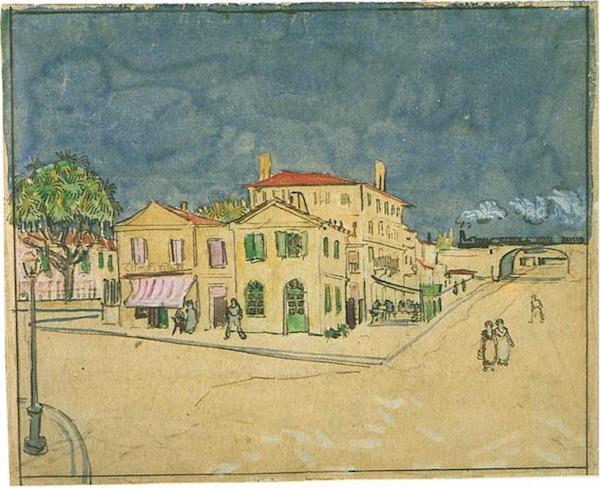

Vincent van Gogh Vincent’s House in Arles (The Yellow House) 1888

Napier thinks Turkey will default on $500 billion in debt by imposing capital controls.

• Turkey Will Be The Largest EM Default Of All Time (Russell Napier)

Regular readers of the Fortnightly will know that The Solid Ground has long forecast a major debt default in Turkey. More specifically, the forecast remains that the country will impose capital controls enforcing a near total loss of US$500bn of credit assets held by the global financial system. That is a large financial hole in a still highly leveraged system. That scale of loss will surpass the scale of loss suffered by the creditors of Bear Stearns and while Lehman’s did have liabilities of US$619bn, it has paid more than US$100bn to its unsecured creditors alone since its bankruptcy. It is the nature of EM lending that there is little in the way of liquid assets to realize; they are predominantly denominated in a currency different from the liability, and also title has to be pursued through the local legal system.

Turkey will almost certainly be the largest EM default of all time, should it resort to capital controls as your analyst expects, but it could also be the largest bankruptcy of all time given the difficulty of its creditors in recovering any assets. So the events of last Friday represent only the end of the beginning for Turkey. The true nature of the scale of its default and the global impacts of that default are very much still to come. Strong form capital controls produce a de facto debt moratorium, and very rapidly investors realize just how little their credit assets are worth. A de jure debt moratorium at the outbreak of The Great War in 1914 bankrupted almost the entire European banking system – it was saved by mass government intervention.

While the imposition of capital controls in recent years has hit selected investors hard, in Iceland, Cyprus, Greece and key emerging markets, there has been nothing of this size and it is to be fully borne by financial institutions who believe they hold not just valuable credit assets but actually liquid credit assets! The loss of hundreds of billions of assets recently considered liquid by global financial institutions, through the de facto debt moratorium of capital controls, will be a huge shock to the global financial system.

Turkey=corporate debt. How do you bail that out?

• ‘What Happens In Turkey Won’t Stay In Turkey’ (CNBC)

The markets have seen much of this movie before: a heavily indebted country finds itself in crisis, the currency plunges and talk quickly turns to contagion and, ultimately, an expensive globally financed bailout. In Turkey’s case, the plot line is a little different, however. Where the other debt crises generally involved government borrowing, Turkey’s is mostly a corporate story, making the bailout mechanics more complicated and thus raising fears that what started in a small country with only marginal systemic importance on its face could quickly escalate. “How can a country where the entire market cap of Turkish equities traded on the Istanbul Stock exchange is less than the market cap of Netflix wreak such havoc? It is all about the direct and indirect impacts,” wrote Katie Nixon, chief investment officer for wealth management at Northern Trust.

“There are certain emerging market countries with relatively weak currencies and a heavy reliance on external (predominately dollar based) financing. The fear is that what happens in Turkey won’t stay in Turkey.” Nixon said that while the crisis does not appear to have major global implications, a strong U.S. dollar coupled with weakening emerging market currencies could fuel the problem. To date, the debt emergencies in Greece, Cyprus, Italy and other euro zone countries — not to mention Argentina, Malaysia and perhaps Pakistan before long — have had limited global spillovers. Several required bailout loans from the IMF, an organization that gets 17.5 percent of its funding from the U.S.

Low market volumes in summer make an attack easier to execute.

• Italy Expects Financial Market Attack In August (R.)

Speculators will probably attack Italian financial markets this month but the country has the resources to defend itself, a senior and highly influential government official said in a newspaper interview on Sunday. Giancarlo Giorgetti, undersecretary in the prime minister’s office and a leading light in the far-right League party, said thin summer trading volumes helped fuel market assaults. “I expect an attack (in August),” Giorgetti told Libero. “The markets are populated by hungry speculative funds that choose their prey and pounce … In the summer the market volumes are small, you can lay the groundwork for aggressive initiatives against countries. Look at Turkey.”

Turkish markets slumped last week on growing concerns over the country’s economy and political leadership. Italian assets have also come under strain in recent weeks, with investors concerned that the governing coalition, made up of the League and the anti-establishment 5-Star Movement, might tear up EU fiscal rules to pay for big-spending budget plans. “If the (market) storm comes, we will open our umbrella. Italy is a big country and has the resources to react, thanks in part to its large amount of private savings,” said Giorgetti, who is seen as a moderating force within the League. Quoting a report by bankers’ federation Fabi, Italian newspapers said on Sunday household savings in Italy totaled some 4.4 trillion euros against 2.2 trillion in 1998.

The reason for all the trouble? Cheap central bank credit.

• The Price of Cheap Dollar/Euro Debts: Local Currencies Come Unglued (WS)

Turkey has its own sets of problems and isn’t even seriously trying to prop up its currency. Now global bondholders are clamoring for the IMF to step in and calm the waters around the currency crisis in Turkey that has turned into a debt crisis that is now dragging some European banks through the dirt. Those global bondholders want the IMF to lend Turkey money to bail out Turkey’s bondholders to put an end to the turmoil and torture in emerging markets bonds that were so hot just eight months ago. In return for an IMF bailout of its bondholders, Turkey would have to follow the IMF’s program, slash its expenses, including social expenses, and curtail its crazy borrowing binge. But no go.

Instead of trying to address the problem, or beg the IMF for a bailout, the Turkish government has heaped scorn on the West. In return, the Turkish lira plunged another 8% against the dollar on Monday, to 7.04 lira to the dollar. Seen the other way around, as the chart below shows, the value of 1 lira has now dropped to 14.4 US cents, from 25 cents just four months ago, which, if nothing else, tells people to go figure out how to invest in gold and silver. Monday’s drop brings the grand collapse over the past three days to 24%, and over the past four months to 43%.

After nine years of experimental monetary policies in the US, Europe, Japan, and elsewhere, the Emerging Market economies have become addicted to this debt borrowed in a hard currency that they cannot inflate away. In Turkey, this cheap debt – cheap even for junk-rated issuers such as the government of Turkey – funded a construction boom in the property sector. This construction boom has been crucial to the economy – which is why the government is trying to ride this bull all the way. Turkey’s inflation is surging. In July, annual inflation reached 16%, the highest since January 2004. Inflation is what ultimately destroys a currency. But it’s not yet 30% as in Argentina, and perhaps the government thinks it still has some leeway.

Are you calling New Zealand an emerging market?

• Indian Rupee Drops To All-Time Low Against Dollar Over Turkish Crisis (Ind.)

The Indian currency has dropped to an all-time low against the dollar, while the New Zealand dollar has slumped to two-year lows as emerging markets feel the effects of the crisis in Turkey. Investors have instead moved towards safe haven currencies such as the yen, which surged to a six-week high, and the Swiss franc, which jumped close to a one-year high against the euro. The Indian central bank reportedly intervened to prevent a sharp drop in the rupee’s value, however, it did little to stem the decline, and the currency fell to 69.62 rupees per dollar. The New Zealand dollar has also felt the effects of the Turkish crisis, dropping below $0.66 for the first time in two years over the weekend. Meanwhile, the euro fell against the dollar to $1.14, as investors try to work out how badly European banks might be affected by the problems in Turkey, with the Spanish, French, and Italian in particular all hugely exposed to Turkish debt.

“President Trump’s tariff monkeyshines are shoving the Chinese banking system up against a wall of utterly irresolvable insolvency problems..”

• Close Up and Long Shot (Kunstler)

Who cares about the currency of a second-rate player in the global economy? A lot of SIFIs (“systemically important financial institutions”) otherwise known as Too-Big-To-Fail banks. That’s who. Deutsche Bank’s stock dropped over 6 percent when the Turkish Lira tanked on Friday. Turkey’s nickname since the collapse of the Ottoman Empire in the 1920s has been “the sick man of Europe” and Deutsche Bank in the post-2008-crash era is widely regarded as the sick man of SIFI banks. One analyst wag downgraded its status a year ago to “dead bank walking.” Its balance sheet was a Cave of Winds littered with the moldering skeletons of malinvestment.

If the European Central Bank (aka Germany) has to bail out DB, all bets are off for the Euro, which was showing serious signs of distress Friday. And who is going to bail out Turkey? If the IMF is your go-to vehicle, then you mean US taxpayers. Anyway, Turkey’s Lira is only one of several Emerging Market currencies whose hands have been called at the global poker table, where the four-flushers are getting flushed out. The Russian ruble was another one, ostensibly to the delight of America’s Destroy-Russia-at-All-Costs faction. China is also having to play a round of super Three Card Monte with its currency, the yuan.

President Trump’s tariff monkeyshines are shoving the Chinese banking system up against a wall of utterly irresolvable insolvency problems and threatening the stability of Xi Jinping’s one-party government. The Chinese export trade is at the heart of the world’s current economic arrangements. If you pull it out of the globalism machine, the machine will stop. It is going to stop one way or another anyway, but the gathering crisis of autumn 2018 will hasten that. All of this is happening because the whole world can’t handle the debts it has racked up, and the whole world knows it. And knowing it, they also know that their debt-based currencies are worthless. And knowing that, they also know that absolutely everybody else is broke and unable to meet their obligations. That is some dangerous knowledge.

Will Musk get away with not following the rules?

• Musk: “I Am Working With Silver Lake, Goldman On Taking Tesla Private” (ZH)

Update 2: And here things get bizarre because according to Reuters, Silver Lake is not currently discussing participating as an investor in Elon Musk’s proposed take-private deal for Tesla, citing an unidentified person. Reuters also adds that Silver Lake is offering assistance to Musk without compensation and hasn’t been hired as financial adviser in an official capacity.

Update: in a tweet sent out on Monday evening, Musk said the he was working with Silver Lake and Goldman Sachs as financial advisors, as well as Wachtell Lipton as legal advisors, on his “proposal” to take Tesla private.

It was not immediately clear why Silver Lake, an investor, is serving as a financial advisor, nor was it clear why Musk defined the “going private” transaction as merely a proposal when he previously classified it as a firm deal, with “secured funding.” The tweet followed a blog post by Musk in which he finally offered more details on his tweet that he had “funding secured” to take Tesla Inc. private, however as Bloomberg echoed our skepticism from earlier (see below) , “it’s unlikely to get U.S. regulators off his back.” Musk’s elaboration doesn’t wash away the investor confusion he triggered a week ago by failing to provide evidence that he had financing. Without more information, investors were left guessing at how far along negotiations on a bid had progressed.

Musk’s fresh disclosure might even help the Securities and Exchange Commission show that his initial tweet was misleading, lawyers said. Bloomberg quoted Keith Higgins, a Ropes & Gray lawyer who said that “a cautious lawyer would have said you shouldn’t have said ‘funding secured’ unless you had a commitment letter,” which Musk clearly did not have, and certainly not from the Saudi Wealth Fund which as Musk admitted, needed to do more due diligence and analysis and had yet to conduct an “internal review process for obtaining approvals.” John Coffee, director of the Center on Corporate Governance at Columbia Law School, agreed. He said Monday’s post indicates Musk was being overly bullish last week, potentially increasing his vulnerability in any SEC investigation. “He clearly had not secured funding at the time of his tweet – he concedes that obliquely,” Coffee said.

How Mueller arrived at Manafort.

• The Law As Weapon (Paul Craig Roberts)

Robert Mueller is supposed to be investigating Russiagate, which has been shown to be a hoax concocted by former CIA director John Brennan, former FBI director James Comey, and current deputy Attorney General Rod Rosenstein. As Russiagate is a hoax, Mueller has not been able to produce a shred of evidence of the alleged Trump/Putin plot to hack Hillary’s emails and influence the last presidential election. With his investigation unable to produce any evidence of the alleged Russiagate, Mueller concluded that he had to direct attention away from the failed hoax by bringing some sort of case against someone, knowing that the incompetent and corrupt US media and insouciant public would assume that the case had something to do with Russiagate.

Mueller chose Paul Manafort as a target, hoping that faced with fighting false charges, Manafort would make a deal and make up some lies about Trump and Putin in exchange for the case against him being dropped. But Manafort stood his ground, forcing Mueller to go forward with a false case. Manafort’s career is involved with Republican political campaigns. He is charged with such crimes as paying for NY Yankee baseball tickets with offshore funds not declared to tax authorities and with attempting to get bank loans on the basis of misrepresentation of his financial condition. In the prosecutors’ case, Manafort doesn’t have to have succeeded in getting a loan based on financial misrepresentation, only to be guilty of trying.

Two of the people testifying against him have been paid off with dropped charges. Mueller’s investigation is restricted to Russiagate. In other words, Mueller has no mandate to investigate or bring charges unrelated to Russiagate. In my opinion, Muller gets away with this only because the deputy Attorney General is in on the Russiagate plot against Trump. Mueller and Rosenstein know that they can count on the presstitutes to continue to deceive the public by presenting the Manafort trial as part of Russiagate.

But people like Mueller still claim a hack, because otherwise they can’t involve Russia.

• Russia-Gate One Year After VIPS Showed a Leak, Not a Hack (CN)

A year has passed since highly credentialed intelligence professionals produced the first hard evidence that allegations of mail theft and other crimes attributed to Russia rested on purposeful falsification and subterfuge. The initial reaction to these revelations—a firestorm of frantic denial—augured ill, and the time since has fulfilled one’s worst expectations. One year later we live within an institutionalized proscription of proven reality. Our discourse consists of a series of fence posts and taboos. By any detached measure, this lands us in deep, serious trouble. The sprawl of what we call “Russia-gate” now brings our republic and its institutions to a moment of great peril—the gravest since the McCarthy years and possibly since the Civil War. No, I do not consider this hyperbole.

Much has happened since Veteran Intelligence Professionals for Sanity published its report on intrusions into the Democratic Party’s mail servers on Consortium News on July 24 last year. Parts of the intelligence apparatus—by no means all or even most of it—have issued official “assessments” of Russian culpability. Media have produced countless multi-part “investigations,” “special reports,” and what-have-yous that amount to an orgy of faulty syllogisms. Robert Mueller’s special investigation has issued two sets of indictments that, on scrutiny, prove as wanting in evidence as the notoriously flimsy intelligence “assessment” of January 6, 2017. Indictments are not evidence and do not need to contain evidence. That is supposed to come out at trial, which is very unlikely to ever happen.

Nevertheless, the corporate media has treated the indictments as convictions. Numerous sets of sanctions against Russia, individual Russians, and Russian entities have been imposed on the basis of this great conjuring of assumption and presumption. The latest came last week, when the Trump administration announced measures in response to the alleged attempt to murder Sergei and Yulia Skripal, a former double agent and his daughter, in England last March. No evidence proving responsibility in the Skripal case has yet been produced. This amounts to our new standard. It prompted a reader with whom I am in regular contact to ask, “How far will we allow our government to escalate against others without proof of anything?” This is a very good question.

I hinted at this in my article Sunday. Many Greek islands are off the Turkish coast, as per the 1923 Lausanne Treaty. If Erdogan wants to push nationalism -and he does-, this may be his best bet. In essence, the Treaty finally ended the Ottoman Empire, and a lot more territory was lost, but this part is what Turks will be receptive to. One other piece on the Treaty: Turkey ceded all claims to Cyprus. We know how that fared.

• Greek Fishermen Accuse Turkish Boats of Opening Fire off Leros Island (GR)

Greek fishermen have reported that they were fired upon by Turkish fishing boats near Kalapodi islet, 300 meters off the coast of Leros island. Two Greek seamen, owners of fishing boats, spoke to Alpha television saying that the Turkish boats were inside Greece’s territorial waters on Sunday when their crews shot at them. They also said that, since July, Turkish fishing boats have repeatedly intruded upon Greek waters to fish in the area. The Greek fishermen said that usually they call the coast guard upon seeing the Turkish boats; the intruders are forced to exit Greek waters upon the arrival of coast guard ships. This time, however, Leros fisherman Kostas Tsiftis told Alpha, the crew of the Turkish boat fired gunshots at them. He also said that the gunfire was from an automatic weapon because some of the shots were repeated.

The Greek fishermen were forced to leave the area and called the Hellenic Coast Guard. Upon the arrival of two coast guard patrol vessels, the Turkish fishing boats moved towards international waters. The fishermen noted that even though they are used to provocative acts by Turkish fishermen, Sunday’s incident was unprecedented. “We heard six shots. The two of them, the third and the fourth, were repeated. The gun was neither a hunting rifle, nor a revolver,” said Lefteris Giannoukas, who was in one of the Greek boats. “The Turkish fishermen were about 200 meters away. This is the first time that the Turks shot at us. Of course we were afraid, we did not expect it,” Tsiftis said. The Greek fisherman noted that this is the first time the Turkish boats came this close.

And there you go. For domestic consumption.

• Turkish FM Accuses Greece Of Escalating Tensions In Aegean (K.)

Greece is responsible for escalating tension in Aegean and Mediterranean, even though Turkey has always stood by Greeks in their times of difficulty, Turkey’s foreign minister has told his country’s ambassadors. “In their difficult days, we are always at their side. But in the Aegean and the Mediterranean, they are again increasing tension. They do bizarre things, which are not acceptable. Don’t we all want the eastern Mediterranean to become a region of peace and prosperity?” Mevlut Cavusoglu told the 10th conference of Turkish ambassadors. He also called for a new process to resolve the Cyprus issue, blaming the Republic of Cyprus for the impasse. “In order to reach a solution in Cyprus, a new process must be launched. Greek Cypriots do not want to cooperate. And this we saw last year. We saw it in Geneva, we saw it in Crans-Montana,” Tsavousoglou said. And “Greece is no different,” he alleged.

It’s devastated Borneo. Now it’s coming for Africa. Next up Amazon?

• Palm Oil A New Threat To Africa’s Primates (BBC)

Endangered monkeys and apes will almost certainly face new risks if Africa becomes a big player in the palm oil industry. That is the message of a study looking at how large-scale expansion of the oil crop in Africa might affect the continent’s rich diversity of wildlife. Most areas suitable for growing palm oil are key habitats for primates, according to researchers. They say consumers can help by choosing sustainably-grown palm oil. Ultimately, this may mean paying more for food, cosmetics and cleaning products that contain the oil, or limiting their use. “If we are concerned about the environment, we have to pay for it,” said Serge Wich, professor of primate biology at Liverpool John Moores University, and leader of the study. “In the products that we buy, the cost to the environment has to be incorporated.”

[..] Many companies growing palm oil are looking to expand into Africa. This is a worry for conservationists, as potential plantation sites are in areas of rich biodiversity. They are particularly worried about Africa’s primates. Nearly 200 primate species are found in Africa, many of which are already under threat. Habitat destruction is one of the main reasons why all great apes are at the edge of extinction. The introduction of palm oil plantations to Africa is expected to accelerate the habitat loss. [..] The study found that while oil palm cultivation represents an important source of income for many tropical countries, there are few opportunities for compromise by growing palm oil in areas that are of low importance for primate conservation.

“We found that such areas of compromise are very rare throughout the continent (0.13 million hectares), and that large-scale expansion of oil palm cultivation in Africa will have unavoidable, negative effects on primates,” said the research team. To put that figure into context, 53 million hectares of land will be needed by 2050 to grow palm oil in order to meet global demand.

An entire article without naming any numbers, only percentages. How many mountain hares are there in Scotland? 2, 20, 2 million?

• Scotland’s Mountain Hare Population Is At Just 1% Of 1950s Level (G.)

The number of mountain hares on moorlands in the eastern Scottish Highlands has fallen to less than 1% of the level recorded more than 60 years ago, according to a long-term study. The Centre for Ecology & Hydrology and the RSPB teamed up to study counts of the animals over several decades on moorland managed for red grouse shooting and nearby mountain land. From 1954 to 1999, the mountain hare population on moorland sites decreased by almost 5% every year, the study found, saying the long-term decline was likely to be due to land use changes such as the loss of grouse moors to conifer forests. However, from 1999 to 2017 the scale of the “severe” moorland declines increased to over 30% every year, leading to counts last year of less than 1% of original levels in 1954, researchers said.

On higher, alpine sites, numbers of mountain hares fluctuated, but increased overall until 2007, and then declined, although not to the lows seen on the moorland sites, the study noted. The report stated: “The study found long-term declines in mountain hare densities on moorland, but not alpine, sites in the core area of UK mountain hare distribution in the eastern Highlands of Scotland. “These moorland declines were faster after 1999 at a time when hare culling by grouse moor managers with the specific aim of tick and LIV [Louping ill virus, which is spread by ticks] control has become more frequent.” Gamekeepers and estate managers claim culls limit the spread of ticks, protect trees and safeguard fragile environments, and a policy of voluntary restraint is in place. However, campaigners believe the practice is cruel and unnecessary.

Home › Forums › Debt Rattle August 14 2018