Harris&Ewing National Press Club Building newssstand, Washington DC 1940

What were you thinking?

• Six Days Until Bond Market Crash Begins (EconMatters)

Early on Thursday morning, realizing this was going to be a robust selloff in equities, the ‘smart money’, i.e., the big banks, investments banks, hedge funds and the like, ran to the old staple of buying bonds hand over fist with little regard for the yield they are getting paid for stepping in front of the freight train of rate rises coming down the tracks. Just six days away from the most important FOMC meeting in the last seven years, and another 300k employment report in the rear view mirror, this looks like an excellent place to hide for nervous investors who have far more money than they have grains of common sense. Newsflash for these investors, yes markets are over-valued, and you need to get out of Apple, and about 100 other high flying overpriced momentum stocks, but you can`t hide out in bonds this time.

That party is over, and next Wednesday`s FOMC meeting is going to make this point abundantly clear. There is no place to hide except cash. You should have thought about that before you gorged yourself on ZIRP to the point where you have pushed stocks and bonds to unsupportable price levels, and you keep begging for the Fed to stall just another six months, so you can continue to buy more stocks and bonds. Well you have done an excellent job hoodwinking the Fed to wait until June, you should thank your lucky stars you have done such a good job manipulating the Federal Reserve; but just like the boy crying wolf, this strategy loses its effectiveness over time. Throwing another temper tantrum right before another important FOMC meeting hoping that Janet Yellen will be alarmed by these Pre-FOMC Selloffs to put off another six months the inevitable rate hike, this blackmail strategy has run its course.

The Fed is forced to finally start the Rate Hiking Cycle after 7 plus years of Recession era Fed policies by an overheating labor market. You knew this day was going to come, but most of you are still in denial. What the heck were you buying 10-year bonds with a 1.6% yield five months before a rate hike?? You only have yourself to blame for the 65 basis point backup in yields on that disaster of an “Investment”. But really what were you thinking here?? That is the problem when the Fed has incentivized such poor investment decisions and poor allocation of capital to useful, growth oriented projects over the past 7 plus years of ZIRP that these ‘investors’ don`t think at all, they have become behaviorally trained ZIRP Crack Addicts!

Read more …

“..the stuff of nightmares for those already caught on the wrong side of the biggest currency margin call in financial history..”

• Global Finance Faces $9 Trillion Stress Test As Dollar Soars (AEP)

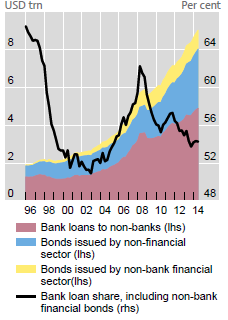

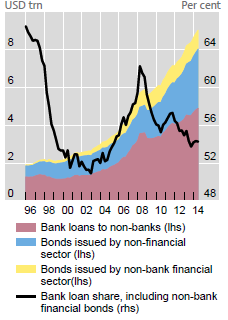

Sitting on the desks of central bank governors and regulators across the world is a scholarly report that spells out the vertiginous scale of global debt in US dollars, and gently hints at the horrors in store as the US Federal Reserve turns off the liquidity spigot. This dry paper is the talk of the hedge fund village in Mayfair, and the stuff of nightmares for those in Singapore or Hong Kong already caught on the wrong side of the biggest currency margin call in financial history. “Everybody is reading it,” said one ex-veteran from the New York Fed. The report – “Global dollar credit: links to US monetary policy and leverage” – was first published by the Bank for International Settlements in January, but its biting relevance is growing by the day. It shows how the Fed’s zero rates and quantitative easing flooded the emerging world with dollar liquidity in the boom years, overwhelming all defences.

This abundance enticed Asian and Latin American companies to borrow like never before in dollars – at real rates near 1pc – storing up a reckoning for the day when the US monetary cycle should turn, as it is now doing with a vengeance. Contrary to popular belief, the world is today more dollarized than ever before. Foreigners have borrowed $9 trillion in US currency outside American jurisdiction, and therefore without the protection of a lender-of-last-resort able to issue unlimited dollars in extremis. This is up from $2 trillion in 2000. The emerging market share – mostly Asian – has doubled to $4.5 trillion since the Lehman crisis, including camouflaged lending through banks registered in London, Zurich or the Cayman Islands. The result is that the world credit system is acutely sensitive to any shift by the Fed. “Changes in the short-term policy rate are promptly reflected in the cost of $5 trillion in US dollar bank loans,” said the BIS.

Read more …

“Europeans need to become a net creditor to the rest of the world. They need to buy a lot more foreign assets..”

• Euro Predicted To Fall To 85 Cents Against US Dollar (CNBC)

As analysts were waiting to see how fast the euro reaches parity against the U.S. dollar, one foreign exchange pro told CNBC he saw the common currency dropping even further, with the dollar strengthening another 20%. George Saravelos, global co-head of FX research at Deutsche Bank, said the euro could fall to 85 U.S. cents against the greenback. “The current account surplus is actually helping the euro to weaken,” he said Wednesday in an interview with “Squawk on the Street.” “There’s just too many savings in Europe, too much cash. When that’s combined with what the ECB is doing, which is basically pushing extra liquidity in the system, charging for that liquidity, the only solution is for that capital to flow out of Europe.”

The euro traded around a 12-year low against the dollar on Wednesday and analysts were betting that party with the greenback would be reached soon. Wednesday morning the euro traded around $1.06. The move comes as the ECB began its quantitative easing program Monday in an effort to simulate the euro zone’s economy. “It’s a once-in-a-century event, really. We’ve never had a period where the Fed is about to hike rates over the next few months while at the same time the second-biggest economic bloc of the world is engaging in an unprecedented QE with negative rates,” Saravelos said. Right now there are more foreigners invested in Europe than there are Europeans abroad, he said. “That has to change. Europeans need to become a net creditor to the rest of the world. They need to buy a lot more foreign assets for that adjustment to be completed.”

Read more …

Korea just DID lower its rate. But…

• Asian Central Banks’ Dilemma: Balancing Debt and Growth (WSJ)

While slowing growth has given central banks across Asia room to cut rates, some are doing so timidly, fearing an even greater buildup in debt. But there’s a growing sense that policy makers are going to have to take bolder action to boost demand in the face of fast-decelerating economies. The Bank of Thailand surprised with a quarter-percentage-point rate cut on Wednesday, and some observers think South Korea’s central bank could follow suit in its meeting on Thursday. “It is clear that Korea’s growth outlook has worsened,” said HSBC economist Ronald Man, who expects a quarter-percentage-point cut to 1.75%, in a note to clients. “The sooner the Bank of Korea lowers its policy rate, the sooner its benefits will transmit through the economy and support growth.”

There are reasons for caution. Both countries have high household debt levels, built up since the onset of the global financial crisis in 2007. As U.S. and European demand for Asia’s exports sagged, Asian governments came to rely more on credit to households and companies to fuel domestic demand. McKinsey, in a report last month, named Thailand and South Korea, along with Australia and Malaysia, as places where household debt levels may be unsustainable. South Korea’s household debt-to-income level stood at 144% at the end of the second quarter last year, the latest data available. That’s higher than the U.S. before its subprime crisis.

Policy makers in South Korea are faced with a problem. Exports of electronics, automobiles and machinery still haven’t picked up, and growth is unlikely to break much above 3% this year for the fourth year in a row. Household spending has remained moribund, in part due to stagnant wages. The high debt overhang also is making consumers cautious. The central bank cut rates twice last year to try to engender more local demand. The moves led to some increase in debt to purchase real estate, and house prices in Seoul, the capital, have begun to recover. But overall domestic spending has remained in the doldrums.

Read more …

QE would be suicidal for China. It already has a mountain of money

• China Economic Data Weaker Than Expected, Fuels Policy Easing Bets (Reuters)

– Growth in China’s investment, retail sales and factory output all missed forecasts in January and February and fell to multi-year lows, leaving investors with little doubt that the economy is still losing steam and in need of further support measures. The figures came a day after data showed deflationary pressures intensified in the factory sector in February, reinforcing expectations of more interest rate cuts and other policy loosening to avert a sharper slowdown in the world’s second-largest economy. “Activity data surprised the market on the downside by a large margin, suggesting that China’s first quarter GDP growth could likely fall to below 7%,” ANZ economist Li-Gang Liu said in a research note.

“In our view, the extremely weak data at the beginning of the year suggest that China needs to engage in more aggressive policy easing, and we see that a reserve requirement ratio (RRR) cut will be imminent,” he said, adding that stimulus measures rolled out since last year seem to have had limited effect. Industrial output grew 6.8% in the first two months of the year compared with the same period a year ago, the National Bureau of Statistics said on Wednesday, the weakest expansion since the global financial crisis in late 2008. Analysts polled by Reuters had forecast a 7.8% rise, down slightly from December. Retail sales rose 10.7%, the lowest pace in a decade and missing expectations for a 11.7% rise.

Fixed-asset investment, a crucial driver of the Chinese economy, rose 13.9%, the weakest expansion since 2001 and compared with estimates for a 15% gain. “Fixed asset investment will likely face even more challenges,” economists at Credit Suisse said in a note this week, adding that crackdowns on corruption and shadow banking have heavily squeezed spending by local governments. “Local officials and executives at state owned enterprises are more worried about their jobs than investment … The central government is pushing out more investment projects, but with the aim of partially offsetting losses in local investment, rather than accelerating growth.”

Read more …

“The government will work in order to honour fully its obligations. But, at the same time, it will work so that all of the unfulfilled obligations to Greece and the Greek people are met..”

• Greece Demands Nazi War Reparations And German Assets Seizures (Telegraph)

Greece’s prime minister has demanded Germany pay back more than €160bn in Second World War reparations as his country is squeezed by creditors to overhaul its economy in return for vital bail-out funds. In an emotive address to his parliament, Alexis Tsipras said his government had a “duty to history, to the people who fought and to the victims who gave their lives to defeat Nazism.” The Leftist government maintains it is owed more than €162bn – nearly half the value of its total public debt – for the destruction wrought during the Nazi occupation of Greece. “The government will work in order to honour fully its obligations. But, at the same time, it will work so that all of the unfulfilled obligations to Greece and the Greek people are met,” said Mr Tsipras on Tuesday at a parliamentary debate on the creation of a reparations committee.

Syriza’s leader added the atrocities of the Nazi occupation remained “fresh in the memory” of Greek people and “must be preserved in the younger generations.” Greece’s demand for reparations centres on a war loan of 476m Reichsmarks the Greek central bank was forced to make to the Nazis, as well as further compensation for the destruction and suffering caused by the occupation. The country’s justice minister went further, threatening the seizure of German assets in order to compensate the relatives of Nazi war crimes. Nikos Paraskevopoulos told Greek television he was willing to back a supreme court ruling which would lead to the foreclosure of German assets in Greece. Germany’s vice-chancellor dismissed the prospect of repayment last month. “The likelihood is zero,” said Sigmar Gabriel.

The Third Reich famously subdued Greek resistance in a matter of weeks in 1941, after the country had held out for months against Mussolini’s Italian army. The Nazi occupation that followed saw more than 40,000 civilians starved to death in Athens alone. Germany has claimed it has already covered its obligations in the post-war reparations it has since paid to Greece. The rhetoric comes as Athens prepares to open its books to its lenders in a bid to release €7.2bn in bail-out funds the country desperately needs to stay afloat. Inspection teams from the ECB, IMF and EC are due to cast their eyes over the country’s finances and begin technical work over the terms of the bail-out extension in the coming days. Athens is scrambling to pay €1.3bn in loans to the IMF before the end of the month.

Read more …

“You cannot pick and choose on ethical issues.”

• Athens Threatens To Seize German Assets Over WWII Reparations (Kathimerini)

Justice Minister Nikos Paraskevopoulos has said he is ready to sign an older court ruling that will enable the foreclosure of German assets in Greece in order to compensate the relatives of victims of Nazi crimes during the Second World War. Greece’s Supreme Court ruled in favor of Distomo survivors in 2000, but the decision has not been enforced. Distomo, a small village in central Greece, lost 218 lives in a Nazi massacre in 1944. “The law states that in order to implement the ruling of the Supreme Court, the minister of justice has to order it. I believe this permission should be given and I’m ready to give it, notwithstanding any obstacles,” Paraskevopoulos told Antenna TV on Wednesday.

“There must probably be some negotiation with Germany,” said Paraskevopoulos, who first announced his intention Tuesday during a Parliament debate on the creation of a committee to seek war reparations, the repayment of a forced loan and the return of antiquities. During the same debate, Prime Minister Alexis Tsipras expressed his government’s firm intention to seek war reparations from Germany, noting that Athens would show sensitivity that it hoped to see reciprocated from Berlin. Tsipras told MPs that the matter of war reparations was “very technical and sensitive” but one he has a duty to pursue. He also seemed to indirectly connect the matter to talks between Greece and its international creditors on the country’s loan program.

“The Greek government will strive to honor its commitments to the full,” he said. “But it will also strive to ensure all unfulfilled obligations toward Greece and the Greek people are fulfilled,” he added. “You cannot pick and choose on ethical issues.” Tsipras noted that Germany got support “despite the crimes of the Third Reich” chiefly thanks to the London Debt Agreement of 1953. Since reunification, German governments have used “silence, legal tricks and delays” to avoid solving the problem, he said. “We are not giving morality lessons but we will not accept morality lessons either,” Tsipras said.

Read more …

“If it carries on like this, it’s a road to a car crash..”

• Greek Alternative Reality Clashes With Eurozone Losing Patience (Bloomberg)

Ask Greek Finance Minister Yanis Varoufakis about his country’s predicament, and you’re likely to get a very different response from the one echoing around the euro region. The Athens University professor said on Monday he’s convinced the six-week-old government is doing what’s needed to secure more funding and avoid bankruptcy. His counterparts, during a euro-area finance ministers’ meeting, spoke of mixed messages, dawdling and a lack of detail over Greece’s deteriorating financial situation. Impressions aside, Greece is running out of time, money and friends. France’s Michel Sapin, whose government had made the most conciliatory noises toward Greek calls for less austerity, expressed frustration with Varoufakis. Spain’s finance minister, concerned about an anti-austerity insurrection at home, also hardened the rhetoric.

“The time comes when what’s needed is not declarations of intentions or slogans, but figures and verifiable data,” Sapin said in Brussels. Greece is seeking the disbursement of an aid payment totaling about 7 billion euros ($7.5 billion) amid speculation its coffers could be empty by the end of the month. With technicians representing the EC, ECB and IMF set to begin work Wednesday to assess the nation’s needs, officials around the euro zone have complained about the lack of progress. Much of the negotiations of the past few weeks have been a “complete waste of time,” according to Dutch Finance Minister Jeroen Dijsselbloem. “Not so much has happened,” in Greece since the euro area in February allowed the government’s loan agreement to be extended by four months,’’ he told reporters after the meeting. “So the question arises: how serious are they?”

For Varoufakis, 53, an economist whose expertise is game theory, all is working well and the government is on course to meet all its debt obligations. “I believe that we are doing our job properly,” Varoufakis said at the conclusion of Monday’s talks. “Our job is to start the process which is necessary for the European Central Bank to have confidence.” After promising the electorate it would break free from the conditions tied to the country’s bailout, the government committed to coming up with a package of economic reforms in exchange for the aid. It now has to give more details of how it will implement them. “If it carries on like this, it’s a road to a car crash,” Andrew Lynch at Schroder in London, told Bloomberg. “Both sides need to stop the posturing and get a deal done as quickly as possible because otherwise you just get to a stage where accidents can happen, and accidents at this stage could be very serious.”

Read more …

“The ECB bought public debt from private banks for a fortune, because the ECB could not buy public debt directly from the Greek state. The icing on this layer cake is that private banks had found the cash to buy Greece’s public debt exactly from…the ECB, profiting from ultra-friendly interest rates. This is outright theft. And it’s the thieves that have been setting the rules of the game all along.” “Goldman Sachs “helped” Greece get into the Eurozone through a highly questionable derivative scheme involving a currency swap that used artificially high exchange rates to conceal Greek debt. Goldman then turned around and hedged its bets by shorting Greek debt.

• The ECB’s Noose Around Greece (Ellen Brown)

Remember when the infamous Goldman Sachs delivered a thinly-veiled threat to the Greek Parliament in December, warning them to elect a pro-austerity prime minister or risk having central bank liquidity cut off to their banks? It seems the ECB (headed by Mario Draghi, former managing director of Goldman Sachs) has now made good on the threat. The week after the leftwing Syriza candidate Alexis Tsipras was sworn in as prime minister, the ECB announced that it would no longer accept Greek government bonds and government-guaranteed debts as collateral for central bank loans to Greek banks. The banks were reduced to getting their central bank liquidity through “Emergency Liquidity Assistance” (ELA), which is at high interest rates and can also be terminated by the ECB at will.

In an interview reported in the German magazine Der Spiegel on March 6th, Alexis Tsipras said that the ECB was “holding a noose around Greece’s neck.” If the ECB continued its hardball tactics, he warned, “it will be back to the thriller we saw before February” (referring to the market turmoil accompanying negotiations before a four-month bailout extension was finally agreed to). The noose around Greece’s neck is this: the ECB will not accept Greek bonds as collateral for the central bank liquidity all banks need, until the new Syriza government accepts the very stringent austerity program imposed by the troika (the EU Commission, ECB and IMF). That means selling off public assets (including ports, airports, electric and petroleum companies), slashing salaries and pensions, drastically increasing taxes and dismantling social services, while creating special funds to save the banking system.

These are the mafia-like extortion tactics by which entire economies are yoked into paying off debts to foreign banks – debts that must be paid with the labor, assets and patrimony of people who had nothing to do with incurring them. Greece is not the first to feel the noose tightening on its neck. As The Economist notes, in 2013 the ECB announced that it would cut off Emergency Lending Assistance to Cypriot banks within days, unless the government agreed to its bailout terms. Similar threats were used to get agreement from the Irish government in 2010. Likewise, says The Economist, the “Greek banks’ growing dependence on ELA leaves the government at the ECB’s mercy as it tries to renegotiate the bailout.”[..]

The ECB bought public debt from private banks for a fortune, because the ECB could not buy public debt directly from the Greek state. The icing on this layer cake is that private banks had found the cash to buy Greece’s public debt exactly from…the ECB, profiting from ultra-friendly interest rates. This is outright theft. And it’s the thieves that have been setting the rules of the game all along. That brings us back to the role of Goldman Sachs (dubbed by Matt Taibbi the “Vampire Squid”), which “helped” Greece get into the Eurozone through a highly questionable derivative scheme involving a currency swap that used artificially high exchange rates to conceal Greek debt. Goldman then turned around and hedged its bets by shorting Greek debt.

Predictably, these derivative bets went very wrong for the less sophisticated of the two players. A €2.8 billion loan to Greece in 2001 became a €5.1 billion debt by 2005. Despite this debt burden, in 2006 Greece remained within the ECB’s 3% budget deficit guidelines. It got into serious trouble only after the 2008 banking crisis. In late 2009, Goldman joined in bearish bets on Greek debt launched by heavyweight hedge funds to put selling pressure on the euro, forcing Greece into the bailout and austerity measures that have since destroyed its economy.

Read more …

Somone’s blowing smoke, but who is it?

• US Fed Slashes Payout Plans Of Large Wall Street Banks (Reuters)

– Four of the largest U.S. banks just scraped by in an annual Federal Reserve check-up on the industry’s health, underscoring their top regulator’s enduring doubts about Wall Street’s resilience more than six years after the crisis. Goldman Sachs, Morgan Stanley and JPMorgan, all with large and risky trading operations, lowered their ambitions for dividends and share buybacks, the Fed said on Wednesday, to keep them robust enough to withstand a hypothetical financial crisis. The revised plans allowed them to pass the Fed’s simulation of a severe recession. And Bank of America was told to get a better grip on its internal controls and its data models even as the Fed approved its payout plans after the so-called stress tests. “Bank of America exhibited deficiencies in its capital planning process…. in certain aspects of (its) loss and revenue modeling practices,” the Fed said.

The failure of four of the largest U.S. banks to win unconditional approval on their first attempt underscores the split between Wall Street banks and their regulators over whether the lenders have enough capital on their books to weather another crisis. Citigroup, whose Chief Executive Mike Corbat has staked his job on not failing the so-called stress tests again, will sigh a breath of relief as it passed, allowing it to raise its payouts after failing last year for the second time in three years. The Fed first started running its so-called stress tests in 2009, when many of the largest U.S. banks were struggling to repay taxpayer bailout funds they took after the collapse of Lehman Brothers a year earlier. Citi said it will raise its quarterly dividend to 5 cents a share from the penny a share payout it had to adopt during the financial crisis and that it had won approval to buy back $7.8 billion of stock over five quarters. Shares in Citi rose by as much as 3.2% after the bell.

The Fed rejected plans for the U.S. units of two European banks, Deutsche Bank and Santander, in line with earlier media reports. The objection came even though both banks satisfied the Fed’s minimum capital requirements, since there were “widespread and substantial weaknesses across their capital planning processes,” the Fed said. JPMorgan, Goldman Sachs and Morgan Stanley each had to adjust their capital plans to meet the Fed’s minimum capital requirements. “For those banks it’s going to be a continuing balancing act between how much leverage can you have to pass the stress tests and still maximize your profitability as a bank,” said David Little, the head of the enterprise Risk Solutions unit at Moody’s, referring to banks with large trading books operating on Wall Street.

Read more …

Mario’s on pills of some kind: “..a slowdown in growth had reversed and that the recovery should “broaden and hopefully strengthen.”

• Draghi: ECB Action Shields Eurozone States From Greek Contagion (Reuters)

ECB buying of government and other debt may be shielding countries in the euro zone from any knock-on effect from events in Greece, ECB President Mario Draghi said on Wednesday. The ECB began a policy of printing money to buy sovereign bonds, or quantitative easing, on Monday with a view to supporting growth and lifting euro zone inflation from below zero up towards its target of just under 2%. “We also saw a further fall in the sovereign yields of Portugal and other formerly distressed countries in spite of the renewed Greek crisis,” Draghi told a conference in Frankfurt. “This suggests that the asset purchase program may be shielding euro area countries from contagion.”

Draghi spoke as Greece embarked on technical talks with its international creditors to agree reforms and unlock further funding amid growing frustration with Athens. The new left-wing Greek government, keen to show voters it is keeping a promise not to work with the detested “troika” of foreign lenders, has been trying to avoid having talks with inspectors from the three institutions in their own country. Earlier this week, ministers spent barely 30 minutes discussing Greece at their monthly meeting, an EU official said, stressing it was time for Athens to engage in serious, detailed discussions with experts from the institutions formerly known as the “troika”.

On the outlook for the euro zone economy, Draghi said a slowdown in growth had reversed and that the recovery should “broaden and hopefully strengthen.” Updated forecasts by ECB staff published last week showed the QE program would support growth in the 19-country euro zone and lift inflation from below zero up to 1.8% in 2017 – in line with the ECB’s goal. Draghi said these forecasts were conditional on the full implementation of all the ECB’s announced measures. The central bank plans to buy €60 billion a month of assets – mostly sovereign bonds – until at least September next year.

Read more …

Trading houses. Or is that casinos?

• How Big Oil Is Profiting From the Slump (Bloomberg)

Europe’s largest oil companies are gaining support from an unlikely source as they confront the industry’s worst slump since the financial crisis: lower oil prices. Although better known for their oil fields, refineries, and petrol stations, BP, Shell and Total are also the world’s biggest oil traders, handling enough crude and refined products every day to meet the consumption of Japan, India, Germany, France, Italy, Spain and the Netherlands. The trio’s sway in commodities trading, largely unknown outside the industry, is set to pay off in 2015 as the bear market allows traders to generate higher returns by storing cheap oil today to sell at higher prices later and using lower prices to make more bets with the same capital.

“Volatility has increased dramatically over the last three or four months,” said Mike Conway, the head of Shell’s trading and supply business. “Parts of your business that are volatility driven are probably doing pretty well.” While companies are shy about revealing the financial results from their trading business, a look at the last major bear market provides clues to the opportunity they have today. In the first quarter of 2009, BP said it made $500 million above its normal level of profits from trading. That means that trading accounted for, at the very least, 20 percent of BP’s adjusted income that quarter of $2.38 billion.

From dealing floors that resemble the operations of Wall Street banks in cities including Geneva, London, Houston, Chicago and Singapore, oil trading could provide BP, Shell and Total with an edge over U.S. rivals Exxon Mobil and Chevron, which sell their own production, but largely eschew pure trading as a means of generating profits.

Read more …

How funny is that?

• Russia Gets Seat On SWIFT Board (RT)

Increased banking traffic means Russia now has a seat on the board of the SWIFT global interbank communications system. The seat comes at a time of increased pressure for Russia to be removed from the organization because of sanctions. It is the first time Russia has had a seat on the 25-member board of directors of the Society for Worldwide Interbank Financial Telecommunication (SWIFT) since it joined in 1989. Every three years the organization reconfigures the shares among the countries participating. Each country receives a number of shares in proportion to the traffic in the system. The reallocation has led to changes in the structure of the board.

“By the end of 2014 the SWIFT traffic growth in Russia allowed us to reach thirteenth place in the world, so Russia has increased its stake to a level that allows it to nominate a candidate to the Board of Directors”, the executive director of the Russian National SWIFT Association Roman Chernov told RBC. On this basis, Russia gained a seat as Hong Kong lost one, Belgium gained an additional seat giving it two and the Netherlands lost a seat giving it one, according to The Banker. “The threat of disconnection from SWIFT does not decrease after the appearance of the Russian representative on the board of directors, since the decision to disconnect from SWIFT is independent, but such a presence means that we can influence decisions made by SWIFT in terms of the introduction of the new standards, service improvements, and tariff systems”, Alma Obaeva, the Chairman of the non-commercial National Payments Council was cited as saying by RBC.

Read more …

Another major chuckle.

• Gas Terms For Kiev To Be Eased If It Pays East Ukraine Bills (RT)

Russia could give Ukraine better terms provided Kiev pays for gas supplied to the Donbass region, said Russian Energy Minister Aleksandr Novak adding that this would open the possibility for new discounts. “We are supplying [East Ukraine – Ed.] under the [2009] contract. Gazprom doesn’t ship for free. Bills, invoices are being prepared,” Novak said Wednesday quoted by Reuters. He added that no clarification has been made over the further payments of gas supplies to Donbass. Ukraine’s Naftogaz owes Gazprom $2.4 billion for deliveries, including $200 million in penalties, according to the minister’s earlier estimates. The so-called ‘winter package’ terms for gas supply to Ukraine expires on March 31, along with a $100 discount per 1,000 cubic meters of gas and a suspension of a take-or-pay agreement that requires payment for gas no matter if Ukraine needs it by that date or not.

Novak said Russia is open to extend those concessions even without signing a new deal after the ‘winter package’ expires. “A discount is possible under the contract as well. No separate packages are needed if Ukraine and Russia reach an agreement. Take-or-pay [suspension – Ed.]… is also possible, it depends on the talks between the companies,” Novak said. If the gas price in the second quarter is $330 per 1,000 cubic meters or higher, the maximum discount for Kiev would be $100, he said. If the price is lower, the discount will be no greater than 30% of the cost. The price for the second quarter may be in the range of $350-360 without discounts, compared $329 in the current quarter.

Read more …

Thanks man, we really need it.

• Saudi King Salman: We’re Looking For More Oil (Reuters)

Saudi Arabia’s King Salman said he would fight corruption, diversify the economy and confront anybody who challenged the stability of the world’s top oil exporter in his first big speech since taking power on Jan. 23. His speech, carried on state television, focused on the need to create private sector jobs for young Saudis, a main policy goal for many years as Riyadh strives to meet a looming demographic challenge while controlling public spending. Addressing the chaos threatening the kingdom from around the region, he said no one would be allowed to tamper with Saudi Arabia’s security or stability. He said Saudi foreign policy would be committed to the teachings of Islam and spoke of a move towards greater Arab and Islamic unity to face shared threats, as well as a continued focus on working with other countries against terrorism.

He also pledged to maintain the kingdom’s Sharia Islamic law, emphasising its central place in the kingdom, in a nod to the powerful clerical establishment that confers religious legitimacy on the unelected ruling dynasty. Salman also reassured Saudis about lower oil prices, noting the historically high revenues of recent years and saying the government would reduce the impact on development projects and continue to explore for oil and gas reserves. Addressing himself to young Saudis of both sexes, he said the state would do all it could to help develop their education, sending them to prestigious universities, to help them get jobs in either the public or private sector. King Salman added that he had directed the government to review its processes to help eradicate corruption, a source of dissatisfaction among many Saudis, alongside concerns about expensive housing and joblessness.

Read more …

More from the land of great recovery.

• UK Ethnic Minority Youth See 50% Rise In Long-Term Unemployment (Guardian)

The number of young people from ethnic minority backgrounds who have been unemployed for more than a year has risen by almost 50% since the coalition came to power, according to figures released by the Labour party. There are now 41,000 16- to 24-year-olds from black, asian and minority ethnic [BAME] communities who are long-term unemployed – a 49% rise from 2010, according to an analysis of official figures by the House of Commons Library. At the same time, there was a fall of 1% in overall long-term youth unemployment and a 2% fall among young white people. Labour described the findings as shameful and accused the coalition of abandoning an already marginalised group of young people.

“These figures are astonishing,” said the shadow justice secretary Sadiq Khan. “At a time where general unemployment is going down and employment is going up, it is doing the reverse for this group… we have got a generation that is being thrown on the scrapheap, and what compounds it is that a disproportionate number are black, asian, minority ethnic.” Labour said the government was paying the price for abandoning many of the measures introduced by the previous government to tackle disadvantage in BME communities – including equality impact assessments. It said the coalition’s work programme had concentrated on the “low-hanging fruit” in the job market instead of trying to help those in more challenging circumstances.

“This is going to lead to problems for years to come,” said Khan. “How can we tackle issues around lack of BAME people in the judiciary, civil service or the boardroom if they can’t even get a job as a young person? We are stopping a generation fulfilling their potential and that is not just a problem for them as individuals or their wider families, it is a problem for all of us.” .

Read more …

Sounds familiar: “They’re too scared to spend because they don’t know what the next day will hold.”

• Suburb With 27% Jobless Shows Danger of Australian Recession (Bloomberg)

In a shopping center full of sale signs in Broadmeadows, a Melbourne suburb with 27% unemployment, Soney Kul is struggling to shift half-price jewelry. “People don’t want to spend,” the 27-year-old said, gesturing at the sparsely-filled display cases in his family-owned store, Altinbas. “They’re too scared to spend because they don’t know what the next day will hold.” After a decade-long mining boom powered by Chinese demand, Australia’s economy is falling back to earth fast. Among the worst hit are industrial areas like Broadmeadows, whose Ford Motor Co. plant will shut after a record-high currency made operations untenable, and the slowdown is spreading. Only four months after economists were forecasting interest-rate increases in 2015, the country’s central bank has cut its benchmark to a fresh record low.

Goldman Sachs estimates a one-in-three chance Australia will fall into recession in the next 12 months. Australians’ wage growth last quarter matched a record-low pace and prices of the country’s key commodity exports were down 27% in February from a year earlier. “You’re at stall speed,” Tim Toohey, chief economist for Goldman Sachs in Australia, said of national income growth. “It’s that level of uncertainty, and excess capacity in the labor market, that is continuing to be the main story on why consumers aren’t engaging.” Australia’s jobless rate stands at a 12 1/2-year high of 6.4% and there are a growing number of pockets in the nation where it’s much worse.

Suburbs like Broadmeadows and Elizabeth in South Australia are dominated by manufacturers that received little benefit from China’s surging demand for raw materials, while suffering the fallout from an overvalued currency driven up by the commodities boom. Across Australia, regions with unemployment of 10% or more of the workforce rose to 13.3% of all areas in the third quarter from 10.9% of the total a year earlier, according to government data released in December. In response, the central bank cut its benchmark interest rate last month for the first time in more than a year, saying growth would stay “below trend” and unemployment peak at a higher level for longer than it previously expected. Traders are pricing in almost two more reductions over the next 12 months from the current record low of 2.25%.

Read more …

And I will sell them my Brooklyn Bridge… Well, you know, either that or I’ll get myself the same brand of printing press that the Chinese have.

• Chinese Tourists Are Headed Your Way With $264 Billion

Book your holiday now, before a wave of 174 million Chinese tourists snap up the best bargains. Already the most prolific spenders globally, the number of Chinese outbound tourists is tipped to soar further as the millennial generation spreads its wings. Here are the numbers: 174 million Chinese tourists are tipped to spend $264 billion by 2019 compared with the 109 million who spent $164 billion in 2014, according to a new analysis by Bank of America Merrill Lynch. To put that in perspective, there were just 10 million Chinese outbound tourists in 2000. How much is $264 billion? It’s about the size of Finland’s economy and bigger than Greece’s.

“China-mania spread globally in the past few years, akin to when the Japanese started travelling some 30 years ago, when the world went into frenzy then, pandering to Japanese customers’ needs,” the analysts wrote. “In our view, this is going to be bigger and will last longer given China’s population of 1.3 billion vs Japan’s population of 127 million.”

Millennials, or 25- to 34- year olds, are expected to make up the bulk of Chinese tourists at 35% of the total, followed by 15- to 24- year olds accounting for around 27%. Only about 5% of China’s 1.3 billion populace are thought to hold passports, meaning the potential for outbound tourism is vast. The projected boom could be good news for the global economy. The Chinese are the world’s biggest consumers of luxury goods, with half of that spending done overseas. Chinese visitors to the U.S. have risen more than 10% since 2009, the fastest pace for a destination outside of Asia. Australia, France and Italy are also popular.

Read more …

Very interesting.

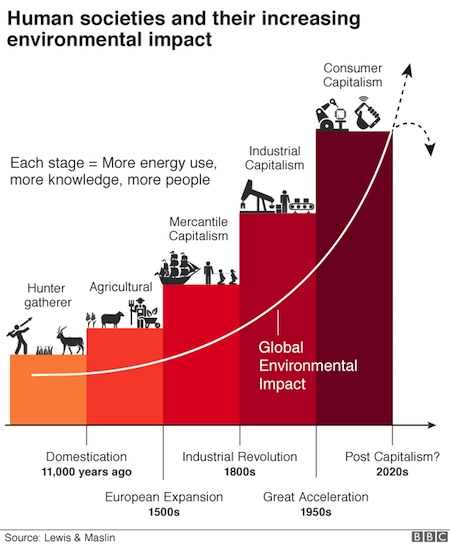

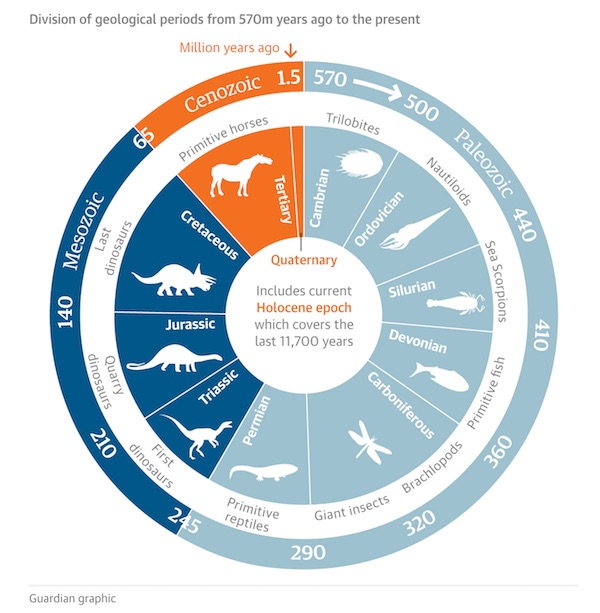

• The Year Humans Started to Ruin the World

Astronomers have been telling us for nearly 500 years that humanity is not the most important thing in the universe. Evolutionary biologists established long ago that we’re not even the greatest show on earth. Now, geologists—the scientists who literally decide what on earth is going on—may reach the opposite conclusion: Humanity is the most powerful force on the planet, shaping the environment more than water, wind, or plate tectonics. Fifteen years ago, two prominent researchers suggested that the earth has formally entered a phase of human domination. Unless there’s some unforeseen calamity caused by volcanic activity or a meteor, they argued, “mankind will remain a major geological force for many millennia, maybe millions of years, to come.”

Nobel prize-winning chemist Paul Crutzen and University of Michigan biologist Eugene Stoermer called this new episode in planetary history the Anthropocene Epoch. The idea has been gaining steam in both the scientific and mainstream press for several years. Enough scientists have bought into the idea that this week, the journal Nature dedicates more than nine pages to the next logical question: If we have crossed into the Anthropocene—which “appears reasonable,” they write with understatement—when did it begin? Geologists are quite insistent on physical evidence. Wherever possible, each of the planet’s eons, eras, periods, epochs, and ages are distinguished with a “golden spike,” a physical marker somewhere in rock, glacier, or sediment that signals evidence of big changes in the earth’s operating system. It needn’t be gold, or even a spike, but without satisfying the International Commission on Stratigraphy’s requirements (which includes several additional procedural hurdles), there will be no new epoch.

The Nature article, by Simon Lewis of University College London and Mark Maslin of the University of Leeds, evaluates nine possibilities that others have put forward as the starter’s pistol of the Anthropocene Epoch. The episodes reach as far back as tens of thousands of years ago, when people hunted large mammals to extinction. Others are as recent as the post-World War II period, when such “persistent industrial chemicals” as plastics, cement, lead, and other fruits of the laboratory started to find their way into nature. The authors ultimately dismiss all but two of the examples because the events were too local (rice farming in Asia) and happened over too long a time span (the extinction of large mammals), which are two main obstacles to a golden spike. The two dates that meet their standard are 1610 and 1964.

Read more …