René Magritte� Companions of fear �1942

Lehman sold bad loans to banks for a fee so it could look better, only to buy them back days later. It was very basic fraud. And Dick Fuld walked away.

Every time Dick Fuld’s publicists succeed in getting a “redemption story” published in the Wall Street Journal or New York Times, I’m going to write an Epsilon Theory brief about Repo 105, the fraudulent scheme that Lehman Brothers ran for years to hide its deteriorating financial condition from investors and regulators alike.

[..] Repo 105 was a multiyear scheme by Lehman to defraud the government and its own investors by falsifying the actual amount of loans it had on the books, making Lehman look safer than it actually was. It worked like this. A few days before the end of the calendar quarter, Lehman would “sell” billions of dollars worth of loans to another bank. I put “sell” in quotation marks, because Lehman ALSO had an agreement with these other banks to buy the loans back a few days after the quarter ended for the same price as they were sold, plus enough money to cover whatever the going interest rate was on that cash for the few days it was in Lehman’s hands. This is what’s called a repurchase agreement, or repo, hence the name Repo 105 (the 105 refers to the 5% overcollateralization that counterparty banks required to lend the cash to Lehman even for a few days – THEY knew Lehman was in trouble).

Since financial reporting happens at the end of the quarter, Lehman’s books would look like they had more cash and fewer loans than they actually did. Surely, you say, no law firm would bless this blatant attempt to cook the books? And I say, don’t call me Shirley. I say, well … no US law firm would bless this, so naturally Lehman found a UK firm, Linklaters, to say that this was, in fact, technically a “true sale”. Even then, to pull this off Lehman had to run Repo 105 through their offshore subsidiaries, not through their US-chartered entities. It was really expensive for Lehman to run Repo 105. But also entirely necessary, or else the entire house of cards that WAS Lehman would have collapsed well before September, 2008.

Risk. It’s back.

• The Everything Bubble” Threatens $400 Trillion In Assets (ZH)

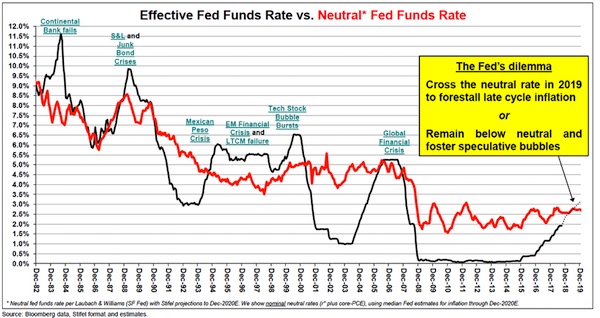

By now, it’s a very familiar question: how high can the Fed hike rates before it causes a major market “event.” Two weeks ago, Stifel analyst Barry Banister became the latest to issue a timeline on how many more rate hikes the Fed can push through before the market is finally impacted. According to his calculations, just two more rate hikes would put the central bank above the neutral rate – the interest rate that neither stimulates nor holds back the economy. The Fed’s long-term projection of its policy rate has risen from 2.8% at the end of 2017 to 2.9% in June. As the following chart, every time this has happened, a bear market has inevitably followed.

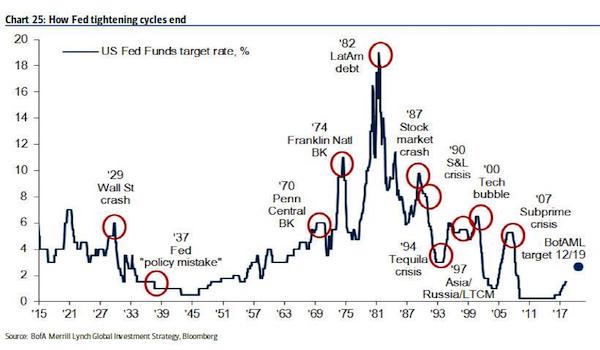

A similar argument was made recently by both Deutsche Bank and Bank of America, which in two parallel analyses observed last year that every Fed tightening cycle tends to end in a crisis. In a report issued on Friday, BCA’s strategists make the key point that the performance of bonds – and stocks – in an inflation scare would depend on the relative size of the inflationary impulse compared with the disinflationary impulse that resulted from sharply lower risk-asset prices. They make the point that if central banks were more concerned about the inflationary impulse, which at least for Fed chair Powell appears to be the case for now – Janet Yellen’s “lower for longer revised forward guidance” notwithstanding – they would have to keep tightening – in which case, bond yields would be liberated to reach elevated territory.

Conversely, if the bigger worry was the disinflationary impulse, which arguably is the case from a legacy standpoint, central banks would quickly reverse course, and bond yields would return to the lowlands. Thus, the disinflationary impulse from lower risk-asset prices would end up as the bigger issue. [..] BCA estimates that the total value of global risk-assets is $400 trillion, equal to about five times the size of the global economy. The takeaway is that any inflationary impulse would – through higher bond yields – undermine the valuation support of global risk-assets that are worth several times the size of the global economy.

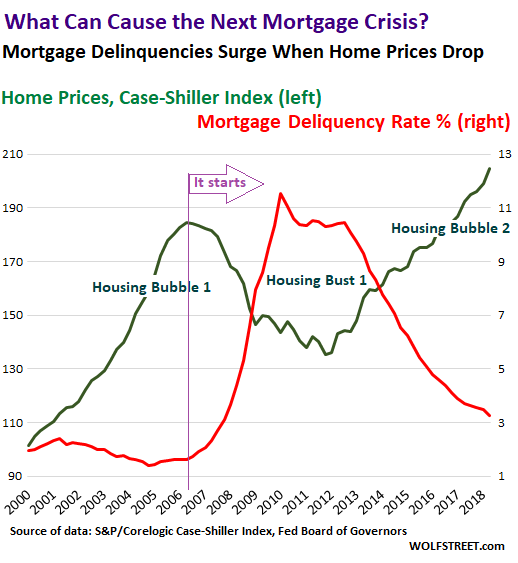

“In a rising housing market, delinquencies will always be low but are not an indicator of future default risks. But home prices are an indicator of default risk.”

• What Can Cause the Next Mortgage Crisis in the US? (WS)

Mortgage delinquencies at all commercial banks in the US inched down to 3.14% in the second quarter, the lowest since Q2 2007, according to the Federal Reserve. But after those soothingly low delinquency rates in 2007, something happened. By Q3 2008, the delinquency rate hit 5.2%, and in Q4 2009, it went over 10%, and stayed in the double-digits until Q1 2013. This was the mortgage crisis. And we’re a million miles away from it, thank God. Or are we? This chart compares home prices in the US (green, left scale) to delinquency rates (red, right scale). Delinquency rates started surging after home prices started falling. The inflection point is marked by the vertical purple line, labeled “it starts”:

Home prices began falling in 2006. By 2008, some homeowners were seriously “underwater” – they owed more on their house than the house was worth. When they ran into financial trouble because they were in over their heads, or because one of the breadwinners in the household lost their jobs, or because they’d lied on their mortgage application and never had enough income to begin with, or because they were investors who couldn’t make the math work out anymore, or whatever, they were stuck. In a rising housing market, they would just sell the home and pay off the mortgage. But they couldn’t sell their home because it was worth less than the mortgage, and default was the only option. The chart above shows the relationship between home prices and delinquencies. In a rising housing market, delinquencies will always be low but are not an indicator of future default risks. But home prices are an indicator of default risk.

“The U.S. government is “missing” $21 trillion between the DOD and HUD.”

• Dollar Dominant & Dangerous, System Not Stable – Catherine Austin Fitts (USAW)

Investment advisor and former Assistant Secretary of Housing, Catherine Austin Fitts, predicts the global financial system “will take some big hits before the end of the year.” Fitts explains, “Right now, economists say the dollar is ‘dangerous and dominant.’ It’s still, if you look at the market shares around the world, it’s still very, very significant portion of total reserves. So, it’s still very important. At the same time, the U.S. dollar hegemony is probably not going to last forever . . . So, I think the long term dollar looks very weak. Short term, it doesn’t look like it’s coming apart anytime soon, as far as I can see. What that means is when you have something that is dangerous and dominant, you have the possibility of extreme volatility events.

That’s the new code word for the ‘you know what’ hits the, you know what. Whether it’s different countries exploding economically, or we whether are pressuring people that makes them very uncomfortable, these kinds of fights over shrinking pies are very dangerous because they mean covert wars. They mean overt wars, and the more we steal pies from each other instead of make new pies, the worse the situation gets. That’s what you are seeing. The system is not stable.” [..] There is good reason people are going to real assets. The U.S. government is “missing” $21 trillion between the DOD and HUD. This fact was uncovered by Fitts and economist Dr. Mark Skidmore last year.

What was the government’s answer to this gigantic accounting fraud that is the size of the federal deficit? Give the government’s budgets basically classified national security status. Fitts says, “Apparently, the people leading the audit have come to them and said if we do this audit, we will disclose classified projects. So, the board (Federal Accounting Standards Advisory Board – FASAB) came out with a new policy. I say it is illegal. You cannot do it under the financial management laws, and you certainly cannot do it under the Constitution, and it said you can keep classified off the books, which means you can cook the books and you can basically do whatever you want.

What was that about reality and fiction?

• Shell Faces One Of The Biggest Corruption Cases In Corporate History (Ind.)

Giant oil companies, offshore accounts, ex-MI6 agents, champagne lunches, a former Nigerian president and allegations of one of the biggest bribes ever paid – the corruption case against Shell and Italy’s Eni filed by prosecutors in Milan over a shady $1.3bn deal for a vast African oil field has all the elements of an espionage thriller. The latest twists thicken the plot further with a cache of documents seized in a raid on a Swiss financier’s apartment that could be crucial to the case, leaving prosecutors in a race against time to get them to Milan as trial hearings get underway this week. The Geneva raid uncovered a briefcase belonging to Emeka Obi, a middleman who received millions of dollars from the deal and is in the dock along with several senior Shell and Eni executives.

Inside the briefcase, Swiss prosecutors found a laptop, two Nigerian passports, five sim cards and a hard drive containing 41,000 documents that prosecutors believe could be crucial to the trial playing out on the other side of the Alps. The stakes are high. Italian prosecutors allege that, of the total $1.3bn fee paid by Shell and Eni for the oil field, $1.1bn went not into the coffers of the Nigerian state but the accounts of former oil minister Dan Etete who then distributed hundreds of millions to well-connected individuals, including former president Goodluck Jonathan. The amount distributed as bribes is more than the entire Nigerian healthcare budget for 2018, in a country where 87 million people live in extreme poverty – more than any other country on earth.

She’s stuck. Dangerous position.

• Only Alternative To Chequers Is No Brexit Deal, Says Theresa May (G.)

May said: “I believe we will get a good deal. We will bring that back from the EU negotiations and put that to parliament. I think that the alternative to that will be not having a deal.” The Chequers plan prompted the resignations of David Davis and Boris Johnson. May tried again to remake the case for it by claiming the other options put forward by the EU were unacceptable. “The European Union had basically put two offers on the table. Either the UK stays in the single market and the customs union – effectively in the EU – that would have betrayed the vote of the British people,” she said.

“Or, on the other side, a basic free trade agreement but carving Northern Ireland out and effectively keeping Northern Ireland in the European Union and Great Britain out. That would have broken up the United Kingdom, or could have broken up the United Kingdom. Both of those were unacceptable to the UK. “We said ‘no’ … we’re going to put our own proposal forward and that’s what Chequers is about … It unblocked the negotiations.”

Preparing to blame the EU for failing.

• Brussels Nearing Impasse With May Over Irish Border Proposal (G.)

The EU is proving unable to convince Theresa May that by using “trusted trader schemes” and technology its proposal to in effect keep Northern Ireland in the customs union and single market will not draw a border in the Irish sea. The Brexit negotiations have reached an impasse over the failure to find an acceptable solution to avoiding a hard border on the island of Ireland after the UK leaves the EU. The solution proposed by Brussels in which Northern Ireland has a different status from the rest of the UK has been rejected by the prime minister as involving the economic and constitutional “dislocation” of the country. The EU’s chief negotiator, Michel Barnier, has nevertheless repeatedly insisted that the issue can be “de-dramatised”.

Barnier has sought to show that the level of trade between Belfast and the rest of the UK is minimal, and that the checks that would be required do not pose a constitutional threat to the British government. But according to what is described as a diplomatic note seen by the Times, the EU is struggling to convince the UK that it is significant that checks at a border could be avoided entirely for many companies through trusted trade schemes. The diplomatic note, said to have been drafted following a meeting of EU ambassadors last Wednesday with Barnier’s deputy, Sabine Weyand, reports that the UK has not been “helpful” over the issue. The note says: “The biggest unsolved problem is Northern Ireland. There is a political mobilisation in the UK in this regard. Therefore, we are trying to clarify the EU position. The controls or checks only have to be organised in a way that would not endanger the EU single market.”

How about you start by picking your own strawberries?

• Four In 10 Think British Culture Is Undermined By Multiculturalism (G.)

A large minority of people in the UK believe multiculturalism has undermined British culture and that migrants do not properly integrate, according to some of the broadest research into the population’s attitudes to immigration. The study, conducted over the last two years, also reflects widespread frustration at the government’s handling of immigration, with only 15% of respondents feeling ministers have managed it competently and fairly. On balance, the UK population appears to be slightly more positive than negative about the impact of immigration; however, 40% of respondents agreed that having a wide variety of backgrounds has undermined British culture. More than a quarter of people believe MPs never tell the truth about immigration and half the population wants to see a reduction in the numbers of low-skilled workers coming into Britain from the EU.

The study was based on a survey of 3,667 adults carried out in June by ICM, as well as 60 citizens’ panels carried out on behalf of the thinktank British Future and the anti-racism group Hope Not Hate. “The lack of trust we found in the government to manage immigration is quite shocking,” said Jill Rutter, the director of strategy for British Future. “People want to have their voices heard on the choices we make, and to hold their leaders to account on their promises. While people do want the UK government to have more control over who can come to the UK, most of them are ‘balancers’ – they recognise the benefits of migration to Britain, both economically and culturally, but also voice concerns about pressures on public services and housing.”

“Should be solved shortly..”

• Musk Says Tesla Now In ‘Delivery Logistics Hell’ (R.)

Tesla Inc’s Chief Executive Officer Elon Musk on Sunday acknowledged that the electric carmaker’s problems have now shifted to delivery logistics from production delays, the latest speed bump in its efforts to achieve profitability. “Sorry, we’ve gone from production hell to delivery logistics hell, but this problem is far more tractable. We’re making rapid progress. Should be solved shortly,” Musk said in a tweet here in response to a customer complaint on delivery delay. The 47-year-old billionaire who earlier this month faced investor ire over smoking marijuana on a live web show, has indicated in the past that Tesla’s customers may face a longer response time because of a significant increase in vehicle delivery volume in North America.

238 academics signed. But it’s not the conversation we’ll have.

• The EU Needs A Stability And Wellbeing Pact, Not More Growth (G.)

This week, scientists, politicians, and policymakers are gathering in Brussels for a landmark conference. The aim of this event, organised by members of the European parliament from five different political groups, alongside trade unions and NGOs, is to explore possibilities for a “post-growth economy” in Europe. For the past seven decades, GDP growth has stood as the primary economic objective of European nations. But as our economies have grown, so has our negative impact on the environment. We are now exceeding the safe operating space for humanity on this planet, and there is no sign that economic activity is being decoupled from resource use or pollution at anything like the scale required. Today, solving social problems within European nations does not require more growth. It requires a fairer distribution of the income and wealth that we already have.

Growth is also becoming harder to achieve due to declining productivity gains, market saturation, and ecological degradation. If current trends continue, there may be no growth at all in Europe within a decade. Right now the response is to try to fuel growth by issuing more debt, shredding environmental regulations, extending working hours, and cutting social protections. This aggressive pursuit of growth at all costs divides society, creates economic instability, and undermines democracy. Those in power have not been willing to engage with these issues, at least not until now. The European commission’s Beyond GDP project became GDP and Beyond. The official mantra remains growth — redressed as “sustainable”, “green”, or “inclusive” – but first and foremost, growth. Even the new UN sustainable development goals include the pursuit of economic growth as a policy goal for all countries, despite the fundamental contradiction between growth and sustainability.

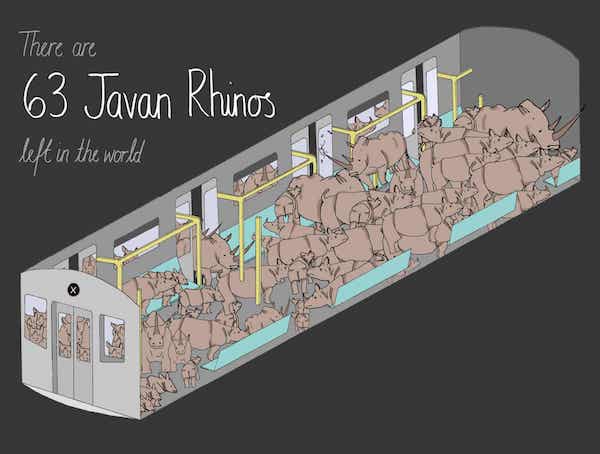

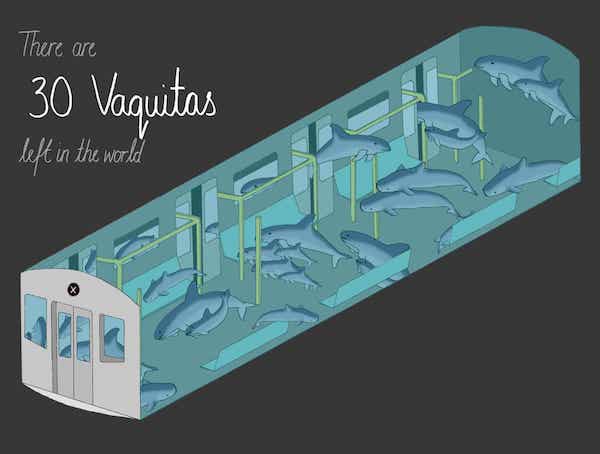

Another way to put it. You could easily do this for 70 species, or 700, 7000.

• 7 Endangered Species That Could (Almost) Fit In A Single Train Carriage (G.)

Some species are so close to extinction, that every remaining member can fit on a New York subway carriage (if they squeeze). All estimates come from the IUCN Red List, 2018.

Home › Forums › Debt Rattle September 17 2018