Carole Lombard 1934

Stupefying. “Of those in the younger generation who are already in the housing market, more than four of every five plan to sell..”

• 54% Of Canadians Think Home Prices Will Never Fall (BNN)

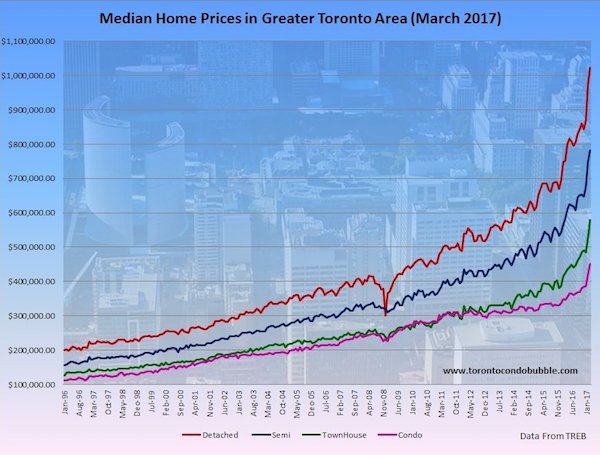

More than half of the country believes home prices will never fall, according to a new poll from CIBC. Despite lofty valuations in the Toronto and Vancouver housing markets, 54% of respondents to the CIBC poll say housing prices will rise indefinitely, while only 40% think prices will decline over the course of the next five years. David Madani, senior Canadian economist at Capital Economics, thinks the unbridled optimism is just one more sign the Toronto housing market is in bubble territory. “The fact that the majority of Canadians still think home prices can continue to shoot up is sort of testament to the fact we’re in a full-blown housing bubble,” he said in an interview with BNN. According to the poll, those high prices are keeping homeowners on the sidelines, with 62% of respondents saying they’re reluctant to sell their home, lest they become buyers again.

Home prices in Toronto are up more than 30% over the course of the last year, and prices in Vancouver have risen more than 14%. Those who are looking to sell are largely of the baby boomer cohort, with more than two-thirds of respondents older than 55 saying they plan to downsize to a smaller home or condo. CIBC says boomers are motivated to sell not just due to the ease of maintaining a smaller home, but also as a boost to their retirement savings. What’s less clear is who they’re going to sell their home to: 52% of the millennial generation either don’t believe they’ll ever own a home, or are unsure if home ownership is in their future, according to the CIBC poll. Of those in the younger generation who are already in the housing market, more than four of every five plan to sell, with 63% complaining the mortgage and housing costs are making them cash-poor.

It drives it and will make it crumble. But Justin isn’t listening.

• Wild Housing Speculation Drives Entire Canadian Economy (WS)

Here’s another data point on the Canadian housing bubble, how immense it really is, and how utterly crucial wild housing speculation has become to the Canadian economy. Housing starts surged to 253,720 units in March seasonally adjusted, the highest since September 2007, according to Canada Mortgage & Housing Corp. Of them, 161,000 were multi-family starts of condos and rental units in urban areas. In Toronto, one of the hot beds of Canada’s house price bubble, housing starts jumped by 16,600 units, all of them condos and apartments, defying any expectation of a slowdown. Housing starts are an indication of construction activity, a powerful additive to the local economy with large secondary effects. Housing construction gets fired up by the promise of ever skyrocketing housing prices, and thus big payoffs for developers, lenders, real estate agents, and the entire industry.

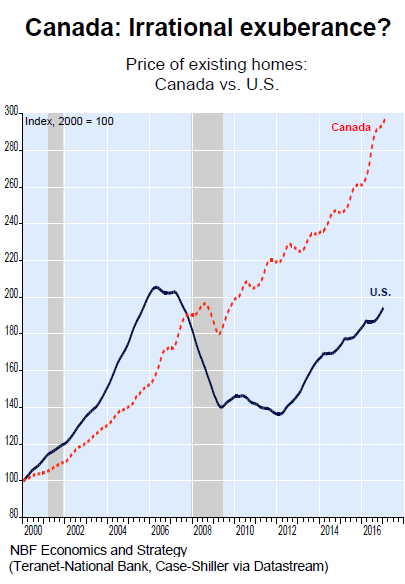

National home price data covers up the real drama in certain cities, particularly Vancouver (British Columbia) and Toronto (Ontario), but it does show by how much Canadian housing prices have overshot the already lofty US housing prices. The chart below by Stéfane Marion, Chief Economist at Economics and Strategy, National Bank of Canada, compares US home prices per the Case-Shiller 20-City index to Canadian home prices per the Teranet-National Bank 26-market index. Both indices are based on similar methodologies of comparing pairs of sales of the same home over time. The shaded areas denote recessions in Canada. Note that during the housing crisis in the US, there was only a blip in Canada’s housing market:

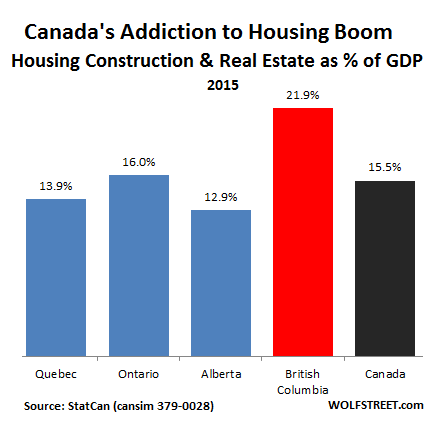

How important is real estate and housing construction to the Canadian economy? Hugely important! It accounts for an ever larger proportion of the Canadian economy. For all of Canada, according to data by Statistics Canada, housing construction and real estate activities combined account for 15.5% of GDP, up from 14.7% in 2011. This chart shows housing construction and real estate activities in the largest four provinces as percent of the province’s GDP in 2015, and for Canada overall. StatCan data for 2016 are not yet available. Note British Columbia: 22% of its economy is based on residential construction and real estate activities – due to Canada’s number one housing hot-bed Vancouver:

As I said last week: it seems there’s an article on this theme every week now.

• Third of US Car Owners Can’t Afford Surprise Repairs (UT)

Nearly one-in-three American motorists cannot pay for vehicle repairs without taking on debt, according to a new study from AAA. The study estimates 64 million drivers could not pay out-of-pocket for an average repair bill of $500 to $600. There are about 210 million licensed motorists in the country, according to the U.S. Department of Transportation. About 76% of men said they could afford the expense, while only 62% of women could do the same. “We were a little shocked at the results,” said Michael Calkins, AAA manager of technical services. “That one-third of American drivers couldn’t afford the cost of a $500 auto repair is a little concerning.”

AAA suggests motorists adhere to a scrupulous vehicle maintenance schedule and set aside $50 a month to build a fund for maintenance and unexpected repairs. But some motorists don’t – or can’t. About one-third of U.S. drivers delay or skip recommended car maintenance, Calkins said, a possible lingering repercussion of the 2008 recession. Motorists pay later for putting off vehicle maintenance now, as worn-down parts increase the likelihood of costly roadside breakdowns, Calkins said. A car-care fund can help motorists stick to their maintenance schedules, but for many low-income families, $50 a month is a big ask, said Asley Orr, executive director of Good News Mountaineer Garage, a nonprofit that donates used cars to West Virginians who need transportation to work.

Who owns the stores and malls? Who owns the debt that keeps them going until it doesn’t?

• The Retail Apocalypse’s Terrifying Impact On One Corner Of Wall Street (BI)

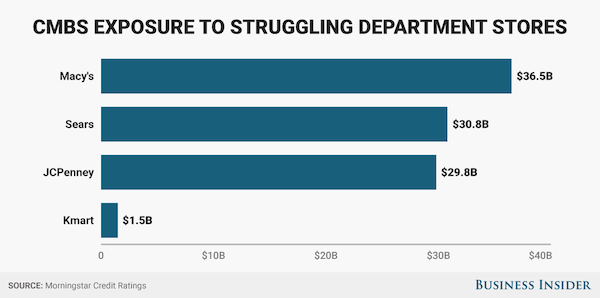

One of the biggest waves of retail closures in decades is killing off malls across the US and taking some Wall Street investments with it. Struggling with online competition, huge retailers like Sears, JCPenney, and Macy’s are closing hundreds of stores that typically anchor malls, meaning they occupy the largest spaces at mall entrances and drive most shopper traffic. When a big store shuts down, it triggers a chain reaction that can end with the shopping mall being unable to collect enough rent to cover its debts, forcing it to default. By one measure, as many as a third of the malls in the US are at risk of facing this situation. This has become a nightmare for investors who are expecting to collect on those debts. They own bonds – called commercial mortgage-backed securities, or CMBSs – that are backed by the mall properties’ rents.

If this sounds familiar, that’s because it’s similar to one element of the financial crisis. Back then, mortgage-backed securities, which pooled homeowners’ mortgages into a multitrillion-dollar financial market, were part of the problem. They encouraged risky lending, and together with derivatives on the bonds that were ginned up by Wall Street, they left banks and investors with massive losses that threatened the financial system. Nobody is predicting anything that dire today, but CMBSs, which Morgan Stanley says account for nearly 10% of the $3.6 trillion commercial real-estate mortgage market, work similarly. They pool debt payments from several malls or other commercial properties and then splice them so that investors can buy the segment and take on the kind of risk they want.

What’s happening in the retail market, though, is worse than anyone who invested in the bonds could’ve imagined a few years ago. “Malls are hard to turn around once they go downhill,” said Steve Jellinek, vice president of CMBS analytical services for Morningstar Credit Ratings. As a result, many CMBS investments are getting wiped out, and “retail lending has really taken a beating,” he said. About $48 billion in loans backed by mall properties are at risk of default, according to Morningstar.

This is how the Chinese see Beijing, first as full of hot air (true), and second as capable of making good on any and all losses (not true): “Cracking down on implicit guarantees is just like curbing home prices,” she says. “It’s something that the government needs to say, but it’s not something they will eventually do.”

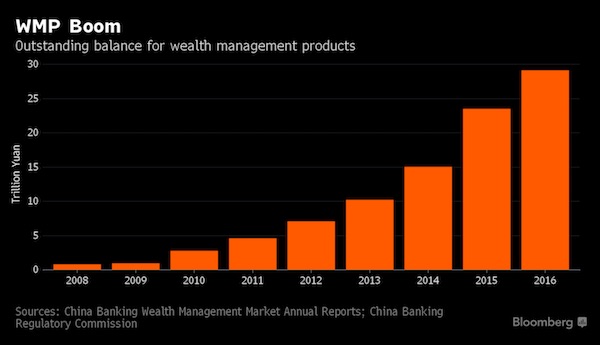

• China Is Playing a $9 Trillion Game of Chicken With Savers (BBG)

Like many individual investors in China, Yang Mo has no idea what’s in the wealth management products that make up a big chunk of her net worth. She says there’s really no point in finding out. Sure, WMPs invest in all kinds of risky assets, but the government would never let a big one fail, she explains. “It’s not how the Chinese government does things, and it’s not even Chinese culture,” says Yang, a 29-year-old public relations professional in Beijing. Hers is a common refrain in Asia’s largest economy, where savers have poured $9 trillion into WMPs and similar products on the assumption that they’ll get bailed out if the investments sour. Even after news in February that policy makers are drafting rules to make it clear that state guarantees don’t exist, Yang is undaunted.

She says she’ll only withdraw money from WMPs in the unlikely event that they start to suffer losses. “Cracking down on implicit guarantees is just like curbing home prices,” she says. “It’s something that the government needs to say, but it’s not something they will eventually do.” Yang’s steadfast faith in bailouts illustrates the dilemma for authorities as they try to reduce moral hazard and improve the pricing of risk in China’s financial system: It may require a major WMP blowup to shake investors out of their complacency, an event that could wreak havoc on banks that increasingly rely on the products for funding. [..] WMPs – a key part of China’s shadow banking system – are getting squeezed as the nation’s central bank increases interest rates to discourage excessive leverage.

That’s not only putting pressure on products that use borrowed funds to meet their fixed return targets, it’s also weighing on the Chinese bond market, where WMPs allocate the biggest portion of their funds. For as long as they can, banks will make investors whole when WMPs run into trouble because they fear the reputational damage of a failed product, according to Hong. At some point, though, WMP shortfalls may be too large for the banks to cover, forcing policy makers to decide whether they’re willing to allow losses. Intervention is becoming less likely, if the new draft rules are anything to go by. Regulators are working on language that would make clear there are no state guarantees on asset-management products – which include WMPs, trusts, mutual funds and other products – people familiar with the matter said in February.

Snippets from a great and long article by Australian economist Bill Mitchell. Everything they tell you about austerity is a lie.

• Currency-Issuing Governments Never Have To Worry About Bond Markets (Bilbo)

How many times have you heard a politician claim they had to cut government spending and move the fiscal balance to surplus because they had to engender the confidence of the bond markets. Apparently, this narrative alleges that if bond markets are not ‘confident’ (whatever that means) then they will stop begging treasury departments for more debt issues and the government, in question, will run out of money and then pensions will stop being paid and the public service will be sacked and public trains and buses will stop running and before we know it the skies will blacken and collapse on us. The narrative ignores the usual statistics that bid-to-cover ratios are typically high (hence my ‘begging’ terminology) which are supplemented by well documented cases where the bond dealers (including banks etc) do actually beg central banks to stop driving yields down in maturity segments where these characters have pitched their “business model” (read: where they make the most profits).

The facts are exactly the opposite to the neo-liberal pitch. Currency-issuing governments never need to worry about how bond markets ‘feel’. Essentially, the bond markets are irrelevant to the ability of such a government to design and implement its fiscal plans. And, the central bank always can counteract any tendencies that the bond markets might seek to impose where governments do actually issue debt. [..] Nothing a student learns in a mainstream macroeconomics course at university (at any level – and the deception becomes worse the in later years as the student enters graduate school) about the relative powers of governments and bond markets is true. [..] So next time you hear an economist or a politician talk about how bond markets have to be satisfied and they use that as a justification for hacking into public spending (and driving up unemployment and poverty rates) you know they are lying and are frauds.

The bond traders never have to be satisfied. They can be forced to live on crumbs by the central bank if it so chooses. [..] The narrative that asserts that governments have to assuage the sentiments of the bond markets – which is an oft-repeated claim to justify job-destroying and poverty-inducing austerity – is just fake. It is a lie. It is just one of many lies that the elites use to pursue their biased austerity. Biased because they never advocate cutting spending or government support that helps them. They just support cuts that help the most disadvantaged who have little political voice and so can be disregarded. The point is that currency-issuing governments never have to worry about bond markets. And it would be better if the government eliminated the public debt market altogether – then the bond traders would have to do something productive for a living and get off the corporate welfare teat!

More Bill Mitchell.

• Recessions Are Never Desirable Events And Are Always Avoidable (Bilbo)

Bloomberg published an article last week (April 7, 2017) that it should not have published given that the article offers only fake knowledge to its readership. The article in question – Australia’s Delayed Recession Fallout Is Showing Up in Its Jobs Data – carried the sub-title “There may be trouble ahead” and purported to argue that because the Australian government’s fiscal stimulus allowed our nation to avoid a recession in 2009 we now have to ‘pay the piper’ and take our medicine and suffer a recession anyway. The proposition is ridiculous to say the least. The article uses as authority some nonsensical statements from a “business management consultant”, who doesn’t appear to have a very sound grasp of either history or what is actually going on. This is another case of misinformation.

The fact is that the Australian government’s fiscal stimulus in 2008 and 2009 saved the economy from recession. The current slowdown and parlous labour market is not some delayed effect from that. Rather, it is because the Australian government caught the ‘fiscal surplus bug’ obsession, and began a misguided pursuits of surpluses, irrespective of what the external and private domestic sectors were doing. It caused an immediate slowdown and all the virtuous dynamics that were accompanying the stimulus-led growth (for example, fall in household debt and the rise in the household saving ratio) were reversed, as we would expect. Far from being delayed effects, the poor jobs data is because current fiscal policy is too restrictive. Simple solution: expand the discretionary fiscal deficit (preferably with a large-scale public sector job creation strategy).

“..Deutsche is ten times larger than Lehman Brothers..”, ” (90% of Deutsche’s revenue has been from derivative trading, which is what brought down Lehman.)”

Deutsche Bank has announced that it will create more shares, selling them at a 35% discount. Existing shareholders have not been pleased and, in the first four days since the offer was announced, the value of existing shares dropped by 13% as shareholders began dumping them. So why on earth would Germany’s foremost bank do something so rash? Well, in recent years, the bank has been involved in many arbitrations, litigations, and regulatory proceedings as a result of fraudulent activities, including the manipulation of markets. Having been found guilty, they presently owe $7.2 billion to the US Department of Justice and are now facing an additional $10 billion litigation bill. Unfortunately, the bank is already broke and, should Deutsche actually be able to sell the new shares, the $8.6 billion they hope to receive will still not save them from bankruptcy.

Business has also not been so good. They’ve lost nearly $2 billion in the last two years, instituted a hiring freeze, cut bonuses by 80%, and are facing a $2.5 million civil penalty to pay to the Commodity Futures Trading Commission for failure to report transactions and, not surprisingly, have been downgraded. The German government has stated that they will not bail out Deutsche and, indeed, under the EU agreement, they cannot do so. It’s safe to say that Germany’s largest bank will soon go the way of the dodo. For those who don’t live in Europe, this may not seem all that significant. However, Deutsche is the bank that funds the euro system, which they can now no longer do. Further, Deutsche is ten times larger than Lehman Brothers, an American bank that famously went down in 2008, heralding in that year’s economic crash. (90% of Deutsche’s revenue has been from derivative trading, which is what brought down Lehman.)

Upon the collapse of Deutsche Bank, four major US banks would be expected to become insolvent in a matter of days. The ripples would then continue to spread outward into the economic system as a whole. For many years, I’ve made repeated reference to the fact that the Western powers have been headed south economically, repeatedly relying on strategies that would provide short-term gain but would ultimately create long-term pain. They’ve been remarkably consistent and steadfast in this trend and, at this point, Deutsche is merely the latest trigger that may bring down the system.

Chilling.

• American Carnage – The New Landscape of Opioid Addiction (Caldwell)

There have always been drug addicts in need of help, but the scale of the present wave of heroin and opioid abuse is unprecedented. Fifty-two thousand Americans died of overdoses in 2015—about four times as many as died from gun homicides and half again as many as died in car accidents. Pawtucket is a small place, and yet 5,400 addicts are members at Anchor. Six hundred visit every day. Rhode Island is a small place, too. It has just over a million people. One Brown University epidemiologist estimates that 20,000 of them are opioid addicts—2% of the population. Salisbury, Massachusetts (pop. 8,000), was founded in 1638, and the opium crisis is the worst thing that has ever happened to it. The town lost one young person in the decade-long Vietnam War. It has lost fifteen to heroin in the last two years.

Last summer, Huntington, West Virginia (pop. 49,000), saw twenty-eight overdoses in four hours. Episodes like these played a role in the decline in U.S. life expectancy in 2015. The death toll far eclipses those of all previous drug crises. And yet, after five decades of alarm over threats that were small by comparison, politicians and the media have offered only a muted response. A willingness at least to talk about opioid deaths (among other taboo subjects) surely helped Donald Trump win last November’s election. In his inaugural address, President Trump referred to the drug epidemic (among other problems) as “carnage.” Those who call the word an irresponsible exaggeration are wrong.

Jazz musicians knew what heroin was in the 1950s. Other Americans needed to have it explained to them. Even in the 1960s and 1970s, with bourgeois norms and drug enforcement weakening, heroin lost none of its terrifying underworld associations. People weren’t shooting it at Woodstock. Today, with much of the discourse on drug addiction controlled by medical bureaucrats, it is common to speak of addiction as an “equal-opportunity disease” that can “strike anyone.” While this may be true on the pharmacological level, it was until quite recently a sociological falsehood. In fact, most of the country had powerful moral, social, cultural, and legal immunities against heroin and opiate addiction. For 99 percent of the population, it was an adventure that had to be sought out. That has now changed.

America had built up these immunities through hard experience. At the turn of the nineteenth century, scientists isolated morphine, the active ingredient in opium, and in the 1850s the hypodermic needle was invented. They seemed a godsend in Civil War field hospitals, but many soldiers came home addicted. Zealous doctors prescribed opiates to upper-middle-class women for everything from menstrual cramps to “hysteria.” The “acetylization” of morphine led to the development of heroin. Bayer began marketing it as a cough suppressant in 1898, which made matters worse. The tally of wrecked middle-class families and lives was already high by the time Congress passed the Harrison Narcotics Tax Act in 1914, threatening jail for doctors who prescribed opiates to addicts. Americans had had it with heroin. It took almost a century before drug companies could talk them back into using drugs like it.

Referendum on April 16: “..some pollsters see the “no” camp ahead by as much as 10%.”

• How Erdogan’s Referendum Gamble Might Backfire (Spiegel)

Support for the presidential system is crumbling. Erdogan may be giving the impression that the entire country is behind him, with his speeches resembling religious masses. On Sunday a week ago, tens of thousands cheered him on in Ankara. But some pollsters see the “no” camp ahead by as much as 10%. Even previously loyal Erdogan supporters, including party functionaries, don’t understand why the president so desperately wants this referendum. According to polls, one third of AKP voters are fluctuating between yes and no. The new system would concede powers to the president that even the nation’s founder, Mustafa Kemal Atatürk, didn’t have.

The president would be able to appoint ministers and 12 of 15 constitutional judges, and he would have the power to dissolve parliament any time he wanted to. The position of prime minister would also be eliminated. Erdogan claims the reform is necessary to secure stability and prevent further coup attempts. But he already has more power than any other politician in recent Turkish history. Campaign posters plasterd with Erdogan’s visage hang everywhere in Bursa. The balconies are decorated with Turkish flags and vehicles drive through the streets blaring AKP election songs. The AKP is trying to create excitement, and that shouldn’t be too difficult here in Bursa. The city is Turkey’s fourth-largest and a higher-than-average share of residents voted for the AKP in the November 2015 parliamentary election.

For a long time, the residents of Bursa were the way Erdogan wanted them to be: hard-working and pious. The city has developed into an industrial center and the government built brand new residential neighborhoods, with shopping malls and mosques. But since the attempted coup, the economy has collapsed and many storefronts now stand empty. Mumcu’s cousin, who runs a textile company, says that his revenue has dropped from €50 million to €2 million in the past year.

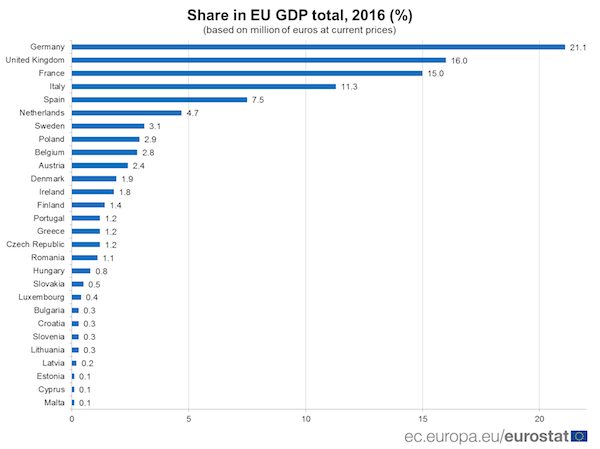

Germany and France are half of EU GDP. The rest are mere pawns.

• Share of Member States in EU GDP (EC)

In 2016, the GDp of the European Union (EU) amounted to €14 800 billion (bn) at current prices. Over half of it was generated by three Member States: Germany, the United Kingdom and France. With a GDP worth €3 100bn in 2016, Germany was the leading EU economy, accounting for over a fifth (21.1%) of EU GDP. It was followed by the United Kingdom (16.0%), France (15.0%), Italy (11.3%), Spain (7.5%) and the Netherlands (4.7%). At the opposite end of the scale, eleven Member States had a GDP of less than 1% of the EU total. They were: Malta, Cyprus, Estonia, Latvia, Lithuania, Slovenia, Croatia, Bulgaria, Luxembourg, Slovakia and Hungary. As regards the 19 Member States which form the euro area, their cumulated GDP stood at €10 700 bn in 2016, meaning that they accounted all together for 72.5% of the EU GDP. Germany (29.2%) and France (20.7%) made up half of the euro area GDP.

Schäuble is shaking his head.

• Austria FinMin Calls For €1 Billion EU Investment In Greece (R.)

The European Union should consider a one-billion-euro special investment programme to spur growth in debt-ridden Greece, Austria’s finance minister told daily Der Standard in an interview published on Monday. Hans Joerg Schelling said Greece would only be able to get back on track and regain access to capital markets if it was able to generate sustainable growth in the mid- and long-term. It was important to help the country participate in a pick-up in growth in the euro zone, he added. There was no immediate comment from Athens which has called for more help and debt relief as it struggles to cope with its financial crisis and attain a budget surplus of 3.5% of economic output, excluding debt servicing outlays next year.

“You must assess whether to start a big investment programme through the European Investment Bank or maybe with the (European bailout fund) ESM… to get an additional boost (for the Greek economy),” the paper quoted Schelling as saying. “I would define a scale of one billion euros.” Schelling, seen as a possible successor to Eurogroup President Jeroen Dijsselbloem, said one project could be an investment in renewable energy to make Greece less dependent on energy imports. The European Investment Bank (EIB) launched a one billion euro credit line to Greek banks in December, mainly to be used for on-lending to small and medium sized companies and firms promoting youth employment.

JP Morgan doesn’t understand the state the Greek economy is in.

• JP Morgan Report Sees ‘Light At The End Of The Tunnel’ For Greece (Amna)

The decision reached by Eurozone finance ministers in Malta concerning Greece increases the chances of a solution for completing the second review of the Greek programme before May 22, according to a report by J. P. Morgan released on Monday. The U.S. banking and financial services giant said the decisions appears to have clarified most of the obstacles that were delaying talks for concluding the review and point to a higher possibility of a good outcome for Greece. J.P. Morgan’s central scenario, to which it gives an 85 pct probability, predicts that the next step will be the return of the institutions’ missions to Greece to finalise the technical details that will support a staff-level agreement (SLA).

If its predictions are correct, the report said, there will be great progress over the next few weeks, while the sequence of events will be the signature of the SLA, passing of the measures agreed by the Greek Parliament and the completion of the review ensuring future disbursements and further details on debt relief measures. As a part of this positive scenario, J.P. Morgan said, it was also expected that Greece will become eligible for inclusion in the ECB’s quantitative easing programme in the summer. “We give an 85 pct probability to this development. This is the most positive result for the Greek bond market and we expect that 10-year Greek bonds will have price/yield rations of about 85 euros/5.5-6 pct with this scenario,” the report says. Even if the worst of the three scenarios it has drawn up should be proved right, J.P. Morgan said that an accident leading to Grexit was extremely unlikely after last Friday’s decisions and that in its medium-term outlook on Greek bonds “the reward for the risk remains attractive.”

Fantastic. The Automatic Earth and its very generous readers play a substantial role in this. Thank you so much for making it possible.

• Refugee Community Center Set To Open On Lesvos (K.)

Just a 10-minute walk from the municipal-run camp of Kara Tepe and a bit over a half-hour from the Moria migrant camp north of Mytilene, the capital of Lesvos, a community center currently under construction on a 1.5-acre site aspires to become a magnet for individuals stranded on the eastern Aegean island by offering a wide range of activities. Run by the Swiss Cross charity, the center, which is set to open in the coming days, was built by migrants with the help of volunteers who arrived here from different parts of Europe. The project is called “One Happy Family.” The facility will provide a coffee shop (complete with nargile), a home cinema, a library and a garden.

The O Allos Anthropos (Fellow Man) group has agreed to provide about 1,000 servings of food [daily]. The entire project will cost 200,000 euros, which includes rent for the first 12 months. “The Swiss are very good at organizing, while the Greeks are good at hospitality, so great things can come out of that mix,” Achilleas Peklaris, a writer and journalist now working for Swiss Cross, told Kathimerini. After doing charity work in Thessaloniki, northern Greece, Swiss Cross moved to Lesvos, prompted by the tragic deaths of Moria camp residents living outdoors in tents in freezing conditions this past winter.

Home › Forums › Debt Rattle April 11 2017