Georgia O’Keeffe New York night 1929

You don’t say.

• Stock Record Ride ‘Has Reached Epic Proportions’ – Morgan Stanley (MW)

Wall Street isn’t just in a bull market, it’s in an “epic” one. That is according to Morgan Stanley, which on Tuesday wrote that the equity market rally “has reached epic proportions.” “We say this not as hyperbole, but based on a quantitative perspective,” the investment bank explained. “Dispersions in valuations and growth rates are among the lowest in the last 40 years; stocks are at their most idiosyncratic since 2001; and equity hedge fund beta is at its highest since March 2008.” Simply from the perspective of price moves, the “epicness” of recent trading activity should come as no surprise to investors. The Dow DJIA, S&P 500 SPX, Nasdaq COMP, and Russell 2000 RUT have all hit repeated records this year alone, notching dozens of all-time highs. Those gains have been widespread and “perpetual,” to use Morgan Stanley’s description.

Only two of the 11 primary S&P 500 sectors are in negative territory for the year, and for broader indexes, even mild pullbacks of 3% have basically been nonexistent for months. Volatility is near record lows. Beta refers to a measure of an assets tendency to fluctuate compared against a benchmark like the S&P 500. [..] “While investors have at times appeared reluctant to embrace the recent rally, there is evidence from last month that risk appetites are increasing,” Morgan Stanley wrote. The investment bank noted that cyclical sectors, which are more closely correlated to the pace of economic growth, have been outperforming defensive ones, just as small-capitalization stocks have outperforming larger companies. “Momentum is now strongly correlated with high beta globally, and the presence of this cohort of investors could produce continued risk-seeking behavior,” wrote the team of analysts, led by Brian Hayes, an equity strategist.

“The big question is whether Yellen was just misreading the data or whether the data she was reading were wrong.”

• Janet Yellen Has Finally Come To Her Senses – Somewhat (Crudele)

I’ve been telling you for years that the employment data produced by the US government were misleading people into thinking the economy was performing better than it really was. Now Federal Reserve Chair Janet Yellen — finally! — agrees. Yellen, speaking before the National Association of Business Economics on Sept. 26, said, “My colleagues and I may have misjudged the strength of the labor market, the degree to which longer-run inflation expectations are consistent with our inflation objective or even the fundamental forces driving inflation.” That’s what she said. Internet news sites picked up that statement, but none of the major newspapers did. And the story behind Yellen’s admission and its importance would be way over the heads of TV news anchors — so they ignored it as well.

Yet Yellen’s statement is important as heck. It means that the Fed has been screwing up in thinking that the US economy was, as Yellen has often said, near full employment. But here’s the kicker — Yellen has been overestimating the strength of the job market and underestimating the amount of inflation in the economy. The big question is whether Yellen was just misreading the data or whether the data she was reading were wrong. There will need to be years of investigation to determine that, but I’ll give you a clue now. Anyone who lives in the real world knows that the unemployment rate is far higher than the 4.2% that the Labor Department reports. And that the job growth each year — as I’ve been harping on — is mostly driven by guesstimates and adjustments made by government statisticians who apparently don’t live in the real world.

And, of course, the economy has been creating crappy-paying, benefit-lacking jobs that don’t come close to replacing the higher-quality employment that went bye-bye after the last recession. Last Friday, Labor said the jobless rate dipped in September to 4.2% from 4.4% in August — and its number crunchers also reported that 33,000 jobs were lost last month. It blamed the hurricanes. The experts were expecting the US economy to have added 100,000 new jobs despite the storms. Labor also announced that it revised August’s figures lower — from growth of 189,000 jobs to just 138,000. So instead of being reasonably good, August was blah, with nary a hurricane to blame.

An award for not understanding?! If you ask me, the very fact that someone gets an award for ‘finding out’ that human behavior affects economies, says all you need to know about economics.

• Nobel Economist Thaler Says He’s Nervous About Stock Market (BBG)

A buoyant and complacent stock market is worrying Richard H. Thaler, the University of Chicago professor who this week won the Nobel Prize in economics. “We seem to be living in the riskiest moment of our lives, and yet the stock market seems to be napping,” Thaler said, speaking by phone on Bloomberg TV. “I admit to not understanding it.” The S&P 500 index has been reaching repeated records since President Donald Trump’s election last November amid steady growth in the U.S. economy and labor market, as well as expectations for lower taxes, though policy action in Washington has been limited. Thaler, who has made a career of studying irrational and temptation-driven actions among economic actors and won the Nobel for such contributions to behavioral economics, expressed misgivings about the low volatility and continued optimism among investors.

“I don’t know about you, but I’m nervous, and it seems like when investors are nervous, they’re prone to being spooked,” Thaler said, “Nothing seems to spook the market” and if the gains are based on tax-reform expectations, “surely investors should have lost confidence that that was going to happen.” The economist said that he didn’t know “where anyone would get confidence” that tax reform is going to happen. “The Republican leadership does not seem to be interested in anything remotely bipartisan, and they need unanimity within their caucus, which they don’t have,” Thaler said. “And the president’s strategy of systematically insulting the votes he needs doesn’t seem to be optimizing anything I can think of, but maybe he’s a deeper thinker than me.”

Schrödinger’s State. On Wikipedia, someone last night put Catalonia at no. 1 on the List of Shortest-Lived States. At 8 seconds, which is how long the applause lasted when Puigdemont said he had the mandate, only to say right after that he would hold off on executing the mandate. Wikipedia took it down.

• Catalans Call Time Out on Independence Bid, Seek Spain Talks (BBG)

Catalan President Carles Puigdemont said that he’ll seek talks with the government in Madrid over the future of his region in Spain, rowing back from an immediate declaration of independence that threatened to turn a constitutional crisis into an economic one. Addressing the regional parliament in Barcelona on Tuesday evening after days of tension in Catalonia, Puigdemont said the result of an Oct. 1 referendum had given him the mandate to pursue independence, but he would hold off for “weeks” for dialogue on the way forward with Prime Minister Mariano Rajoy’s administration. Rajoy convened an extraordinary meeting of his cabinet in Madrid on Wednesday at 9 a.m. to discuss his next move, and is due to address the Spanish Parliament on the crisis in Catalonia later in the day.

“Today Mr. Puigdemont has plunged Catalonia into the highest level of uncertainty,” Spain’s Deputy Prime Minister Soraya Saenz de Santamaria told reporters in Madrid late on Tuesday. “Neither Mr. Puigdemont nor anyone else can draw conclusions from a law that doesn’t exist, from a referendum that hasn’t taken place and from the wishes of the Catalan people which it’s trying to take over.” Pressure has piled on Puigdemont as the Spanish government and Catalan business leaders demand that he desist from pitching the region further down a path to independence that they warn would wreck the economy and tear apart Spain’s social fabric. Rajoy has consistently ruled out talks until the Catalans drop the threat of a declaration of independence that is illegal under Spanish law.

“Today I assume the mandate for Catalonia to become an independent state in the form of a republic,” Puigdemont said to cheers from the packed assembly, with Catalan police deployed around the parliament perimeter. “We propose the suspension of the effects of the declaration of independence for a few weeks, to open a period of dialogue.”

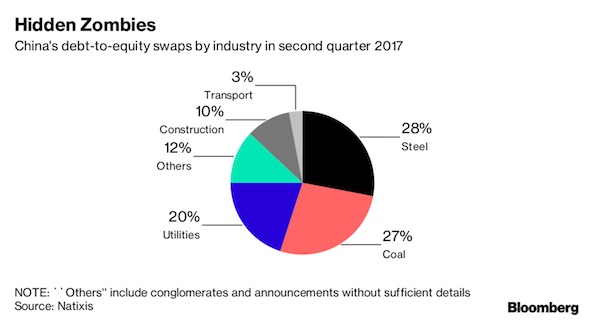

When equity is debt.

• China Debt-for-Equity Swaps Turn Out More Like Debt-for-Debt (BBG)

A key Chinese initiative to rein in the world’s largest corporate-debt load has been a program swapping some loans into equity stakes. As the initiative gets going, however, it’s becoming clear the debt isn’t really going away. In a late-summer notice, central government officials said that new bonds should be used to finance the swaps, effectively moving the debt off the balance sheets of the original lenders onto those buying the new debt. The first such deal came last month, according to China Lianhe Credit Rating Co., a domestic rating firm. Shaanxi Coal and Chemical Industry Group Co., a troubled old-line industrial company, was targeted for a debt-for-equity swap. Then the Shaanxi provincial government in northwest China set up an asset-management company to raise new debt to pay off the existing lending that was designated to be swapped for an equity stake.

One criticism of the debt-for-equity initiative, which was launched a year ago, is that it keeps afloat struggling enterprises, leaving excess capacity intact and pulling down productivity. The Shaanxi example shows a further weakness: while the company won’t need to service debt any more, the new asset-management unit will – without any new source of revenue having been generated. “If the funding comes from debt, it’s really not solving the issue here because the capital is not permanent capital,” Christopher Lee, managing director of corporate ratings at S&P Global Ratings in Hong Kong. “In fact, you are adding more debt just to refinance the debt that was going to be swapped.”

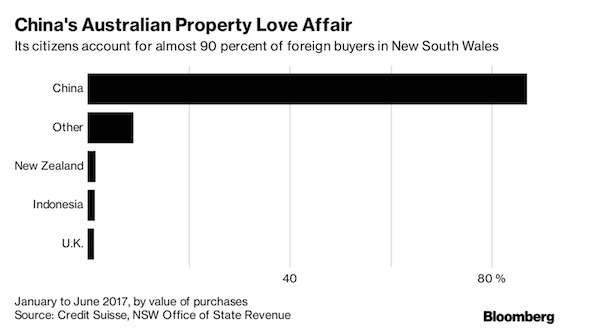

Australia lives off its bubble. It’s all that’s left.

• Chinese Investors Keep Pouring Money Into Australian Housing (BBG)

Property-hungry Chinese investors have shrugged off the impact of tighter capital controls and continue to pour money into Australian housing. Foreign buyers are acquiring about a quarter of new housing supply in New South Wales, and China accounts for about 90% of that demand, according to Credit Suisse analysis of tax office data. Foreigners are buying 17% of new housing in Victoria, and 8% in Queensland, Credit Suisse said. While local property agents say higher state taxes on foreigners are deterring buyers, Credit Suisse isn’t so sure they will have a big impact on prices.

They point to even-higher taxes in other global cities, the relative cheapness of Australian property compared to Chinese cities, and the growing stock of wealth in China. “Local incomes are becoming less relevant in determining the outlook for house prices and regional wealth is becoming more relevant,’’ Credit Suisse analysts Hasan Tevfik and Peter Liu said in the report. “We see no evidence of a slowdown in foreign demand because of the stronger capital controls introduced by Chinese authorities.” That’s not good news for locals already struggling to break into the booming housing market.

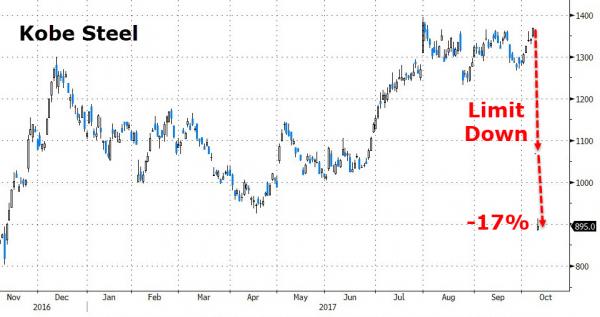

WHy would anyone still want to buy a car or plane made with Kobe metals? Imagine the lawsuits if accidents happen.

• Kobe Steel Shares Plunge As Data Fabrication Concerns Deepen (R.)

Kobe Steel shares tumbled a further 16% on Wednesday after it admitted it may have fabricated data on iron powder products and media reported the possible sale of its real estate business. The latest disclosure comes after Japan’s No.3 steelmaker said on the weekend it had falsified data to show that its aluminum and copper products had met customer specifications, and suggests the problems could be widespread. Japanese manufacturers were thrown into turmoil by the revelation, with implications for materials used in cars, aircraft and possibly a space rocket and defense equipment.

Shares in Kobe Steel were down 15.73% at 900 yen as of 0114 GMT on Wednesday, underperforming the broader market which was steady. They fell 22% the previous day. A Kobe Steel spokesman confirmed a report on Wednesday in the Yomiuri newspaper saying the firm may have fabricated data on iron powder products used in components such as automotive gears. He said the company was investigating the issue. The Nikkei business daily meanwhile reported that Kobe Steel intended to put its real estate business on the block in an effort to shore up already shaky finances now threatened by the data falsification scandal.

And that’s after all those trillions in support.

• 51 Eurozone Banks Vulnerable To Rate Shocks – ECB (R.)

Fifty-one large euro zone banks are leaving themselves exposed to a sudden change in interest rates and may need to aside more capital against that risk, the European Central Bank said on Monday. The ECB is preparing to start dialing back its monetary stimulus after years of ultra-low interest rates and massive bond purchases, paving the ground for rate hikes further down the line. After simulating scenarios ranging from a sudden monetary tightening to the kind of lending freeze that followed Lehman Brothers’ collapse, the ECB found that most of the 111 euro zone banks it tested are well prepared for interest rates shocks. But it cautioned it needed “intense discussions” with 51 of them after finding they may be making themselves vulnerable via large bets on derivative instruments and overly aggressive models for calculating risk.

A hike in interest rates could mean the banks suddenly need more capital. “What we need to do is have intense discussions and check with the banks if they’re aware of the… risk and if they have enough capital if things go wrong,” Korbinian Ibel, a senior supervisor at the ECB, said. Results of the test, which started in February, are incorporated into the ECB’s guidance on how much capital each lender on its watch should hold. Ibel said the 51 banks may, in principle, see their capital demands rise by up to 25 basis points, although any decision would depend on the individual circumstances of each firm. Similarly, the remaining 60 banks could see their guidance reduced by the same amount.

Crypto makes it too easy for money to leave a country.

• Russian Central Bank To Ban Websites Offering Crypto-Currencies (R.)

Russia will block access to websites of exchanges that offer crypto-currencies such as Bitcoin, Russian Central Bank First Deputy Governor Sergei Shvetsov said on Tuesday. He called them “dubious”. Russian financial authorities initially treated any sort of money issued by non-state approved institutions as illegal, saying they could be used to launder money. Later the authorities accepted the globally booming market of crypto-currencies but want to either control the turnover or to limit access to the market “We cannot stand apart. We cannot give direct and easy access to such dubious instruments for retail (investors),” Shvetsov said, referring to households.

Speaking at a conference on financial market derivatives, Shvetsov said the central bank sees rising interest in crypto-currencies because of high returns from buying into such instruments. He warned, however, that crypto-currencies gradually transform into high-yielding assets from being a mean of payment. “We think that for our citizens, for businesses the usage of such crypto-currencies as an investment object carries unreasonably high risks,” he said. Russian authorities said earlier this year they would like to regulate the use of crypto-currencies by Russian citizens and companies.

$4 million? That’s the damage?

• Fukushima Court Rules Tepco, Government Liable Over 2011 Disaster (R.)

A district court in Fukushima prefecture on Tuesday ruled that Tokyo Electric Power and the Japanese government were liable for damages totaling about 500 million yen ($4.44 million) in the largest class action lawsuit brought over the 2011 nuclear disaster, Kyodo news agency said. A group of about 3,800 people, mostly in Fukushima prefecture, filed the class action suit, marking the biggest number of plaintiffs out of about 30 similar class action lawsuits filed across the nation. This is the second court ruling that fixed the government’s responsibility after a Maebashi district court decision in March.

All the three district court decisions so far have ordered Tepco to pay damages. Only the Chiba court decision last month did not find the government liable for compensation. The plaintiffs in Fukushima case have called on defendants for reinstating the levels of radioactivity at their homes before the disaster, but the court rejected the request, Kyodo said. Tepco has long been criticized for ignoring the threat posed by natural disasters to the Fukushima plant and the company and the government were lambasted for their handling of the crisis.

Incredible. You’d expect to see this in Bombay perhaps, or Lagos.

• 10% of New York City Public School Students Were Homeless Last Year (NYT)

The number of homeless students in the New York City public school system rose again last year, according to state data released on Tuesday. The increase pushed the city over a sober milestone: One in every 10 public school students was homeless at some point during the 2016-17 school year. More than 111,500 students in New York City schools were homeless during the last academic year, a 6% increase over the year before and enough people to populate a small city. Of the overall figure, 104,000 students attended regular district public schools, while the rest were in charter schools. Statewide, 148,000 students were homeless, or about 5% of the state’s public school population.

The data was released by the New York State Technical and Education Assistance Center for Homeless Students, a project of Advocates for Children of New York funded by the state Education Department. The plight of homeless students is part of the entrenched and growing problem of homelessness confronting New York City and Mayor Bill de Blasio, who is pushing a controversial plan to expand the city’s shelter system. After rising steadily for about five years, the number of homeless students reported to the state shot up in the 2015-16 school year, reaching nearly 100,000 children, and in the last school year the numbers crossed that threshold. The count this year is the highest since the state began keeping records.

Not great title for interesting article.

• The European Union Is Doomed to Fail (FEE)

Have you ever heard of Deutsch Jahrndorf? No? I don’t blame you. The tiny Austrian village, which is situated four miles from the Danube, is utterly unremarkable, except for the fact that it sits on the border of three countries. To the east is Slovakia. To the south lies Hungary. As such, within shouting distance of one another, live three peoples speaking completely unintelligible languages. Austria belongs to the West Germanic language group, Hungary to Finno-Ugric and Slovakia to West Slavic. I thought about the exquisitely rich tapestry of European languages, cultures, customs, and nationalities as I watched the sad spectacle of Spanish riot police and Catalan separatists confronting one another on the streets of Barcelona. How on earth can the European Union unite that which history forced asunder?

The European Union, French President Emmanuel Macron has recently declared to almost universal acclaim, needs more unity, including the creation of “a eurozone budget managed by a eurozone parliament and a eurozone finance minister”. The need for the centralization of power in Brussels is, apparently, the lesson that the EU establishment has learned from the outcome of the British referendum on EU membership. Meanwhile, in Catalonia, millions of people have set their sights on independence from Spain. Foremost among their complaints is that the Catalan budget is influenced by Madrid. Independence, the Catalans feel, will rectify a grave injustice occasioned by the French capture of Barcelona in 1714. The conqueror, Duke of Anjou, became the first Bourbon king of Spain under the name of Philip V. His descendant, Philip VI, is on the throne today. In Europe, ancient lineages last as long as ancient resentments.

Therein lies the conundrum of European unification. On the one hand, people throughout much of Europe desire greater autonomy. Madrid has the vexing problem of the Basque Country to worry about as well as Catalonia. In Italy, Padania and South Tyrol in the North don’t feel like they have very much in common with the Mezzogiorno in the South. Corsica does not want to be French and Britain has only recently revisited a territorial arrangement that dates back to 1707. On the other hand, every separatist movement in Europe declares its support for the project of European unification. But, how likely is it that people annoyed by Madrid, Rome, Paris, and London will be happy to have their affairs decided upon in Brussels? Will the Catalans, resentful of subsidizing farmers in Andalusia, quietly have no problem with subsidizing Polish peasants in Lower Silesia?

Monbiot has some nice ideas, but underestimates the degree to which our societies profit from carbon. And why bring in Labour?

• How Labour Could Lead The Global Economy Out Of The 20th Century (G.)

We are still living in the long 20th century. We are stuck with its redundant technologies: the internal combustion engine, thermal power plants, factory farms. We are stuck with its redundant politics: unfair electoral systems, their capture by funders and lobbyists, the failure to temper representation with real participation. And we are stuck with its redundant economics: neoliberalism, and the Keynesianism still proposed by its opponents. While the latter system worked very well for 30 years or more, it is hard to see how it can take us through this century, not least because the growth it seeks to sustain smacks headlong into the environmental crisis. Sustained economic growth on a planet that is not growing means crashing through environmental limits: this is what we are witnessing, worldwide, today.

A recent paper in Nature puts our current chances of keeping global heating to less than 1.5C at just 1%, and less than 2C at only 5%. Why? Because while the carbon intensity of economic activity is expected to decline by 1.9% a year, global per capita GDP is expected to grow by 1.8%. Almost all investment in renewables and efficiency is cancelled out. The index that was supposed to measure our prosperity, instead measures our progress towards ruin. But the great rupture that began in 2008 offers a chance to change all this. The challenge now is to ensure that the new political movements threatening established power in Britain and elsewhere create the space not for old ideas (such as 20th-century Keynesianism) but for a new politics, built on new economic and social foundations.

There may be a case for one last hurrah for the old model: a technological shift that resembles the second world war’s military Keynesianism. In 1941 the US turned the entire civilian economy around on a dime: within months, car manufacturers were producing planes, tanks and ammunition. A determined government could do something similar in response to climate breakdown: a sudden transformation, replacing our fossil economy. But having effected such a conversion, it should, I believe, then begin the switch to a different economic model.

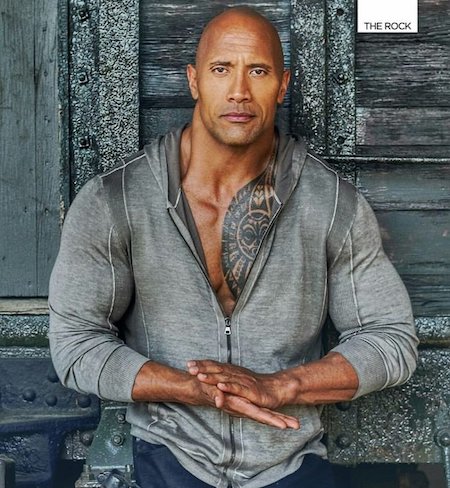

Featuring Dwayne Johnson? All we need then is a ferret to play Dijsselbloem.

• I Will Make A Film Based On Adults in the Room (Costa Gavras)

When the crisis began, the tragedy that the Greek people are still living through, I began to gather material and information in an attempt to make sense of the reasons and the people – published, filmic and oral. However, what I was missing were the goings on behind the closed doors, where the representatives of the European Union and the Greek people met. On 16th July 2015, just after his resignation, I sent a text message to Yanis Varoufakis, whom I did not know personally. In that message I wrote: “Reading your interview in the New Statesman, I believe I found what I have been looking for a long time: the subject for a film, a piece of fiction, about a Europe governed by a group of cynical people disconnected from human, political and cultural concerns – obsessed with numbers and them alone.”

Soon, the arrangements were made and Michele, my wife, and I visited Yanis and Danae in Greece a few weeks later. Meanwhile I read two of his books, The Global Minotaur (London: Zed Books, 2011,2015) and the manuscript of a book he was completing at that time entitled And The Weak Suffer What They Must? (London: The Bodley Head, 2016). I was impressed by the quality and originality of their content, as well as the prose. When we met we had long conversations, in the context of which he let me know that he was about to begin writing his own account of his tenure as Greece’s finance minister, a tale of being an outsider in politics, of the negotiations in the Eurogroup – that illegitimate but ultra powerful EU body. I asked to read the manuscript. He agreed and began sending it to me chapter by chapter, as the book was being written.

Immediately I was convinced by the text’s seriousness and the accuracy of the description of the behaviour of each of the tragedy’s protagonists. Reading it saddened me, and I found myself often angered, indeed enraged, by the violence and the indifference of Eurogroup members, especially the German side, to the drama and unsustainable situation in which the people of Greece lived, and live. I decided to make a film out of this tragedy. Yanis Varoufakis gave me the rights to his book and absolute freedom to adapt it.

Words fail.

• Self-Harm, Suicide Attempts Rise In Greek Refugee Camps (Reuters)

A mental health emergency is unfolding in migrant camps on Greece’s islands, fueled by poor living conditions, neglect and violence, Doctors Without Borders (MSF) said Tuesday. Medical staff have seen a sharp increase in people trying to get help after attempting suicide, harming themselves or suffering psychotic episodes, the humanitarian organization said in a report. More than 13,000 migrants and refugees, mostly Syrians and Iraqis fleeing years of war, are living in five camps on Greek islands close to Turkey, government figures show. Four of those camps are holding two to three times as many people as they were designed for. “Every day our teams treat patients who tell us that they would prefer to have died in their country than be trapped here,” said Jayne Grimes, manager of MSF’s mental health activities on Samos.

The organization said six or seven new patients had visited its clinic on the nearby island of Lesvos each week over the summer following suicide attempts, self-harm or psychotic episodes, 50% more than the previous three months. Violence which many experienced on the journey or in Greece was one factor aggravating mental distress, MSF said. “I know I need to find hope, but when the night falls and I see where I am, I feel like I’m going crazy,” it quoted a Syrian man as saying. The 25-year-old said he was haunted by the images of people dying of hunger in front of him in the long-besieged town of Madaya. “I still remember the taste of the leaves and the smell of death,” he said. On Samos, more than 3,000 people are crammed into facilities designed to hold 700, and about 400 live in the woods. In one Lesvos camp, about 1,500 people are in makeshift shelters or tents without flooring or heating, the UN refugee agency says.

Home › Forums › Debt Rattle October 11 2017