Vincent van Gogh Ward in the hospital in Arles 1889

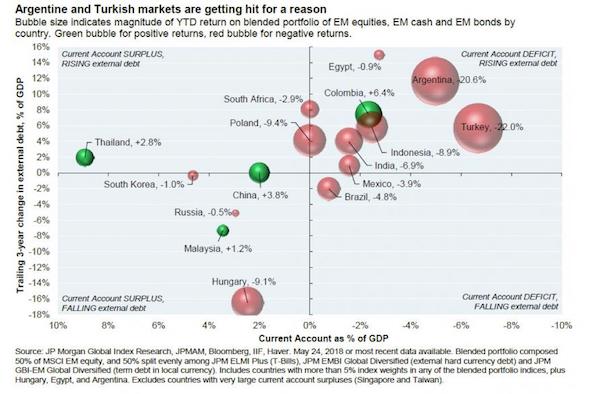

Turkey was already in dire straits, like all EM’s after the dollar strenghtened and the Fed hiked rates. Difference is: Turkey is the most vulnerable of them all.

• Why Has The Turkish Lira Slumped To A Record Low? (Ind.)

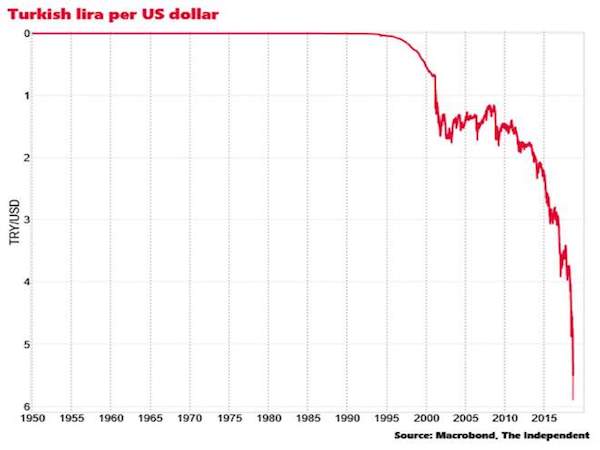

The Turkish lira has slumped to a record low against the US dollar this week. On Friday it was down by as much as 17% before recovering slightly. At one stage on Friday afternoon one dollar bought 6.9 lira. In January a dollar bought just 3.7 units of the Turkish currency. That means it has lost around 44% of its value against the dollar this year. The lira is now the world’s worst performing currency in 2018, overtaking crisis-hit Argentina. And things have got worse very rapidly this month. The currency has experienced 12 straight days of decline. The currency rout has hit the country’s bond market. The yield on 10-year Turkish debt has jumped close to 20%, making it much more expensive for the Ankara government to borrow.

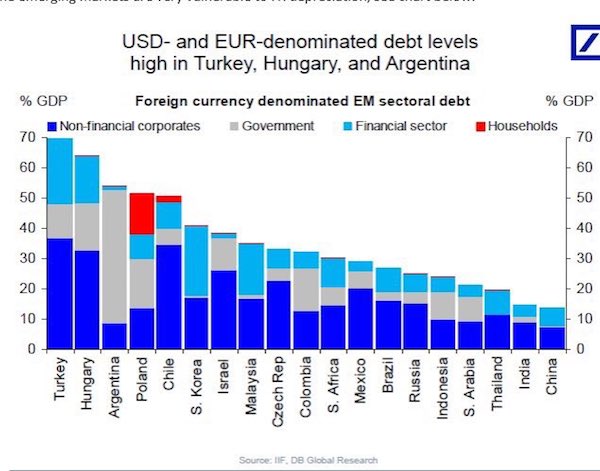

There is also concern about the exposure of European banks such as BNP Paribas, UniCredit and BBVA to borrowers in Turkey. Their share prices were down around 3% on Friday. If Turkish borrowers are not hedged against the collapsing lira the fear is that they could default on their foreign currency loans, forcing European banks to make expensive loan write-offs. For the same reason Turkish banks could also be in trouble given the amount of foreign currency lending they have undertaken.

[..] The proximate cause is a diplomatic row with the US over the detention in Turkey of US pastor Andrew Brunson. Brunson was arrested in October 2016 accused of aiding an organisation which the Turkish government says was behind a failed coup attempt that year. Last month Donald Trump called Brunson’s detention “a total disgrace” and the Washington administration announced last week that Turkey’s duty-free access to the US market is being reviewed, which could hit $1.66bn of annual Turkish imports.

On Friday Trump also tweeted that he was doubling steel tariffs on Turkish steel imports, writing: “Our relations with Turkey are not good at this time!” But there are underlying causes too. Investors’ confidence in the economic competence of the Turkish authorities has been eroding for some time. The country has a large current account gap, equivalent to 7% of GDP last year. That means the economy is heavily reliant on foreign money inflows. Inflation has also soared to 15%, three times the central bank’s 5% target. Such figures are not particularly unusual for an emerging market economy like Turkey, but President Recep Tayyip Erdogan’s slide into capricious authoritarianism has made investors doubt whether he can handle the crisis in a rational way.

Turkey has simply borrowed too much.

• Why Turkey Is Doomed In Two Charts (ZH)

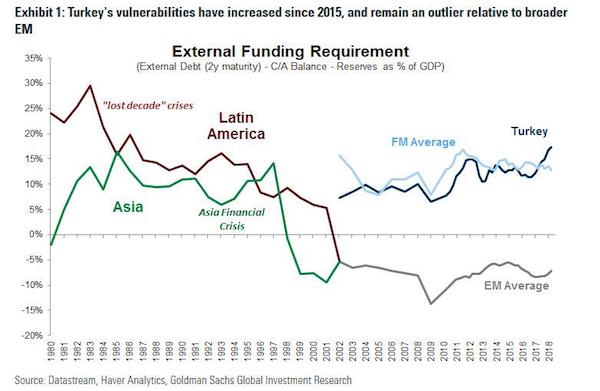

Goldman’s Caesar Maasry this morning [..] notes the biggest vulnerability staring both Emerging and Frontier Markets, namely their external funding needs, and notes that while EM funding needs are completely covered by reserves (meaning the likelihood of USD debt crises is extremely limited), “Turkey’s funding needs are more like Frontier Markets, and in the same ballpark as the needs of Latin America economies in the 1980s and Asia in the 1990s.”

He then notes that floating vs. fixed exchange rates are an important difference compared with the EM crises of yesteryear, but adds that the starting point for Turkey’s recent volatility is that these USD funding needs are extremely significant, much more so than other EMs, and are also the reason for why the market has finally started paying attention to Turkey as a result of foreign bank exposure to Turkey, because should these foreign inflows stop, the entire Turkish economy is in danger of a sudden freeze.

And, as the chart below shows, while Turkey is technically considered an emerging market, where it makes a sharp break with convention is that its external funding need is greater than the average Frontier Market. Should these inflows stop, as a result of a loss of confidence in the country, all bets are off.

But wait there’s more, because as JPMorgan showed 2 months ago, Turkey faces a secondary threat in addition to its gaping current account deficit: a massive and growing debt load. If foreign buyers of Turkish debt go on strike, or if Turkey is unable to rollover near-term maturities, watch how quickly the currency crisis transforms into a broad economic collapse.

They’re going to make it all about the 2016 ‘coup’. That fires up the people.

• Turkish Lawyers Want To Arrest US Troops at Incirlik Air Base (Ditz)

A group of lawyers aligned to Turkish President Recep Tayyip Erdogan has filed formal charges against a number of US Air Force officers who are stationed at Turkey’s Incirlik Air Base. The complaint accuses them of having ties to terrorist groups, and of being in league with the banned Gulenist organization. Since the failed 2016 military coup, Erdogan has blamed cleric Fethullah Gulen for plots against him, and has been targeting any and all perceived enemies, accusing them of being in league with Gulen. This is the first time US troops, let alone US troops inside Turkey, have faced such charges.

Analysts say they believe the charges are a direct response to last week’s imposition of sanctions against two Turkish cabinet members by the US. The sanctions were imposed in protest of Turkey’s detention of American pastor Andrew Brunson, who has been held since 2016 on accusations of Gulenist ties. The criminal complaint names Cols. John C. Walker, Michael H. Manion, David Eaglen, David Trucksa, Lt. Cols. Timothy J.Cook, Mack R. Coker, and Sgts. Thomas S Cooper and Vegas M. Clark. Air Force officials said they were “aware” of the complaint but would not comment beyond that.

The Air Force also praised their relationship with “our Turkish military partners,” though as US-Turkey tensions continue to rise, as they have in recent years, it’s not at all clear how long the US will be able to use the Incirlik base for its military operations in the Middle East. The lawyers, on the other hand, demanded the government halt all flights out of Incirlik to keep the US officers from fleeing the country, and called on the government to raid the base and seek to capture the officers.

They’re going to appeal until the cows come home.

• US Jury Orders Monsanto To Pay $290mn To Cancer Patient Over Weed Killer (AFP)

A California jury ordered chemical giant Monsanto to pay nearly $290 million Friday for failing to warn a dying groundskeeper that its weed killer Roundup might cause cancer. Jurors unanimously found that Monsanto – which vowed to appeal – acted with “malice” and that its weed killers Roundup and the professional grade version RangerPro contributed “substantially” to Dewayne Johnson’s terminal illness. Following eight weeks of trial proceedings, the San Francisco jury ordered Monsanto to pay $250 million in punitive damages along with compensatory damages and other costs, bringing the total figure to nearly $290 million. “The jury got it wrong,” the company’s vice president Scott Partridge told reporters outside the courthouse.

Johnson, a California groundskeeper diagnosed in 2014 with non-Hodgkin’s lymphoma — a cancer that affects white blood cells — says he repeatedly used a professional form of Roundup while working at a school in Benicia, California. “I want to thank everybody on the jury from the bottom of my heart,” Johnson, 46, said during a press conference after the verdict. “I am glad to be here; the cause is way bigger than me. Hopefully this thing will get the attention it needs.” Johnson, who appeared to be fighting back sobs while the verdict was read, wept openly, as did some jurors, when he met with the panel afterward. [..] Robert F. Kennedy Jr — an environmental lawyer, son of the late US senator and a member of Johnson’s legal team — hugged Johnson after the verdict.

“The jury sent a message to the Monsanto boardroom that they have to change the way they do business,” said Kennedy, who championed the case publicly. [..] Johnson’s team expressed confidence in the verdict, saying the judge in the case had kept out a mountain of more evidence backing their position. “All the efforts by Monsanto to put their finger in the dike and hold back the science; the science is now too persuasive,” Kennedy said, pointing to “cascading” scientific evidence about the health dangers of Roundup. “You not only see many people injured, you see the corruption of public officials, the capture of agencies that are supposed to protect us from pollution and the falsification of science,” Kennedy said. “In many ways, American democracy and our justice system was on trial in this case.”

Better come clean.

• Lawsuits Accuse Tesla’s Musk Of Fraud Over Tweets, Going-Private Proposal (R.)

Tesla Inc and Chief Executive Elon Musk were sued twice on Friday by investors who said they fraudulently engineered a scheme to squeeze short-sellers, including through Musk’s proposal to take the electric car company private. The lawsuits were filed three days after Musk stunned investors by announcing on Twitter that he might take Tesla private in a record $72 billion transaction that valued the company at $420 per share, and that “funding” had been “secured.” In one of the lawsuits, the plaintiff Kalman Isaacs said Musk’s tweets were false and misleading, and together with Tesla’s failure to correct them amounted to a “nuclear attack” designed to “completely decimate” short-sellers.

The lawsuits filed by Isaacs and William Chamberlain said Musk’s and Tesla’s conduct artificially inflated Tesla’s stock price and violated federal securities laws. [..] Short-sellers borrow shares they believe are overpriced, sell them, and then repurchase shares later at what they hope will be a lower price to make a profit. Such investors have long been an irritant for Musk, who has sometimes used Twitter to criticize them. Musk’s Aug. 7 tweets helped push Tesla’s stock price more than 13 percent above the prior day’s close. The stock has since given back more than two-thirds of that gain, in part following reports that the U.S. Securities and Exchange Commission had begun inquiring about Musk’s activity.

Musk has not offered evidence that he has lined up the necessary funding to take Tesla private, and the complaints did not offer proof to the contrary. But Isaacs said Tesla’s and Musk’s conduct caused the volatility that cost short-sellers hundreds of millions of dollars from having to cover their short positions, and caused all Tesla securities purchasers to pay inflated prices.

For domestic consumption only?

• Chinese Media Keep Up Drumbeat Of Criticism Of US (R.)

China’s state media continued a barrage of criticism of the United States on Saturday as their tit-for-tat trade war escalated, while seeking to reassure readers the Chinese economy remains in strong shape. Commentaries in the People’s Daily, China’s top newspaper, likened the United States to a bull in a China shop running roughshod over the rules of global trade and said that China was “still one of the best-performing, most promising and most tenacious economies in the world.” The commentaries come as trade tensions between the two countries intensify. China said this week it would put an additional 25% tariffs on $16 billion worth of U.S. imports in retaliation against levies on Chinese goods imposed by the United States.

One commentary accused the United States of “rudely trampling on international trade rules” and not taking into account China’s lowering of tariffs and continued opening of its economy, among other things. “People of insight are soberly aware that so-called ‘America first’ is actually naked self-interest, a bullying that takes advantage of its own strength, challenges the multilateral unilaterally, and uses might to challenge the rules,” it read. Another commentary argued that the Chinese economy was stable and was expected to remain so. In the second half of this year, “comprehensive deepening of reforms will continuously produce benefits.” It said China could take steps to boost domestic demand while continued to cut corporate taxes and fees.

Excellent history lesson.

• China’s Japanese Lesson For Fighting Trump’s Trade War (F.)

Japan recorded its first post-war trade surplus with the U.S. in 1965 on the back of rapidly expanding export-oriented manufacturing. It continued to mount in the following two decades, peaking in 1986 at 1.3% of America’s GDP, according to IMF data. America started to grumble in the early 1970s about Japan’s rising trade surplus. But its was the dramatic increase in the world price of oil in the aftermath of the oil shocks of the 1970s that triggered the American trade war against Japan. The lightening rod was Japan’s auto exports. Post oil shocks, fuel efficient and well made Japanese cars rapidly gained market share in the U.S. at the expense of American auto makers.

By 1979, Chrysler, then one of the largest American auto makers, was about to fold. It needed a $1.5 billion bailout loan from the government to avoid bankruptcy. Suddenly, there was a crescendo of complaints about Japan’s unfair trade practices jeopardizing America’s national security and putting American workers out of work. Sound familiar? Between 1976 to 1989, the U.S. launched 20 investigations under Section 301 of the U.S. Trade Act of 1974 (the very same Section 301 that the Trump administration is now invoking) against Japan’s exports to the U.S., not only in autos, but also in steel, telecom, pharmaceutical, semiconductors, and others. The Japanese government backed down and agreed to a series of oxymoronically termed “voluntary restraints” on exports on all the disputed items.

When America’s trade deficit with Japan failed to decline despite such voluntary restraints, the U.S. government then pressured Japan to import more from the U.S. Again, the Japanese government accommodated America’s demand by loosening monetary policy to encourage more domestic consumption. Japanese domestic consumption did rise, especially in the property market, fueled by rising debts based on low interest rates, but didn’t do much to increase imports from America. This led to the third and last act of the trade war. The U.S. government accused Japan of manipulating its currency, keeping the yen’s exchange rate low against the U.S. dollar, thus giving Japanese exporters an unfair advantage. Japan was coerced to appreciate its currency at the Plaza Accord in September 1985.

This was the agreement engineered by the U.S. as the chief currency manipulator with Japan, France, West Germany, and the U.K. as accomplices to varying degrees of reluctance, to jointly depreciate the U.S. dollar against the yen and the German mark. As far as currency manipulation goes, the Plaza Accord worked. Between 1985 and 1988, the yen appreciated 88% against the U.S. dollar, according to data from the U.S. Federal Reserve. Still, America’s trade deficit with Japan did not go away. But by then it had also become irrelevant. Years of ultra-loose monetary policy created massive asset bubbles in Japan, most notably in its stock and property markets; and this bubble economy burst in 1989.

“.. we haven’t had any trouble from them Grenadian bastards ever since.”

• Anything-Goes-and-Nothing-Matters (Jim Kunstler)

Our President, who I like to call the Golden Golem of Greatness for his role in restoring this limping nation to something like a 1947 Jimmy Stewart movie — all Christmas and kittens — might be accused of overplaying the sanctions blame-game in order to demonstrate to our own Deep State how much he doesn’t love Russia and its leader, Mr. Putin, a verified agent of Satan. Next thing you know, Mr. Trump will don evangelical robes and hurl bibles at a photo of Vladimir P on Don Lemon’s CNN show. That’ll get Ole Horseface Mueller off his back, won’t it? And those pesky Dem-Progs drooling for impeachment.

Alas, this sanctions gambit may lead to serious consequences — a nearly unthinkable outcome in our culture of Anything-Goes-and-Nothing-Matters. Mr. Putin responded to the latest sanctions talk by saying he might withdraw Russia’s ambassador from Washington. (I’m not even sure what he’s still doing there, since the Michael Flynn incident established the new notion in DC that speaking to ambassadors from foreign lands is somehow against the law.) If you read a little history, you may notice that the withdrawal of diplomats is usually one of the last political acts before war.

We need a war with Russia, right? Well, it’s possible that the Deep State’s factotums want one — since they’ve been hollering about the wickedness of Russia at a deafening pitch for two years now. I’m wondering just what their fantasy of this war might be. Anything like the great victory over Grenada back in 1983, our most successful military venture since the surrender of Japan in 1945? Code-named Operation Urgent Fury, this campaign against one of the Caribbean’s most dangerous nations, took only four days to wrap up — and notice, we haven’t had any trouble from them Grenadian bastards ever since.

The economic war on Greece continues unabated.

• ECB Says Waiver For Greek Debt Revoked, Effective Aug. 21 (K.)

The European Central Bank announced on Friday it is revoking a waiver on Greek bonds, with the decision coming into effect on August 21, a day after the country will officially exit from its third bailout program. ECB’s waiver allows Greek debt to be accepted as collateral for regular auctions of ECB cash, despite the junk rating of the country’s bonds. Removing it will shut the lenders’ access to cheap funding. Since Greece will no longer be in an adjustment program, the criteria for accepting the waiver will no longer apply. “From that date (Aug. 21), the conditions for the temporary suspension of the Eurosystem’s credit quality thresholds in respect of marketable debt instruments issued or fully guaranteed by the Hellenic Republic … will no longer be fulfilled,” the bank said in a press release.

The whole Anglosphere is run by sociopaths.

• UK Home Office Accused Of Betrayal Over Child Refugees (Ind.)

The Home Office has been accused of “betraying” child refugees and leaving vulnerable young people stranded in Europe because of failings in its flagship relocation scheme. Under the Dubs amendment, a limited number of unaccompanied minors across Europe are supposed to be brought to the UK and placed in local authority care. But The Independent has learnt that some youngsters relocated to Britain have been counted towards the capped total despite already having the right to be in the country under family reunification laws. Ministers have admitted that children who arrive under the Dubs scheme but are then reunited with family members still count towards the final target of 480, saying placing them with relatives was a decision for local authorities, not the Home Office.

Charities and politicians warn that this means the scheme is leaving children and teenagers stranded on the continent when they should be given refuge in the UK, describing it as a “cruel and callous” means of circumventing the amendment. Safe Passage, which supports child refugees, knows of two children transferred under Dubs who were reunited with a family member in Britain either immediately or shortly after arriving, and therefore would have been eligible to enter the country anyway. The charity said there were likely to be more similar cases. Meanwhile, thousands of lone minors remain stranded in Europe, scores of who are sleeping rough in northern France. Only around 250 of Dubs places have been filled two years after the amendment was passed.

Just make sure you don’t entirely make it the ACLU’s responsibility.

• Judge Encouraged By US Plan To Reunite Separated Immigrant Families (R.)

A federal judge on Friday said he was encouraged by a new U.S. plan to reunite parents and children who had been separated at the U.S.-Mexican border under President Donald Trump’s now-abandoned “zero tolerance” policy toward illegal immigrants. The reunification plan set forth in a Thursday night court filing described several processes to locate parents who had been removed from the country, determine their intentions for their children, and ensure that children remain safe. “There’s no question the government has put in a great deal of thought into this,” U.S. District Judge Dana Sabraw in San Diego said at a hearing. Sabraw also said the plan “appears to be a very good one, a sound one, at least from a broad-brush perspective.”

The plan provided that the government would resolve concerns about the children’s safety and parentage. It also called for the government to work with the American Civil Liberties Union and foreign governments to locate parents and determine their wishes, and arrange travel documents and transportation for children when parents opt for reunification. Sabraw has been monitoring the government’s progress in reuniting 2,551 children with their parents since ordering their reunifications on June 26. The ACLU had brought a lawsuit that led to Sabraw’s reunification order. Many of those separated had crossed the border illegally, while others had sought asylum at a border crossing.

[..] Sabraw gave the ACLU the weekend to study the plan and discuss its concerns with the government, and bring unresolved issues to his attention by Monday morning. He also praised the government and ACLU for “really working collaboratively, which is absolutely essential” for reunifications. The judge’s comments marked a change from a week earlier, when he called the government’s progress in reunifying families “unacceptable.” Roughly 559 of the 2,551 children remain in federal custody, down from 572 a week earlier, according to a separate Thursday court filing. They included 386 whose parents had been removed from the country, that filing said.

Home › Forums › Debt Rattle August 11 2018