OR LIGHT Compassion 2018

Money has left the building.

• Argentina’s Peso Collapses Even Further Despite $50 Billion IMF Bailout (WS)

Today the Argentina peso plunged another 5.5% against the US dollar. It now takes ARS 27.7 to buy $1. Over the past 16 years, the peso has gone through waves of collapses. This collapse began on April 20. The central bank of Argentina (BCRA) countered it by selling $1 billion per day of scarce foreign exchange reserves and buying pesos. The peso fell more quickly. The BCRA responded with three rate hikes, to finally 40%! On May 8, the government asked the IMF for a bailout. On May 16, after a chaotic plunge of the peso, the BCRA was able to refinance about $26 billion in maturing peso-denominated short-term debt (Lebacs) at an annual interest of 40%, and the peso bounced. It was a dead-cat bounce, however, and the peso plunged another 13% against the dollar through today.

Since April 20, the peso has plunged 27.5%. The annotated chart shows the daily moves of the collapse, and the various failed gyrations to halt it (the chart depicts the value of 1 ARS in USD). The collapse of the peso comes despite an endless series of measures to halt it. Just this week so far: On Tuesday, the BCRA decided to keep its key interest rate at 40%; and on Wednesday, the Ministry of Finance announced it would hold daily auctions to sell $7.5 billion in foreign exchange reserves and buy pesos, to prop up the peso. But it was apparently the only one buying pesos. With inflation at 25.5% and heading to 27% by year-end, according to government estimates, with a rising budget deficit, a surging current account deficit, soaring borrowing costs, and burned investors, what else is there to do?

Not Draghi’s finest hour.

• ECB Calls Halt To Quantitative Easing, Despite ‘Soft’ Euro (G.)

The European Central Bank has shrugged off evidence of a slowdown in the eurozone and announced that it will phase out the stimulus provided by its massive three-year bond-buying programme to the eurozone economy by the end of the year. Despite warning that the single currency area was going through a soft patch at a time when protectionist risks were rising, the ECB said it would wind down its bond purchases over the next six months. The ECB is currently boosting the eurozone money supply by buying €30bn of assets each month, but this will be reduced to €15bn a month after September and ended completely at the end of 2018.

The move follows strong pressure from some eurozone countries, led by Germany, that were uncomfortable about the more than €2.4tn of assets accumulated by the ECB since it launched its quantitative easing programme at the start of 2015. Mario Draghi, the ECB’s president, said at the end of a meeting of the bank’s governing council in Latvia that the QE programme had succeeded in its aim of putting inflation on course to meet its target of being below but close to 2%. Eurozone activity has accelerated markedly over the past three years, with some estimates suggesting that QE contributed 0.75percentage points a year to the average 2.25% annual growth rate.

The ECB’s statement reflected the battle between hawks and doves on the bank’s council, with the decision on QE matched by a softening of its approach to interest rates. Draghi said there would be no prospect of an increase in the ECB’s key lending rate – currently 0.0% – until next summer at the earliest. “We decided to keep the key ECB interest rates unchanged and we expect them to remain at their present levels at least through the summer of 2019 and in any case for as long as necessary to ensure that the evolution of inflation remains aligned with our current expectations of a sustained adjustment path,” Draghi said.

No, really, Abenomics is dead.

• Japan’s Central Bank Dials Down Inflation View, Complicates Stimulus-Exit (R.)

The Bank of Japan maintained its ultra-loose monetary policy on Friday and downgraded its view on inflation in a fresh blow to its long-held 2% price goal, further complicating the central bank’s path to rolling back its crisis-era stimulus. Markets are on the lookout for clues from BOJ Governor Haruhiko Kuroda’s post-meeting briefing on how long the central bank could hold off on whittling down stimulus given recent disappointingly weak price growth. As widely expected, the Bank of Japan kept its short-term interest rate target at minus 0.1% and a pledge to guide 10-year government bond yields around zero%.

The move contrasts with the European Central Bank’s decision to end its asset-purchase program this year and the U.S. Federal Reserve’s steady rate increases, which signaled a break from policies deployed to battle the 2007-2009 financial crisis. “Consumer price growth is in a range of 0.5 to 1%,” the BOJ said in a statement accompanying the decision. That was a slightly bleaker view than in the previous meeting in April, when the bank said inflation was moving around 1%. The BOJ stuck to its view the economy was expanding moderately, unfazed by a first-quarter contraction that many analysts blame on temporary factors like bad weather.

He just likes the attention.

• Powell Orchestrates a Masterful Move (DDMB)

Federal Reserve Chairman Jerome Powell has taken the first steps in remaking the central bank in his “plain-English” image, which can only be a good thing for financial markets. Earlier this week, news leaked that the central bank was considering holding a press conference following each Federal Open Market Committee meeting instead of after every other one like it does now. The reports set off a mini-storm. Speculation rose the Fed would implement this new policy immediately, which could mean the central bank was considering accelerating the pace of interest-rate increases as soon as August. After all, investors had become accustomed to the Fed only making a major policy move at meetings followed by a press conference. Now, every meeting would be “live.”

But in a masterful move, Chairman Jerome Powell managed to confirm the policy while also putting financial markets at ease. Rather than announcing the change in the official statement outlining the Fed’s plan to raise its target for the federal funds rate for the seventh time since December 2015, Powell waited until the start of his press conference to drop the bomb, noting that the policy wouldn’t start until January. Here’s Powell’s reasoning: “My colleagues and I meet eight times a year and take a fresh look each time at what is happening in the economy and consider whether our policy needs adjusting. We don’t put our interest rate decisions on auto-pilot because the economy can always evolve in unexpected ways.

History has shown that moving interest rates either too quickly or too slowly can lead to bad economic outcomes. We think the outcomes are likely to be better overall if we are as clear as possible about what we are likely to do and why. To that end, we try to give a sense of our expectations for how the economy will evolve and how our policy stance may change. As Chairman, I hope to foster a public conversation about what the Fed is doing to support a strong and resilient economy. And one practical step in doing so is to have a press conference like this after every one of our scheduled FOMC meetings. We’re going to do that beginning in January. That will give us more opportunities to explain our actions and to answer your questions.

“..the unsustainable excesses of unprofitable debt created by suppressing interest rates..”

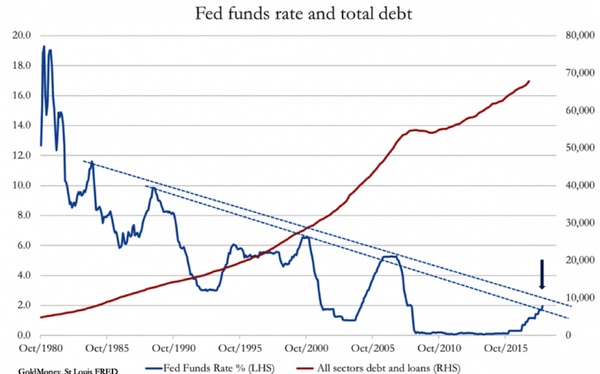

• The Fed Creates Problems For Itself (Macleod)

Since Hayek’s time, monetary policy, particularly in America, has evolved away from targeting production and discouraging savings by suppressing interest rates, towards encouraging consumption through expanding consumer finance. American consumers are living beyond their means and have commonly depleted all their liquid savings. But given the variations in the cost of consumer finance (between 0% car loans and 20% credit card and overdraft rates), consumers are generally insensitive to changes in interest rates. Therefore, despite the rise of consumer finance, we can still regard Hayek’s triangle as illustrating the driving force behind the credit cycle, and the unsustainable excesses of unprofitable debt created by suppressing interest rates as the reason monetary policy always leads to an economic crisis.

The chart below shows we could be living dangerously close to another tipping point, whereby the rises in the Fed Funds Rate (FFR) might be about to trigger a new credit and economic crisis. Previous peaks in the FFR coincided with the onset of economic downturns, because they exposed unsustainable business models. On the basis of simple extrapolation, the area between the two dotted lines, which roughly join these peaks, is where the current FFR cycle can be expected to peak. It is currently standing at about 2% after yesterday’s increase, and the Fed expects the FFR to average 3.1% in 2019. The chart tells us the Fed is already living dangerously with yesterday’s hike, and further rises will all but guarantee a credit crisis.

The view from Asia Times. Many people in that part of the world don’t understand the criticism.

• The Art of the Deal Worked On Sentosa Island (AT)

Some statesmen by their sheer force of personality and unorthodox ways of politicking arouse disdain among onlookers. US President Donald is perhaps the most famous figure of that kind in world politics today. No matter what he does, Trump attracts criticism. He evokes strong feelings of antipathy among a large and voluble swathe of opinion within half of America. The making of history in a virtual solo act on his part, which is the rarest of efforts, on Sentosa Island in Singapore on Tuesday and which the world watched with awe and disbelief, will be instinctively stonewalled. Half of America simply refuses to accept the positive tidings about him coming from Singapore.

The skeptics are all over social media pouring scorn, voicing skepticism, unable to accept that if the man has done something sensible and good for his country and for world peace, it deserves at the very least patient, courteous attention. The problem is about Trump – not so much the imperative need of North Korea’s denuclearization. But western detractors – ostensibly rooting for the “liberal international order” – will eventually lapse into silence because what emerges is that North Korean leader Kim Jong-un has enough to “bite” here in the deal that Trump is offering – broadly, a security guarantee from the US and the offer of a full-bodied relationship with an incremental end to sanctions plus a peace treaty.

Succinctly put, Trump has offered a deal that Kim simply cannot afford to reject. The ending of the US-ROK military exercises forthwith; Trump’s agenda of eventual withdrawal of troops from ROK; the lure of possible withdrawal of sanctions once 20% of the denuclearization process gets underway, or once the process becomes irreversible; Trump’s hint that he has sought assurances from Japan and the ROK that they will be “generous” in offering economic assistance to the reconstruction of North Korea; China’s involvement in the crucial process – these are tangibles.

The view from South Korea.

• Absence of “CVID” In Joint Statement? (Hani)

The absence of any reference to “complete, verifiable, and irreversible dismantlement” (CVID) of North Korea’s nuclear program in the joint statement reached at US President Donald Trump and North Korean leader Kim Jong-un’s June 12 summit in Singapore is being seen by some as a “negotiation failure” on the US’s part. But an analysis of Trump’s subsequent remarks – and a reading between the lines of the Pyongyang’s official announcement – suggests the US achieved practical gains in terms of a commitment from the North in exchange for the face-saving measure of avoiding use of the “CVID” term due to possible North Korean objections to it.

To begin with, the Singapore joint statement’s language marks a step forward from the Panmunjeom Declaration of Apr. 27 in terms of the final goal of denuclearizing the Korean Peninsula. The latest statement refers to Kim having “reaffirmed his firm and unwavering commitment to complete denuclearization of the Korean Peninsula.” While the Panmunjeom Declaration referred to “realizing, through complete denuclearization, a nuclear-free Korean Peninsula,” the new statement includes the additional reference to a “firm and unwavering commitment.”

From the reference to Kim’s “firm and unwavering” commitment to denuclearization, some experts are suggesting North Korea may have agreed to verification in addition to denuclearization – in other words, that the language may be a substitute for the “verifiable” part of the CVID approach demanded by Washington. “You could see them as having used the term out of awareness of North Korea’s discomfort with the word ‘verification,’” Handong Global University professor Kim Joon-hyung said after a Korea Press Foundation debate at Singapore’s Swissotel on June 13. “It may be fair to say North Korea made a definite commitment on the implementation and verification issues,” Kim argued.

“..while you can always count on Capitol Hill to make it incredibly easy for a president to deploy military personnel around the globe, giving that same office the power to bring troops home is a completely different matter. ”

• Optimism (Caitlin Johnstone)

Off the top of my head I have a hard time thinking of anything sleazier than smearing peace talks in order to gain partisan political points, but that has indeed been the theme of the last few days when it comes to the Singapore summit. Liberal pundits everywhere have been busily circulating the narrative that Kim Jong-Un “played” Trump by getting him to temporarily halt military drills in exchange for suspended nuclear testing. It was the most fundamental beginning of peace negotiations and a slight deescalation in tensions on the Korean Peninsula, but the way they talk about it you’d think Kim had taken off from Singapore in Air Force One with the keys to Fort Knox and Melania on his lap.

I’m not sure how far up the military-industrial complex’s ass one’s head needs to be to think that one single step toward peace is a gigantic take-all-the-chips win for the impoverished North Korea, but many of Trump’s political enemies are taking it even further. Senate Democrats have introduced a bill to make it more difficult for Trump to withdraw US troops from South Korea, because while you can always count on Capitol Hill to make it incredibly easy for a president to deploy military personnel around the globe, giving that same office the power to bring troops home is a completely different matter.

Surprising no one, MSNBC’s cartoon children’s program The Rachel Maddow Show took home the trophy for jaw-dropping, shark-jumping ridiculousness with an eighteen-minute Alex Jones impression claiming that the chief architect of the Korean negotiations was none other than (and if you can’t guess whose name I’m going to write once we get out of these parentheses I deeply envy your ignorance on this matter) Vladimir Putin. [..] This president is facilitating acts of military violence and dangerous escalations around the world; anyone who isn’t relieved by the possibility of one powder keg being defused in that rampage actually has a lot more faith in Trump’s competence than they’re pretending to.

Easy pickings.

• Blackstone Becomes Biggest Hotel & Property Owner in Spain (WS)

Private equity firm Blackstone, the undisputed king of property funds, continues to bet big on global real estate. In the last week it raised $9.4 billion for Asian real estate. It was also given the green light to acquire Spain’s biggest real estate investment fund (REIT), Hispania, for €1.9 billion. The move, after its prior acquisitions, will cement its position as Spain’s biggest hotel owner and fully private landlord. Hispania’s 46 hotels, added to Blackstone’s other hotels, will turn the PE firm into Spain’s largest hotelier with almost 17,000 rooms, far ahead of Meliá (almost 11,000), H10 (more than 10,000) and Hoteles Globales (just over 9,000).

It took Blackstone just three moves to become market leader. First, it acquired the hotel group HI Partners from struggling Spanish lender Banco Sabadell for €630 million in October 2017. Then, a month ago, it bought 29.5% of the hotel chain NH Hoteles, which is currently in the hands of the Chinese conglomerate HNA. Now, by raising its stake in Hispania from 16.75% to 100%, it will take up a dominant position in one of the world’s biggest tourist markets. With this deal, it will also expand its residential property empire in Spain. Blackstone has over 100,000 real estate assets controlled via dozens of companies. Those assets include a huge portfolio of impaired real estate assets, including defaulted mortgages and real estate-owned assets (REOs).

Blackstone also owns 1,800 social housing units, which it acquired from Madrid City Hall in a controversial deal brokered by the son of former Spanish prime minister José María Aznar and former Madrid mayor Ana Botella. Blackstone paid €202 million for the apartments in 2013; they are now estimated to be worth €660 million — a 227% return in just five year! Since its purchase of the properties, Blackstone has hiked rents on the flats by 49%. Those who can’t pay have been evicted. Blackstone also played a starring role in one of the world’s biggest real estate operations of 2017, in which it payed €5.1 billion for the defaulted loans Banco Santander inherited from its shotgun-acquisition of Banco Popular.

“..a dramatic drop in the number of Japanese properties available via Airbnb, from more than 60,000 this spring to just 1,000 on the eve of the law’s introduction.”

• ‘Tourism Pollution’: Japanese Crackdown Costs Airbnb $10 Million (G.)

It has become a familiar scene: tourists in rented kimonos posing for photographs in front of a Shinto shrine in Kyoto. They and other visitors have brought valuable tourist dollars to the city and other locations across Japan. But now the country’s former capital is on the frontline of a battle against “tourism pollution” that has already turned locals against visitors in cities across the world such as Venice, Barcelona and Amsterdam. The increasingly fraught relationship between tourists and their Japanese hosts has spread to the short-stay rental market. On Friday a new law comes into effect that requires property owners to register with the government before they can legally make their homes available through Airbnb and other websites.

The restriction has caused the number of available properties to plummet and has cost the US-based company millions of dollars. Thanks to government campaigns, the number of foreign tourists visiting Japan has soared since the end of a flat period caused by a strong yen and radiation fears in the aftermath of the 2011 Fukushima disaster. A record 28.7 million people visited last year, an increase of 250% since 2012. Almost seven million were from China, with visitors from South Korea, Taiwan, Hong Kong Thailand and the US taking the next five spots. By 2020, the year Tokyo hosts the Olympic Games, the government hopes the number will have risen to 40 million.

[..] Under the new private lodging law, which was supposed to address a legal grey area surrounding short-term rentals – known as minpaku – properties can be rented out for a maximum of 180 days a year, and local authorities are permitted to impose additional restrictions. The result has been a dramatic drop in the number of Japanese properties available via Airbnb, from more than 60,000 this spring to just 1,000 on the eve of the law’s introduction. The legislation has forced the firm to cancel reservations for guests planning to stay in unregistered homes after Friday and to compensate clients to the tune of about $10m.

A sign in Kyoto cautions against touching geishas, taking selfies, littering, sitting on fences and eating and smoking on the street. Photograph: Justin McCurry for the Guardian

Surprise!

• Greeks Are Least Satisfied In The EU (K.)

Greece is the least satisfied nation in the European Union, according to a Eurobarometer survey published Thursday. More specifically, the survey, conducted between March 17 and 28, showed that just 52% of Greeks said they were satisfied with their lives, compared to a 83% average for the 28-member bloc. Only 35% of Greeks surveyed said they were satisfied with the financial situation of their households, compared to 71% across the EU. A staggering 98% said the state of the country’s economy is bad while one in two Greeks said the country’s financial crisis is not over yet and that it will deteriorate even further. As for the country’s general situation, 94% said it is negative. Just 6% said the general situation was positive compared to the 51% average for EU member-states.

Even turkeys?!

• Turkey: Even Birds Need Our Consent To Fly In The Aegean (K.)

With Greece featuring prominently in Turkey’s election campaigning, Turkish Foreign Minister Mevlut Cavusoglu raised the tension a notch again Thursday, warning that not even a bird will fly over the Aegean without Ankara’s permission. Responding to criticism by Turkish ultra-nationalists that 18 islands have been “lost” to Greece in recent years, Cavusoglu said that since the crisis over the Imia islets in 1996 there have been no changes in the legal status of the Aegean. “Not only during our own rule, but before that there has been no change in the status of the Aegean. We will not allow this. Even in the case of research we will not give permission, not even to a bird in the Aegean,” he said during an interview with a Turkish radio station.

He went on to say that Turkey will make no concessions in the Aegean and Cyprus, and that Ankara will also begin gas exploration “around” the Eastern Mediterranean island. “We also have a drill,” he said. Turkey has vowed to stop Cyprus from drilling for gas and oil in its exclusive economic zone (EEZ), insisting there can be no development of the island’s natural resources without the participation of the Turkish Cypriots in the island’s Turkish-occupied north. “In the last few months we have prevented drilling and we drove the Italians away. We will not allow anyone to take away the rights of Turkish Cypriots,” he said. Cyprus government spokesman Prodromos Prodromou said that Nicosia will not be dragged into the “climate of tension” that Turkey is cultivating. He cited international law and said that Cyprus has an established EEZ. Moreover, he said the US, Russia and the European Union have all backed Cyprus’s rights.

Wonder what the fallout will be.

• Comey et al Just Made It More Difficult For Mueller To Prosecute Trump (Hill)

James Comey once described his position in the Clinton investigation as being the victim of a “500-year flood.” The point of the analogy was that he was unwittingly carried away by events rather than directly causing much of the damage to the FBI. His “500-year flood” just collided with the 500-page report of the Justice Department inspector general (IG) Michael Horowitz. The IG sinks Comey’s narrative with a finding that he “deviated” from Justice Department rules and acted in open insubordination. Rather than portraying Comey as carried away by his biblical flood, the report finds that he was the destructive force behind the controversy. The import of the report can be summed up in Comeyesque terms as the distinction between flotsam and jetsam.

Comey portrayed the broken rules as mere flotsam, or debris that floats away after a shipwreck. The IG report suggests that this was really a case of jetsam, or rules intentionally tossed over the side by Comey to lighten his load. Comey’s jetsam included rules protecting the integrity and professionalism of his agency, as represented by his public comments on the Clinton investigation. The IG report concludes, “While we did not find that these decisions were the result of political bias on Comey’s part, we nevertheless concluded that by departing so clearly and dramatically from FBI and department norms, the decisions negatively impacted the perception of the FBI and the department as fair administrators of justice.”

The report will leave many unsatisfied and undeterred. Comey went from a persona non grata to a patron saint for many Clinton supporters. Comey, who has made millions of dollars with a tell-all book portraying himself as the paragon of “ethical leadership,” continues to maintain that he would take precisely the same actions again. Ironically, Comey, fired FBI deputy director Andrew McCabe, former FBI agent Peter Strzok and others, by their actions, just made it more difficult for special counsel Robert Mueller to prosecute Trump for obstruction. There is now a comprehensive conclusion by career investigators that Comey violated core agency rules and undermined the integrity of the FBI. In other words, there was ample reason to fire James Comey.

Many heads will roll at the Bureau.

• A Closer Look At Extreme FBI Bias Revealed In OIG Report (ZH)

As we digest and unpack the DOJ Inspector General’s 500-page report on the FBI’s conduct during the Hillary Clinton email investigation “matter,” damning quotes from the OIG’s findings have begun to circulate, leaving many to wonder exactly how Inspector General Michael Horowitz was able to conclude: “We did not find documentary or testimonial evidence that improper considerations, including political bias, directly affected the specific investigative actions we reviewed” We’re sorry, that just doesn’t comport with reality whatsoever. And it really feels like the OIG report may have had a different conclusion at some point.

Just read IG Horowitz’s own assessment that “These texts are “Indicative of a biased state of mind but even more seriously, implies a willingness to take official action to impact the Presidential candidate’s electoral prospects.” Of course, today’s crown jewel is a previously undisclosed exchange between Peter Strzok and Lisa Page in which Page asks “(Trump’s) not ever going to become president, right? Right?!” to which Strzok replies “No. No he’s not. We’ll stop it.” Nevermind the fact that the FBI Director, who used personal emails for work purposes, tasked Strzok, who used personal emails for work purposes, to investigate Hillary Clinton’s use of personal emails for work purposes. Of course, we know it goes far deeper than that…

The Wall Street Journal’s Kimberley Strassel also had plenty to say in a Twitter thread:

1) Don’t believe anyone who claims Horowitz didn’t find bias. He very carefully says that he found no “documentary” evidence that bias produced “specific investigatory decisions.” That’s different

2) It means he didn’t catch anyone doing anything so dumb as writing down that they took a specific step to aid a candidate. You know, like: “Let’s give out this Combetta immunity deal so nothing comes out that will derail Hillary for President.”

3) But he in fact finds bias everywhere. The examples are shocking and concerning, and he devotes entire sections to them. And he very specifically says in the summary that they “cast a cloud” on the entire “investigation’s credibility.” That’s pretty damning.

4) Meanwhile this same cast of characters who the IG has now found to have made a hash of the Clinton investigation and who demonstrate such bias, seamlessly moved to the Trump investigation. And we’re supposed to think they got that one right?

5) Also don’t believe anyone who says this is just about Comey and his instances of insubordination. (Though they are bad enough.) This is an indictment broadly of an FBI culture that believes itself above the rules it imposes on others.

6) People failing to adhere to their recusals (Kadzik/McCabe). Lynch hanging with Bill. Staff helping Comey conceal details of presser from DOJ bosses. Use of personal email and laptops. Leaks. Accepting gifts from media. Agent affairs/relationships.

7)It also contains stunning examples of incompetence. Comey explains that he wasn’t aware the Weiner laptop was big deal because he didn’t know Weiner was married to Abedin? Then they sit on it a month, either cuz it fell through cracks (wow) or were more obsessed w/Trump

8) And I can still hear the echo of the howls from when Trump fired Comey. Still waiting to hear the apologies now that this report has backstopped the Rosenstein memo and the obvious grounds for dismissal.

Home › Forums › Debt Rattle June 15 2018