Claude Monet Camille on the Beach at Trouville 1870

Medvedev is funny, with a serious twist. Note that this has all happened because of US sanctions. Russian grain exports have surged more than 54% this year. Funny that Ukraine fed much of Europe not that long ago (100 years?!) because of its highly fertile back earth.

• Russia Seeks To ‘Feed The Whole Planet’ – PM (RT)

Russia seeks to expand its agricultural exports, ultimately seeking to feed the whole planet, Prime Minister Dmitry Medvedev said. The PM’s statement comes as the country enjoys a record surge in grain exports. “Our country is, as they say, destined by the heavens to feed the whole planet. And we’ll try and do that,” Medvedev told journalists of Russian TV channels in a major interview aired on Thursday. Apart from being the country’s “destiny,” the foods plainly make “nice export goods,” the prime minister added. Russia’s agriculture has expanded greatly over the past few years, becoming a solid and profitable industry, unlike the way it was a couple decades ago.

“Back in 1990s, the agriculture was called a ‘black hole’, where one should not invest, we were told we should not feed ourselves since we can purchase everything elsewhere,” Medvedev said. “Now, it feeds our whole country. We’ve reached the main goals regarding food security and we’re exporting grains, other goods to the world market.” This year, Russia has enjoyed vast growth of its agricultural exports, becoming the world’s top exporter of wheat. From January through September of 2018, exports of Russia’s wheat and meslin flour expanded by 54.3% compared to the previous year. The amount of food which the county imports, in its turn, continued to shrink. Imports of grains to Russia dropped by 11.1% during the same period. Imports of barley have suffered an enormous decline, dropping a whopping 94%.

The logical consequences of central banks strangling price discovery.

• Markets Are Going Haywire, Sudden Moves Are Here To Stay (CNBC)

Wherever Mark Connors looks at markets, from stocks to currencies to oil, he sees signs of the unknown. Equity investors got whipsawed this week during two rough and volatile sessions, but Connors, global head of risk advisory at Credit Suisse, had seen worrying signs long before that. A key technical measure he tracks, the correlation between the price of stocks and currencies, had broken down starting in April. That, along with sharp drops in the price of oil, point to one thing, he says: Uncertainty about the future as central banks around the world unwind programs that bought trillions of dollars of assets.

“We’re seeing two of the biggest asset classes, stocks and currencies, exhibit a degree of uncertainty in their relationship in 2018 that we’ve never seen before,” Connors said. “Crude just exhibited something very unusual in the context of the last 40 years.” The unwinding of central banks’ programs a decade after the financial crisis brought economies to the brink is known as quantitative tightening. J.P. Morgan Chase CEO Jamie Dimon said in July that one of his biggest fears is around how markets would behave as central banks removed their unprecedented stimulus. “If quantitative tightening continues, guess what’s going to happen? More of this,” Connor said, referring to unusually violent moves across markets.

Another factor in the speed of recent declines is the result of several important changes that have happened since the last financial crisis. Automated trading strategies from quant hedge funds and the massive shift to passive investing have helped to remove liquidity from the system in times of panic, according to Marko Kolanovic, J.P. Morgan’s global head of macro quantitative and derivatives research. He said in a September note that index and quant funds made up two-thirds of assets under management globally and the majority of daily trading. So when investors begin to sell, as they did on Tuesday amid concerns over the state of U.S. trade talks with China, the moves were probably amplified by computerized trading strategies.

You’d have to have a -functioning- market for it to miss anything.

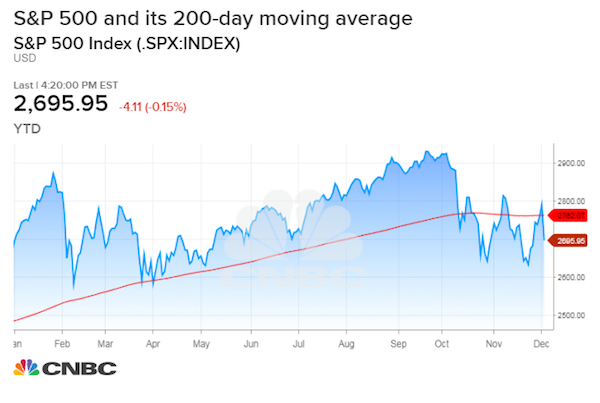

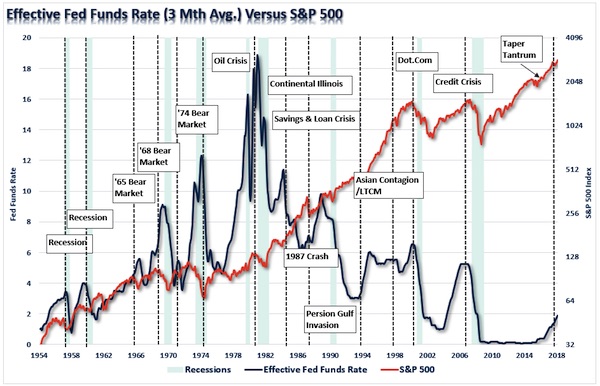

• Did The Market Miss Powell’s Real Message? (Roberts)

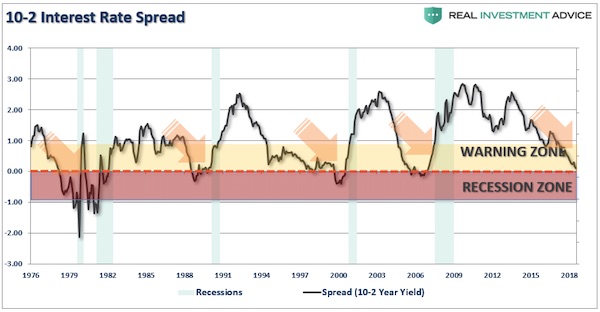

[..] With the Fed Funds rate running at near 2%, if the Fed now believes such is close to a ‘neutral rate,’ it would suggest that expectations of economic growth will slow in the quarters ahead from nearly 6.0% in Q2 of 2018 to roughly 2.5% in 2019.” [..] the bond market has picked up on that realization as the yield has flattened considerably over the last few days as the 10-year interest rate broke back below the 3% mark. The chart below shows the difference between the 2-year and the 10-year interest rate.

Now, there are many who continue to suggest “this time is different” and an inverted yield curve is not signaling a recession, and Jerome Powell’s recent comments are “in line” with a “Goldilocks economy.” Maybe. But historically speaking, while an inversion of the yield curve may not “immediately” coincide with a recessionary onset, given its relationship to economic activity it is likely a “foolish bet” to suggest it won’t. A quick trip though the Fed’s rate hiking history and “soft landing” scenarios give you some clue as to their success.

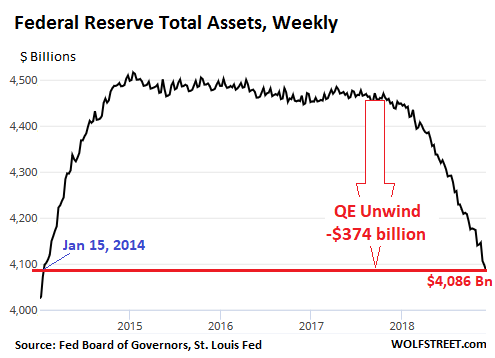

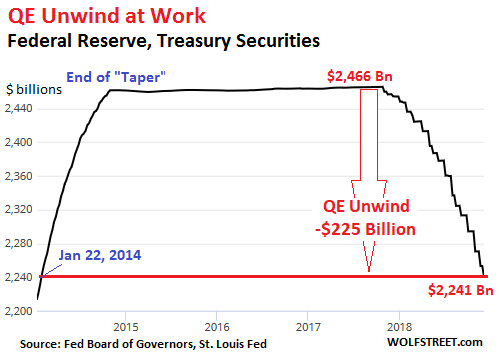

Useful to remember that this is -mostly- an irreversible process.

• Fed’s QE Unwind Reaches $374 Billion (WS)

The Federal Reserve shed $54 billion in assets over the five weekly balance sheet periods that encompass the calendar month of November. This reduced the assets on its balance sheet to $4,086 billion, the lowest since January 15, 2014, according to the Fed’s balance sheet for the week ended December 5, released this afternoon. Since the beginning of the QE unwind — or “balance sheet normalization,” as the Fed calls it — in October 2017, the Fed has now shed $374 billion. The Fed holds a variety of assets, including the Treasury securities and mortgage-backed securities (MBS) that it had acquired as part of QE. Between the end of QE in late 2014 and the beginning of the QE unwind in October 2017, the Fed replaced maturing securities with new securities to keep their levels roughly the same. Starting in October 2017, the Fed has been shedding Treasury securities and MBS.

[..] Treasury Securities Until October, the QE unwind had been in ramp-up mode. In October, it reached cruising speed, according to the Fed’s plan. In the cruising-speed phase, the Fed is scheduled to shed “up to” $30 billion in Treasuries and “up to” $20 billion in MBS a month, for a total of “up to” $50 billion a month. So how did it go in November? From November 1 through December 5, the Fed’s holdings of Treasury Securities fell by $30 billion to $2,241 billion, the lowest since January 22, 2014. Since the beginning of the QE-Unwind, the Fed has shed $225 billion in Treasuries:

Mortgage-Backed Securities (MBS) Under QE, the Fed also acquired residential MBS that were issued and guaranteed by Fannie Mae, Freddie Mac, and Ginnie Mae. Holders of residential MBS receive principal payments as the underlying mortgages are paid down or are paid off. At maturity, the remaining principal is paid off. To keep the balance of MBS from declining after QE ended, the New York Fed’s Open Market Operations kept buying MBS in the market. The Fed books the trades at settlement, which lags the trade by two to three months. Due to this lag, the amount of MBS on today’s balance sheet reflects trades in August and September when the cap for shedding MBS was $16 billion a month. And this is how it panned out. From November 1 through today’s balance sheet, the balance of MBS fell by $16 billion, to $1,653 billion, the lowest since May 7, 2014.

There’s a lot of -often contradictory- talk about yield conversion. Kevin Muir picks out a nice detail: “..we will not see the same degree of yield curve inversion that we have in past cycles. There is simply too much debt out there..

• The Fed Finally Broke Something (Muir)

[..] an inversion of the yield curve has traditionally been one of the best indicators presaging a recession. There has been tons of studies and even more conclusions drawn from the data, so you probably don’t need me to rehash them all. Yet I think it’s amusing to hear all the yield-curve-apologists (a term coined by my colourful pal, Janney’s Guy LeBas in this article) once again claiming that yield curve inversions don’t matter. Whether it’s the fact that we need to wait for the 3-month / 5-year to invert, or whether it is the long lead time between the 2-10-year spread inverting and the actual recession, there are plenty of excuses being offered up about why the yield curve inversion doesn’t matter.

Yeah, let me get this straight. The largest, most liquid market in the world is sending a signal that has consistently been one of the most reliable indicators that a recession is near and somehow it makes sense to fade it? As a trader who cut his eye-teeth in the equity market, I can tell you unequivocally, bond traders are smarter. They just are. Denying it is like trying to argue that people in Malibu are no better looking than any other big U.S. suburb. So when the yield curve starts inverting, you better believe I am paying attention. However, as usual, there is a catch. Market cycles are similar, but never exactly the same.

In the post-GFC era we will not see the same degree of yield curve inversion that we have in past cycles. There is simply too much debt out there. The global economy cannot handle the same amount of tightening as in past cycles. I know the crowd who believes that “Powell is different than all the other Fed Chairs” will cry out in anguish at this proclamation, but last week’s dovish shift shows his stomach to handle any sort of market disruption is way lower than previously believed. Powell will be no different than all the other Fed Chairs. At the end of the day, he will be loose.

How about US shale? Won’t they cut production to help MbS?

• Oil Drops As OPEC Makes Supply Cut Dependent On Russia (CNBC)

Oil prices fell on Friday, pulled down by OPEC’s decision to delay a final decision on output cuts, awaiting support from non-OPEC heavyweight Russia. International Brent crude oil futures fell below $60 per barrel early in the session, trading at $59.50 per barrel at 0144 GMT, down 56 cents, or 0.9% from their last close. U.S. West Texas Intermediate (WTI) crude futures were at $51.24 per barrel, down 25 cents, or 0.5%. The declines came after crude slumped by almost 3% the previous day, with OPEC ending a meeting at its headquarters in Vienna, Austria, on Thursday without announcing a decision to cut crude supply, instead preparing to debate the matter on Friday.

“OPEC has decided to meet Friday again…(as) Russia remains the sticking point,” said Stephen Innes, head of trading for Asia/Pacific at futures brokerage Oanda in Singapore. Analysts still expect some form of supply reduction to be decided. “We are beginning to witness the outline of the next iteration of production cuts, with OPEC conforming to cut its own production by around 1 million barrels per day, with the cartel lobbying non-OPEC members to contribute more,” Japanese bank MUFG said in a note.

Relentless.

• Bitcoin Plunges 10% As December Rout Continues (CNBC)

As of Asia’s Friday afternoon trade, bitcoin had fallen nearly 10% against the U.S. dollar in 24 hours, marking another recent plunge for the world’s largest cryptocurrency. It’s been a rough December for the digital token: Its price dropped 8% on the first day of the month. Bitcoin traded at $3,337.32 as of 12:28 p.m. HK/SIN (11:28 p.m. ET on Thursday), falling 9.88% over the last 24 hours, according to data from industry site Coindesk. Meanwhile, prices for the second and third largest cryptocurrencies by market value, XRP and Ether, also saw sharp declines in the 24 hour period. XRP fell by 10.62% and Ether dropped 15.90%, according to Coindesk.

This calendar year has generally been unkind to cryptocurrency prices, with the industry seeing its entire market cap falling almost 87.09% from its highs in January, according to data from Coinmarketcap. 24-hour trading volumes have also plunged about 61.65% since then. In recent industry related news, the U.S. Securities and Exchange Commission (SEC) posted an update on Thursday regarding the approval process for a rule change proposal for the allowance of a bitcoin exchange traded fund (ETF).

The worst thing Macron could have done: “In a move questioned by both critics and supporters, the president has recently disappeared from public view.” And now his police are going to fire on protesters tomorrow?

• France To Deploy 90,000 Police Over Weekend Riot Fears (Ind.)

French authorities are bracing for the possibility of more riots and violence at planned anti-government protests this weekend. The government is deploying tens of thousands of police and security forces across the country, while in Paris, museums, theatres and shops announced they would close on Saturday as a precaution – including the iconic Eiffel Tower. Police unions and city authorities held emergency meetings to decide how to handle the protests, which are being held despite Emmanuel Macron’s surrender to marchers demanding the scrapping of a planned fuel tax hike. Prime minister Edouard Philippe told senators on Thursday the government would deploy “exceptional” security measures for the protests in Paris and elsewhere.

Speaking on TF1 television, Mr Philippe said 89,000 police officers will be deployed on Saturday across France – up from 65,000 last weekend. In Paris alone, 8,000 police officers will be mobilised. They will be equipped with a dozen armoured vehicles – a first in a French urban area since 2005. Some “yellow vest” protesters, French union officials and prominent politicians across the political spectrum called for calm on Thursday after the worst rioting in Paris in decades last weekend. Mr Macron agreed to abandon the fuel tax hike, part of his plans to combat global warming, but protesters’ demands have now expanded to other issues hurting French workers, retirees and students. In a move questioned by both critics and supporters, the president has recently disappeared from public view.

If this is true, US Big Tech will face the same.

• Chinese Giant Huawei Faces Catastrophe (G.)

The arrest in Canada of the chief financial officer of the Chinese mobile network and handset tech firm Huawei marks a new stage in a technological cold war between western spy agencies and Beijing. This development could be catastrophic for Huawei: according to reports, the US suspects it broke sanctions by selling telecoms equipment to Iran. If that is proven, the response could exclude Huawei from many of the world’s most valuable markets. That quiet war of words had already begun to ramp up this week when first the head of the UK’s secret service, Alex Younger, said in a speech that “we need to have a conversation” about Huawei’s involvement in the UK’s telecoms network.

Then on Wednesday, BT revealed it is stripping out Huawei’s networking kit from parts of the EE mobile network. Huawei has been the world’s largest telecoms network equipment company since 2015, ahead of European rivals Ericsson and Nokia, and far above domestic competitor ZTE and South Korea’s Samsung. But the company has for years struggled against suspicions that it has bowed to pressure from the Chinese government to tap or disrupt telecoms systems in foreign countries. That has seen it banned from selling its profitable network equipment to the US, Australia and New Zealand – three of the “Five Eyes” group of intelligence-sharing countries (the other two being the UK and Canada).

But Meng Wanzhou’s arrest on a federal warrant in Canada is a dramatic escalation. As well as being the CFO and deputy chairwoman of one of the world’s largest makers of telecoms networking equipment that is essential to phone, smartphone and internet traffic, she is also the daughter of Huawei’s 74-year-old founder Ren Zhengfei. Ren attracted suspicion from western agencies because of his role working in IT for the Red Army before he set up the firm in 1987.

Even Bolton has -belatedly- denied involvement.

• White House, Trudeau Seek To Distance Themselves From Huawei Move (R.)

President Donald Trump did not know about plans to arrest a top executive at Chinese telecoms giant Huawei in Canada, two U.S. officials said on Thursday, in an apparent attempt to stop the incident from impeding crucial trade talks with Beijing. Huawei’s CFO, Meng Wanzhou, the 46-year-old daughter of the company’s founder, was detained in Canada on Dec. 1, the same day Trump and Chinese President Xi Jinping dined together at the G20 summit in Buenos Aires. A White House official told Reuters Trump did not know about a U.S. request for her extradition from Canada before he met Xi and agreed to a 90-day truce in the brewing trade war.

Meng’s arrest during a stopover in Vancouver, announced by the Canadian authorities on Wednesday, pummeled stock markets already nervous about tensions between the world’s two largest economies on fears the move could derail the planned trade talks. [..] Meng’s detention also raised concerns about potential retaliation from Beijing in Canada, where Prime Minister Justin Trudeau sought to distance himself from the arrest. “The appropriate authorities took the decisions in this case without any political involvement or interference … we were advised by them with a few days’ notice that this was in the works,” Trudeau told reporters in Montreal in televised remarks.

Top of the Bubble to you!

• Lyft Races To Leave Uber Behind In IPO Chase (R.)

Ride-hailing company Lyft Inc beat bigger rival Uber Technologies Inc in filing for an initial public offering (IPO) on Thursday, defying the recent market jitters and taking the lead on a string of billion-dollar-plus tech companies expected to join Wall Street next year. Lyft’s IPO will test investors’ appetite for the most highly valued Silicon Valley companies and for the ride-hailing business, which has become a wildly popular service but remains unprofitable and has an uncertain future with the advance of self-driving cars. San Francisco-based Lyft, last valued at about $15 billion in a private fundraising round, did not specify the number of shares it was selling or the price range in a confidential filing with the SEC.

Lyft could go public as early as the first quarter of 2019, based on how quickly the SEC reviews its filing, people familiar with the matter said. Lyft’s valuation is likely to end up between $20 billion and $30 billion, one source added. The ride service was set up in 2012 by entrepreneurs John Zimmer and Logan Green and has raised close to $5 billion from investors. While it continues to grow faster than its larger competitor, Uber, it is also losing money. Lyft would follow a string of high-profile IPOs of technology companies valued at more than $1 billion this year, such as Dropbox and Spotify.

However, market turmoil fueled by the escalating trade tensions between the United States and China could dampen enthusiasm for the debuts of other 2019 hopefuls like apartment-rental service Airbnb, analytics firm Palantir. and Stripe Inc, a digital payment company. Including Lyft, these round out four of the top-10 most highly valued, venture-backed tech companies. “Market declines mean that the offer price will be lower than otherwise. But there’s a danger of waiting to go public as well. Markets could go even lower, and the companies could raise less money if they waited longer,” said Jay Ritter, an IPO expert and professor at the University of Florida.

Later today. But forget about collusion. Not going to happen.

• Mueller To Give Details On Russia Probe With Filings On Former Trump Aides (R.)

U.S. Special Counsel Robert Mueller will provide new details on Friday on how two of President Donald Trump’s closest former aides have helped or hindered his investigation into possible collusion between Russia and Trump’s 2016 election campaign. Mueller last month accused Trump’s former campaign chairman Paul Manafort of breaching a plea bargain deal by lying to prosecutors, and he will submit information on those alleged lies in a filing to a federal court in Washington. That could include shedding new light on Manafort’s business dealings or his consulting for pro-Kremlin interests in Ukraine.

Manafort, who maintains he has been truthful with Mueller, managed Trump’s campaign for three months in 2016. Also on Friday, Mueller’s office and the Southern District of New York are to file sentencing memos on Michael Cohen, Trump’s former private lawyer. Cohen pleaded guilty to financial crimes in a New York court in August, and last week to lying to Congress in a Mueller case. Sentencing for both of those cases will be handled by one judge. Attention will focus on whether Mueller discloses new information to supplement Cohen’s admission last week that he sought help from the Kremlin for a Trump skyscraper in Moscow late into the 2016 campaign.

Kimberley Strassel is still a lone(ly) in the US mainstream.

• Mueller’s Gift to Obama (Kim Strassel)

[..] what about the potential crimes that put Mr. Flynn in Mr. Mueller’s crosshairs to begin with? On Jan. 2, 2017, the Obama White House learned about Mr. Flynn’s conversations with Mr. Kislyak. The U.S. monitors phone calls of foreign officials, but under law they are supposed to “minimize” the names of any Americans caught up in such eavesdropping. In the Flynn case, someone in the prior administration either failed to minimize or purposely “unmasked” Mr. Flynn. The latter could itself be a felony. Ten days later someone in that administration leaked to the Washington Post that Mr. Flynn had called Mr. Kislyak on Dec. 29, 2016. On Feb. 9, 2017, someone leaked to the Post and the New York Times highly detailed and classified information about the Flynn-Kislyak conversation.

House Intelligence Committee Chairman Devin Nunes has called this leak the most destructive to national security that he seen in his time in Washington. Disclosing classified information is a felony punishable by up to 10 years in federal prison. The Post has bragged that its story was sourced by nine separate officials. The Mueller team has justified its legal wanderings into money laundering (Paul Manafort) and campaign contributions (Michael Cohen) on grounds that it has an obligation to follow up on any evidence of crimes, no matter how disconnected from its Russia mandate. Mr. Flynn’s being caught up in the probe is related to a glaring potential crime of disclosing classified material, yet Mr. Mueller appears to have undertaken no investigation of that. Is this selective justice, or something worse?

Don’t forget Mr. Mueller stacked his team with Democrats, some of whom worked at the highest levels of the Obama administration, including at the time of the possible Flynn unmasking and the first leak. The Flynn sentencing document, meanwhile, contained yet another outrageous gift to Obama alumni. In laying out the “serious” nature of Mr. Flynn’s crimes, the document asserts that one of the questions about the Flynn-Kislyak discussion was whether “the defendant’s actions violated the Logan Act,” a 1799 statute that criminalizes negotiation by unauthorized persons with foreign governments that are in dispute with the U.S. Only two defendants have ever been charged under the Logan Act, the more recent one in 1852, and neither was convicted.

We have to turn to the Telegraph of all sources, since we -obviously- can’t trust info from the Guardian, which does run a piece on this. That piece was written by Dan Collyns in Quito. Thought for all those who’ve been feeding on the Guardian smear piece for well over a week: investigate instead the link between the paper and the Ecuador government., especially how it changes and intensified around teh time Moreno became president. But don’t forget that the Guardian already had people in the country in at least 2014.

• Julian Assange Rejects UK-Ecuador Deal For Him To Leave The Embassy (Tel.)

Julian Assange’s lawyer has rejected an agreement announced by Ecuador’s president to see him leave the Ecuadorean embassy in London, after six years inside. Lenin Moreno, the president of Ecuador, has made no secret of his wish to be rid of the WikiLeaks founder, who sought asylum inside the embassy in June 2012 and has not left since. On Thursday Mr Moreno announced that a deal had been reached between London and Quito to allow Mr Assange, 47, to be released. “The way has been cleared for Mr Assange to take the decision to leave in near-liberty,” said Mr Moreno. He did not specify what “near liberty” meant.

[..] Mr Moreno added that Britain had guaranteed that the Australian would not be extradited to any country where his life is in danger. But Mr Assange’s lawyer, Barry Pollack, told The Telegraph that the deal was not acceptable. The legal team have long argued that they will not accept any agreement which risks his being extradited to the United States. In November a filing error revealed that Mr Assange faced charges in the US – although it was not clear what those charges were. Many speculate they would be connected to the release of classified information, and Mr Assange fears a long prison sentence in the US for what his supporters say is publishing information in the public interest.

“The suggestion that as long as the death penalty is off the table, Mr Assange need not fear persecution is obviously wrong,” said Mr Pollack. “No one should have to face criminal charges for publishing truthful information. “Since such charges appear to have been brought against Mr Assange in the United States, Ecuador should continue to provide him asylum.”

Home › Forums › Debt Rattle December 7 2018