Harris&Ewing F Street, Washington, DC 1935

All it takes is one spark.

• European Banks Sitting On €1 Trillion Mountain Of Bad Debt (Guardian)

European banks are sitting on bad debts of €1tn – the equivalent to the GDP of Spain – which is holding back their profitability and ability to lend to high street customers and businesses. According to a detailed analysis of 105 banks across 21 countries in the European Union conducted by the European Banking Authority (EBA), the experience of Europe’s banks to troubled customers is worse than that of their counterparts in the US. The €1tn (£706bn) of so-called non-performing loans amount to almost 6% of the total loans and advances of Europe’s banks, and 10% when lending to other financial institutions are excluded. The equivalent figure for the US banking industry is around 3%.

Piers Haben, director of oversight at the EBA, said that while the resilience of the financial sector was improving because more capital was being accumulated in banks, he remained concerned about bad debts. “EU banks will need to continue addressing the level of non-performing loans which remain a drag on profitability,” Haben said. Banks in Cyprus have half their lending classified as non-performing while in the UK the figure is 2.8%. Capital ratios – a closely watched measure of financial strength – had reached 12.8% by June 2015, well above the regulatory minimum, as banks held on to profits and also took steps to raise capital – for instance, by tapping shareholders for cash. In 2011 the figure was 9.7%.

“Without fail, every single industrial commodity company allocated capital horrendously over the last 10 years..”

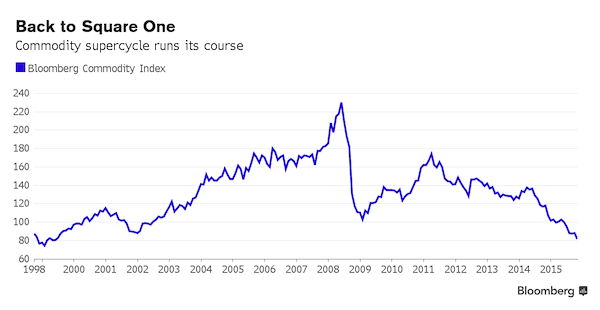

• If China Killed Commodities Super Cycle, Fed Is About to Bury It (Bloomberg)

For commodities, it’s like the 21st century never happened. The last time the Bloomberg Commodity Index of investor returns was this low, Apple’s best-selling product was a desktop computer, and you could pay for it with francs and deutsche marks. The gauge tracking the performance of 22 natural resources has plunged two-thirds from its peak, to the lowest level since 1999. That shows it’s back to square one for the so-called commodity super cycle, a hunger for coal, oil and metals from Chinese manufacturers that powered a bull market for about a decade until 2011. “In China, you had 1.3 billion people industrializing – something on that scale has never been seen before,” said Andrew Lapping, deputy chief investment officer at Allan Gray Ltd., a manager of $33 billion of assets in Cape Town.

“But there’s just no way that can continue indefinitely. You can only consume so much.” If slowing Chinese growth, now headed for its weakest pace in 25 years, put the first nail in the coffin of the super cycle, the Federal Reserve is about to hammer in the last. The first U.S. interest rate increase since 2006 is expected next month by a majority of investors, helping push the dollar up by about 9% against a basket of 10 major currencies this year. That only adds to the woes of commodities, mostly priced in dollars, by cutting the spending power of global raw-materials buyers and making other assets that generate yields such as bonds and equities more attractive for investors.

The Bloomberg Commodity Index takes into account roll costs and gains in investing in futures markets to reflect the actual returns. By comparison, a spot index that tracks raw materials prices fell to a more than six-year low Monday, and a gauge of industry shares to the weakest since 2008 on Sept. 29. The biggest decliners in the mining index, which is down 31% this year, are copper producers First Quantum Minerals, Glencore and Freeport-McMoran. With record demand through the 2000s, commodity producers such as Total SA, Rio Tinto Group and Anglo American Plc invested billions in long-term capital projects that have left the world awash with oil, natural gas, iron ore and copper just as Chinese growth wanes. “Without fail, every single industrial commodity company allocated capital horrendously over the last 10 years,” Lapping said.

Oil is among the most oversupplied. Even as prices sank 60% from June 2014, stockpiles have swollen to an all-time high of almost 3 billion barrels. That’s due to record output in the U.S. and a decision by OPEC to keep pumping above its target of 30 million barrels a day to maintain market share and squeeze out higher-cost producers. A Fed move on rates and accompanying gains in the dollar will make it harder to mop up excesses in raw-materials supply. Mining and drilling costs often paid in other currencies will shrink relative to the dollars earned from selling oil and metals in global markets as the U.S. exchange rate appreciates. Russia’s ruble is down more than 30% against the dollar in the past year, helping to maintain the profitability of the country’s steel and nickel producers and allowing them to maintain output levels.

“..not only affecting our business in China but also in the other international operation markets outside of China because these economies are so dependent on China..”

• US, German Manufacturers Can’t Shake The Slowdown In China (Forbes)

You wouldn’t know it from looking at stocks, but the US manufacturing sector came darn close to contracting in October. Readings above 50 indicate expansion in the ISM gauge of manufacturing activity, and the October reading of 50.1 was the lowest in 29 months. Overall manufacturing activity has expanded for 34 straight months, but the pace of growth in the main ISM gauge has deteriorated for four consecutive months. There is reason for optimism. Factories saw new orders come in at a faster pace and production was strong. But, other than that, the ISM details were far from impressive. Not surprisingly, the prices paid index came in below 40 for the third consecutive month, reflecting the deflationary headwinds flowing through the economy.

More importantly, the employment details showed a sharp contraction, down to 47.6 versus 50.5 in September. The market is more concerned about non-farm payroll figures, but this sure seems to be a leading indicator, especially when you consider the weakness from September’s NFP report. It’s the same story in Germany, where mechanical engineering orders slumped 13% Y/Y in September, hit by an 18% drop in foreign demand. In a sign that the weakness in September wasn’t just a blip, foreign orders from outside the eurozone were down 7% in the nine months through September from the same period a year earlier, hit by a slowdown in developing economies that account for around 42% of Germany’s plant and machinery exports. It’s clear that most of this industrial weakness is being driven by China.

Domestic orders for Germany’s mechanical engineering industry were up 2% in the nine months through September from the same period a year ago, while eurozone demand rose 13% over this period. European demand looks ok, it’s just not strong enough to offset the weakness driven by China. German car maker Audi said Monday that falling Chinese demand is forcing it to slash production of Audi models at a plant in Changchun nearly 11%. General Motors Chief Executive Mary Barra last month said the slowdown in China, the world’s second-largest economy, “is not only affecting our business in China but also in the other international operation markets outside of China because these economies are so dependent on China.”

The divergence between the two indicators should be stunning, but we’re used to it.

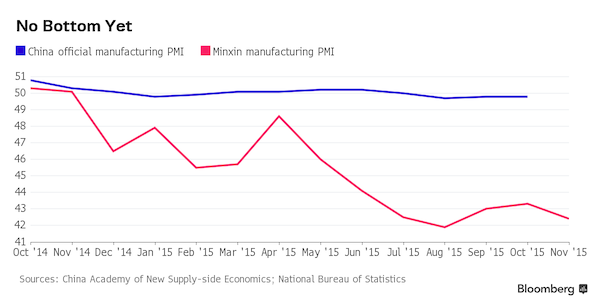

• China’s Latest Economic Indicators Make For Gloomy Reading (Bloomberg)

China’s economy is still showing a muted response to waves of monetary and fiscal easing as of the half-way mark for the last quarter of the year, some of the earliest indicators suggest. A privately compiled purchasing managers’ index and a gauge based on search engine interest in small and medium-sized businesses deteriorated this month, while a sentiment indicator dropped sharply from October. Combined, the reports make gloomy reading ahead of official releases, the earliest of which will be manufacturing and services PMI reports due Dec. 1. Six interest-rate cuts in a year and expedited fiscal spending have yet to revive growth as overcapacity and weakness in old drivers like manufacturing and residential construction weigh on the world’s second-biggest economy. If official data confirm the sluggishness, Premier Li Keqiang’s growth goal may be missed for a second-straight year.

Here’s a look at what the economy’s earliest tea leaves show: The unofficial purchasing managers indexes for manufacturing and services sectors both declined, snapping increases in the two previous months. The manufacturing PMI declined to 42.4 in November from 43.3 in October, while the non-manufacturing reading fell to 42.9 from 44.2, according to reports jointly compiled by China Minsheng Banking and the China Academy of New Supply-side Economics. Numbers below 50 signal deteriorating conditions. “China’s economy hasn’t bottomed yet and downward pressures are mounting,” Jia Kang, director of the Beijing-based academy and former head of the finance ministry’s research institute, wrote. “We expect authorities to step up growth stabilization measures.” The Minxin PMIs are based on a monthly survey covering more than 4,000 companies, about 70% of which are smaller enterprises. The private gauges have shown a more volatile picture than the official PMIs in the past year.

Overleveraged overcapacity.

• Iron Ore Rout Deepens as Rising Supply, Weaker Demand Feed Glut (Bloomberg)

Iron ore has taken a fresh beating, with prices sinking to the lowest level in six years as output cuts at Chinese mills hurt demand while low-cost supplies from the biggest miners expand. It may get worse. “The key problem for iron ore is oversupply: the iron ore heavyweights have overestimated China’s appetite,” Gavin Wendt, founding director at MineLife in Sydney, said after prices dropped on Tuesday to the lowest level since daily data began in 2009. “Further price weakness is inevitable.” The commodity has been hurt this year by increasing output from the biggest miners including BHP Billiton, Rio Tinto and Vale and faltering demand for steel in China, where mills account for half of global output. Goldman Sachs said last week that the global market is oversupplied, with steel consumption in China remaining weak. Mills are battling sinking prices that have eroded profit margins.

“We’re going through a very difficult time,” said Philip Kirchlechner, director of Iron Ore Research. “It was always expected that it would come down to the $40s again, but not over a sustained period,” said Kirchlechner, former head of marketing at Fortescue Metals Group Ltd. Ore with 62% content delivered to Qingdao fell 1.9% to $43.89 a dry metric ton on Tuesday, according to Metal Bulletin Ltd. The commodity is headed for a third annual retreat, and the latest fall eclipsed the previous low of $44.59 set in July. The steel industry in China is reaching a critical point, according to Andy Xie, an independent economist who’s been bearish for years and sees a drop below $40 before year-end. Mills will have to cut production, said Xie, a former Asia-Pacific chief economist at Morgan Stanley. Crude-steel output in China will drop 23 million tons to 783 million tons next year, according to the China Iron & Steel Association.

Last month, the nation’s leading industry group reported wider losses and noted that while official interest rates in China have been cut, mills faced higher funding costs. The biggest miners are betting that higher production will enable them to cut costs and raise market share while less efficient suppliers get squeezed. Rio’s Andrew Harding, chief executive officer for iron ore and Australia, said this month the company will keep defending market share and if it cut output, volumes would simply be taken by less efficient rivals. Kirchlechner said that the onset of winter in China may bring something of a reprieve for prices as local ore producers are forced to curtail supplies, spurring increased demand for cargoes from overseas.

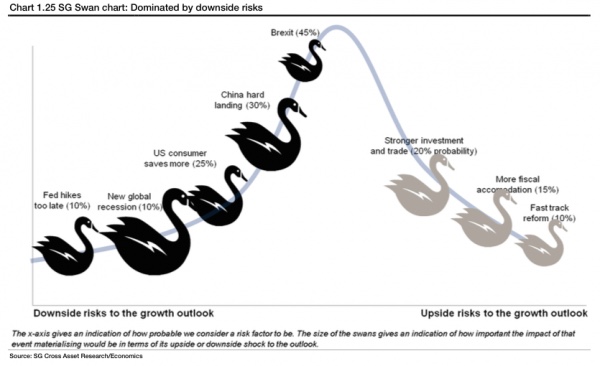

Not sure either Tyler Durden or SocGen defines ‘black swan’ right: they’re the things you’re not supposed to see coming, so how can you predict them?

• Presenting SocGen’s 5 Black Swans For 2016 (Zero Hedge)

In its latest quarterly Global Economic Outlook, SocGen takes a look at five political and economic black swans that could touch down in 2016 and also warns that “high levels of public sector debt, already overburdened monetary policy, still high debt stocks and on-going balance sheet clean ups in a number of economies leave the global economy will a low level of ammunition to deal with new shocks.” Here’s the latest SG “swan chart” which is “dominated by downside risks”:

As we and a bevy of others have pointed out, QE is bumping up against the law of diminishing returns and it’s no longer clear that doubling and tripling down on monetization will do anything at all to boost aggregate demand, juice global trade, or raise inflation expectations (but what it surely will do is continue to inflate asset bubbles). In this environment, fiscal stimulus may be the only “solution.” As SocGen puts it, “in the event of a major new significant shock, our baseline scenario remains that both the US and Europe would opt first for further monetary policy stimulus. Later on, however, as this proves inefficient, we would expect fiscal stimulus to be considered.” China, of course, has already gone this route, boosting fiscal spending by 36% in Ocotber as the country’s credit impulse disappeared despite six rate cuts in less than a year. From SocGen:

• Brexit at a probability of 45%, remains our highest probability risk. At this time, a date has yet to be set for the referendum but 3Q16 seems a likely timing, based on the idea that Prime Minister Cameron will want to hold the referendum within a reasonable timeframe on concluding an agreement with his EU partners (which could come as early as the December 2015 Summit, but more likely in March 2016).

• China hard landing remains a significant risk at 30%. Medium-term, we set an even higher probability of 40% on a lost decade scenario. As opposed to a hard landing, however, such a risk scenario would manifest itself only gradually. The most likely trigger for a China hard- landing is policy error with miscalculation of how much financial risk management or structural reform the system can absorb. We identify three main triggers. In practice, a combination thereof seems the most likely cause of such a risk scenario.

• Credit crunch: An intensification of capital outflows, a growing number of non-performing loans and an insufficient response from the PBoC could result in a credit crunch. Such risks could be further exacerbated by pressure coming from Chinese corporations’ foreign exchange denominated debt and overall high level of leverage.

• Dry-up in housing demand: Should a new housing shock emerge, triggering a buyers strike, then real estate developers (also burdened with foreign currency loans) could suffer renewed stress, triggering a significant scaling back of investment.

• Capacity overhang: The still-large excess capacity in the manufacturing sector would be further exacerbated in such a scenario, weighing on corporate margins and profits. The risk is to see bankruptcies and unemployment increase in such a bleak scenario.

We watch bemused as Ambrose continues to make his case for optimism and inflation.

• Elite Funds Prepare For Reflation And A Bloodbath For Bonds (AEP)

One by one, the giant investment funds are quietly switching out of government bonds, the most overpriced assets on the planet. Nobody wants to be caught flat-footed if the latest surge in the global money supply finally catches fire and ignites reflation, closing the chapter on our strange Lost Decade of secular stagnation. The Norwegian Pension Fund, the world’s top sovereign wealth fund, is rotating a chunk of its $860bn of assets into property in London, Paris, Berlin, Milan, New York, San Francisco and now Tokyo and East Asia. “Every real estate investment deal we do is funded by sales of government bonds,” says Yngve Slyngstad, the chief executive. It already owns part of the Quadrant 3 building on Regent Street, and bought the Pollen Estate – along with Saville Row – from the Church Commissioners last year. But this is just a nibble.

The fund is eyeing a 15pc weighting in property, an inflation-hedge if ever there was one. The Swiss bank UBS – an even bigger player with $2 trillion under management – has issued its own gentle warning on bonds as the US Federal Reserve prepares to kick off the first global tightening cycle since 2004. UBS expects five rate rises by the end of next year, 60 points more than futures contracts, and enough to rattle debt markets still priced for an Ice Age. Mark Haefele, the bank’s investment guru, said his clients are growing wary of bonds but do not know where to park their money instead. The UBS bubble index of global property is already flashing multiple alerts, with Hong Kong off the charts and London now so expensive that it takes a skilled worker 14 years to buy a broom cupboard of 60 square metres.

Mr Haefele says equities are the lesser risk, especially in Japan, where the central bank has bought 54pc of the entire market for exchange-traded funds (ETFs) and is itching to go further. As of late November, roughly $6 trillion of government debt was trading at negative interest rates, led by the Swiss two-year bond at -1.046pc. The German two-year Bund is at -0.4pc. The Germans and Czechs are negative all the way out to six years, the Dutch to five, the French to four and the Irish to three. Bank of America says $17 trillion of bonds are trading at yields below 1pc, including most of the Japanese sovereign debt market. This is a remarkable phenomenon given that global core inflation – as measured by Henderson Global Investor’s G7 and E7 composite – has been rising since late 2014 and is now at a seven-year high of 2.7pc.

In the eurozone, the M1 money supply is rising at a blistering pace of 11.9pc. A case can be made that the ECB should go for broke, deliberately stoking a short-term monetary boom to achieve “escape velocity” once and for all. The risk of a Japanese trap is not to be taken lightly. Yet even those who feared looming deflation in Europe two years ago are beginning to wonder whether the bank is losing the plot. If the ECB doubles down next week with more quantitative easing and a cut in the deposit rate to -0.3pc, as expected, it will validate the iron law that central banks are pro-cyclical recidivists, always and everywhere behind the curve. Caution is in order. The investment graveyard is littered with the fund managers who bet against Japanese bonds, only to see the 10-year yield keep falling for two decades, plumbing new depths of 0.24pc this January.

Something tells me Russia’s info ain’t lying.

• Russia: Ankara Defends ISIS, Financial Interest In Oil Trade With Group (RT)

Some Turkish officials have ‘direct financial interest’ in the oil trade with the terrorist group Islamic State, Russian PM Dmitry Medvedev said as he detailed possible Russian retaliation to Turkey’s downing of a Russian warplane in Syria on Tuesday. “Turkey’s actions are de facto protection of Islamic State,” Medvedev said, calling the group formerly known as ISIS by its new name. “This is no surprise, considering the information we have about direct financial interest of some Turkish officials relating to the supply of oil products refined by plants controlled by ISIS.” “The reckless and criminal actions of the Turkish authorities… have caused a dangerous escalation of relations between Russia and NATO, which cannot be justified by any interest, including protection of state borders,” Medvedev said.

According to Medvedev, Russia is considering canceling several important projects with Turkey and barring Turkish companies from the Russian market. Russia has already recommended its citizens not to go Turkey citing terrorist threats, which have resulted in several tourist operators withdrawing tours to Turkey from the market. Russia may further scrap a gas pipeline project, aimed at turning Turkey into a major transit country for Russian natural gas going to Europe, and the construction of the country’s first nuclear power plant. Turkey shot down a Russian bomber over Syria on Tuesday, claiming it had violated Turkish airspace. Russia says no violation took place and considers the hostile act as ‘a stab in the back’ and direct assistance to terrorist forces in Syria.

Including Turkey.

• Russia Ready For Joint Command Against Islamic State: Paris Envoy (Reuters)

Russia is prepared to coordinate strikes against Islamic State militants in a joint command with the United States, France and others who want to participate, including Turkey, Moscow’s envoy to Paris said on Wednesday. French President Francois Hollande is trying to rally more international support to destroy Islamic State following the Nov. 13 attacks in Paris. He visited Washington on Tuesday and is due to meet Russian President Vladimir Putin on Thursday. “This coalition is a possibility,” Russia’s ambassador to France, Alexandre Orlov, told Europe 1 radio. “For our part, we are prepared to go further, to plan strikes against Daesh (Islamic State) positions together and to set up a joint command with France, America and any country that wants to join this coalition,” he said, noting that this included Turkey.

Tax cases have been easier to make for prosecutors since Al Capone.

• VW Faces Fresh Probe Over Tax Violation Claims in Germany

Volkswagen is facing a new criminal investigation after publishing incorrect emissions data that gave some drivers tax breaks that may have been unjustified. Prosecutors in Braunschweig, already looking into Volkswagen diesels, are now formally examining tax issues linked to faulty carbon-dioxide readings as well, spokesman Klaus Ziehe said by phone Tuesday. A separate probe was necessary because the accusations involve other cars and other people, he said. Five suspects are being investigated, Ziehe said, without identifying them. “German prosecutors like these kinds of investigations,” said Michael Kubiciel, a criminal law professor at the University of Cologne. “It’s easier to pursue charges under German tax law than under environmental protection rules.”

Volkswagen has said the people who bought the cars won’t have to pay the difference in taxes. The bill adds to the mounting tab of recall costs and regulatory fines the carmaker faces over irregular and falsified vehicle emissions, a scandal that began more than two months ago with Volkswagen’s admission to rigging diesel engines in 11 million vehicles worldwide. The CO2 issue arose Nov. 3, after the automaker said about 800,000 cars, mostly in Europe, had emissions of the greenhouse gas that didn’t match up with the levels promised. That matters because CO2 is a key measure for setting tax rates for motor vehicles in many European countries. Improperly labeled cars with higher-than-marketed emissions may lead authorities to reclaim the tax breaks.

Volkswagen estimated the financial risk of manipulating the ratings at about €2 billion. That sum includes paying governments for missing tax revenue. The carmaker already set aside €6.7 billion in the third quarter to fix diesel cars with engine software that allowed them to pass emission tests by illegally restricting pollution during testing. European regulators have approved Volkswagen’s proposals for how to repair about 70% of the diesel engines affected worldwide, Chief Executive Officer Matthias Mueller told a gathering of executives in Wolfsburg, Germany, on Monday. Meanwhile, Volkswagen’s Audi division will resubmit a revised version of software that the EPA and California Air Resources Board has targeted in its latest probe. If approved, the fix for 85,000 Audi, Volkswagen and Porsche cars with 3.0-liter diesel engines should cost roughly €50 million. EPA and CARB will review and test the revised software.

The man behind Jeremy Corbyn.

• This is The Day We Say Farewell To All That Was Good About Britain (Murphy)

I think that today we will say farewell to all that made the UK a compassionate, decent, fair and civilised society. After George Osborne has had his way I have a deeply uncomfortable feeling that this country will be more brutal, unequal, divided and profoundly individualistic. Once Margaret Thatcher said there was no such thing as society. Today I feel like George Osborne is trying to prove it. Tax is not going to be the focus of today, I suspect. It should be: if George Osborne wants to pursue the goal of a balanced budget (which has no economic merit, at all) then tackling the tax gap and cutting tax expenditures would be the obvious thing to do and that would deliver increased economic fairness and social justice. But those will not be at the heart of today.

Today is about shrinking the state. Apart from the economic illiteracy of this (at the macro level cutting government spending is the same as cutting GDP if there is spare capacity in the economy, and so the policy Osborne is pursuing makes it harder for him to achieve his goal) there is the massive social injustice that this entails to worry about. Social inequality will increase as a result of today. The disabled will be worse off again. The young will suffer disproportionately. The education of many will be harmed. Our long term prospects will be reduced. Those in need of care will have less available. Society will be more vulnerable. And yes, some will die as a result of today. That has to be said.

Those are all choices. And none of them is necessary. The policy of austerity is a political affectation designed to increase the wealth of a few, to favour large companies and to appease bankers. It cannot work, although I think George Osborne does not realise that although the evidence is obvious. And so the question as to why it has been adopted has to be asked. And that comes down to greed, a sense of entitlement, a lack of empathy, and a blunt indifference to others.

First encourage them, then…

• UK Consumer Borrowing Binge Troubles Bank Of England (Guardian)

Bank of England policymakers may need to take action to prevent a risky consumer borrowing binge as the economy recovers, the bank’s chief economist has warned. Appearing before the cross-party Treasury select committee alongside the Bank’s governor, Mark Carney, Andy Haldane warned that consumer credit, in particular personal loans, had been “picking up at a rate of knots. That ultimately might be an issue that the financial policy committee [FPC] might want to look at fairly carefully.” The Financial Policy Committee (FPC), created after the financial crisis, is meant to prevent a future crash by allowing the Bank to take action in particular markets without using the blunter tool of interest rates. Chaired by the governor, it has 10 members – but does not include Haldane.

The FPC has already stepped in to constrain mortgage lending but its powers to confront a credit bubble are untested. The latest data from the Bank showed the rate of growth of consumer credit picking up sharply. Andrew Tyrie, the Conservative MP who chairs the Treasury select committee, said: “The FPC has huge new powers which only small numbers of the public have so far been aware of, and it is particularly important that we hold them accountable. Many of these decisions were formerly the preserve of politicians.” Carney told MPs he was limited as to how much he could say about the FPC, as he was in “purdah”, as its next meeting approached; but he confirmed the rapid pace of credit growth was something it might need to look at.

He added that the separate monetary policy committee (MPC), which sets interest rates, has to take into account the historically high debt levels of Britain’s households as it made interest rate decisions. “Without question, more indebted households are more vulnerable,” he said. “The pressure on households because of the debt burden is significant. There is less margin for error.”

The main focus of that worse-than-useless Paris climate summit.

• Consume More, Conserve More: Sorry, But We Just Can’t Do Both (Monbiot)

We can have it all: that is the promise of our age. We can own every gadget we are capable of imagining – and quite a few that we are not. We can live like monarchs without compromising the Earth’s capacity to sustain us. The promise that makes all this possible is that as economies develop, they become more efficient in their use of resources. In other words, they decouple. There are two kinds of decoupling: relative and absolute. Relative decoupling means using less stuff with every unit of economic growth; absolute decoupling means a total reduction in the use of resources, even though the economy continues to grow. Almost all economists believe that decoupling – relative or absolute – is an inexorable feature of economic growth. On this notion rests the concept of sustainable development.

It sits at the heart of the climate talks in Paris next month and of every other summit on environmental issues. But it appears to be unfounded. A paper published earlier this year in Proceedings of the National Academy of Sciences proposes that even the relative decoupling we claim to have achieved is an artefact of false accounting. It points out that governments and economists have measured our impacts in a way that seems irrational. Here’s how the false accounting works. It takes the raw materials we extract in our own countries, adds them to our imports of stuff from other countries, then subtracts our exports, to end up with something called “domestic material consumption”. But by measuring only the products shifted from one nation to another, rather than the raw materials needed to create those products, it greatly underestimates the total use of resources by the rich nations.

For instance, if ores are mined and processed at home, these raw materials, as well as the machinery and infrastructure used to make finished metal, are included in the domestic material consumption accounts. But if we buy a metal product from abroad, only the weight of the metal is counted. So as mining and manufacturing shift from countries such as the UK and the US to countries like China and India, the rich nations appear to be using fewer resources. A more rational measure, called the material footprint, includes all the raw materials an economy uses, wherever they happen to be extracted. When these are taken into account, the apparent improvements in efficiency disappear. In the UK, for instance, the absolute decoupling that the domestic material consumption accounts appear to show is replaced with an entirely different chart.

Not only is there no absolute decoupling; there is no relative decoupling either. In fact, until the financial crisis in 2007, the graph was heading in the opposite direction: even relative to the rise in our gross domestic product, our economy was becoming less efficient in its use of materials. Against all predictions, a recoupling was taking place. While the OECD has claimed that the richest countries have halved the intensity with which they use resources, the new analysis suggests that in the EU, the US, Japan and the other rich nations, there have been “no improvements in resource productivity at all”. This is astonishing news. It appears to makes a nonsense of everything we have been told about the trajectory of our environmental impacts.

Which will only lead to more refugees.

• EU Countries Diverting Overseas Aid To Cover Refugee Bills (Guardian)

A report published on Tuesday by Concord, the European NGO confederation for relief and development, documents an emerging trend among member states to divert aid budgets from sustainable development to domestic costs associated with hosting refugees and asylum seekers. Some of the expenditure items EU countries report as aid do not translate into a real transfer of resources to developing countries or, ultimately, to people who are poor and marginalised, the report has found. This is not the first time that NGOs have reported that EU monies are increasingly being spent on tackling the refugee crisis and border security, rather than fighting poverty and inequality.

But this time the Concord AidWatch report contains data from the OECD CRS dataset complemented by updated national figures. In some cases, data from the European commission and Eurostat is also used. Concord says that some EU countries are misreporting some of their official development assistance (ODA) expenses by including costs which, under existing guidelines, should not have been counted. The reporting of non-eligible migration-related expenses in Spain and Malta, or the misreporting of refugee costs in Hungary, are among the examples cited. Inflated aid is calculated on the bilateral component of EU aid. Many of the components – imputed student costs, refugee costs, interest and tied aid – do not apply to multilateral aid.

The report found that in 2014, the EU28 and the European institutions inflated their aid by €7.1bn, which represents 12% of all aid flows. Some countries inflate aid more than others. While the percentage of inflated aid for Luxembourg is estimated at 0.3% of the country s total aid, and at 0.5% for the UK, it is, in contrast, 50.6% for Malta, 30.9% for Austria and 27.2% for Portugal. The EU institutions are no different from the member states, having ‘inflated’ their aid by 9.9%.

See next article.

• EU Refugee Numbers Drop for First Time This Year as Winter Nears (Bloomberg)

The number of refugees arriving in the European Union from violence-scarred regions of the Middle East and Africa is set to fall in November as traveling conditions worsen and member states looked to strengthen the bloc’s external borders. The number of migrants crossing the Mediterranean Sea to reach the EU this month fell to 116,579 through Nov. 23 compared with a record 220,535 in October, according to the United Nations refugee agency. The deepening chaos in nations from Libya to Syria has spawned an unprecedented wave of more than 860,000 people seeking shelter within the EU this year. The influx opened divisions within the bloc as German Chancellor Angela Merkel insisted Europe must honor its asylum commitments while other leaders such as Hungary’s Viktor Orban complained of the strain on their communities.

The pressure on Merkel increased this month when jihadists who attacked restaurants and a music venue in Paris. At least two of the assailants are thought to have entered the EU as refugees. On Friday EU nations agreed to bolster controls on frontiers around the bloc. They agreed to start carrying out systematic registration, including fingerprinting of all migrants entering into the Schengen area. All travelers will have their passports checked when they arrive in Europe, extending the full-blown screening that is currently limited to non-EU passport holders. The number of people entering Hungary slowed to a trickle this month after Orban closed the country’s border with Croatia on Oct. 18. Austria overtook Croatia as the nation with most arrivals during the first two weeks of November as the number of people embarking on the journey to Europe declined.

Betcha the Greeks know more and better than the UN.

• Rate Of Refugee Arrivals in Greece Picking Up (Kath.)

After a brief dip in the number of refugees and migrants arriving on Greece’s eastern Aegean islands, an increase was noted on Tuesday in the quantity of boats reaching Greek shores from Turkey. The uptick came a day ahead of Frontex’s management board meeting in Warsaw on Wednesday, when it is expected that the European Union border agency will decide to move its operational office from Piraeus. The office has been located in the port city since 2010 and its removal would be seen as a diplomatic blow for Greece, especially given the current flow of refugees to the country. More than 60 dinghies carrying migrants arrived on Lesvos on Tuesday as Alternate Foreign Minister Nikos Xydakis and Immigration Policy Minister Yiannis Mouzalas guided the ambassadors of European Union countries around the island so they could get a closeup view of the impact of the refugee crisis.

Greece has been under pressure to improve the registration process for arrivals and Lesvos is expected to host a so-called hotspot at the Moria camp, where authorities are hoping to register between 1,000 and 1,500 people a day. Police officials said they expect the hotspot to be ready in less than two weeks. The recent letup in the number of people reaching Lesvos allowed authorities in Athens, where migrants are transferred, to empty the sports hall in Galatsi, which is being used for temporary shelter, and move everyone to the Tae Kwon Do Stadium in Faliro. Tuesday’s arrivals on Lesvos included a yacht carrying 140 migrants who had each paid around 3,000 euros to travel from Turkey in its relative safety. Two bodies also washed up in the island pn Tuesday.

How it this possible. Greece needs that money for its own citizens’ health care.

• Greece Spends €800,000 On Migrant Healthcare With EU Funding Absent (Kath.)

Greece has so far this year spent more than €800,000 in healthcare for about 2,000 migrants and refugees, according to data from the Health Ministry. According to the data, which were presented by General Secretary for Public Health Yiannis Baskozos during a conference of the World Health Organization (WHO) in Rome on Tuesday, demand for the EKAV emergency medical assistance service has increased by 42% compared to 2014. Ambulance calls doubled between June – November – when the refugee crisis peaked – over the same period last year. “[Greece] has managed to fulfill the current healthcare needs for refugees and migrants notwithstanding the absence of EU funding,” Baskozos told the conference.

Home › Forums › Debt Rattle November 25 2015