The Kennedies

It’s all fraud, and none of it is persecuted: “When everyone is doing it, you can’t put everyone in jail..”

“Operating out of small, cramped offices, often in residential blocks, loan agents “re-package” – or falsify documents for mortgage applications. “Around 60% of property buyers in Shanghai are involved in some kind of re-packaging..”

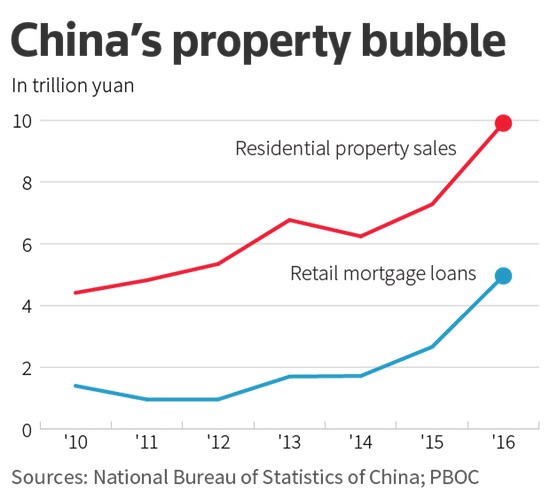

• China’s Property Binge Fuels Mortgage Fraud Frenzy (R.)

[..] across China, unqualified borrowers use fake documents to secure mortgages, while loans deceptively obtained for other purposes are funnelled into property. These frauds are often committed with the consent and encouragement of other parties to the transactions, including lending brokers, property agents, valuation companies and the banks themselves. And these alleged crimes are rarely punished. Hu Weigang, a senior partner at Guangdong Shen Dadi Law Firm, would like to see the law enforced on the mainland as it is in Hong Kong, where creating a bogus document can lead to jail. But, he acknowledges, the scale of this cheating makes it virtually impossible. “When everyone is doing it, you can’t put everyone in jail,” says Hu, who specializes in real estate litigation.

While property prices in China continue to rise, mortgage fraud remains largely a hidden danger, much as subprime loans in the United States remained mostly out of sight ahead of the 2008 global financial crisis. The fear is that in a property correction, fraudulent mortgages would unravel, accelerating a collapse of housing prices in the world’s second biggest economy. This, in turn, would imperil China’s debt-laden financial system. The danger from gravity-defying home prices is clear to the ruling Communist Party. In his marathon speech at the 19th Party Congress in October, Chinese President Xi Jinping warned about the overheated property market. “Houses are built to be lived in, not for speculation,” he said. Top bank officials are also worried. Xu Zhong, head of the research bureau at the central bank, the People’s Bank of China, sees pitfalls ahead.

“We must be very aware that rapidly rising housing prices could not only hamper our economic development, but could easily result in systemic risks and negatively impact the macroeconomy..” The motive for widespread mortgage fraud is simple: fear of missing out. Millions of homeowners are enjoying the sensation of ever-expanding wealth. The average value of residential housing in China more than tripled between 2000 and 2015 as a huge property market emerged from the early decades of economic reforms. So far, China’s new home-owning class has yet to experience a sustained downturn in housing values. Official data showed prices grew 12.4% in 2016, the fastest rate since 2011. A report tracking home price trends by the Chinese Academy of Social Sciences, a state think tank, showed prices in 33 major cities soared 42% in 2016. Private estimates and anecdotal evidence suggest prices in most big Chinese cities actually doubled or tripled since late 2015.

Look at them bubbles…

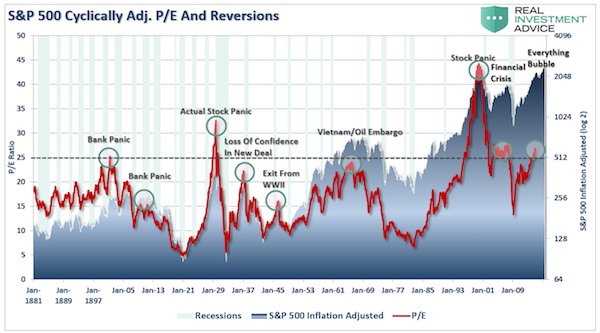

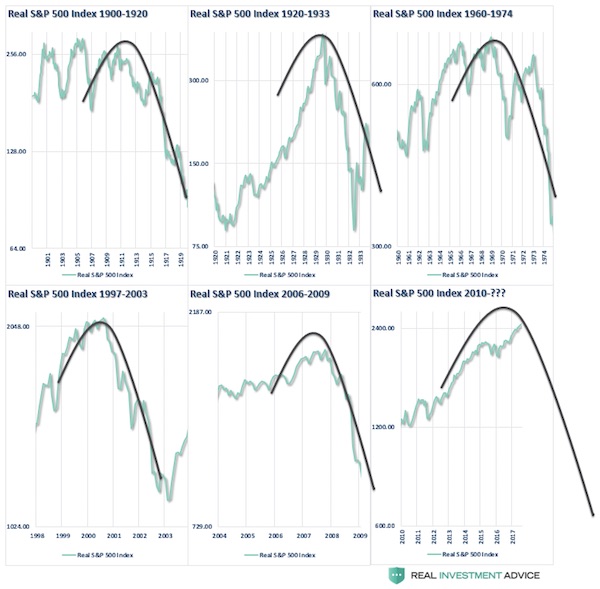

• This Time IS Different, It Just Ends The Same (Roberts)

“Market bubbles have NOTHING to do with valuations or fundamentals.” [..] Stock market bubbles are driven by speculation, greed, and emotional biases – therefore valuations and fundamentals are simply a reflection of those emotions. In other words, bubbles can exist even at times when valuations and fundamentals might argue otherwise. Let me show you a very basic example of what I mean. The chart below is the long-term valuation of the S&P 500 going back to 1871.

The pattern of bubbles is interesting because it changes the argument from a fundamental view to a technical view. Prices reflect the psychology of the market which can create a feedback loop between the markets and fundamentals. This pattern of bubbles can be clearly seen at every bull market peak in history. The chart below utilizes Dr. Robert Shiller’s stock market data going back to 1900 on an inflation-adjusted basis with an overlay of the asymmetrical bubble shape.

There is currently a strong belief that the financial markets are not in a bubble. The arguments supporting those beliefs are all based on comparisons to past market bubbles. The inherent problem with much of the mainstream analysis is that it assumes everything remains status quo. However, the question becomes what can go wrong for the market? In a word, “much.” Economic growth remains very elusive, corporate profits appear to have peaked, and there is an overwhelming complacency with regards to risk. Those ingredients combined with an extraction of liquidity by the Federal Reserve leaves the markets more vulnerable to an exogenous event than currently believed.

I can hear the protests from here…

• What Sowed The Seeds Of The Bitcoin Mania? (TM)

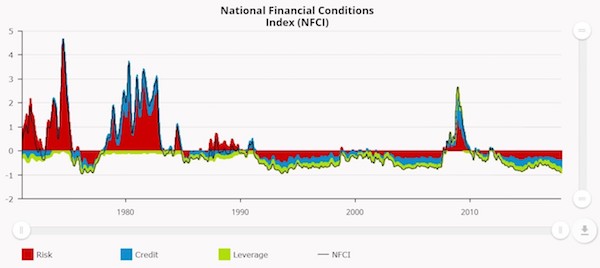

2017 was an unusual year where financial conditions actually eased despite the Federal Reserve raising rates. The financial tightness in 2015 and 2016 was catalyzed by weakness in the energy market. With the help of central banks, as we have previously stated, the economy narrowly avoided a recession. It’s still remarkable to see how much financial conditions have eased since. According to the Taylor Rule, financial conditions are the easiest since 1970. The Chicago Fed’s net financial conditions index has financial conditions the easiest since 1993.

Chicago Fed- Financial Conditions Index

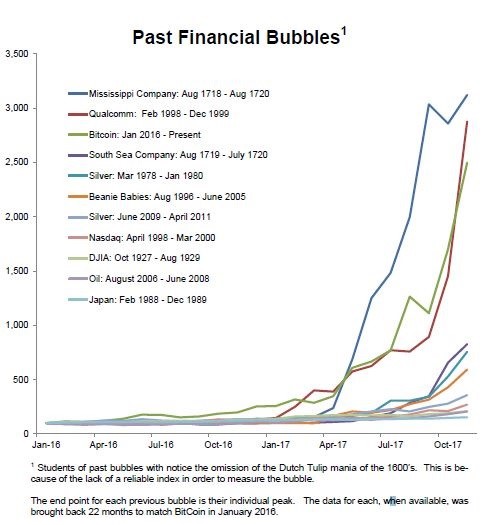

This explains why GDP growth was above 3% in Q2 and Q3 2017 for the first time since 2004-2005. It also explains why stock volatility has been very low; the S&P 500 has been up for 13 straight months which is the longest streak since at least 1928 (the index was created in 1923). With low interest rates and easy financial conditions, it’s not surprising that we’ve seen intense speculation in bitcoin. The cryptocurrency space has had other years with great performance, but the break out in 2017 is partially a result of the easy monetary environment. As you can see, the financial conditions in the 1990s and in the past year have both been very loose. The economic expansions were both elongated which further increases speculation as traders forget what a recession is. The chart below compares bitcoin’s rally since 2016 with other bubbles.

As you can see, Qualcomm’s performance in the 1990s is like bitcoin’s rally. This is a great analogy because Qualcomm saw its stock collapse in the dot com bust, but it has had a viable business model recently, making the Snapdragon chips in smartphones. The tech bubble was based on optimism which ended up being realized with the expansion of the mobile internet. However, the tech bubble witnessed exaggerated valuations, much like cryptocurrencies are experiencing today. Most of the blockchain startups today will fail like Pets.com did in the 1990s. However, blockchain technology in the future will likely become as synonymous with daily life as the internet is today.

And more protests. Lots of older economists speak out against bitcoin.

• Bitcoin Is A ‘Dangerous Speculative Bubble’ – Stephen Roach (CNBC)

With the price of bitcoin moving toward $12,000, a top economist on Tuesday sent a stark warning to investors: The cryptocurrency is in a “dangerous speculative bubble.” “This is a toxic concept for investors,” said Stephen Roach, Yale University senior fellow and the former Asia chairman and chief economist at investment bank Morgan Stanley. Roach, described by Yale as one of Wall Street’s most influential economists, spent the bulk of his 30-year career at Morgan Stanley heading up a highly regarded team of economists around the world. He had a critical take on the explosion of buying the world’s most popular cryptocurrency. “This is a dangerous speculative bubble by any shadow or stretch of the imagination,” he told CNBC’s “The Rundown.” “I’ve never seen a chart of a security where the price really has a vertical pattern to it. And bitcoin is the most vertical of any pattern I’ve ever seen in my career,” he added.

Bitcoin has surged more than 1,000% this year, accelerated by rising interest from retail and institutional investors who view the digital currency as a possible future means of exchange and store of value. Major exchanges like the CME and CBOE have also legitimized the currency’s investment credentials by saying they plan to introduce futures contracts to their respective exchanges, likely further supporting the price. Roach suggested that exchange legitimization makes bitcoin “somewhat dangerous” for investors, given what he described as a “lack of intrinsic underlying economic value to the concept.” Many investors admit to not understanding the technicalities of the instrument or the blockchain technology that underpins its existence, hoping instead to profit on the expectation that bitcoin as an investment will simply continue to rise. “Like all bubbles, they burst,” Roach said. “They go down, and the one who’s made the last investment gets hurt the most, there’s no question about it.”

But the Troika demands 3.5% surpluses! “My estimate is that Greece should be running deficits close to 8 to 10% of GDP to move the economy in the right direction.”

• The Two-Tiered European Community (Bilbo)

This is the final part of my four-part discussion of a so-called progressive proposal advanced by German academic Fritz Sharpf to reform the Eurozone into two tiers: a ‘Northern’ hard currency tier and a ‘Southern’ non-euro tier with the latter nations tying their currencies to the euro. We have seen that rather than providing a framework for convergence between the current Eurozone Member States, Sharpfs’ proposal would not liberate the weaker nations from the yoke of the euro, In fact, the proposal would just tie the exiting nations to the euro in a slightly different way – one that will not provide sufficient flexibility to make much difference.

In questioning the current orthodoxy, Sharpf also notes that if the ECB strictly behaved within the Maastricht rules then the need for even more aggressive internal devaluation would be required as the “sanctions would be inflicted by anonymous market forces”. That is, the Member States currently in trouble would soon go broke as they would have trouble raising funds from the bond markets at acceptable yields, given they do not issue their own currencies. In this context, Sharpf concludes that: “It is hard to see why Southern governments, after all the sacrifices that they have already been forced to make under the present regime, should opt for an alternative that would not loosen economic constraints but remove the present protections against state insolvency.” The same might be said of his Proposal 2.

Why would the Southern states, who would be forced to exit under his plan, not then fully exploit their new found currency capacities to improve domestic demand conditions immediately, which would then, after a while push their external balances into deficit, and once there was sufficient volumes of their own currency in the system, place downward pressure on their exchange rates? Greece only has a current account close to balance because the enduring Depression has killed import growth. Turn the growth back on and they will soon be back in deficit. As I noted in Part 1, the real exchange rate data shows that despite the painful internal devaluation that has been imposed on many Eurozone nations, only Ireland has improved its international competitiveness against Germany.

I also cannot see the ECB agreeing to unconditionally provide euro and other foreign currency reserves to the exiting nations who are running their fiscal policy outside the parameters of the Northern states. Can you imagine Germany, which proudly runs fiscal surpluses while its major transport network is falling apart (bridges etc) tolerating Greece running the fiscal deficits it needs to restore some sense of prosperity? While Germany sits on current account surpluses of around 7-8% and thus creating massive imbalances within the Eurozone, they lecture everyone else about fiscal rectitude. My estimate is that Greece should be running deficits close to 8 to 10% of GDP to move the economy in the right direction.

More entertainment.

• This Could Mean The End Of May – And The Beginning Of Corbyn (Ind.)

Is this it? The moment when the May premiership is over? Could Corbyn end up taking power in a matter of weeks? It’s at least possible, though I concede it sounds far-fetched at first. In history, some British Prime Ministers have had their premierships wrecked by the “Irish Question”. Others, in more recent times, have been destroyed by Europe. Theresa May is unique in managing to combine both famously intractable and insoluble issues into one lethal cocktail. And so, it seems she is about to swallow the poison. Her premiership may be even shorter than many anticipated, and a Jeremy Corbyn-led government could be a fact of British life by the time the snows melt next year. Here’s how.

From what we can discern, the Government is perfectly happy to concede “special status” for Northern Ireland / Ireland in the Brexit talks – anathema to the Ulster Unionists. This is because the Government desperately needs to get onto the second phase of the process – the trade talks for the whole UK – and MPs, without being too crude about it, are happy to sign whatever the EU sticks under their nose and worry about the consequences later. In the end, they will risk their support from the DUP to get moving on Brexit. Jobs (Tory MPs’ included) are at stake. After all, ministers such as David Davis always say that “nothing’s agreed until everything’s agreed”, so having now ratted on the Democratic Unionists, they can, in due course, re-rat on the Irish and the EU, after a trade deal is sorted out.

This looks very amateurish. And everybody knows.

• Theresa May Humiliated As DUP Scuppers Border Deal (Ind.)

Theresa May’s Brexit strategy is in disarray after the Irish Prime Minister dramatically accused her of reneging on an agreement that would have ended the deadlock in the talks. On a day of drama, the Prime Minister pulled the plug on a deal on the Irish border after it was rejected by the Democratic Unionist Party which props her up in power – triggering claims she is being “held to ransom”. The embarrassment left Ms May scrambling to arrange crisis talks with the DUP before she heads back to Brussels later this week, with the clock ticking on the negotiations. EU leaders have demanded she guarantee there will no hard land border in Ireland before a summit next week, if the talks are to move on to discussing future trade and a transitional deal.

The unravelling of the deal also left many Conservatives questioning Ms May’s handling of the talks, amid disbelief that the DUP had not been squared off in advance. The talks broke down after Arlene Foster, the DUP leader, ruled out any move “which separates Northern Ireland economically or politically from the rest of the United Kingdom”. “We have been very clear. Northern Ireland must leave the EU on the same terms as the rest of the United Kingdom,” she said, speaking at Stormont. The party – despite being the Tories’ partner in government – appeared to be blindsided by the UK’s apparent concession of “regulatory alignment” on both sides of the border, to avoid checks. Within 20 minutes, Ms May interrupted her talks with Jean-Claude Juncker, the EU Commission President, to telephone Ms Foster. When she went back to the lunch, the deal was off.

“By the time Cornwall had got in on the act by insisting its dogs be allowed to surf wherever they wanted..”

• Confused May In Alignment Only With Herself Over Irish Issue (G.)

“Are you sure we can’t fudge the Northern Ireland border issue just a little bit?” she had asked Juncker on arrival in Brussels. Juncker had sniggered. Absolutely not. What bit of “regulatory alignment” did she not get? Theresa had another go. How about we say that pigs, cheese and a few cows are allowed to wander across the border without a passport? So you’re basically giving in and accepting that Northern Ireland must stay inside the single market and the customs union, Juncker had observed. Mmm, yes and no, Theresa whispered, checking over her shoulder to make sure no one was listening. It was like this. Regulatory divergence and regulatory alignment could almost mean exactly the same thing. It just depended which side you were looking at it from. The secret was to persuade the divergers that you weren’t aligning and the aligners you weren’t diverging by drafting something that was equally open to misinterpretation by both.

“Whatever,” Juncker had yawned. Having persuaded herself she had got a deal she could sell – to herself if no one else – Theresa set about drafting an agreement with the Irish government. As the news seeped out that an agreement had been reached, all hell broke loose. If the Northern Irish could have a special nod and a wink for pigs, the Scots must have the same exemptions for scotch. And heather. Then London started making demands. Just because it could. It had never fancied leaving the EU anyway. By the time Cornwall had got in on the act by insisting its dogs be allowed to surf wherever they wanted, it dawned on the prime minister that maybe she ought to run the agreement past the DUP. Arlene Foster’s response had been unequivocal. Theresa could keep her £1bn. Any deal that didn’t make Northern Ireland exactly the same as the rest of the UK was unacceptable. No special status, no nothing. And if push came to shove, she’d bring down the UK government.

Erik Prince and Oliver North. Yeah, those are the guys I would trust.

• White House Weighing Plans For Private Spies To Counter “Deep State” (IC)

The Trump administration is considering a set of proposals developed by Blackwater founder Erik Prince and a retired CIA officer — with assistance from Oliver North, a key figure in the Iran-Contra scandal — to provide CIA Director Mike Pompeo and the White House with a global, private spy network that would circumvent official U.S. intelligence agencies, according to several current and former U.S. intelligence officials and others familiar with the proposals. The sources say the plans have been pitched to the White House as a means of countering “deep state” enemies in the intelligence community seeking to undermine Trump’s presidency. The creation of such a program raises the possibility that the effort would be used to create an intelligence apparatus to justify the Trump administration’s political agenda.

“Pompeo can’t trust the CIA bureaucracy, so we need to create this thing that reports just directly to him,” said a former senior U.S. intelligence official with firsthand knowledge of the proposals, in describing White House discussions. “It is a direct-action arm, totally off the books,” this person said, meaning the intelligence collected would not be shared with the rest of the CIA or the larger intelligence community. “The whole point is this is supposed to report to the president and Pompeo directly.” Oliver North, who appears frequently on Trump’s favorite TV network, Fox News, was enlisted to help sell the effort to the administration. He was the “ideological leader” brought in to lend credibility, said the former senior intelligence official.

Some of the individuals involved with the proposals secretly met with major Trump donors asking them to help finance operations before any official contracts were signed. The proposals would utilize an army of spies with no official cover in several countries deemed “denied areas” for current American intelligence personnel, including North Korea and Iran. The White House has also considered creating a new global rendition unit meant to capture terrorist suspects around the world, as well as a propaganda campaign in the Middle East and Europe to combat Islamic extremism and Iran. “I can find no evidence that this ever came to the attention of anyone at the NSC or [White House] at all,” wrote Michael N. Anton, a spokesperson for the National Security Council, in an email. “The White House does not and would not support such a proposal.”

“The deal had allowed Apple to pay an effective corporate tax rate of 1% on its European profits in 2003, down to as low as 0.005% in certain years..”

• Apple Agrees To Pay Over $15 Billion To Ireland In Back Taxes (ArsT)

According to a top Irish official, Apple has agreed to to pay Ireland around $15.4 billion in back taxes. “We have now reached agreement with Apple in relation to the principles and operation of the escrow fund,” Finance Minister Paschal Donohoe told reporters before a meeting with European Competition Commissioner Margrethe Vestager. “We expect the money will begin to be transmitted into the account from Apple across the first quarter of next year.” Ireland was formally referred to the European Court of Justice after it failed to implement a 2016 order that required the island nation to collect the same amount in unpaid taxes. Over a year ago, as Ars reported, the EU’s competition chief Vestager said that a two-year investigation into so-called sweetheart tax deals in 1991 and 2007 had found Apple guilty of receiving illegal state aid from the Emerald Isle.

The deal had allowed Apple to pay an effective corporate tax rate of 1% on its European profits in 2003, down to as low as 0.005% in certain years, according to Vestager. Apple has denied any wrongdoing and has also said that it received no “special deal.” “We have a dedicated team working diligently and expeditiously with Ireland on the process the European Commission has mandated,” Apple said in a Monday statement according to UPI. “We remain confident the General Court of the EU will overturn the Commission’s decision once it has reviewed all the evidence.” Both Apple and Ireland have challenged the EU’s court order.

Why not check this for fraud too?

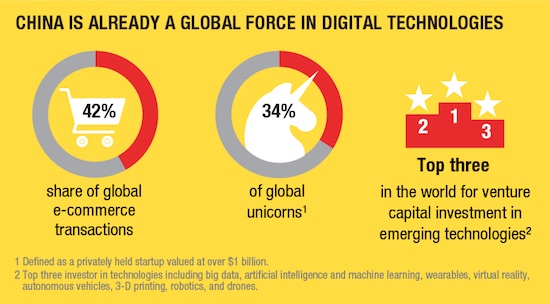

• China, the Digital Giant (PS)

China has firmly established itself as a global leader in consumer-oriented digital technologies. It is the world’s largest e-commerce market, accounting for more than 40% of global transactions, and ranks among the top three countries for venture capital investment in autonomous vehicles, 3D printing, robotics, drones, and artificial intelligence (AI). One in three of the world’s unicorns (start-ups valued at more than $1 billion) is Chinese, and the country’s cloud providers hold the world record for computing efficiency. While China runs a trade deficit in services overall, it has lately been running a trade surplus in digital services of up to $15 billion per year. Powering China’s impressive progress in the digital economy are Internet giants like Alibaba, Baidu, and Tencent, which are commercializing their services on a massive scale, and bringing new business models to the world.

Together, these three companies have 500-900 million active monthly users in their respective sectors. Their rise has been facilitated by light – or, perhaps more accurate, late – regulation. For example, regulators put a cap on the value of online money transfers a full 11 years after Alipay introduced the service. Now, these Internet firms are using their positions to invest in China’s digital ecosystem – and in the emerging cadre of tenacious entrepreneurs that increasingly define it. Alibaba, Baidu, and Tencent together fund 30% of China’s top start-ups, such as Didi Chuxing ($50 billion), Meituan-Dianping ($30 billion), and JD.com ($56 billion). With the world’s largest domestic market and plentiful venture capital, China’s old “copy-cat” entrepreneurs have transformed themselves into innovation powerhouses.

They fought like gladiators in the world’s most competitive market, learned to develop sophisticated business models (such as Taobao’s freemium model), and built impregnable moats to protect their businesses (for example, Meituan-Dianping created an end-to-end food app, including delivery). As a result, the valuation of Chinese innovators is many times higher than that of their Western counterparts. Moreover, China leads the world in some sectors, from livestreaming (one example is Musical.ly, a lip-syncing and video-sharing app) to bicycle sharing (Mobike and Ofo exceed 50 million rides per day in China, and are now expanding abroad).

Most important, China is at the frontier of mobile payments, with more than 600 million Chinese mobile users able to conduct peer-to-peer transactions with nearly no fees. China’s mobile-payment infrastructure – which already handles far more transactions than the third-party mobile-payment market in the United States – will become a platform for many more innovations.

Merkel is losing ground fast. First inviting refugees and then paying them to leave, what is that?

• Pilots Across Germany Are Blocking The Deportation Of Asylum Seekers (IBT)

Pilots across Germany are refusing to carry out deportations of asylum seekers and have prevented at least 222 planned flights so far, the government said on Monday (4 December) Germany’s main airline Lufthansa and its subsidiary Eurowings halted at least 85 flights in the first eight months of this year, according to a freedom of information request obtained by the Left party. The majority of the cancellations took place at Frankfurt airport, Germany’s largest and most important transport hub. A large number of the flights were scheduled to repatriate refugees to Afghanistan, a move which has been widely condemned by human rights organisations. Earlier this year, Amnesty International called on European governments to “implement a moratorium on returns to Afghanistan until they can take place in safety and dignity”.

Anna Shea, Amnesty International’s Researcher on Refugee and Migrant Rights, said that government was being “wilfully blind” to the fact that violence was at a record high in Afghanistan. Despite an increase in deportations, Germany remains the top destination for refugees in the European Union. This year, Germany has taken in more asylum seekers than all other 27 EU countries combined. In the first six months of 2017 the country processed 388,201 asylum cases, Die Welt reported, quoting statistics agency Eurostat. To try and curb the numbers, the German government is offering rejected asylum seekers up to €1000 in benefits if they voluntarily return home. Families who agree to leave are entitled to receive up to €3000. Interior Minister Thomas de Maizière (CDU) told the Süddeutsche Zeitung on Sunday (3 December): “If you decide by the end of February for a voluntary return, you will get in addition to first aid, a housing aid for the first 12 months in your country of origin.”

Tsipras has to ask Brussels (re: Merkel) for permission.

• Push To Move Refugees From Greek Islands To Mainland (K.)

Municipal officials from the islands of Lesvos, Chios and Samos, which are bearing the brunt of an increased influx of migrants from neighboring Turkey, are due in Athens on Tuesday to press the government for action to ease the pressure on their local communities. The officials decided to coordinate their protests and seek a meeting with Migration Minister Yiannis Mouzalas to speed up the transfer of migrants from the islands to mainland Greece. There are currently more than 15,000 migrants living in state-run camps on Lesvos, Chios, Samos, Leros and Kos. More than 15,000 have been transferred to the mainland over the past year. Of those more than 3,500 were transferred in the last month alone. But islanders say more action is needed due to growing tensions in the reception centers and among the local communities as arrivals from Turkey have increased.

Hopes that a European Union refugee relocation program could ease some of the pressure have been largely frustrated as the process is a slow one. European Migration Commissioner Dimitris Avramopoulos has said the so-called Dublin Regulation, which dictates that refugees apply for asylum in the first EU country they enter, must be reformed for pressure on countries such as Greece and Italy to ease. In a related development on Monday, a court on Lesvos indicted 16 North African migrants who participated in the occupation of a central square in Mytilene, the main port of Lesvos. Authorities on the island detained a total of 25 protesters late on Sunday but the other nine were released as they are minors. The migrants had staged the protest in a bid to press authorities to accelerate their asylum applications and their transfer to mainland Greece.

No question there.

• The World’s Oceans Are Under The Greatest Threat In History – Attenborough (G.)

The world’s oceans are under the greatest threat in history, according to Sir David Attenborough. The seas are a vital part of the global ecosystem, leaving the future of all life on Earth dependent on humanity’s actions, he says. Attenborough will issue the warning in the final episode of the Blue Planet 2 series, which details the damage being wreaked in seas around the globe by climate change, plastic pollution, overfishing and even noise. Previous BBC nature series presented by Attenborough have sometimes been criticised for treading too lightly around humanity’s damage to the planet. But the final episode of the latest series is entirely dedicated to the issue. “For years we thought the oceans were so vast and the inhabitants so infinitely numerous that nothing we could do could have an effect upon them. But now we know that was wrong,” says Attenborough.

“It is now clear our actions are having a significant impact on the world’s oceans. [They] are under threat now as never before in human history. Many people believe the oceans have reached a crisis point.” Attenborough says: “Surely we have a responsibility to care for our blue planet. The future of humanity, and indeed all life on Earth, now depends on us.” BBC executives were reportedly concerned about the series appearing to become politicised and ordered a fact-check, which it passed. The series producer, Mark Brownlow, said it was impossible to overlook the harm being caused in the oceans: “We just couldn’t ignore it – it wouldn’t be a truthful portrayal of the world’s oceans. We are not out there to campaign. We are just showing it as it is and it is quite shocking.”

Strict management of the herring fishery in Norway has saved it from collapse. Herring now draw in humpback whales and orca. Photograph: Audun Rikardsen

Home › Forums › Debt Rattle December 5 2017