M. C. Escher� Still life and street �1937

We’re getting real close to core constitutional issues now.

• FBI, DOJ To Defy Trump Declassification Order (ZH)

Despite President Trump’s Monday order for the “immediate declassification” of sensitive materials related to the Russia investigation, “without redaction,” the agencies involved are planning to do so anyway, according to Bloomberg, citing three people familiar with the matter. “The Justice Department, FBI and Office of the Director of National Intelligence are going through a methodical review and can’t offer a timeline for finishing, said the people, who weren’t authorized to speak publicly about the sensitive matter.” -Bloomberg. Trump ordered the DOJ to release the text messages of former FBI Director James Comey, his deputy Andrew McCabe, now-fired special agent Peter Strzok, former FBI attorney Lisa Page and twice-demoted DOJ official Bruce Ohr.

Also ordered released are specific pages from the FBI’s FISA surveillance warrant application on former Trump campaign aide Carter Page, as well as interviews with Ohr. The DOJ and the FBI are expected to submit proposed redactions to the Office of the Director of National Intelligence – which will prepare a package for Trump to sign off on. “When the president issues such an order, it triggers a declassification review process that is conducted by various agencies within the intelligence community, in conjunction with the White House counsel, to seek to ensure the safety of America’s national security interests,” a Justice Department spokesman said in a statement. “The department and the Federal Bureau of Investigation are already working with the Director of National Intelligence to comply with the president’s order.”

Ahead of a meeting with Jeff Sessions.

• Louisiana AG Jeff Landry Wants To Break Up Social Media Giants (Advocate)

Louisiana Attorney General Jeff Landry would like to see Google, Facebook and other major social media behemoths broken up like the federal government did to Standard Oil more than a century ago. Landry says the internet giants are suppressing conservative agendas, stifling competition, and infringing on antitrust laws. “This can’t be fixed legislatively,” Landry told The Advocate Tuesday. “We need to go to court with an antitrust suit.” Landry – or Chief Deputy Attorney General Bill Stiles – will go to Washington, D.C. next week to push that solution to U.S. Attorney General Jeff Sessions. Sessions, who is considering an investigation against the social media companies, set a Sept. 25 meeting with about a half dozen Republican state attorney generals.

[..] “The U.S. Department of Justice weighing in absolutely gives us an edge … their participation accelerates the timeline,” Landry said. The federal lawyers have the funding, experience and expertise that states can’t match when handling such complex litigation. “I thought it would be years to get this going,” Landry said. “This moves up the timeline.” He is against the idea, at first blush, of letting the companies settle for some huge sum and promises to behave better in the future – a frequent outcome of anti-trust lawsuits, Landry said. “I’m not prepared to say what the exact remedy would look like,” Landry said. But his gut feel is “that breaking up the monopoly is a good idea.”

“Vestager has the power to fine companies up to 10 percent of their global turnover..”

• Amazon Hit By EU Antitrust Probe (CNBC)

The EU regulators behind a $5 billion fine against Google are turning their attentions to Amazon. European Competition Commissioner Margrethe Vestager has begun questioning merchants on Amazon’s use of their data, Vestager said Wednesday. The issue, she said, is whether Amazon is using data from the merchants it hosts on its site to secure an advantage in selling products against those same retailers. “These are very early days and we haven’t formally opened a case. We are trying to make sure that we get the full picture,” Vestager said during a news conference Wednesday.

The probe comes as the world’s largest online retailer faces growing calls for regulation. Investors and insiders have long cited Amazon’s size and reach as reason to break the company up. President Donald Trump has hinted at antitrust action against Amazon as part of continued attacks against CEO Jeff Bezos, who also owns The Washington Post. U.S. Attorney General Jeff Sessions was set to meet this month with state officials to discuss antitrust concerns in Silicon Valley, though much of the regulation on Big Tech thus far has come out of Brussels. Vestager has the power to fine companies up to 10 percent of their global turnover for breaching EU antitrust rules. Earlier this year, she levied a record $5 billion fine against Google related to its Android business.

You mean, by the FBI and CIA?

• Facebook Building A ‘War Room’ To Battle Election Meddling (AFP)

Facebook on Wednesday said it will have a “war room” up and running on its Silicon Valley campus to quickly repel efforts to use the social network to meddle in upcoming elections. “We are setting up a war room in Menlo Park for the Brazil and US elections,” Facebook elections and civic engagement director Samidh Chakrabarti said during a conference call. “It is going to serve as a command center so we can make real-time decisions as needed.” He declined to say when the “war room” — currently a conference room with a paper sign taped to the door — would be in operation.

Teams at Facebook have been honing responses to potential scenarios such as floods of bogus news or campaigns to trick people into falsely thinking they can cast ballots by text message, according to executives. “Preventing election interference on Facebook has been one of the biggest cross-team efforts the company has seen,” Chakrabarti said. The conference call was the latest briefing by Facebook regarding efforts to prevent the kinds of voter manipulation or outright deception that took place ahead of the 2016 election the brought US President Donald Trump to office.

What social media tech can lead to. If they do it in China, what would keep them from doing it here?

• Leave No Dark Corner: China Is Building A Digital Dictatorship (ABC.au)

What may sound like a dystopian vision of the future is already happening in China. And it’s making and breaking lives. The Communist Party calls it “social credit” and says it will be fully operational by 2020. Within years, an official Party outline claims, it will “allow the trustworthy to roam freely under heaven while making it hard for the discredited to take a single step”. Social credit is like a personal scorecard for each of China’s 1.4 billion citizens. In one pilot program already in place, each citizen has been assigned a score out of 800. In other programs it’s 900. Those, like Dandan, with top “citizen scores” get VIP treatment at hotels and airports, cheap loans and a fast track to the best universities and jobs.

Those at the bottom can be locked out of society and banned from travel, or barred from getting credit or government jobs. The system will be enforced by the latest in high-tech surveillance systems as China pushes to become the world leader in artificial intelligence. Surveillance cameras will be equipped with facial recognition, body scanning and geo-tracking to cast a constant gaze over every citizen. Smartphone apps will also be used to collect data and monitor online behaviour on a day-to-day basis. Then, big data from more traditional sources like government records, including educational and medical, state security assessments and financial records, will be fed into individual scores.

The link doesn’t go to an article about the interview, but it’s what Bloomberg provided on Twitter.

• Steve Keen Says U.S. Heading for 2020 Recession (BBG)

Kingston University Professor Steve Keen says that the Fed has accentuated the financial crisis through quantitative easing https://t.co/CX7SPJsaYd pic.twitter.com/Okj2kP2cD5

— BSurveillance (@bsurveillance) September 19, 2018

Inequality CAN bring down societies.

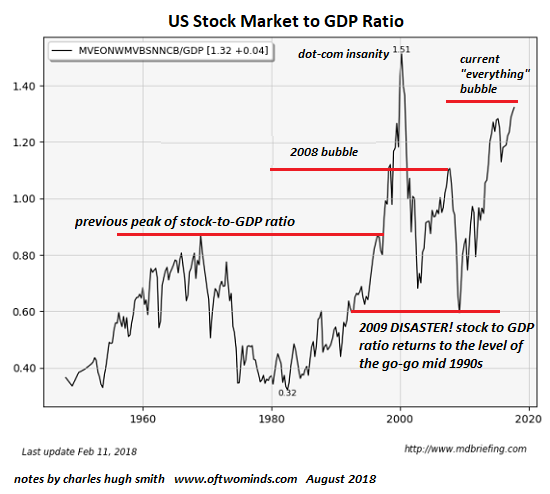

• Digging into Wealth and Income Inequality (CHS)

The assets of U.S. households recently topped $100 trillion, yet another sign that everything is going swimmingly in the U.S. economy. Let’s take a look at the Federal Reserve’s Household Balance Sheet, which lists the assets and liabilities of all U.S. households in very big buckets (real estate: $25 trillion). (For reasons unknown, the Fed lumps non-profit assets and liabilities with households, but these modest sums are easily subtracted.) If we look at the numbers with a reasonably skeptical view, we start wondering about aspects that might have previously been taken as “facts” that were above questioning. For example, households hold $11.6 trillion in cash (deposits). That’s unambiguous.

So is the $29.3 trillion in stocks (owned directly and indirectly, i.e. retirement funds, etc.). But what about the $16 trillion in “other financial assets”? This isn’t cash, stocks, bonds, retirement funds or noncorporate businesses–then what is it? Offshore banking? That $16 trillion is equal to all homeowners’ equity (real estate minus mortgages). It’s a non-trivial chunk of the $100 trillion in net assets everyone is crowing about. I also wonder about the valuation of noncorporate businesses–small family businesses, LLCs, sole proprietorships, etc.– $11.9 trillion. How do you value a business that’s hanging on by a thread? Or one that’s a tax shelter?

We know from other sources that roughly 85% of all this wealth is held by the top 10% of households. This isn’t included in this balance sheet, but without those statistics, these numbers lack critical context: if household wealth is soaring, that sounds wonderful. But what if 95% the gains are flowing to the top 5%, and within the top 5%, mostly to the top .1%?

Like she’s in a position to issue ultimatums.

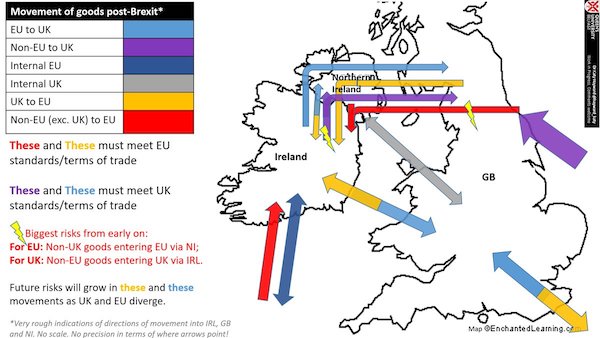

• Theresa May Tells EU27 She Won’t Delay Brexit Despite Lack Of A Deal (G.)

Theresa May has tried to threaten EU leaders over dinner at a special summit in Salzburg by telling them the UK would not seek to delay Brexit, prompting European leaders to warn that the two sides remained far apart on trade and the Irish border despite months of negotiations. The prime minister told her counterparts “that the UK will leave on 29 March next year” and as a result “the onus is now on all of us to get this deal done” by the end of an emergency summit that the EU confirmed would happen in mid-November. It was the first time since Chequers that May has had a chance to address the EU’s other 27 heads of government instead of going through their chief negotiator, Michel Barnier, with No 10 hoping that it would inject some urgency into the divorce talks.

“We all recognise that time is short but extending or delaying these negotiations is not an option,” she said. But as the summit started Jean-Claude Juncker, the president of the European commission, said that a deal remained “far away” while Donald Tusk, the president of the European council, warned that the UK’s proposals for the Irish border and future trade relations with the EU needed to be “reworked and further negotiated”. Tusk added that “various scenarios are still possible” – a clear hint that no deal was still a possibility. Despite the EU leaders’ statements, No 10 is hoping that May’s pitch to EU leaders will eventually prompt some greater flexibility on the part of Brussels in the critical period for the Brexit negotiations between a scheduled European council meeting in October and the decisive summit in November.

No berries for you next summer.

• ‘Seven In 10’ EU Workers In UK Would Be Barred Under Brexit Proposals (G.)

The majority of EU workers in the UK would not be eligible to work in the country following Brexit if they were subject to proposals put forward by the government’s chief migration advisers, analysis by a leading leftwing thinktank shows. EU citizens currently in the UK are expected to be protected under the terms of the UK-EU withdrawal agreement but findings by the Institute for Public Policy Research (IPPR) illustrate how proposals by the Migration Advisory Committee (MAC) will potentially restrict businesses recruiting migrants from the EU in future.

In its report on EU migration after Brexit, published on Tuesday, the committee recommended lifting the cap on highly skilled workers applying to take up jobs in the UK but also backed maintaining the salary threshold of £30,000. The committee also recommended only allowing in individuals at level three or above on the nine-level regulated qualifications framework (RQF). Comparing this criteria to data from the labour force survey, the IPPR estimates that around 75% of the UK’s current EU workforce would not be eligible were they subject to the proposals. The findings will likely enflame concerns from business leaders over proposals they have already branded “ignorant and elitist”.

Long overview by Adam Tooze.

• The Forgotten History of the Financial Crisis (Tooze)

Although more banks failed during the Depression, these failures were scattered between 1929 and 1933 and involved far smaller balance sheets. In 2008, both the scale and the speed of the implosion were breathtaking. According to data from the Bank for International Settlements, gross capital flows around the world plunged by 90 percent between 2007 and 2008. As capital flows dried up, the crisis soon morphed into a crushing recession in the real economy. The “great trade collapse” of 2008 was the most severe synchronized contraction in international trade ever recorded.

Within nine months of their pre-crisis peak, in April 2008, global exports were down by 22 percent. (During the Great Depression, it took nearly two years for trade to slump by a similar amount.) In the United States between late 2008 and early 2009, 800,000 people were losing their jobs every month. By 2015, over nine million American families would lose their homes to foreclosure—the largest forced population movement in the United States since the Dust Bowl. In Europe, meanwhile, failing banks and fragile public finances created a crisis that nearly split the eurozone.

[..] bankers on both sides of the Atlantic created the system that imploded in 2008. The collapse could easily have devastated both the U.S. and the European economies had it not been for improvisation on the part of U.S. officials at the Federal Reserve, who leveraged trans-atlantic connections they had inherited from the twentieth century to stop the global bank run. That this reality has been obscured speaks both to the contentious politics of managing global finances and to the growing distance between the United States and Europe. More important, it forces a question about the future of financial globalization: How will a multipolar world that has moved beyond the transatlantic structures of the last century cope with the next crisis?

Wow.

• Turkish Treasury Borrows $347 Million At 25% Interest Rate (Hu.)

The Turkish Treasury borrowed some 2.2 billion Turkish liras (around $347 million) from domestic markets, the Treasury and Finance Ministry announced on Sept. 18. The auction was held for 12-month zero coupon bonds – new issuance – to be settled on Sept. 19 and mature on Sept. 18, 2019, according to an official statement. The average annual simple and compound interest rates of the 364-day bonds were 25.05 percent, the ministry added. According to the domestic borrowing strategy, the ministry has projected 21.9 billion liras (around $3.4 billion) of borrowing from the market through auctions in the September-November period. Sept. 18’s auction was second out of a total 11 planned auctions on the ministry’s issuance calendar for the three-month period.

“Controversial pesticide pits farmer vs farmer in US.” Can we perhaps just stop using poison to produce food?

• US Officials Face Growing Pressure Over Dicamba Herbicide Use (AFP)

US environmental regulators are under increasing pressure over a controversial pesticide known for laying waste to nearby crops as well as the harmful weeds it is meant to control. Critics worried about the harm are calling for increased restrictions, following the example of many states, while producers and some farmers want fewer obstacles to use of a chemical they view as one of their last options. Much like Roundup, another much-criticized herbicide marketed by Monsanto, dicamba has been on the market a long time. But use of the chemical has jumped since Monsanto – which was bought by Germany’s Bayer in June – introduced seeds that can resist the weed-killer.

Dicamba has been a boon for farmers at a time when they have seen other leading herbicides lose their effectiveness and the battle against damaging weeds. Use of seeds resistant to dicamba doubled over the last year, reaching 20 million hectares (50 million acres) this summer. But the product has been blamed for polluting around four percent of US soybean fields in 2017. A common complaint is that the herbicide is volatile, meaning it spreads to nearby areas. It is only meant for use during the growing season for plants resistant to the chemical, and the US Environmental Protection Agency last year received reports of “significant crop damage from off-field movement of dicamba.” The EPA authorized use of the weed-killer for two years, through November, so it will soon need to announce any changes to the rules on when and how it can be used.

Home › Forums › Debt Rattle September 20 2018