% of economics is common sense You don’t need a degree to understand it. We’ve got this profession wrong; a lot of professional economists think what they do is too difficult for ordinary people. You’d be surprised how often these people are stupid enough to say things, at least in private, like ‘you wouldn’t understand what I do even if I explained it to you’. If you cannot explain it to other people, you have the problem.

2. Economics is not a science Despite what the experts want you to believe, there is more than one way of ‘doing’ economics People have been led to believe that, like physics or chemistry, economics is a ‘science’, in which there is only one correct answer to everything; thus non-experts should simply accept the ‘professional consensus’ and stop thinking about it.

3. Economics is politics Economic arguments are often justification for what politicians want to do anyway Economics is a political argument. It is not – and can never be – a science. Behind every economic policy and corporate action that affect our lives – the minimum wage, outsourcing, social security, food safety, pensions and whatnot – lies some economic theory that either has inspired those actions or, more frequently, is providing justification of what those in power want to do anyway.

4. Never trust an economist It is one thing not to foresee the financial crisis; it’s another not to have changed anything since. Most economists were caught completely by surprise by the 2008 global financial crisis. Not only that, they have not been able to come up with decent solutions to the ongoing aftermaths of that crisis. Given all this, economics seems to suffer from a serious case of megalomania. The financial crisis has been a brutal reminder that we cannot leave our economy to professional economists and other ‘technocrats’. We should all get involved in its management – as active economic citizens.

5. We have to reclaim economics for the people It’s too important to be left to the experts alone. You should be willing to challenge professional economists (and, yes, that includes me). They do not have a monopoly over the truth, even when it comes to economic matters. Like many other things in life – learning to ride a bicycle, learning a new language, or learning to use your new tablet computer – being an active economic citizen gets easier over time, once you overcome the initial difficulties and keep practicing it. Unless you are willing and able to challenge the professionals, challenge the experts, what’s the point of having a democracy?

Read more …

• 13 Facts They Don’t Tell You About Economics (Zero Hedge)

Yesterday, Ha-Joon Chang exposed the shortest economics textbook ever. Today the Cambridge University Economics professor uncovers everything you didn’t know about economics (in 13 simple points)…

1. Economics Was Originally Called ‘Political Economy’ – Economics is politics and it can never be a science. Yet the dominant neoclassical school of economics succeeded in changing the name of the discipline from the traditional ‘political economy’ to ‘economics’ at the turn of the 20th Century. The Neoclassical school wanted economics to become a pure science, shorn of political (and thus ethical) dimensions that involve subjective value judgments. This change was a political move in and of itself.

2. The Nobel Prize In Economics Is Not A Real Nobel Prize – Unlike the original Nobel Prizes (Physics, Chemistry, Physiology, Medicine, Literature and Peace), established by the Swedish industrialist Alfred Nobel at the end of the nineteenth century, the economics prize was established by the Swedish central bank (Sveriges Riksbank) in 1968 and is thus officially called the Sveriges Riksbank Prize in Economic Sciences in Memory of Alfred Nobel. Members of the Nobel family are known to have criticized the Swedish central bank for giving prizes to free-market economists of whom their ancestor would have disapproved.

7. Capitalism Did Best Between The 1950s And The 1970s, An Era Of High Regulation And High Taxes – Despite what we hear these days about the detrimental economic effects of high taxes and strong government regulation, the advanced capitalist economies grew the fastest between the 1950s and the 1970s, when there were a lot of regulations and high taxes.Between 1950 and 1973, per capita income in Western Europe grew at an astonishing rate of 4.1% per year. Japan grew even faster at 8.1%, starting off the chain of ‘economic miracles’ in East Asia in the next half a century. Even the US, the slowest-growing economy in the rich world at the time, grew at an unprecedented rate of 2.5%. Per capita income for these economies collectively have since then managed to grow at only 1.8% per year between 1980 and 2010, when they cut taxes for the rich and deregulated their economies.

13. Most Poor People Don’t Live In Poor Countries – Currently, around 1.4billion people – or about one in five people in the world – live with less than $1.25 per day, which is the international poverty line (below which survival itself becomes a challenge). But most poor people do not live in poor countries. Over 70% of people in absolute poverty actually live in middle-income countries. As of the mid-2000’s, over 170 million people in China (around 13% of its population) and 450 million people in India (around 42% of its population) lived with incomes below the international poverty line. These show the enormity of challenges that the two most populous countries face.

Read more …

• Spot The Oxymoron: “Growth Down, Optimism Up” (Simon Black)

With a nod to the absurd, Federal Reserve Chair Janet Yellen freely admitted earlier this week that the Fed really has no idea what’s going to happen to the economy. Bear in mind this is the person who controls interest rates in the United States, effectively setting the ‘price of money’ for the most widely used currency in the world. This is key– because the price of money (interest rates) influence the prices of so many other things. Real estate. Business investment. Automobile sales. Agricultural commodity prices. Oil prices. Etc. Of course, there’s a knock-on effect. Consider, for example, how many products and services are influenced by the price of oil… fertilizers, plastics, shipping, etc. And then how many products and services are influenced by the price of shipping… like everything in the world that’s imported/exported. So in setting the price of money, Ms. Yellen is influencing the price of just about everything.

Yet she and her fellow members of the Federal Open Market Committee (FOMC) admittedly don’t have a clue where the economy’s going. This stands in stark contrast to what investors are used to. Back in the 90s, Fortune put former Fed Chair Alan Greenspan on the cover with a headline– “It’s HIS economy, stupid”. That’s how clear it was back then. Greenspan was the benevolent wizard… the ‘maestro’ in masterful command pulling the strings of the largest economy in the world. And investors had all the [misplaced] confidence in the world in this arrangement. So you’d think that with such a demonstration of ignorance that investors would be heading for the hills, right? Not so. The big banks and institutional investors (who appointed most of the FOMC members to begin with) rewarded the Fed’s stunning admission and lack of foresight with… record high stock prices.

If I could quote our long-lost Billy Mays– BUT WAIT, THERE’S MORE! The Fed also reduced its GDP growth forecasts for the US economy from 2.9% to 2.2%. In case you’re not too fast on the ‘calc’ icon, that’s a 24% proportional reduction in GDP growth. Not exactly a drop in the bucket. AND, of course, there’s the recent data that inflation has ticked up, even according to their own official numbers. Of course Ms. Yellen proceeded to downplay the inflation, writing it off as ‘noise’. So this morning I received yet another analysis from a large private bank I deal with; the report’s headline– FED: Growth down, optimism up. Hmmm. Spot the oxymoron here (OK fine, paradox). Growth is down. Inflation is up. The grand wizards don’t have a clue. Yet people are excited about this?

Read more …

Yay! Bank run!

• Bank Run Prompts Bulgarian Central Bank To Seize Control (Reuters)

A run on Corporate Commercial Bank (Corpbank) prompted Bulgaria’s central bank to take control of the country’s fourth-largest lender on Friday and its governor appealed to depositors to stay calm. The Bulgarian National Bank (BNB) said it would handle Corpbank’s operations for three months and removed its management and supervisory board after the run, which was sparked by media reports of shady deals involving the bank. The BNB said it acted after Corpbank said on Friday morning it had stopped all payments and bank operations due to a liquidity drain. The central bank said Corpbank was not bankrupt and other lenders in the country were safe from the effects. “As you know, there has been a lot of talk about the bank and one of its shareholders, which triggered bank runs,” central bank governor Ivan Iskrov said at a news conference. “It is very important to be very careful when we talk about banks. Let’s not tear down our house alone unnecessarily.”

“Let me make this very clear. Corporate Commercial Bank is not a bankrupt bank. We are acting swiftly to avoid a bankruptcy,” said Iskrov. He declined to give further details of the bank’s problems and said supervisors would carry out a full audit of its books. The central bank action did not stop dozens of people from queuing outside the main office of the bank in the capital Sofia on Friday, and credit default swaps on the country’s debt hit a six-month high on fears of contagion. Sofia’s blue-chip shares index closed at its lowest level since February. The central bank blocked depositors from withdrawing cash after it took control. “We are worried, because my husband and I have deposits there in euros and in U.S. dollars,” said Lilia Polova, editor at a lifestyle magazine. “These are our family savings. He was reading newspapers and was asking me to take our money out of there … but I waited.”

Read more …