James McNeill Whistler Nocturne in Blue and Silver, The Lagoon, Venice 1880

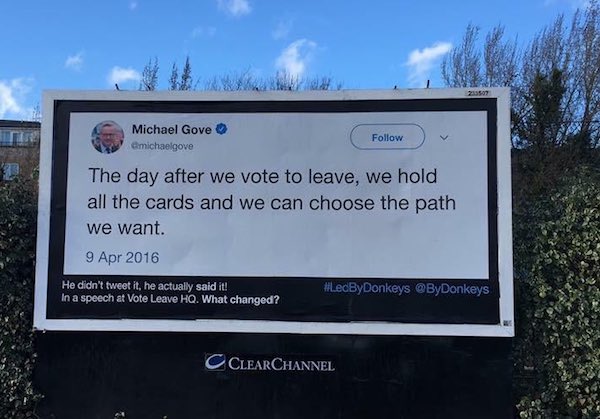

Flip flop idiocy.

• Covid Passports Could Be Required For Clothes Shopping (Ind.)

“Covid passports” could be required for customers visiting clothes shops in England after the removal of lockdown restrictions on 21 June, Downing Street has indicated. The idea provoked horror among retailers, with one trade body describing it as neither “appropriate or useful”. A briefing document on Monday confirmed the government is considering the introduction of “Covid-status certification” as lockdown eases, so that individuals wanting to enter premises can prove that they have either been vaccinated, recently tested or gained immunity through previous infection. The report said that ministers believe shoppers should never be required to supply such proof in order to use “essential” retail venues, but did not make clear exactly which shops were exempted.

Boris Johnson said no decision had been made on whether to require certification domestically, but said that it would not come into force during stages two and three of England’s lockdown relaxation, due to begin on 12 April and 17 May. Pressed today on whether shoppers could eventually be asked for their vaccine passport to enter shops like Next or H&M, the prime minister’s official spokesman did not rule it out. Asked whether clothes shops would use Covid status certificates, the spokesman said only: “We have been clear that we will not require them as businesses reopen in stages two and three of the roadmap. “But again the PM was clear that longer term there will some essential services such as essential retail and public transport where they will not be required.”

From The One Year Emergency . Feb 4:

“Vaccination is not a prerequisite for the exercise of any other institutional requirement, such as education or otherwise recognized basic right such as the right to employment and free movement. Correspondingly, no private company has the legal authority to impose restrictions violating citizens’ constitutional rights. Discrimination and Stigmatization are forbidden (Universal Declaration on Bioethics and Human Rights, UNESCO). Moreover, imposition of a medical action in any manner constitutes torture and is illegal.”

• Notre Dame Is The Latest University To Require Students To Get A Vaccine (F.)

The University of Notre Dame in Indiana has joined an increasing number of universities in announcing they will require students and faculty to receive a coronavirus vaccine before stepping on campus this fall. On Wednesday, Notre Dame said all students will be required to be fully vaccinated as a condition of enrolling at the university next year, and will open an on-campus vaccination site Thursday. Boston’s Northeastern University said Tuesday students attending in-person classes on campus in the fall will be required to be fully vaccinated by the first day of the term. On Friday, New York’s Cornell University announced it “intends to require” immunization for all students attending in-person classes in the fall, and asked the university community to register their vaccination status so the administration can determine immunization rates to base reopening plans on.

Fort Lewis College in Colorado said Friday all students enrolled next semester will be required to be vaccinated against coronavirus. Florida’s Nova Southeastern University will require all students, faculty and staff to be fully vaccinated by August 1 in order to resume in-person classes on campus next school year, the university announced Friday. Texas’ St. Edward’s University said March 29 it would require students and faculty over the age of 16 to receive a vaccine before September. Last month, Rutgers University in New Jersey was the first large U.S. college to announce it would require all on-campus students to be fully vaccinated against coronavirus before fall semester classes begin. Oakland University in Detroit is mandating vaccines for students who live on campus, school officials said Monday, but not for the wider university community.

More universities may opt to require vaccines for students, but there could be pushback from critics. The idea of “vaccine passports” that document the holder has been vaccinated have proved controversial with Republicans who say they are an invasion of privacy. On Tuesday, Texas Gov. Greg Abbott signed an executive order to ban vaccine passports from being used in the state by government entities or organizations that receive public funds. Florida Gov. Ron DeSantis issued a similar order Friday to ban them in his state, even by private businesses. It’s still unclear how these executive orders will affect universities wishing to mandate vaccines.

Long article that heaps all “sceptics” on one big pile, so they all get tainted by the most extreme amongst them. And then describes some reasonable people who get lured into Telegram groups and deceived. How to build a narrative.

• Among the Covid Sceptics (G.)

When the pandemic hit in March 2020, Anna, a young woman from Bradford, was waiting for surgery for endometriosis. The surgery was cancelled, leaving her in excruciating pain. She was forced to close her business, a small tattoo studio that she had opened two years earlier, at the age of 24. She could no longer pay for the weekly counselling that had been helping her deal with her troubled childhood. Her partner lost his job. Anna was convinced that if she caught Covid, she would die. “I was in a terrified bubble, having the news on constantly, crying, worrying, panicking,” she told me. For weeks, she waited anxiously for news about support for shuttered businesses. The cash grant, when it finally came, fell far short. Other business expenses – insurance, bills – went on her credit card. She considered suicide.

Feeling abandoned by the government and frustrated by the daily press briefings, Anna and her partner researched the virus online. On Facebook, Instagram and YouTube, they came across theories about the origins of coronavirus that the mainstream media weren’t talking about – that it was engineered in a lab in China, say, or that it had been artificially spliced with HIV. Some of it seemed implausible to Anna, but it was enough to convince her that the media wasn’t telling the full story. “Loads of people were saying ‘even if you die from a heart attack, they’ll put it down as a Covid death’. I was looking into that, and how many people who died had pre-existing health conditions,” she said. “It was to make me feel better, so I wouldn’t be as scared.”

She read dense, seemingly scientific material which claimed that PCR testing – the throat and nasal swabs that are considered the gold standard of Covid tests – leads to enormous numbers of false positives. She read that the World Health Organization had said that Britain is testing at too high a sensitivity. She read about the cost of lockdowns, and Sweden’s more permissive approach. She read about the death rate; 1% didn’t sound that high at all. Looked at another way, 99% survived. By the end of the first lockdown, Anna was no longer afraid. She was angry. “I’d been sat in my house for four months, in absolute agony, no mental health support, no financial support, and it did an absolute number on me,” she said.

Gerald Celente is a big fan of TAE. Whenever he doesn’t get his daily Debt Rattle, he protests. The video is worth it. Very much. Sounds doesn’t quite seem to sync, but hey…

• Anti-Vax & Anti-Tax – 2 Huge Trends of 2021 –Gerald Celente (USAW)

Gerald Celente, a renowned trends researcher and publisher of “The Trends Journal,” is back to talk about two of the biggest trends taking shape for 2021. One revolves around Covid-19 (CV-19) and the experimental so-called vaccine, otherwise known as the “jab.” The other is a rebounding economy destined to crash. First, the CV-19 jab, as Celente explains, “There are going to be new political movements: anti-tax, anti-vax, anti-immigration and anti-establishment. We are going to see a big anti-vax movement. To make the point on how they are going to be selling this . . . They are selling it now that there is going to be a new strain of CV-19, and you better prepare for it. It’s going to happen every year, and you are going to have to get vaccinated. So, we are going to start seeing a big anti-vax movement.”

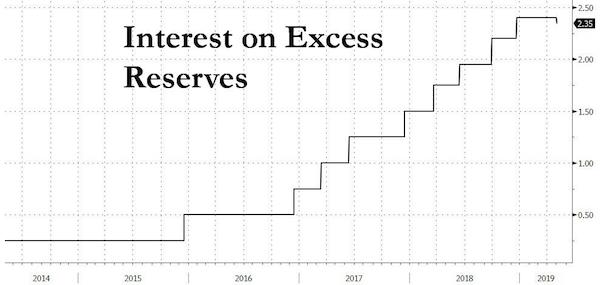

The economy in blue states is performing much worse that in Red states, and that is fueling big government to raise big taxes. Celente says, “The streets out here in New York are dead. . . . They are dead. Now, they are raising the taxes. The first thing they did was tolls. The next thing they are going to do is a gas tax, soda tax, sales tax, property tax and school tax. Business is dead. New York City is dead. Brooklyn is dead. Park Slope is a slope alright, a downhill slope. The office occupancy rate in New York City is still at 14%. All the businesses that depend on commuters are gone, and this isn’t coming back.” All the economic news is not bad. Celente is forecasting, “This is the other important thing. There is going to be an economic rebound. It’s going to happen because all of the cheap money they are pumping into the system. We are going to start seeing inflation really skyrocket. They are going to have to raise interest rates.

We had a cover on The Trends Journal, and it showed two big needles. One injection is the vaccine, the other is the money junkies injecting money into the system. They are drug dealers and money junkies. The money junkies need cheap money from the Federal Reserve to keep gambling. They are going to have to raise interest rates. When the equity markets crash, people will be forced to wake up to know how bad it is. . . . It’s artificially propped up, and when the markets crash, the reality will be felt. The reality is already being felt by the hundreds of millions of people around the world whose lives and livelihoods have been destroyed. When the markets crash, we are going to be living in hell on earth. . . . We are heading into the Greatest Depression, and you better prepare now. The other biggest trend is there is going to be a ‘vax war.’ There is no question about it.”

Dystopia.

“Hi, dude!” “Oh. Hi. How are you?” “I’m good. How do you like my shoes?” “Nice. Are those…” “Yeah. The original Nike Lil Nas X Satan’s Shoes, version 2030.” “Wow. But don’t those cost a fortune? How can you afford them, with just the Universal Basic Income?” “Well, duh. I didn’t buy them, dude. I’m just renting them from Amazon Prime, of course. All of my clothes are rented, including the original Calvin Klein underwear.” “Eew… Well, they did say that ‘you’ll own nothing, and you’ll be happy’…” “What are you talking about?” “Nothing, just remembering an old joke here. So, what’s new? What are your plans for next week?” “Not sure. Maybe I’ll go to the City Hall Yearly Masked Ball. You want to come? The masks are all N95 compliant, so it’s safe.”

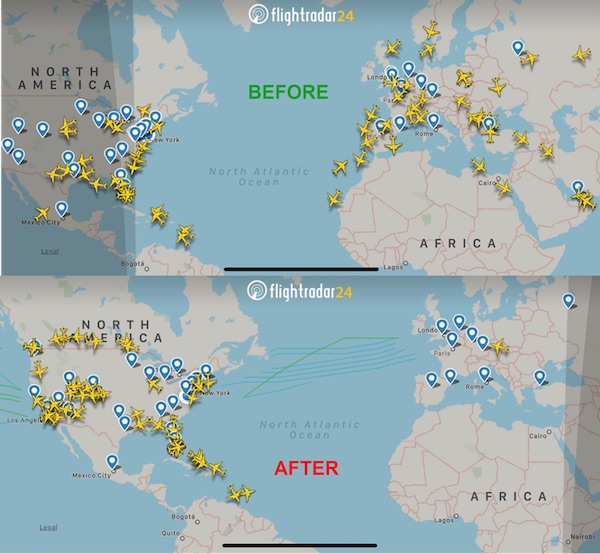

“No, thanks. I thought you were travelling to Italy for the holidays?” “Nah, I can’t board a plane this month. I didn’t get my Moderna monthly booster shots. I wanted to, but the lines were so big, the next appointment available for me is only next month.” “This Covid-29 is really pesky, isn’t it?” “You bet. But I’m sure the vaccine is working. Just give it time. It takes a few years to achieve full immunization, but of course, with the new variants and viruses that appear every month, it’s always a game of catching up. We got to be patient. So, yeah, no travel this month for me.” “Well, you know, you could always travel around your own room.” “What?” “Oh. I just got reminded of an old 18th century novel. ‘Voyage around my room,’ by Xavier de Maistre.”

“What it’s about?” “It’s about a guy who, well, travels around his room.” “18th century? Man, that’s like, old. When was that exactly? I guess that’s when the first lockdowns happened, right? In the first Covid era?” “Yeah, sort of… Anyway, forget it, you just reminded me of that book. But I guess reading is not really your thing.” “Nah. Is there a YouTube version? You are funny, you’re one of those guys who still read, right? You’re really old-fashioned. I bet you don’t even have a microchip in your brain, L.O.L.” “Thankfully not…” “…” “What’s wrong?” “Don’t get close to me.” “What? Why? Who are you calling?” “Who am I calling? Who am I calling? The police, dude. Not having a brain chip is a felony, and it’s my duty as a citizen to report you, sorry. I know you’re a friend and neighbour and all, but, that’s just sick, dude. That’s really fucked-up.”

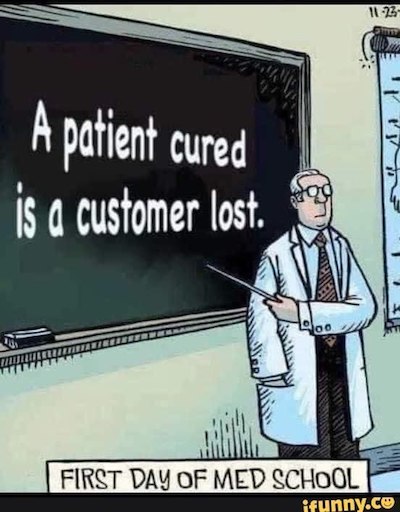

Cancel the doctors.

• YouTube Removes Recent DeSantis Public Health Roundtable (JTN)

March public health roundtable event hosted by Florida Gov. Ron DeSantis that featured reputable doctors including former White House coronavirus advisor Dr. Scott Atlas and the authors of The Great Barrington Declaration has been removed from YouTube for “violating YouTube’s Community Guidelines,” according to Reclaim the Net. The video garnered over 500,000 views while it was published and covered a group of panelists advising against lockdowns, contact tracing and mask mandates. The doctors – including Drs. Sunetra Gupta, Jay Bhattacharya, and Martin Kulldorff – also called the measures harmful and said that schools should reopen for in-person learning.

“We also talk about removing information that is problematic,” YouTube CEO Susan Wojcicki told CNN last spring. “We’ve had to update our policy numerous times associated with COVID-19.” While the video was taken down from one channel, the video remains available on NBC 6 South Florida’s page. YouTube’s parent-company, Google, along with Facebook and Twitter have [been] adding misinformation warnings and removed posts that violate company guidelines including some related to coronavirus health-safety measures.

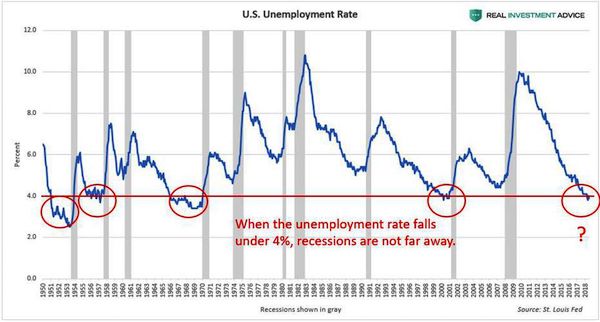

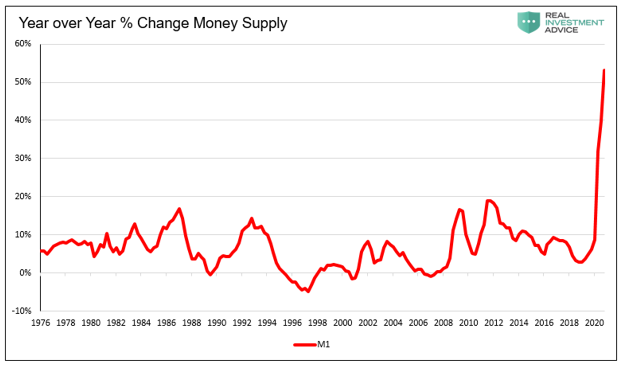

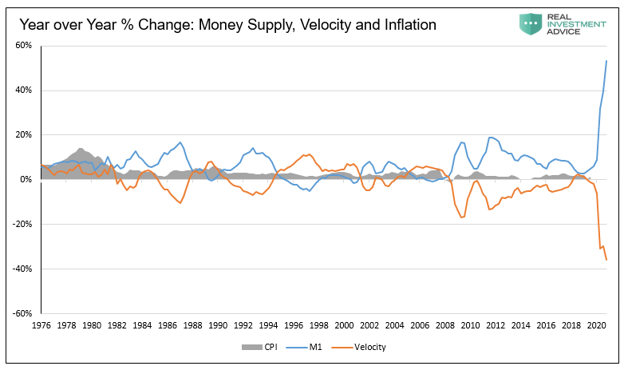

“Inflation is a function of money supply but equally critical, the demand for money (velocity).”

• Inflation: Making the Complex, Simple – Part 1 (RIA)

We could devote pages to the multitude of factors affecting the supply, demand, and pricing of a Big Mac. The exercise would explain why the Big Mac price rises or falls versus Burger King Whoppers and every other good and service available. Such analysis is critical to McDonalds, but often overemphasized from a macroeconomic perspective. Economists cite increasing oil prices as a driver for inflation and stronger retail sales from time to time. They assume consumers will still buy everything they were consuming, yet pay an extra $20 at the pump each week. In reality, consumers often substitute goods and services based on their budgets and needs. Economists often fail to consider the extra $20 spent at the gas pump is $20 not spent elsewhere.

The price of oil may rise, but the price of oranges may fall as consumers spend less on oranges to compensate. What matters most from a macroeconomic perspective is the aggregate price change for oil, oranges, Big Macs, and every other good and service. To correctly anticipate inflation, we must look beyond the supply and demand for goods and services. The truth lies in the supply and the demand for money. Unfortunately, the supply of money gets the headlines, while its demand is an afterthought. The chart below shows the forthcoming evidence of inflation used by most inflationists.

The following graph captures monetary velocity for an appropriate view of inflation.

Inflation is a function of money supply but equally critical, the demand for money (velocity).

“The tentacles of Wokery have reached into every last compartment of American life now, more effectively even than the Covid-19 corona virus.”

What were the execs of these mighty companies thinking — these knights of the boardroom, these capitalist geniuses, these moral nonpareils — when they cancelled Atlanta’s turn to host the midsummer All-star Game to “protest” Georgia’s passage of a law that requires voter ID? Surely that they were striking a righteous blow against systemic racism. And then, the rest of the world realized — almost immediately — that Major League Baseball requires online ticket buyers to show ID when they pick up their tickets at any stadium… and that Delta Airlines requires passengers to show ID (duh) before being allowed to fly in one of their airplanes… and that various other corporations snookered into this latest hustle such as Nike, Coca-Cola, and Calvin Klein support forced labor in the Asian nations that manufacture their products.

They’re Woke, you see. The tentacles of Wokery have reached into every last compartment of American life now, more effectively even than the Covid-19 corona virus. Wokeness emerged on the scene in 2014 when the feckless teenager Michael Brown was shot to death by police officer Darren Wilson upon arrest in Ferguson, Missouri, an event that kicked off the Black Lives Matter movement. The moral panic BLM ignited proved to be a spectacularly effective device for repelling the truth of the situation, and many more like it, which was that Michael Brown resisted arrest, fought with, and menaced officer Wilson before getting shot.

The Woke moral panic that proceeded from this effectively suppressed two truths about police relations with Black America: 1) that Blacks committed crimes against life and property at a disproportionately high rate to their percentage in the US population, and 2) that the number of unarmed black people killed by police was statistically minuscule, and in most cases involved people resisting arrest or fighting with police. As the 2016 election approached, the Democratic Party realized it was in its interest to cultivate the Woke moral panic so as to marshal the Black voting bloc so crucial to victory at the polls.

Victoria Nuland et al.

• Biden Admin Plots Revenge On Russia For Alleged Hacking, Meddling (ZH)

President Joe Biden – whose son Hunter received $3.5 million by the wife of the late Moscow Mayor Yuri Luzhkov for reasons unknown – is preparing to retaliate for various Russian misdeeds, including the SolarWinds hack and election interference, according to Bloomberg. Retaliatory options may include sanctions on people close to Russian President Vladimir Putin, agencies linked to alleged election meddling, and the expulsion of Russian intelligence officers in the US who are currently under diplomatic cover, according to anonymous officials – one of whom said that the US response ‘would likely comprise several elements.’

“The actions will be the outcome of the review President Joe Biden ordered on his first full day in office into four areas: Interference in the U.S. election, reports of Russian bounties on U.S. soldiers in Afghanistan, the SolarWinds attack and the poisoning of Russian opposition leader Alexey Navalny. The administration announced sanctions against Russian officials over Navalny last month but had so far held off on action in the other three areas.” -Bloomberg. Last month, Biden nodded in agreement when asked if he thought Putin was a “killer,” to which Putin said ‘takes one to know one.’ Putin then challenged Biden to a live, televised debate to discuss geopolitical friction, which the US President promptly declined.

According to the report, beyond sanctioning individuals, the Biden administration could expel diplomats or other measures designed to establish ‘effective deterrence against cyber attacks’ such as the SolarWinds exploit which affected several government agencies and private corporations.

VIPS. McGovern, Kiriakou, Binney, Ritter etc.

• Veteran Intelligence Officials Urge Biden To Avoid War In Ukraine (ZH)

1. It must be made clear to Ukrainian President Zelensky that there will be no military assistance from either the US or NATO if he does not restrain Ukrainian hawks itching to give Russia a bloody nose — hawks who may well expect the West to come to Ukraine’s aid in any conflict with Russia. (There must be no repeat of the fiasco of August 2008, when the Republic of Georgia initiated offensive military operations against South Ossetia in the mistaken belief that the US would come to its assistance if Russia responded militarily.)

2. We recommend that you quickly get back in touch with Zelensky and insist that Kiev halt its current military buildup in eastern Ukraine. Russian forces have been lining up at the border ready to react if Zelensky’s loose talk of war becomes more than bravado. Washington should also put on hold all military training activity involving US and NATO troops in the region. This would lessen the chance that Ukraine would misinterpret these training missions as a de facto sign of support for Ukrainian military operations to regain control of either the Donbas or Crimea.

3. It is equally imperative that the U.S. engage in high-level diplomatic talks with Russia to reduce tensions in the region and de-escalate the current rush toward military conflict. Untangling the complex web of issues that currently burden U.S.-Russia relations is a formidable task that will not be accomplished overnight. This would be an opportune time to work toward a joint goal of preventing armed hostilities in Ukraine and wider war.

There is opportunity as well as risk in the current friction over Ukraine. This crisis offers your administration the opportunity to elevate the moral authority of the United States in the eyes of the international community. Leading with diplomacy will greatly enhance the stature of America in the world.

For the Steering Group, Veteran Intelligence Professionals for Sanity

“..without clear sign US ready for bilateral relations..”

• Russia Unlikely To Send Recalled Ambassador Back To Washington (RT)

Russia’s Foreign Ministry has revealed it has no plans to restore full diplomatic representation in Washington until it sees evidence that the US is interested in building constructive relations between the two countries. Deputy Foreign Minister Sergey Ryabkov was asked by RIA Novosti on Wednesday whether Ambassador Anatoly Antonov would return to America in the near future, having been recalled in March amid a growing diplomatic row. “This is not a question for the next few days,” he said. “The timings will be determined based on what steps Washington plans to take on the bilateral track,” he continued. “We expect that they are still able to demonstrate a desire to at least relatively stabilize our relationship and that they will do something visible and noticeable in this regard.”

Antonov flew to Moscow for a series of crunch talks with senior officials in the days following US President Joe Biden’s interview with the ABC news network, in which he was asked whether he believes Russian President Vladimir Putin is a “killer,” and replied, “Mmm hmm, I do.” The American leader also said he had warned the Russian president that the US would potentially take action if it found evidence of Moscow’s interference in the US election. “He will pay a price,” Biden added. His comments came as a joint report by Washington’s spy agencies, including the CIA and the Department of Homeland Security, was declassified and made available to the public. It declared that Russia attempted to influence the 2020 US election with the aim of “denigrating President Biden’s candidacy and the Democratic Party, supporting former President Trump, undermining public confidence in the electoral process, and exacerbating sociopolitical divisions in the US.”

“This will be a message for a new age..” “the most important political and public event.”

• Putin Poised To Set Out Vision For Future In Dramatic Speech (RT)

Russian President Vladimir Putin is reportedly preparing to give a major address in which he will fire the starting pistol on a “new era” and set out a different vision for the future of his country as the Covid-19 pandemic wanes. The chairwoman of the Russian Senate, Valentina Matvienko, told reporters on Tuesday that the speech would set out answers to a number of challenges facing the world. “This will be a message for a new age,” she said. “But at the same time, as always, current issues will be addressed, focuses will be defined and direct instructions will be given.” Matvienko added that “in the current difficult environment facing the world, which comes with many obstacles for countries including Russia,” the address would become “the most important political and public event.”

Putin is due to speak to the national parliament, encompassing both the Senate and its lower house, the State Duma, on April 21. Kremlin spokesman Dmitry Peskov revealed on Monday that the annual message would be delivered in person, amid a relaxing of social distancing rules governing workplaces across the country. “The rest of the details are being worked out,” he added. At a meeting of the World Economic Forum in January, Putin warned that the coronavirus pandemic was driving countries to borrow beyond their means and driving up inequality. Increasing the debt burden, he said, was an outdated way of stimulating growth. “If 20 or 30 years ago the problem could be solved by means of stimulating macro-economic policy, today these mechanisms have reached their limits,” the president said.

“Over the past 30 years, real incomes of people living in most of the developed countries have stagnated while the cost of education and health services has increased. Millions of people, even in rich countries, no longer see the prospect of boosting their incomes,” Putin added.

Big game hunters.

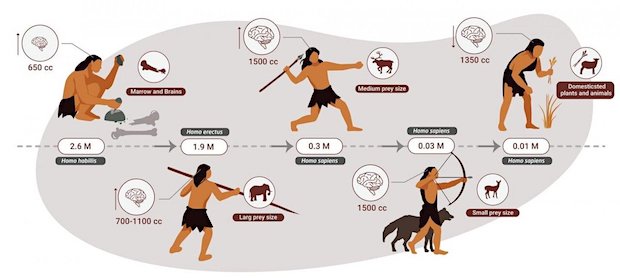

• Humans Were Apex Predators For Two Million Years (Phys.org)

Only the extinction of larger animals (megafauna) in various parts of the world, and the decline of animal food sources toward the end of the stone age, led humans to gradually increase the vegetable element in their nutrition, until finally they had no choice but to domesticate both plants and animals—and became farmers. “So far, attempts to reconstruct the diet of stone-age humans were mostly based on comparisons to 20th century hunter-gatherer societies,” explains Dr. Ben-Dor. “This comparison is futile, however, because two million years ago hunter-gatherer societies could hunt and consume elephants and other large animals—while today’s hunter gatherers do not have access to such bounty. The entire ecosystem has changed, and conditions cannot be compared.

We decided to use other methods to reconstruct the diet of stone-age humans: to examine the memory preserved in our own bodies, our metabolism, genetics and physical build. Human behavior changes rapidly, but evolution is slow. The body remembers.” In a process unprecedented in its extent, Dr. Ben-Dor and his colleagues collected about 25 lines of evidence from about 400 scientific papers from different scientific disciplines, dealing with the focal question: Were stone-age humans specialized carnivores or were they generalist omnivores? Most evidence was found in research on current biology, namely genetics, metabolism, physiology and morphology. “One prominent example is the acidity of the human stomach,” says Dr. Ben-Dor. “The acidity in our stomach is high when compared to omnivores and even to other predators. Producing and maintaining strong acidity require large amounts of energy, and its existence is evidence for consuming animal products.

Strong acidity provides protection from harmful bacteria found in meat, and prehistoric humans, hunting large animals whose meat sufficed for days or even weeks, often consumed old meat containing large quantities of bacteria, and thus needed to maintain a high level of acidity. Another indication of being predators is the structure of the fat cells in our bodies. In the bodies of omnivores, fat is stored in a relatively small number of large fat cells, while in predators, including humans, it’s the other way around: we have a much larger number of smaller fat cells. Significant evidence for the evolution of humans as predators has also been found in our genome. For example, geneticists have concluded that “areas of the human genome were closed off to enable a fat-rich diet, while in chimpanzees, areas of the genome were opened to enable a sugar-rich diet.”

Whitney Webb: “Anyone who is down to let Silicon Valley “hack” life processes and nature in general can fuck right off.”

• Can Blood from Young People Slow Aging? (NW)

The Spanish firm Grifols helped set off a kerfuffle last year when it, along with other firms, offered nearly double the going price for blood donations for a COVID-19 treatment trial. Brigham Young University in Idaho had to threaten some enterprising students with suspension to keep them from intentionally trying to contract COVID-19. The trial failed, however, and now the Barcelona-based firm is hoping to extract something far more valuable from the plasma of young volunteers: a set of microscopic molecules that could reverse the process of aging itself. Earlier this year, Grifols closed on a $146 million-deal to buy Alkahest, a company founded by Stanford University neuroscientist Tony Wyss-Coray, who, along with Saul Villeda, revealed in scientific papers published in 2011 and 2014 that the blood from young mice had seemingly miraculous restorative effects on the brains of elderly mice.

The discovery adds to a hot area of inquiry called geroscience that focuses on identifying beneficial elements of blood that dissipate as we age and others that accumulate and cause damage. In the last six years, Alkahest has identified more than 8,000 proteins in the blood that show potential promise as therapies. Its efforts and those of Grifols have resulted in at least six phase 2 trials completed or underway to treat a wide range of age-related diseases, including Alzheimer’s and Parkinson’s. Alkahest and a growing number of other geroscience health startups signal a change in thinking about some of the most intractable diseases facing humankind. Rather than focusing solely on the etiology of individual diseases like heart disease, cancer, Alzheimer’s and arthritis—or, for that matter, COVID-19—geroscientists are trying to understand how these diseases relate to the single largest risk factor of all: human aging.

Their goal is to hack the process of aging itself and, in the process, delay or stave off the onset of many of the diseases most associated with growing old. The idea that aging and illness go hand and hand is, of course, nothing new. What’s new is the newfound confidence of scientists that “aging” can be measured, reverse-engineered and controlled. Until recently, “people working on diseases did not think that aging was modifiable,” says Felipe Sierra, who recently retired as director of the Division of Aging Biology, part of the National Institutes of Health. “That is actually what many medical books say: The main risk factor for cardiovascular disease is aging, but we cannot change aging so let’s talk about cholesterol and obesity. For Alzheimer’s, aging is the main risk factor—but let’s talk about the buildup in the brain of beta-amyloid proteins. Now that is beginning to change.”

We try to run the Automatic Earth on donations. Since ad revenue has collapsed, you are now not just a reader, but an integral part of the process that builds this site. Thank you for your support.

Support the Automatic Earth in virustime. Click at the top of the sidebars to donate with Paypal and Patreon.