Guatave Courbet The cliffs of Étretat after the storm 1870

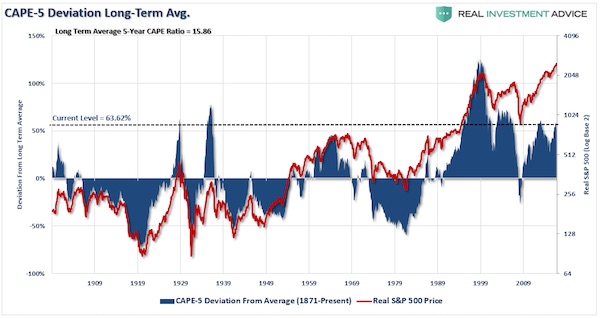

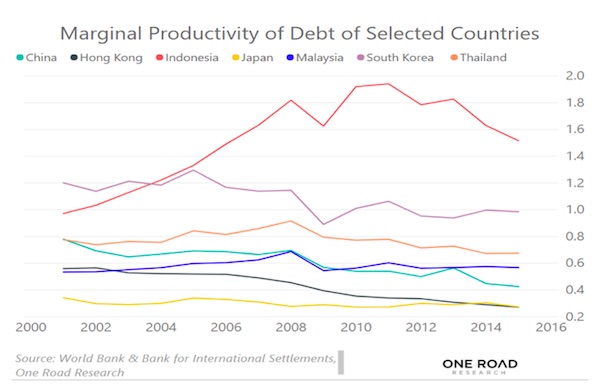

Asia, that is. Check the marginal productivity of debt graph. And remember, once you’re at zero, you’re done. I’d venture you’re done way before even.

• Why Are We Addicted To Debt? (Forbes)

Almost everyone is familiar with Asia’s rags to riches story. The recent economic miracle led to huge increases in living standards across the region. Average incomes rose by factors of 100% to even 400% in some areas. Not to mention the number of people surviving on less than $2 USD a day was cut in half. A major turning point for this economic wonder was when China joined of the World Trade Organization in 2002. Shortly after, Asia’s contribution to the global GDP jumped from 11% to 21%. However, debt distorts these figures in a variety of ways. So, that begs the question; was it a miracle or just an illusion? What tricks does Asia have up its sleeve? Many are becoming increasingly anxious over Asia’s debt-fueled economy. Their fears may soon become a reality.

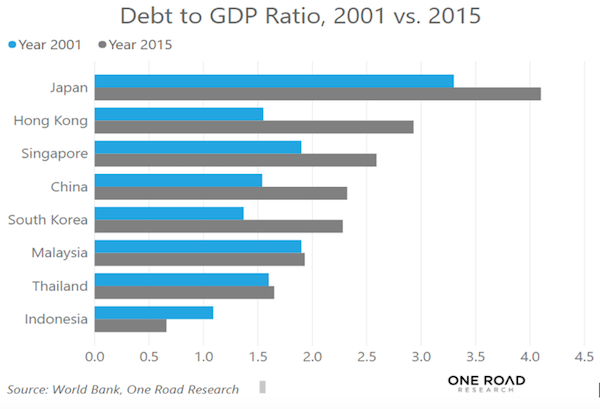

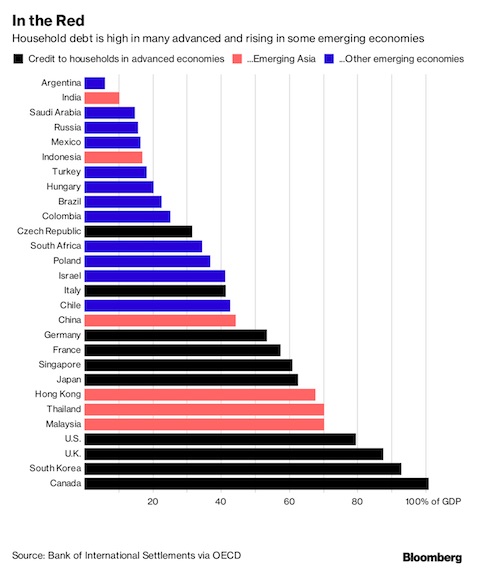

[..] Asia’s ability to consume credit seems never ending. Even during the recent financial crisis, Asia witnessed governments working hard to maintain cheap money flowing into their financial systems. The Chinese government implemented a stimulus package with record low interest rates. They wanted to mimic the methods used by other global central banks during the 2007 and 2008 financial crisis. Despite the large amount of media attention China’s borrowing levels received, they’re not special. As you can see in the chart below, credit levels have soared throughout Asia. Singapore, Hong Kong, Thailand, and Malaysia all have increased their debt to GDP ratios since 2001.

An increased dependency on cheap, available credit produced household debt to shoot up in South Korea and Taiwan. What are the possible outcomes? In many of these economies, high debt levels could lead to tragedy. The main culprit would be GDP growth rate’s inability to balance out spiraling debt levels. This situation is called the marginal productivity of debt. Or put more simply, new debt is not as efficient at creating new growth. Look at the chart below to see how the marginal productivity of debt plays out in Asian economies. Even major, regional growth contributors like South Korea, Japan and China, have experienced this downward trend. Indonesia is the only exception.

Since 2001 China’s marginal productivity has declined by a factor just short of 50%. Since investment has been one of China’s main growth drivers (almost entirely financed by debt), this is concerning. To add fuel to the fire, much of that debt has been funneled into China’s state-owned enterprises (SOEs). For instance, while corporate debt was at 165% of the GDP in 2015, SOEs made up 71% of it. Meanwhile, those SOEs only contributed around 20% to China’s total GDP.

Unstoppable?

• China Debt Grows At Faster Pace Despite Years Of Efforts To Contain It (R.)

For years China’s top officials have touted their ambitious policy priority to wean the world’s second-largest economy off high levels of debt, but there is not much to show for it. On the contrary, a Reuters analysis shows the debt pile at Chinese firms has been climbing in that time, with levels at the end of September growing at the fastest pace in four years. The build-up has continued even as policymakers roll out a series of measures to end the explosive growth of debt, including persuading state firms and local governments to prune borrowing and tighter rules and monitoring of banks’ short-term borrowing. By some estimates, China’s overall debt is now as much as three times the size of its economy.

Without a comprehensive strategy to tackle the overhang, there is a growing risk China will have a banking crisis or sharply slower growth or both, the IMF said last year. China’s central bank governor, Zhou Xiaochuan, made global headlines with a warning last month of the risks of a “Minsky moment”, referring to a sudden collapse in asset prices after long periods of growth, sparked by debt or currency pressures. On the sidelines of a key, twice-a-decade Communist Party Congress in October, Zhou referred to relatively high corporate debt and the fast pace of growth in household lending. While also pledging to fend off such risks, Zhou has acknowledged it will take some time to bring debt down to more manageable levels.

Reuters analysis of 2,146 China listed firms showed their total debt at the end of September jumped 23% from a year ago, the highest pace of growth since 2013. The analysis covered three-fifths of the country’s listed firms, but excluded financials, which have seen the brunt of government de-risking and deleveraging efforts so far.

Michael Pettis still sees isolationism as an answer. But isn’t China too open for that already?

• Maybe China Shouldn’t Open Up (Pettis)

China needs reform. This has long been the consensus advice from economists and multilateral institutions such as the World Bank, whose recent “China 2030” report argues that Chinese leaders should strengthen the role of markets and liberalize legal, financial and other institutions governing the economy. Their to-do list is virtually gospel by now: free up trade and investment, unshackle the exchange rate and ease capital controls. Such reforms are held not only to be worthy in themselves, but critical to solving China’s biggest problem: its debt, which has skyrocketed to well over 260% of GDP from 162% in 2008. The speed and scale of credit expansion has raised fears of a financial crisis, even from such normally staid figures as central bank governor Zhou Xiaochuan. The hope is that reforms will boost productivity enough to allow China to outgrow its debt burden before that crisis hits.

This logic is flawed for two reasons. First, China is unlikely to suffer a financial crisis, and this is precisely because of the government’s ability to restructure banking-sector liabilities at will. The real threat is different. Once a country’s debt burden is high enough to create uncertainty about allocating future debt-servicing costs, the debt itself becomes an obstacle to growth. This process – known as “financial distress” – is well-understood in finance theory but is still unfamiliar to many economists. So, unfortunately, is the corroborating history. In the past two centuries, there have been dozens of cases of overly-indebted countries whose policymakers have promised to implement liberalizing reforms meant to allow the country to outgrow its debt. None has succeeded. No excessively indebted country has ever outgrown its debt until a meaningful portion has been forcibly assigned to one economic sector or another.

There are many ways this can occur. Mexico restructured its debt at a discount in 1990, thereby forcing the cost onto creditors. Germany inflated the debt away after 1919, forcing the cost onto pensioners and others with fixed incomes. A decade ago, China forced the cost onto household savers through negative real interest rates. If it is going to regain sustainable growth, China, too, must deleverage. The only healthy way to do so is first, to force local governments to liquidate assets and assign part of the proceeds to debt reduction, and second, to wean China off its dependence on excessive investment by transferring wealth from local governments to households, so they can consume more.

I wanted to include this article because it raises a serious question. The countries with arguably the highest household debt levels (or close) are New Zealand, Australia, Holland, Sweden, Denmark, Norway. They are all missing from the OECD numbers. How can that be a coincidence?

• OECD Warns on Rising Debt Risk as Canadians Most in the Red (BBG)

The OECD warned that rising private debt loads in both advanced and developing economies pose a risk to growth as Canada, South Korea and the U.K. lead the world in household borrowing. “Household and corporate debt in many advanced and emerging market economies is high,” the OECD said Thursday in a pre-released section of a report to be presented next week. “While higher indebtedness does not necessarily imply that problems are just around the corner, it does increase vulnerability to shocks”. With the global economy showing its most even expansion since the financial crisis, debt levels and credit quality are among the risks that could trigger a downturn. Consumer debt tops 100% of GDP in Canada, with South Korea and Britain both above 80%. On corporate borrowing, the OECD warned about a shift in risk from banks to the bond market and a “substantial” decrease in credit quality.

As bitcoin nears $10K, Tchir reflects.

Bit from Twitter: @JorgeStolfi: “Bitcoin’s market cap just passed 150 billion USD. For those who do not know, that is how much money NEW bitcoin “investors” will have to spend, in order for the current bitcoin holders to get the money that they THINK they have.”

• Bitcoin – Too Far Too Fast? (Peter Tchir)

As Bitcoin surges above $9,250 on the open this Sunday, I have to admit to having some real trepidation at these levels. I have been a proponent of the view that Bitcoin and cryptocurrencies would benefit from the launch of ETFs and futures. My view is that allowing for easier ‘adoption’ of Bitcoin will help fuel its growth as it lets new investors participate indirectly. I should not limit that theory to just more traditional ways to invest, like ETFs and futures, but should also include easier ways to establish wallets and to own Bitcoin (and other cryptocurrencies) the ‘traditional’ way. There are a growing number of ‘easy’ to use guides to getting Bitcoin (I have glanced at many but haven’t followed through to verify how well they work of don’t work).

I am convinced that ease of access and the potential for more mainstream products linked to Bitcoin has helped fuel its surge. But now, I am concerned it has gone too far, too fast. I have three major concerns that could slow the price rise or even cause it to have a significant correction (yes, I am converting from bullish Bitcoin to at best neutral). Here are the three concerns:

1) Are all the ETF and Futures launches a ‘sell the news’ event? Basically the question is, while I believe that easier adoption will lead to inflows, how much of that is priced in? Have speculators loaded their electronic wallets with Bitcoin hoping to capitalize on the expected gains to the point, there won’t be more expected gains? Understanding when something is ‘already’ priced in is difficult at the best of times, let alone with something as complex and growing exponentially like Bitcoin, but, I can’t help but wonder. I have felt a switch in discussions I’m having over the last few weeks. A subtle switch, but one where the Bitcoin bulls seem more eager to name ever higher price targets, while the agnostics seem more willing to do work and think about it more, rather than in a rush to get some money into Bitcoin. The sort of behavior that may be indicating a ‘sell the news’ type of environment.

2) There are becoming too many competing investments which are causing some investors to question how ‘real’ the existing ones are. Yes, I understand that ICO’s aren’t necessarily dilutive, if you can purchase them with Bitcoin, but it does start to appear odd when it seems like virtually every day, someone or some entity is announcing some new variation on the theme.

3) Fedcoin, the potential for the Fed could be classified within concern number 2, but is really only part of a larger, separate concern – that governments or central banks will push back. I read this week, along with a lot of other people, an article describing that Bitcoin was now worth more than McDonald’s. While that sort of article is designed to ‘shock’ investors, especially more conservative investors, I think it represents a larger, growing concern that the ‘establishment’ has surrounding cryptocurrencies. Whether the concerns are more focused on the potential for illegal funds to enter the system, taxation, controlling ‘pump and dump’ schemes or making your own job more difficult to manage, I’m sensing they are rising to the surface again. I think we have hit another tipping point where to expect a response to attempt to slow down the growth and valuation of crytpocurrencies should be expected.

Something that has risen almost a ‘ten-bagger’ in less than a year is bound to attract attention. Bitcoin rebounded strongly after the China crackdown, so this fear might be over-rated, but a more organized government or central bank crackdown shouldn’t come as a surprise to anyone. The bigger question, in my mind, is whether Bitcoin can withstand that – but that is a question for another day. I am torn, because my thesis of ‘ease of adoption’ seems to be playing out and in general it is a long way from being fully played out, which by itself is supportive of greater price appreciation. But, at the moment, my concerns are winning out and I’d be taking some chips, or bits, as the case may be, off the table.

Russigate spreads its wings. But what if Russiagate is the real fake news?

• Italy’s 5-Star, Stung By Fake News Claims, Wants OSCE Election Monitors (R.)

Italy’s anti-establishment 5-Star Movement wants international observers to monitor next year’s national election campaign to help ward off “fake news”, party leader Luigi Di Maio said on Sunday. His comments came after the ruling Democratic Party (PD) accused 5-Star supporters of using interlinked internet accounts to spread misinformation and smear the center-left government. Di Maio, who was elected 5-Star leader in September, said his party was often misrepresented by the traditional media and said the Organization for Security and Cooperation in Europe (OSCE) should oversee the forthcoming election. “The problem of fake news exists and we think it is necessary to have the OSCE monitor news and political debate during the election campaign,” Di Maio said on Facebook.

Such a request is unlikely to gain traction with 5-Star’s opponents, who allege that the maverick group is to blame for some of the most egregious smear campaigns. Last week unofficial Facebook accounts that back 5-Star published a photograph purportedly showing a close ally of PD leader Matteo Renzi attending the funeral of Mafia boss Salvatore Riina. In fact it was a photo taken in 2016 at the funeral of a murdered migrant. “Di Maio says he wants to call up OSCE monitors. Why doesn’t he call up U.N. peacekeepers and the Red Cross, and while he is at it, why not telephone (his associates) who are continuing to post this filth,” Renzi told a conference on Sunday. The sharing of false or misleading headlines and mass postings by automated social media “bots” has become a global issue, with accusations that Russia tried to influence votes in the United States and France. Moscow has denied this.

Some PD leaders called this weekend for legislation ahead of the elections, which are due by May, to crack down on the spread of false news. Renzi ruled that out on Sunday, but said his party would release twice-monthly reports on web abuses. “We do not want to shut down any website, but we want accountability,” Renzi said. The 5-Star party complains that it is unfairly treated by mainstream media, saying state broadcaster RAI is under the sway of the government, while the largest private media group is controlled by the family of former center-right prime minister Silvio Berlusconi. Italy’s leading newspapers, which are owned by large industrial concerns, have also been highly critical of 5-Star, which has promised a campaign against corruption and is seen as unfriendly to big business.

Latest polls show 5-Star has built a stable lead over other parties, with support of around 28% against 24% for the PD and 15% for Forza Italia. A new electoral law which encourages coalition building ahead of the vote, means Berlusconi’s center-right bloc should emerge as the single largest political force, albeit without a clear parliamentary majority.

Or the problem is that nobody wants to understand this.

• The Problem Isn’t Populism: the Problem Is the Status Quo Has Failed (CHS)

The corporate/billionaires’ media would have us believe that the crisis we face is populism, a code word for every ugly manifestation of fascism known to humanity. By invoking populism as the cause of our distemper, the mainstream media is implicitly suggesting that the problem is “bad people” -those whose own failings manifest in an attraction to fascism. If we can successfully marginalize these troubled troglodytes, then our problem, populism, would go away and the wonderfulness, equality and widespread prosperity of pre-populist America will be restored. The problem isn’t populism -the problem is the status quo has failed 95% of the populace.

Life isn’t wonderful, prosperous and filled with expansive equality except in the Protected Elite of the top 5% of technocrats, corporate executives, tenured academics, bureaucrats, financiers, bankers, lobbyists and wealthy (or soon to be wealthy) politicos. The bottom 95% need a time machine to recover any semblance of prosperity. They need a time machine that goes back 20 years so they can buy a little bungalow on a postage-stamp lot for $150,000 on the Left and Right Coasts, because now the little bungalows cost $1 million and up. Housing valuations have become so detached from what people earn that even the top 5% has trouble qualifying for a jumbo mortgage without the help of the Bank of Mom and Dad or the family trust fund. The bottom 95% need a time machine to return to the days when college tuition and fees were semi-affordable–say, 30 years ago.

The bottom 95% also need a time machine to return to a time when they could afford healthcare insurance without government subsidies–a generation ago, or better yet, two generations ago. In an age where phantom wealth sprouts like poisoned mushrooms from speculative bubbles, the bottom 95% need a time machine that goes back 8 years so they buy the S&P 500 at 670, or better yet, buy bitcoin for $1 or $10, just to make up the loss in the purchasing power of their wages. Populism is the dismissive propaganda term that the media uses to distract us from the real cause of our problems: the total failure of the status quo, the corrupt, predatory, exploitive, inefficient, rentier pay-to-play-“democracy” cartel-state hierarchy that has failed the bottom 95%.

Boomerang. Right back at you.

• Britain Must Accept High Immigration Or Forget Trade Deal With India (BI)

Britain will struggle to sign new free trade deals with economic powerhouses like India after Brexit unless it is willing to accept high levels of immigration from these countries into Britain. That’s according to Lord Bilimoria, co-founder of Cobra beer, and one of Britain’s most well-known entrepreneurs. Bilimoria spoke to Business Insider on Friday following International Trade Secretary Liam Fox’s claim that his efforts to make Britain a great trading nation are being undermined by the unwillingness of British businesses to export. The Indian-born British businessman described Fox as “utterly unfit” to serve as International Trade Secretary and claimed that nobody “across the board” in British business “has any respect” for the Conservative minister. “Nobody takes him seriously. That’s a fact,” Bilimoria told BI.

Bilimoria then described what he felt was a contradiction at the heart of the case for Brexit, in that Britain will not be able to significantly reduce inward migration — as many have Brexiteers promised — if it wants any hope of ambitious and wide-ranging free trade deals with countries like India. “What trade deals has he [Fox] actually done?” the life peer said. “The Indian high commissioner has warned that an agreement [between Britain and India] might not be in place until 2030 — and said talks haven’t even begun. “He said India will want the movement of professionals; the movement of doctors, the movement of engineers. He said both sides will benefit from this exchange. It won’t be a one-way street.”

Excellent expansive overview of the past 100 years.

• Why There Is No Peace On Earth (Stockman)

After the Berlin Wall fell in November 1989 and the death of the Soviet Union was confirmed two years later when Boris Yeltsin courageously stood down the red army tanks in front of Moscow’s White House, a dark era in human history came to an end. The world had descended into what had been a 77-year global war, incepting with the mobilization of the armies of old Europe in August 1914. If you want to count bodies, 150 million were killed by all the depredations which germinated in the Great War, its foolish aftermath at Versailles, and the march of history into the world war and cold war which followed inexorably thereupon. To wit, upwards of 8% of the human race was wiped-out during that span.

The toll encompassed the madness of trench warfare during 1914-1918; the murderous regimes of Soviet and Nazi totalitarianism that rose from the ashes of the Great War and Versailles; and then the carnage of WWII and all the lesser (unnecessary) wars and invasions of the Cold War including Korea and Vietnam. [..] The end of the cold war meant world peace was finally at hand, yet 26 years later there is still no peace because Imperial Washington confounds it. In fact, the War Party entrenched in the nation’s capital is dedicated to economic interests and ideological perversions that guarantee perpetual war; they ensure endless waste on armaments and the inestimable death and human suffering that stems from 21st century high tech warfare and the terrorist blowback it inherently generates among those upon which the War Party inflicts its violent hegemony.

In short, there was a virulent threat to peace still lurking on the Potomac after the 77-year war ended. The great general and president, Dwight Eisenhower, had called it the “military-industrial complex” in his farewell address, but that memorable phrase had been abbreviated by his speechwriters, who deleted the word “congressional” in a gesture of comity to the legislative branch. So restore Ike’s deleted reference to the pork barrels and Sunday afternoon warriors of Capitol Hill and toss in the legions of beltway busybodies that constituted the civilian branches of the cold war armada (CIA, State, AID etc.) and the circle would have been complete. It constituted the most awesome machine of warfare and imperial hegemony since the Roman legions bestrode most of the civilized world. In a word, the real threat to peace circa 1991 was that Pax Americana would not go away quietly in the night.

What’s happening to us? Manus, Greece, let alone Yemen, Myanmar, Syria, where are we heading?

• Australia’s Final Solution (Connelly)

Over the weekend, 620 refugees were forcibly removed from the now decommissioned prison on Manus Island, following a ruling in October that their incarceration was unconstitutional. Under instruction from Australia’s Immigration Minister Peter Dutton, prisoners were beaten with steel bars by Papua New Guinea’s paramilitary guards, starved of food, water, and electricity. They are forbidden access to doctors, nurses, social workers, urgently needed medication, and legal representation. Water supplies were deliberately destroyed. Makeshift wells were poisoned. The Australian government claims the prisoners were relocated to new facilities in nearby town, Lorengau, however those at the site say the facilities are both still under construction and at excess capacity. Prisoners forced onto buses were turned away at the gates, left sitting out in the heat for hours with no word on when they would be allowed to enter their new makeshift prisons.

[..] Australia, the ‘innovation nation’, the country of the fair go, could not possibly entertain a system of incarceration whose cruelty wasn’t entirely by design. So anchored are they to the lie that they ‘stopped the boats’, they will let more than 620 refugees fleeing civil war and religious persecution die from starvation, malnutrition, heart-problems and disease than find them a permanent home, lest they appear soft on national security. (FYI, they haven’t stopped the boats. The government has simply stopped reporting on their arrival. I have been told by members of the defence force who work on refugee ‘intercept vessels’ of mothers whose children had died in their arms, being sent back out to sea to drift aimlessly towards… anywhere but here. The boats haven’t stopped).

New Zealand’s Labour government has already volunteered to resettle the prisoners on both Manus and Nauru but their offers have been met with vitriol, scorn and diplomatic threats. Taking responsibility for a mess of its own making is a response too compassionate for this government. It needs to be barbaric. That’s the point of deterrence. If the barbarism isn’t obviously, outrageously cruel, then the system has failed. This is Australia’s final solution: ‘Deterrence’. Robbed of even the right to their own name, the refugees languishing in detention on Manus Island were literally issued numbers that would become their formal identity and how they are referred to by the prison guards (who incidentally have a long and “well-documented history of rapes, sexual assaults, physical abuse, murders and other serious human rights abuses”, according to a report from The Age).

We’re picking off species one by one. We no longer respect life itself. Who are the gods we’re praying to, and why would they listen?

• Fears For World’s Rarest Penguin As Population Plummets (G.)

Almost half the breeding population of the world’s most endangered penguin species, the yellow-eyed penguin, has disappeared in one part of New Zealand and conservation groups believe commercial fishing is to blame. The yellow-eyed penguin is endemic to New Zealand’s South Island and sub-Antarctic islands, where there are just 1,600 to 1,800 left in the wild, down from nearly 7,000 in 2000. During a recent survey of the island sanctuary of Whenua Hou (Codfish Island), department of conservation staff made the alarming discovery that close to half the island’s breeding population of penguins had vanished. Elsewhere in New Zealand the bird’s population is at its lowest level in 27 years. Forest & Bird’s chief executive Kevin Hague said because the island was predator-free the evidence pointed to the animals being caught and drowned in the nets of commercial fishing trawlers.

Only 3% of commercial trawlers have independent observers on them to report bycatch deaths. “Unlike previous years where disease and high temperatures caused deaths on land, this year birds have disappeared at sea,” said Hague. “There is an active set net fishery within the penguins’ Whenua Hou foraging ground, and the indications are that nearly half the Whenua Hou hoiho population has been drowned in one or more of these nets.” Last year 24 nests were recorded on Whenua Hou, but this year rangers only found 14. Penguin numbers are declining in other parts of the South Island as well, and researchers fear the beloved bird, which appears on the New Zealand $5 note, is heading ever closer to extinction. University of Otago’s Thomas Mattern, a penguin expert, told the Otago Daily Times he believed time was running out for the birds. “Quite frankly, the yellow-eyed penguins, in my professional opinion, are on their way out,” Mattern said.