Henri Matisse Woman with a hat 1905

There are Japanese ships in the Persian Gulf literally every moment of every day. But Iran only decides to attack them when the first Japanese PM ever(?!) visits the country. Bolton is dementing.

• US Consults Allies On How To Protect Shipping In Wake Of Tanker Attacks (R.)

The United States is discussing with its allies a variety of options on how to protect international shipping in the Gulf of Oman in the wake of tanker attacks that Washington has blamed on Iran, senior Trump administration officials said on Thursday. Two officials, speaking to a small group of reporters on condition of anonymity, said the United States wants to ensure the freedom of navigation in the Strait of Hormuz and make sure international commerce is not disrupted. Two oil tankers were attacked on Thursday and left adrift in the Gulf of Oman. “We don’t think this is over,” one official said of the possibility of more such attacks. The official said options are being reviewed.

“We’re discussing and will be discussing with our partners and allies suggestions on how we collectively can take steps to ensure, one, that we maintain freedom of navigation and international commerce is not disrupted and, second, that we protect our forces’ interests and our commercial assets and those of our partners and allies,” the official said. The official said the attacks appeared “designed to have a political outcome” and suggested it could have been an attempt to disrupt a visit to Tehran by Japanese Prime Minister Shinzo Abe. “We are going to obviously evaluate our presence in the region and the growing threat and make subsequent decisions,” the official said. “We have to look at the threat, as we always do, to our personnel and our forces but the threat to a strategic chokepoint. There’s a significant amount of trade that transits the Strait of Hormuz every day.”

Another hearing today.

• Julian Assange Is Not On Trial, British Justice Is (Wight)

The most honest man in Britain today is Julian Assange, while the most dishonest are those who are engaged in his ongoing persecution. The latest instalment in that persecution is a court hearing in London on June 14, where details of the request for his extradition to the US, it is expected, will be revealed for the first time. The formal request for the extradition of the founder of WikiLeaks was made to the UK by US authorities earlier in the week – and with British Home Secretary Sajid Javid signing the relevant papers sanctioning it, the final decision on whether Julian Assange’s extradition to the US goes ahead now rests with the courts.

[..] In revealing to the world the beast of US hegemony that resides behind the velvet curtains of democracy and human rights, Julian Assange exposed the lie upon which this American Empire (and make no mistake, it is an empire) depends. It depends on it in order to persuade its supposed beneficiaries – i.e. people living in the West – to continue to suspend disbelief as to the reality of a system they’ve been conditioned to believe is rooted in values that emanate from the human heart rather than from the heart of the machine. The end result is that in exposing this lie, Assange and WikiLeaks became a bigger threat to the ability of US hegemony to function normally than a million bayonets. As such, it became imperative that he, as the founder and face of WikiLeaks, be destroyed.

Britain’s role in this process couldn’t be any more sordid or shameful. Its legal system and judiciary has effectively been turned into a subsidiary of its US counterpart; its function not to dispense justice but to deliver a man into the arms of injustice. The fate to befall Assange proves that there’s a world of difference between believing that you live in a free society and behaving as if you do. He is the canary down the coalmine of Western democracy, signalling the warning that its foundations are rotten to the core.

“..American Hitler (i.e., Donald Trump) will “push back” (i.e., intervene) against British Hitler (i.e., Jeremy Corbyn)..”

• The Hitlerization of Jeremy Corbyn – Among Others (Hopkins)

Apparently, American Hitler and his cronies are conspiring with some secret group of “Jewish leaders” to stop British Hitler from becoming prime minister and wiping out all the Jews in Great Britain. Weird, right? But that’s not the weird part, because maybe American Hitler wants to wipe out all the Jews in Great Britain himself, rather than leaving it to British Hitler … Hitlers being notoriously jealous regarding their genocidal accomplishments. No, the weird part is that everyone knows that American Hitler does not make a move without the approval of Russian Hitler, who is also obsessed with wiping out the Jews, and with destroying the fabric of Western democracy. So why would Russian Hitler want to let American Hitler and his goons thwart the ascendancy of British Hitler, who, in addition to wanting to wipe out all the Jews, also wants to destroy democracy by fascistically refunding the NHS, renationalizing the rail system, and so on?

It doesn’t make a whole lot of sense, does it? In any event, here’s the official story. In “a recording leaked to The Washington Post,” and then flogged by the rest of the corporate media, Reichsminister des Auswärtigen, Mike Pompeo, told a group of unnamed “Jewish leaders” that American Hitler (i.e., Donald Trump) will “push back” (i.e., intervene) against British Hitler (i.e., Jeremy Corbyn) to protect the lives of Jews in Great Britain if British Hitler becomes prime minister (and is possibly already doing so now). The identities of these “Jewish leaders” have not been disclosed by the corporate media, presumably in order to protect them from being murdered by Corbyn’s Nazi hit squad.

Whoever they were, they wanted to know whether American Hitler and his fascist cabinet were “willing to work with [them] to take on actions if life becomes very difficult for Jews” after Jeremy Corbyn seizes power, declares himself Führer of Communist Britannia, and orders the immediate invasion of France. To anyone who has been closely following the corporate media’s relentless coverage of Jeremy Corbyn’s Nazi Death Cult (i.e., the UK Labour Party) and the global Anti-Semitism Pandemic, it comes as no real surprise that this group of “Jewish leaders” (whoever they are) would want to stop him from becoming prime minister. I doubt that their motives have much to do with fighting anti-Semitism, or anything else specifically “Jewish,” but … well, I’m kind of old-fashioned that way. I still believe there’s a fundamental difference between “the Jews” and the global capitalist ruling classes.

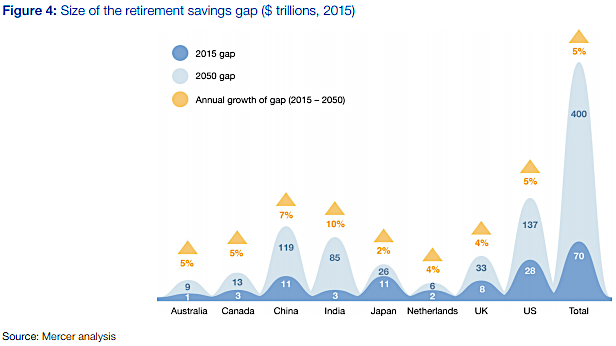

Thanks to the Fed.

• US Retirement Savings Gap Grows By $3 Trillion Each Year (MW)

Many Americans haven’t saved as much money as they need for retirement — and the gap is expected to widen dramatically in the next 30 years. The retirement savings gap — between what people have and should have — was $28 trillion in the U.S. in 2015, but by 2050, it’s expected to swell to $137 trillion, according to the World Economic Forum, a Cologny-Geneva, Switzerland-based nonprofit that researched international financial affairs. The disparity grows $3 trillion every year in the U.S.

The organization calculated this gap assuming most individuals’ retirement income sources would include a combination of government-provided pensions (such as Social Security), employer pensions in the public or private workforce and individual savings. They also analyzed the level of savings across expectations of income needs and life expectancies, assuming individuals would retire between 60 and 70 years old, for countries including China, Canada, Japan and the United Kingdom. The gap is most pronounced in the U.S., followed by China and Japan tied for $11 trillion in 2015. China is also expected to see a significantly wider discrepancy in 2050, at $119 trillion, followed by India, with an $85 trillion gap. Overall, the eight countries the WEF analyzed will see a $400 trillion disparity.

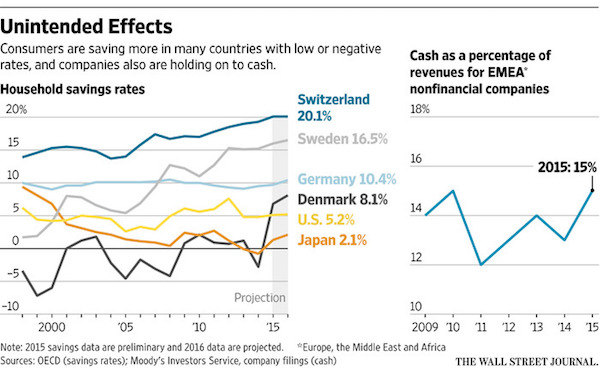

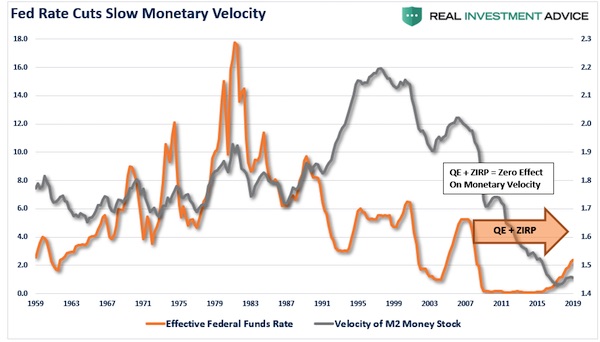

Velocity of money and inflation.

• The Fed Is Pushing On A String (Roberts)

Historically, the reason the Fed cuts rates, and interest are falling, is because the Fed has acted in response to a crisis, recession, or both. [..] Secondly, after a decade of QE and zero interest rates inflation, outside of asset prices, (as measured by CPI), remains muted at best. The reason that QE does not cause “inflationary” pressures is that it is an “asset swap” and doesn’t affect the money supply or the velocity of money. QE remains confined to the financial markets which lifts asset prices, but it does not impact the broader economy.

Unfortunately, the Fed is still misdiagnosing what ails the economy, and monetary policy is unlikely to change the outcome in the U.S., just as it failed in Japan. The reason is simple. You can’t cure a debt problem with more debt. Therefore, monetary interventions, and government spending, don’t create organic, sustainable, economic growth. Simply pulling forward future consumption through monetary policy continues to leave an ever growing void in the future that must be filled. Eventually, the void will be too great to fill.

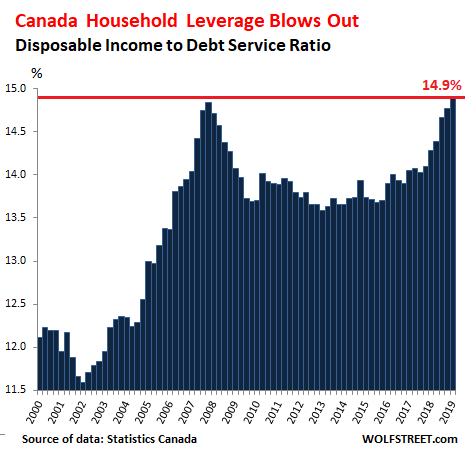

Time to start defaulting?

• The State of the Canadian Debt Slaves (WS)

Canadian households are known around the world for their uncanny ability to pile on debt. And American debt slaves, who’d gotten trampled during the Great Recession, turn out to be lackadaisical these days in comparison. The share of disposable income (total incomes from all sources minus taxes) that Canadian households spent on making principal and interest payments on their ballooning mortgage debts and non-mortgage debts reached a new record of 14.9% in the first quarter, despite still ultra-low interest rates and despite the highest disposable income ever, according to data released today by Statistics Canada:

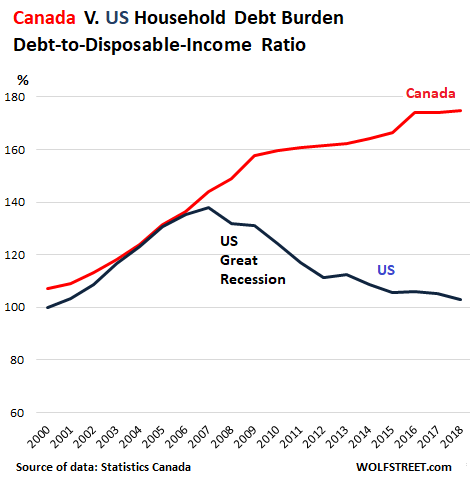

[..] So how do Canadian debt slaves stack up against American debt slaves? Statistics Canada released a report on just this topic at the end of March perhaps because authorities in Canada should get a tad nervous. [..] The annualized data it provided included the household debt-to-disposable income ratios for Canada and for the US through 2018. The ratio shows how large debt is relative to disposable income. For Canada, this ratio was 175% annualized in 2018, one of the highest in the world, and rising. For the US, it was 103%, and declining:

Canada’s household debts have continued to surge since the year 2000 except for a brief dip during the Financial Crisis. But US household debts plunged during years of deleveraging after the Financial Crisis, in part by consumers defaulting on their mortgages and credit cards. Household debts didn’t start growing again until 2013. And it took until 2017 before they surpassed the pre-Financial Crisis peak. But over the decade since the Financial Crisis, the US population has grown, and the number of working people has grown, and the national disposable income has increased, and so the ratio of household debt to disposable income has continued to drop.

“..could make Canadians around the world less safe..”

• Canada Rejects Idea Of Halting Extradition Of Top Huawei Executive To US (R.)

Canadian Foreign Minister Chrystia Freeland on Thursday dismissed a suggestion that Ottawa block the extradition of a top executive from China’s Huawei Technologies Co Ltd to the United States, saying it would set a dangerous precedent. Huawei’s Chief Financial Officer Meng Wanzhou, who was arrested on U.S. fraud charges in Vancouver last December, will challenge Washington’s extradition request at hearings that are set to begin next January. China angrily demanded Canada release Meng and detained two Canadians on spying charges. It has also blocked imports of Canadian canola seed and Prime Minister Justin Trudeau has said he fears further retaliation.

The Globe and Mail newspaper on Thursday said former Canadian Prime Minister Jean Chretien had floated the idea of the government intervening to stop the extradition case and thereby improve ties with Beijing. “When it comes to Ms Meng there has been no political interference … and that is the right way for extradition requests to proceed,” Freeland told a televised news conference in Washington. “It would be a very dangerous precedent indeed for Canada to alter its behavior when it comes to honoring an extradition treaty in response to external pressure,” she added, saying to do so could make Canadians around the world less safe.

And what about all the others?

• Elizabeth Warren To Propose Cancelling Up To $50,000 In Student Debt (MW)

Elizabeth Warren’s proposal to cancel student debt will soon be one step closer to reality — even if she doesn’t become president. The Democratic Senator of Massachusetts plans to introduce legislation in the coming weeks that mirrors her presidential campaign proposal to cancel at least a portion of the student debt held by many of the nation’s 44 million borrowers, her Senate office announced Thursday. Rep. James Clyburn, Democrat of South Carolina and the house majority whip, will introduce companion legislation in the House of Representatives. Warren’s office hasn’t yet released a draft of the legislative text, but the bill is slated to propose cancelling up to $50,000 in student debt for the bulk of student loan borrowers, her office said.

Under the proposal Warren released as part of her presidential campaign in April, borrowers with a household income of less than $100,000 would have $50,000 of their student debt cancelled and borrowers with an income between $100,000 and $250,000 would be eligible for some student debt cancellation — though not the full $50,000. Borrowers earning $250,000 or more would receive no debt cancellation. Her campaign estimated the plan would cost $640 billion, which would be paid through a tax on the ultra-wealthy. The idea of student debt cancellation has been popular in some circles for years, but Warren’s campaign proposal nudged it into the mainstream. Sen. Bernie Sanders, a Vermont independent seeking the Democratic nomination, has vowed to cancel “massive amounts of student debt,” though hasn’t offered specifics.

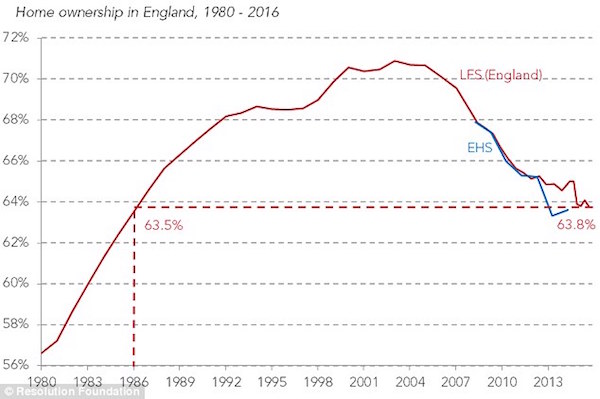

All governments blow housing bubbles.

• UK Government Blew Billions on “Help to Buy” Scheme (DQ)

Here’s how the scheme works: First-time property buyers get to put down a deposit of as little as 5% on a new-build home worth as much as £600,000 ($761,000) and receive an “equity loan” from the government. The size of the loan varies depending on where borrowers live. In London, where the price of property is an order of magnitude higher than in most other places, buyers can receive as much as 40% of the property price. Across the rest of the country the upper limit is 20%. The rest of the financing is covered by a traditional mortgage. While Help to Buy may have had a limited effect in terms of making housing affordable for first time buyers who are genuinely priced out of the market, it has proven to be effective at sustaining the UK’s all-important housing bubble by jacking up the prices of new-build houses, resulting in even less affordable housing.

Since Help to Buy was first launched in 2013, average UK house prices have increased by 35%, from £167,000 to £226,000, according to the Office for National Statistics. Through the scheme, the government has so far issued around 211,000 loans worth £11.7 billion ($14.8 billion) to home buyers. According to the NAO, this has helped increase sales of new-build properties from 61,357 a year in 2013-14 to 104,245 a year in 2017-18. That, in turn, has helped fuel a spike in profits for the UK’s biggest home builders. The nine largest builders dished out £2.3 billion in dividends in their most recent financial year, 39 times greater than the £53 million they paid out in 2012, a year before the scheme was introduced.

Greeks have had enough of ‘left’; look what it brought them.

• Varoufakis, Kotzias And The Dwindling ‘Progressive Army’ (K.)

Prime Minister Alexis Tsipras has been blindsided and thrown completely off his game plan. His narrative of a “progressive army” and a fresh rally of forces for elections “that will determine the future” is coming under constant attack. The Progressive Alliance was intended to move SYRIZA closer to the center so that it could resonate more strongly with the broader “progressive” section of voters – though what constitutes progressive and conservative in today’s world is a matter of debate – and to more fully acquire the characteristics of one of the two pillars of the two-party system, pushing center-left Movement for Change to the sidelines.

Tsipras’ plan, however, has been scuppered by two developments in the broader area of the Left, which are of significant symbolic importance and may affect the balance of power. What he hopes to achieve in the next few weeks is to convince many of the voters who chose not to vote in the European elections and who are mainly former supporters of SYRIZA to return to the fold and put their weight behind the big battle against the “socially insensitive, neoliberal” Kyriakos Mitsotakis of the opposition New Democracy party. His path in this ambitious plan, however, is littered with obstacles. The first was the surprisingly strong performance of Yanis Varoufakis’ DiEM25 party in the European elections, which shook things up.

There is now a party to the left of SYRIZA that is pro-European and has a leader with what a leftist voter might see as a convincing position. Moreover, he is neither Zoe Constantopoulou nor Panagiotis Lafazanis. He is a TV star who is in a position to boost his popularity thanks to his strong social media presence. It is also quite likely, if not certain, that he will make it into Parliament next month, and not just by scraping by with 3 percent. You can say a lot about Varoufakis, but what is certain is that he represents the thinking of a significant portion of the people who voted for SYRIZA in January 2015. He exercises charm over this portion of voters, and this is something that will be evident at the polls.

Has been true for a very long time. Still poorly written though.

• School’s Purpose is Indoctrination (Carbone)

The near sole purpose of present-day academia is indoctrination. This is a fairly bold thesis, but the evidence is in its favor. The increasingly progressive leftist agenda is sweeping through academia and conservatives are passively watching it happen. The main indoctrination stories you hear are those of radical professors on college campuses, outlandish majors created to forward social justice movements, and, on occasion, a political outburst by a high school teacher. Although these issues need addressing, by far the biggest – and the one that should scare everyone the most – is the silent indoctrination.

Indoctrination is no longer dependent upon the political beliefs of teachers. We are now past that. Course material is blatant political propaganda. Not just the course material for gender studies and similar. The core curricula of grade school through college. Sciences, economics, literature – any core course you can think of is politically influenced. The only course that may still be an exception is mathematics. Unless you account for the left-wing system of common core – which is a complete disaster. If you don’t believe this, sit through a grade school math class or open up your child’s text book. Disaster.

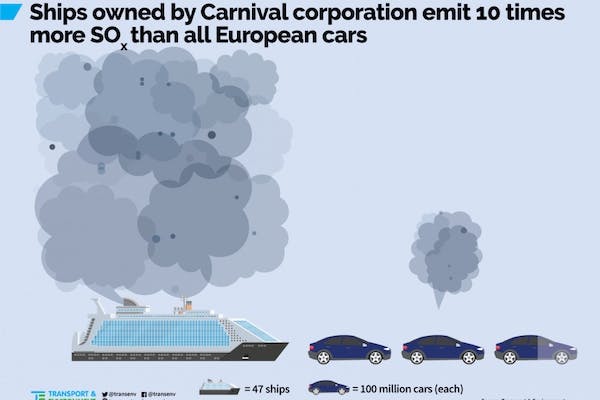

But who ever measures sulfur oxides?

• Carnival Cruise Ships Pollute 10 Times More Than All Cars in Europe (D.)

Commercial cruise lines are some of the world’s worst polluters, and Carnival is near the top of that list according to a study of European cruise line operators. Research found that Carnival alone is responsible for almost 10 times as much sulfur dioxide release as all 260 million of Europe’s cars combined. The study from Transport & Environment says that the 203 cruise ships that operated in European waters in 2017 emitted a combined total of 62 kilotons of sulfur oxides (SOx), which form airborne gases known to cause lung cancer and acid rain. During the same period, Europe’s 260 million known registered vehicles let out just 3.2 kilotons, the study found.

Of these 62 kilotons of SOx, more than half allegedly were the product of the 47 ships operated by Carnival Cruise Lines or its subsidiaries. Of the 20 worst offenders, seven are Carnival properties, which together made up half of the industry’s SOx emissions in Europe. Carnival denied any wrongdoing when asked for comment by Fast Company, pointed the finger at the rest of the maritime transportation industry, and insinuated that the study’s methodology was unscientific. [..] This statement arrived days after Carnival agreed to a $20 million fine and undergo increased scrutiny of its plastic and sewage disposal practices, which included dumping both directly into the ocean in large quantities. Carnival allegedly tried to hide these activities from regulators by falsifying records or pressuring the United States Coast Guard to relax the terms of its environmental compliance agreement.