Dorothea Lange Migrant agricultural workers in California 1935

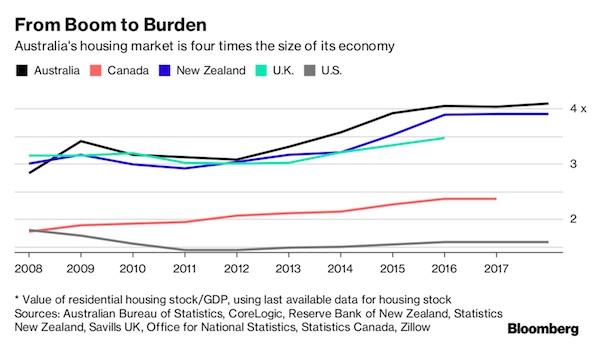

In case you were wondering just how big the bubble has become. Look at New Zealand too.

• The Party Is Over for Australia’s $5.6 Trillion Housing Frenzy (BBG)

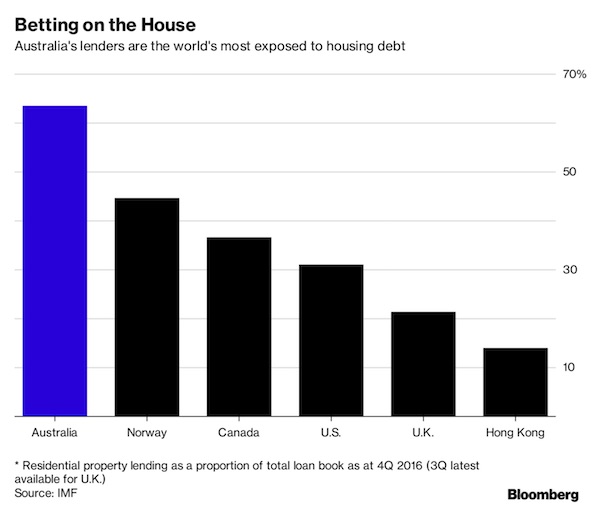

The party is finally winding down for Australia’s housing market. How severe the hangover is will determine the economy’s fate for years to come. After five years of surging prices, the market value of the nation’s homes has ballooned to A$7.3 trillion ($5.6 trillion) – or more than four times gross domestic product. Not even the U.S. and U.K. markets achieved such heights at their peaks a decade ago before prices spiraled lower and dragged their economies with them. Australia’s obsession with property is firmly entrenched in the nation’s economy and psyche, fueled by record-low interest rates, generous tax breaks, banks hooked on mortgage lending, and prime-time TV shows where home renovators are lauded like sporting heroes. For many, homes morphed into cash machines to finance loans for boats, cars and investment properties. The upshot: households are now twice as indebted as China’s.

So far, the Reserve Bank of Australia has relied on banking regulators to apply the brakes with lending curbs. It reckons the financial system is well-placed to withstand any shocks, but isn’t so confident on consumers. That puts it out of step with developed-world peers that are incrementally tightening policy, with Governor Philip Lowe this week making clear local interest rates aren’t going anywhere soon. To be sure, there are key dynamics that differentiate Australia’s housing boom with those that soured in recent years around the world. Aussie banks can claim against other income and assets or chase individuals into bankruptcy if borrowers default. Tax deductions for interest paid on investment loans also support demand, as does a rich pipeline of demand from Asian buyers, especially Chinese. But with prices in major cities like Sydney finally leveling off and a wave of new apartments about to hit markets in Brisbane and Melbourne, it’s worth taking a look at housing’s out-sized influence on Australia’s economy.

The weight of Australian homes on the economy is heavier than policy makers would like. On one hand, the dizzy valuations reflect a desirable location and strong population growth. But they also reflect the massive liabilities that are now tied to these assets. “The risk is that it leaves the Australian economy extremely exposed, and a minor shock could become far more significant,” said Daniel Blake, an economist at Morgan Stanley in Sydney.

The increasing treatment of housing as a financial commodity has seen borrowers rush into a byzantine maze of mortgage-related products. That’s made banks very profitable, but very exposed. While the RBA is satisfied that lenders have adequate buffers to cope with any downturn, banks may find it harder to value their collateral in a falling market as investors look to consolidate their portfolios of multiple homes, said Blake.

Projecting until 2070 may not be the most useful exercise. The next 10 years is wobbly enough.

• The UK’s Future Economic Storm Just Got Worse (CNBC)

Britons should better get used to austerity. Even though the U.K. government has mostly fixed its short-run fiscal problems caused by the global financial crisis, the long-run challenge of keeping fiscal policy on a sustainable path has grown even bigger, according to the latest economic projections published alongside Wednesday’s Autumn Budget. Over the medium term, U.K. fiscal policy looks to be heading towards calm waters. Combining the progress made under then-Finance Minister George Osborne from 2010 until early 2016 with the tax and spending plans announced on Wednesday by the incumbent Philip Hammond, will manage to get the annual fiscal deficit down from a peak of 8% of GDP in 2009 to less than 2.5% this year, and eventually to close to 1% by early next decade.

This should be enough for debt as a percentage of GDP to begin to fall gradually from around 87% of GDP from next year onwards into the 2020s. This is good news. But looking further out, U.K. fiscal policy appears to be heading towards a storm. Back in January, the Office for Budget Responsibility (OBR), the U.K.’s independent fiscal watchdog, projected that U.K. public debt will rise again from the 2030s onwards to nearly 250% of GDP by the 2070s. Rising health, state pension and long-term social care costs linked to demographic factors are likely to cause the fiscal deficit to surge again. U.K. public sector debt is projected to reach highs not seen since World War II. It gets worse. Keep in mind that the projections made in January assumed that productivity growth, the major determinant of economic growth, would average 2% per year into the long run.

Yesterday, the OBR downgraded this judgement to 1.3%. While productivity growth has declined across the advanced world in the past decade, the Brexit-stricken U.K. is suffering an extra hit by weakening the economic ties with its biggest market, the EU. In this new context, the earlier forecast that debt would rise to 250% of GDP within 50 years looks like a significant underestimate, to put it mildly. By reducing projected growth rates for wages and profits, the new lower outlook for trend productivity growth steepens the U.K.’s future fiscal hill. Unlike revenues from taxation, which mostly rise and fall in line with the rate of economic growth, future costs coming from the ageing population are independent of economic factors.

Everyone can see the clowns in the news everyday.

• UK Consumer Confidence Hits Lowest Level Since Aftermath Of Brexit Vote (BBG)

U.K. consumer confidence tumbled in November, reaching the lowest level since the aftermath of the Brexit vote. YouGov and the Centre for Economics and Business Research said optimism suffered its biggest monthly decline since the month after the referendum, with all eight measures that make up the index falling. The score for household financial situations in the past 30 days dropped to its lowest since January 2014, and a gauge of home owners’ expectations for values over the next 12 months slid to the least in a year following the Bank of England’s rate increase on Nov. 2. The report on Friday comes after official data this week highlighted the importance of consumers to the U.K. economy, as a jump in household spending offset slowing business investment and a drag from trade to drive a 0.4% expansion in the third quarter.

It also follows Chancellor of the Exchequer Philip Hammond’s announcement of a downgrade to the economic outlook as a result of a sluggish productivity and Brexit headwinds. Warnings of a consumer slowdown are coming ahead of the crucial Christmas shopping period as the squeeze on incomes from inflation continues. Figures last week showed retail sales fell in October from a year earlier, the first decline in more than four years. “Households are understandably worried.” said Christian Jaccarini, an economist at the CEBR. “The first interest-rate hike in over a decade triggered fears that higher borrowing costs will compound the inflation-induced squeeze on household incomes.”

How do you go from running a casino to having actual stock markets?

• After Sudden Rout, China Stock Traders Question Beijing Put

What happened to the Beijing put? That’s what investors in China are asking themselves after a gauge of large-cap stocks plunged 3% on Thursday, rattling a market that’s grown accustomed to state support when losses get extreme. While there were signs over the past week that the government was looking to cool gains in high-flying shares like Kweichow Moutai – along with concerns over rising corporate bond yields – the severity of Thursday’s slump caught some traders off guard. The biggest surprise was that losses accelerated into the close. The nation’s CSI 300 Index sank 52 points in the final 45 minutes of trading, the steepest afternoon decline since the depths of China’s stock market crash in January 2016. Such late-day selloffs have been rare this year, with the index rising an average 2.9 points.

While it’s unclear why state funds allowed shares to tumble this time, analysts said the episode may help wring some of the complacency out of China’s stocks. Before Thursday’s slump, the CSI 300 had climbed 28% this year to the highest level since July 2015. Margin debt, while still well below its bubble peak in 2015, has increased for six straight months. “Some investors might have been just taking profit in the morning, and that turned into a selling stampede in the afternoon,” said Wang Chen, Shanghai-based partner with XuFunds Investment Management Co. “Investments in blue chips were overcrowded, and a lot of them were bought with margin financing.”

[..] For Sun Jianbo, president of China Vision Capital Management, valuations among large-cap shares are too expensive for state-backed funds to intervene. The CSI 300 traded at its highest level relative to the broader Shanghai Composite Index in at least 12 years at the start of this week as investors flocked to large caps such as Moutai and Ping An Insurance. “There’s no need to prop up the market yet,” Sun said. “A lot of big caps are still expensive and it would do more harm than good to state-backed funds if they buy now.”

The divergence between large-cap shares and the rest of the market may be one reason why the government took aim at Moutai. Before Xinhua warned last week that gains in the liquor maker were excessive, the stock had more than doubled this year. Given that much of the gains in Chinese shares this year can be explained by improving earnings prospects, it’s likely that government’s bigger target is leverage, according to Ken Peng at Citi Private Bank in Hong Kong.

Aimed at the shadows, but…

• China Bank Profits Face Squeeze From Tighter Rules – Fitch (BBG)

Profit margins at Chinese banks will be squeezed next year and credit growth is likely to slow as increasing regulation eats up capital, Fitch Ratings said. The lending businesses of the country’s smaller banks face the most pressure and they will rely more on larger state-owned rivals for liquidity, the ratings company said in a statement Friday. At the same time, the shadow-banking sector, which one brokerage values at about $19 trillion, will attract even more regulatory scrutiny in 2018, Fitch said. Chinese regulators are sweeping through the country’s $40 trillion financial sector in a bid to contain risk after total debt ballooned to about 260 percent of the size of the economy. In the past week alone, they’ve proposed rules governing returns from asset-management products, laid out limits on bank shareholdings and unveiled a purge of cash micro-lenders.

“Credit growth is likely to decelerate next year, given the tighter regulatory stance,” Fitch said. “Funding conditions are likely to remain tight, pointing to continued margin pressure at smaller banks which rely more on non-deposit funding.” The predictions from Fitch and S&P Global Ratings on Thursday suggest the cost of the system-wide measures will be sluggish profit growth at domestic banks, which include Industrial & Commercial Bank of China, the world’s largest by assets. New rules pushing shadow-banking items back on to lenders’ balance sheets will lead to an increase in risk that could weigh on bank capital, Fitch said. Net income growth in the banking sector will remain in the “low single digits” in 2018, it said. The ratings company kept its outlook on Chinese banks at stable, saying sovereign support for the sector remains “very strong.”

“..as many as 10,000 people might have been involved..”

• China Reports Breaking Up Gang That Moved $3 Billion Abroad (AP)

Chinese police say they have broken up a gang that smuggled 20 billion yuan ($3 billion) out of the country, evading financial controls imposed by Beijing to stem an outflow of capital from the economy. Seven suspects were detained in the case centered in the southern city Shaoguan near Hong Kong but as many as 10,000 people might have been involved, the official Xinhua News Agency reported. Chinese authorities have steadily tightened foreign-exchange controls to stem a multibillion-dollar outflow of capital that they say hampers financial management in the world’s second-largest economy. The group in Shaoguan is accused of moving money illegally using 148 bank accounts opened in 20 provinces with stolen identity cards, according to Xinhua.

It said they made unspecified “huge profits” by trading on the difference in exchange rates between Hong Kong dollars and the mainland’s yuan. Beijing allowed an informal financial industry to flourish over the past two decades to support entrepreneurs but is tightening controls due to mounting concern about financial stability. Regulators are especially worried about unauthorized cross-border movement of money at a time when they are trying to stem an outflow of capital. Companies and investors rushed to export money after a change in the mechanism used to set the government-controlled exchange rate in 2015 prompted expectations the yuan would weaken in value. That forced the Chinese central bank to spend heavily to shore up the yuan.

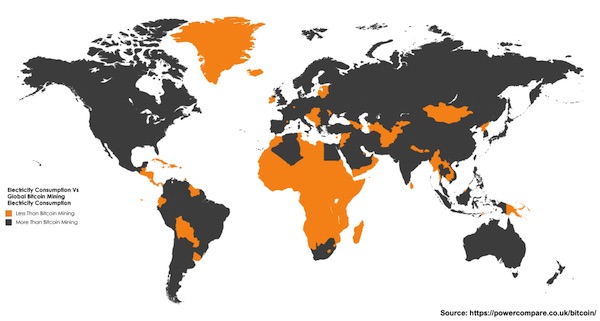

“In the past month alone, Bitcoin mining electricity consumption is estimated to have increased by 29.98%..”

• Bitcoin Mining Now Consumes More Electricity Than 159 Countries (PCUK)

Bitcoin’s ongoing meteoric price rise has received the bulk of recent press attention with a lot of discussion around whether or not it’s a bubble waiting to burst. However, most the coverage has missed out one of the more interesting and unintended consequences of this price increase. That is the surge in global electricity consumption used to “mine” more Bitcoins. According to Digiconomist’s Bitcoin Energy Consumption Index, as of Monday November 20th, 2017 Bitcoin’s current estimated annual electricity consumption stands at 29.05TWh. That’s the equivalent of 0.13% of total global electricity consumption. While that may not sound like a lot, it means Bitcoin mining is now using more electricity than 159 individual countries. More than Ireland or Nigeria. If Bitcoin miners were a country they’d rank 61st in the world in terms of electricity consumption.

Here are a few other interesting facts about Bitcoin mining and electricity consumption:

• In the past month alone, Bitcoin mining electricity consumption is estimated to have increased by 29.98%

• If it keeps increasing at this rate, Bitcoin mining will consume all the world’s electricity by February 2020.

• Estimated annualised global mining revenues: $7.2 billion USD (£5.4 billion)

• Estimated global mining costs: $1.5 billion USD (£1.1 billion)

• Number of Americans who could be powered by bitcoin mining: 2.4 million (more than the population of Houston)

• Number of Britons who could be powered by bitcoin mining: 6.1 million (more than the population of Birmingham, Leeds, Sheffield, Manchester, Bradford, Liverpool, Bristol, Croydon, Coventry, Leicester & Nottingham combined) Or Scotland, Wales or Northern Ireland.

• Bitcoin Mining consumes more electricity than 12 US states (Alaska, Hawaii, Idaho, Maine, Montana, New Hampshire, New Mexico, North Dakota, Rhode Island, South Dakota, Vermont and Wyoming)

Gracias Mexico.

• Mexico Revokes Monsanto Permit To Market GMO Soy In Seven States (R.)

Monsanto said on Thursday that Mexico’s agriculture sanitation authority SENASICA had revoked its permit to commercialize genetically modified soy in seven states, criticizing the decision as unjustified. Monsanto said in a statement that the permit had been withdrawn on unwarranted legal and technical grounds. The company said it would take the necessary steps to safeguard its rights and those of farmers using the technology, but did not elaborate. Mexican newspaper Reforma cited a document saying the permit had been withdrawn due to the detection of transgenic Monsanto soya in areas where it was not authorized. Monsanto rejected that argument, saying in its statement that authorities had not done an analysis of how the soy on which their decision was based was sown. The revocation applies to the states of Tamaulipas, San Luis Potosi, Veracruz, Chiapas, Campeche, Yucatan and Quintana Roo and follows a 2016 legal suspension of the permit.

China will build much of it all, but it won’t pay for it. It’s exporting a Ponzi.

• Turkey, Iran, Russia and India are Playing the New Silk Roads (Escobar)

Vladimir Putin, Recep Tayyip Erdogan and Hassan Rouhani will hold a summit this Wednesday in Sochi to discuss Syria. Russia, Turkey and Iran are the three power players at the Astana negotiations – where multiple cease-fires, as hard to implement as they are, at least evolve, slowly but surely, towards the ultimate target – a political settlement. A stable Syria is crucial to all parties involved in Eurasia integration. As Asia Times reported, China has made it clear that a pacified Syria will eventually become a hub of the New Silk Roads, known as the Belt and Road Initiative (BRI) – building on the previous business bonanza of legions of small traders commuting between Yiwu and the Levant. Away from intractable war and peace issues, it’s even more enlightening to observe how Turkey, Iran and Russia are playing their overlapping versions of Eurasia economic integration and/or BRI-related business.

Much has to do with the energy/transportation connectivity between railway networks – and, further on the down the road, high-speed rail – and what I have described, since the early 2000s, as Pipelineistan. The Baku-Tblisi-Ceyhan (BTC) pipeline, a deal brokered in person in Baku by the late Dr Zbigniew “Grand Chessboard” Brzezinski, was a major energy/geopolitical coup by the Clinton administration, laying out an umbilical steel cord between Azerbaijan, Georgia and Turkey. Now comes the Baku-Tblisi-Kars (BTK) railway – inaugurated with great fanfare by Erdogan alongside Azerbaijani President Ilham Aliyev and Georgian Prime Minister Giorgi Kvirikashvili, but also crucially Kazakh Prime Minister Bakhytzhan Sagintayev and Uzbek Prime Minister Abdulla Aripov. After all, this is about the integration of the Caucasus with Central Asia.

Erdogan actually went further: BTK is “an important chain in the New Silk Road, which aims to connect Asia, Africa, and Europe.” The new transportation corridor is configured as an important Eurasian hub linking not only the Caucasus with Central Asia but also, in the Big Picture, the EU with Western China. BTK is just the beginning, considering the long-term strategy of Chinese-built high-speed rail from Xinjiang across Central Asia all the way to Iran, Turkey, and of course, the dream destination: the EU. Erdogan can clearly see how Turkey is strategically positioned to profit from it.

Alexis, Alexis, we know you don’t mean it that way, so why risk getting caught with your foot in your mouth?

• Greek PM Tsipras ‘Proud’ Of Living Conditions Of Refugees (K.)

Prime Minister has said he is “proud” of living conditions for refugees on the Greek mainland, although he admitted that “the situation remains difficult” for those stranded on the islands of the eastern Aegean. Speaking to France’s Le Figaro newspaper on the occasion of his visit to Paris, Tsipras also defended a deal between the European Union and Ankara to stem migrant flows in the Aegean. “The deal between the EU and Turkey is hard but necessary; it helped put an end to the daily deaths in the Aegean. We have received more than 60,000 refugees on mainland Greece who live in good conditions, with access to health and education. It is something I am proud of,” Tsipras said.

“The situation on the islands remains difficult. There is a large number of migrants and refugees and asylum procedures are time-consuming,” he said. Greece has seen a surge of migrant arrivals in recent months. With winter fast approaching and migrant reception centers on the Aegean islands reaching breaking point due to overcrowding, 20 human rights groups this week sent a letter to the Greek government calling for immediate action.

People are dying already. It’s only autumn.

• Greece Vows Greater Effort To Protect Refugees Over Winter (AP)

Greece has promised to step up efforts to protect migrants and refugees over the winter on the Greek islands, but defended a 2016 deal between Turkey and the European Union to stop the westward flow of migrants into Europe. On a visit to France, Prime Minister Alexis Tsipras told the country’s Figaro newspaper on Thursday that the agreement was difficult but necessary. His remarks followed strongly criticism from aid agencies and human rights groups over conditions at migrant shelters on Lesvos and other Greek islands. Greece has seen a surge of migrant arrivals in recent months. On Thursday, Greek border police recovered the body of a man believed to be a migrant in a river that divides Greece and Turkey – the second such incident in two days.

“They’re killing us and they’re mocking us at the same time..”

• Greek Pensioners March Against Government That ‘Took Everything’ (R.)

Several hundred elderly Greeks marched through Athens on Thursday, protesting against a government they say “took everything” with a new round of cuts to pensions and crumbling health care benefits. Greece’s three bailouts since 2010 have repeatedly taken aim at the pension system. Cuts have pushed nearly half its elderly below the poverty line with incomes of less 600 euros ($710.70) a month. With nearly a quarter of the workforce unemployed, a quarter of children living in poverty and benefits slashed, parents have grown dependent on grandparents for handouts. But after the cuts to pensions, some Greeks have seen their monthly cheque fall between 40 and 50 percent in seven years. After rent, utility bills and health care, they barely make ends meet.

“I have never seen the country in this state, not even during war,” said 80-year-old Nikos Georgiadis, a former hotel employee whose pension has been reduced by 40 percent. “Pensioners are impoverished, and not only can they not afford to buy medicines, some are looking for food in the trash,” he said, leaning on a tree to catch his breath. Fotini Karavidou, a 75-year-old retired accountant who joined the march in a wheelchair, said she had to “cut back on everything” to afford medicine. “It’s simple – many pensioners cannot afford to eat and to buy medicine,” said Yiannis Karadimas, 67, who heads a local pensioners association. Karadimas said it was “a joke” that the government had legalised marijuana for medical purposes while cutting back on health care spending. “They’re killing us and they’re mocking us at the same time,” he said.

The popularity of Prime Minister Alexis Tsipras has waned since he first won elections in 2015. In an effort to rebuild public support, the government gave Greece’s 1.3 million pensioners a one-off Christmas bonus last year, worth 300 to 500 euros each. But the handouts have failed to whip up any obvious increase in support. Pensioners have taken to the streets time and again in recent months. About 2,000 people joined Thursday’s march. “Unfortunately, I voted for them, and they turned out to be the biggest liars of all,” Georgiadis, the pensioner, said. “It [the government] promised us everything, and it took everything.”

Home › Forums › Debt Rattle November 24 2017