Banksy Devolved Parliament 2009

For anyone who wanted to stop Brexit, this seemed the way out: show illegal activity. Plenty appears to be there, but it’s been swept under the carpet. Why hasn’t it been investigated much more?

• Boris Johnson and Michael Gove Under Fire On Vote Leave’s Law-Breaking (G.)

Conservative leadership candidates Boris Johnson and Michael Gove are facing growing calls to account for illegal behaviour by the official Vote Leave Brexit campaign. The group has dropped its appeal against the Electoral Commission’s ruling that it broke the law by channelling hundreds of thousands of pounds of donations to an ostensibly independent campaign group, BeLeave. When the Observer revealed evidence a year ago that Vote Leave had broken spending rules, Johnson attacked the report on Twitter as “utterly ludicrous” and said it had “won … legally”. A Johnson adviser said on Saturday that the former foreign secretary would not comment on the end of the appeal.

There has been no government response to the appeal being dropped and little media coverage. And while national broadcasters and newspapers gave prime coverage to Vote Leave chief executive Matthew Elliot when he launched an aggressive media campaign against the watchdog’s initial findings, few covered the decision to to end the appeals process in any depth. After the announcement, whistleblower Shahmir Sanni, who was outed by a member of Theresa May’s team, lost his job and was vilified as a fantasist after his revelations about Vote Leave’s spending, said: “The [end of the appeal] feels extremely vindicating, but the way the media has responded to it has been extremely disappointing. The only excuse they had is that they were appealing. Now we know they broke the law, they need to be held to account.”

Liberal Democrat MP Layla Moran said the confirmation that Vote Leave had broken the law underlined the need for a second referendum. “It is now incumbent on the government to act. We have heard minister after minister say the referendum is valid. This is proof it was not,” she said. “Going ahead with Brexit in these circumstances would be the biggest betrayal of our democracy of all.”

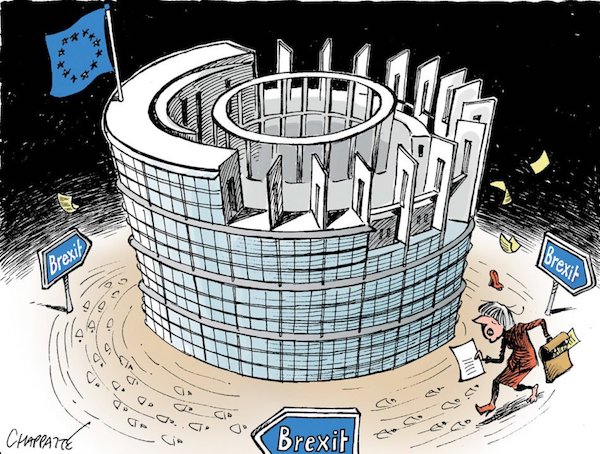

Britain can only do what the EU will allow.

• EU Will Delay Brexit To Allow Another Referendum (Ind.)

EU leaders are prepared to let Britain delay Brexit again to allow time for a second referendum, The Independent understands. After parliament rejected Theresa May’s deal for a third time, the bloc called a summit on 10 April – two days before the UK is on course to leave without a deal. And senior Brussels officials familiar with leaders’ thinking say that barring a credible plan to get a majority for the withdrawal agreement, the UK would be given more time only if it was for another clear option such as a general election or a referendum. The EU has already warned that a further extension, which could run until at least the end of the year, would also require the UK to take part in European parliament elections scheduled for the end of May.

As reported by The Independent, the prime minister is considering a general election as a way out of the Brexit chaos in Westminster, where MPs have rejected all options – including a no-deal Brexit. Senior officials in Brussels have made clear that an extension would also be justified if it was to make time for a referendum. Indicative votes in the Commons this week showed relatively strong support for a confirmatory referendum among MPs, with numbers such that only around a dozen more would need to be convinced to back one to pass it. One senior EU official said there were “three possible justifications” for a long extension emerging in member states’ thinking following their summit last week.

Obviously. But a lot more could collapse.

• May Risks ‘Total Collapse’ Of Government In Brexit Impasse – Sunday Times (R.)

British Prime Minister Theresa May risks the “total collapse” of her government if she fails to get her battered Brexit deal through parliament, the Sunday Times newspaper said, amid growing speculation that she might call an early election. Underscoring the tough choices facing May to break the Brexit impasse, the newspaper said at least six pro-European Union senior ministers will resign if she opts for a potentially damaging no-deal departure from the EU. But at the same time, rival ministers who support Brexit were threatening to quit if May decides to stay close to the EU with a customs union or if she sought a long delay to Brexit, the Sunday Times said.

May’s Brexit strategy is in tatters after the exit deal she hammered out with other EU leaders was rejected for a third time by the House of Commons on Friday, the day that Britain was supposed to leave the bloc. [..] The Mail on Sunday newspaper said May’s advisors were divided over whether she should call an early election if she fails to win support for her Brexit deal from parliament in the coming week. The newspaper said a possible “run-off” vote could take place on Tuesday in parliament between May’s deal and whatever alternative emerges as the most popular from voting by lawmakers on Monday. That meant an election could be called as early as Wednesday, the newspaper said …

The Sunday Telegraph said senior members of the Conservative Party did not want May to lead them into a snap election, fearing the party would be “annihilated” at the polls if she faced down parliament over Brexit in the coming months. An opinion poll in the Mail on Sunday gave the opposition Labour Party a lead of five percentage points over the Conservatives. That lead fell to three points if voters were offered the chance to vote for a new group of independent lawmakers who have not yet created an official party.

“The threat of an election immediately angered both pro-Brexit and pro-Remain MPs. May would need a two-thirds majority in the Commons to secure one..”

• Furious Tory MPs Tell May: We’ll Block Snap Brexit Election (G.)

Conservative MPs from across the party are threatening to vote down any attempt by Theresa May to lead them into a snap election, warning it would split the Tories and exacerbate the Brexit crisis. In a sign of the collapse in authority suffered by the prime minister, cabinet ministers are among those warning that there will be a serious campaign by Conservative MPs to vote against an election headed by May, a move she hinted at last week to break the Brexit deadlock. The threat of an election immediately angered both pro-Brexit and pro-Remain MPs. May would need a two-thirds majority in the Commons to secure one, meaning a serious rebellion by Tories could block it. May would then be forced to secure an election by backing a no-confidence vote in her own government, which only requires a simple majority of MPs.

Foreign Office minister Alan Duncan said: “If we have a general election before Brexit is resolved, it will only make things worse.” Antoinette Sandbach, a Tory MP who backs another referendum being held on any deal agreed by parliament, said she would vote against calling an election. “The answer is not a general election, and I would vote against that. We need to find a way forward in parliament and then put that to the people in a confirmatory referendum.” Mark Francois, a member of the European Research Group of pro-Brexit MPs, said there was “not a chance” that Conservative MPs would back an election under May. “‘Of course they wouldn’t – not after last time. And remember, she needs a super majority to do it.”

Then call for a national government, you twit.

• Corbyn Accuses Government Of ‘Bullying’ MPs (G.)

The Labour leader, Jeremy Corbyn, has accused the government of running down the clock and “bullying and threatening” MPs as it tried to force through Theresa May’s Brexit deal. Speaking in Newport, south Wales, before a byelection on Thursday, Corbyn also refused to say what his party’s parliamentary tactics would be during a second round of indicative votes due to take place on Monday. He said that the option of giving the public a confirmatory referendum on any Brexit deal “is the Labour position so far, but there hasn’t been enough support for that across the floor in the House of Commons”. During this week’s indicative votes, the option for a public vote was whipped by Labour but was defeated by 295 to 268 votes, with 27 of the party’s MPs rebelling.

Corbyn said: “The absolute priority at the moment is to end this chaos the government has brought us to by their endlessly running down the clock and basically bullying and threatening people. The bullying hasn’t worked, the threats haven’t worked. It’s time now for the sensible people to take over.” He cautioned: “This is a very dangerous period, because if we crash out without a deal then the supply chains get interrupted, jobs are at stake, and also the sense of security of many EU nationals living in Britain, and of course British people living across Europe.” [..] “However people voted in the referendum, no one voted to lose their jobs, no one voted to be worse off, and no one voted to deregulate our society.”

Maximizing waste production is our economic model. Lovely video.

• The Insanity of Global Trade (Roar)

The way trade works in the global economy is often absurd. Food routinely gets shipped halfway across the world to be processed, then shipped back to be sold right where it started. Mexican calves — fed imported American corn — are exported to the United States to be butchered, and then the meat is exported back to Mexico for sale. More than half of the seafood caught in Alaska gets processed in China, and much of it is sent right back to American grocery store shelves. Compounding the insanity of this “re-importation” is the equally head-scratching phenomenon of “redundant trade”. This is a common practice whereby countries both import and export identical quantities of identical products in a given year.

For instance, in 2007, Britain imported 15,000 tons of chocolate-covered waffles, while exporting 14,000 tons. In 2017, the US both imported and exported nearly 1.5 million tons of beef and nearly half a million tons of potatoes. On the face of it, this kind of trade makes no economic sense. Why would it be worth the immense cost — in money as well as fuel — of sending perfectly good food abroad only to bring it right back again? The answer lies in the way the global economy is structured. Direct and indirect subsidies for fossil fuels, on the order of $5 trillion per year worldwide, allow the costs of shipping to be largely borne by taxpayers and the environment instead of the businesses that actually engage in it. This allows transnational corporations to take advantage of differences in labor and environmental laws between countries, not to mention tax loopholes, in service of making a bigger profit.

The consequences of this bad behavior are already severe, and set to become worse in the coming decades. Small farmers, particularly in the Global South, have seen their livelihoods undermined by influxes of cheap food from abroad. Trade agreements have made it impossible for companies to compete in the global economy unless they base their operations in places with the weakest protections for workers and the environment. And all the while, the share of global carbon emissions produced by commercial shipping is set to rise to 17 percent by 2050, if action isn’t taken to curb our addiction to trade.

So far, the law has not been on Chelsea’s side. Or actually, it has. It just doesn’t count for much anymore.

• Chelsea Manning’s Lawyers File An Appeal Against Her Detention (Canary)

Chelsea’s Manning’s legal team have filed an appeal on her behalf. They’ve asked that the fourth circuit court order her release from detention. On 8 March, Manning refused to testify in front of a grand jury about Julian Assange and WikiLeaks. Judge Claude Hilton found that Manning was in contempt of court and ordered her jailed. Manning will walk free when she either chooses to testify or the grand jury finishes its work. As a result, Manning could be held in jail for a further 18 months. Her support group Chelsea Resists! published a statement about the appeal. It said that her legal team are basing the appeal on three issues. Firstly, it said: “Judge Hilton denied Chelsea’s motion asking the government to disclose the existence of any unlawful surveillance without actually considering the evidence.”

This is important, it argued, because “evidence derived from unlawful surveillance may not be used in a grand jury”. Secondly, it claimed judge Hilton did not get assurances that the government’s subpoenaing of Manning was “properly motivated”. Chelsea Resists! said: “Prosecutors may not use the grand jury for the primary purpose of preparing for trial of an already-secured indictment. Chelsea raised concerns that the government did not need her testimony to further their investigation, and that rather they intended to use the subpoena to preview and perhaps undermine any testimony she might give at trial for an already-pending indictment.” It said this is “an abuse of process” which would void the initial subpoena. It argued that the judge “did not consider the facts or the law on this motion”.

For now, the US government is still holding Manning in detention. As The Canary previously reported, her support group has also accused the government of torturing her. According to Chelsea Resists!, prison authorities confine Manning to her cell for 22 hours a day. It says that “this treatment qualifies as Solitary Confinement” which “amounts to torture” when maintained for over 15 days. In its latest statement, it also said that this confinement: “..is especially egregious given that Chelsea has not been charged with or convicted of a crime.” The US government previously held Manning in solitary confinement from May 2010 to April 2011.

“..US district judge Vince Chhabria [..] said there were “large swaths of evidence” showing that the company’s herbicides could cause cancer. He also said there was “a great deal of evidence that Monsanto has not taken a responsible, objective approach to the safety of its product..”

• Who Is Paying For Monsanto’s Crimes? We Are (G.)

The chickens are coming home to roost, as they say in farm country. For the second time in less than eight months a US jury has found that decades of scientific evidence demonstrates a clear cancer connection to Monsanto’s line of top-selling Roundup herbicides, which are used widely by consumers and farmers. Twice now jurors have additionally determined that the company’s own internal records show Monsanto has intentionally manipulated the public record to hide the cancer risks. Both juries found punitive damages were warranted because the company’s cover-up of cancer risks was so egregious.

The juries saw evidence that Monsanto has ghost-written scientific papers, tried to silence scientists, scuttled independent government testing, and cozied up to regulators for favorable safety reviews of glyphosate, the active ingredient in Roundup. Even the US district judge Vince Chhabria, who oversaw the San Francisco trial that concluded Wednesday with an $80.2m damage award, had harsh words for Monsanto. Chhabria said there were “large swaths of evidence” showing that the company’s herbicides could cause cancer. He also said there was “a great deal of evidence that Monsanto has not taken a responsible, objective approach to the safety of its product… and does not particularly care whether its product is in fact giving people cancer, focusing instead on manipulating public opinion and undermining anyone who raises genuine and legitimate concerns about the issue.”

Oh dear…

• $80 Million Roundup Verdict Is Only $2.5M After Taxes, New IRS Math (F.)

Another Roundup verdict is in. This time, jurors found that Monsanto failed to warn users its product was dangerous and awarded Edwin Hardeman $200,000 for economic losses, $5 million for past and future pain and suffering, and $75 million in punitive damages. Last year, jurors gave $289 million to a man they say got cancer from Monsanto’s Roundup. That verdict was later reduced, and is on appeal. But the latest case is federal, and suggests that others could be headed for big numbers. The jury had already concluded that the weedkiller was a substantial factor in causing Mr. Hardeman’s non-Hodgkins lymphoma. Monsanto faces over 10,000 claims, and can be expected to continue fighting hard. But even if Monsanto pays up, new tax rules could swallow up many of the verdicts plaintiffs might be hoping to collect. Wait until you see the new tax math.

Under President Trump’s tax bill passed in late 2017, there is a new tax on litigation settlements: no deduction for legal fees. Amazingly, many legal fees can no longer be deducted. That means many plaintiffs must pay taxes even on monies their attorneys collect. Of course, the attorneys must also pay tax on the same money. Here’s the new math. Hardeman was awarded a bit over $5 million in compensatory damages, and $75M in punitive damages. The combined contingent fees and costs Mr. Hardeman pays his attorneys might total as much as 50%. If so, the plaintiff would get to keep half, or $2.5 million of the $5 million compensatory award. Since it is for his claimed non-Hodgkin’s lymphoma, that part for physical injuries should not be taxed.

Then, of the $75 million punitive award, $37.5 million goes to legal fees and costs, and $37.5 million to Hardeman. So before taxes, the plaintiff’s take home is $40 million. What about after taxes? The $75 million in punitive damages are fully taxable, with no deduction for the fees to his lawyer. Between federal taxes of 37% and California taxes of up to 13.3%, Hardeman could lose about 50% to the IRS and California Franchise Tax Board. That makes his after-tax (and after legal fee) haul from an $80 million verdict only $2.5 million.

Everything dies baby that’s a fact. We live in a death culture.

• EU Bans UK’s Most-Used Pesticide Over Health And Environment Fears (G.)

One of the world’s most common pesticides will soon be banned by the European Union after safety officials reported human health and environmental concerns. Chlorothalonil, a fungicide that prevents mildew and mould on crops, is the most used pesticide in the UK, applied to millions of hectares of fields, and is the most popular fungicide in the US. Farmers called the ban “overly precautionary”. But EU states voted for a ban after a review by the European Food Safety Authority (Efsa) was unable to exclude the possibility that breakdown products of the chemical cause damage to DNA. Efsa also said “a high risk to amphibians and fish was identified for all representative uses”.

Recent research further identified chlorothalonil and other fungicides as the strongest factor linked to steep declines in bumblebees. Regulators around the world have falsely assumed it is safe to use pesticides at industrial scales across landscapes, according to a chief scientific adviser to the UK government. Other research in 2017 showed farmers could slash their pesticide use without losses, while a UN report denounced the “myth” that pesticides are necessary to feed the world.

A European commission spokeswoman said: “The [chlorothalonil ban] is based on Efsa’s scientific assessment which concluded that the approval criteria do not seem to be satisfied for a wide range of reasons. Great concerns are raised in relation to contamination of groundwater by metabolites of the substance.” Chlorothalonil has been used across the world since 1964 on barley and wheat, as well as potatoes, peas and beans. The ban will be passed formally in late April or early May and then enter into force three weeks later, the commission spokeswoman said.

Inbreeding.

• How The Lion Lost Its Strength (G.)

For more than a century, explorers and settlers have warned about the likely impact of the hunting of lions and other wild animals in Africa. One of the most prescient, Frederick Selous, the inspiration for the character Allan Quatermain in the novels of H Rider Haggard, wrote in 1908 that “since my first arrival in 1871, I had seen game of all kinds gradually decrease and dwindle in numbers to such an extent that I thought that nowhere south of the Great Lakes could there be a corner of Africa left where the wild animals had not been very much thinned out”.

Now researchers have uncovered the impact of that predation on the lion. Lion numbers and range have plunged – but it appears their genetic fitness has also declined. An alarming new study has revealed that lions shot by colonial hunters more than 100 years ago were more genetically diverse than the ones that now populate Africa. The discovery is worrying because it indicates that the species’ fight to survive may be even more difficult than had been previously thought. “Loss of genetic diversity means that lions are now less able to withstand new diseases or environmental problems, such as heatwaves or droughts,” said lead author Simon Dures, of the Zoological Society of London. “It means that we will have to be even more careful about how we try to protect them.”

In the late 19th century there were about 200,000 members of Panthera leo roaming the savannahs of Africa. Then European colonialists arrived and began shooting lions – the most social of all cats – in their thousands, first as sport and later to protect the cattle that the newcomers had begun to farm. With fewer than 20,000 of these majestic predators left on the continent, the species has now been designated as “vulnerable”.

Lions have lost some of their ability to cope with diseases, environmental changes or other threats. Photograph: Heinrich van den Berg/Getty Images

Always fascinating.

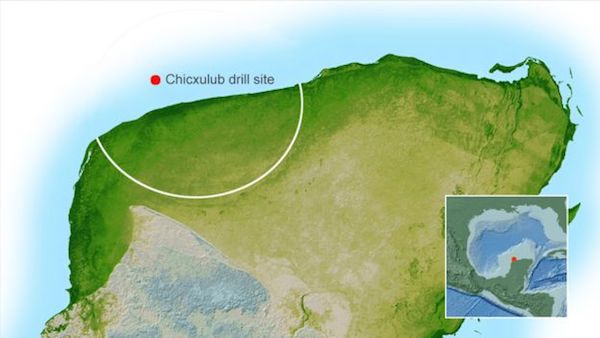

• Chicxulub: Stunning Fossils Record Dinosaurs’ Demise (BBC)

Scientists have found an extraordinary snapshot of the fallout from the asteroid impact that wiped out the dinosaurs 66 million years ago. Excavations in North Dakota reveal fossils of fish and trees that were sprayed with rocky, glassy fragments that fell from the sky. The deposits show evidence also of having been swamped with water – the consequence of the colossal sea surge that was generated by the impact. Robert DePalma, from the University of Kansas, and colleagues say the dig site, at a place called Tanis, gives an amazing glimpse into events that probably occurred perhaps only tens of minutes to a couple of hours after the giant asteroid hit the Earth.

Fossilised fish piled one atop another as they were flung ashore by the seiche

When this 12km-wide object slammed into what is now the Gulf of Mexico, it would have hurled billions of tonnes of molten and vaporised rock into the sky in all directions – and across thousands of kilometres. And at Tanis, the fossils record the moment this bead-sized material fell back down and strafed everything in its path. Fish are found with the impact-induced debris embedded in their gills. They would have breathed in the fragments that filled the water around them. There are also particles caught in amber, which is the preserved remnant of tree resin. It is even possible to discern the wake left by these tiny, glassy tektites, to use the technical term, as they entered the resin.

Dating the tektites gives an age for the impact – 65.76 million years ago

Geochemists have managed to link the fallout material directly to the so-called Chicxulub impact site in the Gulf. They have also dated the debris to 65.76 million years ago, which is in very good agreement with the timing for the event worked out from evidence at other sites around the world. From the way the Tanis deposits are arranged, the scientists can see that the area was hit by a massive surge of water. Although the impact is understood to have generated a huge tsunami, it would have taken many hours for this wave to travel the 3,000km from the Gulf to North Dakota, despite the likely presence back then of a seaway cutting directly across the American landmass.

The outer rim (white arc) of the crater lies partly under Mexico’s Yucatan Peninsula