Mayfair Building, Times Square NYC 1954

Is this where central banks fail in their quest for control?

• Sea Change Is Underway in Money Markets for Banks, Investors (BBG)

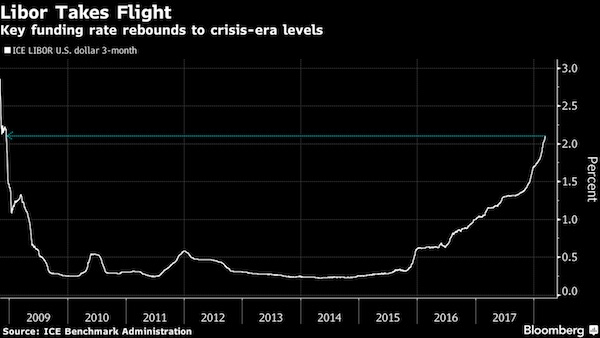

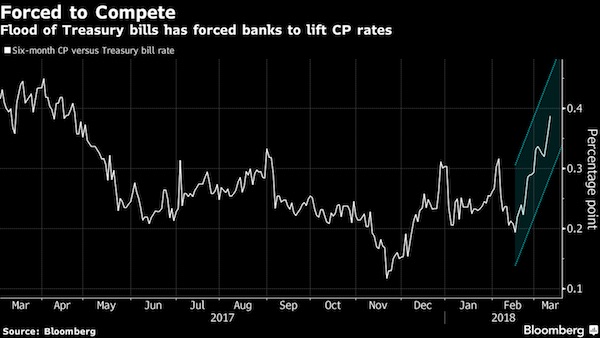

While many fixed-income investors may be focused on the specter of higher long-term Treasury yields, there’s a sea change afoot at the shorter end – in U.S. money markets. The London interbank offered rate, or Libor, and rates on Treasury bills are at levels not seen since 2008. The Fed’s move to tighten policy forms the backdrop for the increase, but an added force behind the surge this year has come from a deluge of supply as U.S. deficits widen. Higher short-term borrowing costs have implications for investors and also for banks, which find themselves paying up to borrow through the commercial-paper market as they compete to lure cash. “We are in a new paradigm,” said Jerome Schneider at Pimco. “The clear focus for the market is where will incremental demand come from to meet this supply.”

The Treasury has been jacking up debt sales this quarter: Net issuance is slated to exceed $400 billion, with the bulk coming in bills. The Treasury increased the 4-week bill sale to $65 billion, from as low as $15 billion earlier in the year. The march higher in Libor has widespread consequences despite regulatory efforts to replace it following a price-fixing scandal. About $350 trillion of financial products and loans are linked to Libor, with a large chunk hinged to the dollar-based version of the benchmark. Libor is among the main indexes, along with one-year T-bill rates, used to set U.S. adjustable-rate mortgages.

Assets in U.S. government-only money funds, which include bills among key holdings, have risen to $2.26 trillion, from $2.07 trillion last year. As the Fed keeps hiking, with the next move likely this month, the influx may continue. But for banks, the increasing appeal of T-bill rates is making them pay up to compete, through offering better returns on the commercial paper they use for short-term borrowing. “Banks still need funding and they need to entice investors,” Schneider said.

Protectionism, national security. Where’s the anti-Trump lobby on this?

• The Real Reasons Trump Blocked Broadcom’s Qualcomm Takeover (CNBC)

The threat of China factored heavily into the U.S. government’s decision to block Broadcom’s proposed buyout of Qualcomm. President Donald Trump, for his part, officially declared on Monday that the proposed $117 billion deal was prohibited on national security grounds. The president said in his order that “there is credible evidence” leading him to believe that Broadcom through control of San Diego-based Qualcomm “might take action that threatens to impair the national security of the United States.” That conclusion may seem extreme given that Broadcom is based in Singapore — and looking to redomicile to the U.S., where it conducts most of its operations — but it’s not a fear of the Southeast Asian city state that is raising national security concerns.

“The case that has been constructed is that, given Broadcom’s business practices, the worry is that they will cut investment significantly, particularly in the 5G roadmap, weaken Qualcomm, as well as the U.S. position and allow Huawei, a Chinese company to take the lead,” explained Stacy Rasgon, chip analyst at Bernstein. The Treasury Department said last week in a letter to lawyers involved in the deal that Qualcomm was trusted by the U.S. government and cited Huawei as a competitive threat in the development of 5G, which is a telecommunications standard that will allow for faster transfer of data. Beyond those 5G concerns, there’s even more to Trump’s decision to block the deal, experts said.

“It is not just China, it is not just chips. It is broad technology. It is U.S. military power and economic power going forward and he’s got a very consistent point of view,” said Ron Napier, head of Napier Investment Advisors. “Trump has been saying all year long since he was inaugurated that security is very important to him, technology is very important to him, trade is very important to him and getting jobs back to the United States is very important to him. He’s making this all into one fabric,” he added. “He sees this as the U.S.’ last big stand if it’s going to remain the leader of the free world,” Napier told CNBC.

Far too much steep is produced every year. THAT is the problem.

• Donald Trump’s Attack on German Prosperity (Spiegel)

The looming conflict is a sign of the turning point at which the global economy finds itself. Recently, the economy in most corners of the globe has been healthy, with the world experiencing a rare phase of synchronous growth. But it looks as though that phase is now coming to an end. Interest rates are rising and sovereign debt is growing, the result of which is that governments are beginning to lose their flexibility and it is likely that some countries will soon face difficulties borrowing money on the open market. Increasing financial market instability shows that insecurity is on the rise. And in this situation, protectionist policies pursued by populists and nationalists harm economic growth and endanger international prosperity.

It is something on which a majority of economists actually agree: tariff barriers slow growth, put jobs at risk and drive up inflation. Once a trade war is triggered, there is no winner, although Munich-based economist Gabriel Felbermayr says that Germany has the most to lose. “There is no other country in the world that would be hit as hard.” Felbermayr, 41, heads up the Center for International Economics at the Center for Economic Studies (CES). The shaved-headed economics professor, originally from Austria, has examined just how devastating Trump’s economic policies could be for the German economy. Every fourth job in the country, he says, is dependent on exports. And in five key sectors – automobiles, machinery, electrical engineering, pharmaceuticals and precision instruments – fully three-quarters of all exports go to the United States.

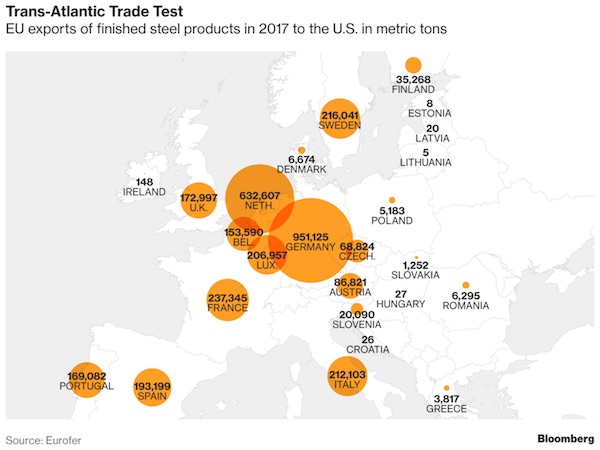

“If the U.S. were to cut itself off, it would threaten the German business model,” Felbermayr says. “Everything would start teetering.” [..] The global steel market has been imbalanced for years, with producers manufacturing 1.6 billion tons of crude steel each year against an annual demand of just 900 million tons. China is primarily to blame for this lopsidedness. Inexpensive energy and low wages enable the country’s steel producers to sell their products cheaply around the world. If the U.S. were to make moves to protect its domestic steel producers, even more cheap steel would flow into the EU than is already the case. Were that to happen, says Wolfgang Eder, head of the Austrian steel concern Voestalpine, “Europe would threaten to become the world’s garbage pail.”

The EU vows to stand up to bullies. Ask the Greeks about that one. What kind of person has the guts to say that?

• Trump Pushes EU to Cut Tariffs as Bloc Vows to Resist ‘Bullies’ (BBG)

The EU told U.S. President Donald Trump it won’t be cowed by his escalating protectionist rhetoric and talk of punitive tariffs. “Europe is prepared,” Dutch Finance Minister Wopke Hoekstra said Monday as he headed into a meeting with his counterparts from the rest of the euro area. “We are not afraid, we will stand up to the bullies,” Trade Commissioner Cecilia Malmstrom said earlier in the day. Trump returned to the offensive over the weekend, raising the prospect of higher levies on European cars and telling supporters at a rally that the countries of the EU have banded together “to screw the U.S. on trade.” The latest brinkmanship follows new tariffs on steel and aluminum imports that are straining a transatlantic relationship already tested by disputes from climate change to Middle East policy.

“Secretary of Commerce Wilbur Ross will be speaking with representatives of the European Union about eliminating the large Tariffs and Barriers they use against the U.S.A.,” Trump tweeted on Monday. “Not fair to our farmers and manufacturers.” Trump’s rhetoric drew unanimous condemnation from European finance ministers gathering in Brussels. France’s Bruno Le Maire said that he’s concerned about “a trade war between the EU and the U.S.” while his Spanish counterpart Roman Escolano, making his debut as minister, said protectionism is always a mistake. Malmstrom accused the Trump administration of using trade “to threaten and intimidate” Europeans and using the issue as a “scapegoat.”

A meeting in Brussels between Malmstrom and her U.S. counterpart Robert Lighthizer on Saturday ended without a breakthrough, as the EU didn’t receive assurances that it will be exempted from the metal tariffs. “If anyone starts throwing stones, it’s better first to make sure he’s not living in a glass house,” European Commission spokesman Enrico Brivio said.

If even more Chinese steel floods into Europe, that is now Trump’s fault.

• Trump’s Metal Tariffs ‘Like An Atomic Bomb’ For European Firms (CNBC)

Donald Trump’s decision to impose tariffs on steel and aluminum could cause major disruption for companies in Europe, a business lobbyist told CNBC Monday, who argued that the U.S. president should have taken less severe measures to protect his domestic market. U.S.’s allies, including the European Union and Japan, are hoping to be excluded from new tariffs that Trump announced last week. The decision to raise steel import taxes by 25% and aluminum by 10% could hurt not only those industries directly, but also carmakers and construction firms which use the raw materials. Trump decided that the tariffs would be the best way to deal with overcapacity in these sectors and based his argument on national security.

“This is a very exceptional mechanism that is rarely used. It’s a bit considered like an atomic bomb, because really to use this is like saying ‘look we are really at a level where we cannot use anti-dumping or anti-subsidies’,” Luisa Santos, the international relations director at BusinessEurope, told CNBC Monday. [..] European steel and aluminum businesses are reportedly preparing for a collapse in local prices if the tariffs are indeed applied to their region. Charles de Lusignan, from the Steel Association for Europe, said ultimately the tariffs could mean a scaling back in Europe, with firms letting people go, cutting investment and also innovation. “We need to act immediately because the damage will be done within the first weeks,” he said. “In fact it might already be happening, because obviously an exporter knows that the steel might be blocked in the future so they already start sending it ahead.”

Not a relevant question.

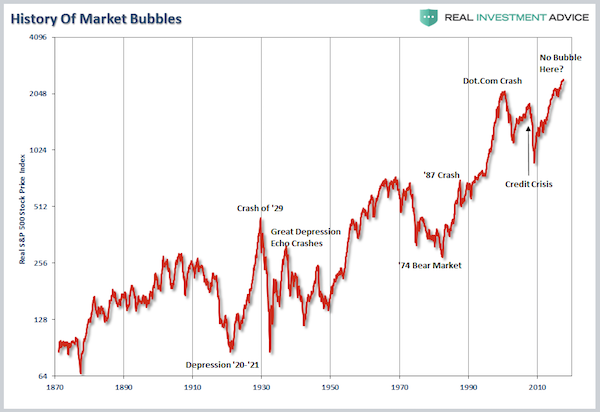

• Is The Dot.Com Bubble Back? (Roberts)

Whether you believe there is a “bubble” in the Technology stocks, or the markets, is really not important. There are plenty of arguments for both sides. At the peak of every bull market in history, there was no one claiming that a crash was imminent. It was always the contrary with market pundits waging war against those nagging naysayers of the bullish mantra that “stocks have reached a permanently high plateau” or “this is a new secular bull market.” (Here is why it isn’t.) Yet, in the end, it was something unexpected, unknown or simply dismissed that devastated investors. This is why the discussion of “this time is not like the last time” is largely irrelevant.

Individuals no longer “invest” to become a “shareholder” in a publicly traded business. The “quaint concept” of “valuations” died with the mainstreaming of investing during the 1990’s as the “Wall Street Casino” opened for business. Today, investors only think in terms of speculating on “electronically traded bits of paper” in the hopes the value will rise over time. The problem, of course, is they are never told when to “sell” to capture that valuation increase which is the most critical aspect of the investment process. Instead, individuals continue to “bet” the “greater fool” will always appear. For now, the “bullish case” remains alive and well. The media will go on berating those heretics who dare to point out the risks that prevail, but the one simple truth is “this time is indeed different.”

There goes the last shred of transparency.

• China Plans New Ministries, Merger Of Regulators In Massive Revamp (R.)

China said it will merge its banking and insurance regulators, according to a parliament document released on Tuesday, in a series of proposed changes in the biggest ministry shake-up in years. In a long-awaited move to streamline and tighten oversight of the financial system in the world’s second-biggest economy, China will also transfer some of the banking and insurance regulators’ roles to the central bank, documents showed. In much-anticipated plans to create seven new ministries and a raft of government agencies announced on Tuesday, one of the most significant changes was creation of the national markets supervision management bureau.

The new body will decide on antimonopoly and pricing issues, replacing the roles played by the three national antitrust regulators: the National Development & Reform Commission (NDRC), the Ministry of Commerce and the State Administration for Industry and Commerce (SAIC). Unifying the structure under one agency, rather than handing the responsibility to one of the three existing watchdogs, reflects the growing importance of the issue for the government. China will also form a powerful new competition regulator in a bid to ramp up oversight of mergers and acquisitions and price-fixing as the world’s second-largest economy seeks to make policymaking more efficient and coordinated. Since the beginning of last year, Beijing has cracked down on leverage and risky market practices, with China’s various regulators releasing a flurry of new rules in an attempt to rein in risks.

Only, they don’t know what it is.

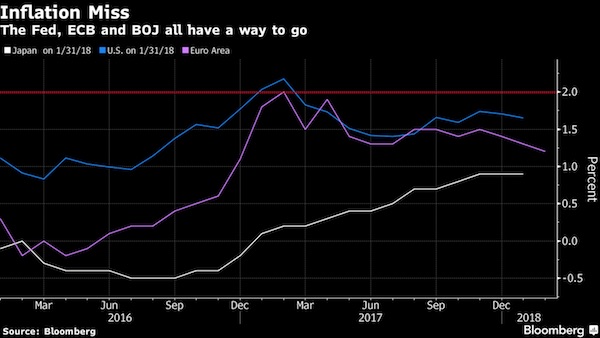

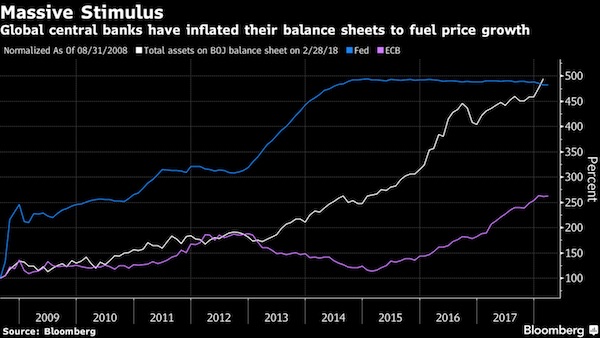

• Central Banks Are Looking for New Ways to Meet Inflation Targets (BBG)

With so many central banks failing to hit their inflation targets, some are considering changes to the tool kits they use to steer their economies. Norway’s decision to lower its price target is just the latest example, and follows more or less official adjustments in Sweden, Argentina and the euro area. Even in New Zealand, the birthplace of inflation targeting, the central bank is shifting to a broader goal that includes a focus on employment. But there’s no one-fits-all solution for monetary authorities and debate is splintered. Raising inflation targets has been discussed equally intensively in recent years as reducing or amending them.

And while some central banks acknowledge a need to reconsider their mandates, others are doubling down on existing policies. Claudio Borio, a top official at the Bank for International Settlements, poured fuel on the debate in September with a provocative speech calling for a broad rethink that accounts for how globalization and technological advances have influenced inflation. “Shall we throw away the books?” ECB President Mario Draghi asked on Thursday. “There are serious costs about changing course on credibility and the anchoring of expectations. We can go on on this for a while about changing objective.”

Think tanks are your friend.

• Labour’s Nationalisation Plans As Damaging As ‘No Deal’ Brexit – CBI (G.)

The head of Britain’s biggest business lobby group has attacked Labour’s nationalisation plans as potentially just as damaging to the economy as Britain leaving the European Union without a deal. In a speech on Monday, Paul Drechsler, the CBI president, said renationalising large parts of the economy would cause serious harm to the UK’s reputation as a place for international investors, which he argued would be as bad as a hard Brexit and would damage job prospects and living standards. “So you want to nationalise energy, rail and water, and bring public services contracts back in house? Let’s see the evidence that it will deliver a better service to consumers at a lower cost,” he said.

The intervention by the lobby group – which represents about 190,000 companies, including transport and utility firms – constitutes a warning from the boardrooms of corporate Britain that they harbour concerns over Labour’s plans for the economy despite supporting the party over its stance on Brexit. The CBI was among leading business voices supporting Jeremy Corbyn’s move to keep Britain in a customs union with the EU. The lobby group warned before the referendum that Brexit could lead to almost a million job losses and cost the economy £100bn – the equivalent of 5% of GDP – by 2020. Drechsler challenged Labour to provide evidence that its plans would lead to a better service for consumers at a lower cost.

He said private investment had helped create jobs and improve the efficiency of utility companies since they were sold off under the Thatcher government of the 1980s, and argued that progress could be undone if they were taken back into state control. However, utility companies and railway operators have faced intense pressure over their service standards and prices at a time when households are under increasing financial strain. Public support has swung behind Labour’s plans for greater state control of several key industries – shown in recent polls that suggest widespread backing for nationalisation of the railways, water, gas and electricity.

Mentally ill, cannabis.

• Another Quandary (Jim Kunstler)

That crusty ole rascal, Gov. Jerry Brown of California, seems to be enjoying his sunset journey into Civil War Two or maybe the destination is more like Blade Runner (since we know that history only rhymes but does not repeat). Anyway, it’s not a good place. The once-golden state begins to look something like what one federal official recently called — dare I say it? — a shithole. “A mix of used hypodermic needles, human feces, and other trash litters the streets and sidewalks in a large section of downtown San Francisco, a local news outlet reported Sunday night. It’s a problem that has grown by epic proportions in recent years and has many concerned for the health and safety of some the city’s youngest residents…” — The Blaze

Yes, quite literally. This particular failure of the political Left started in the 1970s when states began aggressively shuttering their large mental hospitals. Many of these institutions dated from the late 19th century – ghastly old gothic revival warehouses for the mentally ill, fraught with overtones of abuse and neglect, scenes out of Vincent Price movies… lightning flashes through the barred windows… a scream in the night… hysterical laughter echoing down the dark, tiled hallways…. They were an embarrassment, for sure, and certainly an affront to liberal sensibilities. But, of course, they fucked up the remedy for that. Instead of replacing the giant old state insane asylums with smaller, better-managed institutions, they just released the inmates under the rationale that they were a politically oppressed minority group. And there it ended.

And so here we are, going on a half-century later, with an economy that manufactures failure and immiseration at a greater volume than its other finished products, and many more lost souls out on the city streets, and now we are an even more ideologically inflamed society than we were in 1973, with the ranks of intersectional oppressed minorities and aggrieved victim groups grown into virtual armies-of-the-night — and the mentally ill just lost in the crowd. It never seems to occur to anyone that a mental hospital can be run humanely, at an appropriate scale, and that these poor, sad creatures might, at least, be better off there with a bed, a bathroom, and somebody to check in on them daily than they are wallowing in the gutters of San Francisco and other cities. Surely there are up-to-date models in other lands for this kind of caretaking — if maybe we sent a few bureaucrats overseas to have a look.

Who needs proof in an echo chamber? Whether it’s Theresa May or the House Intelligence case, the lines have been drawn long ago.

• Russian Foreign Ministry Slams UK’s Comments On Skripal Poisoning Case (Tass)

Russian Foreign Ministry Spokeswoman Maria Zakharova has dubbed as a ‘circus show’ comments of UK Prime Minister Theresa May on the poisoning of Sergey Skripal, a former colonel in Russia’s GRU military intelligence, and his daughter. “This is a circus show in Britain’s parliament,” she stressed. “The conclusion is obvious – a next political media campaign based on provocation,” Zakharova added. Earlier, Theresa May said it is “highly likely” that Russia is responsible for the poisoning of Sergey Skripal and his daughter. Moscow urges London to make public the results of the investigation into the deaths of Alexander Litvinenko and Boris Berezovsky, Zakharova said.

“Before making up new stories, let somebody in the Kingdom tell us what the previous fairy-tales ended in – those about Litvinenko, Berezovsky, Perepilichny and many others who died under mysterious circumstances on British soil,” the diplomat said. Former GRU Colonel Sergey Skripal, 66, and his 33-year-old daughter Julia on March 4 suffered from the effects of an unidentified nerve agent. They were found in an unconscious condition on a bench near The Maltings shopping center in Salisbury. Both are now in hospital in critical condition.

In 2004, Skripal was arrested by the federal security service FSB, charged, tried and convicted of high treason and stripped of all ranks and awards. In 2010 he was handed over to the United States under an arrangement to exchange persons arrested on spying charges. Later in the same year Skripal settled in Britain.

The price of freedom.

• Saudis Reportedly Wielding Veto Power Over Prince Alwaleed (CNBC)

Prince Alwaleed Bin Talal remains chairman of Kingdom Holding Company following his release from detention, but the Saudi government reportedly has final say over decisions at the investment firm. Investment decisions at Kingdom Holding are now subject to approval by the government, The Wall Street Journal reported on Monday, citing senior Saudi advisers. Kingdom Holding has $12.5 billion invested across more than a dozen sectors around the world, according to its website. Alwaleed’s personal investment portfolio is also under government control, according to the Journal. Alwaleed holds substantial stakes in companies like Citigroup, Twitter, Lyft and Time Warner.

The Journal report does not indicate whether the government has exercised its newfound influence over these investments. However, sources tell the Journal the government has already intervened in a major real estate project, ordering senior managers at Kingdom Holding to abandon the Jeddah Tower, which would be the world’s tallest skyscraper when — and if — it is completed. Officials have directed Kingdom Holding to instead focus its energy on a new city called Neom, which is expected to cost $500 billion to build. The project was announced in October by Crown Prince Mohammed bin Salman, the influential king in waiting who is overseeing the kingdom’s economic transformation and spearheaded the campaign that led to Alwaleed’s detention.

What happens when there’s only rich people left? Or: who cares about New Zealanders?

• The Rich Aren’t Happy About New Zealand Foreign Bolthole Ban (BBG)

Rich-listers like Californian billionaire Ric Kayne have issued a warning to New Zealand – banning house sales to foreigners could hurt the country’s reputation and turn wealthy investors away. Kayne, who has built an exclusive golf course in New Zealand and wants to expand his investments, is one of several rich businessmen who claim the proposed new law will have unintended consequences. They’re seeking amendments to the draft legislation or its withdrawal in its current form. “The vision we have for what we would like to contribute to New Zealand is now being threatened,” Kayne wrote in submissions to a parliamentary committee examining the proposed law change.

“The new rules will “impact on us personally, and others like us who, having discovered this country, want to devote considerable resources to preserving, protecting and enhancing it.” The new Labour-led government came to power in October on a pledge to fix a housing crisis with a raft of measures, including a ban on foreign speculators buying residential property. While data suggest non-residents have only a minor impact on the wider housing market, support for the move was boosted by headlines about rich foreigners buying mansions and farms in New Zealand as boltholes away from the world’s ills.

House prices have surged more than 60% in the past decade amid record immigration and a construction shortfall. In biggest city Auckland, prices have almost doubled since 2007 to an average of more than NZ$1 million ($730,000). That’s made it more difficult for first-time buyers to enter the market and driven up rents, leaving increasing numbers of poor people homeless. “It’s really important for us that we sort our housing market out, that we give New Zealanders a fair go at buying their first home,” Finance Minister Grant Robertson said in a television interview Sunday. While the country welcomes foreign investment, “what we want is good-quality investment that supports the productivity of the New Zealand economy,” he said.

Ethics and Hollywood.

• The Pentagon & Hollywood’s Successful And Deadly Propaganda Alliance (RT)

The Pentagon helps Hollywood to make money and, in turn, Hollywood churns out effective propaganda for the brutal American war machine. The US has the largest military budget in the world, spending over $611 billion – far larger than any other nation on Earth. The US military also has at their disposal the most successful propaganda apparatus the world has ever known… Hollywood. Since their collaboration on the first Best Picture winner ‘Wings’ in 1927, the US military has used Hollywood to manufacture and shape its public image in over 1,800 films and TV shows. Hollywood has, in turn, used military hardware in their films and TV shows to make gobs and gobs of money.

A plethora of movies like ‘Lone Survivor,’ ‘Captain Philips,’ and even blockbuster franchises like ‘Transformers’ and Marvel, DC and X-Men superhero movies have agreed to cede creative control in exchange for use of US military hardware over the years. In order to obtain cooperation from the Department of Defense (DoD), producers must sign contracts that guarantee a military approved version of the script makes it to the big screen. In return for signing away creative control, Hollywood producers save tens of millions of dollars from their budgets on military equipment, service members to operate the equipment, and expensive location fees.

Capt. Russell Coons, director of the Navy Office of Information West, told Al Jazeera what the military expects for their cooperation: “We’re not going to support a program that disgraces a uniform or presents us in a compromising way.” Phil Strub, the DOD chief Hollywood liaison, says the guidelines are clear. “If the filmmakers are willing to negotiate with us to resolve our script concerns, usually we’ll reach an agreement. If not, filmmakers are free to press on without military assistance.”

We’ve screwed up even the bottom of the food chain. Winning!

• Krill Fishing Poses Serious Threat To Antarctic Ecosystem (G.)

Industrial fishing for krill in the pristine waters around Antarctica is threatening the future of one of the world’s last great wildernesses, according to a new report. The study by Greenpeace analysed the movements of krill fishing vessels in the region and found they were increasingly operating “in the immediate vicinity of penguin colonies and whale feeding grounds”. It also highlights incidents of fishing boats being involved in groundings, oil spills and accidents, which it said posed a serious threat to the Antarctic ecosystem. The report, published on Tuesday, comes amid growing concern about the impact of fishing and climate change on the Antarctic.

A global campaign has been launched to create a network of ocean sanctuaries to protect the seas in the region and Greenpeace is calling for an immediate halt to fishing in areas being considered for sanctuary status. Frida Bengtsson, from Greenpeace’s Protect the Antarctic campaign, said: “If the krill industry wants to show it’s a responsible player, then it should be voluntarily getting out of any area which is being proposed as an ocean sanctuary, and should instead be backing the protection of these huge swaths of the Antarctic.” Last month a study found a combination of climate change and industrial-scale fishing is hitting the krill population, with a potentially disastrous impact on larger predators.

Photograph: Justin Hofman/Alamy Stock Photo

The study warned that the penguin population could drop by almost one-third by the end of the century due to changes in krill biomass. Krill are a key part of the delicate Antarctic food chain. They feed on marine algae and are a key source of food for whales, penguins and seals. They are also important in removing the greenhouse gas carbon dioxide from the atmosphere by eating carbon-rich food near the surface and excreting it when they sink to lower, colder water. There is a growing global demand for krill-based health products which are claimed to help with a range of ailments from heart disease to high blood pressure, strokes and depression. A recent analysis of the global krill industry predicted it was on course to grow 12% a year over the next three years. Krill populations have declined by 80% since the 1970s.