Harris&Ewing Washington, DC, Storm damage..” Between 1913 and 1918

Things get crowded, it’s inevitable. And much more so in manipulated markets.

• Global Bonds Suffer Worst Monthly Meltdown as $1.7 Trillion Lost (BBG)

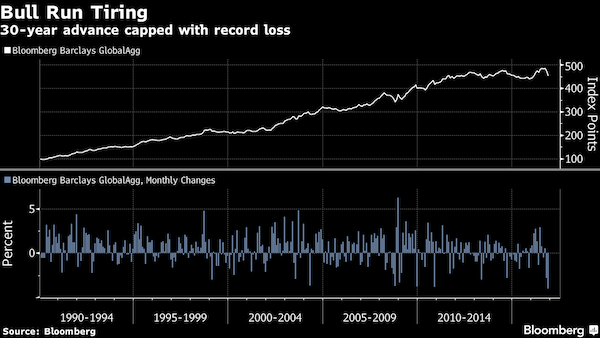

The 30-year-old bull market in bonds looks to be ending with a bang. The Bloomberg Barclays Global Aggregate Total Return Index lost 4% in November, the deepest slump since the gauge’s inception in 1990. Treasuries extended declines Thursday along with European bonds on speculation that the ECB will consider sending a signal that stimulus will eventually end. The reflation trade has been driving markets since Donald Trump’s election victory due to his promises of tax cuts and $1 trillion in infrastructure spending. Calling an end to the three-decade bond bull market is no longer looking like a fool’s errand: the Federal Reserve is expected to raise interest rates again – and do so more often than once a year, inflationary expectations are climbing and there are hints global central banks may buy less sovereign debt going forward.

Investors pulled $10.7 billion from U.S. bond funds in the two weeks after Trump’s victory, the biggest exodus since 2013’s “taper tantrum,” while American stock indexes jumped to records. “The market has moved with remarkable swiftness to price in the anticipated reflationary impact of a Trump administration,” said Matthew Cairns, a strategist at Rabobank International in London. “This has, in turn, prompted a notable rotation out of fixed income and into equities.” Still, Cairns cautioned the moves are “remarkable given the distinct lack of clarity as regards what policies the president-elect will actually pursue.” November’s rout wiped a record $1.7 trillion from the global index’s value in a month that saw world equity markets’ capitalization climb $635 billion.

Eevrybody’s been on the same side of the boat for too long.

• What’s Causing The Fire Sale In The Bond Market (CNBC)

There’s a fire sale in the bond market, and the November jobs report could make it burn even hotter. The wild move came amid speculation that Friday’s employment report could be better-than-expected and drive interest rates even higher. Interest rates surged Thursday, with the 10-year yield spiking as much as 12 basis points at its peak, to 2.49%, the highest yield since June 2015. Yields move inversely to prices and rates snapped higher across the whole yield curve. The 2-year pressed up against 1.17% and the 30-year rose to as high as 3.15%. In afternoon trading, some of the selling subsided, and the 10-year yield slipped back to just under 2.44%, but 2.50 is being watched as the next psychological line in the sand.

“In order to stay above 2.50, it’s got to be a really good number. The way we’re going, it’s like an unhinged market. It’s also going to be counterproductive for things down the road. This is not a healthy adjustment in rates. There’s going to be some losses on this,” said George Goncalves at Nomura. The 10-year yield affects consumer loans especially home mortgage rates, which have already risen near 4%, slowing borrowing activity. The 2-year is the rate most closely watched as a signal about the market’s expectation for Fed rate activity. The Fed is expected to hike rates Dec. 14 but traders have been speculating a stronger economy could force it into a faster hiking cycle next year.

Strategists say Thursday’s rate spike was driven by a combination of factors and at the same time inexplicable in its scope. The overriding themes are that the world is moving to a higher interest rate environment and for the first time in years, there could be inflation. OPEC’s deal to cut production Wednesday, drove oil prices 15% higher in just two days, ramping up inflation expectations that already had been on the rise.

“There is no global anthem, no global currency..”

• Donald Trump Promises to Usher In New ‘Industrial Revolution’ (WSJ)

President-elect Donald Trump on Thursday said his administration would usher in a new “Industrial Revolution,” one of numerous promises he made in Cincinnati as he began a nationwide “Thank You” tour following his Nov. 8 election. Mr. Trump used the 53-minute speech, the first of its kind since he became president-elect, to reflect on his victory but also to outline a number of goals, many of them lofty, for his term as president. The speech was more than just thematic, however. He said for the first time that on Monday he would announce that he was nominating Ret. Gen. James Mattis as his first secretary of defense. Mr. Trump promised sweeping changes to trade policy, national security, infrastructure, military spending and immigration. He said he wanted to work with Democrats but said he could get the work done without them, even without his supporters.

“Now that you put me in this position, even if you don’t help me one bit, I’m going to get it done,” he said. “Don’t worry.” The Cincinnati rally resembled, in some ways, the campaign rallies he held for months as his candidacy gained steam during the year. There were chants of “U.S.A.,” and vendors sold Trump campaign memorabilia. But there was one notable difference: with the election over, the crowd was far smaller[..] During his speech, he stuck to many of his campaign promises. He said a wall would be built along the U.S.-Mexico border. He said his administration would “repeal and replace” the Affordable Care Act. He said the Trump administration would seek plans and deals that benefited Americans first and not get duped into deals with other countries. “There is no global anthem, no global currency,” he said. “We pledge allegiance to one flag, and that flag is the American flag.”

It’ll fail. You can’t ‘make’ growth.

• Trump Will End Growth-Zapping Fiscal Austerity – McCulley (CNBC)

Economist Paul McCulley told CNBC on Thursday he’s had a “big ax to grind” with Washington for years over the need for more deficit spending, and it appears Republican Donald Trump may actually be the one to deliver. The stock market rally since Trump won the presidential election has been reflecting that notion, argued McCulley, who said he voted for Democrat Hillary Clinton. “The market is essentially celebrating the end of fiscal austerity. And it just happens to be a vehicle of Mr. Trump. But the end of fiscal austerity is the key economic issue.” “My big ax to grind in recent years — not months but years — is that we needed to have more fiscal policy expansion, because we’re in a liquidity trap,” said McCulley, former chief economist at Pimco. He said too much responsibility has fallen on the Federal Reserve for growing the economy.

“We needed some help with larger budget deficits.” “I’ve never had an issue with increasing the size of the budget deficit. I think it’s been too small. I have zero problem with increased public investment and funding it with deficits,” he said. “To the extent that Mr. Trump wants to do that, I think that is the right Keynesian policy.” McCulley was referring to the British economist John Maynard Keynes, who is often credited with the concept of deficit spending as a means of fiscal policy. “My biggest complaints for the person I voted for, Mrs. Clinton, is that she said, ‘I will not add a penny to the national debt.’ That was basically putting you in a straightjacket of fiscal austerity forever,” said McCulley, senior fellow in financial macroeconomics at Cornell Law School.

Mundell: “..nations can’t sustain a fixed exchange rate, independent monetary policy, and open capital borders all at the same time..”

• China’s Central Bank Is Facing a Major New Headache (BBG)

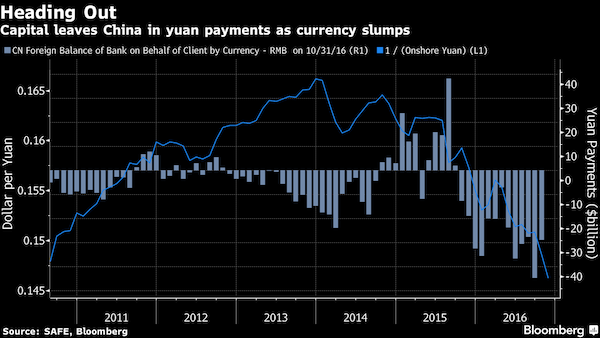

People’s Bank of China Governor Zhou Xiaochuan already has one policy headache with the currency falling to near an eight-year low. He could have an even bigger one next month. That’s when a $50,000 cap on how much foreign currency individuals are allowed to convert each year resets, potentially aggravating capital outflow pressures that are already on the rise. If just 1% of China’s almost 1.4 billion people max out those limits, that’s an outflow of about $700 billion – more than the estimated $620 billion that Bloomberg Intelligence estimates indicate has already flowed out in the first 10 months of this year. Middle class and wealthy Chinese have been converting money into other currencies to protect themselves from devaluation, exacerbating downward pressure on the yuan.

Outflows could intensify if Federal Reserve interest-rate hikes fuel further dollar appreciation. That leaves Zhou in a bind identified by Nobel-prize winning economist Robert Mundell as the “impossible trinity” – a principle that dictates nations can’t sustain a fixed exchange rate, independent monetary policy, and open capital borders all at the same time. “At a moment like this, you have to compare two evils and pick the less-worse one,” said George Wu, who worked as a PBOC monetary policy official for 12 years. “Capital free flow may have to be abandoned in order to maintain a relatively stable currency rate.” China is moving further away from balance among trinity variables, at least temporarily, and “it may take a while before the situation stabilizes” for the yuan and capital outflows, said Wu, who’s now chief economist at Huarong Securities in Beijing.

[..] rather than raise borrowing costs to try to make domestic returns more attractive – China has added new restrictions on the flow of money across its borders. They include a pause on some foreign acquisitions and bigger administrative hurdles to taking yuan overseas, people familiar with the steps have told Bloomberg News. China should cut intervention in foreign exchange markets while stepping up capital control, Yu Yongding, a former academic member of the PBOC’s monetary policy committee, said Friday at a conference in Beijing. Yuan internationalization shouldn’t be promoted too aggressively, said Yu, a senior research fellow at the Chinese Academy of Social Sciences.

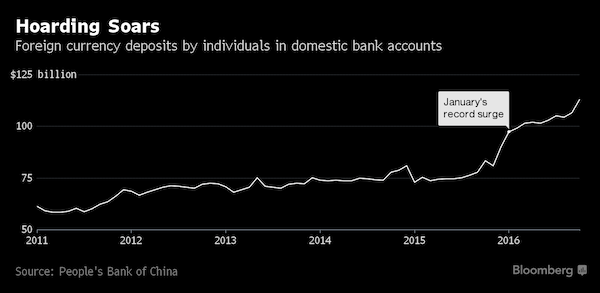

About $1.5 trillion has exited the country since the beginning of 2015. While China still has the world’s largest foreign exchange stockpile, the hoard shrank in October to a five-year low of $3.12 trillion, PBOC data show. That means there’s less in the armory to battle depreciation if China’s famously frugal savers park more cash abroad. The outflow pressure rose in January as individuals socked away a record amount in domestic bank accounts denominated in other currencies. Household foreign deposits surged 8.1% to $97.4 billion, according to the central bank, for the biggest jump since it began tracking the data in 2011. Those holdings stood at $113.1 billion in October.

The correct way to write this is: “Assets”.

• Rural China Banks With $4 Trillion Assets Face Debt Test (BBG)

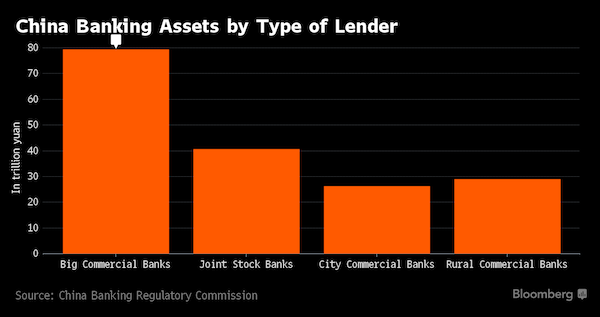

Bond investors are weighing rising risks that smaller Chinese banks will fail against growing signs the government will do anything to avoid a financial meltdown. A lender called Guiyang Rural Commercial Bank in the southwestern province of Guizhou sparked concern that risks among smaller lenders are spreading after its rating outlook was cut last month following a jump in overdue loans to 30% of the total. That compares with just 3% at the nation’s biggest lender. Short-term borrowing costs surged for the riskiest lenders including rural commercial banks, which hold 29 trillion yuan ($4.2 trillion) of assets, 13.4% of the total amount in China’s banking system.

Yet confidence in the government’s readiness to step in and offer support to struggling borrowers is rising as authorities allow a credit-fueled recovery of manufacturing activity, helping an official factory gauge match a post-2012 high last month. While 17 onshore public bonds defaulted in the first half of the year, there have since been only seven. The combination of government support and desperation for yield helps explain why Guiyang Rural was able to sell a junior bond at 4.7% last month, 1.7 %age points less than a similar offering last year. “Investors have yet to suffer losses from any bank capital securities, which adds to their confidence,” said He Xuanlai at Commerzbank.

“Smaller banks have a less diversified business profile and will likely get less support from the central government compared with bigger banks. Still, the base case is the government is still not ready to let any bank fail in a disorderly way.” That assumption has helped cut the extra yield investors demand to hold AA- rated five-year bank subordinated notes over AAA rated peers to a record low of 81 basis points, from 113 at the start of the year. There are some positive fundamentals. Rural banks are tied with the big five state-owned banks for the best Tier 1 capital ratio at 12%, according to an analysis by Natixis.

And Germany says what?

• Obama Set To Block Chinese Takeover Of German Semiconductor Supplier (BBG)

U.S. President Barack Obama is poised to block a Chinese company from buying Germany’s Aixtron, people familiar with the matter said, which would mark only the third time in more than a quarter century that the White House has rejected an investment by an overseas buyer as a national security risk. The president is expected Friday to uphold a recommendation by the Committee on Foreign Investment in the U.S. that the sale of the semiconductor-equipment supplier to China’s Grand Chip Investment should be stopped, according to the people, who asked not to be identified as the details aren’t public. Blocking the €670 million ($714 million) acquisition would mark the second time Obama has rejected a deal on national security grounds. The first was in 2012 when he stopped Chinese-owned Ralls Corp. from developing a wind farm near a Navy base in Oregon.

Before that, in 1990 then-president George H.W. Bush stopped a Chinese acquisition of MAMCO, an aircraft-parts maker. CFIUS reviews purchases of U.S. companies by foreign buyers and pays particular attention to purchases of technology, especially when it has defense applications. It has a say in the Aixtron deal because the company has a subsidiary in California and employs about 100 people in the U.S., where it generates about 20% of its sales. Aixtron technology can be used to produce light-emitting diodes, lasers, transistors, solar cells, among other products, and can have military applications in satellite communications and radar. Northrop Grumman, a major U.S. defense contractor, is among its customers, according to a Bloomberg supply chain analysis. “It will be extremely difficult for China’s state owned enterprises to do deals in the semiconductor industry looking forward,” said He Weiwen at the Center for China and Globalization.

A No vote is also a vote against the ECB.

• QE Infinity Eyed In Europe If Renzi Loses Crucial Italian Referendum (CNBC)

Dovish words from the ECB this week have fueled speculation of more accommodative monetary policy if Italians reject constitutional reforms this weekend, but one economist has told CNBC that it might not be that simple. “The market believes that we are basically in for QE infinity in Europe and that might be a stretch of the imagination,” said Elga Bartsch, Morgan Stanley’s global co-head of economics. While the Morgan Stanley economist acknowledged the rhetoric emanating from ECB President Mario Draghi this week arguably did imply there could be a so-called “Draghi put” in the case of a “no” vote in the referendum, she also posited that this view was somewhat simplistic.

“There was strong communication from him (Draghi) and a number of executive board members at the ECB, but at the same time, the views of the broader council and among the national central bank governors seem to be a little bit more mixed,” she explained. “For instance, the debate as to whether instead of extending by six months at €80 billion, just to do nine months of €60 billion doesn’t really want to go away,” Bartsch noted.

“December 4 referendum fails >> M5S comes to power >> Italians vote to leave the euro currency >> European Union collapses.”

• December 4 Could Trigger the “Most Violent Economic Shock in History” (IM)

The Five Star Movement (M5S) is Italy’s new populist political party. It’s anti-globalist, anti-euro, and vehemently anti-establishment. It doesn’t neatly fall into the left–right political paradigm. M5S has become the most popular political party in Italy. It blames the country’s chronic lack of growth on the euro currency. A large plurality of Italians agrees. M5S has promised to hold a vote to leave the euro and reinstate Italy’s old currency, the lira, as soon as it’s in power. That could be very soon. Given the chance, Italians probably would vote to return to the lira. If that happens, it would awaken a monetary volcano. The Financial Times recently put it this way: “An Italian exit from the single currency would trigger the total collapse of the eurozone within a very short period. It would probably lead to the most violent economic shock in history, dwarfing the Lehman Brothers bankruptcy in 2008 and the 1929 Wall Street crash.”

If the FT is even partially right, it means a stock market crash of historic proportions could be imminent. It could devastate anyone with a brokerage account. Here’s how it could all happen… On December 4, Italian Prime Minister Matteo Renzi’s current pro-EU government is holding a referendum on changing Italy’s constitution. In effect, a “Yes” vote is a vote of approval for Renzi’s government. A “No” vote is a chance for the average Italian to give the finger to EU bureaucrats in Brussels. Given the intense anger Italians feel right now, it’s very likely they’ll do just that. According to the latest polls, the “No” camp has 54% support and all of the momentum. Even prominent members of Renzi’s own party are defecting to the “No” side.

If the December 4 referendum fails, Renzi has promised to resign. Even if he doesn’t, the loss would politically castrate him. In all likelihood his government would collapse. (Italian governments have a short shelf life. There have been 63 since 1945. That’s almost a rate of a new government each year.) One way or another, M5S will come to power. It’s just a matter of when. If Renzi’s December 4 referendum fails—and it looks like it will—M5S will likely take over within months. Once it’s in power, M5S will hold a referendum on leaving the euro and returning to the lira. Italians will likely vote to leave. [..] December 4 referendum fails >> M5S comes to power >> Italians vote to leave the euro currency >> European Union collapses.

Don’t be fooled: it’s all Putin, the one non-OPEC voice. And he’s playing the rest like so many fiddles.

• How Putin, Khamenei And Saudi Prince Got OPEC Deal Done (R.)

[..] Heading into the meeting, the signs were not good. Oil markets went into reverse. Saudi Prince Mohammed had repeatedly demanded Iran participate in supply cuts. Saudi and Iranian OPEC negotiators had argued in circles in the run-up to the meeting. And, then, just a few days beforehand, Riyadh appeared back away from a deal, threatening to boost production if Iran failed to contribute cuts. But Putin established that the Saudis would shoulder the lion’s share of cuts, as long as Riyadh wasn’t seen to be making too large a concession to Iran. A deal was possible if Iran didn’t celebrate victory over the Saudis. A phone call between Putin and Iranian President Rouhani smoothed the way.

After the call, Rouhani and oil minister Bijan Zanganeh went to their supreme leader for approval, a source close to the Ayatollah said. “During the meeting, the leader Khamenei underlined the importance of sticking to Iran’s red line, which was not yielding to political pressures and not to accept any cut in Vienna,” the source said. “Zanganeh thoroughly explained his strategy … and got the leader’s approval. Also it was agreed that political lobbying was important, especially with Mr. Putin, and again the Leader approved it,” said the source. On Wednesday, the Saudis agreed to cut production heavily, taking “a big hit” in the words of energy minister Khalid al-Falih – while Iran was allowed to slightly boost output. Iran’s Zanganeh kept a low profile during the meeting, OPEC delegates said.

Zanganeh had already agreed the deal the night before, with Algeria helping mediate, and he was careful not to make a fuss about it. After the meeting, the usually combative Zanganeh avoided any comment that might be read as claiming victory over Riyadh. “We were firm,” he told state television. “The call between Rouhani and Putin played a major role … After the call, Russia backed the cut.”

As you can see here, Putin even prepared for the cuts: all Russia needs to cut is that 2016 production surge. Which may have been untenable to begin with. And it catches out those who haven’t created a surge, but will have to cut anyway.

• Russian Oil Output Near Post-Soviet Record as It Prepares to Cut (BBG)

Russia, the world’s largest energy exporter, held November output near a post-Soviet record , which is likely to remain a high-water mark in the near term after a pledge to cut production. Russian crude and condensate production averaged 11.21 million barrels a day in November, compared with a record 11.23 million barrels a day in October, according to the Energy Ministry’s CDU-TEK statistics unit. Russia promised to support a push by OPEC to reduce a global oil oversupply after the group agreed to cut production by 1.2 million barrels a day on Wednesday.

Energy Minister Alexander Novak pledged Russia would cut its own output by as much as 300,000 barrels a day, a stronger move than the previously preferred position of a freeze. Russia will make a gradual reduction over the first half of the year starting in January, Novak said Thursday. The reduction, supported by Russian oil producers, would be spread proportionally among companies, he said without providing further detail. Gazprom Neft and Novatek led Russian output growth in November compared with a year earlier, although both companies posted lower oil production than October, according to the data.

“I bought a one-way ticket [..] Hopefully we can shut this down before Christmas.”

• US Veterans Arrive At Pipeline Protest Camp In North Dakota (R.)

U.S. military veterans were arriving on Thursday at a camp to join thousands of activists braving snow and freezing temperatures to protest a pipeline project near a Native American reservation in North Dakota. However, other veterans in the state took exception to the efforts of the group organizing veterans to act as human shields for the protesters, saying the nature of the protests reflected poorly on the participants. Protesters have spent months rallying against plans to route the $3.8 billion Dakota Access Pipeline beneath a lake near the Standing Rock Sioux reservation, saying it poses a threat to water resources and sacred Native American sites.

State officials on Monday ordered activists to vacate the Oceti Sakowin camp, located on U.S. Army Corps of Engineers land near Cannon Ball, North Dakota, citing harsh weather conditions. Officials said on Wednesday however that they will not actively enforce the order. Matthew Crane, a 32-year-old Navy veteran who arrived three days ago, said the veterans joining the protest were “standing on the shoulders of Martin Luther King Jr and Gandhi” with the their plans to shield protesters. “I bought a one-way ticket,” he told Reuters as he worked to build a wooden shelter at the main camp. “Hopefully we can shut this down before Christmas.”

[..]Veterans Stand for Standing Rock, a contingent of more than 2,000 U.S. military veterans, intends to reach North Dakota by this weekend and form a human wall in front of police, protest organizers said on a Facebook page. The commissioner of the state’s Department of Veterans Affairs, who appeared at the West Fargo event, said he was worried about the involvement of individuals who have been in war situations. “We’re going to have veterans that we don’t know anything about coming to the state, war time veterans possibly with PTSD and other issues,” Lonnie Wangen told Reuters. “They’re going to be standing on the other side of concertina fence looking at our law enforcement and our (National) Guard, many of whom have served in war zones also,” he added. “We don’t want to see veterans facing down veterans.”

“Thirty years ago there were 50,000 rivers in China; today there are less than 23,000.”

• Joy As China Shelves Plans To Dam ‘Angry River’ (G.)

Environmentalists in China are celebrating after controversial plans to build a series of giant hydroelectric dams on the country’s last free-flowing river were shelved. Activists have spent more than a decade campaigning to protect the Nujiang, or “angry river”, from a cascade of dams, fearing they would displace tens of thousands of people and irreparably damage one of China’s most spectacular and bio-diverse regions. Since the start of this year, hopes had been building that Beijing would finally abandon plans to dam the 1,750-mile waterway, which snakes down from the Tibetan plateau through some of China’s most breathtaking scenery before entering Myanmar, Thailand and eventually flowing into the Andaman Sea.

On Friday, campaigners said that appears to have happened after China’s State Energy Administration published a policy roadmap for the next five years that contained no mention of building any hydroelectric dams on the Nu. “I am absolutely thrilled,” said Wang Yongchen, a Chinese conservationist and one of the most vocal opponents of the plans, which first surfaced in 2003. Wang, who has made 17 trips to the Nu region as part of her crusade to protect the river, said geologists, ecologists, sociologists and members of the public who had been part of the campaign could all take credit for halting the dams. “I think this is a triumph for Chinese civil society,” the Beijing-based activist said. Stephanie Jensen-Cormier, the China programme director for International Rivers, said environmentalists were “very happy and very excited” at what was a rare piece of good news for China’s notoriously stressed waterways.

“The state of rivers in China is so dismal. Thirty years ago there were 50,000 rivers in China; today there are less than 23,000. Rivers have completely disappeared. They have become polluted, they have become overused for agriculture and manufacturing,” she said. “So it is so exciting when a major river – which is a major river for Asia – is protected, at least where it flows in China.” Jensen-Cormier said the shelving of plans to dam the Nu – which is known as the Salween in Thailand and the Thanlwin in parts of Myanmar – represented “a great turning point for the efforts to preserve China’s rivers”. “It is a really good indication that China is starting to look at other ways of developing energy, and renewable energies especially, that mean they don’t have to sacrifice their remaining healthy river.”

I don’t know, I think perhaps many people are born followers: “People are not born to be job seekers – they are entrepreneurs by nature..”

• World’s Growing Inequality Is ‘Ticking Time Bomb’: Nobel Laureate Yunus (R.)

The widening gap between rich and poor around the world is a “ticking time bomb” threatening to explode into social and economic unrest if left unchecked, Nobel Peace laureate Muhammad Yunus said on Thursday. The banking and financial system has created a world of “the more money you have, the more I give you” while depriving the majority of the world’s population of wealth and an adequate standard of living, Yunus told the Thomson Reuters Foundation. “Wealth has become concentrated in just a few places in the world … It’s a ticking time bomb and a great danger to the world,” said the founder of the microfinance movement that provides small loans to people unable to access mainstream finance.

Yunus cited Donald Trump’s victory in the U.S. presidential election on Nov. 8 and Britain’s vote to leave the EU on June 23 as expressions of popular anger with ruling elites who have failed to stem the widening global wealth gap. A 2016 report by charity Oxfam showed that the wealth of the world’s richest 62 people has risen by 44% since 2010, with almost half of the super-rich living in the United States, while the wealth of the poorest 3.5 billion fell 41%. “This creates tension among people at the bottom (of the income ladder). They blame refugees and minorities – and unscrupulous politicians exploit this,” said Yunus [..]

To break free from an unequal financial system that disadvantages the poor, people should use their creative energy to become entrepreneurs themselves and spread wealth among a broader base of citizens, said Yunus. “People are not born to be job seekers – they are entrepreneurs by nature,” he said, adding that businesses that are focused more on doing social good than generating maximum profit can help to rectify economic and gender inequality. “If wealth comes to billions of people, this wealth will not come to the top one percent (of rich people), and it will not be easy to concentrate all the wealth in a few hands,” he said.

It’s a little painful to see Hawking lose himself in a field of logic that is not his. He claims we should go to Mars, but then he says earth is our only planet. Isn’t it true that the time and energy dispensed in efforts to get to Mars might be better used in saving earth? Or are we going to claim we can do both?

• This Is The Most Dangerous Time For Our Planet (Stephen Hawking)

As a theoretical physicist based in Cambridge, I have lived my life in an extraordinarily privileged bubble. Cambridge is an unusual town, centred around one of the world’s great universities. Within that town, the scientific community that I became part of in my 20s is even more rarefied. And within that scientific community, the small group of international theoretical physicists with whom I have spent my working life might sometimes be tempted to regard themselves as the pinnacle. In addition to this, with the celebrity that has come with my books, and the isolation imposed by my illness, I feel as though my ivory tower is getting taller. So the recent apparent rejection of the elites in both America and Britain is surely aimed at me, as much as anyone.

Whatever we might think about the decision by the British electorate to reject membership of the EU and by the American public to embrace Donald Trump as their next president, there is no doubt in the minds of commentators that this was a cry of anger by people who felt they had been abandoned by their leaders. It was, everyone seems to agree, the moment when the forgotten spoke, finding their voices to reject the advice and guidance of experts and the elite everywhere. I am no exception to this rule. I warned before the Brexit vote that it would damage scientific research in Britain, that a vote to leave would be a step backward, and the electorate – or at least a sufficiently significant proportion of it – took no more notice of me than any of the other political leaders, trade unionists, artists, scientists, businessmen and celebrities who all gave the same unheeded advice to the rest of the country. What matters now, far more than the choices made by these two electorates, is how the elites react.

Should we, in turn, reject these votes as outpourings of crude populism that fail to take account of the facts, and attempt to circumvent or circumscribe the choices that they represent? I would argue that this would be a terrible mistake. The concerns underlying these votes about the economic consequences of globalisation and accelerating technological change are absolutely understandable. The automation of factories has already decimated jobs in traditional manufacturing, and the rise of artificial intelligence is likely to extend this job destruction deep into the middle classes, with only the most caring, creative or supervisory roles remaining. This in turn will accelerate the already widening economic inequality around the world. The internet and the platforms that it makes possible allow very small groups of individuals to make enormous profits while employing very few people. This is inevitable, it is progress, but it is also socially destructive.

Home › Forums › Debt Rattle December 2 2016