Pablo Picasso Marie-Thérèse Walter 1937

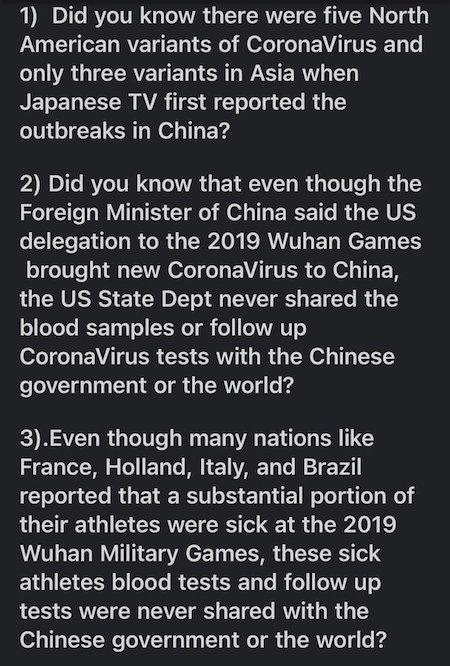

Wonder how the families of the dead and wounded look at an Annie Leibowitz glossy.

O’Looney

Funeral Director John O'Looney talks about the contracts for babies deaths – straight to crematoria. pic.twitter.com/7IXC9moJjx

— PBC174 (@PBC174) July 25, 2022

Russia oil imports

3-5 weeks. Bigger weapons. Word has it that Ukraine has already fired US weapons ito Russia. Be very careful.

• US Says Coming Weeks ‘Crucial’ For Ukraine (RT)

Kiev needs longer-range weaponry before it is too late, the head of the House Armed Services Committee, Adam Smith, believes Ukraine might only have a few weeks left if it hopes to take back territories controlled by Russia, Chairman of the House Armed Services Committee Adam Smith told Politico’s National Security Daily on Monday. The Ukrainian forces would need longer-range weapons like tactical missiles and strike drones to change the tides of battle, he said, in the wake of his visit to Kiev. The approaching winter would turn the ongoing conflict between Moscow and Kiev into a war of attrition that would only benefit Russia, the news outlet said, adding that Kiev has asked the American congressional delegation to convince Washington to urgently send aid.

“Help them now as much as possible. The next three to six weeks are crucial,” Smith (D-WA) told the outlet. According to the congressman, the Ukrainian government is willing to reach a peace agreement with Moscow but still wants its territories back, particularly those in the south. Russian troops have seized control over Ukraine’s southern Kherson region and most of the neighboring Zaporozhye Region soon after the start of the military operation in February. Local officials in the two regions have considered holding referendums on joining Russia since then. Kiev has repeatedly stated that its goal is to take back all of its territories. Earlier in July, Ukrainian Foreign Minister Dmitry Kuleba said that his nation’s goal in the conflict was to “restore our territorial integrity, and full sovereignty in the east and south of Ukraine.”

But this is not the first time Kiev has indicated that it wants to see the end of the conflict before cold temperatures set in. In late June, President Vladimir Zelensky told the G7 summit that he wanted to see the conflict end by the onset of winter, according to Reuters. Smith believes the Ukrainian forces would need heavier weapons to achieve this goal. “The HIMARS systems with their range … [of] 30 to 50 kilometers is really helpful. We’ve seen the impact already just in the last month. But if they had a longer range, it’d be tougher for the Russians to hide their stuff,” Smith told RFE/RL on Saturday while still in Kiev. Washington supplied Kiev with 12 HIMARS multiple-launch rocket systems so far. Last week, the Pentagon announced Ukraine was about to get another four of these systems, which would bring their total number on the battlefield to 16.

“Kiev police announced that they had raided two nightclubs in the capital over violating a curfew, and handed a summons for service to more than 200 male partygoers…”

• Ukraine’s Military Morale In Decline – NYT (RT)

Kiev’s “secretive and arbitrary” military recruitment, which leads to the drafting of soldiers who are unwilling to serve, is affecting the morale of the Ukrainian troops fighting against Russia, the New York Times has reported. There are “signs, five grueling months into the war, that the sense of unity is fraying at the edges” within the Ukrainian military, the paper pointed out in a report on Monday. Some soldiers are unhappy that they have done “long, hard service,” while many others managed to stay away from service, it said. “There is no one to replace us. There are too few people. It’s very hard for the guys, psychologically,” a Ukrainian soldier, who’d spent months fighting, commented.

There is also “disillusionment” among Kiev’s troops with the country’s draft system, which “turns away some who want to fight [due to bureaucratic reasons], while taking in others who are unwilling and unqualified,” the NYT reports. Some Ukrainian commanders have been complaining that “summoning men unwilling to serve is lowering morale among those who volunteered,” it added. The paper recalled how, in June, Kiev police announced that they had raided two nightclubs in the capital over violating a curfew, and handed a summons for service to more than 200 male partygoers.

This angered Valery Markus, a senior sergeant of the 47th Armed Forces Battalion, who wrote on Facebook that he was “outraged” because the military profession is “being reduced to the level of punishment for these scumbags.” In his post, Markus slammed Ukraine’s “chaotic” draft system, arguing that poorly trained and unmotivated recruits are endangering the lives of other troops. He also recalled cases of alcoholism and other troubling issues among the newly arrived soldiers. The Ukrainian government, which has barred all men aged between 18 and 60 from leaving the country, has been undertaking a massive recruitment drive amid the conflict with Russia.

“..the internet is flooded with videos of Ukrainian soldiers refusing to fight, complaining that their fleeing commanders are throwing them at tanks as cannon fodder– without any equipment or training. There are hundreds of these videos..”

• Public Opinion Turns Against The Military Draft In Ukraine (Artemyev)

Five months into Russia’s military offensive in Ukraine many in the latter state are starting to vocalise their objection to the draft imposed by the regime in Kiev. Especially as the propaganda about victory, any day now, starts to lose its power. Popular Ukrainian blogger and activist Yury Kasyanov recently made a post on his Facebook page, in which he complained: “Let’s stop the mobilization, open the borders, and dissolve all the military recruitment offices… Let the professionals do the fighting – after all, they get paid for it – and let the volunteers join in, because they want to fight. But I am an untrained civilian, unfit for war, I’m going to get myself killed. And I pay my taxes, too!” With this provocative post, Kasyanov intended to spark a discussion about mandatory conscription in Ukraine.

But the results of the debate came as a shock to the blogger: “Judging by the comments on the previous post, nine out of ten Ukrainians have no intention to fight; they oppose nationwide mobilization, as well as the ban on men leaving the country.” It should be noted that Kasyanov’s followers, like himself, are fierce supporters of the idea that Ukraine must fight Russia to the bitter end. And yet, even among them, the vast majority have no desire to die for the glory of Ukraine. Modern civilization is built on a very self-conscious attitude toward one’s health. The first thing you see when you go online are banner ads that read ‘10 Warning Signs That You Have Cancer’ or ‘How to Relieve Joint Pain’, etc. Other core values include bodily integrity, the right to privacy, and of course, everyday comfort and convenience.

None of these go together well with the squalid realities of the front line. One might say that the whole ethos of war stands in opposition to the values of today’s society. Ukraine is a country largely populated by one or two-child families. How many of its citizens would voluntarily go to war to be killed or crippled? It should come as no surprise, therefore, that Ukrainians do not want to go to war. Yes, if you listen to what they say, the majority of Ukrainians are patriots. But when it comes to getting up from the couch and actually going to the front, very few are willing to ‘walk the talk’. And I don’t imagine that, after 30,000 more Ukrainian soldiers have perished on the battlefield, anyone would feel more motivated to join the cause. In fact, it would likely produce the opposite effect: ‘I don’t want to die like all the others’.

[..] Ukraine is going through a demographic crisis with its population shrinking from 52 million in 1991 to barely more than 30 million, even before the conflict erupted in February. The situation is so bad that the state has avoided holding a census for over two decades. I read Ukrainian mass and social media daily, which is heavily censored by the regime in Kiev. It’s output is rather different from the reality on the ground. While the internet is flooded with videos of Ukrainian soldiers refusing to fight, complaining that their fleeing commanders are throwing them at tanks as cannon fodder– without any equipment or training. There are hundreds of these videos and new ones are uploaded every day. They are shot by Ukrainians in military fatigues, not Russian state media. Also, the number of videos showing Ukrainian women refusing to let their men be taken by the police or recruiters is also growing.

Blackmail?

• Ukraine Wants Citi, JPMorgan And HSBC Prosecuted For ‘War Crimes’ (ZH)

Ukraine wants major US and European banks prosecuted for “committing war crimes” because they finance companies that trade oil with Russia, according to CNBC, citing President Volodomyr Zelensky’s top economic aide, Oleg Ustenko. “Everybody who is financing these war criminals, who are doing these terrible things in Ukraine, are also committing war crimes in our logic,” Ustenko told the network on Tuesday, calling out banks such as JPMorgan, HSBC and Citi. When asked if the banks should be prosecuted for war crimes, Ustenko replied “Exactly.” “Ustenko said Zelenskyy believes these banks should be held accountable for prolonging the conflict and the war on Ukraine.His comments came in response to a FT report last week, which said that Ukraine’s government wrote to the chiefs of U.S. and European banks — such as Jamie Dimon from JPMorgan and Noel Quinn from HSBC — urging them to cut ties with the groups that are trading Russian oil.” -CNBC

According to letters seen by the FT, Ustenko asked the banks to cut off financing to any businesses that deal in Russian oil, and to divest from Gazprom and Rosneft, Russia’s primary state-owned oil and gas companies. The letters directly accuse Citigroup and Credit Agricole of “prolonging” the war by extending financing to companies that ship Russian oil, and warns that said banks won’t be allowed to take part in Ukraine’s reconstruction when the war is over. Ustenko told CNBC that the Zelensky administration is gathering evidence to send to the International Criminal Court. “We are collecting all these information” on companies that are financing Russia, he said. “Our Ministry of Justice and our security service of Ukraine are collecting. And then later, this is going to be passed to the ICC.”

“This isn’t the first time that Ukraine has gone after Western companies for having business dealings with Russia. In March, the government was highly critical of big oil companies for still doing business with Russia, and warned that some of those firms could find themselves on the wrong side of history. Ustenko said the war has taken a significant toll on Ukraine’s economy since Russia’s invasion began on Feb. 24.” -CNBC

“..Even in the most difficult moments Russia continued to fulfil its obligations.”

• Russia Rebukes Germany’s Gas-supply Claim (RT)

Comments by German Chancellor Olaf Scholz, that Russia is not a reliable gas supplier, contradict the facts, the Kremlin spokesperson Dmitry Peskov said on Monday. “These statements absolutely contrast with reality and with the history of supplies. Even in the most difficult moments Russia continued to fulfil its obligations.” Peskov told journalists in Moscow. Last week, German Chancellor Olaf Scholz suggested that Berlin could no longer rely on Moscow when it came to gas supplies. Scholz was likely referring to a reduction of gas flow through the Nord Stream-1 pipeline by 60% last month, and a complete halt in supplies due to annual maintenance last week. The two developments led to a gas shortage in the EU and to a panic that supplies would not be resumed. However, Russian deliveries were resumed at 40% capacity on July 21.

“[Things] will not get more reliable than today.”Scholz said on Friday, also suggesting that he wasn’t convinced by Russia’s statements that the delayed return of the repaired Siemens turbine was necessary for the full functioning of the Nord Stream-1 pipeline. The turbine, which was stuck where it was being fixed in Canada due to sanctions, is now in Germany awaiting shipment to Russia. Pipeline operator Gazprom cited the delay with its return as the reason for the slashing of gas supplies to the EU. “The fact that now there has been a decrease in the volume of supplies is due to the illegal restrictions that the Europeans, in particular Germany, have imposed.” Peskov stated. According to him, the equipment will be installed after all formalities of the process are completed, and the pumping will resume in volumes that are technologically possible.

Yeah, K street works for free…

• Pro Bono Lobbying For Ukraine ‘Hottest Trend’ In Washington DC (Kolomoets)

If you’ve wondered why so much Western media coverage of the Ukraine conflict seems to be based on “Kiev says,” the answer is largely down to the power of lobbying. The Ukraine is always good and Russia is always bad narrative didn’t create itself. On July 11, Washington DC-based public affairs consultancy Ridgely Walsh registered as a Foreign Agent on behalf of Ukrainian interests with the US Justice Department. The company – which typically advises Silicon Valley big hitters such as eBay, Google, Snapchat, SpaceX, and Uber – is just the latest Beltway operator to enlist under the Foreign Agent Registration Act (FARA). This is archaic and abstruse legislation thrust to the forefront of the mainstream news agenda during the ‘Russiagate’ hoax of the Donald Trump presidency. Last July, just 11 US-based firms were registered as lobbyists for Ukrainian clients under FARA.

Over the course of 2021, these influencers attempted to pressure Washington to kill the Nord Stream 2 project, increase lethal aid shipments to Kiev, and post ever-more US and NATO forces along Russia’s border. In the process, they amassed over 10,000 contacts with lawmakers, think tanks, and journalists. This is a staggering figure when one considers the Saudi lobby – one of the largest and most influential in the US – had just 2,834 interactions with these elements in the same timeframe. Lobbying activity on behalf of Kiev over 2022 will inevitably dwarf even that vast total. Now, the number of registered pro-Ukrainian agents in Washington stands at an unprecedented 24, with six being compelled to register in June alone. Strikingly too, many of these companies are providing their services free of charge – to the extent pro bono lobbying for Zelensky’s government has been dubbed the ‘hottest trend’ in Washington DC political circles.

“In Private, Cassidy Hutchinson Joked About Riot, Called J6 Committee ‘Phony,’”

• Private Chats Show Cassidy Hutchinson’s Flip Flop (Fed)

In November 2021, Hutchinson was among the first former White House staffers to be subpoenaed by the Select Committee. In the weeks and months following, Hutchinson continued to disparage the politicized committee in private, and repeatedly joked about the same riot she now says leaves her with emotional scars today. Six days after she was issued a subpoena, Hutchinson called the Jan. 6 panel a “phony committee.” Around the same time, she told a former colleague her testimony would have nothing to offer. “Other than a handful of irrelevant texts, I have literally no documents or anything they’re asking about,” one ex-White House staffer texted her.

“Same,” she wrote back. Of being subpoenaed in November, Hutchinson wrote, “we were [f—–] by Bennie Thompson,” the titular chair of the committee. She joked that he would be sending her to jail, and hoped that another friend would come visit her. In a text published by the Daily Caller earlier this month, Hutchinson called the panel’s probe “bs.”

[..] Hutchinson also aimed fire at Committee Vice Chair Liz Cheney, the Wyoming Republican so consumed by her opposition to Trump and his voters that polls show she is about to lose her re-election bid. The two women publicly embraced in the committee room immediately after Hutchinson’s testimony, an unusual interaction for congressional proceedings purporting to be legitimate. In a gauzy puff piece for The New York Times, the two were described as forming an “unlikely bond.” It was particularly unlikely given what Hutchinson was saying about Cheney until recently. In September, Hutchinson disparaged Cheney and Illinois Rep. Adam Kinzinger, the two Republicans hand-picked to serve on the committee by Pelosi, as a “crop of losers.”

Discussing how other anti-Trump extremists had declined to run for re-election rather than face certain defeat at the hands of Republican voters, Hutchinson said she didn’t think Kinzinger or Cheney would take that approach because, “Their egos are too [f——] big.” She mocked their self-conception as “The REPUBLICAN MARTYRS.” “I think Liz being the ‘future of the GOP’ is a massive stretch,” Hutchinson wrote in one string of messages just two months before her appearance. “I think she does have the power to cement the anti-Trump, RINO movement and really capitalize off it on a national scale. She’ll never ever turn the tides in her favor. Ever.”

All of a sudden the wet market is back. It’s hard to keep up.

• Former CDC Director Challenges Fauci On Covid-19 Origin (JTN)

Former Centers for Disease Control and Prevention Director Robert Redfield on Monday challenged National Institute of Allergy and Infectious Diseases Director Dr. Anthony Fauci’s view that the coronavirus originated naturally. Fauci has eschewed the notion that the coronavirus originated in a Chinese lab, the Wuhan Institute of Virology, insisting COVID-19 likely originated in nature. The NIAID director has long been at odds which his right-leaning critics, especially Kentucky Republican Sen. Rand Paul, over this position. Redfield, however, gave more credence to the Wuhan lab origin in a Fox News interview, saying the virus had to be educated in the laboratory to gain the efficient human-to-human transmission capability that it has.”

“So it’s really exceptional that this virus is one of the most infectious viruses for man. And I still argue that’s because it was educated how to infect human tissue,” he continued. While health officials and the mainstream media largely derided the Wuhan theory as misinformation, evidence has mounted to lend greater credibility to the idea. The FBI launched an inquiry into the lab’s work on coronaviruses while Congress ultimately lent the theory enough weight to ban further federal funding specifically to the WIV and to labs in adversary nations. Redfield expressed disappoint that American health institutions were so stalwartly opposed to examining the WIV as an origin site for COVID-19. “I’ve been very disappointed in the scientific community led by [National Institutes of Health] that has really dug their heels in from the beginning to try to minimize any of us that have a different hypothesis,” he said, per the Epoch Times.

Two new studies just as the lab leak was getting confirmed. Curious.

• New Studies Bolster Theory Coronavirus Emerged From The Wild (AP)

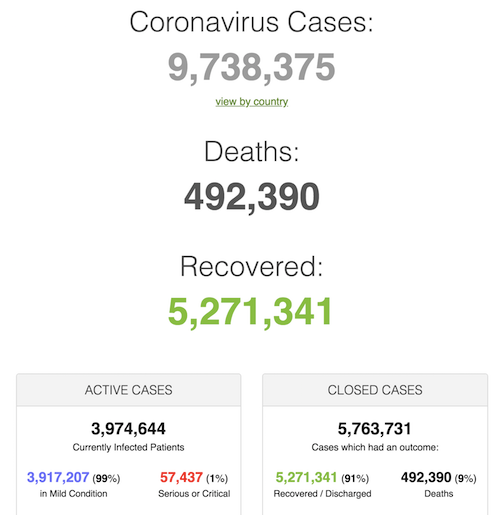

Two new studies provide more evidence that the coronavirus pandemic originated in a Wuhan, China market where live animals were sold – further bolstering the theory that the virus emerged in the wild rather than escaping from a Chinese lab. The research, published online Tuesday by the journal Science, shows that the Huanan Seafood Wholesale Market was likely the early epicenter of the scourge that has now killed nearly 6.4 million people around the world. Scientists conclude that the virus that causes COVID-19, SARS-CoV-2, likely spilled from animals into people two separate times. “All this evidence tells us the same thing: It points right to this particular market in the middle of Wuhan,” said Kristian Andersen a professor in the Department of Immunology and Microbiology at Scripps Research and coauthor of one of the studies.

“I was quite convinced of the lab leak myself until we dove into this very carefully and looked at it much closer.” In one study, which incorporated data collected by Chinese scientists, University of Arizona evolutionary biologist Michael Worobey and his colleagues used mapping tools to estimate the locations of more than 150 of the earliest reported COVID-19 cases from December 2019. They also mapped cases from January and February 2020 using data from a social media app that had created a channel for people with COVID-19 to get help. They asked, “Of all the locations that the early cases could have lived, where did they live? And it turned out when we were able to look at this, there was this extraordinary pattern where the highest density of cases was both extremely near to and very centered on this market,” Worobey said at a press briefing.

“Crucially, this applies both to all cases in December and also to cases with no known link to the market … And this is an indication that the virus started spreading in people who worked at the market but then started to spread into the local community.” Andersen said they found case clusters inside the market, too, “and that clustering is very, very specifically in the parts of the market” where they now know people were selling wildlife, such as raccoon dogs, that are susceptible to infection with the coronavirus. In the other study, scientists analyzed the genomic diversity of the virus inside and outside of China starting with the earliest sample genomes in December 2019 and extending through mid-February 2020.

They found that two lineages – A and B – marked the pandemic’s beginning in Wuhan. Study coauthor Joel Wertheim, a viral evolution expert at the University of California, San Diego, pointed out that lineage A is more genetically similar to bat coronaviruses, but lineage B appears to have begun spreading earlier in humans, particularly at the market. “Now I realize it sounds like I just said that a once-in-a-generation event happened twice in short succession,” Wertheim said. But certain conditions were in place — such as people and animals in close proximity and a virus that can spread from animals to people and from person to person. So “barriers to spillover have been lowered such that multiple introductions, we believe, should actually be expected,” he said.

George Webb.

The FBI looks awful here.

• FBI Jeopardized National Security With Hunter Biden ‘Disinformation’ (Fed.)

FBI whistleblowers claim that agents opened a sham investigation into Hunter Biden to brand reliable and verifiable derogatory evidence as “disinformation,” according to an explosive news release issued yesterday by Sen. Chuck Grassley, R-Iowa. If true, beyond exposing the FBI’s role in running cover for the Biden family, the whistleblowers’ claims prove significant for a second reason: By failing to thoroughly vet the evidence in its possession related to Hunter Biden — which included the hard drive for the MacBook Hunter had abandoned at a repair shop — the intelligence community ignored a momentous national security threat, namely that the Russians potentially possessed a second Hunter Biden laptop.

[..] The FBI whistleblowers’ charges, if accurate, are devastating and mean that at a time that Hunter Biden was already reportedly under investigation by the Delaware U.S. Attorney’s Office, rather than work with the agents already investigating then-candidate Joe Biden’s son, FBI headquarters initiated its own “assessment.” Then, according to the whistleblowers, agents improperly shut down sources, falsely framed evidence as disinformation, and hid the reasoning for that determination from other FBI agents behind restricted areas. The press release also suggests that the FBI’s “assessment” served to frame the investigation Grassley and Sen. Ron Johnson, R-Wis., were conducting into Hunter Biden’s foreign business dealing as tainted by Russian disinformation.

As part of that investigation, in May 2020, “Senate Republicans issued a subpoena seeking documents from the younger Biden and asked for information related to more than two dozen entities, including Burisma,” which was the Ukrainian energy company that paid Hunter nearly $1 million a year to sit on its board. With the Trump-Biden presidential contest in full force, Grassley and Johnson’s investigation into Hunter prompted pushback from Democrats, with Democrat members of the Gang of Eight sending a letter and classified addendum in July 2020 to FBI Director Christopher Wray “specifically citing the Johnson-Grassley probe into Hunter Biden as reason for an urgent briefing for Congress about foreign ‘disinformation.’”

You’re going to need more than a few people sitting in lawn chairs…

• National Peace Rally Blacklisted by Mainstream and Social Media (Celente)

Saturday’s “Peace and Freedom Rally,” launched by Occupy Peace in historic Kingston, NY, featured some of the top names in America, but was blacklisted by the mainstream and social media. Featured speakers included Judge Andrew Napolitano, the former chief legal analyst for Fox News; Phil Giraldi, the former CIA operative; Gary Null, the host at Progressive Radio Network; Scott Ritter, an ex-weapons inspector for the UN; and Gerald Celente, publisher of The Trends Journal, founder of Occupy Peace, and Deacon of the Universal Church of Freedom, Peace and Justice. Despite sending thousands of press releases over the past three weeks to international, national, and local media, there was no coverage of the heavily attended Rally. Moreover, Twitter and Facebook banned Occupy Peace ads for the event.

However, when rallies are held to support Ukraine and America and NATO’s fight against Russia, there’s massive coverage. Thus, considering the establishment media’s pro-war and anti-peace sentiments… they deplore the Founding Fathers who fought for America’s freedom and independence. Never a word from their featured “experts” or government “officials” of George Washington’s farewell address when he warned that any nation which “indulges towards another in habitual hatred or an habitual fondness is in some degree a slave.” Total media silence of Washington’s plea to “Observe good faith and justice towards all nations; cultivate peace and harmony with all.” In fact, by their deeds, the mainstream media does not “Observe good faith and justice to all.” Instead, their one-sided-war-hawk-narratives are making Americans “a slave” to the military-industrial complex.

Yes, the same military-industrial complex that President Dwight D. Eisenhower warned about in his farewell address when he said they were taking control of America and robbing the nation of the genius of scientists, the sweat of the laborers, and the future of the children. Indeed, not only is America’s defense secretary a former board member of Raytheon, the second largest military contractor in the United States, last month the Senate Armed Services Committee approved a record $858 billion military budget for 2023. Considering how low the mainstream media has fallen, it is clear why the latest Gallup poll shows just 16 percent of U.S. adults have respect or confidence in newspapers, and just 11 percent in TV news.

Artificial shortages. Great for profits. Signed: Bayer.

• Grain Inflation: Starve the Poor, Feed the Rich (Pettifor)

In a world of financialised globalisation, prices of food are not determined by the simplistic laws of supply and demand. Prices are determined by a wall of money wielded by relatively few, invisible speculators and aimed at largely unregulated global grain markets. Yesterday, the Financial Times ran an article on global food security. Editors made clear the text was not the work of FT journalists, but “partner content.” The name of the partner? Bayer AG – by their own definition “a global leader in agriculture.” The article began thus: “While the people of Ukraine face an ongoing nightmare, the Russian invasion has set in motion a global food crisis that requires our attention and immediate action. In fact, the war has knocked the global food system off its axis, risking a humanitarian disaster.”

As readers will know from an earlier post, I take a different view. The global food crisis is a consequence of commodity price speculation on Wall St and the CME – not directly the Russian invasion of Ukraine. Readers may think this controversial, but bear with me, as we hear Bayer out: “Ukraine is one of the most important suppliers of wheat, corn, oils, and other essential commodities to the world. Known as the breadbasket of the world, the country has secured the food supply for parts of the Middle East and East Africa, including countries like Egypt and Lebanon whose stability is paramount for the region.” These facts – the invasion of Ukraine, and the latter’s role as “as one of the most important suppliers of wheat, corn…” were directly contradicted by Bayer AG on another platform: when announcing its Q1 earnings results – as Seeking Alpha reported in May this year – fully three months after war began:

The German conglomerate’s core EPS grew +36.3% Y/Y to €3.53. Net income (including discontinued operations) grew +57.5% to ~€3.29B. Group sales grew +18.7% Y/Y (or +14.3% on a currency and portfolio-adjusted basis, or Fx & portfolio adj.) to ~€14.64B. “We achieved outstanding sales and earnings growth, with particularly substantial gains for our agriculture business,” said Werner Baumann, chairman of the board of management. The company said that in Q1 group sales and earnings were not negatively impacted by Russia’s invasion of Ukraine. In total, the two countries account for ~3% of sales.

Support the Automatic Earth in virustime with Paypal, Bitcoin and Patreon.