Jack Delano Migratory farm worker from Florida in her Sunday clothes July 1940

I know I’ve talked about it more than once lately, but at least for now I don’t think it can be said enough. The world energy situation is much worse than you have been, and are being, led to believe. Even if you do understand the principle that underlies peak oil (by no means a given).

I’ve also repeatedly made the point that the real energy predicament is the real driver behind recent geopolitical events, notably Ukraine. Which is not to say that Libya, Iraq, Gaza or the South China Sea are not, just the Ukraine seems fresher and a more overt play for fossil resources. But let’s stay away from politics today – much as we can -.

The Daily Telegraph gives a podium to Tim Morgan, former global head of research at inter-dealer money broker Tullett Prebon, to present his view of the shale industry. Morgan draws the same conclusion that we at The Automatic Earth drew years ago – only now it’s news … -, and wrote about on numerous occasions.

See for instance Get ready for the North American gas shock , Fracking Our Future , Shale Gas Reality Begins to Dawn , Shale Is A Pipedream Sold To Greater Fools , The Darker Shades Of Shale . And that’s just a sample.

I may like to think that we have over time demolished shale as a viable energy industry so rigorously that nothing should need to be said it anymore. But no, it needs to be repeated by ever more well-placed individuals before it sinks in. So be it.

That conclusion is, shale is about money, not energy. And as such it is a huge money drain. It’s not an asset, it’s a sinkhole. As I cited only last week, the US shale industry lost over $110 billion per year over the past 5 years. That’s half a trillion dollars down the waste hole. In cheap credit. Who’s going to pick up that tab?

In essence, shale, and hence fracking, is nothing more, or less, than the purest form of land speculation. Location, location, location. The only thing that appears to make it stick out from other forms of land speculation is its utterly destructive character. It smells of desperation no matter what direction the wind comes from.

Money broker Morgan focuses on Britain and its ill-fated shale dreams:

Shale Gas: ‘The Dotcom Bubble Of Our Times’

[..] hardly anyone seems to have asked the one question which is surely fundamental: does shale development make economic sense? My conclusion is that it does not. That Britain needs new energy sources is surely beyond dispute. Between 2003 and 2013, domestic production of oil and gas slumped by 62% and 65% respectively, while coal output decreased by 55%. Despite sharp increases in the output of renewables, overall energy production has fallen by more than half. [..]

Those who claim that Britain faces an energy squeeze are right, then. But those who claim that the answer is using fracking to extract gas from shale formations are guilty of putting hope ahead of reality. The example held up by the pro-fracking lobby is, of course, the US, where fracking has produced so much gas that the market has been oversupplied, forcing gas prices sharply downwards.

The trouble with this parallel is that it is based on a fundamental misunderstanding of the US shale story. We now have more than enough data to know what has really happened in America. Shale has been hyped (“Saudi America”) and investors have poured hundreds of billions of dollars into the shale sector. If you invest this much, you get a lot of wells [..]. If a huge number of wells come on stream in a short time, you get a lot of initial production. This is exactly what has happened in the US.

The key word here, though, is “initial”[..] Compared with “normal” oil and gas wells, where output typically decreases by 7%-10% annually, rates of decline for shale wells are dramatically worse. It is by no means unusual for production from each well to fall by 60% or more in the first 12 months of operations.

All this is old fodder for our readership. If anything, that 60% decline in the first year of a typical well is greatly underestimated.

Faced with such rates of decline, the only way to keep production rates up (and to keep investors on side) is to drill yet more wells. This puts operators on a “drilling treadmill”, which should worry local residents just as much as investors. Net cash flow from US shale has been negative year after year, and some of the industry’s biggest names have already walked away. The seemingly inevitable outcome for the US shale industry is that, once investors wise up, and once the drilling sweet spots have been used, production will slump, probably peaking in 2017-18 and falling precipitously after that. The US is already littered with wells that have been abandoned, often without the site being cleaned up.

2017-18? I doubt the US shale industry’s will make it in one piece that long. My bet would be investors will run for cover before.

Meanwhile, recoverable reserves estimates for the Monterey shale – supposedly the biggest shale liquids play in the US – have been revised downwards by 96%. In Poland, drilling 30-40 wells has so far produced virtually no worthwhile production. In the future, shale will be recognised as this decade’s version of the dotcom bubble. In the shorter term, it’s a counsel of despair as an energy supply squeeze draws ever nearer. [..]

The dotcom bubble may be, or seem to be, a somewhat fitting metaphor for shale, but I’m thinking much more along the lines of Klondike, and any other kind of gold rush. Plus the ghost towns they all left behind.

And it’s by no means just shale where our fossil fuel supplies get squeezed. The problems Big Oil is drowning in are much broader. Take, for instance, the Arctic. It’s starting to look a lot like shale, only in a much harsher climate. That even the billions of Big Oil are no match for. Oilprice.com has this:

More Oil Companies Abandoning Arctic Plans, Letting Leases Expire

After years of mishaps and false starts, some oil companies are giving up on drilling in the Arctic. Many companies have allowed their leases on offshore Arctic acreage to expire, according to an analysis by Oceana that was reviewed by Fuel Fix. Since 2003, the oil industry has allowed the rights to an estimated 584,000 acres in the Beaufort Sea to lapse.

It wasn’t supposed to happen this way. The oil industry was once enormously optimistic about drilling for oil in the Beaufort and Chukchi Seas, off the north coast of Alaska. The U.S. Geological Survey estimated in a 2008 study that offshore Alaska holds almost 30 billion barrels of oil and 221 trillion cubic feet of natural gas.

In July 2012, Shell temporarily lost control of its Noble Discoverer rig, which almost ran aground. Shell’s oil spill response ship also failed inspections, which delayed drilling. Shell ultimately had to throw in the towel for the year as the summer season drew to a close. Finally, on December 31, Shell’s Kulluk ship ran aground as the company was towing it out of Alaskan waters. The events forced Shell to take a step back, and the company announced in February 2013 that it would suspend its drilling campaign for the year. It hasn’t returned.

[..] … earlier this year, a court issued a critical setback to the oil company, ruling that the Interior Dept. didn’t follow the law in an earlier Arctic auction. In response to the ruling, Shell’s new CEO Ben van Beurden cancelled drilling for yet another year. “This is a disappointing outcome, but the lack of a clear path forward means that I am not prepared to commit further resources for drilling in Alaska in 2014,” he said.

Van Beurden has also embarked upon a $15 billion two-year divestment program, with the intention of shedding higher cost assets around the world in an effort to improve Shell’s financial position, which had deteriorated in recent quarters due to high-cost “elephant projects.” That would suggest that the Arctic program could get the axe.

Big Oil, Shell, Exxon, Total, BP and others, are desperate for additional reserves. Exxon’s output fell 5.7% last year. If these companies let options expire that they paid millions for, something’s wrong. In simple terms: they can’t get to the resources at a price that’s economically viable.

The Oilprice article is based on this from FuelFix. And while we’re at it, let’s delve a bit deeper, so at the end of the day we understand what is happening as best we can.

Oil Companies Forfeit Arctic Drilling Rights

Oil companies that locked up more than 1.3 million acres of the Beaufort Sea for drilling in 2007 have since relinquished nearly half that territory. The industry’s appetite for tapping those Arctic waters may be waning even as the Obama administration plans to auction off more of the area. Oil companies have ceded rights to drill on roughly 584,000 acres[..]

… all but seven of the 141 still-active oil and gas leases in the Beaufort Sea along Alaska’s northeast coast are partly or completely held by a single firm, Shell [..] “Nearly half of the leases purchased in the 2003 to 2007 lease sales have been allowed to expire as company after company decides to forgo or delay activities in the U.S. Arctic Ocean …

Still on Tuesday, the Obama administration took the first formal steps to do precisely that, inviting oil companies, environmentalists, Alaska residents and other stakeholders to weigh in on what parts of the U.S. Beaufort Sea should be open for leasing during a 2017 auction. The Interior Department’s Bureau of Ocean Energy Management also has asked for public input on what coastal waters – from California and Alaska to the Gulf of Mexico – should be available for leasing from 2017 to 2022. [..]

Interior Department officials have stressed they want to balance any future oil development in the Arctic with preservation of the area’s unique ecosystem and subsistence fishing in the region. So far, the ocean energy bureau is continuing to work on the Chukchi Sea sale, even without a single specific industry nomination for territory that should be sold off. The agency was flooded with maps and other data suggesting areas that should be off limits from local communities and conservation groups.

Administration officials have suggested they are looking for ways to get more input from oil companies as they decide whether to hold the Chukchi Sea auction or cancel it. [..]

But oil companies have struggled to tap the potential lurking under those remote and icy waters — vividly illustrated by the series of mishaps that befell Shell as it drilled exploratory wells in the Chukchi and Beaufort seas two years ago. A specialized, first-of-its-kind oil spill containment system was not ready on time, engines discharged more air pollution than authorities had permitted to be released and the company’s Kulluk drilling unit ended up beached on a rocky Alaskan island’s shore on Dec. 31, 2012. [..]

Many of the forfeited Beaufort Sea oil leases documented by Oceana may have simply been allowed to expire — the likely fate for 39 blocks sold for $9 million in a 2003 auction. Others may have been relinquished early. Industry representatives say the decline in active Beaufort Sea oil leases represents a natural release of acreage based on individual company’s decisions about what they believe to be the most promising prospects.

Arctic oil exploration is also an expensive proposition that may be tough for even well-capitalized companies to justify amid an onshore drilling boom.

Shell has 100% ownership of 406,283 leased Beaufort Sea acres and 40% ownership in an additional 310,573 acres where leases are jointly held with ENI and Repsol. Outside of Shell and BP’s close-to-shore operations, ENI and Repsol are the only other companies holding active Beaufort Sea leases, about 23,861 acres’ worth. That’s a big contrast from 2007, when seven companies held active leases in the Beaufort Sea, including France’s Total, Canada’s EnCana Corp., Armstrong Oil and Gas, and Conoco.

While there seems to be a subtle way to blame the greens for the giant mishaps in there, the overall message is clear: it just can’t be done. It’s not viable at present prices. And before you dream away about the industry benefits of $200 oil, don’t forget that if prices were to go up substantially, a lot less people would be able to afford them. Catch 22.

Someone may still try at some point in the – increasingly desperate – future, but by then oil and gas won’t be anywhere near the industry it is today, and has been for 50-100 years. The money won’t be there, not on the supply side, and not on the demand side.

Obviously, the issue with that is fossil fuels give nations and societies, as well as corporations and individuals, power. Energy=power.

We presently, each of us in the west, have 200+ energy slaves at our disposal night and day, provided by coal, oil and gas. As a group, we maintain our domination over the rest of the world by applying the energy provided by oil fossil fuels to our defense against ‘others’, and to attacking them where we see fit.

If we stop doing that, if we run out, we risk being overrun. To prevent that from happening, we will attempt to grab, and hold on to, to as much as we can from what is left. But so do the ‘others’.

Arctic and shale are about the only ‘new’ sources of oil and gas we have, or had, and the Saudi’s won’t be able to make up for the difference. Not even close.

What is happening at this very moment in the shale industry and in the Arctic is like a big angry bull waving a bright red flag and waiting to have a go at the torero (that would be us).

The only possible way to go from here is to lower your energy demand, and your reliance on the energy demand of your society, as much as you can. 90% is a good and viable number to go for. If you don’t, you will be swept up in the biggest and deadliest battle ever.

The westworld will be hit hard and bloody by a financial collapse well before the energy war comes, and it’s therefore not much use right now to focus on energy, but in the end it’s really the same battle. It’s a very primitive fight for power. That’s what we do when push comes to shove. You too.

• Shale Gas: ‘The Dotcom Bubble Of Our Times’ (Telegraph)

Public opinion has been divided very starkly indeed by the government’s invitation to energy companies to apply for licences to develop shale gas across a broad swathe of the United Kingdom. On the one hand, many environmental and conservation groups are bitterly opposed to shale development. Ranged against them are those within and beyond the energy industry who believe that the exploitation of shale gas can prove not only vital but hugely positive for the British economy. Rather oddly, hardly anyone seems to have asked the one question which is surely fundamental: does shale development make economic sense? My conclusion is that it does not. That Britain needs new energy sources is surely beyond dispute. Between 2003 and 2013, domestic production of oil and gas slumped by 62pc and 65pc respectively, while coal output decreased by 55pc.

Despite sharp increases in the output of renewables, overall energy production has fallen by more than half. A net exporter of energy as recently as 2003, Britain now buys almost half of its energy from abroad, and this gap seems certain to widen. The policies of successive governments have worsened this situation. The “dash for gas” in the Nineties accelerated depletion of our gas reserves. Labour’s dithering over nuclear power put replacement of our ageing reactors at least a decade behind schedule, and a premature abandonment of coal has taken place alongside an inconsistent, scattergun approach to renewables. Those who claim that Britain faces an energy squeeze are right, then. But those who claim that the answer is using fracking to extract gas from shale formations are guilty of putting hope ahead of reality. The example held up by the pro-fracking lobby is, of course, the United States, where fracking has produced so much gas that the market has been oversupplied, forcing gas prices sharply downwards.

The trouble with this parallel is that it is based on a fundamental misunderstanding of the US shale story. We now have more than enough data to know what has really happened in America. Shale has been hyped (“Saudi America”) and investors have poured hundreds of billions of dollars into the shale sector. If you invest this much, you get a lot of wells, even though shale wells cost about twice as much as ordinary ones. If a huge number of wells come on stream in a short time, you get a lot of initial production. This is exactly what has happened in the US. The key word here, though, is “initial”. The big snag with shale wells is that output falls away very quickly indeed after production begins. Compared with “normal” oil and gas wells, where output typically decreases by 7pc-10pc annually, rates of decline for shale wells are dramatically worse. It is by no means unusual for production from each well to fall by 60pc or more in the first 12 months of operations alone.

Read more …

• Oil Companies Abandoning Arctic Plans, Letting Leases Expire (OilPrice)

After years of mishaps and false starts, some oil companies are giving up on drilling in the Arctic. Many companies have allowed their leases on offshore Arctic acreage to expire, according to an analysis by Oceana that was reviewed by Fuel Fix. Since 2003, the oil industry has allowed the rights to an estimated 584,000 acres in the Beaufort Sea to lapse. It wasn’t supposed to happen this way. The oil industry was once enormously optimistic about drilling for oil in the Beaufort and Chukchi Seas, off the north coast of Alaska. The U.S. Geological Survey estimated in a 2008 study that offshore Alaska holds almost 30 billion barrels of oil and 221 trillion cubic feet of natural gas. Shell Oil has been the leader in the Arctic, venturing into territory where other oil companies were unwilling to go. It promised billions of dollars in revenue and enhanced energy security. But it ran into a seemingly endless series of accidents and setbacks.

In 2009, the Department of Interior approved Shell’s drilling plan. But the following summer, a court suspended Shell’s lease until the offshore regulators could conduct a more thorough scientific review. After providing more detail, Shell received another go-ahead, with high expectations for drilling in the summer of 2012. But that proved to be a fateful year for Shell’s Arctic campaign. In July 2012, Shell temporarily lost control of its Noble Discoverer rig, which almost ran aground. Shell’s oil spill response ship also failed inspections, which delayed drilling. Shell ultimately had to throw in the towel for the year as the summer season drew to a close. Finally, on December 31, Shell’s Kulluk ship ran aground as the company was towing it out of Alaskan waters. The events forced Shell to take a step back, and the company announced in February 2013 that it would suspend its drilling campaign for the year. It hasn’t returned.

Read more …

This is how badly bernanke f***ed up the US economy.

• US Banks Braced For $1 Trillion Deposit Outflows (FT)

US banks are steeling themselves for the possibility of losing as much as $1tn in deposits as the Federal Reserve reverses its emergency economic policies and raises interest rates. JPMorgan Chase, the biggest US bank by deposits, has estimated that money funds may withdraw $100bn in deposits in the second half of next year as the Fed uses a new tool to help wind down its asset purchase programme and normalise rates. Other banks including Citigroup, Bank of New York Mellon and PNC Financial Services have also said they are trying to gauge the potential effect of the Fed’s exit on institutional or retail depositors who might choose to switch to higher interest accounts or investments. “There are investors, traders and sellside analysts that are very concerned about it,” said one top-10 investor in several large US banks.

An outflow of deposits would be a reversal of a five-year trend that has seen significant amounts of extra cash poured into banks thanks to the Fed flooding the financial system with liquidity. These deposits, which act as a cheaper source of funding, have helped banks weather the aftermath of the financial crisis. Now the worry is that such deposit funding may prove fleeting as the Fed retreats. Banks might have to pay higher rates on deposits to retain customers – potentially hitting their profits and sparking a price war for client funds. SNL Financial estimates that US banks have collectively increased their deposits by 23% over the past four years, at the same time that their cost of deposit funding has dropped to a 10-year low. “You essentially have frictionless non-interest bearing deposits funding much of the banking system today,” said Peter Atwater, former JPMorgan banker and president of research firm Financial Insyghts. “There’s no financial incentive to stay.”

Read more …

• Half-Trillion-Dollar Exodus Magnifying US Bill Shortage (Bloomberg)

One of the biggest winners in the push to make money-market funds safer for investors is turning out to be none other than the U.S. government. Rules adopted by regulators last month will require money funds that invest in riskier assets to abandon their traditional $1 share-price floor and disclose daily changes in value. For companies that use the funds like bank accounts, the prospect of prices falling below $1 may prompt them to shift their cash into the shortest-term Treasuries, creating as much as $500 billion of demand in two years, according to Bank of America Corp. Boeing Co., the world’s largest maker of planes, and the state of Maryland are already looking to make the switch to avoid the possibility of any potential losses. With the $1.39 trillion U.S. bill market accounting for the smallest share of Treasuries in six decades, the extra demand may help the world’s largest debtor nation contain its own funding costs as the Federal Reserve moves to raise interest rates.

“Whether investors move into government institutional money-market funds or just buy securities themselves, there will be a large demand” for short-dated debt, Jim Lee, head of U.S. derivatives strategy at Royal Bank of Scotland Group Plc’s capital markets unit in Stamford, Connecticut, said in a telephone interview on July 28. “That will lower yields.” He predicts investors may shift as much as $350 billion to money-market funds that invest only in government debt. During the past five years, America has enjoyed some of the lowest financing costs in its history as the Fed held its benchmark rate close to zero and bought trillions of dollars in bonds to restore demand after the credit crisis.

Based on prevailing Treasury bill rates, it costs the U.S. just 0.02% to borrow for three months as of 1:13 p.m. today in Tokyo. In the five decades prior to 2008, the average was more than 5%. Now, with traders pricing in a 58% chance the Fed will raise its overnight rate by July, speculation is building that borrowing costs are bound to increase. That’s made finding buyers for the nation’s debt securities even more important. The sweeping rule changes in the money-market fund industry may help provide that demand. Since 1983, money-market funds have been permitted to keep share prices at $1, meaning a dollar invested can always be redeemed for a dollar.

Read more …

Right facts, wrong logic.

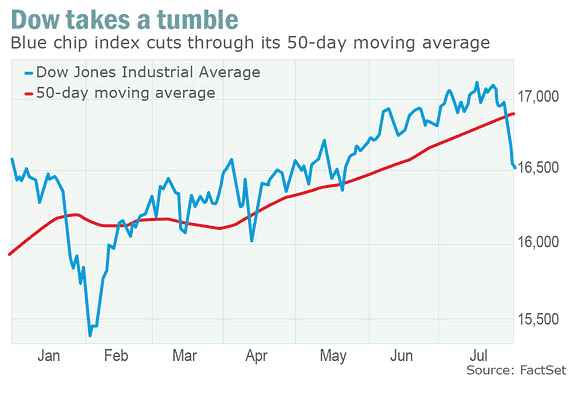

• That Plunge In Stocks Is Just The Beginning (MarketWatch)

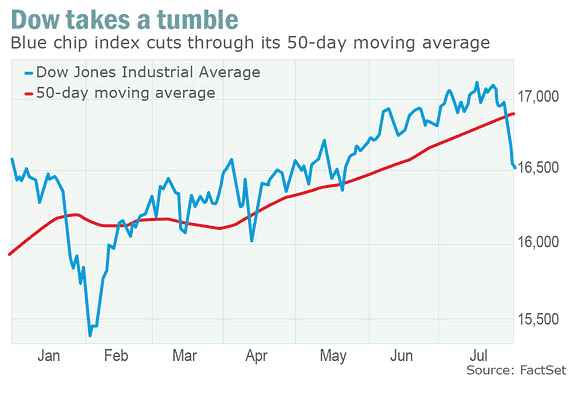

If the ups and downs of the past week have taught investors anything, it’s that there are cracks in this 5 1/2-year-old bull market. The lesson for investors? Tread carefully. Stocks took a tumble as a raft of economic data sparked fears the Federal Reserve could speed up its timetable for raising interest rates. The S&P 500 took its biggest weekly hit in more than two years, losing 2.7%. The Dow Jones Industrial Average, meanwhile, sliced through its 50-day moving average and erased the gains that had tenuously built up this year. “It reminded people that the stock market can actually go down. It seems like a lot of people had forgotten,” said Mike O’Rourke, chief market strategist at JonesTrading.

This past week saw a number of economic indicators: a robust 4% expansion in second-quarter GDP suggested a resurgence in economic activity, while a jump in a highly-watched wage index was a sign that employee earnings, the holy grail of labor market growth, was finally picking up. Even Friday’s soft jobs report didn’t undo the worries about the Fed. Indeed, investors should expect more volatility, not less, as the Fed moves closer to rate hikes, analysts say. The central bank is generally expected to begin raise its key lending rate in the middle of next year. “Every time we see data really heat up, it will really spook investors and keep a cap on the equity market for the time being.” said O’Rourke.

Read more …

A great example of how the world of finance risks missing out on ‘external’ factors driving policy. This guy once worked at the NY Fed, now owns an economic research company, and says “We all have to do what the Fed does: Watch the data on economic activity, labor markets, costs and prices.” I think the Fed looks at other things too, and so should ‘we’.

• A Wild Card In Fed’s Rate Hike Timing (CNBC)

The U.S. economy is leaking. Europe’s self-flagellants are happy about that. Suffering from excessive fiscal retrenchment and corrosive sanctions, they see a path to salvation in exports to America. Asia’s trade surplus runners also hope that their 5.4% increase in exports to the U.S. during the first five months of this year will continue – and that they will get bigger as American domestic demand picks up speed and leaks out to the rest of the world. What’s the leak? In the first half of this year, America’s trade deficit subtracted 1.14 percentage points from its economic growth. And that is the time when the U.S. economy just managed to eke out a 1% increase in its gross domestic product (GDP). The American financial community – and, apparently, some governors of the U.S. Federal Reserve (Fed) advocating an early interest rate increase – are blissfully oblivious to the trade deficit speed bumps. They are obsessing instead with non-issues. What are these?

Inflationary capacity pressures, of which there are no signs in American wages, unit labor costs or on factory floors. In spite of that, market operators see tightening credit conditions and the Fed’s alleged confusion about the technical aspects of liquidity withdrawals. It all seems like a trading case is being built to take equity prices down. That may well happen, but if it does I believe that would be a good buying opportunity. The reason is simple. A sustained decline of equity prices can only happen if the Fed is determined to cool down an overheated economy driven by excessive capacity pressures in labor and product markets. We are nowhere near that point. The Fed is now contemplating a gradual “normalization” of its policies after a long period of rescuing its badly damaged financial system and managing the recovery from the Great Recession – under conditions of a pronounced fiscal tightening since 2010. Nothing at the moment suggests that the Fed should rush that “normalization” process. And it is reassuring to see no signs that the Fed is about to do that.

Read more …

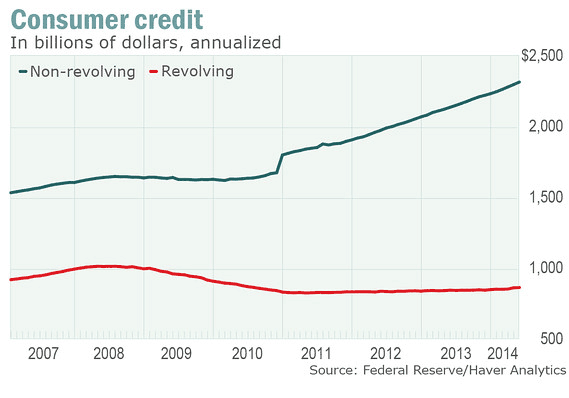

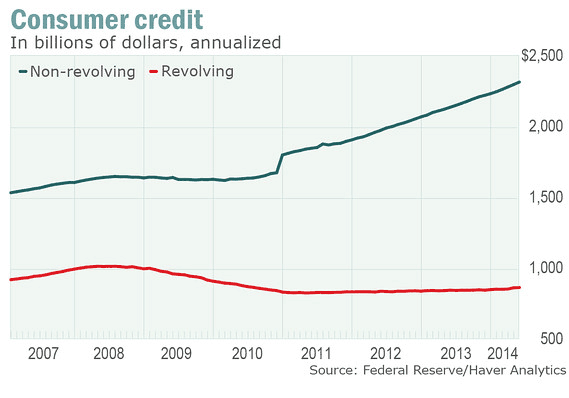

If people don’t get deeper into debt, the economy is bad. We live upside down. Ever feel that blood rushing to your head?

• Paltry Credit-Card Debt Growth Signals Restrained Consumer (MarketWatch)

Jobs growth has been solid of late, and manufacturing sentiment has been strong. But the lack of wage growth has been apparent, and one manifestation of that has been the paltry growth of credit-card debt. The latest data on consumer credit is due out Thursday. Non-revolving debt like auto and student debt has been growing gangbusters. But you have to squint to see the rise in credit-card debt. Data from the Labor Department showed hourly wages growing at just a 2% year-on-year clip , even though some survey data point to better wage acceleration than that. Another measurement of wage costs, the somewhat cumbersome unit labor costs, comes Friday.

“Incomes are only growing so much,” said Josh Shapiro, chief economist at MFR. “[Consumers] are not going to go two-fisted on credit-card and auto debt.” “A lot of people were wiped out,” added Chris Christopher, an economist at IHS Global Insight. “There aren’t as many credit cards out there.” This reticence to spend aggressively is reflected in consumer-sentiment data . Richard Curtin, the chief economist for the University of Michigan consumer sentiment survey, says current readings should support consumer spending growth of 2.5% this year. That would be the highest rate since 2006 but still below the median growth rate of 3.5% for the last 50 years.

Read more …

Oh loevely, more MBS under another name.

• Banks Burdened With Compliance Costs Outsource Home Loans (Bloomberg)

As banks lose money on mortgages and retreat from the business, PHH Corp. is rushing to cash in. PHH, the biggest U.S. outsourcer of home loans, processes and originates mortgages on behalf of small banks and some of the world’s largest financial firms, including Morgan Stanley and HSBC Holdings Plc. PHH Chief Executive Officer Glen Messina is so convinced he can make money where others can’t that in July he sold the company’s cash-producing fleet management unit and plans to plow the proceeds into mortgages.

Lenders are backing away from home loans as an array of new regulations in the aftermath of the housing crash push up compliance costs. Banks lost an average $194 a mortgage in the first quarter, according to the Mortgage Bankers Association. The losses may spur banks to increase outsourcing of home loans by $180 billion a year while keeping their brand name on the mortgage, Messina said on a July 8 call with analysts. “The biggest banks have the resources to implement the new regulations, but if you’re a smaller bank or a wealth manager, it may not make sense to invest in all that infrastructure,” said Bose George, a mortgage analyst at Keefe, Bruyette and Woods Inc. in New York. “The risks are too high for companies to lend without a very high level of compliance expertise.”

Read more …

Without hypothecation, what is China?

• Legal Fight Chills China Metal Trade After Qingdao Fraud Probe (Reuters)

As global banks and trading houses fire off lawsuits over their estimated $900 million exposure to a suspected metal financing fraud in China, the tangled legal battle to recoup losses is set to drag on for years and hinder a swift recovery in metal trade. HSBC is the latest bank to launch legal action since Chinese authorities started a probe into whether the firm at the center of the allegations, Decheng Mining, used fake warehouse receipts to obtain multiple loans. Several banks had already ditched their commodity trading divisions due to low returns. The scandal, centered on the eastern port of Qingdao, means those remaining in the commodity financing business will have to consider their future, or at least bring in new controls on lending requirements.

It has also acted as a warning over murky business practices in China and highlighted the difficulties of navigating the Chinese legal system for foreign companies, some of which have since frozen new financing business. “In the next six to twelve months, the impact would likely be reduced appetite for lending on metal collateral,” said Daniel Kang, Asia head of basic materials equity research at JP Morgan. “Copper imports may come under pressure in the second half, partly related to smaller traders going bankrupt.” [..] With multiple claimants, cross-country jurisdictions, involvement of state-owned entities and a separate corruption probe into Chen Jihong, the chairman of Decheng’s parent firm, the lawsuits stemming from the alleged fraud are unlikely to be wrapped up soon.

“The problem is that court judgments attained outside of China are not recognized on the mainland. Companies cannot simply take the judgments into China and have Chinese courts freeze assets,” said William McGovern, a lawyer at Kobre & Kim who specializes in international commercial disputes. Firms may also try to recoup losses via arbitration, as China recognizes international arbitration awards, but that process typically takes at least two to three years. “The other question is, where are the assets?,” said McGovern. “Obtaining an arbitration award against a fraudulent entity is only valuable if the defendant’s assets can be located and seized to satisfy the judgment.” In the Qingdao case, a problem for some Western banks trying to retrieve cash is that their contracts were signed with global warehousing firms acting as collateral managers, leaving them no direct way of claiming in Chinese courts.

Read more …

Is that a bomb ticking in the background?

• China Swap Rate Rises as PBOC Expresses Credit Growth Concern (Bloomberg)

China’s one-year interest-rate swaps rose for the first time in three days after the central bank expressed concern over credit expansion. The People’s Bank of China warned that credit and money supply have increased rapidly and indicated it will refrain from broader monetary easing to support growth, according to its Aug. 1 quarterly policy statement. “It’s inappropriate to rely on aggressive expansion of credit to solve structural problems,” the report said, adding that targeted monetary policies such as selective cuts in banks’ reserve ratios will undermine the role of markets in the long run.

The cost of one-year swaps, the fixed payment needed to receive the floating seven-day repurchase rate, climbed one basis point, or 0.01 percentage point, to 3.78% as of 4:10 p.m. in Shanghai, according to data compiled by Bloomberg. The rate climbed by a total of 35 basis points in June and July, after sliding for five months in a row. “It’s very likely the PBOC will slow the pace of monetary easing in the future,” Xu Gao, chief economist at Everbright Securities Co. in Beijing, wrote in a research note yesterday. “Although the central bank has done some targeted easing in the second quarter under pressure to stabilize growth, the remarks in this report seem to contain more elements of concern.”

Read more …

Not if they’re broke.

• Mervyn King: New Stress Tests Are European Banks’ ‘Last Chance’ (CNBC)

The upcoming European banking asset quality review will represent the sector’s “last chance” to prove its credibility, former Bank of England Governor Mervyn King told CNBC. The European Central Bank (ECB) plans to publish the results of the review of 128 bank balance sheets in late October and will assess the actions banks have taken to strengthen their capital positions. “Financial markets will be looking very carefully in the autumn at whether the statements made about the capital positions of different banks are really credible and a lot hangs on this,” King told CNBC following his keynote speech at the Diggers and Dealers 2014 conference in Kalgoorlie on Monday. “The previous stress tests for banks in Europe didn’t really convince markets of their seriousness – and this is a really last chance for Europe to put in place a really credible set of tests on the financial worthiness of all the banks in Europe,” he added.

European authorities have conducted regular bank ‘stress tests’ since 2009, designed to increase the sector’s resilience to another economic downturn and restore investor confidence, but the 2014 round has been billed as the toughest. ECB President Mario Draghi earlier this year sounded a warning that some of the banks were likely to fail. King, who was governor of the BOE from 2003 to 2013, told CNBC it’s paramount for banks to take an honest and transparent approach. “What will be disappointing is if the review comes up with very reassuring answers about the banking system that markets clearly don’t believe,” he said. “This is a time when honesty is absolutely vital. Transparency and honestly; facing up to problems on bank balance sheets; [and] injecting new capital, is the only way forward from now on and it will be a test of Europe to see whether it’s willing to do that,” he added.

Read more …

A bail-in really, Cyprus style, with shareholders and subordinated bondholders wiped out.

• Portugal Uses $6.6 Billion In EU Funds To Bail Out Espírito Santo (Guardian)

Portugal injected almost €5bn into Banco Espírito Santo on Sunday night to stave off the collapse of the country’s biggest bank following a series of financial scandals. Carlos Costa, governor of the Bank of Portugal, said the bank’s healthy businesses would be spun off into a “good” bank, while its toxic assets would be hived off into a “bad” bank. The bailout plan, which was agreed with Brussels, was sparked by the far bigger than expected €3.5bn (£2.8bn) net loss reported last week by the bank. The loss wiped out its capital buffers and sent its shares falling by more than 75% before the stock was suspended on Friday. Espírito Santo is expected to be delisted from the Lisbon stock exchange, meaning that shareholders will be wiped out. Costa said the injection of money would come mostly from Portugal’s international bailout, which made €6.4bn available for bank recapitalisation through a fund set up by Portugal in 2012.

The fund is aimed at limiting the political fallout from using taxpayers’ money to prop up a bank at a time when Portugal is only just emerging from a deep economic downturn. Pedro Passos Coelho, the prime minister, had pledged that taxpayers would not be called on to bail out failing banks. The “bad” bank will hold the troubled assets, mostly related to its exposure to the Espírito Santo family, which has faced difficulties after financial irregularities were uncovered at one of its array of holding companies last year. An audit ordered by the Portuguese central bank earlier this year discovered material irregularities at the Luxembourg-registered ESI, part of the empire.

Read more …

HFT is too powerful already.

• ‘Flash Boys’ and the Speed of Lies (Katsuyama)

In the last few months, I have had a strange and interesting experience. In early April, I found myself the main character in Michael Lewis’s book “Flash Boys.” It told the story of a quest I’ve been on, with my colleagues, to expose and to prevent a lot of outrageous behavior in the U.S. stock market. Many of us had worked at big Wall Street firms or inside stock exchanges, and many of us believed something was amiss in the market. But it took the better part of five years to discover exactly how the market had been organized to benefit financial intermediaries, rather than the investors, the companies or the economy it was meant to serve. Only after looking at a flurry of market innovations – 40-gigabit cross-connects, esoteric order types, microwave towers – did we understand that the market’s focus was less about capital formation and more about giving certain market participants an advantage over others. In the end, we felt that the best way to solve these problems was to build a stock market of our own, which we did.

After the book, our stock market, IEX Group Inc., became a topic of discussion – some positive, some negative, some true and some false. Fair enough. If you’re in the spotlight and doing something different, you should take the heat along with the light. It’s for this reason that we have done our best to resist responding publicly to misinformation about our company – even when we read memos circulated inside banks that “Michael Lewis has an undisclosed stake in IEX” (he does not); that “brokers own stakes in IEX” (they don’t); or articles in the Wall Street Journal that said we let “broker-dealers jump to the front of the trading queue,” putting retail investors and mutual funds at a disadvantage (in reality, all orders arrive at IEX via brokers, including those from traditional investors). Our hope in staying quiet was that the truth would win out in the end. But in recent weeks, the misinformation campaign has hit a new high (or low), and on one particularly critical matter, we feel compelled to set the record straight.

Read more …

I call bull.

• Denmark Breaks Debt Trap of World’s Most Indebted Households (Bloomberg)

Denmark’s efforts to stop the world’s most indebted households from building up more debt are starting to pay off as amortization rates improve. The Danish Mortgage Bankers’ Federation says issuance of interest-only loans — criticized by the central bank and rating companies for posing a threat to financial stability – has now peaked. Danske Bank A/S, Denmark’s biggest lender, also estimates the share of non-amortizing loans is set to decline. “The trend is broken now,” Jan Oestergaard, a senior analyst at Danske in Copenhagen, said in a phone interview. “Depending on how interest rates move going forward, I think we’ll see a lower share of interest-only loans.”

Interest-only mortgage bonds, which give borrowers a grace period of as long as 10 years on principal payments, made up 56% of Denmark’s $500 billion mortgage bond market at the end of June. The International Monetary Fund said in January the securities risk destabilizing the country’s home finance market, the world’s largest per capita. The Organization for Economic Cooperation and Development has urged Denmark to design policy to reduce gross household debt, which topped 300% of disposable incomes last year — a rich-world record. The Danish government is grappling with how to cut issuance of interest-only loans. A new set of rules for the mortgage market could include a limit. The guidelines “will be published in the fall,” Kristian Vie Madsen, deputy director at the FSA, said in an e-mailed reply to questions.

Read more …

Why am I starting to think all US sales numbers come together like this?

• GM Props Up Sales Numbers With ‘Creative’ Discounts To Dealers (AP)

As General Motors tackles a safety crisis, a look its numbers from June show just how intent the company is on keeping new-car sales on the rise during a record spate of safety recalls. The Detroit automaker has recalled nearly 30 million cars and trucks this year, including some models that had barely rolled off the assembly line. Yet sales have been resilient, up 3.5% through the first seven months of the year. In mid-June, however, the automaker was headed for a year-over-year monthly sales decline, according to data compiled by automotive research firms. Then, on June 20, GM asked dealers to buy more cars, and it threw in another $1,000 in discounts per vehicle, five dealership representatives told The Associated Press. The company finished the month with a 1% gain.

The dealers said they were asked to buy the cars for a rental program, one that provides loaner cars for people whose vehicles are being serviced. When they buy the cars for the program, GM counts them as a retail sale. It’s a longstanding practice used by nearly all automakers to boost sales results. At GM, though, the incentive was unusually generous and came as GM executives try to steer the company through the worst safety crisis in its history, including the recall of 2.6 million small cars with defective ignition switches tied to at least 13 deaths. The company has allayed investor fears by saying that recalls have actually helped sales by bringing in customers who see vastly improved new models. “Clearly the timing seems a little suspicious,” said Jesse Toprak, senior analyst for the Cars.com website who predicted on June 22 that GM sales would be down 7% for the month, compared with a 2% decline for the rest of the industry. “Retail numbers at that point did not show any kind of strength.” The industry eked out a 1.2% gain for the month.

Read more …

Would Washington ever let GM go under, again? No way. they got a free pass.

• GM Recall Help Site As Defective As Its Ignition Switches (USA Today)

Federal safety regulators say that not only are General Motors ignition switches defective, so is GM’s website for determining if you are driving one of the defective cars. People who use the GM “VIN look-up” site are told their cars aren’t part of an active recall if the repair parts aren’t yet available, even when the cars are, in fact, being recalled. VIN is the vehicle identification number. GM and other automakers maintain websites that allow owners to check for recalls by plugging in their vehicle’s VIN. The National Highway Traffic Safety Administration said late Friday that it “determined that owners of some recalled GM vehicles are receiving incorrect and misleading results” using the automaker’s VIN look-up system. NHTSA said it told GM to fix the system and tell owners about the problem. “Consumers who have used GM’s tool and found no recall should recheck,” NHTSA said. GM spokesman Greg Martin said Friday night, “We are aware of NHSTA’s inquiry on the VIN look-up issue. We are making the necessary changes to our website.”

He said that people who are unsure if they got the right answer from the website “should call the customer care numbers listed on our website.” Starting Aug. 20, NHTSA is requiring all automakers to provide a free online tool that lets car owners search for recalls using the VIN. Many automakers already do so. NHTSA said in its statement that it was alerted to the faulty GM VIN look-up system by Sen. Barbara Boxer, D-Calif. Boxer has been especially tough on GM and its CEO, Mary Barra, at Senate subcommittee hearings, accusing the automaker of a cover-up for not disclosing sooner that millions of its vehicles had ignition switches with a potentially fatal flaw. GM documents show that the switch problem was noticed in 2001, but nothing was done to fix it until engineer Ray DeGiorgio, since fired by GM, tried to improve the switch quietly in 2006, under the guise of fixing a different switch problem.

Read more …

Not terribly new info for Automatic Earth readers, but worth repeating.

• Public Pension Funds Making Big Bets On Hedge Funds (NPR)

Public pension funds have been doing something new in recent years — investing in hedge funds. Hedge funds are often secretive investment firms led by supposedly supersmart fund managers. Though, sometimes they implode spectacularly — think Long-Term Capital Management. Another prominent firm, Galleon Group, recently got shut down for rampant insider trading. Those may be rare examples, but one thing that’s true about nearly all hedge funds is that they charge high fees. And some experts are questioning whether public pension funds should be investing this way. Ten years ago, public pension funds stayed away from hedge funds. Maybe hedge funds seemed too pricey or opaque or exotic. After all, public pension funds invest money so they can afford to keep sending checks to retired schoolteachers, police officers and firefighters. “They didn’t have anything in hedge funds,” says David Kotok, the chief investment officer at Cumberland Advisors. He advises public pension funds on their investments.

Hedge funds claim to be able to provide a good return — while protecting the investor if, say, the stock market crashes. That’s why they’re called “hedge” funds — as in hedging your bets. And in recent years more pension funds have invested in them. But Kotok says, “our concern has been that in some cases this seems to have become a fad.” If it is a fad, it’s a very expensive one. Hedge funds generally charge what’s called “2 and 20.” Every year, they take 2% of all the money you have invested with them plus 20% of any profits. If they lose money, they still get the 2%. For public pension funds that invest billions of dollars, those are very steep fees. They’re more than 10 times the percentage cost of a typical stock market index fund. In recent months many hedge funds have cut those fees a bit, under pressure from investors. Some surveys have found the hedge funds willing to take 1.6% and 18% of profits. Those fees are still much higher than other investment options. “The fees are extraordinarily high,” says Julia Bonafede, the president of Wilshire Consulting.

Both she and Kotok advise their public pension fund clients not to invest in hedge funds. Kotok says that over time, the odds are too slim that returns will justify those high fees. “We think that a high-cost structure works against the investor,” he says. Still, some pension funds have been plowing money into hedge funds. “What has happened since the financial crisis is you’ve seen a huge flow of assets into hedge funds,” Bonafede says. Most public pension funds are not investing heavily in hedge funds, according to data from Wilshire. But some of the funds definitely are. The Teacher Retirement System of Texas is investing 10% of its money in hedge funds. The state of New Jersey’s pension system is investing around 12%. For the Ohio school’s pension fund, it’s 15%.

Read more …

• Snowden, Greenwald Reveal Scale Of US Aid To Israel (RT)

The turmoil gripping the Middle East is a direct result of the provision of cash, weapons and surveillance to Israel by the US, the latest Snowden leak illustrates. Obama’s “helpless detachment” is just for show, the Intercept’s Glenn Greenwald writes. In a bold examination, the former Guardian journalist reveals the amazing contrast between what the United States says publicly, and what it does behind the curtain. This involves President Barack Obama’s apparent heartbreak over the Middle Eastern region, as well as the American love for publicly listing Israel as a threat to regional peace at a time when billions of dollars’ worth of its weaponry and intelligence were being supplied to the Jewish state since the 1960s. Greenwald has published his analysis of the latest leaked Edward Snowden document, wherein it’s explained just how false the notion that the US is a bystander to the Middle Eastern crisis really is. In fact, “the single largest exchange between NSA and ISNU is on targets in the Middle East which constitute strategic threats to US and Israeli interests,” the leaked paper reveals.

“The mutually agreed upon geographic targets include the countries of North Africa, the Middle East, the Persian Gulf, South Asia, and the Islamic republics of the former Soviet Union. Within that set of countries, cooperation covers the exploitation of internal governmental, military, civil and diplomatic communications; and external security/intelligence organizations.” One of the “key priorities” of this cooperation is “the Iranian nuclear development program, followed by Syrian nuclear efforts, Lebanese Hizbullah plans and intentions, Palestinian terrorism, and Global Jihad.” The paper talks about “targeting and exploiting” these. It goes on to show that both intelligence services have liaison officers in each other’s embassies, enjoy a “cryptanalytic” partnership, and that Israel has direct access to the highest American military technology. Greenwald supplements this with proof of millions in emergency US funds stockpiled in the Middle East, which Israel can use for its own strategic purposes by simply writing a request.

Read more …

Say a little prayer.

• More Than 100 Health Workers Have Been Infected By Ebola (Reuters)

Jenneh became a nurse in Sierra Leone 15 years ago with the hope of saving lives in one of the world’s poorest countries. Now she fears for her own after three of her colleagues died of Ebola. Health workers like Jenneh are on the frontline of the battle against the world’s worst ever outbreak of the deadly hemorrhagic fever that has killed 729 people in Sierra Leone, neighboring Liberia, Guinea and Nigeria so far. With West Africa’s hospitals lacking trained staff, and international aid agencies already over stretched, the rising number of deaths among healthcare staff is shaking morale and undermining efforts to control the outbreak.

More than 100 health workers have been infected by the viral disease, which has no known cure, including two American medics working for charity Samaritan’s Purse. More than half of those have died, among them Sierra Leone’s leading doctor in the fight against Ebola, Sheik Umar Khan, a national hero. “We’re very worried, now that our leader has died from the same disease we’ve been fighting,” said Jenneh, who asked for her real name not to be used. “Two of my very close nursing friends have also been killed … I feel like quitting the profession this minute.”

[..] like other carers, she is worried the fabric of the yellow full-body suits used to protect workers on isolation wards is too flimsy to block the virus. “Improper personal protective gear is a serious issue here,” she said. World Health Organization (WHO) experts strongly deny there is any problem with the protective equipment. They point to a chronic lack of experienced staff that is forcing health workers to cut corners in the arduous daily task of decontaminating wards and treating patients. The WHO launched an urgent appeal for hundreds more trained medical personnel on Thursday as part of a $100 million drive to bring the outbreak under control. It said it was seeking ways to safeguard scarce medical workers from infection.

Read more …

• US Spy Plane Intercepted By Russian Jet Invades Swedish Airspace (RT)

US officials have confirmed Swedish media reports of a mid-July incident in which an American spy plane invaded Sweden’s airspace as it was evading a Russian fighter jet. The maverick plane was spying on Russia when it was intercepted. The incident, which happened on July 18, went public last Wednesday after a classified document from Sweden’s Defense Ministry was leaked to the press. The plane, a Boeing RC-135 Rivet Joint, entered Sweden’s airspace after permission to do so was denied by traffic control, Svenska Dagbladet (SvD) newspaper said. It passed from the east over the island of Gotland and flew more than 200km over 90 minutes before leaving. The aerial incursion was caused by a Russian fighter jet, which scrambled from a base in the exclave Kaliningrad Region and approached the American reconnaissance plane.

Neither party involved in the incident confirmed or denied it, but a source in the US military told CNN on weekend that it indeed happen. The source said the plane was conducting an electronic eavesdropping mission on the Russian military when the latter locked on to the aircraft with a radar station and sent at least one jet to intercept it. The quickest path of escape was through Swedish airspace, which was what the spy plane pilot did despite the Swedes’ objection. The source said similar incidents may happen in future, a fact which the US officials made known to Sweden. The CNN report didn’t elaborate on how it was perceived by Sweden, a country that is not even a member of NATO and maintains a non-alliance stance.

Read more …