DPC Peanut stand, New York 1900

But wait, didn’t Obama say the US has to set the rules for the entire world?

• At Global Economic Gathering, US Primacy Is Seen as Ebbing (NY Times)

As world leaders converge [in Washington] for their semiannual trek to the capital of what is still the world’s most powerful economy, concern is rising in many quarters that the United States is retreating from global economic leadership just when it is needed most. The spring meetings of the IMF and World Bank have filled Washington with motorcades and traffic jams and loaded the schedules of President Obama and Treasury Secretary Jacob J. Lew. But they have also highlighted what some in Washington and around the world see as a United States government so bitterly divided that it is on the verge of ceding the global economic stage it built at the end of World War II and has largely directed ever since. “It’s almost handing over legitimacy to the rising powers,” Arvind Subramanian, chief economic adviser to the government of India, said of the United States.

“People can’t be too public about these things, but I would argue this is the single most important issue of these spring meetings.” Other officials attending the meetings this week, speaking on the condition of anonymity, agreed that the role of the United States around the world was at the top of their concerns. Washington’s retreat is not so much by intent, Mr. Subramanian said, but a result of dysfunction and a lack of resources to project economic power the way it once did. Because of tight budgets and competing financial demands, the United States is less able to maintain its economic power, and because of political infighting, it has been unable to formally share it either.

Experts say that is giving rise to a more chaotic global shift, especially toward China, which even Obama administration officials worry is extending its economic influence in Asia and elsewhere without following the higher standards for environmental protection, worker rights and business transparency that have become the norms among Western institutions. President Obama, while trying to hold the stage, clearly recognizes the challenge. Pitching his efforts to secure a major trade accord with 11 other Pacific nations, he told reporters on Friday: “The fastest-growing markets, the most populous markets, are going to be in Asia, and if we do not help to shape the rules so that our businesses and our workers can compete in those markets, then China will set up the rules that advantage Chinese workers and Chinese businesses.”

In an interview on Friday, Mr. Lew, while conceding the growing unease, hotly contested the notion of any diminution of the American position. “There is always a lot of noise in Washington; I’m not going to pretend this is an exception,” he said. “But the United States’ voice is heard quite clearly in gatherings like this.”

All managing directors are eventually arrested.

• IMF Credibility Faces Tipping Point Over Greece (USA Today)

It was perhaps inevitable that the Greek crisis would hijack the spring meeting of International Monetary Fund this week, but the damage to the international lending agency could grow much worse as the situation in Europe becomes increasingly acute. The standoff between a new Greek government seeking debt relief after five years of grinding recession and authorities at the IMF and European Union, who were unbending in their demands to follow through on further austerity measures to get more bailout money, dominated discussions at the meeting that brings economic policymakers from around the world.

The Greek imbroglio overshadowed other messages from IMF officials this week regarding new sources of financial instability in the world, the need to stimulate economies to more vigorous growth and even discussion about other financial and geopolitical hot spots, such as Ukraine. But the unwillingness of IMF Managing Director Christine Lagarde and her staff to countenance any relief for Greece stands to make the agency an accessory to the potential turmoil that could spread well beyond Greece as the chances for a reasonable, agreed solution to the crisis grow slim. A debacle in Greece would further tarnish the reputation of an agency that has already seen its credibility and influence diminished.

It was perhaps a fitting sideshow to the drama in Washington that a former IMF managing director, Rodrigo Rato, was briefly detained Thursday in Spain as part of a money-laundering investigation and may be charged in the case, even as he is being investigated for other infractions. Rato led the IMF from 2004 to 2007, and was succeeded by Dominique Strauss-Kahn, a political heavyweight who aspired to the presidency of France but who had to leave the IMF post under a cloud of scandal in 2011 over charges of sexual assault against a New York hotel maid. Lagarde, then French finance minister, was parachuted in to take his place, though she herself is involved in a long-running judicial probe over an arbitration process she approved that awarded half a billion dollars to a businessman with ties to her center-right political party.

The legal travails of a succession of IMF leaders have diminished its ability to take the moral high ground in forcing lenders to implement the difficult policy measures that are the conditions for its loans. But that is not the only problem. The neoliberal economic principles enshrined in the IMF economic prescription — which generally call for a reduction in government spending and higher taxes even in the midst of recession — are part of a so-called “Washington consensus” that is finding very little consensus in other parts of the world.

Former IMF economist Peter Doyle, a 20-year veteran who left the agency in anger in 2012 saying he was “ashamed” he had ever worked there, this week urged his fellow economists “to turn on the IMF in public.” Citing several leading economists by name, Doyle noted they had expressed support of the Greek position sotto voce. He called upon these economists to “shout, together, right now,” to be on the record against the IMF stance before the “Euro-tinder box” explodes.

Along with Monti, Draghi, Kuroda and Yellen.

• ‘Bernanke To Go Down As One Of The Most Vilified People Of The Century’ (CNBC)

Former Federal Reserve Chair Ben Bernanke is heading down a well-beaten path: shuffling through the revolving door between Washington’s policy circles and Wall Street’s big money institutions. In a move announced on Thursday, he’s going from his former position at the Federal Reserve to Wall Street as a senior adviser at Citadel. The latter is what has “Fast Money” trader Guy Adami—and a number of other Street watchers—outraged. The $25 billion hedge fund, Citadel, in a statement said, “Dr. Bernanke will consult with Citadel teams on developments in monetary policy, financial markets and the global economy.” Adding a note from its founder and CEO Ken Griffin, “He has extraordinary knowledge of the global economy and his insights on monetary policy and the capital markets will be extremely valuable to our team and to our investors.”

Adami, however, said this week on Thursday’s Fast Money of Bernanke’s new role: “It’s wrong. It’s wrong on so many levels.” Bernanke “was a hero for a month, [and now] he’s going to go down as one of the most vilified people of the 21st century. Mark my words,” the trader added. In an interview with Andrew Ross Sorkin, co-anchor of CNBC’s “Squawk Box” and a columnist for the New York Times, Bernanke said he understood the concerns about going from Washington to Wall Street. He said he decided in Citadel because the hedge fund “is not regulated by the Federal Reserve and I won’t be doing lobbying of any sort.” He also said banks had approached him about jobs but he declined because “wanted to avoid the appearance of a conflict of interest” by working for an institution the Fed does regulate.

Bernanke is not the first and likely won’t be the last federal worker to jump to Wall Street. In 2008 after handing over the reins to Ben Bernanke, Alan Greenspan joined hedge fund Paulson & Co. as an adviser. And just last month, Ex-Fed Governor Jeremy Stein joined hedge fund Blue Mountain Capital Management. “He shouldn’t have been allowed to leave the Fed, number one,” Adami stated. “He should have saw [quantitative easing] through, in my opinion, and for him to go to a place that can take advantage of the information that he has privy to, it’s just wrong.” Indeed, Wall Street observers were broadly critical of Bernanke’s move into the world of big money hedge funds. The Washington Post said this week that the former Fed chief “deserves a seven figure sinecure” based on hisHerculean efforts to save the world economy from another Great Depression.

There are no markets left, only casinos.

• Markets Face New Threat As US Fed Ponders Interest Rate Rise (Guardian)

The moment US central bank chief Janet Yellen presses the button will be a massive economic event. The prospect that higher interest rates in the world’s largest economy could come this year has already sent the dollar surging against the pound and euro. It has also fuelled fears of a meltdown in countries that have borrowed heavily in the US currency. Borrowing is inherently risky, all the more so when the interest rate can change at short notice. Higher costs for those that have borrowed in dollars could cripple companies in Brazil and Turkey that were enticed by cheap credit to fund a new factory or office building, or just to pay the wages. At the IMF’s spring meeting last week, chief economist Olivier Blanchard dismissed these concerns, arguing that companies may have hedged their position, while investors and finance ministers were well prepared.

But a succession of market shocks in the last two years has convinced many in the financial community that a bigger crash is coming. There have been violent movements in currencies, bonds and commodity prices, especially crude oil and metals. A rise in US interest rates could add to this already volatile situation and drag stock markets towards another sudden crash. The IMF discussed the context in which another financial crash could occur in its latest financial stability report. It highlighted how any shock can send investors fleeing; with only sellers in the market, the price keeps plunging until someone believes it has gone far enough and starts buying. The nervous state of markets these days means there is generally either a surplus of buyers or a surplus of sellers; only rarely have we seen periods of calm with roughly equal numbers.

Last January, for instance, the Swiss franc soared an unprecedented 30% after the central bank conceded that tracking the ailing euro was no longer possible. The previous year, markets had been rocked by the first hint from the US that it would end the era of ultra-cheap credit. It happened after former Fed boss Ben Bernanke let slip that he might stop pumping funds into the US economy through quantitative easing. The “taper tantrum” – referring to the premature “tapering” of QE – sent shock waves through world markets and forced a clarification from the Fed to steady the ship. The IMF’s financial stability report discussed the potential for Taper Tantrum II. The scenario was worse, yet the warning was described by Larry Fink, boss of BlackRock, the world’s biggest private investment fund, as too optimistic.

He is concerned about the European insurance industry, which must pay returns on pensions and other products at a time when the European Central Bank has been driving interest rates in much short-term government debt below zero; in other words, rather than earning interest on government bonds, insurers are paying to park their money in such assets. How could they survive for long under this regime, he asked. The IMF posed the same question, but again expected everything to work out for the best, somehow.

Young people can’t afford a home, can’t afford an education. What a sad country it has become. And there‘s much worse to come yet.

• Most Americans Think College Is Out of Reach (Bloomberg)

Most Americans believe people who want to go to college can get in somewhere—they just don’t think they’d be able to afford it, according to a new Gallup-Lumina Foundation poll. While 61% of adults believe education beyond high school is available to anyone who needs it, only 21% agree that it’s affordable, according to the poll results, released on Thursday. Some racial groups were much more optimistic than others. 51% of Hispanic adults said higher education is still affordable, Gallup found. Just 19% of black adults and 17% of white adults agreed. The results, based on a survey of 1,533 adults who were contacted from November through December 2014, show there’s a sizable gap between the share of Americans who believe people can merely access college and those who believe people can still afford it.

“If a bachelor’s degree is one important way for today’s young adults to achieve the American dream, affordability in particular could jeopardize that dream,” the report said. Tuition at public colleges has risen more than 250% over the last 30 years, the two organizations noted. At the same time, financial aid hasn’t kept up. Students have been leaving school with record amounts of debt: In a separate study, Gallup and Purdue University found more than a third of students who graduated college from 2000 to 2014 were saddled with more than $25,000 in loans. Even if Americans believe anyone, in theory, could find their way to a college classroom, they’re not optimistic anyone could pay to stay there.

And still many keep claiming China will be just fine.

• Record Drop In House Prices Suggests China Is Already In A Recession (Zero Hedge)

Another month, and another confirmation that China’s hard landing is if not here, then likely mere months away. Overnight, the NBS reported that in March, Chinese house prices dropped in 69 of 70 cities compared to a year ago. According to Goldman’s seasonal adjustments, in March home prices dropped another 0.5% from February, the same as the prior month’s decline, suggesting that the February 28 rate cut hasn’t done much to boost housing spirits. However, it is the annual data that truly stands out, because with a drop of 6.1% this was the biggest drop in Chinese house prices in history.

To be sure, the PBOC is now scrambling to halt what, unless it is stopped, will become a full-blown hard landing in months, if it isn’t already. As a result, as shown in the chart below it has recently engaged in several easing steps, with many more to come according to the sell-side consensus. So far these have failed to stimulate the overall economy, which continues to be pressured by a deflation-importing world, but have certainly lead to a massive surge in the Chinese stock market. Incidentally, the ongoing collapse in Chinese home prices is precisely why the PBOC and the Politburo have both done everything in their power to substitute the burst housing bubble with another: that of stocks, by pushing everyone to invest as much as possible in the stock market, leading to the biggest and fastest liquidity and margin debt-driven bubble in history.

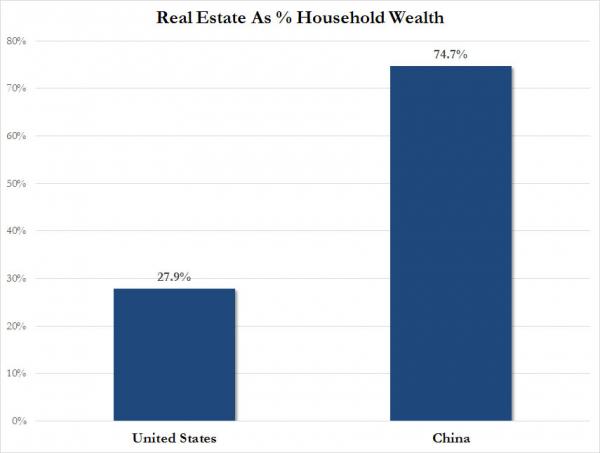

Unfortunately for China, as we have shown before, all Chinese attempts to do what every self-respecting Keynesian would do, i.e., replace one bubble with another, are doomed to fail for the simple reason that unlike in the US, where the bulk of assets are in financial form, in China 75% of all household wealth is in real estate. [..]

And this is where things get scarier, because if one compares the history of the Chinese and US housing bubbles, one observes that it was when US housing had dropped by about 6% following their all time highs in November 2005, that the US entered a recession. This is precisely where China is now: a 6.1% drop following the all time high peak in January of 2014. If the last US recession is any indication, the Chinese economy is now contracting! So much for hopes of 7% GDP growth this year. The good news, if any, is that Chinese home prices have another 12% to drop before China, which may or may not be in a recession, suffer the US equivalent of the Lehman bankruptcy.

All you need to know: “..debt has nearly quadrupled since 2007”.

• Germany FinMin Schaeuble Worried About China’s Debt And Shadow Banking (BIA)

Should we concerned about growing debt levels around the world? Wolfgang Schaeuble, Germany’s finance minister, certainly seems to thinks so, stating overnight that debt levels in the global economy continue to give cause for concern. Singling out China in particular, Schaeuble noted that debt has nearly quadrupled since 2007, adding that its growth appears to be built on debt, driven by a real estate boom and shadow banks. Certainly, according to McKinsey’s research, total outstanding debt in China increased from $US7.4 trillion in 2007 to $US28.2 trillion in 2014. That figure, expressed as a percentage of GDP, equates to 282% of total output, higher than the likes of other G20 nations such as the US, Canada, Germany, South Korea and Australia. With China slowing and expectations for further monetary and fiscal easing growing by the day, the concerns raised by Schaeuble may well amplify from here.

“There will not be the slightest privatisation in the country, particularly of strategic sectors of the economy.”

• Europe Ready For Grexit Contagion As Athens Gets Closer To Russian Cash (AEP)

The ECB has warned that a rupture of monetary union and Greek exit from the euro could have dramatic consequences, but insisted that it has enough powerful weapons to avert contagion. Mario Draghi, the ECB’s president, said it would be far better for everybody if Greece recovers within EMU but made it clear that the currency bloc is no longer vulnerable to the immediate chain-reaction seen in earlier phases of the debt crisis. This sends an implicit message to the radical-Left Syriza government that it cannot hope to secure better terms from EMU creditors by threatening to unleash mayhem. “We have enough instruments at this point of time, the OMT (bond-buying plan), QE, and so on, which though designed for other purposes could certainly be used in a crisis if needed,” said Mr Draghi, speaking after a series of tense meetings at the IMF.

“We are better equipped than we were in 2012, 2011.” In effect, the ECB now has the license to act as a full lender-of-last-resort and mop up the bond markets of Portugal, Spain, or Italy, preventing yields from rising. Yet Syriza appears to be countering such pressure with its own foreign policy gambits as events move with electrifying speed in Athens. Greek sources have told The Telegraph that Syriza may sign a deal with Russia for Gazprom’s “Turkish Stream” pipeline project as soon as next week, unlocking as much as €3bn to €5bn in advance funding. This confirms a report in Germany’s Spiegel magazine, initially denied by both the Russian and Greek governments. It is understood that the deal is being managed by Panagiotis Lafazanis, Greece’s energy minister and head of Syriza’s militant Left Platform, a figure with long-standing ties to Moscow.

Mr Lafazanis warned defiantly on Saturday that Syriza would not “betray the people’s mandate” even if this means a full-blown clash with the creditor powers. “There can’t be a deal with neo-liberal, neo-colonial powers that rule the EU and the IMF unless Greece really threatens their deep economic and geo-strategic interests. We still do not know our own strength,” he told Greek television. Mr Tsipras visited the Kremlin last month insisting he would pursue an independent foreign policy “Several of the so-called partners and certainly some in the IMF want to denigrate and humiliate our government, blackmailing us to implement measures against the working classes,” added Mr Lafazanis. “There will not be the slightest privatisation in the country, particularly of strategic sectors of the economy.”

Draghi’s way out of his league.

• ECB’s Draghi Says Urgent That Greece Strikes Deal With Creditors (Bloomberg)

European Central Bank President Mario Draghi said it is urgent that Greece strikes a deal with creditors, although its banks continue to meet the requirements for Emergency Liquidity Assistance. “ELA will continue to be given to the banks if they’re judged to be solvent and if they have adequate collateral which is the case now,” Draghi told reporters on Saturday at the International Monetary Fund’s meetings in Washington. The Frankfurt-based ECB decides on Greece’s financial lifeline on a weekly basis. The funding has so far helped defer a financial meltdown as euro-area governments hold back bailout money, complaining that Prime Minister Alexis Tsipras must do more to revamp his country’s economy.

Draghi said “much more work is needed now and it’s urgent” if Greece and its creditors are to strike a deal to release aid. He said any package of policies should produce “growth, fairness, fiscal sustainability and financial stability.” “We all want Greece to succeed,” he said. “The answer is in the hands of the Greek government.” While Europe is better equipped to deal with any fallout in financial markets if Greek negotiations fail than it was when it first fell into crisis, Draghi said the region is still in “uncharted waters.” Draghi said the euro zone economy is strengthening after the ECB began a €1.1 trillion bond-buying program last month. Still, he warned an extended period of low interest rates could prove “fertile ground” for instability in financial markets. “We should be alert to these risks,” Draghi said, adding the risk was not currently a reason to tighten monetary policy.

And here he admits he doesn’t have a clue.

• Draghi Warns Of Uncharted Waters If Greece Crisis Deteriorates (FT)

Mario Draghi said the euro area was better equipped than it had been in the past to deal with a new Greek crisis but warned of uncharted waters if the situation were to deteriorate badly. The ECB president called for the resumption of detailed discussions aimed at resolving the country’s debt woes and urged the Greek authorities to bring forward proposals that ensured fairness, growth, fiscal stability, financial stability. Asked about the risks of contagion from a new flare-up in Greece, he said: we have enough instruments at this point in time … which although they have been designed for other purposes would certainly be used at a crisis time if needed. The two tools he referred to were the ECB’s so-called outright monetary transactions, which have never been used, and Quantitative Easing, which the ECB launched in January.

He added: we are better equipped than we were in 2012, 2011 and 2010. However Mr Draghi added: Having said that, we are certainly entering into uncharted waters if the crisis were to precipitate, and it is very premature to make any speculation about it. The ECB president was speaking following meetings in Washington that have been overshadowed by renewed fears about the risk of a Greek debt default and possible exit from the euro. US Treasury secretary Jack Lew warned on Friday that a full-blown crisis in Greece would cast a new shadow of uncertainty over the European and global economies, as he put pressure on Athens to come forward urgently with detailed reforms to its economy. Mr Lew said that while financial exposures to Greece had changed significantly since the turmoil of 2012, it was impossible to know how markets would respond to a default.

“In the back of our minds these are possibilities of finding a way out, if there is a dead end.”

• Greece Wants EU/IMF Deal But Impasse Could Bring Referendum (Reuters)

Greece aims for a deal with its creditors over a reforms package but will not retreat from its red lines, the country’s deputy prime minister told the Sunday newspaper To Vima, not ruling out a referendum or early polls if talks reach an impasse. Athens is stuck in negotiations with its euro zone partners and the International Monetary Fund over economic reforms required by the lenders to unlock remaining bailout aid. Ongoing talks are not expected to produce a deal for the approval of euro zone finance ministers at their next meeting in Riga on April 24 as progress is painfully slow. “Our objective is a viable solution inside the euro,” Yanis Dragasakis told the paper. “We will not back off from the red lines we have set.”

Asked whether the government had thought of calling a referendum or even going to the polls if talks become deadlocked, Dragasakis said this could be a possibility, although the government’s goal was to reach an agreement. “In the back of our minds these are possibilities of finding a way out, if there is a dead end. The aim is (to reach) an agreement.” Greece is quickly running out of cash and in the next few weeks may face a choice of either paying salaries and pensions or paying back loans from the International Monetary Fund. Shut out of bond markets, Athens could get more loans from both the IMF and euro zone governments, but it would first have to implement reforms, agreed with the creditors, to make its finances sustainable and its economy more competitive. The leftist-led government does not want to implement measures including cuts in pensions as it won elections in late January on pledges to end austerity.

A credit is not the same as an advance payment.

• Moscow Denies Planning Multibillion Credit To Greece (RT)

Russia denied media reports that it is going to give Greece a loan of up to $5 billion as advance payment for future transit profits from a future gas pipeline. The sum was mooted by the German magazine Spiegel. Greece is expected to shortly join a joint Russian-Turkish pipeline project that will pump Russian gas to Europe via Turkey. The magazine cited a senior source in the Greek government as saying that the country would get from $3 billion to $5 billion in credit as part of the deal. It was reportedly agreed during Greek Prime Minister Alexis Tsipras’ visit to Moscow last week. But on Saturday, the Russian president’s spokesman Dmitry Peskov said no such loan is planned.

“[Russian President Vladimir] Putin said himself during the media conference that nobody asked for our help. Naturally energy cooperation was discussed. Naturally, the parties of the high level talks agreed to work out all details of these issues at an expert level. Russia didn’t offer financial help because it was not asked,” the spokesman told the Russian radio station Business FM. Earlier Greek and Russian officials said an energy deal that would have Greece join the Turkish stream project would be inked in a matter of days, but no exact date or particular terms were given. If Russia did loan money to Greece, it would help it deal with a looming national default. The new Greek government is in difficult negotiations with Germany and the IMF to secure further loans to help its economy.

Anti-euro gets a foot in the door.

• Finns Set to Topple Government as Vote Focuses on Economic Pain (Bloomberg)

Finns look set to vote out a government marred by political infighting and elect a party led by a self-made millionaire promising a business-driven recovery. After three years of economic decline, Finland’s next government will need to fix chronic budget deficits, a debt load that’s set to breach European Union limits, rising unemployment and economic growth that’s about half the average of the euro zone. Juha Sipila, who leads the opposition Center Party, has promised business-friendly policies he says will create 200,000 private-sector jobs. His party is polling about 6% ahead of the next-biggest groups, according to newspaper Helsingin Sanomat. If he wins Sunday’s vote, Sipila will probably try to form a majority coalition that’s likely to include the euro-skeptic The Finns party.

“Putting together a new, workable government that can turn around Finland’s public finances is the most important economic policy step,” Anssi Rantala, chief economist at Aktia Bank Oyj, said by phone. “The government has to take seriously the gigantic deficits we have in state and municipal budgets, and it has to change the way it implements austerity: most has been through tax increases.” Austerity isn’t what splits Finland’s political parties. All major groups have pledged some combination of belt-tightening and growth policies. The Finance Ministry estimates €6 billion euros of austerity measures are needed by 2019 to prevent debt reaching 70% of gross domestic product. It also says there’s no scope to raise taxes without stifling economic growth.

Lovely prospect.

• How Sleepy Finland Could Tear The Euro Apart (Telegraph)

Finland is the unlikely stage for the latest turn in Greece’s interminable eurozone drama this weekend. With events having decamped temporarily to Washington DC, Athens will be keeping half an eye on developments in Helsinki, where the Nordic state of just 5.4m people heads for the polls on Sunday. In the five years since Greece’s financial woes were revealed to the world, it has been sleepy Finland which has emerged as the most trenchant critic of EU largesse to the indebted Mediterranean. The outcome of the country’s general election could now determine Greece’s future in the monetary union. In a leaked memo seen last month, it was revealed that the Finns had already drawn up contingency plans for a Greek exit from the euro.

Although ostensibly a sensible measure for any finance ministry to contemplate, the document confirmed the Finns’ position as the most uncompromising of the EU’s creditor nations. The reputation is well-deserved. At the height of Greece’s bail-out drama in 2011, Helsinki negotiated an unprecedented bilateral agreement with Athens, receiving €1bn in collateral in return for supporting a rescue deal. A year later, the Finns were prime candidates to become the first dissenters to voluntarily break the sanctity of the monetary union. “We have to be prepared,” the country’s then foreign minister told the Telegraph three years ago. Greece’s current impasse is also partly a result of Finnish obstinacy.

Helsinki was one of the main obstacles to securing a long-term extension to Greece’s bail-out programme under the previous Athens government late last year. The eventual compromise of a three-month, rather than six-month reprieve, has seen the new Leftist regime scramble desperately for cash since February. With the situation in Athens deteriorating by the day, both Finland’s prime minsiter and central bank governor have eschewed high-minded rhetoric about European unity, to insist creditors should be ready to pull the plug on Greece. But unlike its fellow creditor giant Germany, Finland is more economic laggard than European powerhouse. Having been mired in a three-year recession, the country heads to the polls with economic output still 5pc below its pre-crisis levels.

Finland has suffered an economic downturn of almost Greek proportions. The boon from falling oil prices and launch of eurozone QE will still only see the economy expand at a paltry 0.8pc this year, worse only to Italy and Cyprus. Stagnating growth saw Finland stripped of its much coveted Triple-A sovereign debt rating last year. The IMF now recommends a cocktail of structural reforms and fiscal consolidation that would make officials in Athens bristle. “There is no sympathy for Greece any more, especially because our own economy is struggling,” says Jan von Gerich, strategist at Nordea bank in Helsinki.

“Everyone believed that it would all work out OK. Then one day it didn’t.”

• Australia, The Latest Country With Negative Interest Rates (Simon Black)

Let’s talk about idiots. Somewhere out there, some absurdly well-paid banker just placed his investors’ capital in yet another financial instrument which is guaranteed to lose money: Australian government debt. 47 investors participated in the Australian government’s $200 million bond tender; the participants typically bid the amount they’re willing to pay, and the highest bids win the auction. In this case, and for the first time in Australia, every single one of the 47 bidders offered a price so high that it implies a negative interest rate. Even the lowest bid in the auction, for example, implied a net loss… or an effective yield of NEGATIVE 0.015%. The highest price implied a yield of negative 0.085%. What’s really bizarre is that this particular issue was for ‘inflation-linked’ bonds.

Which means that if the government’s official monkey math shows that inflation is falling, the yield could actually become even MORE NEGATIVE. Insane? Of course. But here’s the thing. These bankers aren’t investing their own money. It’s not like some guy is taking his million dollar bonus and saying, “Hey I think I’ll go buy some government debt that guarantees I’ll lose money.” No. He buys a Maserati. Then he picks up this garbage debt with his customers’ money. Not only is this idiotic, it’s borderline criminal. At a minimum it’s seriously unethical. Banks and other money managers have a solemn obligation… a fiduciary responsibility that comes with the sacred charge of safeguarding other people’s money. Just like the golden rule, this obligation is very simple: take care for other people’s money even more than you care for their own.

But that went out the window a long time ago. Back in the 1500s, Renaissance-era merchant bankers risked their own capital alongside their customers, doing meaningful deals that financed exploration and the expansion of world trade. Now it’s all about commissions, obtuse regulations, and following the latest banking fad. This is officially now the latest banking fad—buying government bonds at negative yields. You’ll remember a few years ago when the latest banking fad was handing out no-money-down mortgages to dead people and unemployed bus drivers… or buying “AAA-rated” bonds which pooled these subprime loans together. That didn’t exactly work out so well. Neither will this. In fact there are plenty of similarities between today’s negative interest rates and the early 2000s housing bubble.

Back then, banks were essentially paying people to borrow money. They offered the least creditworthy borrowers absurd amounts of money which sometimes even exceeded the purchase price of the home they were buying. 102% loans were not uncommon back then, which financed the entire purchase along with the extra closing costs. We even saw 105% loans which allowed a little bit extra to make home improvements. It doesn’t take a rocket scientist to figure out that it’s criminally stupid to pay someone to borrow money. Yet that’s exactly what’s happening now. Instead of people, though, it’s governments who are effectively being paid to borrow. We all remember last time how much this impacted the global financial system. Everyone believed that it would all work out OK. Then one day it didn’t. Lehman Brothers went bust, and the entire banking system started to collapse.

High time to pack up and go.

• California’s New Drought Rules Would Require Cuts of Up to 36% (Bloomberg)

California issued proposed rules calling for mandatory reductions in water use by municipal agencies as a historic drought drags into a fourth year. The state’s 411 urban water suppliers would have to cut use by as much as 36%, with those that conserved less facing tougher restrictions and a daily penalty of as much as $500 for not complying, the California State Water Resources Control Board said in the proposed rules released Saturday. The board will meet May 5 and 6 to finalize the rules, which would take effect by June 1. “Some of these communities have achieved remarkable results with residential water use now hovering around the statewide target for indoor water use, while others are using many times more,” the Sacramento-based agency said in its proposal.

The emergency rules would be in effect for 270 days. The regulations are based on an executive order Governor Jerry Brown, a 77-year-old Democrat, issued April 1 calling for a mandatory 25% reduction in water use compared with 2013 levels and requiring 50 million square feet of lawns to be replaced by drought-tolerant landscaping. California, the most-populous U.S. state, and its $43 billion agriculture industry are experiencing the worst of the arid conditions moving across the western U.S., with 67% of the state in an extreme drought, according to the U.S. Drought Monitor.

The agency this week released nearly 300 comment letters from the public, businesses, water agencies and cities on an initial proposal. The planned 35% reduction in water use for Beverly Hills would “place a significant burden on our small permanent customer base” of 42,157 residents, Mahdi Aluzri, interim city manager, said in the letter. Beverly Hills’ daytime population, including commuters who work in the city, shoppers and visitors, can rise to more than 250,000 water users, Aluzri said. California’s residents in February reduced water use by 2.8% below 2013 levels, the worst monthly performance since June, the water board said.

For this alone, the EU should be dismantled. “A new policy will be presented in May”. May? You should be out there on the water! Another boat with 650 people just capsized as I’m writing this.

• Pope Francis Urges EU To Do More To Help Italy With Flood Of Migrants (CT)

Pope Francis on Saturday joined Italy in pressing the European Union to do more to help the country cope with rapidly mounting numbers of desperate people rescued in the Mediterranean during journeys on smugglers’ boats to flee war, persecution or poverty. While hundreds of migrants took their first steps on land in Sicilian ports, dozens more were rescued at sea. Sicilian towns were running out of places to shelter the arrivals, including more than 10,000 this week. The Coast Guard said 74 migrants were saved from a sailboat shortly before it sank Saturday about 100 miles east of the coast of Calabria in southern Italy. A Coast Guard plane and a Dutch aircraft, part of an EU patrol mission, spotted the boat. Passengers included 10 children and three pregnant women.

With his wide popularity and deep concern for social issues, the pope’s moral authority gives Italy a boost in its lobbying for Brussels and northern EU countries to do more. Since the start of 2014, nearly 200,000 people have been rescued at sea by Italy. “I express my gratitude for the commitment that Italy is making to welcome the many migrants who, risking their life, ask to be taken in,” said Francis, flanked by Italian President Sergio Mattarella. “It’s evident that the proportions of the phenomenon require much broader involvement.” “We must never tire of appealing for a more extensive commitment on the European and international level,” Francis said.

Italy says it will continue rescuing migrants but demands that the European Union increase assistance to shelter and rescue them. Since most of the migrants want to reach family or other members of their community in northern Europe, Italian governments have pushed for those countries to do more, particularly by taking in the migrants while their requests for asylum or refugee status are examined. “For some time, Italy has called on the EU for decisive intervention to stop this continuous loss of human life in the Mediterranean, the cradle of our civilization,” Mattarella said. The EU’s commissioner for migration, Dmitris Avramopoulos, says a new policy will be presented in May. Meanwhile, he has also called for member states to help.

But it can get worse, believe it or not. The Abbott government quite literally has no shame. They send people back to countries they’re fleeing.

• Australia Government In Secret Bid To Hand Back Asylum Seekers To Vietnam (SMH)

Vietnamese Australians and human rights activists have blasted the Abbott Government over a secret Navy-led mission to return a group of asylum seekers back to the Communist government of Vietnam. In a new milestone for the Coalition’s hard-line border policy, an Australian Navy ship was entering Vietnamese waters on Friday after what is believed to be a week-long journey to prevent boats reaching Australia. HMAS Choules was close to the the southern port city of Vung Tau, south of Ho Chi Minh City, Defence sources confirmed to Fairfax Media. The vessel was expected to hand over detainees to the Communist government some time after arriving late Friday or in the early hours of Saturday.

The vessel is carrying asylum seekers intercepted by customs and navy vessels earlier this month, north of Australia, the West Australian newspaper reported on Friday. Immigration Minister Peter Dutton’s office said no comment would be made on “operational matters” but human rights activists lashed the Coalition for another on-water action cloaked in secrecy. Daniel Webb, director of the Human Rights Law Centre, said: “Australia should never return a refugee to persecution. All governments – whatever their policy position – should respect democracy and should respect the rule of law. Continually operating behind a veil of secrecy is a deliberate subversion of both. “If the government truly believed its actions were humane, justified and legal, it wouldn’t go to such extraordinary lengths to hide them from view.” [..]

The Vietnamese community, many of whom arrived in Australia by boat after the fall of Saigon in 1975 as the Communist regime of Hanoi took control of the country, expressed horror at asylum seekers being handed back. Thang Ha, president of the Vietnamese Community in Australia, NSW Chapter, said the government should be aware it could be “throwing people back into hell”. He said returnees would likely be left alone initially but would be followed by party operatives and eventually harassed and likely jailed. “Human rights activists, democracy activists, Christians, Buddhists, artists and singers, they have all been harassed. Some people have been hunted down, their family members have been harassed. Some have been thrown in jail and never heard from again,” he said. “They are throwing them back into hell.”

Yes, we are a smart animal.

• Air-Pocalypse: Breathing Poison In The World’s Most Polluted City (BBC)

Saharan dust, traffic fumes and smog from Europe may be clogging up London’s air at present – and causing alarm in the newspapers – but in the world’s most polluted city London’s air would be considered unusually refreshing. That city is Delhi, the Indian capital, where air quality reports now make essential reading for anxious residents. In London last week, the most dangerous particles – PM 2.5 – hit a high of 57; that’s nearly six times recommended limits. Here in Delhi, we can only dream of such clean air. Our reading for these minute, carcinogenic particles, which penetrate the lungs, entering straight into the blood stream – is a staggering 215 – 21 times recommended limits. And that’s better than it’s been all winter. Until a few weeks ago, PM 2.5 levels rarely dipped below 300, which some here have described as an “air-pocalypse”.

Like the rest of the world, those of us in Delhi believed for years that Beijing was the world’s most polluted city. But last May, the World Health Organization announced that our own air is nearly twice as toxic. The result, we’re told, is permanent lung damage, and 1.3 million deaths annually. That makes air pollution, after heart disease, India’s second biggest killer. And yet, it’s only in the past two months as India’s newspapers and television stations have begun to report the situation in detail that we’ve been gripped, like many others, with a sense of acute panic. It’s a little bit like being told you’re living next to an active volcano that might erupt at any moment. At first, we simply shut all our doors and windows and sealed up numerous gaps. No more seductively cool Delhi breezes could be allowed in.

We began checking the air quality index obsessively. Then, we rushed out to buy pollution masks, riding around in our car looking like highway robbers. But our three-year-old wouldn’t allow one anywhere near her face. Our son only wore his for a day, and only because I told him he looked like Spider-Man. Despite our alarm, many Delhi-ites reacted with disdain. “It’s just dust from the desert,” some insisted. “Nothing a little homeopathy can’t solve,” others said. But we weren’t convinced. When we heard that certain potted plants improve indoor air quality, we rushed to the nursery to snap up areca palms, and a rather ugly, spiky plant with the unappealing moniker, mother-in-law’s tongue. But on arrival, the bemused proprietor informed us that the American embassy had already purchased every last one. In any case, we calculated that to make a difference, we needed a minimum of 50 plants. “We could get rid of the sofa to make room for them,” my husband offered.

Home › Forums › Debt Rattle April 19 2015