Arthur Rothstein General store and railroad crossing, Atlanta, Ohio 1938

Huh? Didn’t Ireland grow 26% just last week?

• Ireland Hits Brexit Alarm in Biggest Foreign Crisis in 50 Years (BBG)

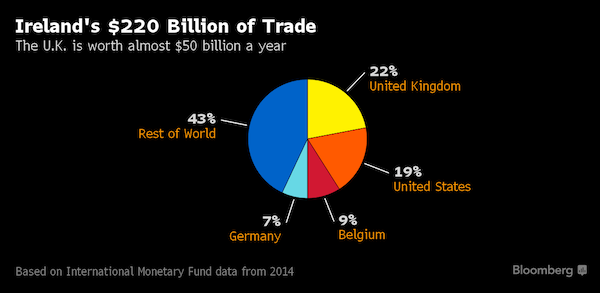

The prime minister is under pressure, economists are slashing growth forecasts and companies are warning of Brexit’s dire consequences. London? No, Dublin. The intertwining of trade and finance means no other country is feeling the fallout from the U.K.’s vote to leave the European Union more than Ireland. In the year the Irish marked the centenary of their uprising against British rule, the country remains at the mercy of the unfolding drama in its closest neighbor. “It’s the most serious, difficult issue facing the country for 50 years,” said John Bruton, 69, who was Irish prime minister between 1994 and 1997 and later served as the EU’s ambassador to the U.S.

Exporters have warned the plummeting pound will erode earnings and economic growth, just as a recovery had taken hold after the 2010 international bailout that followed the banking meltdown. Irish shares have declined, not least because the U.K. is the top destination for the country’s exports after the U.S. and the biggest for its services. Meantime, Prime Minister Enda Kenny is fending off demands by Northern Irish nationalists for a reunification poll as he comes to terms with the loss of a key EU ally and plotters from his own party try to topple him. Then there’s the future of the U.K.’s only land border with the EU. “The consequences are mind-boggling,” said Eoin Fahy, chief economist at Kleinwort Benson Investors in the Irish capital.

Britain and Ireland joined the European Economic Community in 1973. Ireland was drawn in part to escape what one politician called “our gate-lodge attitude towards England.” More than four decades later, the two countries remain woven together economically as well as culturally and linguistically. Ireland uses the euro, yet does about $45 billion of trade with the U.K. About 380,000 Irish citizens living in Britain were eligible to vote in the Brexit referendum. Britain also chipped in for Ireland’s bailout six years ago, despite not being part of the euro region. When Theresa May took over as British prime minister last Wednesday, Kenny was among three leaders she spoke to, along with Germany’s Angela Merkel and Francois Hollande of France.

Bloomberg should simply say: “The yuan fell, and we have no idea why”.

• Yuan Declines to 2010 Low as Property Prices Slow, Dollar Rises (BBG)

China’s yuan fell to the weakest level since 2010, pulled down by cooling property prices, a dollar rebounding on haven demand and a weaker central bank fixing. New home prices rose in fewer cities in June compared with a month earlier, according to official data released Monday, blunting optimism prompted by last week’s figures showing forecast-beating economic growth. The monetary authority weakened the yuan’s daily fixing to the lowest since 2010 after the dollar strengthened Friday following a coup attempt in Turkey.

The greenback was supported on Monday also as China said it would hold military exercises in the South China Sea. “The dollar strengthened as orders to buy the currency jumped, pressuring the yuan and the rest of Asian currencies lower,” said Andy Ji, a Singapore-based foreign-exchange strategist at Commonwealth Bank of Australia. “There’s news that China will hold military exercises in the South China Sea later this month,” which could spur some haven-demand for the greenback.

Lookalike contest.

• Goodbye Lenin, Hello Bernanke (ABC.au)

Maybe it’s just me, but have you noticed the striking similarity between Vladimir Lenin and Ben Bernanke lately? Superficially, there’s the obvious physical resemblance; whippet build, glabrous pate, facial hair and a penchant for stylish, if somewhat conservative, garb. More significantly, both appear to harbour the same ideological distrust of free markets or, at the very least, a burning desire to control them as much as possible. Separated by almost a century, both men have made it a lifelong ambition to impose state control over the economy. And it has to be said, while Vladimir Ilyich Ulyanov Lenin achieved significant success in spreading the word from Russia through developing nations, he and his successors never quite got across the line when it came to the so-called free world.

Maybe it was his reputation as a firebrand, an over-reliance on bloody revolution by force and the frightening prospect – for the ruling elite at least – that wealth would be redistributed to the poor. Enter Ben Bernanke. In the space of a mere eight years, the former Federal Reserve chief has managed to achieve what Vladimir could barely conceive. He’s convinced the United States of America, the United Kingdom, Japan and Europe to embark on a revolutionary journey to completely subvert free market instincts. Unlike his Russian predecessor, Ben has opted for the calm, congenial exterior of Central Banker from Central Casting, complete with a mogadon monotone designed to lull his audience into a state of torpor.

He’s also wisely decided to modify the wealth distribution bit. As western governments have raided the kitty, plunging themselves into an ocean of debt, much of the proceeds have flowed directly into asset markets – stocks, bonds and property – which has helped maintain the flow of wealth towards the wealthy. Brilliant! Last week, Ben was in Japan. And that got twitchy fingered traders across the globe all hot under the collar. Ben, after all, is the man who pioneered the implementation of “unorthodox monetary policy”.

“Bond markets are signaling something very nasty coming down the road at us — an all-encompassing, worldwide deflation.”

• Stocks and Bonds Are on a Collision Course (DR)

One of the following is correct: A) The stock market is lying. B) The bond market is lying. They both can’t be true. Consider: The stock market has sprung to record highs this week. Shocking, given the world was coming to an end after Brexit. But it’s true. Both the S&P and the Dow eclipsed previous records this week. What does that normally indicate? A rollicking economy in high gear, stability, investor belief in the future. Maybe some “healthy” inflation into the bargain. Now consider: Bonds are also trading at record highs. Meaning yields are at historic lows (prices and yields move in opposite directions – the higher the price, the lower the yield, and vice versa). Yields on 10-year Treasuries plunged to all-time lows this month. Same with 30-year Treasuries.

That would normally signal an economy on the brink of ruin and investors panicking into government bonds. It also means deflation of the hide-the-women-and-children variety. TheTelegraph: “Bond markets are signaling something very nasty coming down the road at us — an all-encompassing, worldwide deflation.” Two completely different narratives. One wrong, one right. Someone’s in for a nasty shock – and probably soon. Says analyst William Koldus, founder of The Contrarian: The tug of war between inflationary and deflationary assets is likely to be resolved in 2016. Either U.S. stock prices, which have been an outlier to the upside, are wrong, and a significant correction awaits stock investors, or U.S. bond prices, and global sovereign bond yields, which have priced in a significant deflationary head wind, are wrong, and safe-haven bondholders are set for losses.

Who’s the jury to believe? Generally, the bond market. As Neil Irwin of The New York Times explains, “Savvy economic analysts have always known the bond market is the place to look for a real sense of where the economy is going, or at least where the smart money thinks it is going.” Here he dumps more rain on the parade: “And right now, if the bond market is correctly predicting the economic path ahead, we should all be terrified.”

“Surely, BOJ Governor Kuroda will go down in history as the stupidest central banker of all-time.”

• Bubbles in Bond Land (David Stockman)

Last year Japan lost another 272,000 of its population as it marches steadily toward its destiny as the world’s first bankrupt old age colony. At the same time, the return on Japan’s 40-year bond during the last six months has been an astonishing 48%. That’s right! We aren’t talking Tesla, the biotech index or the FANGs. To the contrary, like the rest of the Japanese Government Bond (JGB) yield curve, this bond has no yield and no prospect of repayment. But that doesn’t matter because it’s not really a sovereign bond, anyway. It has actually morphed into a risk free gambling chip. Leveraged front-runners are scooping up whatever odds and sots of JGBs that remain on the market and are selling them to the Bank of Japan (BOJ) at higher, and higher and higher prices.

At the same time, these punters face virtually no risk. That’s because the BOJ already owns 426 trillion yen of JGBs, which is nearly half of the bonds outstanding. And it is buying up the rest at a rate of 80 trillion yen per year under current policy, while giving every indication of sharply stepping up its purchase rate as it segues to outright helicopter money. It can therefore be well and truly said that the BOJ is the ultimate roach motel. Virtually every scrap of Japan’s gargantuan public debt will go marching into its vaults never to return, and at “whatever it takes” bond prices to meet the BOJ’s lunatic purchase quotas. Surely, BOJ Governor Kuroda will go down in history as the stupidest central banker of all-time.

But in the interim the man is contributing — along with Draghi, Yellen and the rest of the central bankers guild — to absolute mayhem in the global fixed income market. That’s because these fools have succeeded in unleashing a pincer movement among market participants that is flat-out suicidal. That is, the leveraged fast money gamblers are chasing prices ever higher as sovereign bonds become increasingly scarce. At the same time, desperate bond fund managers, who will lose their jobs for just sitting on cash, are chasing yields rapidly lower on any bond that still has a positive current return. This is the reason the 30-year U.S. treasury bond has produced a 22% return during the last six months. To say the least, that’s not shabby at all considering that its current yield is just 2.25%.

Want to see a real housing crisis?

• Chinese Cities’ Expansion Plans Could House 3.4 Billion People (BBG)

New areas planned by China’s small cities could accommodate 3.4 billion people by 2030 – or almost half the world’s current population – a target that even Chinese state media calls problematic. A report by the National Development & Reform Commission, China’s central planning agency, found that small- and medium-sized cities were planning more than 3,500 new areas that could accommodate more than twice the country’s current population of 1.4 billion. The entire world has a population of 7.4 billion, according to U.S. Census estimates. The findings were detailed in an analysis by the official Xinhua News Agency, which criticized the planned new areas as unworkable: “Who’s going to live in them? That’s a problem,” the piece said.

The expansion comes amid urbanization calls by President Xi Jinping and Premier Li Keqiang as China prepares for another 100 million people to move from the countryside to urban metropolises by the end of the decade. People tend favor bigger markets with more opportunities and fewer than 1-in-10 migrant workers moved to small cities last year, according to an NDRC report published in April. Even without the new areas, China already has more housing than it needs and “ghost cities” have proliferated. China has been building more than 10 million new units annually for the past five years, outstripping an estimated of demand of less than 8 million, according to an analysis by Bloomberg Intelligence Economists Tom Orlik and Fielding Chen.

Look, Reuters, there comes a point where things like “..a construction-led rebound in the economy may not be sustainable..” become meaningless. We reached that point quite a while ago.

• Slowing China Home Price Rises Add To Doubts About Economy (R.)

Home price rises in China slowed in June for a second straight month, adding to fears that a construction-led rebound in the economy may not be sustainable. The property market is a key driver of the world’s second-largest economy and a robust recovery in home prices and sales gave a stronger-than-expected boost to activity in the first half of the year. But slowing price growth in smaller cities and cooling property investment show the bounce may already be fading, raising the risk of weaker economic growth in coming months. Home prices in China’s 70 major cities rose 7.3% in June from a year earlier, an official survey showed on Monday, accelerating from a 6.9% rise in May.

To be sure, some of the biggest cities showed eye-popping gains on a yearly basis, with prices in the southern boomtown of Shenzhen up 46.7% and Shanghai up 27.7%. Gains on a monthly basis continued to slow, however, as cities tightened policies amid fears of a housing price bubble. The monthly rise slowed slightly to 0.8% in June, easing from 0.9% in May, according to a Reuters calculation based on data issued by the National Bureau of Statistics (NBS). “We continue to expect the property rebound to subside and property investment growth to fall in the second half of the year,” economists at Nomura said in a note, predicting sales would stabilize and a large glut of unsold homes would keep pressure on prices in some areas.

Stupidest term in a long time: “generational pay progress”.

• Under-35s Could Be The First Generation To Earn Less Than Their Parents (DM)

Millennials could become the first generation to earn less than their predecessors, analysis by a think-tank has found. The Research Foundation found that under-35s have been hit hardest by the recent pay squeeze and earned £8,000 less during their 20s than a typical person in the previous generation – known as generation X. The finding comes just days after new Prime Minister Theresa May warned of a ‘growing divide between a more prosperous older generation and a struggling younger generation’. The report, which comes as the thank-tank launches its Intergenerational Commission, warns that a post-Brexit downturn could depress millennials’ wages further.

The Intergenerational Commission report states that while some of the pay squeeze is down to millennials entering the job market as the recession hit, it also found generational pay progress had actually stopped before the 2007/08 financial crash. If the future pay of millennials follows the path of generation X, that would reduce their lifetime earnings to around £825,000 – making them the first ever generation to earn less than their predecessors over the course of their working lives. The comparable figure for Generation X is around £832,000. Even if their wages followed a more optimistic path and improved rapidly like their baby boomer parents, their lifetime earnings would be around £890,000. This would be just 7% more than generation X and a third of the size of the pay progress that generation X are set to enjoy over the baby boomers.

“Boomers got the Pill, free love, free education and easy jobs. Gen X got AIDS, HECS and the GFC.”

I feel sorry for Generation X, those of you born between 1965 and 1983 and who are now straddling the load-bearing years of the late 30s and 40s. There is no escaping the big responsibilities at this time in the life cycle. At this very moment, Xers are raising families and paying taxes and working flat out… and yet nary a peep from this lot does anyone hear. It’s all about the baby boomers, and if it’s not about the baby boomers and their interminable retirement woes then it’s all about their gifted Generation-Y children. Are we paying you enough, Gen Y? Is anyone being mean to you? Can I get you a pillow? You do realise that I am a Generation Xer, trapped inside a baby boomer body. The reason I feel sorry for the Xers is that they’re always in the wrong place at the wrong time.

Xers are the pissed-off generation. They are heartily sick of baby boomers and their cultural chest-beating. Yes, boomers, we know it was you who saved humanity from the Vietnam War. Yes, we know you discovered free love in the 1960s. No one had thought of sex prior to that, had they? This is what I mean about being pissed off. Baby boomers got the Pill and free love when they were coming of age. But what did older Xers get when they passed through their teens and 20s? The 1980s. Out went the concept of free love; in came the mortal threat of HIV-AIDS. Kind of puts a dampener on the sex thing, don’t you think?

Boomers got fee-free university education courtesy of Gough Whitlam. When did most Xers go to uni? Oh, that’d be after 1989, when we decided fee-free tertiary education was unsustainable and in came HECS. When did many Xers enter the workforce? Oh, that’d be in the early 1990s, when unemployment peaked at nearly 12 per cent. And then they worked for baby boomer managers, biding their time, pacing, scheming, forever waiting for the boomers to let go of the reins. And when was it that baby boomer management let go of the reins? Oh, that’d be around the time of the global financial crisis. “Here you go Xers, it’s your turn now. We’re off on a Rhine River cruise. Make sure you pay your taxes. Bye.”

If the Department of Justice won’t obey the law, what do you get?

• Justice Department ‘Uses Aged Computer System To Frustrate FOIA Requests’ (G.)

A new lawsuit alleges that the US Department of Justice (DoJ) intentionally conducts inadequate searches of its records using a decades-old computer system when queried by citizens looking for records that should be available to the public. Freedom of Information Act (Foia) researcher Ryan Shapiro alleges “failure by design” in the DoJ’s protocols for responding to public requests. The Foia law states that agencies must “make reasonable efforts to search for the records in electronic form or format”. In an effort to demonstrate that the DoJ does not comply with this provision, Shapiro requested records of his own requests and ran up against the same roadblocks that stymied his progress in previous inquiries.

A judge ruled in January that the FBI had acted in a manner “fundamentally at odds with the statute”. Now, armed with that ruling, Shapiro hopes to change policy across the entire department. Shapiro filed his suit on the 50th anniversary of Foia’s passage this month. Foia requests to the FBI are processed by searching the Automated Case Support system (ACS), a software program that celebrates its 21st birthday this year. Not only are the records indexed by ACS allegedly inadequate, Shapiro told the Guardian, but the FBI refuses to search the full text of those records as a matter of policy. When few or no records are returned, Shapiro said, the FBI effectively responds “sorry, we tried” without making use of the much more sophisticated search tools at the disposal of internal requestors.

“The FBI’s assertion is akin to suggesting that a search of a limited and arbitrarily produced card catalogue at a vast library is as likely to locate book pages containing a specified search term as a full text search of database containing digitized versions of all the books in that library,” Shapiro said.

Will be a big story again when Holland produces its ‘objective’ report. Which has lost all credibility way before publication.

• MH-17: Russia Convicted By Propaganda (PCR)

Today is the second anniversary of the downing of Malaysia Airlines Flight 17, and we still do not know the explanation. Washington and its European vassal politicians and media instantly politicized the event: The Russians did it. End of story. After 15 months of heavy anti-Russian propaganda had imprinted the message on peoples’ minds, the Dutch Safety Board issued its inconclusive report. By then, it was irrelevant what the report said. Everyone already knew that “the Russians did it.” I remember when pre-trial media accusations resulted in dismissed cases. Anyone declared guilty prior to presentation of evidence and conviction was considered to have been convicted in advance and unable to receive a fair trail. Such cases were dismissed by judges.

Washington’s story never made any sense. Neither Russia nor the separatists in the Donetsk region had any reason to shoot down a Malaysian airliner. In contrast Washington had enormous incentives as Washington’s propaganda machine could place the blame on Russia and use the incident to compel European governments to accept Washington’s sanctions placed on Russia. It worked for Washington. Washington successfully used the incident to wreck Europe’s political and economic relationships with Russia. Four months into the anti-Russian propaganda campaign, a website called Bellingcat, claiming to be an open source site for citizen journalists, but which could be a MI-5, MI-6, or CIA front, issued a report that the Buk missile was fired by a Russian unit, the 53rd Buk Brigade, based in the Russian city of Kursk.

This allegation exposed the propaganda for what it is. Whereas it is possible that separatists unfamiliar with the Buk weapon system could accidentally shoot down a civilian airliner, it is not possible for a Russian military unit to make such a mistake. Moreover, it is unclear why separatists or the Ukrainian government would have any reason to use Buk missiles in their conflict. The separatists have no air force. The Ukrainians attack the separatists at ground level with ground attack aircraft and helicopters, not with high altitude bombing. The Buk missile is a high altitude missile. The only way the separatists could have acquired Buk missiles is by overrunning and capturing Ukrainian positions that for unfathomed reasons had deployed Buk missiles.

It seems to me that if a Buk missile was present in the conflict area, it was moved there for a reason unrelated to the conflict. A European air traffic controller said that MH-17 and the airliner carrying Russian President Vladimir Putin were initially on the same course. Possibly Washington and its vassal in Kiev thought MH-17 was Putin’s plane and destroyed the Malaysian flight by mistake.

Brought to you by the Clinton Foundation: “I put lipstick on a pig,” he said. “I feel a deep sense of remorse that I contributed to presenting Trump in a way that brought him wider attention and made him more appealing than he is.” He went on, “I genuinely believe that if Trump wins and gets the nuclear codes there is an excellent possibility it will lead to the end of civilization.”

• Donald Trump’s Ghostwriter Tells All (New Yorker)

Last June, as dusk fell outside Tony Schwartz’s sprawling house, on a leafy back road in Riverdale, New York, he pulled out his laptop and caught up with the day’s big news: Donald J. Trump had declared his candidacy for President. As Schwartz watched a video of the speech, he began to feel personally implicated. Trump, facing a crowd that had gathered in the lobby of Trump Tower, on Fifth Avenue, laid out his qualifications, saying, “We need a leader that wrote ‘The Art of the Deal.’ ” If that was so, Schwartz thought, then he, not Trump, should be running. Schwartz dashed off a tweet: “Many thanks Donald Trump for suggesting I run for President, based on the fact that I wrote ‘The Art of the Deal.’ ”

Schwartz had ghostwritten Trump’s 1987 breakthrough memoir, earning a joint byline on the cover, half of the book’s five-hundred-thousand-dollar advance, and half of the royalties. The book was a phenomenal success, spending forty-eight weeks on the Times best-seller list, thirteen of them at No. 1. More than a million copies have been bought, generating several million dollars in royalties. The book expanded Trump’s renown far beyond New York City, making him an emblem of the successful tycoon. Edward Kosner, the former editor and publisher of New York, where Schwartz worked as a writer at the time, says, “Tony created Trump. He’s Dr. Frankenstein.”

Starting in late 1985, Schwartz spent eighteen months with Trump—camping out in his office, joining him on his helicopter, tagging along at meetings, and spending weekends with him at his Manhattan apartment and his Florida estate. During that period, Schwartz felt, he had got to know him better than almost anyone else outside the Trump family. Until Schwartz posted the tweet, though, he had not spoken publicly about Trump for decades. It had never been his ambition to be a ghostwriter, and he had been glad to move on. But, as he watched a replay of the new candidate holding forth for forty-five minutes, he noticed something strange: over the decades, Trump appeared to have convinced himself that he had written the book. Schwartz recalls thinking, “If he could lie about that on Day One—when it was so easily refuted—he is likely to lie about anything.”

While being responsible for 91% of them fleeing in the first place.

• Six Wealthiest Countries Host Less Than 9% Of World’s Refugees (G.)

The six wealthiest countries in the world, which between them account for almost 60% of the global economy, host less than 9% of the world’s refugees, while poorer countries shoulder most of the burden, Oxfam has said. According to a report released by the charity on Monday, the US, China, Japan, Germany, France and the UK, which together make up 56.6% of global GDP, between them host just 2.1 million refugees: 8.9% of the world’s total. Of these 2.1 million people, roughly a third are hosted by Germany (736,740), while the remaining 1.4 million are split between the other five countries. The UK hosts 168,937 refugees, a figure Oxfam GB chief executive, Mark Goldring, has called shameful.

In contrast, more than half of the world’s refugees – almost 12 million people – live in Jordan, Turkey, Palestine, Pakistan, Lebanon and South Africa, despite the fact these places make up less than 2% of the world’s economy. Oxfam is calling on governments to host more refugees and to do more to help poorer countries which provide shelter to the majority of the world’s refugees. “This is one of the greatest challenges of our time yet poorer countries, and poorer people, are left to shoulder the responsibility,” said Mark Goldring, chief executive of Oxfam GB. “It is a complex crisis that requires a coordinated, global response with the richest countries doing their fair share by welcoming more refugees and doing more to help and protect them wherever they are.

“Now more than ever, the UK needs to show that it is an open, tolerant society that is prepared to play its part in solving this crisis. It is shameful that as one of the richest economies the UK has provided shelter for less than 1% of refugees.”

Look away.

• 20 Migrants Dead, 366 Saved From Boats In Mediterranean (NW)

Rescuers saved 366 migrants from rickety boats trying to cross the Mediterranean to Italy but at least 20 people were reported to have drowned, Italian police said on Saturday. The survivors, who were rescued in four separate operations, were crammed onto three rubber dinghies and a wooden fishing boat. They were all taken to the Sicilian port of Augusta, where they were questioned on Friday evening by the Italian police unit Interforce, which combats illegal immigration.

The Norwegian ship Siem Pilot went to the aid of one dinghy that sank in the Sicilian Channel, but many migrants were already in the sea when it arrived, Antonio Panzanaro, an Interforce official, told Reuters. One corpse was recovered but survivors said that at least 20 people had drowned before the ship arrived, he said. There were 82 women and 25 children among the 366 people rescued, he said. The survivors were mainly from Nigeria, Ethiopia, Eritrea and Bangladesh. Seven people were arrested from the four boats, including their drivers, on suspicion of people-trafficking, he said.

Home › Forums › Debt Rattle July 18 2016