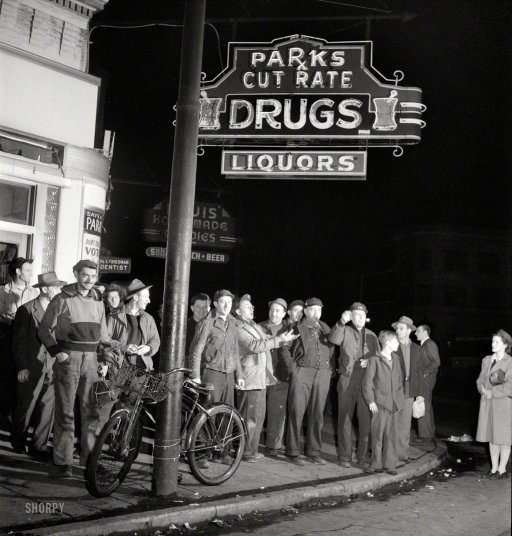

Marjory Collins Carpool for 3rd shift defense workers, midnight, Baltimore April 1943

Da markets today sort of refound their – shaky – feet, oil up a dollar, EU exchanges up 3% or so, Greece even over 7%, while interestingly gold didn’t move much at all during the wild week (no safe haven), and most movement was perhaps, through all the see-saw, in bonds. To sum up the week: panic followed by plunge protection teams. And now the ‘leaders’ hope plunge protection will save another day too.

And they may. Germany sinks a bit, but Germany is strong. US housing is at least not falling further, but US consumer spending stalls and drops. The deep dark weakness has not yet hit the big economies. But the nerves are back. Volatility is back with a vengeance. As it should. And that will paint the picture going forward, plunge protection or not. Da markets will come again and again and dare central banks to plunge protect.

Well, either that or more QE, but despite whatever Bullard says the Fed will go ahead with the taper – just listen to Yellen waxing dreamily about the US ‘expansion’ -, and the ECB won’t go full QE because the member states will never agree on anything. And Merkel feels the euroskeptics breathing down her neck as much as the ‘leaders’ of Britain, Italy, France et al.

But as we’ve seen today, there’s sufficient fire power left on both sides of the pond to survive one week of mayhem. But that’s not the main lesson on this Friday. The main lesson is that Europe’s Achilles heel has been laid bare, once more, in full sight, and Europe – re: Draghi, Merkel – thinks that denial is its best defense. Big mistake.

The lofty leaders at the ECB, and Berlin, Paris, Brussels, pretend they can make everything right that’s wrong inside their toy monetary union through asset purchases, sovereign bond purchases, and anything that falls in the ‘whatever it takes’ category. But it’s all just bluff. Because, what it all boils down to, they can’t keep buying Greek bonds with German taxpayer money until the end of time.

And the markets know this. And when they feel like it, for example because other profits (free QE funds) have dried up, the markets will call that bluff at craftfully chosen intervals. It’s the easiest thing in the world: they only need to bet against something they know is hollow gaping hot air to begin with. There’s no there there. Draghi cannot save Greece. Period. And if he can’t save Greece, he can’t save the euro. Period.

In Brussels, like in Washington, Tokyo, Beijing, only one thing really counts: they have to achieve economic growth, because if they do, all problems will vanish into thin air. Which is not only an idiotic notion, it’s been 7 years now and they still haven’t achieved even just that one thing they focus on. It’s exactly like converting to some religion because it promise that the deity of their choice will relieve you of all your troubles, only in modern economics the deity is growth. And its apostles are debt, debt and credit.

If it were you or me, we’d say: let’s try something else, go for some other approach, but not Brussels or Washington, they live in one dimension only, they lack every form of depth perspective, and they will keep pushing for growth until they die trying. And in the case of the ECB, drag Europe down with them, first of all the young people of Greece, Italy, Spain and Portugal.

The idea is that all problems will be solved by the return of growth, but how is Greece ever going to grow again when over 50% of its young people haven’t, for 6-7 years running now, ever worked a decent job in their lives, and those who are now 25-28 years old, and never had a shot at real work, despite college degrees, university degrees, face the competition of all graduating classes of those 6-7 years for the same jobs, which still don’t exist?!

It’s an impossibly dumb concept that can exist only in the minds of well-paid bureaucrats in both Athens and Brussels – and Rome and Madrid-. And it can lead to only one outcome: Greece will leave the EU. Because no matter what you think about the Greeks’ abilities to govern themselves, they couldn’t possibly do worse for themselves, for their young people, and thereby their entire economy, than the present system has done. What could possibly have been worse than this?

Greece wanted to join the EU because of the promise of added riches. Instead, they see their entire society dissolve through the EU ideal of lifting all Mediterranean boats to the level of Germany. It’s not like Germany wanted itself to become poorer, that was never their reason to set up the EU.

Berlin wanted Greece to become Germany, and Germany to become an economic Nirvana. They still do. Politicians know that to get (re-)elected they need to promise growth, they need to paint a rosier picture than people see around them today. As if we’re not rich enough yet. It’s not just the politicians who lack depth perspective, it’s their voters too. If you can choose between a promise of more or a threat of less, you know how you will vote.

What this turbulent week exposed was this: Greek 10-year bond yields rose to close to 9%. They’re back down to 7.8% as we speak, plunge protection. 7% is the major ‘sustainable’ level. Greece, just very recently, said they wanted to free themselves of the Troika. The financial markets have now let them know what they think of that.

First Greece, then Cyprus, and Spain, and Italy, and Portugal, and Ireland, will continue to be the targets of the global financial markets. And the EU can’t save them all. There will be more moments like the past week, and the ECB is powerless to stop them all, other than at such gigantic costs that the voters in the richer nations will move their support to other parties.

4-5 years ago, when the PIIGS crisis was at its height, Europe could have enabled the poorer countries to leave the euro straightjacket. Soon, it won’t be a question of enabling anymore, it will turn into a dogfight. The eurozone as a whole will never achieve growth anymore, but Germany and Holland and Finland might; at the cost of the PIIGS.

This will stop at some point, da markets will make sure it does. Achilles was a mighty warrior, with one fatal weakness. That weakness for the eurozone was laid bare this week in the Greek 10-year bond 9% yield. The only ways that exist to bring that back down are artificial: it’s not like Greece itself, with 25% unemployment and more than twice that among young people, can lift itself up by its hairs.

And still, no, it’s not Greece that is Europe’s Achilles heel. It’s the hubris and megalomania that has made Europe, Brussels, blind to its inherent weaknesses. If Greece, and perhaps Spain, Italy, Portugal, would have been allowed to leave the eurozone in 2008/9, they would all have done much better than they are now, and so would the richer core of the EU.

After all, how could the PIIGS possibly have done worse than the present 50%+ youth unemployment? Greece is not Germany, and never will be. Italy is not Helsinki, and never will be.

The peace ideals behind the European unification will, unless something changes very soon, turn into them’s fightin’ words. Because the hunger for power floated like so much excrement to the top of yet another supra-national organization that this world of ours should never have built. EU, World Bank, UN, IMF, NATO, you name them. They take on powers we never designed them for, and before we know it we can’t stop them anymore from accumulating ever more power.

The eurozone’s Achilles heel was there for everyone to see this week, and it’s fatal, lethal: Greek 10-year yields at 9%. That will end up killing the whole edifice. Unless Brussels comes up with a plan to let the PIIGS leave. Brussels won’t. The power hungry don’t give up power voluntarily. So we’ll fight. Suit yourself. But don’t think this will somehow turn out alright all by its smooth and easy self. Europe is on the verge of disintegration. For no reason at all, other than the power dreams of a bunch of borderline psychopaths.

Home › Forums › Europe’s Fatal Flaw Laid Bare For All To See. Again.