Joan Miro Dancer 1925

My guess is that once one of them starts falling, the others will domino right along.

• The Shoeshine Boy Moment For FANG And Friends (DR)

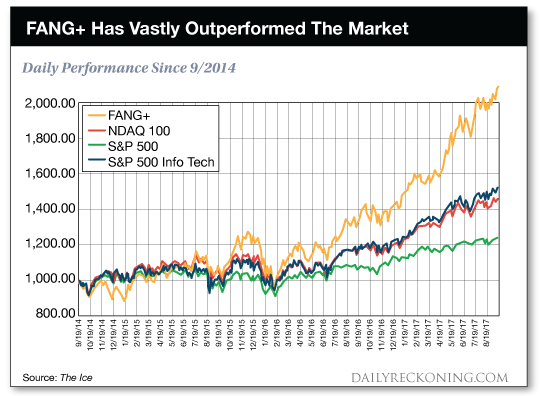

In early March 2009, the current bull market began in the same way that most of the great bull runs in history have, at a moment when investors were terrified to own stocks. Since then it has been nothing but good times. We are now eight and a half years into this bull market making it the second longest in history. This party has been fun. And for a handful of the most popular stocks, fun doesn’t do it justice. The party has been positively off the chains. The stocks that I’m talking about are the FANG (Facebook, Amazon, Netflix and Google) stocks plus a few of their friends (Tesla, Alibaba and others). These stocks have vastly outperformed the market during this bull-run. Now this is where I become a bit of a party-pooper.

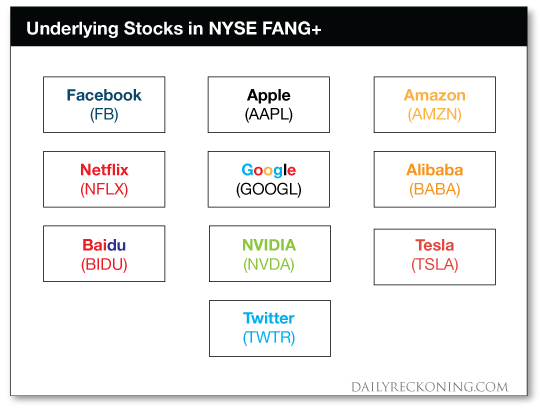

Where Joseph Kennedy Sr. had his shoeshine boy moment for the market in 1929, I believe that a similar warning sign arrived for FANG and friends this summer. Remember, they don’t ring a bell at the top but there are signs. This I believe is a big one… The demand for these stocks has become so high that specific ETFs and dedicated index funds are being launched that are comprised only of FANG and friends. Not just an ETF or index fund, but multiple versions. That latest is called the NYSE FANG+ index. It includes 10 highly liquid stocks that are considered innovators across tech and internet/media companies. It is marketed as a benchmark of today’s tech giants. That may be true, but it is also a benchmark of some of the most expensive stocks in the entire S&P 500. Here are its components:

Yes, I’d love to go back in history and own this group of stocks three years ago. But would I want to own them after an already incredible run? No! As a group these stocks are frighteningly expensive today. That is generally what happens when stocks go up that fast, they become much less attractively valued.

Another great effort by Lance.

• Valuations Are Expensive (Lance Roberts)

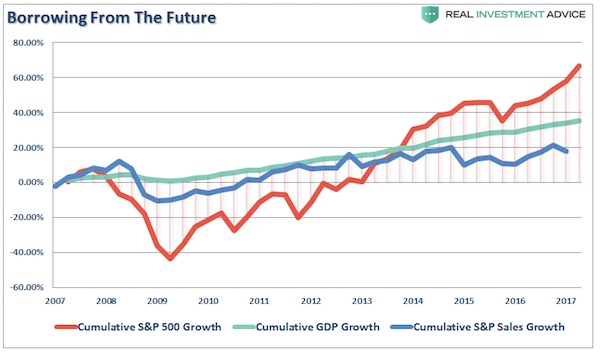

[..] the repetitive cycle of monetary policy: • Using monetary policy to drag forward future consumption leaves a larger void in the future that must be continually refilled. • Monetary policy does not create self-sustaining economic growth and therefore requires ever larger amounts of monetary policy to maintain the same level of activity. • The filling of the “gap” between fundamentals and reality leads to consumer contraction and ultimately a recession as economic activity recedes. • Job losses rise, wealth effect diminishes and real wealth is destroyed. • Middle class shrinks further. • Central banks act to provide more liquidity to offset recessionary drag and restart economic growth by dragging forward future consumption. •Wash, Rinse, Repeat.

If you don’t believe me, here is the evidence. The stock market has returned more than 60% since 2007 peak, which is more than three times the growth in corporate sales growth and 30% more than GDP. The all-time highs in the stock market have been driven by the $4.5 trillion increase in the Fed’s balance sheet, hundreds of billions in stock buybacks, PE expansion, and ZIRP.

It is critical to remember the stock market is NOT the economy. The stock market should be reflective of underlying economic growth which drives actual revenue growth. Furthermore, GDP growth and stock returns are not highly correlated. In fact, some analysis suggests that they are negatively correlated and perhaps fairly strongly so (-0.40). However, in the meantime, the promise of a continued bull market is very enticing as the “fear of missing out” overrides the “fear of loss.” This brings us back to Jack Bogle and the importance of valuations which are often dismissed in the short-term because there is not an immediate impact on price returns. Valuations, by their very nature, are HORRIBLE predictors of 12-month returns should not be used in any strategy that has such a focus. However, in the longer term, valuations are strong predictors of expected returns.

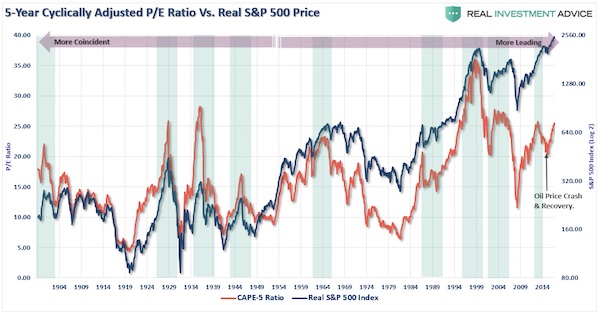

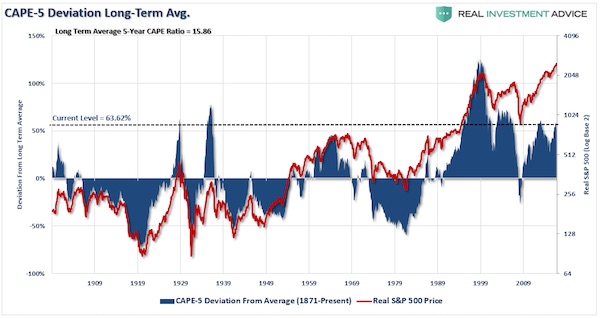

[..] I have also previously modified Shiller’s CAPE to make it more sensitive to current market dynamics. “The need to smooth earnings volatility is necessary to get a better understanding of what the underlying trend of valuations actually is. For investor’s, periods of ‘valuation expansion’ are where the bulk of the gains in the financial markets have been made over the last 116 years. History shows, that during periods of ‘valuation compression’ returns are more muted and volatile. Therefore, in order to compensate for the potential ‘duration mismatch’ of a faster moving market environment, I recalculated the CAPE ratio using a 5-year average as shown in the chart below.”

To get a better understanding of where valuations are currently relative to past history, we can look at the deviation between current valuation levels and the long-term average going back to 1900.

“Central Banks’ Return to Normalcy Is Nothing But a Charade”

• Central Banks Have Effectively Manufactured The World’s Biggest Economy (BBG)

The Federal Reserve keeps talking about a “return to normal” in monetary policy. The media must buy into it, because it keeps repeating the phrase. Many investors buy into it, too. After all, it is the high and mighty Fed speaking. This “normal” is defined by interest rates, but interest rates are defined by the economics that surround them. Interest rates do not exist in a vacuum. But since we are in an economic environment never before seen in history, where data compiled by Bloomberg show that central banks have amassed $21.5 trillion in assets, how can there possibly be any notion of “normal?” Nothing in history supports the claim. Without a history, “normal” is a meaningless term. Think about it: In response to the financial crisis, central banks have essentially manufactured in just nine years an economy that is bigger than the gross domestic products of either the U.S. or China.

I am more than willing to recognize the accomplishment, but to call it “normal” is either a ruse or the height of foolishness. There is nothing “normal” about it. Some may say it is the “crown of creation,” and a case can be made for this argument, but it is not a crown that was ever seen before. This is why, when assessing financial markets, I keep pointing at the money. It is the giant amount of manufactured capital that is holding interest rates down, pushing equities up and compressing all risk assets against their sovereign benchmarks. It isn’t inflation or housing data or wages or any other piece of data that can be singled out. Those are, by comparison, flyspecks in the wind. Simply put, all that money has created demand that outstrips the current supply in bonds, in equities, in stock price-to-earnings multiples, in historical risk valuations and in credit assets.

Therefore, the economic environment that underlies asset pricing is, in fact, distorted. The Fed’s claim of some sort of “normalcy” is a charade. Fed Chair Janet Yellen can say it, and so can Fed governors and presidents, but there is not one grain of truth in the telling. It is nothing more than mumbo-jumbo because they do not wish you to recognize what is actually happening. They have taken over markets and now totally control and dominate them, regardless of the usual day-to-day antics.

More ‘normalcy’.

• ECB to Consider Cutting QE Purchases in Half Next Year (BBG)

ECB officials are considering cutting their monthly bond buying by at least half starting in January and keeping their program active for at least nine months, according to officials familiar with the debate. Reducing quantitative easing to €30 billion ($36 billion) a month from the current pace of €60 billion is a feasible option, said the officials, who asked not to be identified because the deliberations are private. While the central bank’s governors are split on the need to identify an end date for purchases, a pledge to keep buying bonds until September – with the proviso that it could be extended if needed – may offer grounds for compromise, they said. Policy makers led by President Mario Draghi are becoming increasingly confident that ECB policy makers will on Oct. 26 agree to the specifics of how much debt the euro-area’s central banks will buy in the coming year.

After more than 2 1/2 years of trying to revive the region’s economy through bond purchases, some governors see the recent period of robust growth as a reason to rein in the support. Others are concerned that inflation remains too weak. Any changes to the sum and time frame of quantitative easing would still fit into the ECB’s present guidance on monetary policy, which commits the ECB to promise “a sustained adjustment in the path of inflation consistent with its inflation aim.” It also pledges that if “the outlook becomes less favorable, or if financial conditions become inconsistent with further progress toward a sustained adjustment in the path of inflation, the Governing Council stands ready to increase the program in terms of size and/or duration.”

The Japanese government better act fast. Kobe requires controlled demolition.

And this sort of comment needs to stop: “Boeing does not as yet consider the issue a safety problem..”

Of course it’s safety problem. Or are we to believe the safety standards never amounted to anything?

• Boeing Passenger Jets Have Falsely Certified Kobe Steel Products (R.)

Boeing, the world’s biggest maker of passenger jets, has used Kobe Steel products that include those falsely certified by the Japanese company, a source with knowledge of the matter told Reuters. Boeing does not as yet consider the issue a safety problem, the source stressed, but the revelation may raise compensation costs for the Japanese company, which is embroiled in a widening scandal over the false certification of the strength and durability of components supplied to hundreds of companies. The U.S. airline maker is carrying out a survey of aircraft to ascertain the extent and type of Kobe Steel components in its planes and will share the results with airline customers, said the source who has knowledge of the investigation.

Even if the falsely certified parts do not affect safety, given the intense public scrutiny that airlines operate under they may opt to replace suspect parts rather than face any backlash over concerns about safety. Any large-scale program to remove those components, even during scheduled aircraft maintenance, could prove costly for Kobe Steel if it has to foot the bill. Kobe Steel’s CEO, Hiroya Kawasaki, on Thursday said his company’s credibility was at “zero.” The company, he said, is examining possible data falsification going back 10 years, but does not expect to see recalls of cars or airplanes for now.. Also in the U.S., General Motors said it is checking whether its cars contain falsely certified components from Kobe Steel, joining Toyota and around 200 other firms that have received falsely certified parts from the company.

Boeing does not buy products such as aluminum composites, used in aircraft because of their light weight, directly from Kobe Steel. Its key Japanese suppliers, including Mitsubishi Heavy Industries, Kawasaki Heavy Industries and Subaru, however, do. These Japanese companies are key parts of Boeing’s global supply chain, building one fifth of its 777 jetliner and 35% of its carbon composite 787 Dreamliner.

This is getting bigger by the minute.

“..the company holds roughly half of the global market share for the wires used in valve springs of auto engines

• Kobe Steel Scandal Expands Into Core Business Overseas (BBG)

Kobe Steel’s fake data scandal expanded to its core business after the company admitted “inappropriate actions” related to steel wire produced overseas, triggering a fresh collapse in its shares and heightened speculation that the steelmaker may get broken up. Customers have been informed about the issue, which has been resolved, Tokyo-based spokeswoman Eimi Hamano said by phone, declining to provide details. Kobe Steel falsified quality certification data for steel wire used in auto engines and to strengthen tires, the Nikkei newspaper reported Friday. Kobe’s admission of misconduct in its steel business, which accounts for about a third of revenue, ratchets up the pressure on Japan’s third-biggest steelmaker.

The company’s disclosures had up until now dealt with aluminum, copper and iron ore products used in everything from cars to computer hard drives to Japan’s iconic bullet trains, although there haven’t been any reports of products being recalled or safety concerns raised. The deepening scandal “suggests that this is company culture, not just the actions of a few rogue employees,” Alexander Robert Medd, managing director at Bucephalus Research in Hong Kong, said by email. The question to be resolved is “were they trying to save money or just unable to produce the right spec in the right quantities,” he said. Kobe’s shares have plunged 42% this week, including a 9.1% drop on Friday, after it revealed on Sunday that it had fudged data on the strength and durability of metals supplied to as many as 200 customers around the world, including Toyota, General Motors and space rocket-maker Mitsubishi Heavy Industries.

[..] SMBC Nikko Securities said in a note the new revelations around steel wires could be “quite negative” for Kobe Steel’s creditworthiness as the company holds roughly half of the global market share for the wires used in valve springs of auto engines. If doubts arose over the safety of the wires, it could “shake the foundation” of the company, according to chief credit analyst Takayuki Atake.

“The whole thing makes me feel like there’s a bunch of vultures sitting on my back fence..”

• Distressed Investors Buying Houston Homes for 40 Cents on the Dollar (BBG)

Bryan Schild drives through the byways of Houston looking for what could be the investment opportunity of a lifetime: homes selling for as little as 40¢ on the dollar. “We Pay Cash For Flooded Homes $$$$$$$$ Don’t fix it, sell it. Quick close,” read the signs piled in the back seat of his Ford pickup. Schild stops by a ranch-style house where 74-year-old Paul Matlock lives with his wife, disabled from multiple sclerosis. Matlock is desperate to leave and is considering Schild’s offer of $120,000—half the home’s value three weeks earlier. A half-dozen other investors have made offers, one as low as $55,000. “The whole thing makes me feel like there’s a bunch of vultures sitting on my back fence,” Matlock says. “They’re waiting for the dead body to fall over.”

It’s axiomatic on Wall Street that the time to buy is when fear overtakes greed—when blood (or, in this case, water) is in the streets. Now some are eyeing the billions of dollars in hurricane-ravaged property in Texas and Florida and deciding it may be the time to take out their checkbooks. Investors such as Schild figure they can buy low, either fix up and flip the houses or rent them out for several years, and unload them later, doubling their money or more. Those kinds of bets have often paid off. Buyers who snapped up co-ops and office towers when New York was near bankruptcy in the 1970s made a killing. More recently, companies including Blackstone and other marquee names bought foreclosed homes after the 2008 financial crisis and are sitting on billions in potential gains.

The cycle begins with small-time investors such as Schild, who’s bought more than 30 waterlogged houses for an average $175,000 apiece. Then Wall Street swoops in. Gary Beasley, former CEO of Waypoint Homes, also sees an opportunity. He’s pitching private equity firms and pension funds on the potential profit in buying flooded homes, repairing them, and renting them back to homeowners. Bain Capital and billionaire Marc Benioff, co-founder of Salesforce.com, are backing Beasley’s two-year-old company, Roofstock. It runs a website where investors can buy and sell single-family rental properties. Beasley thinks owner-occupants may be interested in selling there, too, and that flooded neighborhoods are the Next Big Thing. “It’s much like the housing crisis, when the institutional guys came in to buy homes nobody wanted,” he says. Like other investors, Beasley and Schild view themselves as helping homeowners to move on and Houston to rebuild.

Will Musk take Silicon Valley down with him?

• Tesla Plays Auto Game By Silicon Valley Rules (DN)

Lest there be any doubt, the electrified race for supremacy in self-driving cars is being played by Silicon Valley rules. How do we know this? By Tesla Chairman Elon Musk’s recognition that his long-awaited Model 3 compact is “in production hell,” that it’s complicated by “bottlenecks” and by confirmation that parts of the cars are being “hand-built.” This amazing accomplishment is being greeted, well, differently by investors than it would if, say, General Motors Chairman Mary Barra copped to the same kind of chaos with its electric Chevrolet Bolt … or just about any other eagerly anticipated model in its lineup. Tesla mostly gets a pass, as it does for losing money on every car it produces. The nearly 4% slide in its shares Monday, the first trading day after The Wall Street Journal reported the messy Model 3 launch, has since recouped most of the loss, judging by the market close Wednesday.

To free “resources to fix Model 3 bottlenecks” and increase battery production to help hurricane-ravaged Puerto Rico, Musk tweeted that Tesla’s anticipated demonstration of its self-driving truck would be delayed until Nov. 16. Detroit (and its foreign-owned rivals) would get crucified for a similar mess. Analysts, the news media and, especially, investors would show scant tolerance for misses of that magnitude from traditional auto industry players — and all of them would demand answers. Tesla? Not so much. Never mind that Musk, the automotive wunderkind, might risk missing what Barclays Research calls the “iPhone moment” for the Model 3, Tesla’s long-awaited entry into the volume-priced electric car segment. You know, the segment already occupied by GM’s Chevy Bolt, Nissan’s Leaf and a slew of coming electric entrants from global automakers.

As a rule, they don’t botch production launches with the same aplomb as Musk’s hand-built production hell. They also have broader distribution networks under existing state franchise laws; more disciplined production systems with longer lead times to ensure more consistent quality at launch; and greater transparency with investors, analysts and the news media. This will be fascinating to watch. Tesla’s Model 3 is one of the most highly anticipated car launches in a long time. It’s supposed to be sheet metal and electric powertrain proof that Silicon Valley innovation can beat Detroit and Stuttgart, Tokyo and Seoul at their own game.

Click the link to see the whole thing.

The US electricity system is often described as the world’s largest machine. It is also incredibly diverse, reflecting the policy preferences, needs and available natural resources of each state. Carbon Brief has plotted the nation’s power stations in an interactive map to show how and where the US generates electricity. A few key messages can be gleaned from the map and associated data interactives below: • The US electricity system has been changing rapidly over the past decade. This reflects not only federal policy, but also technologies, geographies, markets and state mandates. •The average US coal plant is 40 years old and runs half the time. Some 15% are at least 50 years old, against an average retirement age of 52. • Planned new power plants are almost exclusively gas, wind or solar.

Supplying electricity to a nation’s homes, business and industry is an almost uniquely challenging enterprise. For now, electrical energy is either expensive or inconvenient to store, meaning supply and demand must be balanced in real time. It is also easier to generate power close to home than to transport it over long distances. The way electricity is generated fundamentally depends on the fuels and technologies available. The march of progress means this mix is changing – but natural resources and geographies are fixed. Moreover, US states have broad powers to influence the electricity systems within their borders. Putting the US electricity system on a map offers visual confirmation of how important these factors are. Why is solar so prevalent in North Carolina, for example? Or coal in West Virginia?

You can use Carbon Brief’s interactive map to view all the power plants in the US and their relative electricity generating capacities, which are proportional to the size of the bubbles. The dynamic chart in the sidebar summarises the makeup of the capacity mix. It’s important to note that the map and related charts, below, are based on electrical generating capacity. The electricity generated each year by each unit varies according to its load factor (average output of a power station, relative to its installed capacity). US wind has a load factor of around 35% while solar is around 27%. These are lower load factors than for nuclear at around 90%. Coal and gas can, in theory, have similarly high load factors, but in practice both are at around 50% in the US.

Article gets numbers mixed up, but one thing is certain: Greeks make very little money compared to cost of living.

• Greek Civil Servants’ Wages 38% Higher Than Private Sector Staff (K.)

Despite years of austerity policies, Greek civil servants remain significantly better paid than private sector wages, with their average wages 38% higher than their counterparts in the private sector, according to the Hellenic Federation of Enterprises (SEV). The average net monthly wage in the public sector is €1,075 compared to €777 in the private sector, according to figures made public in SEV’s weekly bulletin which underlined that the gap between the two is widening rather than closing. In the first half of this year, the average wage in the public sector rose marginally – by 0.1% – compared to a drop of 1.3% for private sector salaries, according to SEV’s analysis, which concluded that private sector workers saw their wages shaved by about €10 a month over that period.

In a related development, a report conducted by the civil servants’ union ADEDY reported an increase in permanent staff in the Greek civil service over the past year. An additional 1,293 staff were hired between August 2016 and last August, bringing the total number to 566,022, according to the report. Another finding was that most Greek civil servants – 80% of the total – take home a net monthly salary of less than €1,300. Half earn up to €1,000 a month, 44% take home between €1,000 and €1,500 and 3.6% net between €1,500 and €2,100, according to the report. Last month, SEV painted a dire picture of the state of the Greek pension system, which it described as running on empty, while warning that the country’s beleaguered private sector has taken on a disproportionate share of the burden to support pensioners and the public sector.

Easy to figure out what this will mean to health care. The richest country in the world kills its people for profit.

• US Obesity Rates Hit New Records: 39.6% of Adults Now Obese (AFP)

The rate of obesity in the United States has reached a new high, at 39.6% of adults, according to US government data released Friday. Health experts are concerned about obesity because it is associated with a number of life-threatening health conditions, including heart disease, stroke, diabetes and certain kinds of cancer. The adult obesity rate in the United States has risen steadily since 1999, when 30.5% of adults were obese. “From 1999–2000 through 2015–2016, a significantly increasing trend in obesity was observed in both adults and youth,” said the report, based on a nationally representative sample of the population, and issued by the National Center for Health Statistics.

“The observed change in prevalence between 2013–2014 and 2015–2016, however, was not significant among both adults and youth.” Its previous report for 2013 to 2014 found that 37.7% of adults were obese. Researchers said the difference between the current and last report is not statistically significant because it falls within the margin of error of the estimate. Adult obesity is defined as having a body mass index (BMI) of 30 or higher. Among youths aged two to 19, 18.5% are obese, the report said. The rate of youth obesity was 13.9% in 1999.

Another example of killing people for profit.

• Antibiotic Resistance Could Spell End Of Modern Medicine (G.)

England’s chief medical officer has repeated her warning of a “post-antibiotic apocalypse” as she urged world leaders to address the growing threat of antibiotic resistance. Prof Dame Sally Davies said that if antibiotics lose their effectiveness it would spell “the end of modern medicine”. Without the drugs used to fight infections, common medical interventions such as caesarean sections, cancer treatments and hip replacements would become incredibly risky and transplant medicine would be a thing of the past, she said. “We really are facing – if we don’t take action now – a dreadful post-antibiotic apocalypse. I don’t want to say to my children that I didn’t do my best to protect them and their children,” Davies said.

Health experts have previously said resistance to antimicrobial drugs could cause a bigger threat to mankind than cancer. In recent years, the UK has led a drive to raise global awareness of the threat posed to modern medicine by antimicrobial resistance (AMR). Each year about 700,000 people around the world die due to drug-resistant infections including tuberculosis, HIV and malaria. If no action is taken, it has been estimated that drug-resistant infections will kill 10 million people a year by 2050. The UK government and the Wellcome Trust, along with others, have organised a call to action meeting for health officials from around the world. At the meeting in Berlin, the government will announce a new project that will map the spread of death and disease caused by drug-resistant superbugs.

Too sad for words.

• Penguin Disaster As Only Two Chicks Survive From Colony Of 40,000 (G.)

A colony of about 40,000 Adélie penguins in Antarctica has suffered a “catastrophic breeding event” – all but two chicks have died of starvation this year. It is the second time in just four years that such devastation – not previously seen in more than 50 years of observation – has been wrought on the population. The finding has prompted urgent calls for the establishment of a marine protected area in East Antarctica, at next week’s meeting of 24 nations and the European Union at the Commission for the Conservation of Antarctic Marine Living Resources (CCAMLR) in Hobart. In the colony of about 18,000 breeding penguin pairs on Petrels Island, French scientists discovered just two surviving chicks at the start of the year. Thousands of starved chicks and unhatched eggs were found across the island in the region called Adélie Land (“Terre Adélie”).

The colony had experienced a similar event in 2013, when no chicks survived. In a paper about that event, a group of researchers, led by Yan Ropert-Coudert from France’s National Centre for Scientific Research, said it had been caused by a record amount of summer sea ice and an “unprecedented rainy episode”. The unusual extent of sea ice meant the penguins had to travel an extra 100km to forage for food. And the rainy weather left the chicks, which have poor waterproofing, wet and unable to keep warm. This year’s event has also been attributed to an unusually large amount of sea ice. Overall, Antarctica has had a record low amount of summer sea ice, but the area around the colony has been an exception.

Ropert-Coudert said the region had been severely affected by the break-up of the Mertz glacier tongue in 2010, when a piece of ice almost the size of Luxembourg – about 80 km long and 40km wide – broke off. That event, which occurred about 250km from Petrels Island, had a big impact on ocean currents and ice formation in the region. “The Mertz glacier impact on the region sets the scene in 2010 and when unusual meteorological events, driven by large climatic variations, hit in some years this leads to massive failures,” Ropert-Coudert told the Guardian. “In other words, there may still be years when the breeding will be OK, or even good for this colony, but the scene is set for massive impacts to hit on a more or less regular basis.”

Home › Forums › Debt Rattle October 13 2017