Roger Viollet Great Paris Flood, Avenue Daumesnil 1910

“I don’t think any of us know what the implications are for a $50 trillion debt build since the great financial crisis (of 2008). It is impossible to say. We have never dealt with anything of this magnitude.”

• Fed Fears New Record High Credit Bubble – Danielle DiMartino Booth (USAW)

Former Federal Reserve insider Danielle DiMartino Booth says the record high stock and bond prices make the Fed nervous because it’s fearful of popping this record high credit bubble. DiMartino Booth says, “The Fed’s biggest fear is they know darn well this much credit has built up in the background, and the ramifications of the un-wind for what has happened since the great financial crisis is even greater than what happened in 2008 and 2009. It’s global and pretty viral. So, the Fed has good reason to be fearful of what’s going to happen when the baby boomer generation and the pension funds in this country take a third body blow since 2000, and that’s why they are so very, very intimidated by the financial markets and so fearful of a correction.”

Why will the Fed not allow even a small correction in the markets? DiMartino Booth says, “Look back to last year when Deutsche Bank took the markets to DEFCON 1. Maybe you were paying attention and maybe you weren’t, but it certainly got the German government’s attention. They said the checkbook is open, and we will do whatever we need to do because we can’t quantify what will happen when a major bank gets into a distressed situation. I think what central banks worldwide fear is that there has been such a magnificent re-blowing of the credit bubble since 2007 and 2008 that they can’t tell you where the contagion is going to be. So, they have this great fear of a 2% or 3% or 10% (correction) and do not know what the daisy chain is going to look like and where the contagion is going to land.

It could be the Chinese bond market. It could be Italian insolvent banks or it might be Deutsche Bank, or whether it might be small or midsize U.S. commercial lenders. They can’t tell you where the systemic risk lies, and that’s where their fear is. This credit bubble is of their making.” In short, the Fed does not know what is going to happen, and according to DiMartino Booth, nobody does. DiMartino Booth contends, “I don’t think any of us know what the implications are for a $50 trillion debt build since the great financial crisis (of 2008). It is impossible to say. We have never dealt with anything of this magnitude.”

“2017 is the record for quantitative easing (money printing) globally. We have never, not even in the darkest days of the financial crisis, central banks have never injected as much money as they have into the markets. . . . I am not a gold bug, but we do know that in times of corrections that there is no place to hide in traditional asset classes that you can get at your Merrill Lynch brokerage. Gold and silver in the precious metals complex are the only places to hide and get true diversification and safety.”

They do know what’s going on.

• Global Debt Is Rising, Especially in Emerging Economies (St. Louis Fed)

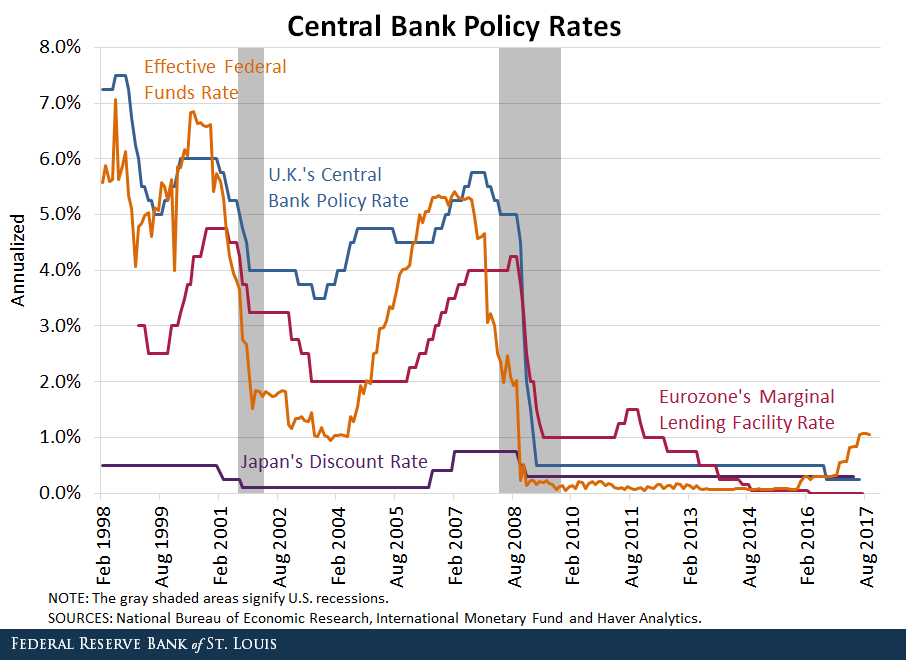

The world has become used to cheap credit. And the increase in borrowing by emerging economies could pose a risk as monetary policy normalizes. In response to the most recent recession, central banks around the world decreased their main policy rates to almost zero, as seen in the figure below.

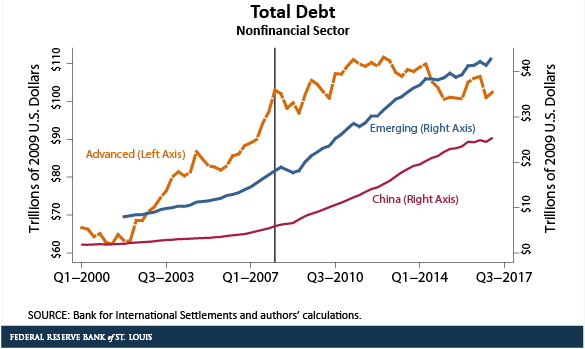

[..] The downward trend in short-term and long-term interest rates has made borrowing cheaper over time. As a result, global debt has increased substantially since 2007. According to Bank for International Settlements (BIS) data, total debt of the nonfinancial sector (that is, households, government and nonfinancial corporations) amounted to $145 trillion in the first quarter of 2017, an increase of 40% since the first quarter of 2007. Most of this increase has been driven by an increase in total debt in emerging economies, especially in China, as seen in the following figure.

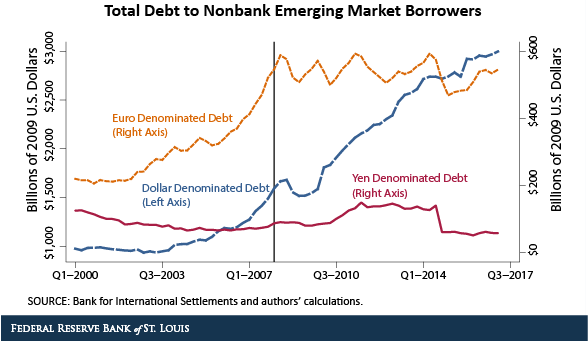

Furthermore, emerging economies have borrowed heavily in foreign currency, mainly in U.S. dollars, shown in the figure below.

According to the BIS, total dollar-denominated debt outside the U.S. reached $10.7 trillion in the first quarter of 2017, and about a third of this debt is owed by the nonfinancial sector of emerging economies. Analysts have stressed that the rapid accumulation of debt in emerging economies could pose risks for the global economy in the presence of U.S. monetary policy normalization. Market expectations of a rapid increase in the policy rate and the reduction of the Federal Reserve’s balance sheet could lead to higher borrowing costs and an appreciation of the U.S. dollar. This, in turn, would increase the cost of refinancing debt in emerging economies. If these risks materialized, there could be an increase in the demand for safe assets, particularly U.S. Treasuries. This would lead to a decrease in long-term rates. In times of monetary normalization, the yield curve would flatten, and banks profitability could be eroded.

After the storms…

• Pressure on US Households Intensifies (DDMB)

The full effects of Hurricanes Harvey and Irma are rapidly showing up in the data. In September, according to Black Knight, the number of mortgages either past due or in foreclosure rose by 214,000, or 9%, compared with August. At 5.1%, the combined rate is far off the previous month’s 4.7% and the most recent low of 4.5% recorded in March 2007. October’s numbers have brought the picture more clearly into focus. More than 229,000 past-due mortgages are tied to the storms. Hurricane Irma accounted for 163,000 and Harvey, 66,000. To place the damage to households in context, before the storms, Florida and Texas ranked 22nd and 20th among non-current mortgage states. As of October, Florida has risen to second place and Texas is in fifth place.

The economy has also enjoyed a rush of car sales as sufficiently-collateralized and insured drivers immediately replaced vehicles destroyed by the storms. According to the latest retail data, car sales slowed to a 0.7% growth rate in October, far below September’s blistering 4.6-percent pace. Nonetheless, the next development could be a further deterioration in auto delinquencies attributed to storm victims. The most recent third-quarter data from the New York Fed suggest struggling households continue to buckle under the strains of their monthly payments. The delinquency rate for subprime loans originated by auto-finance companies, as opposed to banks, hit 9.7% in the three months ended in September.

With one in four auto loans outstanding going to subprime borrowers, the rate has been rising since 2013 and is at a seven-year high. What’s most notable is that these delinquency rates are being recorded outside recession, all but ensuring 2009’s peak of 10.9% will be breached in the next downturn. And while credit-card delinquencies are nowhere near their crisis-era double-digit peaks, the New York Fed noted that serious delinquencies have been on the rise for one year. The serious delinquency rate hit 4.6% in the third quarter, up from 4.4% the prior quarter. Adjusted for inflation, the growth of U.S. credit-card spending has outpaced that of incomes for 26 straight months.

Anyone shorting Italy for real yet?

• Zombie Firms Roam Europe Because Banks Help Keep Them Undead

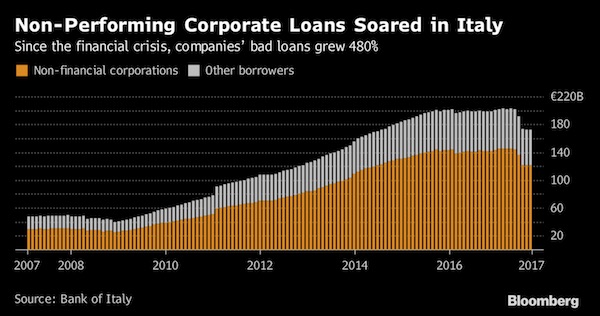

So-called zombie firms – companies that would be out of business or painfully restructured in a competitive economy – have become a key issue for policy makers grappling with sluggish productivity growth in developed economies. The fear is that those “zombies” are sucking up capital that could otherwise go to more productive firms. A new study by the OECD helps explaining how banks favor the spread of zombie firms. It shows that weak companies tend to be connected to weak banks which prefer to roll over or restructure bad loans rather than declaring them delinquent and writing them off. The OECD’s research by Dan Andrews and Filippos Petroulakis lends new urgency to the ECB’s efforts to slash non-performing loans in the region.

Supervisors have asked for detailed plans of how NPLs will be cut and are mulling requiring banks to set aside more capital for soured loans. “In order to facilitate the unwinding of the zombie problem, it is essential that bank balance sheets are strong, underlining the need for fast recapitalizations after crises and other measures to reduce NPLs,” write the authors. “The zombie firm problem in Europe may at least partly stem from bank forbearance.” Weak productivity matters in an ageing continent like Europe, where a shrinking working population is expected to support an ever increasing number of retirees. This can’t happen unless technology and education make it possible to squeeze more and more output from labor and capital.

The OECD has been investigating the impact of living-dead companies for years. It argues that zombification leads to capital misallocation, as weak banks tend to steer less capital to healthier and more productive firms. This in turn leads to low productivity and returns, making it more difficult to get credit even for innovative companies. Andrews and Petroulakis also say that, in addition to forcing banks to work down their NPLs and bolster capital, efficient laws on insolvency are needed. It is not a coincidence that Italy – the European country with the largest NPL problem – overhauled its bankruptcy rules last month to make them quicker and more efficient.

Mr. Xi, sir, it’s time to be careful.

• China Is Pumping A Lot Of Cash Into Its Economy To Calm Investors (CNBC)

China has been pumping a lot of cash into its system to lift market sentiment, as the world’s second-largest economy walks a thin line between curbing debt and keeping everything running smoothly. Last week, the People’s Bank of China injected cash totaling 810 billion Chinese yuan ($122.4 billion) in five straight days of daily liquidity management operations. Those actions, which represented the largest weekly net increase since January, were in part a Beijing response to its 10-year sovereign bond yields spiking to multiyear highs, experts said. “Surging Chinese government bond yields hit the nerve of policymakers, so in order to further prevent a greater surge, they injected liquidity into the system to improve market sentiment,” said Ken Cheung, a foreign exchange strategist at Mizuho Bank who focuses on Chinese currencies and monetary policies.

Nomura analysts said last week in a note that the bond rout was due to fears of regulatory tightening from Beijing. Bond yields, which move inversely to prices, briefly hit 4% in China for the first time in three years. A rise in the benchmark government bond yield threatens to drive up overall borrowing costs — and potentially worsen the country’s debt situation. On Monday and Tuesday of this week, the PBOC injected a net 30 billion yuan ($4.5 billion), but it didn’t expand that money supply on Wednesday. Analysts said that pause may have been due to market sentiment seemingly stabilizing, but it may be short-lived. As Chinese 10-year yields are still near the psychologically important 4% level, Cheung told CNBC he expects more injections ahead if necessary, as Beijing needs to “maintain liquidity to please the market.”

“It’s dangerous territory. Leveraging BB-rated bonds – is that a good idea?”

• Chinese Investors Eye Leverage to Juice U.S. CLO Returns (BBG)

The last time Asian investors borrowed money to invest in structured-credit products – during the run-up to the financial crisis – it didn’t work out so well. Now, a new set of buyers from China are hoping things turn out differently. Instead of snapping up packages of risky derivatives tied to U.S. home loans, they’re buying collateralized loan obligations that bundle together corporate loans to highly leveraged companies. And while such CLOs weathered the last crisis relatively well, there’s already concern that these investors are being tempted to deploy leverage to amplify their returns. The problem is that even the riskiest pieces of CLOs can yield less than the 8 to 10% targets Chinese investors have grown accustomed to in their markets, according to Collin Chan, a CLO analyst at Bank of America Corp.

So CLOs, the junk-rated slices of which yield just 5.5 percentage points more than Libor, “may not be crazily attractive” to them, said Chan, whose team has trekked to China multiple times this year to pitch the products to investors there. On a recent trip to China, potential new investors expressed interest in the idea of applying leverage for the purchase of CLOs, even at the riskier BB level, Chan said. He estimates levered returns for the BB-rated CLO slice may be almost 20%. Leverage is employed using the repo financing market, where short-term loans allow investors to borrow money by lending securities. It’s the latest evidence of the search for yield that has engulfed credit markets and provided a significant boost for CLO sales this year. China and its many types of financial institutions now look like promising buyers for a product that in Asia has typically been bought by Japanese banks and Korean insurers.

“It wouldn’t be wise for the Chinese to use leverage at this stage,” said Asif Khan, head of CLO origination and distribution at MUFG. “It’s dangerous territory. Leveraging BB-rated bonds – is that a good idea? Any potential use of leverage by Chinese investors could pose potential risk in case of severe volatility.” [..] Chinese investors have yet to enter the CLO market en masse. However signs point to their growing participation. In some cases, investment banks and CLO managers have made as many as five trips to Asia this year, adding on special CLO-focused investor conferences in mainland China for the first time ever to raise the product’s profile. The demand to diversify into dollar assets has grown from a wide range of investors, despite Chinese-government capital controls limiting deployment of capital abroad.

$3.4 trillion sounds low.

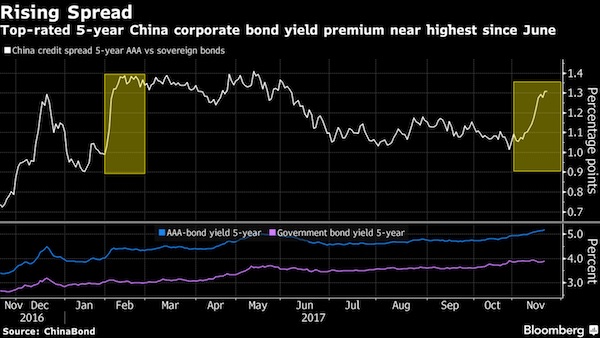

• China’s $3.4 Trillion Corporate Bond Market Faces Rocky 2018 (BBG)

China’s deleveraging campaign is finally starting to bite in the nation’s corporate-bond market, a shift that will make 2018 a clearer test of policy makers’ appetites to let struggling companies fail. Yields on five-year top-rated local corporate notes have jumped about 33 basis points since the month began, to a three-year high of 5.3%, according to data compiled by clearing house ChinaBond. Government bonds, which have far greater liquidity, had already moved last month as the central bank warned further deleveraging was needed. With more than $1 trillion of local bonds maturing in 2018-19, it will become increasingly expensive for Chinese companies to roll over financing – and all the tougher for those in industries like coal that the nation’s leadership wants to shrink.

Two companies based in Inner Mongolia, a northern province that’s suffered from a debt-and-construction binge, missed bond payments on Tuesday, in a demonstration of the kind of pain that may come. In the long haul, that all may be good for China. Allowing more defaults could see its bond market become more like its overseas counterparts, with a greater differentiation in price. And that could mean it channels funds more productively. “The deleveraging campaign and the new rules on the asset management industry will further differentiate good and bad quality credits, and make the onshore credit market more efficient,” said Raymond Gui at Income Partners Asset Management. “Weaker companies will find it harder to roll over their debts because funding costs will stay high.” Gui predicts yields will keep climbing. The average for top-rated corporate bonds is already 2.2 percentage points above what investors demanded to hold them in October last year.

More austerity.

• Worst Growth In Decades Pushes UK To Inject £25bn Into Economy (Ind.)

Britain faces its worst period of economic growth in more than half a century after official data revealed a country hamstrung by feeble productivity and Brexit. Dismal figures released alongside Philip Hammond’s Budget led the Chancellor to announce a £25bn cash injection to strengthen the ailing economy. The major giveaway will see money head towards housebuilding, preparing Whitehall for Brexit, the NHS and boosting the tech sector. But despite the extra cash most government departments will still experience deep cuts over the next five years, as Mr Hammond struggles to get the public finances under control. Mr Hammond tried to put a positive sheen on progress towards reducing net debt and abolishing the deficit, but data suggested Britain would now fail to achieve a budget surplus before 2031.

Forecasts from the Office for Budget Responsibility indicated GDP would grow by 1.5% in 2017, down from the 2% forecast in March. The Government’s official financial auditor said growth would drop to 1.4% next year – as low as 1.3% in 2019 and 2020 – and then pick up to 1.5% in 2021 and 1.6% in 2022. The OBR said the main downward pressure on growth was a big fall in the UK’s projected productivity, intensifying public spending cuts and Brexit uncertainty. The body was established in 2010 by then-Chancellor George Osborne to end a system under which the Treasury produced its own economic growth estimates. The latest predictions are the gloomiest that the auditor has ever given, and they are also smaller than any produced by the Treasury since 1983. Institute for Fiscal Studies director Paul Johnson said the 1.4% average growth forecast over the period was “much worse than we have had over the last 60 or 70 years”.

“.. the reality will be – a lot of people will be no better off. And the misery that many are in will be continuing.”

• Budget Shows Tories Are Unfit For Office – Corbyn (G.)

In his response to the budget, Corbyn – it is the leader of the opposition who traditionally speaks rather than the shadow chancellor – said Hammond had completely failed to tackle a national crisis of stagnation and falling wages. “The test of a budget is how it affects the reality of people’s lives all around this country,” the Labour leader said. “And I believe as the days go ahead, and this budget unravels, the reality will be – a lot of people will be no better off. And the misery that many are in will be continuing.” Largely eschewing direct focus on Hammond’s specific announcements in favour of a broader critique of the government’s wider economic approach, Corbyn castigated Hammond for again missing deficit reduction targets, and for a continued spending squeeze on schools and the police.

Speaking about housing, Corbyn said rough sleeping had doubled since 2010, and that this Christmas 120,000 children would be living in temporary accommodation. “We need a large-scale publicly funded housebuilding programme, not this government’s accounting tricks and empty promises.” Summing up, he said: “We were promised a revolutionary budget. The reality is nothing has changed. People were looking for help from this budget. They have been let down. Let down by a government that, like the economy they’ve presided over, is weak and unstable and in need of urgent change. They call this budget ‘Fit for the Future’. The reality is this is a government no longer fit for office.”

Mish commented on Twitter he’d be more interested in seeing which CIA propaganda sites he’d liked.

Question is: should we trust Facebook’s assessment of what is Russian and what not? I don’t think so.

• Facebook To Let Users See If They ‘Liked’ Russian Accounts (R.)

Facebook said on Wednesday it would build a web page to allow users to see which Russian propaganda accounts they have liked or followed, after U.S. lawmakers demanded that the social network be more open about the reach of the accounts. U.S. lawmakers called the announcement a positive step. The web page, though, would fall short of their demands that Facebook individually notify users about Russian propaganda posts or ads they were exposed to. Facebook, Alphabet Inc’s Google and Twitter are facing a backlash after saying Russians used their services to anonymously spread divisive messages among Americans in the run-up to the 2016 U.S. elections. U.S. lawmakers have criticized the tech firms for not doing more to detect the alleged election meddling, which the Russian government denies involvement in.

Facebook says the propaganda came from the Internet Research Agency, a Russian organization that according to lawmakers and researchers employs hundreds of people to push pro-Kremlin content under phony social media accounts. As many as 126 million people could have been served posts on Facebook and 20 million on Instagram, the company says. Facebook has since deactivated the accounts. Facebook, in a statement, said it would let people see which pages or accounts they liked or followed between January 2015 and August 2017 that were affiliated with the Internet Research Agency. The tool will be available by the end of the year as “part of our ongoing effort to protect our platforms and the people who use them from bad actors who try to undermine our democracy,” Facebook said.

The web page will show only a list of accounts, not the posts or ads affiliated with them, according to a mock-up. U.S. lawmakers have separately published some posts. It was not clear if Facebook would eventually do more, such as sending individualized notifications to users.

NATO is a real threat.

• Putin Tell Russian Firms To Be Ready For War Production (Ind.)

Russian business should be prepared to switch to production to military needs at any time, said Vladimir Putin on Wednesday. The Russian president was speaking at a conference of military leaders in Sochi. “The ability of our economy to increase military production and services at a given time is one of the most important aspects of military security,” Mr Putin said. “To this end, all strategic, and simply large-scale enterprise should be ready, regardless of ownership.” A day earlier, the president had spoken of a need to catch up and overtake the West in military technology. “Our army and navy need to have the very best equipment — better than foreign equivalents,” he said. “If we want to win, we have to be better.”

Since the 2008 Georgian war, which was a difficult operation, the Russian military has undergone extensive modernisation. Ageing Soviet equipment has gone. There is a new testing regime. There are new command structures. The budget has also increased exponentially. This year, military expenses will cross 3 trillion roubles, or 3.3% of GDP. This would be a record were it not for one-off costs in 2016. Over the next two years, spending is forecast to be cut back slightly, to approximately 2.8% of GDP. Though that budget remains less than 30% of the combined Nato budget in Europe, many countries are increasing their military spending in response to the “Russian threat”. Nato military command has also been restructured — it says in response to Russian cyber and military threats.

First thing that needs to happen is Australian media reporting on this. Then people must protest. New Zealand recently offered to take a whole group of these people, Australia declined. Many need medical treatment. Australia refuses.

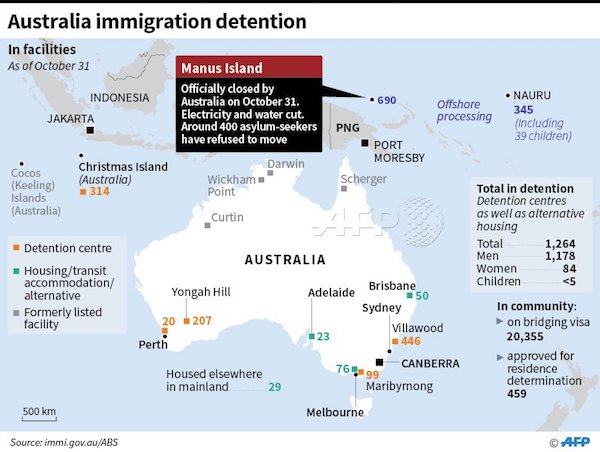

• PNG Police Move In On Closed Australia Refugee Camp On Manus (AFP)

Papua New Guinea police moved into the shuttered Australian refugee camp on the country’s Manus Island Thursday in the most aggressive push yet to force hundreds of men to leave, the Australian government and detainees said. The police operation was confirmed by Australia’s Immigration Minister Peter Dutton, who said Canberra was “very keen for people to move out of the Manus regional processing centre”. “I think it’s outrageous that people are still there,” he told Sydney commercial radio station 2GB. “We want people to move.” Iranian Behrouz Boochani tweeted from inside the camp earlier Thursday, writing that “police have started to break the shelters, water tanks and are saying ‘move, move'”.

“Navy soldiers are outside the prison camp. We are on high alert right now. We are under attack,” he said, adding that two refugees were in need of urgent medical treatment. Other refugees posted photos to social media sites showing police entering the camp, which Australia declared closed on October 31 after the PNG Supreme Court declared it unconstitutional. [..] Australia had shut off electricity and water supplies to the camp and demanded that some 600 asylum-seekers detained there move to three nearby transition centres. Around 400 of the asylum-seekers have refused to leave, saying they fear for their safety in a local population which opposes their presence on the island. They also say the three transition centres are not fully operational, with a lack of security, sufficient water or electricity.

[..] Canberra has strongly rejected calls to move the refugees to Australia and instead has tried to resettle them in third countries, including the United States. But so far, just 54 refugees have been accepted by Washington, with 24 flown to America in September. Despite widespread criticism, Canberra has defended its offshore processing policy as stopping deaths at sea after a spate of drownings.

Oh, the lights will go out eventually…

• Night Being Lost To Artificial Light (BBC)

A study of pictures of Earth by night has revealed that artificial light is growing brighter and more extensive every year. Between 2012 and 2016, the planet’s artificially lit outdoor area grew by more than 2% per year. Scientists say a “loss of night” in many countries is having negative consequences for “flora, fauna, and human well-being”. A team published the findings in the journal Science Advances. Their study used data from a Nasa satellite radiometer – a device designed specifically to measure the brightness of night-time light. It showed that changes in brightness over time varied greatly by country. Some of the world’s “brightest nations”, such as the US and Spain, remained the same. Most nations in South America, Africa and Asia grew brighter. Only a few countries showed a decrease in brightness, such as Yemen and Syria – both experiencing warfare.

The nocturnal satellite images – of glowing coastlines and spider-like city networks – look quite beautiful but artificial lighting has unintended consequences for human health and the environment. Lead researcher Christopher Kyba from the German Research Centre for Geoscience in Potsdam said that the introduction of artificial light was “one of the most dramatic physical changes human beings have made to our environment”. He and his colleagues had expected to see a decrease in brightness in wealthy cities and industrial areas as they switched from the orange glow of sodium lights to more energy-efficient LEDs; the light sensor on the satellite is not able to measure the bluer part of the spectrum of light that LEDs emit.

“I expected that in wealthy countries – like the US, UK, and Germany – we’d see overall decreases in light, especially in brightly lit areas,” he told BBC News. “Instead we see countries like the US staying the same and the UK and Germany becoming increasingly bright.” Since the satellite sensor does not “see” the bluer light that humans can see, the increases in brightness that we experience will be even greater than what the researchers were able to measure.

UK, Netherlands, Belgium

Home › Forums › Debt Rattle Thanksgiving 2017