Paul Gauguin Contes barbares �1902

Later today: Nobel Peace Prize. US jobs numbers. And more Kavanaugh, no doubt.

But first: Stockpiling before tariffs set in.

• Economy on Sugar High Before Trade War Worsens (DDMB)

Across the U.S., companies are hitting the panic button. The Trump administration has levied 10 percent tariffs on $200 billion of Chinese goods, a charge that is expected to rise to 25 percent by 2019. This tops the tariffs on $50 billion of Chinese goods that were imposed in August, and is an effective tax on U.S. consumers, who will soon be paying more for everything from cosmetics to clothing to cars if they aren’t already. Against that backdrop, it’s becoming clear that many companies are rushing to secure products and materials before prices rise regardless of current demand. You could say they are in panic-buying mode.

The upside is that this behavior bolsters economic growth in the short term. The downside is that there is likely to be a nasty hangover. The noise in the economic data will be amplified by the rebuilding from Hurricane Florence. The estimates of the storm’s damage span from $20 billion to $50 billion. Evidence that panic buying has set in was seen in the September Chicago Purchasing Managers Index report, which is a bellwether for the broader national manufacturing sector. While the results “disappointed,” with the index falling from 63.6 to a still high 60.4 and the new orders component sinking to a six-month low, the inventory component surged above the 60 mark. (In these diffusion indexes, readings above 50 denote expansion.)

To put the stockpiling in context, inventories have only breached 60 twice this year. Such nosebleed readings are so rare that they rank in the 97th percentile over the last 30 years. As per the Chicago PMI: “Firms continued to add to their stock levels, building on August’s marked rise. The scarce availability of inputs continued to encourage stockpiling while forecasts of higher future demand also contributed to the rise in inventories.”

Large sums of money are moving.

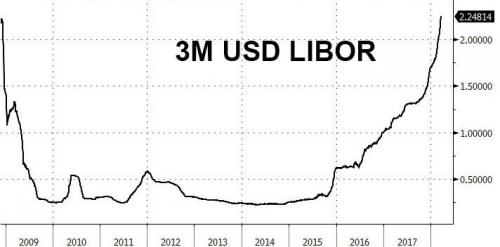

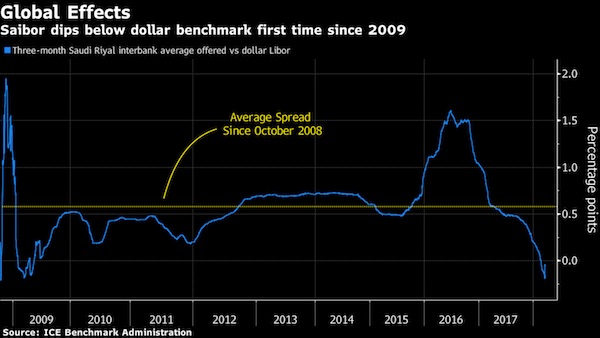

• Gundlach Says Treasury Market Is Witnessing A ‘Game Changer’ (MW)

For investors looking for an inflection point in the bond market, this is it. Jeff Gundlach, chief executive of Doubleline Capital, on Thursday projected that U.S. Treasury yields are likely to rise further and investors should adjust accordingly. The so-called bond king said in an interview with CNN that the 10-year yield could rise to 3.5% and the 30-year could climb to 4%, which are likely to hurt companies sensitive to higher rates, such as auto makers. In a tweet last month, Gundlach had forecast that the 30-year Treasury yield closing above 3.25% two days in a row will signify a “game changer,” a view he reiterated Thursday.

His prophecy has been fulfilled. The 30-year Treasury yield ended at 3.357% on Thursday after rising to 3.316% on Wednesday, according to FactSet. The 30-year yield has “definitively broken above a multiyear base that should, over time, carry us to significantly higher yields,” Gundlach told Reuters. “Also, the curve is steepening a little in this breakout, which is another sign that the situation has changed.” Yields rose sharply this week on the back of strong economic data that supported the widespread belief that the Federal Reserve will maintain its hawkish bias to forestall a possible overheating of the economy.

Ugliness assured.

• Republicans Aim To Confirm Kavanaugh On Weekend; Protesters Arrested (R.)

President Donald Trump’s fellow Republicans gained confidence on Thursday that his U.S. Supreme Court nominee, Brett Kavanaugh, could win Senate confirmation after two wavering lawmakers responded positively to an FBI report on accusations of sexual misconduct against the judge. The report, sent by the White House to the Senate Judiciary Committee in the middle of the night, was denounced by Democrats as a whitewash that was too narrow in scope and ignored critical witnesses. Thousands of anti-Kavanaugh protesters rallied outside the Supreme Court and entered a Senate office building, holding signs such as “Believe Survivors” and “Kava-Nope.”

Hundreds of demonstrators were arrested, including actress Amy Schumer. But Republicans moved forward with plans for a key procedural vote on Friday and a final vote on Saturday on confirming the conservative federal appeals judge for a lifetime job on the top U.S. court. The timing of the vote could be complicated by Republican Senator Steve Daines, whose office said on Thursday he planned to attend his daughter’s wedding in Montana on Saturday, making him unavailable to cast his vote.

Was reading this yesterday. What a story.

• Explosive Report Details Chinese Infiltration Of Apple, Amazon And The CIA (ZH)

The story begins with a Silicon Valley startup called Elemental. Founded in 2006 by three engineers who brilliantly anticipated that broadcasters would soon be searching for a way to adapt their programming for streaming over the Internet, and on mobile devices like smartphones, Elemental went about building a “dream team” of coders who designed software to adapt the super-fast graphics chips being designed for video gaming to stream video instead. The company then loaded this software on to special, custom-built servers emblazoned with its logo. These servers then sold for as much as $100,000 a pop – a markup of roughly 70%. In 2009, the company received its first contract with US defense and intelligence contractors, and even received an investment from a CIA-backed venture fund.

Elemental also started working with American spy agencies. In 2009 the company announced a development partnership with In-Q-Tel Inc., the CIA’s investment arm, a deal that paved the way for Elemental servers to be used in national security missions across the U.S. government. Public documents, including the company’s own promotional materials, show that the servers have been used inside Department of Defense data centers to process drone and surveillance-camera footage, on Navy warships to transmit feeds of airborne missions, and inside government buildings to enable secure videoconferencing. NASA, both houses of Congress, and the Department of Homeland Security have also been customers. This portfolio made Elemental a target for foreign adversaries.

Like many other companies, Elementals’ servers utilized motherboards built by Supermicro, which dominates the market for motherboards used in special-purpose computers. It was here, at Supermicro, where the government believes – according to Bloomberg’s sources – that the infiltration began. Before it came to dominate the global market for computer motherboards, Supermicro had humble beginnings. A Taiwanese engineer and his wife founded the company in 1993, at a time when Silicon Valley was embracing outsourcing. It attracted clients early on with the promise of infinite customization, employing a massive team of engineers to make sure it could accommodate its clients’ every need.

Customers also appreciated that, while Supermicro’s motherboards were assembled in China or Taiwan, its engineers were based in Silicon Valley. But the company’s workforce featured one characteristic that made it uniquely attractive to China: A sizable portion of its engineers were native Mandarin speakers. One of Bloomberg’s sources said the government is still investigating whether spies were embedded within Supermicro or other US companies).

Hard to believe. Holland has been targeting Russia for years, can’t trust them when it comes to these stories.

• Mattis Says Russian GRU Caught Red-Handed Hacking OPCW (ZH)

Russia is facing new multiple wide-ranging charges of hacking as Western officials on Wednesday alleged its intelligence agencies conducted four high profile cyber attacks, including an attempt to spy on the Organisation for the Prohibition of Chemical Weapons (OPCW), which is the independent body responsible for investigating chemical attacks in Syria and in the UK. The OPCW is headquartered the Netherlands, and according to breaking reports a group that the Dutch government has alleged are Russian operatives may have been caught red-handed in the act. Moscow has dismissed the charges as but more “Western spy mania” while leveling its own accusations that the Pentagon is conducting an illegal and dangerous germ and bio-weapons research program near Russia’s borders.

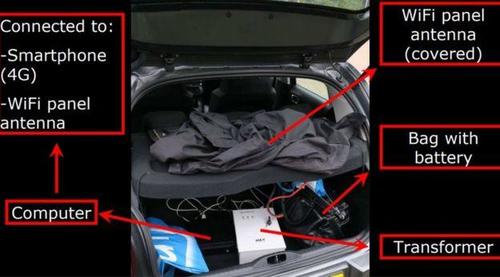

The BBC reports based on Dutch government statements: “The four suspects identified by Dutch officials had diplomatic passports and included two IT experts and two support agents, officials said. They hired a car and parked it in the car park of the Marriot hotel in The Hague, which is next to the OPCW office, to hack into the OPCW’s wifi network, Major General Onno Eichelsheim from the Dutch MIVD intelligence service said.” Authorities were quick to release photographs of the group’s alleged hacking equipment and computers in the trunk of a car. Police say they are GRU operatives (also known as the Main Intelligence Directorate – the intelligence arm of the Russian military) who planned to intercept login passwords to gain access to OPCW internal files (in what appears to have been a low security environment, given wifi use to store sensitive files).

The Dutch government released the above photo which it says proves Russian spies tried to hack OPCW headquarters

But strangely the four men, identified as spies, were immediately escorted out of the Netherlands as opposed to being detained for further questioning and possible trial. Meanwhile the UK government further accused the GRU of conducting cyber-attacks on private firms in Ukraine and Russia, the US Democratic Party, as well as a small TV network in Britain. U.S. Defense Secretary Jim Mattis, addressing the charges on Thursday after a two-day meeting in Brussels, said Russia must be held accountable for its attempts to hack the OPCW office.

Not only are Russians mean people, they are dumb too. Who believes that?

• String Of Own Goals By Russian Spies Exposes A Strange Sloppiness (G.)

It must go down as one of the most embarrassing months ever for Russia’s military intelligence. In the 30 days since Theresa May revealed the cover identities of the Salisbury poison suspects, the secretive GRU (now GU) has been publicly exposed by rival intelligence agencies and online sleuths, with an assist from Russia’s own president. Despite attempts to stonewall public inquiry, the GRU’s dissection has been clinical. The agency has always had a reputation for daring, bolstered by its affiliation with special forces commando units and agents who have seen live combat.

But in dispatching agents to the Netherlands who could, just using Google, be easily exposed as graduates of an elite GRU academy, the agency appears reckless and absurdly sloppy. One of the suspected agents, tipped as a “human intelligence source” by Dutch investigators, had registered five vehicles at a north-western Moscow address better known as the Aquarium, the GRU finishing school for military attaches and elite spies. According to online listings, which are not official but are publicly available to anyone on Google, he drove a Honda Civic, then moved on to an Alfa Romeo. In case the address did not tip investigators off, he also listed the base number of the Military-Diplomatic Academy.

A judge just oredred Musk and the SEC to explain their settlement.

• Elon Musk Mocks SEC as ‘Shortseller Enrichment Commission’ (CNBC)

Tesla CEO Elon Musk mocked the Securities and Exchange Commission in a tweet Thursday, calling the agency the “Shortseller Enrichment Commission,” days after settling fraud charges brought against him by the agency. The tweet, which is missing a word and appears to take a sarcastic tone, says “the Shortseller Enrichment Commission is doing incredible work” and commends the SEC on a name change that did not occur. Musk doubled down on the remark when another Twitter user said Musk needs a “a social team that can get attention without typos and without enraging the Shortseller Enrichment Committee.” The Tesla CEO asked, “Why would they be upset about their mission? It’s what they do.”

Hardly ever a useful idea to go after short sellers.

• Elon Musk Accuses BlackRock Of Helping Short Sellers (CNBC)

Tesla CEO Elon Musk has accused large fund managers such as BlackRock for fueling short sellers, a group of investors he has been criticizing on his Twitter account. In a series of Twitter posts on Thursday night, Musk alleged that BlackRock and other financial firms pocket “excessive profit” from lending shares they hold to short sellers because “they’re suffering a net loss.” Short sellers are investors who bet on the decline of a security, such as a stock. They make money by selling the shares they borrow, and hope the price falls so they can buy them back at a lower price and make profits from it.

Musk also said those funds were “pretending to charge low rates” for their passive “index tracking” products. Fund managers have lowered management fees on certain products due to increased competition in the space. Fidelity Investments said last month it was launching two no-fee index funds, while Vanguard announced in July that investors using its online brokerage platform could trade exchange-traded funds without commission. At the same time, fund managers have been growing their business in securities lending — which is the process of temporarily transferring ownership of shares or bonds to another party, such as short sellers.

The companies earn a fee in return for loaning out their holdings. Securities lending is a lucrative business, according to an opinion piece by Financial Times in April. The newspaper, which cited a regulatory filing, said BlackRock made $597 million in revenue last year from lending securities. Musk hit out at that practice, saying “there is no rational basis” for long-term shareholders to engage in that business. He claimed that doing so “dilutes the shareholder base” while giving short sellers “a strong incentive to attack the company by whatever means possible.”

The EU should not let Tusk do these things, he’s too easy a target. Let Barnier do the talking.

• EU Tells UK To Stop ‘Wasting Time’, Find Irish Border Solution (Ind.)

The EU has told the UK to stop “wasting time” and find a solution to the Irish border row, with just two weeks until the next showdown summit over Brexit. Donald Tusk, the European Council president, turned his fire on Jeremy Hunt for likening the EU to the Soviet Union – accusing ministers of rousing the Tory faithful, instead of striving to reach an agreement. “Unacceptable remarks that raise the temperature will achieve nothing except wasting more time,” Mr Tusk said. “I was a party leader myself for 15 years, so I know what the rules of party politics are. But now, once the Tory conference is over, we should get down to business.”

Speaking alongside Leo Varadkar, the Irish president, Mr Tusk made clear the EU remained “united behind Ireland” in its determination to prevent a return to border posts and checks. But he also made clear his anger at the delay to Theresa May’s promised fresh border proposals – linking it to a reluctance to risk a backlash at the Tory conference. In Birmingham, Mr Hunt, the foreign secretary, triggered fury across the EU by accusing it of trying to keep the UK in a “prison” with behaviour similar to the Soviet Union. After the Salzburg summit, the prime minister accused Mr Tusk of showing disrespect, but he tuned that accusation on the UK, saying: “In respecting our partners, we expect the same in return.

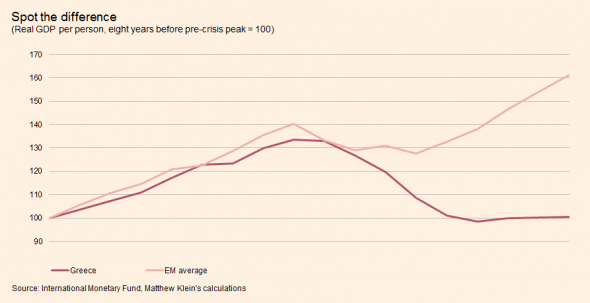

It sucks too many resources from the ’periphery’. Re: Rome.

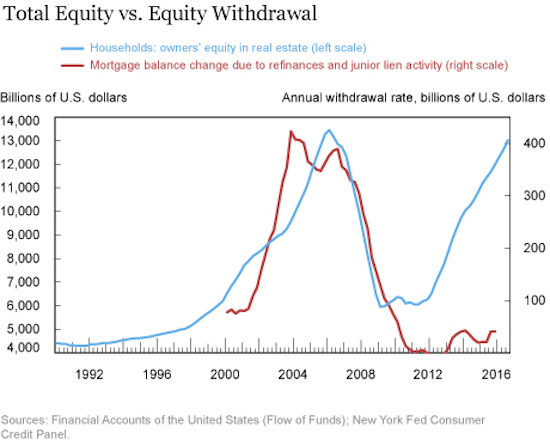

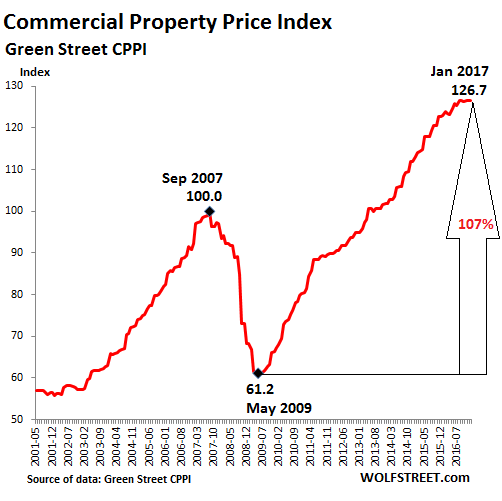

• The Outsized Power Of The City Of London Makes Britain Poorer (G.)

To argue that the City hurts Britain’s economy might seem crazy. But research increasingly shows that all the money swirling around our oversized financial sector may actually be making us collectively poorer. As Britain’s economy has steadily become re-engineered towards serving finance, other parts of the economy have struggled to survive in its shadow, like seedlings starved of light and water under the canopy of a giant, deep-rooted and invasive tree. Generations of leaders from Margaret Thatcher to Tony Blair to Theresa May have believed that the City is the goose that lays Britain’s golden eggs, to be prioritised, pampered and protected. But the finance curse analysis shows an oversized City to be a different bird: a cuckoo in the nest, crowding out other sectors.

[..] A growing body of economic research confirms that once a financial sector grows above an optimal size and beyond its useful roles, it begins to harm the country that hosts it. The most obvious source of damage comes in the form of financial crises – including the one we are still recovering from a decade after the fact. But the problem is in fact older, and bigger. Long ago, our oversized financial sector began turning away from supporting the creation of wealth, and towards extracting it from other parts of the economy. To achieve this, it shapes laws, rules, thinktanks and even our culture so that they support it. The outcomes include lower economic growth, steeper inequality, distorted markets, spreading crime, deeper corruption, the hollowing-out of alternative economic sectors and more.

Stop producing the stuff. It’s not hard. Stop using it.

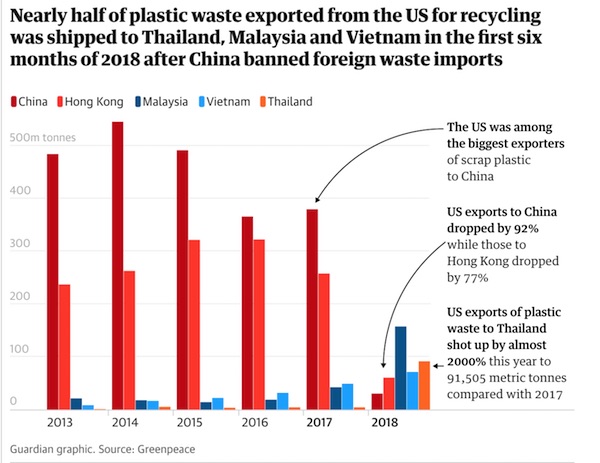

• Huge Rise In US Plastic Waste Shipments To Poor Countries After China Ban (G.)

Exports of plastic waste from the US to developing countries have surged following China’s crackdown on foreign waste imports, new research has shown. Nearly half of plastic waste exported from the US for recycling in the first six months of 2018 was shipped to Thailand, Malaysia and Vietnam, according to analysis of US census bureau data by Unearthed, Greenpeace’s investigative arm. The previous year, the US sent more than 70% to China and Hong Kong. This year’s ban on foreign waste imports by China, previously the world’s biggest importer of plastic waste for recycling, has left western countries scrambling to offload its extra plastic waste. The US, along with Britain, Germany, Japan and Mexico, is among the biggest exporters of scrap plastic to China.

Campaigners said the analysis, which Unearthed shared with the Guardian, shows the US is exploiting developing countries where there is no regulatory framework to ensure plastic waste is processed in an environmentally friendly way. “Instead of taking responsibility for their own waste, US companies are exploiting developing countries that lack the regulation to protect themselves,” said John Hocevar, Oceans campaign director for Greenpeace USA. The waste, some of which consists of household recycling produced in the US, includes single-use plastic bottles, plastic bags and food wrappings, said Hocevar. It can, however, contain toxic materials. “It’s a problem for the US and other developed countries to produce, often, toxic material which they can’t or won’t take care of themselves.”