Detail of a fresco from the House of the Tragic Poet, Pompeii, 2nd century BC

Now coming to an AstraZeneca place near you.

• Sputnik V Likely Provides COVID Immunity For 2 Years, Pfizer For Months (Sp.)

Russia’s vaccine showed efficacy of over 95 percent during Phase III trials. According to Kirill Dmitriev, CEO of the Russian Direct Investment Fund (RDIF), the organisation that invested in the development of Russia’s inoculation, over 50 countries have already ordered 1.2 billion doses of Sputnik V. The Sputnik V vaccine, developed by Russia’s Gamaleya Research Institute, will likely provide immunity from COVID-19 for two years, while the inoculation developed by Pfizer will shield for 4-5 months, said the institute’s director Alexander Gintsburg. Gintsburg emphasised, however, that this data needs to be checked during experiments.

“The method used in Sputnik V was used in the vaccine against Ebola and experimental data has proved that it provides immunity from the disease for a minimum of two years, but it could be more. I don’t know how long Pfizer’s vaccine will protect from infection”, Gintsbur said. The director of Gamaleya Research Institute also said there is a 96 percent chance that people who have received the Sputnik V jab won’t get sick with COVID-19. Only 4 percent of people who got the vaccine might get sick, Gintsburg said, but stressed that this would be a mild case of the disease that will not affect the lungs. Most likely an individual will have a cough, sniffles, and minor temperature.

Both Sputnik and Pfizer vaccines showed efficacy rates of 95 percent. However, two UK National Health Service workers who received the Pfizer inoculation had allergic reactions to the jab, which prompted UK’s health department to issue a warning that people with a history of allergic reactions should not receive Pfizer’s vaccine. Alexander Gintsburg previously said that the Sputnik V vaccine can be used by people with allergies.

Excellent background.

“The possible reason for 62% efficacy of AstraZeneca’s full dose regiment is that immunity to chimpanzee adenoviral vector from the 1st shot makes 2nd shot not effective. #SputnikV addresses this issue by using two different human adenoviral vectors for two shots (92% efficacy)”

• Russian Cooperation Saves British Vaccine (MoA)

In late November Debs is dead and I wrote about the ruthless vaccine competition. The cause were the ambiguous results of the non-profit AstraZeneca vaccine trials which led to delighted criticism from those who prefer commercial vaccine suppliers. The good news today is that cooperation between vaccine developers is still possible and can lead to better results. As Debs had opined: “In the real world that means if the AstraZeneca vaccine is more than 60% efficacious (which is better than any flu vaccine – 95% is new big pharma BS IMO) and has no major side effects (one case of MS tells us nothing for the reason I outlined above), then it will be that or nothing for a sizeable slab of the world’s population. If everyone falls for big pharma’s transparent attempt to stop this possible vaccine in its tracks, prior to testing completion, then that will mean no vaccine for billions of our fellow humans, so rather than joining in the big pharma sabotage, it makes better sense to consider that vaccine more objectively than de Noli, that Harvard minion of corporations seems to do.”

I agreed with that and discussed the most likely reason why the AstraZeneca vaccine did not create a higher efficacy: “The AstraZeneca vaccine uses an adenovirus as ‘vector’ to deliver a DNA sequence that human cells then use to create one specific (but harmless) SARS-CoV-2 protein. The immune system will then learn to attack that protein. Afterwards it should be able to protect against SARS-CoV-2 infections. … In order to safeguard against cases where an already existing immunity to human adenoviruses may impede inoculation AstraZeneca is using a chimpanzee-originated version of an adenovirus as a vector. The Russian Sputnik V vaccine, hyped by Prof. de Noli on RT, uses two doses with different human adenoviruses (Ad-26, Ad-5) as vectors to increase the chance of inoculation.

Other vaccine developers, CanSino Biologics and Johnson & Johnson, are also using adenovirus vectors. Sinopharm’s vaccine uses an inactivated SARS-CoV-2 virus. AstraZeneca found by chance that its vaccine works best when the first dose is smaller than the second one. Vector immunity can explain why this is the case. A first high dose will create some immunity against the SARS-CoV-2 virus but also some immunity against the vector virus, the chimpanzee-originated adenovirus. When a first high dose has trained the immune system to fight the vector virus the second ‘booster’ vaccine dose using the same vector will become inefficient. A lower first dose can make sure that the second higher dose is not prematurely defeated by vector immunity but can still do its work.

Unbeknownst to me the Russian developers of the Sputnik V vaccine had come to the same conclusion: Sputnik V @sputnikvaccine – 13:10 UTC · Nov 23, 2020 “The possible reason for 62% efficacy of AstraZeneca’s full dose regiment is that immunity to chimpanzee adenoviral vector from the 1st shot makes 2nd shot not effective. #SputnikV addresses this issue by using two different human adenoviral vectors for two shots (92% efficacy). They had offered AstraZeneca to cooperate with them: Sputnik V @sputnikvaccine – 2:41 PM · Nov 23, 2020 “Sputnik V is happy to share one of its two human adenoviral vectors with @AstraZeneca to increase the efficacy of AstraZeneca vaccine. Using two different vectors for two vaccine shots will result in higher efficacy than using the same vector for two shots.” Today the Sputnik V website announced that AstraZeneca has accepted the proposal. Trials will start immediately.

How many Australians are still stuck abroad after 11 months?

• No Need For Vaccine This Year: Australia’s Chief Medical Officer (Yu)

Acting Chief Medical Officer Paul Kelly says Australia’s success against coronavirus means, unlike other countries, we can wait for full vaccine approvals. Australia’s top doctor says news of the U.S. drug regulator granting emergency use of the Pfizer vaccine – like the UK and Canada have also recently done – is not necessary in Australia. “We don’t need any vaccine this year,” Kelly told reporters in Canberra on Saturday. “Other countries are in far different state than us and they should be prioritised.” Australia will wait for the Therapeutic Goods Administration—the national drug regulator—to run through its own approvals of the Pfizer vaccine with the expectation it will be distributed in early 2021.

He highlighted the nation’s success at controlling virus transmission. “Today is eighth day in a row we’ve not had any community transmission,” Kelly said. “That’s the first time we’ve been able to say that since February.” This is compared with the fact that Friday was the most deadly day of the virus yet, with more than 13,000 deaths and skyrocketing infections, Kelly said. The emphasis right now is on having an impenetrable hotel quarantine system. “Whilst we’re concentrated on bringing Australians home… we have to make sure absolutely that our hotel quarantine system is the very best it can be,” Kelly said.

Feels a bit much like guesswork.

• Global Economy To Contract By 5.6% This Year Due To Pandemic – UN (RT)

The volume of global trade is set face the sharpest decline since the end of the global financial crisis, falling as much as 5.6 percent this year, the UN Conference for Trade and Development (UNCTAD) predicts. The figure, announced by the agency earlier this week, is more optimistic than its previous forecast, which expected global trade to contract by nine percent year-on-year. The previous largest decline was seen in 2009, when global merchandise trade took a 22-percent nosedive. However, the UNCTAD downgraded its forecast for the service sector, which was hit hard by a steep decline in travel, transport and tourism activity during the pandemic.

The troubled sector is on path to fall by a staggering 15.4 percent to levels last seen in the 1990s, according to nowcasts – data-led projections for the immediate future – from UNCTAD’s 2020 Handbook of Statistics. Even following the previous crisis, services trade was down by less than 10 percent. The pandemic has also transformed business as usual in 2020, the UN agency said, adding that it had to adjust statistics methods to provide up-to-date figures on the economic fallout. “Unlike previous years however, the models that nowcast international trade and GDP had to grapple with some of the most unusual circumstances in living memory,” said UNCTAD’s chief statistician, Steve MacFeely.

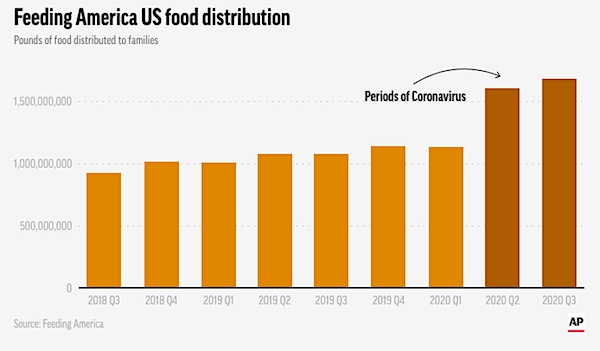

“Feeding America handed out 4.2 billion meals from March through October, the most ever.”

• Millions Of Working-Poor Americans Forced To Turn To Food Banks (ZH)

For the first time, millions of Americans waited in food bank lines this year, unlike anything seen since the Great Depression of the 1930s. According to AP, as the pandemic rages on, with more than 20 million still claiming unemployment benefits, food banks are dishing out more meals than ever. The one place millions of Americans found themselves this year, as readers may recall, really starting in mid-March, have been food bank lines. We highlighted this phenomenon sweeping across the country as the pandemic wrecked the working poor as they grappled with food insecurity. Among some of the most memorable sights this year, reminiscent of the Depression-era, were mile-long food bank lines.

Huge traffic jams captured by civilian drones documented large lines in San Antonio, Texas to Toledo, Ohio to Pittsburgh, Pennsylvania to Orlando, Florida, where thousands of vehicles carrying hungry people waited for care packages. Feeding America, a nationwide network of more than 200 food banks, was overwhelmed with demand as 20% of the organization’s food banks were at severe risk of running out of food earlier this year Demand at food banks has been so high, that Feeding America handed out 4.2 billion meals from March through October, the most ever. The organization reported a 60% average increase in food bank users during the pandemic – and at least 30% are first-timers. Data from Feeding America showed 181 food banks in its network distributed nearly 57% more food in the third quarter than the same period in 2019.

Estimates from the food bank suggest 1 in 6 Americans, from 35 million in 2019 to more than 50 million by the end of this year, will have food insecurity problems. The problem is worse for children – nearly 1 in 4 will go hungry as the pandemic deeply scarred the economy. Shockingly, Feeding America found that 1 in 5 residents in Mississippi, Arkansas, Alabama, and Louisiana could not put food on the table.

“The Silicon Valley tech giants, who in the run-up to the election censored and suppressed the story about Joe Biden’s family business deals overseas – that later turned out to be accurate – and slapped “disputed” warnings on Trump’s claims of electoral fraud the way they never did on ‘Russiagate,’ are now openly censoring any notion that 2020 wasn’t perfectly legal. You’re now forbidden to say that. Soon you won’t be allowed to think it.”

• SCOTUS Had One Last Chance To Keep The American Republic Together (Malic)

By washing its hands of responsibility to hear the Texas challenge to the 2020 presidential election, the nine Justices of the US Supreme Court may have sealed the country’s fate and made a kinetic civil war much more likely. On Friday, the highest court in the land decided that Texas “lacked standing” to challenge the conduct of elections in Georgia, Michigan, Pennsylvania and Wisconsin under Article 3 of the US Constitution. Yet the article in question explicitly states that the SCOTUS will be the original jurisdiction in “Controversies between two or more States; – between a State and Citizens of another State; – between Citizens of different States,” among other things. Contrary to media reports, Texas did not seek to “overturn” the election of Democrat Joe Biden.

The motion filed by Attorney General Ken Paxton very explicitly called for the court to order the state legislatures thereof to seat the electors, as is their constitutional prerogative. Yes, those legislatures are majority Republican, but nothing guaranteed they would actually back President Donald Trump. After all, Georgia has a Republican governor and secretary of state, and both declared the election clean as a whistle, brushing off all evidence of alleged irregularities. The very same media that brayed for the past four years about how the 2016 election was somehow tampered with by Russia – never offering any evidence for that – have declared the 2020 one pure as driven snow, the most secure in history, perfect in every way.

In what was surely a massive coincidence, it even happened to exactly mirror the 2016 result, with Biden getting 306 electoral college votes to Trump’s 232. The Silicon Valley tech giants, who in the run-up to the election censored and suppressed the story about Joe Biden’s family business deals overseas – that later turned out to be accurate – and slapped “disputed” warnings on Trump’s claims of electoral fraud the way they never did on ‘Russiagate,’ are now openly censoring any notion that 2020 wasn’t perfectly legal. You’re now forbidden to say that. Soon you won’t be allowed to think it. In America, the country that invented the constitutional amendment guaranteeing the freedom of speech and thought!

Democrats and their allies in the media and Silicon Valley were eager to declare the Texas motion “seditious.” One influential House Democrat said any Republican backing the lawsuit was “engaging in rebellion against the United States” and should be stripped of their office under the 14th Amendment, originally written to justify disenfranchising the Confederates after 1865. The irony here is that the Supreme Court could have actually prevented another civil war had it chosen to hear the Texas lawsuit, and then ruled against it on non-pretextual grounds. That, at least, would have sent the message to Trump supporters that the System works, and that they should continue to place their trust in it. There would always be the possibility of a rematch in the 2022 midterms or 2024.

“I am not sure when it became acceptable for politicians to expressly refuse to state their intentions and policies until after they are elected.”

• Reporters Disclosing Embarrassing Comments From Joe Biden (Turley)

We have been discussing the open bias shown by the media in the last four years. It is not clear if we can regain the ground lost for journalism as even journalism professors call for the rejection of objectivity in favor of advocacy. This has included shielding Joe Biden from any challenging questions during the recent election. That includes the news blackout on reporting on the Hunter Biden scandal, the subject of my column today in the Hill. CNN’s April Ryan personifies this trend. Even as the media is facing widespread criticism for burying the Hunter Biden story (and is now doing the same with the Swalwell scandal), Ryan lashed out at confidential sources responsible for leaking a recording of Joe Biden making embarrassing comments about the “defund the police” movement.

Ryan is demanding to know who is responsible for allowing the embarrassing comments to be made public despite her past enthusiastic discussion of such leaks against President Donald Trump. President-elect Biden lashed out at the “defund the police” movement this week in a meeting with civil rights leaders, stating “That’s how they beat the living hell out of us across the country, saying that we’re talking about defunding the police. We’re not.” The recording was obtained by The Intercept. What I felt was most notable was that Biden said that he would not share his plans for reforming the police until after the Georgia runoff to avoid any backlash from voters. While NBC paraphrased the quote as Biden warning “about getting ‘too far ahead of ourselves’ with critical Senate runoff elections in Georgia on Jan. 5,” it was more direct and disturbing than that.

Biden stated: “Just think to yourself and give me advice whether we should do that before Jan. 5th, because that’s how they beat the living hell out of us across the country, saying that we’re talking about defunding the police.” It was precisely what Biden did with regard to packing the Supreme Court. He expressly refused to tell voters whether he would support such a plan because it might cost him votes. The key issue in the Georgia runoff is whether, once in control of the Senate, the Democrats would move forward on what are viewed as radical proposals, including sweeping police reforms. Biden’s answer again is not to tell the voters what they have planned. As I mentioned yesterday, I am not sure when it became acceptable for politicians to expressly refuse to state their intentions and policies until after they are elected.

Biden has now twice said that he does not want voters to know in case it might cost votes. There are a host of issues raised by Biden’s remarks, but Ryan lashed out at the use of such tapes, which are standard in journalism; “I asked an incoming White House source was the meeting contentious with civil rights leader and @JoeBiden and the answer was ‘no’. A rights leader at the meeting says @JoeBiden was passionate,” Ryan tweeted. “The question is who taped this meeting and why? What is the agenda?”

We’re not allowed to find out what went on with Balding and his story.

• How NBC News Helped the Biden Campaign Ruin an Innocent Man (PJM)

Hunter Biden was the October Surprise that wasn’t. A report so explosive, so potentially damaging, so dangerous for national security that it should have destroyed Joe Biden’s bid for the White House. In any other election, fleets of investigative reporters would have been unleashed to verify the claims in the report. Instead, in the ultimate expression of Trump Derangement Syndrome, a major media company set out to personally destroy the man who they thought put the report together and thereby discredit the report to the point that the entire media complex in America took turns ridiculing the story instead of investigating it. The results could have dire implications for national security. But hey, at least they got rid of the Bad Orange Man.

The week before Election Day, RedState published a series of articles about Joe Biden and Hunter Biden, based on a 64-page report from researchers who combed public records to reveal how compromised the Biden family is to the Chinese Communist Party (CCP). You can read Part 1 here. The four-part series lays out deeply disturbing connections between Hunter Biden, Joe Biden, John Kerry, and the CCP. The pro-democracy news outlet Apple Daily, based in Hong Kong, used an earlier 40-page version of the report and was the first to report on its findings. In response, NBC News launched a coordinated attack on one of the publishers of the report, Christopher Balding. This attack had all the appearances of being coordinated with the Biden campaign and it had the effect of benefiting the CCP.

The report goes into intimate detail about the deep connections between the Biden family and the CCP. In fact, Hunter Biden’s company BHR is listed as a subsidiary of the Bank of China, owned by the CCP. Balding, who taught English for several years in China before moving to Vietnam to teach there for a couple of years, appeared on a Facebook Live event for the Oregon Republican Party (ORP) on October 30 to talk about his report. In that event, he said, “Hunter Biden started going to China, the first trips that we picked up were shortly before Biden became vice president in 2008, and there was a steady stream of visits to Beijing over time. I would say it was probably almost once a year to China during that time. He was meeting with individuals and institutions that would ultimately become the investors in the BHR Fund.”

“The first thing to note,” Balding said, “is this appears to significantly predate 2013 going back to probably 2008, that’s when you really see the groundwork being laid for this. I think another thing that is very important to note is that all of the individual institutions that are surrounding everything’s going on here … are very closely linked to the state, whether it is with a quasi-state type of organizations, whether it is state-owned banks, whether it is part of the actual government, everyone that you’re seeing here is very closely linked to the state. A lot of people that you’re seeing are also very closely tied to Chinese organizations that are known by the U.S. government and other governments to be intelligence, their cover institutions for Intel, and until an influence operation, and what I mean by that is China has a lot of very innocuous-sounding institutional or organizational names, you know, one of the ones that pops to mind is the Chinese Council for the Promotion of International Trade.

“Such challenges and concerns are brought to the courts where we can have disputes resolved without violence in a constitutional system.”

• Pascrell Seeks To Block 120 House Republicans From Being Seated (Turley)

It appears that Rep. Bill Pascrell (D., NJ) has a serious problem with Republicans going to court. We recently discussed Pascrell’s absurd effort to disbar roughly two dozen Republican lawyers for challenging the results of the 2020 election. Now Pascrell is declaring that 120 House Republicans signing a “Friend of the Court brief” (or amicus brief) is tantamount to supporting a rebellion against the United States and that they should be blocked from taking their seats in Congress. I previously denounced Pascrell for his “dangerous form of demagoguery.” This latest call shows the demagoguery has reached a level of utter delusion.

From the outset of the Texas lawsuit, I stated that it was virtually guaranteed to fail on standing. It did fail last night. However, courts are where we take cases alleging such injuries. Tens of millions of American believe that the election was not fair, including many Democratic voters. Roughly 70 percent of Republican voters believe the election was stolen. Such challenges and concerns are brought to the courts where we can have disputes resolved without violence in a constitutional system. Rather than welcome such review, Democrats have launched a scorched earth campaign, including an abusive campaign of harassment and abuse by the Lincoln Project. These efforts notably began shortly after Biden was declared the presumptive winner of the election and before any challenges were actually ruled upon by the courts.

Speaker Nancy Pelosi has also fueled such reckless rhetoric, declaring that the Republicans are “subverting the Constitution by their reckless and fruitless assault on our democracy which threatens to seriously erode public trust in our most sacred democratic institutions, and to set back our progress on the urgent challenges ahead.” Pascrell’s move against his colleagues mirrors language in the response of Pennsylvania’s Attorney General Josh Shapiro calling the Texas lawsuit “seditious.” Seeking judicial review is the antithesis of sedition or rebellion. It is working within our constitutional system for a legal opinion on the merits of a challenge. These litigants have complied with court orders, as has President Trump.

On Twitter, Pascrell declared: “Stated simply, the men and women who would act to tear the United States Government apart cannot serve as Members of the Congress. These lawsuits seeking to obliterate public confidence in our democratic system by invalidating the clear results of the 2020 presidential election undoubtedly attack the text and the spirit of the Constitution, which each Member swears to support and defend.”

Blackstone.

• GOP Megadonor Celebrates His Profits From “Huge Increases In Rents” (DP)

The world’s largest private equity firm has bankrolled campaigns against rent control and been accused by the United Nations of fueling a global housing crisis. Now, as millions are threatened with eviction during the pandemic, Blackstone’s top executive is openly bragging that the firm is making huge profits off of rent increases. At the Goldman Sachs’ Financial Services Conference on December 9, Blackstone’s billionaire CEO Stephen Schwartzman boasted that after the 2008 financial crisis, his firm was able to cash in on the mortgage crisis. At the time, the company was able to buy up foreclosed homes and convert them into rental properties subsequently plagued by accusations of dilapidation and excessive fees — all while it received a big financial boost from the government. Schwartzman, a top Republican donor and close ally of President Trump, indicated his firm is positioning itself for a similar jackpot.

“You always have winners and losers — Blackstone was a huge winner coming out of the global financial crisis and I think something similar is going to happen,” he said. Noting that about half of his private equity firm’s revenues are now from real estate, Schwarzman added: “We’re the largest owner of real estate in the private world. And that asset class has boomed with huge increases in rents, almost no occupancies, [and] rent collections from almost everyone.” Blackstone recently made billions selling off its single-family residential rental business — but in the last year, the company has been buying new stakes in residentialrental properties. In 2018 and 2020, it gave millions to political groups that successfully fought to defeat rent control ballot initiatives in California, where Blackstone has significant real estate investments.

Is there any paper money left in Sweden?

• Sweden Considers E-krona Amid Rapid Growth Of Cash-free Transactions (RT)

Swedish authorities have announced plans for a step-by-step replacement of the traditional krona with a digital equivalent, signaling a potential shift away from paper money in one of the world’s most cashless societies. A detailed review of the possibility was launched earlier this week, and is expected to be completed by the end of November 2022, according to the country’s financial markets minister, Per Bolund. It followed the launch of a pilot Central Bank Digital Currency (CBDC) earlier this year. The ministry reportedly set up a committee to oversee the review headed by Anna Kinberg Batra, a former chairwoman of the central bank’s finance committee. Sweden is among the world’s pioneers when it comes to integrating a digital currency into a national financial system.

Earlier this year, the Riksbank, the country’s central bank, launched a pilot project to introduce an electronic krona based on the same blockchain technology that underpins digital currencies like bitcoin. The government will officially launch e-krona as soon as the review is completed. “Depending on how a digital currency is designed and which technologies are used, it can have large consequences for the entire financial system,” Bolund told Bloomberg, stressing that “it’s crucial that the digitalized payments market functions safely, and that it’s available to everybody.” The use of paper money in Sweden has significantly declined in recent years, with that trend strongly reinforced during the peak of the coronavirus pandemic. The national mobile payment system, Swish, has bolstered the move since it was introduced in 2012 by Sweden’s six largest banks.

The Brexit stories will increasingly come in fast and furious for the rest of the year.

• UK Ministers Warn Supermarkets To Stockpile Food On No-deal Brexit Fears (R.)

British ministers have warned supermarkets to stockpile food amid possibilities of a no-deal Brexit, with shortages feared as talks with the European Union remain deadlocked, The Sunday Times newspaper reported. UK Prime Minister Boris Johnson is set to take control of planning if Britain opts for no deal and will chair an exit operations committee to prepare the response, the newspaper reported. Ministers have told suppliers of medicines, medical devices and vaccines to stockpile six weeks’ worth at secure locations in the United Kingdom, the report added.

How about his own government?

• Australian MP Calls On Trump To Pardon Assange Before Leaving WH (RT)

Australian MP George Christensen called on Donald Trump to pardon WikiLeaks founder and fellow Australian citizen Julian Assange while he still can, as it seems to be the US president’s last month in the Oval Office. Christensen – a member of the Liberal National Party who represents Dawson, Queensland – launched a petition this week encouraging the president to pardon the journalist, who faces up to 175 years in prison for publishing classified material. Christensen also appeared on Sky News Australia to make his case. He told the network that Assange “has been a target of the Democrats,” noting that his persecution started under the administration of former president Barack Obama.

“I mean Hillary Clinton hates his guts, obviously, for exposing who the real Hillary was, and you’ve had a war on Assange by the Democrats and the deep state,” he claimed, pointing out that projected president-elect Joe Biden has called Assange a criminal and a “hi-tech terrorist.” The MP argued that a pardon is “one way that Donald Trump can stand up for free speech,” and against the Democratic establishment, and would also allow him to “poke the deep state in the eye.” At the center of the United States’ “great document of democracy that is the United States Constitution” is free speech and freedom of the press, Christensen declared, before concluding, “So I’m hoping that he will pardon Julian Assange. It’s the right thing to do.”

During his Sky News appearance, Christensen also sided with Trump’s allegations of 2020 election voter fraud, claiming that the Democrats have “successfully stolen an election from Donald Trump.” Also on Saturday, Stella Morris, Assange’s partner and the mother of his children, told the Australian government in her own Sky News Australia interview to “pick up the phone and speak to its closest allies” in order to get Assange freed.

We try to run the Automatic Earth on donations. Since ad revenue has collapsed, you are now not just a reader, but an integral part of the process that builds this site.

Click at the top of the sidebars for Paypal and Patreon donations. Thank you for your support.

Support the Automatic Earth in virustime, election time, all the time. Click at the top of the sidebars to donate with Paypal and Patreon.