Roy Lichtenstein Crying girl 1964

Biden + Kamala vaccines

https://twitter.com/i/status/1405804353240420353

Dr. Byram Bridle

Scary if true… pic.twitter.com/KArX6DpKdA

— Heidegger (@heidegger79) June 18, 2021

Has India reached herd immunity?

• Kids, Adults Have Similar Seroprevalence (HT)

The exposure of children to Covid-19 has been similar to adults’, a serological surveillance study spearheaded by the All India Institute of Medical Sciences (AIIMS) has found, addressing fears that a third wave of Covid-19 could disproportionately affect children. The seroprevalence, presence of virus-fighting antibodies against Sars-CoV-2, among children was 55.7% across five study sites, in comparison to 63.5% among adults — the difference was judged to be statistically insignificant. In Delhi, which was one of the five sites for the study, the researchers found that 74.7% of the population – both children and adults – had been exposed to the infection. This is much higher seroprevalence than the state government’s survey from January where 56.1% were found to have antibodies against the virus.

The samples for the AIIMS study were collected between April and May, and would not have detected antibodies of those who got the infection during the second wave. There was also an urban-rural divide in prevalence in Delhi-NCR. As compared to the 74.7% in urban settlements of South Delhi, the prevalence was 59.3% in villages of Delhi and Ballabhgarh. “Results show that a large majority of the population had already been infected by the time we conducted the study at Delhi urban site which belongs to lower and middle socioeconomic strata population and very congested neighbourhood,” the study said. With all locations other than Delhi being rural, the average seroprevalence in rural areas stood at 58.8% as per the study. The highest seroprevalence was found in Gorakhpur, Uttar Pradesh where 87.9% of the people had been exposed to the infection.

More importantly, the seroprevalence among children and adults in the same regions were similar. “Wherever the prevalence of antibodies was high among the adults, it was high among the children, busting the myth that so far children have been less affected. The thing is, the binding of the virus to the human cell receptors is not very good in children and hence they mostly develop either asymptomatic or mildly symptomatic infection,” said Dr Sanjay Rai, one of the authors of the study and the head of the department of community medicine at the AIIMS. He added, “People have been saying that after the young, the third wave will impact children more. The fact is most of them have been already exposed to the infection along with their families. And, numerous studies have now shown that natural infection can provide better and longer protection against a second infection.”

More India.

• Avalanche of Numbers (D’Eramo)

In the last few weeks, a report has been circulating in the online fora of the ultranationalist Indian diaspora. Its author, Shantanu Gupta, an ideologue closely associated with Prime Minister Narendra Modi’s Bharatya Janata Party, ‘tracked the coverage of the COVID-19 pandemic in India of 6 global publications – BBC, the Economist, the Guardian, Washington Post, New York Times and CNN – via web search results over a 14-month period’. His argument is that these outlets have distorted and exaggerated the effects of coronavirus in India. On what does Gupta base this thesis? On the fact that all these sources have used absolute numbers rather than cases per million. By the latter metric, we are told, ‘India is one of the better performing countries on the global map’. Here he is undoubtedly correct.

Countless times this spring we’ve seen the dramatic, record-shattering daily death counts from India, as it reportedly became the country with the third highest Covid deaths in the world. A quick look at these records: deaths in India reached their highest level on May 18th, with 4,525 per day. The USA topped this morbid leaderboard on January 12th with slightly lower numbers: 4,466. The UK reached its peak on January 20th, with 1,823 daily deaths; Italy on December 3rd with 993.

The problem is, India’s population stands at 1.392 billion. The USA’s is just 332 million, while the UK and Italy have 68 and 60 million respectively. If, then, we were to count the number of deaths per million inhabitants, ranking the highest daily death count yields quite different results: the UK holds a strong lead, with 28 deaths a day per million inhabitant; Italy is in second place with 17; the USA follows with 14; and India comes last, with just 3 per million inhabitants. Regarding the total number of deaths per million since the beginning of the pandemic, each country is almost identical, the only change coming at the very top: Italy clinches gold with 2,091 deaths per million, the UK 1,873, the USA 1,836, and India just 243.

One might argue that Indian statistics are unreliable (a fair objection, no doubt), due to the impossibility of accurately recording deaths in slums and other deprived areas. We now know that the true Covid death count in Peru was around triple the official figure. But multiply the Indian death count by four and it would still be inferior to that of more developed countries with far higher per capita incomes such as the USA, UK and Italy.

So has the pandemic in India been a bed of roses, as Modi has repeated for around a year, and as Gupta still maintains? Not at all. Try selling this to the families brought to ruin buying oxygen tanks on the black market or rooms in facilities with ventilators, or to the millions of precarious workers sent back home on foot, without a penny or subsidy to speak of. Even if, epidemiologically, Covid has not hit India more violently than other countries, it nonetheless spelled catastrophe for the health service and the wider economy. The numbers presented to underscore India’s Covid ‘tragedy’ in reality told an entirely different story. They were a testament to the brutal inequality of Indian society and the awful state of its health service: underfunded, staffed with underpaid workers, and lacking all kinds of vital equipment.

Malone

Appalling if true…

Source: https://t.co/QTOWrQzO2s pic.twitter.com/pD93ReUr4g— Heidegger (@heidegger79) June 17, 2021

Can vaccinated pilots be trusted to fly a plane?

• VAERS ID: 1026783 (OpenVaers)

AGE: 33| SEX: M|State: MS. i noticed a headache in the very top of my head within an hour of getting the vaccine. i thought it was normal because everyone i know said they got a headache from it. over the next few hours, the pain moved down the back of my neck and became a burning sensation at the bottom of my skull. the pain was not excruciating but was constant. i thought it would eventually go away. i’m a pilot and fly for a living. two days after receiving the vaccine i flew my plane and immediately noticed something was wrong with me. i was having a very hard time focusing. approximately 2 hours into my flying i felt sudden and extreme pressure in my head and nearly blacked out.

i immediately landed and stopped flying. two days later i tried flying again and the exact same thing happened again after 20 minutes. the burning in my neck intensified and was now accompanied by dizziness, nausea, disorientation, confusion, uncontrollable shaking, and tinkling in my toes and fingers. i immediately went to my hometown doctor and he diagnosed me with vertigo. he prescribed me meclizine on friday 02/05/2021. i took the medicine as prescribed all weekend with no relief. monday 02/08/2021 i made an appointment for that wednesday at the institute.

during wednesday 02/10/2021-02/11/2021 i had roughly 10-15 test performed on me including balance, eye and hearing test, ct scan, mri, and measured my spinal fluid pressure. the physician determined on 02/11/2021 that i had an allergic reaction to the pfizer covid vaccine the severely increased the pressure in my spinal cord and brain stem. that pressure causes my vision problems and ultimately ruptured my left inner ear breaking off several crystals in the process. i cannot fly with this condition. i’m currently taking diamox to reduce the pressure in my spinal cord and brain stem.

BA pilots

THREE BRITISH AIRWAYS PILOTS HAVE DIED OF THE COVID "VACCINE" IN THE PAST 7-DAYS pic.twitter.com/Ca71lIqmnR

— ZNeveri (@ZNeveri) June 17, 2021

Vaccination Indemnity Fund.

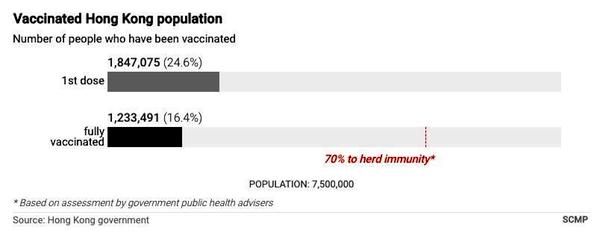

• Hong Kong Pays Off 3 Patients Who Suffered “Adverse” Reaction To Vaccines (ZH)

For the first time since its mass-vaccination campaign kicked off three months ago, Hong Kong’s vaccination indemnity fund has paid out a total of HK$450,000 ($58,000) as compensation for patients who suffered particularly severe reactions to inoculation against COVID. Out of more than 3MM doses of vaccines that have been administered in the city-state since February, HK’s Food and Health Bureau said it had received 74 applications for compensation as of June 10, 58 of which were still being processed. As of Sunday, 3,605 people had reported an adverse reaction to their jabs, roughly 0.12% of all vaccination recipients. Only 1.2MM, or 16.3% of the city’s population, has been fully vaccinated.

Awards were given to patients whose reactions were deemed especially severe. “The principles of severity assessment include fairness to applicants, prudent use of public funding, transparency to the public, and based on medical science,” the bureau said in a statement. “Severity of individual cases is subject to case-by-case assessment according to their circumstances.” The compensation figures were revealed while authorities also confirmed a new imported case from Sri Lanka, which brought the city’s official tally to 11,881, with 210 related deaths. So far 21 deaths have been recorded involving people who received a jab two weeks before dying, although no connection has been made between he vaccination and the deaths, according to the state authorities.

“Do private property rights and free markets extend to them as well, even if their goal is the destruction of the very principles of freedom we hold dear?”

• Vaccine Passports: Business Rights vs Personal Freedom (Smith)

The formation of totalitarianism is often insidious in that it is almost always sold to the public as “humanitarian”; a solution for the greater good of the greater number. But beyond that, tyrants will also exploit the ideals of the target population and use these principles against them. Like weaknesses in the armor of a free society, our ideals of freedom are not necessarily universally applicable at all times and in all circumstances; we have to place some limits in order to prevent oligarchy from using liberalism as a tool to gain a foothold. This battle for balance is the defining drama of all societies that endeavor to be free. It might sound hypocritical, and your typical anarchist and some libertarians will completely dismiss the notion that there should be any limits to what people (or companies) can do, especially when it comes to their private property.

But at what point do private property rights encroach on the rights of others? Is it simply black and white? Does anything go? The bottom line is, in the wake of covid controls and mass online censorship, it is time for those of us in the liberty movement to have a frank discussion about where the line is for the rights of businesses. The problem went mainstream initially a few years back when Big Tech companies that control the majority of social media sites decided that they were going to start actively targeting conservative users with shadow bans and outright censorship. Here’s the thing: If we are talking about smaller websites run by private individuals, then yes, I would argue in defense of their right to remove anyone from their site for almost any reason.

Their website is their property, and much like their home they can do whatever they want within it. Denial of access to an average website is not going to damage the ability of a person to live their normal lives, nor will it fundamentally restrict their ability to share information with others. There are always other websites. But what if we are talking about massive international conglomerates? Should these corporations be given the same free rein to do as they wilt? Do private property rights and free markets extend to them as well, even if their goal is the destruction of the very principles of freedom we hold dear? And, what if a host of small businesses in a given place decide they are going to implement freedom crushing mandates along with major corporations? What if they are all manipulated by government incentives or pressure? What if governments do not need to implement totalitarianism directly at first because businesses are doing it for them? Do the dynamics of private property change in this case?

“..a xenophobic cousin to climate change denialism and anti-vaxxism..”

• Scientist Backing Probe Into Wuhan Lab: We Waited Because Of Trump (DW)

A scientist that signed onto a letter recently backing a probe in the possibility that the coronavirus pandemic originated from the Wuhan Institute of Virology admitted in an interview this week that she and other scientists did not come forward sooner to back the possibility that the pandemic originated in a lab because they did not want “to be associated with Trump.” NBC News reports: Chan was one of 18 scientists who published a letter in the journal Science last month calling for a more in-depth investigation into the virus’s origin that takes into account theories about both natural occurrence and laboratory spillovers. The letter helped kick-start a new round of calls to investigate the “lab leak hypothesis,” including demands from President Joe Biden and several leading scientists.

The report noted that numerous experts in the field have said that little-to-no evidence has emerged over the last year or so and that the only thing that has changed is the “context and circumstances” around the debate of the pandemic’s origins. The report continued: “Chan said there had been trepidation among some scientists about publicly discussing the lab leak hypothesis for fear that their words could be misconstrued or used to support racist rhetoric about how the coronavirus emerged. Trump fueled accusations that the Wuhan Institute of Virology, a research lab in the city where the first Covid-19 cases were reported, was connected to the outbreak…” “At the time, it was scarier to be associated with Trump and to become a tool for racists, so people didn’t want to publicly call for an investigation into lab origins,” Chan claimed in the interview.

Scientists rushed to downplay the possibility that the pandemic could have originated in the lab by publishing a letter in The Lancet that cast it “as a xenophobic cousin to climate change denialism and anti-vaxxism,” Vanity Fair reported. “The Lancet statement effectively ended the debate over COVID-19’s origins before it began.” “To Gilles Demaneuf, following along from the sidelines, it was as if it had been ‘nailed to the church doors,’ establishing the natural origin theory as orthodoxy,” the report added. “‘Everyone had to follow it. Everyone was intimidated. That set the tone.’” Former CDC Director Robert Redfield said this week that he believes that the pandemic originated in the lab and that those who moved to shut down the lab leak theory were “very anti-science.”

It’s all one big movement.

• The Real B3W-NATO Agenda (Escobar)

For those spared the ordeal of sifting through the NATO summit communique, here’s the concise low down: Russia is an “acute threat” and China is a “systemic challenge”. NATO, of course, are just a bunch of innocent kids building castles in a sandbox. Those were the days when Lord Hastings Lionel Ismay, NATO’s first secretary-general, coined the trans-Atlantic purpose: to “keep the Soviet Union out, the Americans in, and the Germans down.” The Raging Twenties remix reads like “keep the Americans in, the EU down and Russia-China contained”. So the North Atlantic (italics mine) organization has now relocated all across Eurasia, fighting what it describes as “threats from the East”. Well, that’s a step beyond Afghanistan – the intersection of Central and South Asia – where NATO was unceremoniously humiliated by a bunch of Pashtuns with Kalashnikovs.

Russia remains the top threat – mentioned 63 times in the communiqué. Current top NATO chihuahua Jens Stoltenberg says NATO won’t simply “mirror” Russia: it will de facto outspend it and surround it with multiple battle formations, as “we now have implemented the biggest reinforcements of our collective defense since the end of the Cold War”. The communiqué is adamant: the only way for military spending is up. Context: the total “defense” budget of the 30 NATO members will grow by 4.1% in 2021, reaching a staggering $1.049 trillion ($726 billion from the US, $323 billion from assorted allies). After all, “threats from the East” abound. From Russia, there are all those hypersonic weapons that baffle NATO generals; those large-scale exercises near the borders of NATO members; constant airspace violations; military integration with that “dictator” in Belarus.

As for the threats from China – South China Sea, Taiwan, the Indo-Pacific overall – it was up to the G7 to come up with a plan. Enter “green”, “inclusive” Build Back Better World (B3W), billed as the Western “alternative” to the Belt and Road Initiative (BRI). B3W respects “our values” – which clownish British PM Boris Johnson could not help describing as building infrastructure in a more “gender neutral” or “feminine” way – and, further on down the road, will remove goods produced with forced labor (code for Xinjiang) from supply chains. The White House has its own B3W spin: that’s a “values-driven, high-standard, and transparent infrastructure partnership” which will be “mobilizing private-sector capital in four areas of focus – climate, health and health security, digital technology, and gender equality – with catalytic investments from our respective development institutions”

“..that a foreign court with foreign judges should be allowed to overrule a majority of the Swiss people proved incompatible with the Swiss idea of democracy..”

On May 26, the Swiss government declared an end to year-long negotiations with the European Union on a so-called Institutional Framework Agreement that was to consolidate and extend the roughly one hundred bilateral treaties now regulating relations between the two sides. Negotiations began in 2014 and were concluded four years later, but Swiss domestic opposition got in the way of ratification. In subsequent years Switzerland sought reassurance essentially on four issues: permission to continue state assistance to its large and flourishing small business sector; immigration and the right to limit it to workers rather than having to admit all citizens of EU member states; protection of the (high) wages in the globally very successful Swiss export industries; and the jurisdiction, claimed by the EU, of the Court of Justice of the European Union over legal disagreements on the interpretation of joint treaties.

As no progress was made, the prevailing impression in Switzerland became that the framework agreement was in fact to be a domination agreement, and as such too close to EU membership, which the Swiss had rejected in a national referendum in 1992 when they voted against joining the European Economic Area. There are interesting parallels with the UK and Brexit. Both countries, in their different ways, have developed varieties of democracy distinguished by a deep commitment to a sort of majoritarian popular sovereignty that requires national sovereignty. This makes it difficult for them to enter into external relations that constrain the collective will-formation of their citizenry. Britain of course partly solved this problem by becoming the centre of an empire, as opposed to being included in one, defending its national sovereignty by appropriating the national sovereignty of others; while Switzerland became forever neutral and ready to defend itself, as de Gaulle had put it for France, tous azimuts.

Constitutionally, British popular sovereignty resides in a parliament that is not bound by a written constitution and can therefore decide everything with a simple majority, no two-thirds or other supermajority ever required. Also, there is no constitutional court that could get in Parliament’s way, nor can the second chamber, the House of Lords. That a supreme court like the EU Court of Justice should be entitled to overrule the British parliament was always fundamentally incompatible with the British idea of democracy-cum-sovereignty, and became a major source of British popular discontent with the EU, leading to Brexit and undoing Brentry. Similarly, that a foreign court with foreign judges should be allowed to overrule a majority of the Swiss people proved incompatible with the Swiss idea of democracy, standing in the way of Swentry and thereby making a future Swexit dispensable.

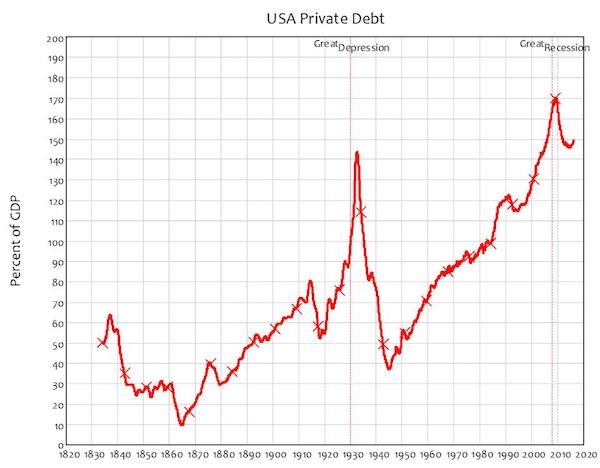

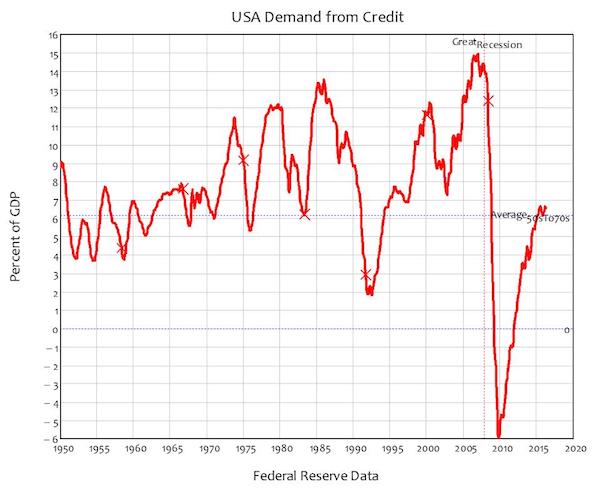

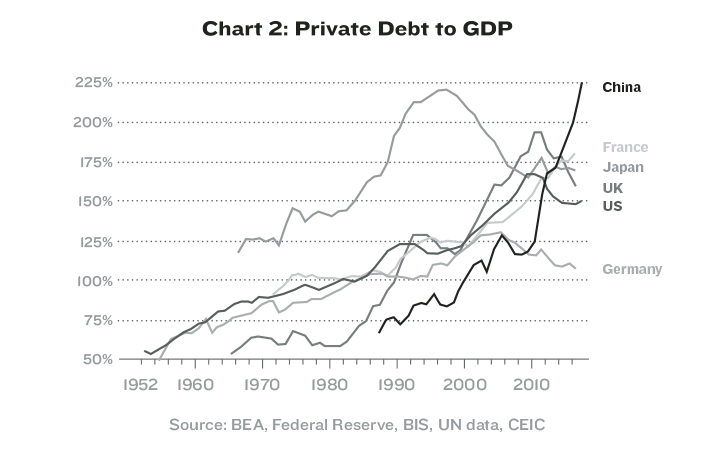

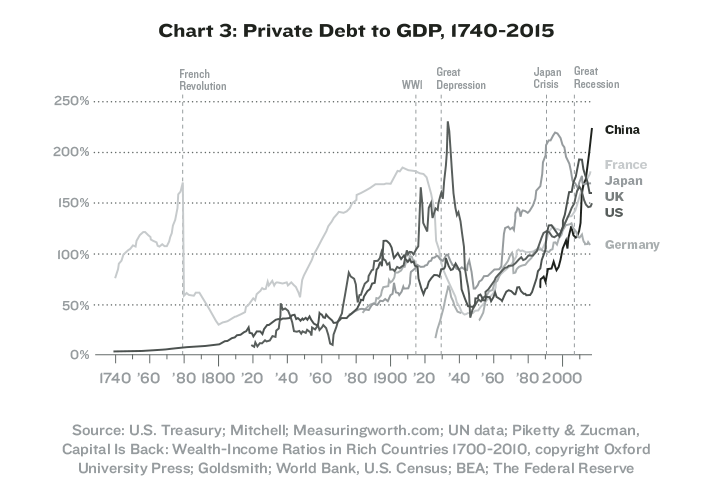

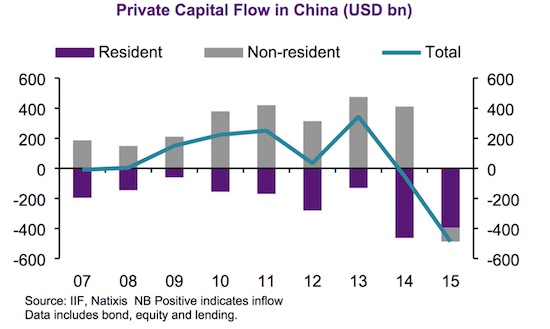

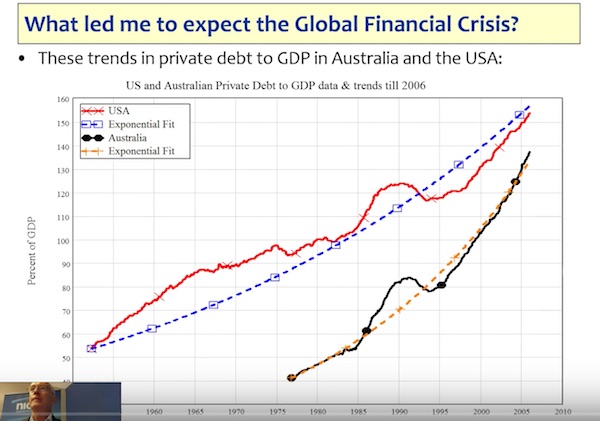

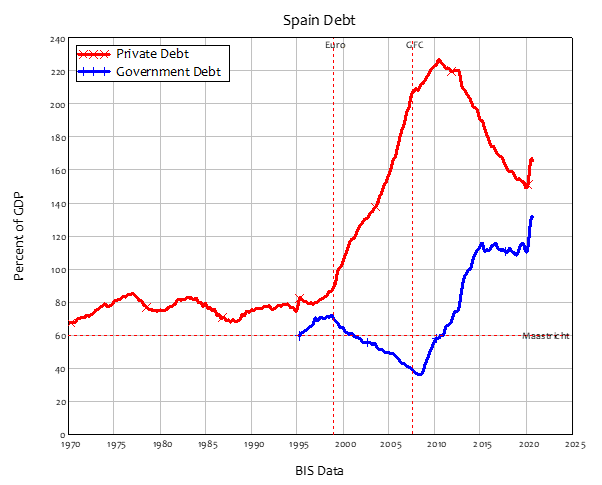

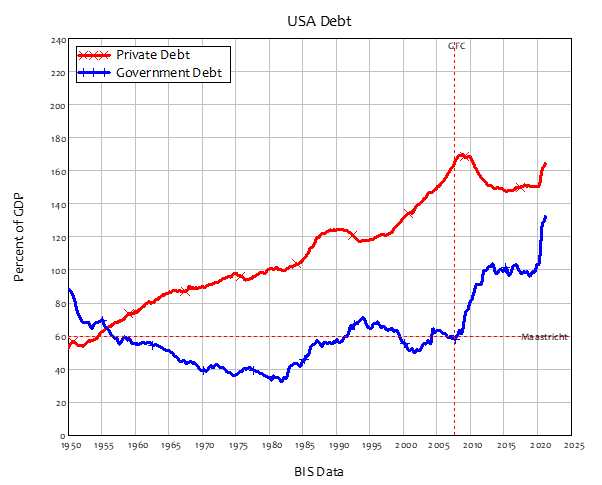

Private debt is the ignored killer.

• The Role Of Public Debt And Private Debt In The Next Crisis (Steve Keen)

Their roles are opposite in any crisis, like two sides of a see-saw: private debt causes crises, and public debt, to some extent, ends them. But conventional economic theory gets this completely wrong, by ignoring private debt, while seeing government debt as a problem rather than a solution. The conventional economic argument is firstly, that private debt simply transfers spending power from one private person to another—the debtor has more money to spend when money is borrowed, the creditor has more to spend when debt is repaid. In the aggregate, this cancels out: the borrower’s spending power rises when debt is rising and falls when it is falling, but the lender’s spending power goes in the opposite direction. They claim, therefore, that changes in the level of private debt have very little impact on the economy.

As Ben Bernanke put it in his book Essays on the Great Depression, “pure redistributions should have no significant macroeconomic effects” (Bernanke 2000, p. 24). On the other hand, they see government debt as “crowding out” the private sector, by competing with private borrowers for the available stock of “loanable funds”, and thus driving up the interest rate—the price of borrowed money. Excessive government deficits add to the demand for money, drive up interest rates, and therefore reduce private investment, and hence the rate of economic growth. As Gregory Mankiw puts it in his influential textbook, “government borrowing reduces national saving and crowds out capital accumulation” (Mankiw 2016, pp. 556-57).

This is why the Maastricht Treaty put limits on government debt and deficits, but completely ignored private debt and credit. Spain shows the impact of this conventional attitude to debt: while government debt halved from 72% to 36% GDP from the introduction of the Euro until just after the Global Financial Crisis in 2007, private debt almost trebled, from 88% of GDP to a peak of 227% of GDP in 2010.

The USA shows a similar pattern—unrestrained growth in private debt until the crisis, government debt growing after it in response to the collapse of demand as credit turned negative.

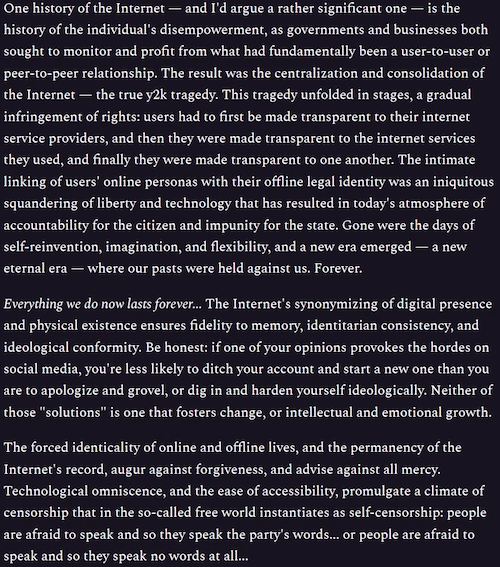

Snowden wants to make the internet have integrity again.

• Lifting The Mask (Edward Snowden)

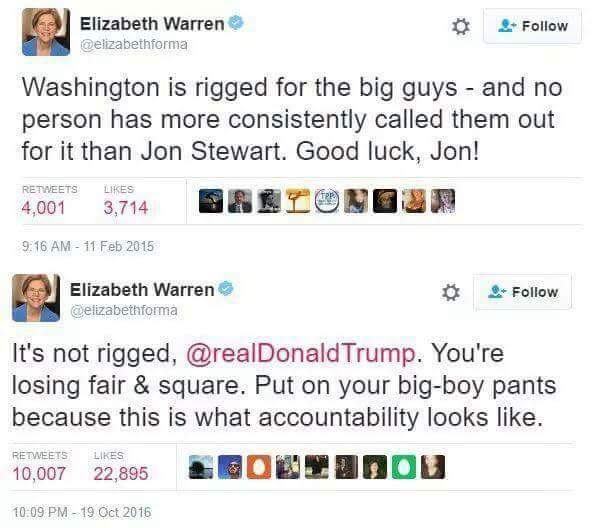

Since 2013, it feels as though the world has accelerated, when really only the rate of opinion has — through the sheer speed and volume of bite-sized algorithmically “curated” social media. On Facebook, and especially on Twitter, plots and characters appear and vanish in moments, imparting emotions, but never lessons, because who has time for those? The only thing that most of us manage to take away from social media, besides the occasional chuckle, is an updated roster of villains — the daily roll-call of transgressors and transgressions. This is the reality of the fully commercialized mainstream internet: our exposure to an indigestible mass of shortest-form opinions that are purposefully selected by algorithms to agitate us on platforms that are designed to record and memorialize our most agitated, reflexive responses.

These responses are, in turn, elevated in proportion to their controversy to the attention — and prejudice — of the crowd. In the resulting zero-sum blood sport that public reputation requires, combatants are incentivized to occupy the most conventionally defensible positions, which reduces all politics to ideology and splinters the polis into squabbling tribes. The products of the irreconcilable differences this process produces are nothing more than well-divided “audiences,” made available to the influence of advertisers, and all that it cost us was the very foundation of civil society: tolerance. For this reason, I’d like to do my part in encouraging a return to longer forms of thinking and writing, which provide more room for nuance and more opportunity for establishing consensus or, at the very least, respecting a diversity of perspective and, you know, science.

I want to revive the original spirit of the older, pre-commercial internet, with its bulletin boards, newsgroups, and blogs — if not in form, then in function. The utopianism of these blogs might seem as quaint today as the sites’ graphics (and glamorous MIDI audio), but whatever those outlets lacked in sophisticated design, they more than made up for in curiosity and intelligence and in their fostering of originality and experimentation. They were, when it comes down to it, not curated and templated “platforms” so much as direct expressions of the creative primacy of the individual.

We try to run the Automatic Earth on donations. Since ad revenue has collapsed, you are now not just a reader, but an integral part of the process that builds this site. Thank you for your support.

Support the Automatic Earth in virustime. Click at the top of the sidebars to donate with Paypal and Patreon.