Paul Klee Angelus Novus 1920 (see last article)

Sorry, but I see nothing other than Trump reaffirming the Fed’s independence.

• Trump “Doesn’t Like What The Fed Is Doing” (ZH)

With the dollar spiking and rates surging to 7 years highs, President Trump doubled down on his criticism of the Fed and on his way to a rally in Iowa, said the Federal Reserve is moving too fast with interest rates increases, dismissing concerns about inflation. “I don’t like what the Fed is doing”, Trump told reporters at the White House. “I think we don’t have to go as fast” on rate hikes. “I like low interest rates,” Trump said. Trump also said that rates are too high because there’s no inflation, but said that he has not talked to Chair Powell about it because he doesn’t want to get involved. Trump’s comments echoed prior criticisms of the Fed.

When the Fed announced its third increase of the year in September, Trump said he was “not happy” about it. Trump has publicly criticized the Fed’s interest-rate increases on several occasions, breaking with more than two decades of White House tradition of avoiding comments on “independent” monetary policy. Some commented that this is another sly move by the president to preemptively shift blame on the Fed chair ahead of what may be a turbulent 2019 when rates are expected to keep rising, potentially resulting in a sharp slowdown in the economy and/or a stock market crash.

Separately, hours after Nikki Haley announced her departure as US ambassador to the UN, Trump said he would consider Goldman’s Dina Powell for the post. “Dina is certainly a person I would consider,” Trump told reporters at the White House on the way to board the presidential helicopter as he embarked on a trip to Iowa. But he added there are others he would also consider. Earlier CNBC reported that Dina Powell, a Goldman Sachs exec and Trump’s former deputy national security advisor, has had discussions with senior members of the administration about possibly replacing Nikki Haley as U.S. ambassador to the United Nations.

Manipulation?

• Chinese Yuan Could Reach A Record Low Against The Dollar (MW)

The pressure on China’s currency continues to mount as the world’s second-largest economy shows more signs of slowing and traders bet that the dollar will soon buy a record amount of yuan in the offshore market. As the country returned to work on Monday after the Golden Week holiday, the People’s Bank of China cut the Reserve Ratio Requirement, the percent of deposit liabilities owed to its customers banks are required to hold, for the fourth time this year. While that may spur banks to lend more, it sent the Chinese yuan another leg lower, moving toward its August low against the greenback and in sight of the psychological 7.00 level. A move through 7.00 would be a record low in offshore trading.

The yuan has already posted six straight monthly declines against the dollar, including a drop of 0.6% in September. The slide in the yuan comes as the economy shows more signs of slowing. A closely watched economic activity indicator, the official Purchasers Manufacturing Index, fell to 52 in September, from 52.2 in August, according to Wei Yao, an economist at Société Générale. Magnifying concerns around the Chinese economy was a steeper-than-expected drop in China’s foreign-exchange holdings during September, to $3.087 trillion. A decline in the country’s reserves raises concerns that the PBOC could not defend the yuan in should a large amount of money flee the country.

“For most, business has never been worse.”

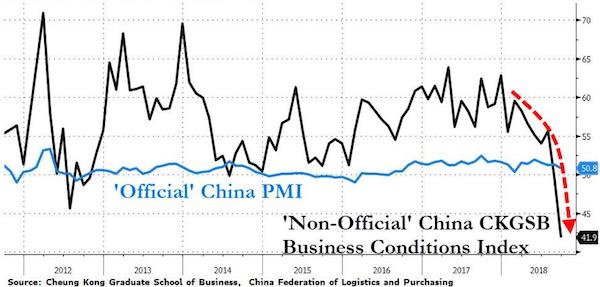

• China’s (Non-Government) Business Survey Collapses As Trade War Strikes (ZH)

As China returns from its Golden Week vacation, it is not just its currency and stock market that is collapsing… As Bloomberg reports, an indicator produced by a Beijing-based business school in the style of the closely-watched purchasing managers index plunged last month, adding to concerns about the slowing economy and raising the question of whether business conditions may be worse than official statistics show. The index is based on a survey of CKGSB students and graduates who are executives at companies operating in China. The respondents represent around 300 privately-owned small and mid-sized enterprises across several sectors of the economy.

“Most surveyed companies are now experiencing unprecedented difficulties and have become increasingly pessimistic about business prospects for the next six months,” Li Wei, the economics professor at CKGSB who oversees the survey, said in a commentary accompanying the September survey results. “For most, business has never been worse.”

Next up: military presence?

• Chinese Firms Now Hold Stakes In Over A Dozen European Ports (NPR)

In the past decade, Chinese companies have acquired stakes in 13 ports in Europe, including in Greece, Spain and, most recently, Belgium, according to a study by the OECD. Those ports handle about 10 percent of Europe’s shipping container capacity. It is part of China’s 21st Century Maritime Silk Road, which aims to better connect the country to commercial hubs in Africa, Asia, Europe and Oceania. China is the European Union’s biggest source of imports and its second-largest export market, adding up to more than $1 billion in trade per day. And sea shipping outweighs rail or air freight. But this is about more than just moving cargo, analysts say. President Xi Jinping’s new silk road, named after the ancient trade route, has sped up China’s advance toward becoming a superpower of the seas, spreading not just commercial ships but naval power and influence to more and more areas of the world.

For instance, Chinese investments in the ports of Djibouti, Sri Lanka and Pakistan have been followed by Chinese naval deployments. While there are no public plans to turn European ports into Beijing’s military bases, Chinese warships have already paid a friendly visit to Greece’s Piraeus port. This all raises a slew of questions about issues ranging from military defense to labor conditions. “The main issue is for Europe to decide how it wants to deal with China’s influence,” says Frans-Paul van der Putten, a China expert at the Netherlands Institute of International Relations. “What degree of China’s influence is unavoidable and acceptable especially in sectors such as ports?”

[..] COSCO, with the world’s fourth-largest container shipping fleet, is leading the charge in Europe, beginning with Piraeus. In 2016, after years of investment, the company bought a majority stake in the Piraeus Port Authority in a concession agreement that runs until at least 2052. It is now in charge of container terminals, cruise ship piers and ferry quays. “A few years ago, when COSCO first became involved in Greece, the European view was it was good because Greece was in a lot of financial difficulties and at least someone wanted to invest there,” van der Putten says. “Piraeus was not a top-ranking port. People in Brussels thought it wouldn’t have a lot of significance.”

Today, about 20 million passengers go through Piraeus each year. Since COSCO’s takeover, it has become the fastest-growing port in the world, according to the industry news outlet Seatrade Maritime. COSCO’S chief executive in Piraeus, Capt. Fu Cheng Qui, says he wants to make it the largest in the Mediterranean.

“corporation liabilities from zero in 2007 to 189% of GDP in 2008..”

• UK Public Finances Are Among Weakest In The World – IMF (G.)

Britain’s public finances are among the weakest in the world following the 2008 financial crash, according to a fresh assessment of government assets and liabilities by the IMF. The Washington-based lender said a health check on the wealth of 31 nations found almost £1tn had been wiped off the wealth of the UK’s public sector – equivalent to 50% of GDP – putting it in the second weakest position, with only Portugal in a worse state. In calculations that combine measures of wealth and stress tests that mimic those applied to the banking sector, the IMF said the bailout of UK banks and the growth of Britain’s public sector pension liabilities were significant factors in the UK’s low ranking.

The tests are an effort by the IMF to show the balance of assets and liabilities in relation to a nation’s overall income to judge how well governments are prepared for economic shocks. Norway ranked as the most secure nation with a war chest built on its publicly held oil wealth, in contrast to the UK, which allowed private sector companies to extract North Sea oil reserves and spent the tax revenues during the 1980s and 1990s. The Gambia, Uganda and Kenya rank above the UK because while they have smaller assets and liabilities than Britain, they have a higher net wealth relative to GDP.

Cruder measures taking a snapshot of a country’s assets and liabilities showed Italy and Greece, which were excluded from the broader tests, fared worse than the UK. Barbados was another country with a lower rating. But most other countries were in a better position relative to their national income, the IMF said. [..] The report said: “The United Kingdom balance sheet expanded massively during the crisis. Most of the expansion in the balance sheet was the result of large-scale financial sector rescue operations that resulted in reclassification of the rescued private banks into the public sector. [This] increased (non–central bank) public financial corporation liabilities from zero in 2007 to 189% of GDP in 2008, with similar [falls] in financial assets.”

Austerity still rules. Sovereignty, not so much.

• IMF Warns Italy Not To Breach EU Spending Rules In Next Budget (G.)

The International Monetary Fund has thrown its weight behind Brussels in its battle with Italy’s coalition government over plans to increase the indebted country’s borrowing in its next budget. The Washington-based lender of last resort, which is holding its annual conference in Bali this week, warned Rome to abide by the EU’s financial rulebook or risk a rebellion by investors that could trigger a debt default. Italy’s populist coalition is targeting a deficit of 2.4% of GDP next year, tripling the previous government’s target, as it pledges more spending despite a huge debt pile, which at about 130% of GDP is the biggest in the eurozone behind Greece.

Brussels has rejected the idea of Italy running a larger budget deficit – the gap between income from taxes and government spending – than previously planned over the next three years. Rome is due to submit its draft budget by 15 October to the EU commission, the bloc’s executive arm, which will check whether it is in line with EU rules. The government has said it wants to use a spending boost to kickstart investment and consumer spending to fuel growth. The IMF’s chief economist, Maurice Obstfeld, said it was important to maintain the confidence of international money markets, especially when the risks of an escalating trade war and a damaging no-deal Brexit were rising.

The IMF’s intervention could prove significant while both sides seek allies in the budget battle as it is considered an important ally by governments as they seek to persuade electorates that debt-fuelled spending could lead to a collapse in confidence and rising borrowing costs. Obstfeld said EU rules that prevented governments adding to already sky-high levels of debt to GDP should be maintained in the current unstable economic climate.

Only £70 trillion in derivatives?!

• Bank of England Warns EU Over Brexit Risk To Financial Stability (G.)

The Bank of England has issued its strongest warning yet to the EU that its lack of adequate planning for Brexit has created growing risks for almost £70tn of complex financial contracts. Threadneedle Street said the bloc had made only limited progress to protect the financial system and time was running out, with little more than six months before the UK is due to leave the EU. Stressing the urgency of the situation in a statement from its financial policy committee, the Bank said: “In the limited time remaining, it is not possible for companies on their own to mitigate fully the risks of disruption to cross-border financial services.”

Without action, the contracts governing the financial derivatives – currently sold across the UK-EU border by banks to companies looking to protect themselves from movements in interest rates and changes in global markets – could be rendered illegal the moment Britain leaves, it warned. EU firms have about £69tn of outstanding derivatives contracts that are handled through a process known as “clearing” in the UK, while as much as £41tn mature after Britain exits the EU in March 2019. In a corner of the finance industry worth more than three times the overall value of the EU economy, the process of clearing derivatives involves banks organising their trades through a central third-party organisation – known as a clearing house – which takes on the risk of either party defaulting.

Clearing has become increasingly important since the financial crisis as the EU introduced rules forcing banks to trade greater volumes via clearing houses, with the idea of improving transparency and to avoid the confusion of banks going bust with complex webs of contracts with multiple parties – as was the case in 2008. EU-authorised clearing houses must handle EU banks’ trades, but UK organisations such as the London Stock Exchange’s LCH handle the bulk of business and could fall outside the rules in the event of a hard Brexit. As much as 90% of EU firms’ interest rate swaps – one of the most common types of financial derivative – are cleared in the UK.

Don’t think I’ve ever understood how this got so out of hand.

• One Good Thing About Brexit: Leaving Disgraceful EU Farming System (Monbiot)

I’m a remainer, but there’s one result of Brexit I can’t wait to see: leaving the EU’s common agricultural policy. This is the farm subsidy system that spends €50bn (£44bn) a year on achieving none of its objectives. It is among the most powerful drivers of environmental destruction in the northern hemisphere. Because payments are made only for land that’s in “agricultural condition”, the system creates a perverse incentive to clear wildlife habitats, even in places unsuitable for farming, to produce the empty ground that qualifies for public money. These payments have led to the destruction of hundreds of thousands of hectares of magnificent wild places across Europe.

It is also arguably the most regressive transfer of public money in the modern world. Farmers are paid by the hectare for owning or using land; so the more you have, the more you get. While in the UK benefits for poor people are capped at £20,000 (outside London), these benefits for the rich are uncapped. Some landowners receive £1m or more. You don’t even have to live in the EU to take this money: you just have to own land here. Among the benefit tourists sucking up public funds in the age of austerity are Russian oligarchs, Saudi princes and Texas oil barons.

It is hard to discern any just principle behind an occupational qualification for receiving public money. Some farmers are poor, but seldom as poor as rural people who have no land, no buildings and no jobs. Why should one profession be supported when others aren’t? Yet even farmers have been hurt by these payments. European subsidies have helped turn farmland into a speculative honeypot, making it highly attractive to City financiers. The price of land has more than doubled since payments by the hectare were introduced, pushing it out of reach of most farmers. By reinforcing economies of scale, these subsidies have driven out small farmers and accelerated the consolidation of land ownership.

Craziest headline in ages.

• UK Fracking Rules On Earthquakes Could Be Relaxed (G.)

Rules designed to halt fracking operations if they trigger minor earthquakes could be relaxed as the shale industry begins to expand, the UK energy minister, Claire Perry, has said. A series of small tremors seven years ago prompted tough regulations that mean even very low levels of seismic activity now require companies to suspend fracking. The shale gas firm Cuadrilla plans to start fracking near Blackpool this week if it can see off a last-minute legal challenge on Thursday. If seismic sensors detect anything above 0.5 magnitude on the Richter scale – far below what people can feel at the surface – the company would have to stop and review its operations.

But Perry has told a fellow Conservative MP that the monitoring system was “set at an explicitly cautious level … as we gain experience in applying these measures, the trigger levels can be adjusted upwards without compromising the effectiveness of the controls”. The comments were made in a letter to Kevin Hollinrake, the MP for Thirsk and Malton, whose constituency has several prospective fracking sites. The letter was obtained by Greenpeace’s investigative unit, Unearthed. Hollinrake, who is pro-fracking if it can be done safely, told the Guardian: “We’d need to be very careful about any revision to the regulations put in place. I’d want to understand why we were doing that and take plenty of evidence. We certainly wouldn’t want to see those rules being relaxed now.”

Or close down your business?

• Shell CEO: Mass Reforestation Needed To Limit Temperature Rises To 1.5C (G.)

The boss of Shell has said a huge tree-planting project the size of the Amazon rainforest would be needed to meet a tougher global warming target, as he argued more renewable energy alone would not be enough. Ben van Beurden said it would be a major challenge to limit temperature rises to 1.5C (equivalent to a rise of 2.7F), which a landmark report from the UN’s climate science panel has said will be necessary to avoid dangerous warming. “You can get to 1.5C, but not by just by pulling the same levers a little bit harder, because they are being pulled roughly as fast and and as hard as we are currently imagining. What we think can be done is massive reforestation. Think of another Brazil in terms of rainforest: you can get to 1.5C,” he told an oil and gas industry audience in London.

“It’s not what some people sometimes think: we’ll just do a little bit more solar, a bit more wind and we’ll get there,” he added. Reforestation is seen as essential in the scenarios outlined this week by the UN’s intergovernmental panel on climate change, if the world is to restrict warming to 1.5C. But Van Beurden stressed that meeting the challenge would be an uphill battle, because while it was “technically about doable”, it would not be commercially viable without changes to government policies and regulation. “Already to get to less than 2C will be [a] quite unimaginable, unprecedented scale of collaboration. Getting to 1.5C is a major challenge on top of it,” he said.

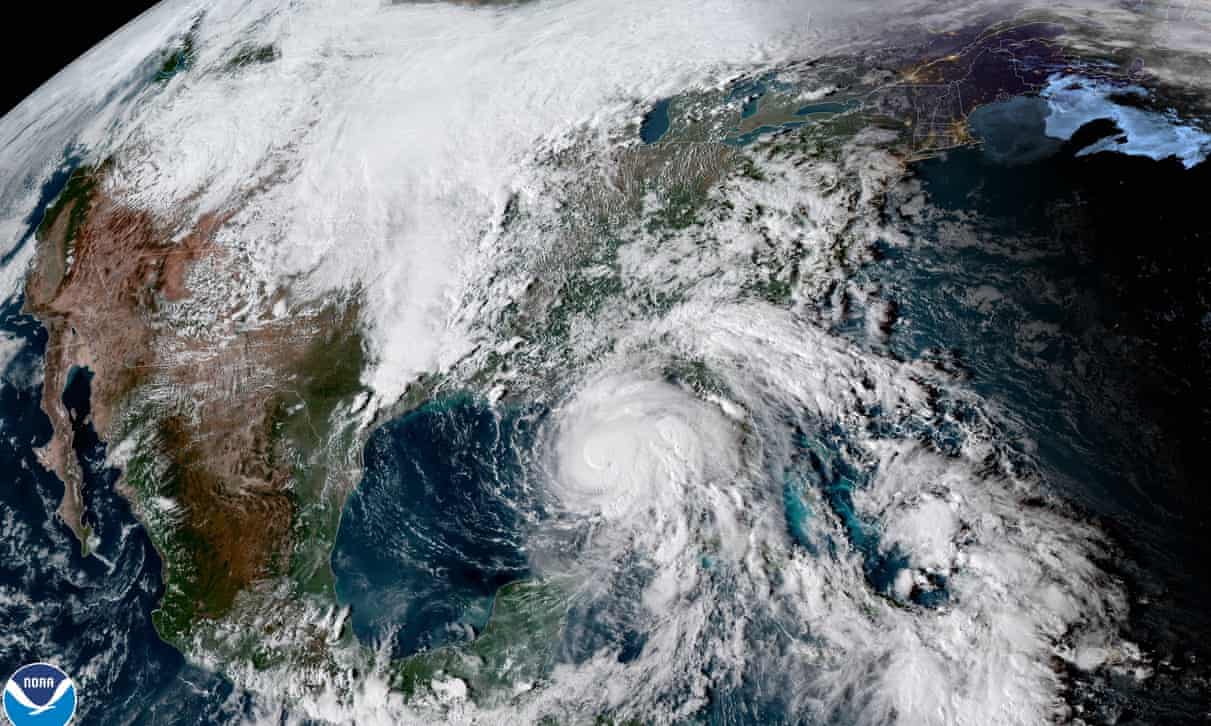

Florida Panhandle has never seen a Cat 4 storm make landfall since records began 167 years ago.

• Florida Panhandle Bracing for Category 4 Hit from Michael (WU)

Just hours away from an expected Wednesday afternoon landfall, Hurricane Michael became ever stronger and more organized on Tuesday night over the eastern Gulf of Mexico. Michael’s high winds, torrential rain, and very large storm surge were pushing briskly toward the Florida Panhandle and the Big Bend region just to the east, the areas in line to experience the worst impacts. Update (2 am EDT Wednesday): Michael has been upgraded to Category 4 strength as of 2 am EDT, with top sustained winds of 130 mph. Some additional strengthening is possible before landfall.

Satellite images of Michael’s evolution on Tuesday night were, in a word, jaw-dropping. A massive blister of thunderstorms (convection) erupted and wrapped around the storm’s eye, which has taken taking a surprisingly long time to solidify. A layer of dry air several miles above the surface being pulled into Michael from the west may have been one of the factors that kept Michael from sustaining a classic, fully closed eyewall (see embedded tweet below). A closed eyewall is normally a prerequisite for a hurricane to intensify robustly, but somehow Michael managed to reach Category 3 status without one.

[..] If Michael reaches the coast with top winds of at least 130 mph (minimal Category 4 strength), it will be the strongest hurricane landfall ever recorded in the Florida Panhandle, as well as along most of Florida’s Gulf Coast—all the way from the Alabama border to Punta Gorda—in records going back to 1851.

See the painting at the top of this Debt Rattle.

• The Emergency Brake (Sperber)

Because we seem to be living through a stretch of history in which history is threatening to extinguish history itself, an examination of the 20th century philosopher and critic Walter Benjamin’s concept of the angel of history, and his interrelated notion of the emergency brake, may point to a way. Evoked by the Swiss artist Paul Klee’s watercolor Angelus Novus, Benjamin introduced the figure of the angel of history in his final essay, “Theses on the Philosophy of History.”Appearing with its face “turned toward the past,” hurtling backward through space by “a storm blowing from paradise,” the angel is unable to close its wings and determine its own movement. Overpowered by this storm, it can do little more than watch impotently as catastrophic wreckage (the manifestation of history and progress) piles up at its feet.

That is, caught in the storm blowing from paradise, the storm of history is preventing the angel from doing what it desires to do. But just what does it desire? As Benjamin writes: the angel “would like to stay, awaken the dead, and make whole what is smashed.” Although prevented from doing so by the storm of progress that determines (and undermines) its flight, the angel’s utopian desire is to repair the world – not in order to restore paradise (a longstanding tendency of utopian messianism), but, rather, to restore life and autonomy to a social world destroyed by the coercive and destructive forces of history and ideology. While the angel desires this, however, the ecocidal storm (the bulldozer of progress, as the Supreme Court Justice William O. Douglas phrased the world-ravaging forces of history and technology) is far too powerful.

This is where the messianic notion of the emergency brake enters the picture – rupturing history and releasing its utopian essence. As Benjamin famously put it in his essay’s paralipomena; “Marx said that revolutions are the locomotive of world history. But perhaps things are very different. It may be that revolutions are the act by which the human race traveling in the train applies the emergency brake.” That is, the emergency brake would stop the “bulldozer of progress,” would cut off the ecocidal storm of history, and thereby allow the revolutionary potential of the angel (and humanity) to realize itself.