Andy Warhol Ingrid Bergman 1983

Everyone has an opinion on Elon Musk buying Twitter. I’ll add mine: he couldn’t make it any worse than it is.

Mass graves

Have you heard the latest (according the Western media, in chorus)? Russian forces apparently secretly buried *up to 9000 Mariupol civilians* in "mass graves" in a town just west of the city.

Except, it never happened, there is no mass grave. pic.twitter.com/yBMOMA30Ei

— Freedom Media (@WeAreTheMSM) April 25, 2022

“There is opportunity for much more understanding of how the social media platforms operate just by permitting increased transparency.”

• Tucker: You Just Became A Little More Powerful (CTH)

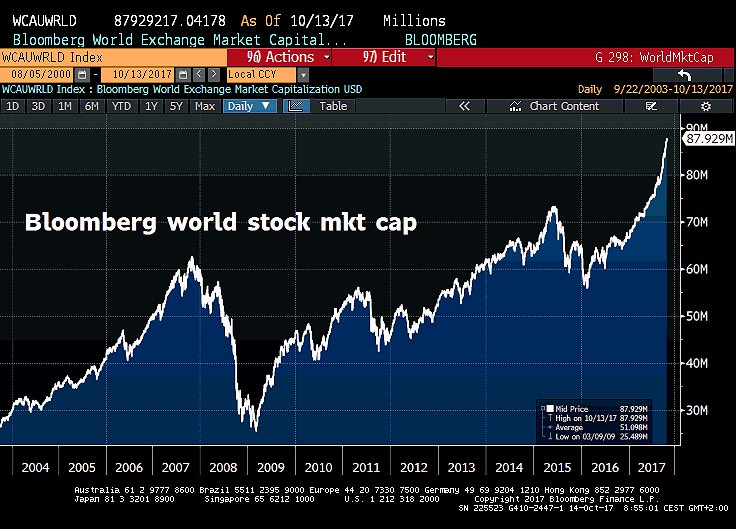

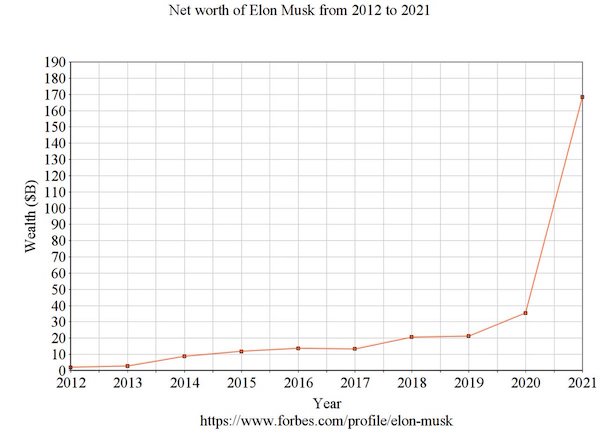

There is an angle to this move which looms. If the doomsday predictions of Twitter’s Thursday anticipated first quarter financial earnings are correct, it is entirely possible that Musk is about to take a massive financial hit. Some, including myself, who understand the financial black hole that Twitter’s business model represents, have suspicions that Twitter may be hung around Musk’s neck like a millstone as he’s thrown into the deep state sea of social media. It will be interesting to see how quickly Musk responds to those Q1 financials. [NOTE: I foresee be a small user fee in the future]

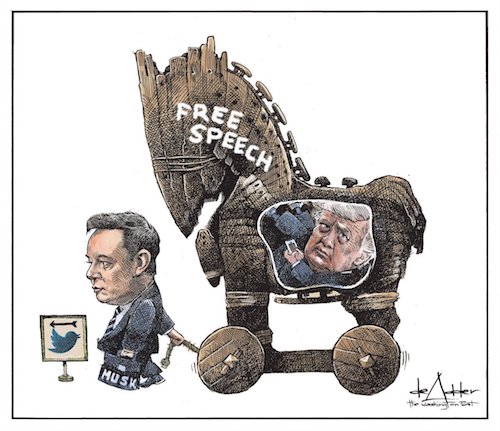

News Release – “Free speech is the bedrock of a functioning democracy, and Twitter is the digital town square where matters vital to the future of humanity are debated,” said Mr. Musk. “I also want to make Twitter better than ever by enhancing the product with new features, making the algorithms open source to increase trust, defeating the spam bots, and authenticating all humans. Twitter has tremendous potential – I look forward to working with the company and the community of users to unlock it.” Tucker Carlson outlined the political ramifications surrounding breaking one of the big social media platforms away from the deep state control agents.

President Donald Trump will not be returning to Twitter, he is sticking with TruthSocial which is nearing completion. “I am not going on Twitter, I am going to stay on TRUTH,” Trump told Fox News. “I hope Elon buys Twitter because he’ll make improvements to it and he is a good man, but I am going to be staying on TRUTH.” There are a lot of downstream ramifications that have yet to surface as a result of the Musk-Twitter purchase. Will users find out what the rules are for the specific network containers they have been assigned to? Will the scale of simultaneous user data-processing be made public along with the algorithms that Twitter uses once you have been given a specific container assignment?

There is opportunity for much more understanding of how the social media platforms operate just by permitting increased transparency. There’s a possibility once the container assignment process is made public, people will then start to inquire about Facebook, Instagram, YouTube and other Big Tech platform processes that divide people based on arbitrarily determined viewpoints. Most social media users do not understand the technology behind the platform they are using, although a greater awareness is ongoing.

@jack was running the joint when Trump et al were banned, and all the “non-compliant” Covid doctors.

• Taking It Back From Wall Street Is the Correct First Step: Jack Dorsey (Var.)

Twitter co-founder and former CEO Jack Dorsey commented on Elon Musk’s acquisition of the social media platform on Monday night, kicking off his thread with Radiohead’s song “Everything In Its Right Place.” “I love Twitter. Twitter is the closest thing we have to a global consciousness,” he wrote. After stepping down from Twitter in November 2021, Dorsey continued to sit on the company’s board of directors. The board approved Musk’s $44 billion acquisition Monday morning. “The idea and service is all that matters to me, and I will do whatever it takes to protect both. Twitter as a company has always been my sole issue and my biggest regret. It has been owned by Wall Street and the ad model. Taking it back from Wall Street is the correct first step,” his Twitter thread continued.

“In principle, I don’t believe anyone should own or run Twitter. It wants to be a public good at a protocol level, not a company. Solving for the problem of it being a company however, Elon is the singular solution I trust. I trust his mission to extend the light of consciousness,” Dorsey wrote. “Elon’s goal of creating a platform that is “maximally trusted and broadly inclusive” is the right one. This is also @paraga’s goal, and why I chose him. Thank you both for getting the company out of an impossible situation. This is the right path…I believe it with all my heart. “I’m so happy Twitter will continue to serve the public conversation. Around the world, and into the stars!,” Dorsey wrote.

Musk: Asphyxiation of society

"I don't think we should try to have people live for a really long time. That'd cause asphyxiation of society because the truth is, most people don't change their mind. They just die. So if they don't die, we will be stuck with old ideas and society wouldn't advance." — @elonmusk pic.twitter.com/0tOYaUwUcu

— Pranay Pathole (@PPathole) April 25, 2022

“..we’ve gotten into a system where we have the media in cahoots with the executive branch, sort of overlooking all the other safeguards that we have in our system..”

• Media/Politics Collusion Destroyed Trust in Public Health: Dr. Ben Carson (ET)

In the wake of a court decision to end federal mask mandates, Dr. Ben Carson, former U.S. secretary of the Housing and Urban Development and chief of pediatric neurosurgery at Johns Hopkins Hospital, said he is glad there are checks and balances in our system of government but in order to truly restore trust in public health agencies, the mainstream media needs to be held accountable for colluding with the executive branch. “What we’ve done is we’ve gotten into a system where we have the media in cahoots with the executive branch, sort of overlooking all the other safeguards that we have in our system,” Carson told The Epoch Times. “And as a result of that, what we’ve done has completely destroyed the trust of the people in the CDC, the NIH, the government health system. It’s going to take a very long time to get that trust back.”

A Trump-appointed district judge struck down federal mask mandates in a ruling on Monday, saying that the CDC exceeded its authority with the mask mandate and inappropriately did not seek public comment before imposing the order. In addition, Carson said the Biden administration’s decision to end the CDC health rule, Title 42—which limits the entry of illegal immigrants into the country during the pandemic—but at the same time having its health agency heads calling to keep mask mandates for U.S. citizens doesn’t make sense and is divergent thinking. “There is no justification for getting rid of Title 42 on the one hand, and telling us we need to extend the mask mandates,” said Carson, adding that the public has to push back for agencies to actually follow the science, instead of ideology.

“If you have an executive branch that just begins to dictate, without any pushback, we’ve got to a very bad place. It’s too bad that a federal court system had to come in and bring some common sense into the discussion,” said Carson. “But the fact of the matter is, we all know, from multitudinous data, that the masks aren’t doing very much, particularly in things like airplanes that already have HEPA filters.” The neurosurgeon said common sense and scientific data should drive public health policies, including a broad range of treatments for COVID-19 and not just vaccinations.

“[Hydroxychloroquine] was roundly criticized by our government officials. So was ivermectin and some other therapeutics that work perfectly fine in other parts of the world. Why would they work in other parts of the world and not work here?” said Carson. “Why is it, in Western Africa, there’s almost no COVID? Because they take hydroxychloroquine as an anti-malarial. Why in southern India is there almost no COVID? Because they take ivermectin. Maybe they’re not taking it specifically for COVID, but look at the results.

“My guess: they tried to persuade Mr. Zelenskyy to throw in the towel. He may be too desperate and crazy to listen, but it’s truly game-over.”

• Shocks to the System (Kunstler)

There is something about being detached from reality that makes it hard to go about your everyday business. In the quaint asylums of yore, it was understood that a few shocks to the system could bring lunatics out of a fugue state of derangement — a cold water plunge… an insulin hot-shot to induce convulsions… some electrodes placed artfully on select regions of the brain…. It looks like America is about to be treated to some shocks. Will they break the mass formation psychosis that styles itself unironically as “progressive politics?”

The first shock will be the painful recognition that Ukraine is not prevailing against Russia’s Operation Z, despite the combined efforts of the US news media and the Intel Community to put over that narrative. True, it took Russia more than a few days to overcome Ukraine’s NATO-fortified defenses, but now most of that has been neutralized, and we’re into the final weeks heading towards resolution — which will be a Ukraine that is unable to make any more trouble in that corner of the world. That’s right, hard as it is to accept, Operation Z came down on Ukraine because it misbehaved badly, egged-on by delusional war-gamers in Washington, who could only pretend to support Ukraine once the real action started.

No amount of chanting Putin-Putin-Putin availed to stop the grinding Russian advance. State’s Antony Blinken and DoD’s General Austin were in Kiev over the weekend on a face-saving mission. My guess: they tried to persuade Mr. Zelenskyy to throw in the towel. He may be too desperate and crazy to listen, but it’s truly game-over. The Russians will treat him with kid gloves, perhaps give him leave to settle in Miami and enjoy the American dream with the fortune he has squirreled away. There will be changes in the map. Ukraine will sink back into peaceful obscurity while the US and Europe have to struggle with the impoverishing blowback from wrecking the global trade settlement system.

“likely we have a limited footprint on the ground in Ukraine, but under Title 50, not Title 10..”

• US A ‘Co-belligerent’ In Ukraine War (Carden)

Conversations over the past week with current and former US officials about whether, to their knowledge, there is any real debate inside President Joe Biden’s administration over the approach it is taking in Ukraine has produced only slight variations of the same answer: “Not really.” As of now, what the Biden policy amounts to is a replay along the lines of president Franklin D Roosevelt’s policy toward the war in Europe from 1939 to December 1941, during which the US was a co-belligerent all but in name. In their public statements, Biden and his Defense Secretary Lloyd Austin seem intent on obfuscating the true extent of American involvement. A story in the defense-industry-sponsored Politico quoted unnamed US officials as saying “military options in Ukraine aren’t on the table – echoing Biden’s repeated position of not wanting to spark World War III.”

If taken at face value, Biden’s policy would seem to be at odds with itself. Not wanting to start a third World War is a prudent, appropriate policy objective, but if that’s the goal, the administration is taking the long way around, because whether they admit it or not, the US is, and has been for some time, a co-belligerent in the war. [..] The open spigot of funding has naturally attracted the attention of the defense industry, and last week, the chief executives of Raytheon, Lockheed Martin, Boeing, Northrop Grumman, General Dynamics and L3Harris Technologies met at the Pentagon with Deputy Defense Secretary Kathleen Hicks. But US involvement goes deeper than arms sales and intelligence sharing.

A Pentagon official who requested anonymity told me it is “likely we have a limited footprint on the ground in Ukraine, but under Title 50, not Title 10,” meaning US intelligence operatives and paramilitaries – but not regular military. Bruce Fein, a constitutional expert and former associate attorney general in the Ronald Reagan administration, told me this week that in his view, “the United States and several NATO members have become co-belligerents with Ukraine against Russia by systematic and massive assistance to its military forces to defeat Russia.” According to Fein, the US and its NATO allies are now vulnerable to attack by “an enemy belligerent,” meaning Russia, because of their “systematic or substantial violations of a neutral’s duties of impartiality and non-participation in the conflict.”

“The Kremlin has also said it views any Western military aid entering the country as a “legitimate target”.

• Kremlin Condemns Blinken Visit To Ukraine & US Arms Shipments (ZH)

Moscow has reacted to the Sunday visit of top US officials to Kiev where they met with Ukrainian President Volodymyr Zelensky in which Secretary of State Antony Blinken and Defense Secretary Lloyd Austin discussed specific weapons systems to soon be transferred into Ukraine, also as Zelensky and his team reportedly requested heavier weaponry and in larger quantities. “What the Americans are doing is pouring oil on the flames,” Russia’s ambassador to the US Anatoly Antonov told Rossiya 24 TV channel. “I see only an attempt to raise the stakes, to aggravate the situation, to see more losses.” Antonov confirmed that the Kremlin recently delivered another diplomatic note of protest to the US condemning the arms shipments and formally requesting their cessation, but said no response has been given.

Instead, the “response” came in the form of the Pentagon chief meeting face-to-face to Zelensky while saying “we have the mindset that we want to help them win.” And specifying further the purpose of the hundreds of millions of dollars in approved military aid making its way to Ukraine: “We believe that they can win if they have the right equipment,” Defense Secretary Austin said, and added: “the right support, and we’re going to do everything we can … to ensure that gets to them.” Austin in statements given to the press after the Zelensky meeting went so far as to say Washington’s strategy is to see a “weakened” Russia.

“We want to see Russia weakened to the degree that it can’t do the kinds of things that it has done in invading Ukraine,” the Pentagon chief said. “It has already lost a lot of military capability, and a lot of its troops quite frankly” – he added, speaking of the Russian military. But Antonov in his Monday statements emphasized further: “We stressed the unacceptability of this situation when the United States of America pours weapons into Ukraine, and we demanded an end to this practice.” The Kremlin has also said it views any Western military aid entering the country as a “legitimate target”.

“By many accounts these shipments of weapons like the Javelin anti-tank missile (jointly manufactured by Raytheon and Lockheed Martin) are getting blown up as soon as they arrive in Ukraine. This doesn’t bother Raytheon at all”

• The Ukraine War is a Racket (Ron Paul)

“War is a racket, wrote US Maj. General Smedley Butler in 1935. He explained: “A racket is best described, I believe, as something that is not what it seems to the majority of the people. Only a small ‘inside’ group knows what it is about. It is conducted for the benefit of the very few, at the expense of the very many. Out of war a few people make huge fortunes.” Gen. Butler’s observation describes the US/NATO response to the Ukraine war perfectly. The propaganda continues to portray the war in Ukraine as that of an unprovoked Goliath out to decimate an innocent David unless we in the US and NATO contribute massive amounts of military equipment to Ukraine to defeat Russia. As is always the case with propaganda, this version of events is manipulated to bring an emotional response to the benefit of special interests.

One group of special interests profiting massively on the war is the US military-industrial complex. Raytheon CEO Greg Hayes recently told a meeting of shareholders that, “Everything that ‘s being shipped into Ukraine today, of course, is coming out of stockpiles, either at DOD or from our NATO allies, and that’s all great news. Eventually we’ll have to replenish it and we will see a benefit to the business.” He wasn’t lying. Raytheon, along with Lockheed Martin and countless other weapons manufacturers are enjoying a windfall they have not seen in years. The US has committed more than three billion dollars in military aid to Ukraine. They call it aid, but it is actually corporate welfare: Washington sending billions to arms manufacturers for weapons sent overseas.

By many accounts these shipments of weapons like the Javelin anti-tank missile (jointly manufactured by Raytheon and Lockheed Martin) are getting blown up as soon as they arrive in Ukraine. This doesn’t bother Raytheon at all. The more weapons blown up by Russia in Ukraine, the more new orders come from the Pentagon. Former Warsaw Pact countries now members of NATO are in on the scam as well. They’ve discovered how to dispose of their 30-year-old Soviet-made weapons and receive modern replacements from the US and other western NATO countries. While many who sympathize with Ukraine are cheering, this multi-billion dollar weapons package will make little difference. As former US Marine intelligence officer Scott Ritter said on the Ron Paul Liberty Report last week, “I can say with absolute certainty that even if this aid makes it to the battlefield, it will have zero impact on the battle. And Joe Biden knows it.”

“..If the Russian Ministry of Defense finds out that NATO did it, they will let loose all the dogs from Hell on NATO, as in “asymmetrical, lethal and fast”.

Neither NATO nor Russia is telling us what really happened with the Moskva, the legendary admiral ship of the Black Sea fleet. NATO because in theory, they know. Moscow, for its part, made it clear they are not saying anything until they can be sure what happened. One thing is certain. If the Russian Ministry of Defense finds out that NATO did it, they will let loose all the dogs from Hell on NATO, as in “asymmetrical, lethal and fast”. [..] it’s hard to believe the Neptune/Bayraktar fairytale angle. After all, as we’ve seen, the Russian fleet had established a multidimensional surveillance/defense layer in the direction of Odessa. The Moskva was near Odessa, closer to Romania.

A year ago, the source maintains, a new phased array locator was installed on it: the illumination range is 500 km. According to the standard Ukrainian narrative, first the Moskva was hit by a drone, and the locators and antennas were smashed. The Moskva was half blind. Then – according to the Ukrainian narrative – they launched two Neptune cruise missiles from the shore. Guidance was carried out by NATO’s Orion, which was hanging over Romania. The missiles zoomed in on the ship with the homing heads turned off, so that the radiation beam would not be detected. So we have guidance by NATO’s Orion, transmitting the exact coordinates, leading to two hits, and subsequent detonation of ammunition (that’s the part acknowledged by the Russian Ministry of Defense).

The Moskva was on combat duty 100-120 km away from Odessa – controlling the airspace within a radius of 250-300 km. So in fact it was ensuring the overlap of the southern half of Moldova, the space from Izmail to Odessa and part of Romania (including the port of Constanta). Its positioning could not be more strategic. Moskva was interfering with NATO’s covert transfer of military aircraft (helicopters and fighter jets) from Romania to Ukraine. It was being watched 24/7. NATO air reconnaissance was totally on it. As the Moskva “killer”, NATO may have not chosen the Neptune, as spread by Ukrainian propaganda; the source points to the fifth-generation NSM PKR (Naval Strike Missile, with a range of 185 km, developed by Norway and the Americans.)

He describes the NSM as “able to reach the target along a programmed route thanks to the GPS-adjusted INS, independently find the target by flying up to it at an altitude of 3-5 meters. When reaching the target, the NSM maneuvers and deploys electronic interference. A highly sensitive thermal imager is used as a homing system, which independently determines the most vulnerable places of the target ship.” As a direct consequence of hitting the Moskva, NATO managed to reopen an air corridor for the transfer of aircraft to the airfields of Chernivtsi, Transcarpathian and Ivano-Frankivsk regions.

Go get yer booster…

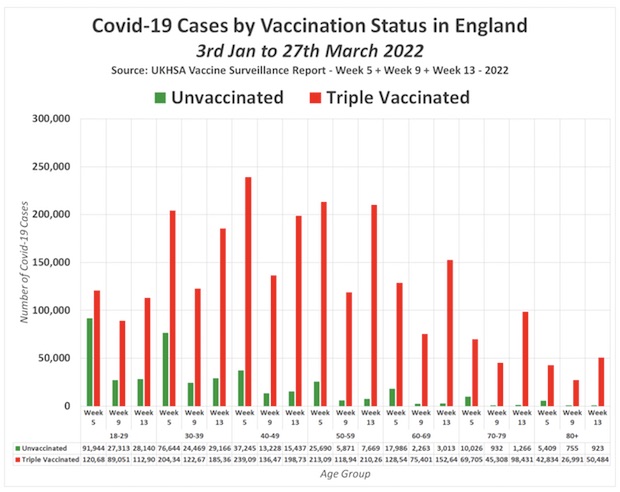

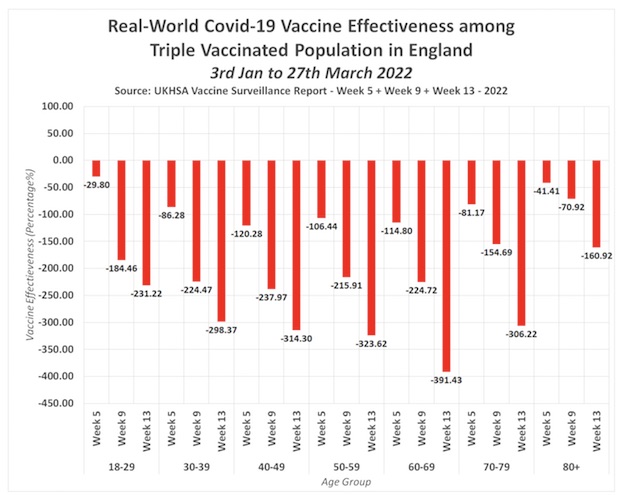

• Vaccine Effectiveness Falls To MINUS-391% (DE)

Official data published by the UK Health Security Agency confirms Covid-19 vaccine effectiveness against infection has fallen to minus-391% among triple jabbed 60-69-year-olds, and between minus-298% and minus-324% among those aged 30 to 59. All other age groups have also suffered a significant drop in vaccine effectiveness with figures showing all triple vaccinated adults now between 3 and 5 times more likely to be infected with Covid-19 than unvaccinated adults. The following chart shows the total number of Covid-19 cases by vaccination status in England between 3rd Jan and 27th March 2022, separated by age group and week. The data has been extracted from the the Week 5, (page 43), Week 9 (page 41) and Week 13 (page 41) UK Health Security Agency (UKHSA) Covid-19 Vaccine Surveillance reports –

[..] cases have been highest among all age groups who are triple vaccinated since at least the turn of the year. This data on its own at least shows the Covid-19 injections clearly do not prevent infection. But the UKHSA also provide us with further figures that indicate something is seriously wrong, and those figures are the Covid-19 case-rate per 100,000 individuals by vaccination status. [..] Here’s a chart showing the real-world Covid-19 vaccine effectiveness among the triple vaccinated population by age-group and week in England between 3rd January and 27th March 2022.

This is old news treated as new. We’re standing still.

• Heart Inflammation More Prevalent Among Vaccinated Than Unvaccinated (ET)

Heart inflammation requiring hospital care was more common among people who received COVID-19 vaccines than those who did not, according to a new study of tens of millions of Europeans. Rates of myocarditis or pericarditis, two types of heart inflammation, are above the levels in an unvaccinated cohort, pegged at 38 per 100,000 after receipt of a second dose of a vaccine built on messenger RNA (mRNA) technology in males aged 16 to 24—the group studies have shown are most at risk of the post-vaccination condition—researchers with health agencies in Finland, Denmark, Sweden, and Norway found.

“These extra cases among men aged 16–24 correspond to a 5 times increased risk after Comirnaty and 15 times increased risk after Spikevax compared to unvaccinated,” Dr. Rickard Ljung, a professor and physician at the Swedish Medical Products Agency and one of the principal investigators of the study, told The Epoch Times in an email. Comirnaty is the brand name for Pfizer’s vaccine while Spikevax is the brand name for Moderna’s jab. Rates were also higher among the age group for those who received any dose of the Pfizer or Moderna vaccines, both of which utilize mRNA technology. And rates were elevated among vaccinated males of all ages after the first or second dose, except for the first dose of Moderna’s shot for those 40 or older, and females 12- to 15-years-old.

Researchers pulled data from national health registers, analyzing 23.1 million people aged 12 or older. The analysis was of data from Dec. 27, 2020, to incidence of myocarditis or pericarditis, or the end of the study time period, which was Oct. 5, 2021. “The risks of myocarditis and pericarditis were highest within the first 7 days of being vaccinated, were increased for all combinations of mRNA vaccines, and were more pronounced after the second dose,” researchers wrote in the study, which was published by the Journal of the American Medical Association following peer review.

“Federal Judge Kathryn Mizelle did what a federal judge is supposed to do—she reined in the CDC when it went too far.”

• The CDC’s Mask Mandate Is Dead and Won’t Be Back (TH)

Federal Judge Kathryn Mizelle did what a federal judge is supposed to do—she reined in the CDC when it went too far. She struck down the mask mandate for mass transit. Most travelers rejoiced and said goodbye to masks, perhaps for good. But not everyone was happy. The ruling sent COVID doomsdayers into panic mode. There was a flurry of claims that Mizelle made an improper decision because TheScience™ is not for the courts – or so they say. Doctor “TheScience™” Anthony Fauci himself was quick to condemn the ruling while exposing his legal ignorance at the same time. “We are concerned…about courts getting involved in things that are unequivocally public health decisions…This is a CDC issue. It should not have been a court issue.”

Fauci is wrong. He exposed his ignorance of how American government works. This was not a ruling based on science. Judge Mizelle did not issue a public health order – she issued a legal order. And as much as Fauci may dislike it, Mizelle got it exactly right! Fauci and TheExperts™ will not want to hear that her ruling is ironclad and will hold on appeal. Public health policies made by government agencies are not merely scientific actions. They’re government actions. Government actions are subject to review by courts when they violate federal law. Federal agencies are creatures of statute and are bound by law to operate within the law imposed by Congress. Agencies are not separate entities that may act as they wish. Their authority is limited to what Congress grants them.

So the CDC is governed by Congress – not by any President – and certainly not by career bureaucrats like Fauci. Judge Mizelle made that expressly clear in her ruling. Specifically, she addressed how the CDC and government officials violated the Administrative Procedures Act (APA) in issuing this mandate. The issue was not whether masks work to prevent the spread of Covid-19. Nor is the issue whether it is wise policy to order millions of traveling Americans to strap a piece of cloth over their breathing and talking holes (except when chomping Biscoff cookies or chugging chardonnay.) The real issue was whether the CDC had legal authority to issue such an edict in the first place – and if so, did it issue the rule as prescribed by law. The answer to both questions is: no.

“..63 percent of young adults experienced symptoms of depression or anxiety in June 2020..”

• Most Young Adults Say US Has A ‘Mental Health Crisis’ (Hill)

Nearly three-quarters of young adults across the country believe “the United States has a mental health crisis,” according to a new poll. A survey released Tuesday by the Institute for Politics at Harvard Kennedy School found that only six percent of survey respondents disagreed with the idea that the U.S. is undergoing a mental health crisis. 52% of young adults surveyed reported experiencing feelings of depression and hopelessness, and nearly a quarter said they had thought about self-harm. The latter represents a four percent decline from a year earlier when 28 percent of survey respondents said they thought about harming themselves. More than a quarter said they know someone who has committed suicide. The Spring 2022 survey measured the responses of more than 2,000 U.S. adults between the ages of 18 and 29 from March 15-20.

The Harvard poll adds to a growing body of research regarding the decline of mental health in the U.S. during the coronavirus pandemic. A recent study revealed that nearly half of young adults experienced mental health symptoms during the pandemic’s second year. Researchers at the University of California, San Francisco (UCSF) used a sample of 2,809 adults ages 18-25 years from the U.S. Census Bureau’s Household Pulse Survey data to evaluate the scope of anxiety and depression symptoms from June through early July 2021. They found 48 percent of young adults reported mental health symptoms. Meanwhile, 39 percent of the population with symptoms said they used prescription medications, although more than a third reported being unable to receive needed counseling treatment. The teams’ findings showed a decline from a year prior. A study from the Centers for Disease Control and Prevention found 63 percent of young adults experienced symptoms of depression or anxiety in June 2020.

What must the pressure on him be like?

• Durham Has Hundreds Of E-mails Between Fusion GPS And Reporters (TFog)

Durham also destroys the declarations of John Podesta and Robby Mook on behalf of Hillary for America, stating Mook has stated Perkins Coie was to handle and oversee “international” opposition research. Mook also received “general updates concerning” these findings though he says he was unaware who had been specifically retained. As to Joffe’s privilege arguments? They fail because “Perkins Coie hired Fusion GPS to assist HFA and the DNC, not [Joffe].” Today’s filing follows a series of interesting developments disclosed in these last few days. On Friday, April 22, attorneys for Michael Sussmann filed this motion relating to evidentiary issues. I’ll spare you the long and boring legal arguments (your humble author favors brevity) and get to the good stuff: the Special Counsel has issued trial subpoenas to the Clinton Campaign and the Democratic National Committee.

The reason for calling the Clinton Campaign and DNC as trial witnesses is to get them to testify to their assertion of attorney-client privilege under oath. As you might recall, the Clinton Campaign, the DNC, Fusion GPS, Perkins Coie, and Rodney Joffe have all made appearances in this case in order to fight against the production of records to Durham. We reported on that story here, stating Durham requested the court require production of records that included “emails and attachments between and among” Perkins Coie, Rodney Joffe, and Fusion GPS.” On behalf of the Clinton Campaign, Robby Mook (Hillary’s campaign manager) and John Podesta (the Clinton Campaign chair, who has already been interviewed by Durham) submitted declarations in support of the position that Fusion GPS was assisting with “legal services and legal advice to [Hillary for America].”

One would rightly assume, then, that those trial subpoenas were issued to Robby Mook and John Podesta. Last Friday also saw this filing by Special Counsel Durham which also addressed evidentiary issues. It explained a “joint venture” starting in June 2016 by Rodney Joffe and his team of researchers to collect derogatory information on Trump and his associates. Durham described the goal of the joint venture to be: “to gather and disseminate derogatory non-public information regarding the internet activities of [Trump] and his associates.

This “joint venture” – what is also called a conspiracy – continued into August 2016, where: Sussmann, Rodney Joffe, and “agents of the Clinton Campaign” met at the Perkins Coie office of Mark Elias where they discussed the same Alfa Bank allegations that Sussmann would give to the FBI. “The evidence will show that at the meeting, the parties agreed to conduct work in the hope that it would benefit the Clinton Campaign, namely, gathering and disseminating purportedly derogatory data regarding Trump and his associates’ internet activities.”

And don’t you forget it:

“The fact that there is currently no ongoing court case means that Patel has a purely political decision to make.”

• Assange’s Fate Can’t Be Left In The Hands Of Priti Patel (John Rees)

Priti Patel, the uber-conservative Home Secretary, is about to make a life-or-death decision: whether or not to send Julian Assange to the United States to face charges of espionage. If found guilty, he could be sentenced to a maximum of 175 years in jail. It is not an exaggeration to say that, even if he served a small fraction of that time, he would likely die in prison. The fact that there is currently no ongoing court case means that Patel has a purely political decision to make. Should she sanction an application for extradition when the charges being brought equate investigative journalism with spying? Should she allow that the US 1917 Espionage Act, under which the charges are being made, can for the very first time be used against a journalist?

Should the US be allowed to extend the reach of its archaic spying laws to other countries and to a journalist who is not a US citizen? These are far from the only fundamental questions that Patel should consider. She might want to consider the irregularities of the trial. These include the fact that the lead prosecution witness has admitted that he lied in court, the discovery that that the CIA spied on the defendant and his lawyers, and that the CIA also discussed kidnapping and assassinating Assange in London. She might also want to consider whether an Extradition Treaty that has allowed 200 individuals to be taken from the UK to the US but only allowed eleven to pass the other way is fit for purpose.

In any normal case any, let alone all, of these issues might be enough for a Home Secretary to declare the extradition request void. But this is no ordinary case and no ordinary Home Secretary, even by the House of Horror standards of previous Tory Home Secretaries. This case is above all a political revenge attack on Julian Assange for revealing material which the US government found embarrassing about the Afghan and Iraq wars, about Guantanamo Bay prison, and about US diplomatic manoeuvres. And this is the crux of the matter: should journalists only be allowed to report government press hand-outs and corporate PR statements, the news the rich and powerful want to be heard, or should they have the freedom to report matters which are otherwise hidden from the public gaze?

No harm was suffered by any individual as a result of WikiLeaks publications. That much was admitted in court by the US lawyers. No foreign state supplied or was given privileged access to material published by WikiLeaks. The sole beneficiaries were the public who learned facts of the gravest importance which they would otherwise not have known. It is for that public service that Julian Assange is spending his fourth year in Belmarsh High Security Prison and now faces extradition to the US. Priti Patel is an ultra-hawk and a devotional worshipper of US power. She is currently engaged in attempting to send desperate refugees seeking asylum to Rwanda, and is highly unlikely to do anything but sign the extradition order.

But she can, and has been, politically embarrassed in the past. Both her off-piste illegal lobbying of Israel and the bullying of staff in her own department have damaged her and the government. Mass lobbying of Patel now can have the same effect and prepare the ground for the next stage in the legal battle. This is essential because Patel does not yet have the final say. Even if she signs the extradition order Julian Assange’s lawyers have one more chance to reverse the extradition in the UK courts. They can and will appeal the elements of the original Magistrates Court ruling which turned down their original case against extradition.

Safety profile

I explained to @ericbolling @newsmax what we mean by "a well-characterized safety profile" an important regulatory term. We simply don't have assurances on long-term safety with the novel products for which there are now >1000 concerning papers on side effects. @Covid19Critical pic.twitter.com/608RfPVCyx

— Peter McCullough, MD MPH (@P_McCulloughMD) April 26, 2022

Real nazis

https://twitter.com/i/status/1518707848863264770

Support the Automatic Earth in virustime with Paypal, Bitcoin and Patreon.