Odilon Redon Breton harbor 1879

MAGA kids

Putin dollar

Putin: Global foreign currency reserves will move away from the dollar and euro, which have become unreliable. pic.twitter.com/zL1LZbmyMA

— Putin Direct (@PutinDirect) September 3, 2022

Biden day after

Doocy: "Do you consider all Trump supporters to be a threat to the country?"

Biden: "I don't consider any Trump supporter a threat to the country." pic.twitter.com/QB7f3XVG7z

— Washington Free Beacon (@FreeBeacon) September 2, 2022

Rallies

Donald Trump and Joe Biden Both held rallies in Wilkes-Barre Pennsylvania this week.

Here is what they looked like back to back.

Incredible. pic.twitter.com/Xe7cWQzrQO

— Benny Johnson (@bennyjohnson) September 4, 2022

The man who does not read has no advantage over the man who cannot read.

– Mark Twain

Ha ha ha! That’s one big gaping barn door he’s opening here:

“It should not be a Western measure against Russia, it should be a global measure against war..”

• France Says Imposing Price Cap On Russian Oil Will Be Difficult (CNBC)

French Finance Minister Bruno Le Maire said on Saturday that efforts by G-7 nations to introduce a price cap on Russian oil would require commitment from the wider international community to be successful. The G-7 economic powers announced Friday that they had agreed on a plan to impose a set price on Russian oil. The initiative is the latest attempt to apply economic pressure on Moscow over its invasion of Ukraine. But aside from cutting Russia’s oil revenues — a key source of funding for President Vladimir Putin’s war chest — Le Maire said the policy should be implemented as a “global measure against war.” “You need an outreach because we don’t want this measure to be only a Western measure,” Le Maire told CNBC’s Steve Sedgwick at the Ambrosetti Forum in Italy.

“It should not be a Western measure against Russia, it should be a global measure against war,” he added. The G-7 — which consists of the U.S., Canada, France, Germany, the U.K., Italy and Japan — is yet to finalize how the price cap will be implemented, a process that Le Maire acknowledged will be “quite difficult.” However, it is expected to be ready before early December when EU sanctions on seaborne imports of Russian crude kick in. “We know that we need the unity from all the 27 member states if you want to get the green light for introducing that cap,” he said, referring to the EU bloc of nations, a non-enumerated member of the G-7. More than that, however, Le Maire said the policy would require participation by other major global economies.

It follows comments from Kadri Simson, the EU’s energy chief, who urged involvement from China and India, both of which have increased their purchases of Russian oil this year, benefiting from discounted rates. “If we want to be efficient in these sanctions, we need to reduce the revenues that Russia is gaining from oil and gas selling,” Le Maire said.

First step. “The protesters demanded the Czech Republic to take a neutral military stance, as well as to secure direct contracts with gas suppliers, including Russia.”

“They require direct gas supplies from Russia and food and energy guarantees for the Czech Republic. They hold the EU solely responsible for the European economic disaster and the rise in energy bills.”

• Mass Anti-Government Protest Hits Prague (RT)

Tens of thousands hit central Prague on Saturday, taking part in a protest dubbed ‘Czech Republic First.’ The protesters urged the government to resign over soaring energy prices, inflation and the international policies they believe have brought the country to that state. According to police estimates, some 70,000 took part in the rally, with the organizers putting the mark even higher at 100,000. The event brought together people of polar political views, with the Communist party and right-wing Freedom and Direct Democracy Party alike taking part in the protest. “The aim of our demonstration is to demand change, mainly in solving the issue of energy prices, especially electricity and gas, which will destroy our economy this autumn,” one of the event’s co-organizers, social democrat Jiri Havel, told local media.

In Prague in 100,000 people for freedom. They require direct gas supplies from Russia and food and energy guarantees for the Czech Republic. They hold the EU solely responsible for the European economic disaster and the rise in energy bills. pic.twitter.com/3LlflMsJBZ

— RadioGenova (@RadioGenova) September 3, 2022

The protesters demanded the Czech Republic to take a neutral military stance, as well as to secure direct contracts with gas suppliers, including Russia. They have also condemned the government for supporting the EU’s sanctions against Moscow, adopted in multiple waves in wake of the ongoing conflict between Russia and Ukraine. “The best for the Ukrainians and two sweaters for us,” one of the banners displayed at the event read, referring to the rising heating costs and potential energy cuts in winter. The protest came a day after the government survived a no-confidence vote over the same issues, with the opposition blaming it for inaction in wake of the soaring energy prices and inflation.

Czech Prime Minister Petr Fiala, leading the ruling five-party, center-right coalition, was quick to accuse the protesters of acting against the country’s best interests, implying the Kremlin might have had a hand in staging the protest. “The protest on Wenceslas Square was called by forces that are pro-Russian, are close to extreme positions and are against the interests of the Czech Republic,” he told CTK broadcaster. “It is clear that Russian propaganda and disinformation campaigns are present on our territory and some people simply listen to them.”

70,000 people took to the streets of Prague in a mass protest against the EU and NATO. They demanded neutrality in the war and action on energy prices. This is the future for all governments that act against the interests of their people. pic.twitter.com/HbsRTIjL3t

— Paweł Wargan (@pawelwargan) September 3, 2022

The protests won’t be long now.

• One In Six Italians Faces Energy Poverty (RT)

One in six Italians, or up to nine million people, could sink into energy poverty due to soaring bills across the EU, Italy’s ANSA news agency reported on Saturday, citing the Italian General Confederation of Crafts. Households are considered to be in energy poverty if they cannot afford to regularly heat their homes in winter or use air conditioning in summer, and are forced to stop using high-energy household appliances, or severely limit their use. Southern regions of the country are reportedly the worst-hit. In Campania, between 519,000 and 779,000 households are using electricity or gas on an irregular basis. In Sicily the figure is between 481,000 and 722,000, and in Calabria there are 287,000 such households.

Earlier this week, local media reported that Italy’s Ecological Transition Minister Roberto Cingolani planned to ask the entire population to turn the heating down, starting from October. Italy has already introduced some limits on the use of central heating in public buildings and apartment blocks, and these are expected to be tightened under the new measures. On Friday, Italy’s Serie A football league announced plans to put a four-hour limit on the use of floodlights in stadiums on match days, as part of energy-saving measures. The new rule is expected to cut floodlight electricity consumption by about 25%.

Evgeny Norin is a Russian historian focused on conflicts and international politics.

“The US diplomat offered Serbs a brighter future in exchange for giving up their historic lands.”

• The West Wants To Disarm The ‘Powder Keg’ Of Europe, Risks Igniting It (Norin)

Just a day before the agreement was struck between Serbia and Kosovo, US Deputy Assistant Secretary of State for European and Eurasian Affairs Gabriel Escobar made an infuriating statement, “It’s time to forget the narrative ‘Kosovo is Serbia’ and move to the one that says ‘Kosovo and Serbia are actually Europe.’” The US diplomat offered Serbs a brighter future in exchange for giving up their historic lands. His words, however, sparked protest among the Serbian public and politicians. “The line between terrorists and freedom fighters is very thin for them. This is US policy. What can you expect from Mr. Escobar? Why do we keep pretending we don’t know what it is about?” said an outraged Serbian president, Alexandar Vucic, in an address to the nation.

Escobar’s rhetoric didn’t go unnoticed in Russia either. Russian Foreign Ministry spokeswoman Maria Zakharova reminded her American colleague that “UN Security Council Resolution 1244 <…> is still the legal framework for the Kosovo settlement, clearly reaffirming the territorial integrity of Serbia.” There are two sides to this story, but history definitely favors the Serbian and Russian perspectives. Kosovo is located in the south-west of Serbia, near the Albanian border. In the 12th century, it became part of the nascent Serbian state, gaining prominence during the Middle Ages. The head of the Serbian Orthodox Church resided in Kosovo’s Peja. Kosovo also played an important role in the building of the Serbian nation. The Battle of Kosovo, when the Turkish army fought the Serbs and won, became one of the bloodiest battles in Serbia’s history and a symbol of heroic defeat. A large portion of Serbian poetry is dedicated to those events.

Siemens denies.

• Gazprom Discloses Major Challenge For Nord Stream (RT)

Germany’s Siemens Energy is ready to correct a turbine fault in the Nord Stream 1 natural gas pipeline, but there is currently nowhere to service the failed equipment, Russian energy major Gazprom said on Saturday. “Siemens is taking part in the repair works under the terms of the current contract [with Gazprom], has detected faults and signed an act on diagnosing of oil leaks, and is ready to fix them,” the Russian company said via its Telegram channel. “There is just no place to carry out the repair works,” Gazprom added, providing no further details. Earlier this week, the company [said] an engine oil leak was found in the turbine during a joint inspection with manufacturer Siemens Energy at the Portovaya compressor station near St.Petersburg. Natural gas supplies via Nord Stream, a major gas route from Russia to Europe, have been terminated for an indefinite period due to the leakage. The pipeline had been due to restart early on Saturday after a three-day maintenance break.

Add this to the war tab. All EU countries must follow.

• Sweden, Austria Bail Out Energy Companies, Trigger Europe’s Minsky Moment (ZH)

Last weekend, Credit Suisse repo guru Zoltan published what may have been the most insightful snippet of the entire European energy crisis (to date) when he extended the infamous “Minsky Moment” framework to Europe, and specifically Germany, which he said “can’t cover its payments without Russian gas and the government is asking citizens to conserve energy to leave more for industry.” He then elaborated that “Minsky moments are triggered by excessive financial leverage, and in the context of supply chains, leverage means excessive operating leverage: in Germany, $2 trillion of value added depends on $20 billion of gas from Russia… …that’s 100-times leverage – much more than Lehman’s.”

But while Germany still pretends it can somehow avoid a devastating crisis this winter besides bailing out Uniper, one of the country’s biggest utilities (after all, admission would make Trump’s 2018 warning accurate and prescient, and everyone knows that according to Western intellectual snobs Trump can’t possibly ever be correct), other European nations are succumbing to what Zoltan dubbed a “supply-chain Minsky moment.” On Wednesday it was Austria, which announced it would bail out the country’s main energy supplier with a two-billion-euro ($2 billion) loan, the AFP reported. Chancellor Karl Nehammer said the loan to Wien Energie was an “extraordinary rescue measure” to ensure its two million customers – mainly Vienna households – continue to receive electricity. It will run until next April.

Wien Energie asked for a bailout this weekend after suffering financial trouble amid soaring energy prices and speculation the company mismanaged their funds. Nehammer said Wien Energie, which is owned by Vienna, would have to answer questions as to how they got into trouble. “The goal was to help people quickly… It has now been agreed that all of these questions, which are rightly raised, must be answered promptly by Vienna (and) the energy supplier,” he told reporters. The company – almost entirely dependent on Russian gas – said earlier this week that it had been hit by the “price explosion” which it has not yet passed on to customers, assuring it remained solvent. As part of its rescue, the company is expected to pass through soaring costs, which means a historic price shock is coming to Austria next… and soon Sweden.

Following in Austria’s footsteps, on Saturday morning Sweden announced it will give emergency liquidity support to electricity producers after the government said it feared Russia’s decision to halt gas deliveries to Europe could place its financial system under severe strain. Prime minister Magdalena Andersson said the government would offer hundreds of billions of kroner in support to electricity producers, the FT reported. The PM warned that, left unchecked, rising collateral demands for electricity producers could ripple through the main Nasdaq Clearing market in Stockholm and, in the worst case, spark a financial crisis…. just as Zoltan warned almost half a year ago. Her remarks came after Russia said on Friday evening that it would no longer supply gas via the Nordstream 1 pipeline. That announcement came after energy markets had closed for the weekend. s

Visas for UN diplomats.

1947: “visas shall be granted without charge and as promptly as possible… irrespective of the relations existing between the governments of the persons referred to… and the government of the US.”

• Russia Wants UN To Pressure US On Visas (RT)

Russia’s permanent representative at the United Nations, Vassily Nebenzia, has asked the organization to persuade the US to grant visas for members of Moscow’s delegation to the UN General Assembly. They are heading to New York to attend the high-level general debate that will be held between September 20 and 26. The request was made in a letter that Nebenzia forwarded to UN Secretary-General Antonio Guterres on Friday. The document has been seen by both Russian and the Western media. In his message, the envoy pointed out that, with less than three weeks remaining before the General Assembly, not a single member of Russia’s delegation has received entry visas from the US.

The Russian side, headed by Foreign Minister Sergey Lavrov, had submitted the relevant applications to attend the event to the American embassy in Moscow, the diplomat reportedly added. “This is even more alarming since, for the last several months, the authorities of the US have been constantly refusing to grant entry visas to a number of Russian delegates assigned to take part in the official United Nations events,” the letter read, as quoted by the media. Earlier this week, Nebenzia pointed out that Russian Interior Minister Vladimir Kolokoltsev and his delegation could not attend a meeting of UN police chiefs because the US refused to grant them visas.

The Russian envoy cited the 1947 agreement between the UN and the US, which states that “visas shall be granted without charge and as promptly as possible… irrespective of the relations existing between the governments of the persons referred to… and the government of the US.” The already strained relations between Moscow and Washington have deteriorated even further since the launch of the Russian military operation in Ukraine. The US has slapped harsh economic sanctions on Russia while backing Kiev and providing it with billions of dollars in military aid, as well as with intelligence. Nebenzia urged Guterres “to once again emphasize to the authorities of the US that they must promptly issue requested visas for all Russian delegates and accompanying persons,”including the Russian journalists covering Lavrov’s trip to the General Assembly.

They even searched Barron’s bedroom.

• Bill Barr Slams Trump’s Special Master Request As ‘Red Herring’ (Fox)

The legal fight between former President Donald Trump and the Department of Justice escalated Friday morning when the DOJ released a detailed inventory of the documents seized in last month’s Mar-a-Lago raid. The inventory list comes following an order from Florida Federal Judge Aileen M. Cannon, who is deciding whether to appoint a “special master” to the case. On “America Reports” on Friday, former Attorney General Bill Barr criticized Trump’s push for a “special master” as a distraction from the details of the case and argued it is not likely to be granted. “I think the whole idea of a special master is a bit of a red herring,” Barr told hosts Sandra Smith and John Roberts. “I think it’s a waste of time.”

Since the raid on Trump’s Mar-a-Lago home, the former president has slammed the DOJ for what he argues was a politically motivated witch hunt. Trump recently called for a special master to hold an independent review of the documents. According to details revealed in the warrant, affidavit and the inventory list, dozens of the documents seized from Trump’s property were classified materials. A portion of the items taken were not classified, with several entries labeled “Article of Clothing/Gift Item.” Trump has claimed the documents at his Florida home were documents he had “declassified” prior to leaving office and were protected under executive privilege.

“With Hillary Clinton selling “But Her Emails” hats at $30 a pop, Merrick Garland will have to explain the prospect of one politician going to jail while the other goes retail.”

• Prosecuting Trump In The Shadow Of Hillary’s Emails (Turley)

A criminal charge of obstruction against Trump would offer certain political benefits for Garland. As previously discussed, the government has routinely elected not to prosecute high-ranking officials for improperly removing classified material or has sought mere misdemeanor charges in the most egregious cases. Prosecuting Trump for a misdemeanor for possessing or removing classified documents would seem gratuitous, while prosecuting him for a felony would raise questions of biased or selective prosecution. After all, in 2016, Hillary Clinton had not just 113 documents containing classified material but some documents “classified at the Top Secret/Special Access Program level” on her private email servers. (In Trump’s case, the government allegedly found roughly 100 documents in the Mar-a-Lago raid in addition to roughly 150 handled over by the Trump team under an earlier subpoena.)

Clinton’s documents were even more vulnerable to being compromised via her unclassified email account and, according to the FBI, “hostile actors gained access” to some of the information. Yet she was never subjected to a raid, let alone a charge. Yet, while less glaring as a contradiction than the charges on the possession or handling of classified information, an obstruction charge would allow up to a 20-year sentence and could be brought with misdemeanor charges on the mishandling or retention of classified information. Thus, an obstruction charge against Trump would be prosecuted in the shadow of Hillary Clinton’s case. In addition to the transfer of top-secret and other classified documents to her private server, Clinton and her staff did not fully cooperate with investigators.

During the investigations of her conduct, some of us marveled at the temerity of the Clinton staff in refusing to turn over her laptop and other evidence to State Department and DOJ investigators. The FBI had to cut deals with her aides to secure their cooperation. Later, more classified material was found on the laptop of former congressman Anthony Weiner (D-N.Y.), who was married to top Clinton aide Huma Abedin — 49,000 emails potentially relevant to the Clinton investigation. After Congress sought these emails, Clinton’s staff unilaterally destroyed thousands of emails with BleachBit. Clinton was aware that Congress and the State Department were seeking the emails in 2014. Her lawyers turned over about 30,000 work-related emails to the State Department and deleted 33,000 others while insisting they unilaterally deemed them “personal.”

Democracy is something else.

• Biden Admin Held Weekly Censorship Meetings With Social Media Giants (PM)

Federal officials in the Biden administration secretly conspired and communicated with social media companies to censor and suppress Americans’ private speech. This is revealed in a new lawsuit brought in a joint effort by The New Civil Liberties Alliance, the Attorney General of Missouri, and the Attorney General of Louisiana against the President of the United States. The suit is brought under the first amendment right to freedom of speech. The lawsuit seeks to identify among other things “all meetings with any Social-Media Platform relating to Content Modulation and/or Misinformation.” The discovery shows that there was “A recurring meeting usually entitled USG – Industry meeting, which has generally had a monthly cadence, and is between government agencies and private industry.

Government participants have included CISA’s Election Security and Resilience team, DHS’s Office of Intelligence and Analysis, the FBI’s foreign influence task force, the Justice Department’s national security division, and the Office of the Director of National Intelligence. Industry participants have included Google, Facebook, Twitter, Reddit, Microsoft, Verizon Media, Pinterest, LinkedIn and the Wikimedia Foundation. The topics discussed include, but are not limited to: information sharing around elections risk, briefs from industry, threat updates, and highlights and upcoming watch outs.” Communications across 11 federal agencies reveal that the federal government, under the Biden administration, “has exerted tremendous pressure on social-media companies—pressure to which companies have repeatedly bowed,” the New Civil Liberties Alliance details in a new release.

The social media companies that were part of this Partner Support Portal include Twitter, Facebook, Instagram, YouTube, and LinkedIn. The CDC invited “all tech platforms” in to their meeting to discuss how to suppress free speech about Covid online. Those agencies involved include the White House, HHS, DHS, CISA, the CDC, NIAID, the Office of the Surgeon General, the Census Bureau, the FDA, the FBI, the State Department, the Treasury Department, and the U.S. Election Assistance Commission. The NCLA notes further that, during the discovery process of this lawsuit, “the government has been uncooperative and has resisted complying with the discovery order every step of the way—especially with regard to Anthony Fauci’s communications.”

Eugyppius has read The Great Reset, so you don’t have to.

• The Terrifying Vacuity of Klaus Schwab (Eugyp)

Like many bad books, The Great Reset lapses into occasional inadvertent autobiography. In the final pages especially, where Klaus Schwab writes of his hopes for a “Personal Reset” through state repression, we catch a glimpse of the man during the first-wave lockdown at his house in Cologny. At first he enjoyed the break with routine and the opportunity to commune with nature, but before long he began to feel a nagging unease. He’d spent most of his years prior to 2020 flogging “stakeholder capitalism”, his umbrella term for various schemes to disarm criticism of the globalist corporate borg and co-opt leftist opposition.

Schwab succeeded in parlaying his simplistic ideas into an international conference circuit, known today as the World Economic Forum, where he could hobnob with corporate and political celebrities and burnish his Bond-villain reputation among political dissidents. But the pandemic had thrown Schwab off balance. For once his reprocessed nostrums about environmental, social and corporate governance issues were no longer in demand; virologists and epidemiologists and exponential growth curves filled the news instead. His powerful celebrity clients were suddenly listening to other people. Obscurity loomed.

Thus Schwab enlisted his sidekick research-assistant Thierry Malleret, booted up his laptop, and spent a few months decanting the cloud of buzzwords, talking points and half-remembered powerpoint presentations plaguing his brain into a meandering and thoroughly pointless document. When he had finished, he sent the whole thing to Malleret’s wife for a proof-read, and then he ordered his own Forum Press to print off a few thousand copies. Thus did yet another lamentable exercise in self-publishing come to pass.

“..forced preference falsification..”

• Fauci’s Red Guards (Michael P. Senger)

One aspect of dictatorships that citizens of democratic nations often find puzzling is how the population can be convinced to support such dystopian policies. How do they get people to run those concentration camps? How do they find people to take food from starving villagers? How can they get so many people to support policies that, to any outsider, are so needlessly destructive, cruel, and dumb? The answer lies in forced preference falsification. When those who speak up in principled opposition to a dictator’s policies are punished and forced into silence, those with similar opinions are forced into silence as well, or even forced to pretend they support policies in which they do not actually believe. Emboldened by this facade of unanimity, supporters of the regime’s policies, or even those who did not previously have strong opinions, become convinced that the regime’s policies are just and good – regardless of what those policies actually are—and that those critical of them are even more deserving of punishment.

One of history’s great masters of forced preference falsification was Chairman Mao Zedong. As László Ladány recalled, Mao’s decades-long campaign to remould the people of China in his own image began as soon as he took power after the Chinese Civil War. By the fall of 1951, 80 percent of all Chinese had had to take part in mass accusation meetings, or to watch organised lynchings and public executions. [..] This decades-long campaign of forced preference falsification reached its apex during the Cultural Revolution, in which Mao deputized radical youths across China, called Red Guards, to purge all vestiges of capitalism and traditional society and impose Mao Zedong Thought as China’s dominant ideology. Red Guards attacked anyone they perceived as Mao’s enemies, burned books, persecuted intellectuals, and engaged in the systematic destruction of their country’s own history, demolishing China’s relics en masse.

Through this method of forced preference falsification, any mass of people can be made to support virtually any policy, no matter how destructive or inimical to the interests of the people. Avoiding this spiral of preference falsification is therefore why freedom of speech is such a central tenet of the Enlightenment, and why it is given such primacy in the First Amendment of the US Constitution. No regime in American history has ever previously had the power to force preference falsification by systematically and clandestinely silencing those critical of its policies. Until now. As it turns out, an astonishing new release of discovery documents in Missouri v. Biden – in which NCLA Legal (New Civil Liberties Alliance) is representing plaintiffs including Jay Bhattacharya, Martin Kulldorff, and Aaron Kheriaty against the Biden administration for violations of free speech during Covid – reveal a vast federal censorship army, with more than 50 federal officials across at least 11 federal agencies having secretly coordinated with social media companies to censor private speech.

“Secretary Mayorkas of DHS commented that the federal Government’s efforts to police private speech on social media are occurring “across the federal enterprise.” It turns out that this statement is true, on a scale beyond what Plaintiffs could ever have anticipated. The limited discovery produced so far provides a tantalising snapshot into a massive, sprawling federal “Censorship Enterprise,” which includes dozens of federal officials across at least eleven federal agencies and components identified so far, who communicate with social-media platforms about misinformation, disinformation, and the suppression of private speech on social media—all with the intent and effect of pressuring social-media platforms to censor and suppress private speech that federal officials disfavour.” The scale of this federal censorship enterprise appears to be far beyond what anyone imagined, involving even senior White House officials. The government is protecting Anthony Fauci and other high level officials by refusing to reveal documents related to their involvement.

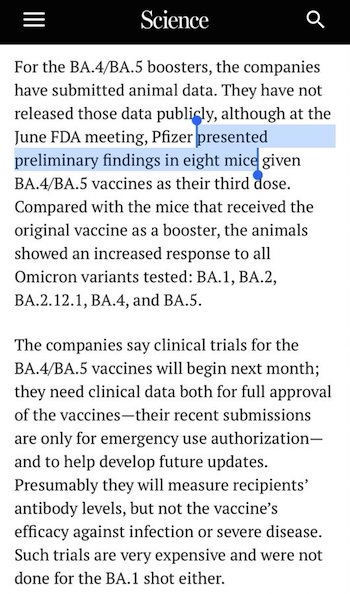

8 mice.

• 1st Peer-Reviewed Study on Pfizer, Moderna Vaccines Confirms ‘Excess Risk’ (BN)

A landmark peer-reviewed study appears to be the first of its kind to provide hard data on the “excess risk” of adverse side effects of Pfizer-BioNTech and Moderna mRNA vaccines in an independent “randomized clinical trial.” The results of the accepted scientific study confirm that the concerns that many patients had about the mRNA vaccines were well-founded. “In the Moderna trial, the excess risk of serious AESIs (15.1 per 10,000 participants) was higher than the risk reduction for COVID-19 hospitalization relative to the placebo group (6.4 per 10,000 participants),” the study found. “In the Pfizer trial, the excess risk of serious AESIs (10.1 per 10,000) was higher than the risk reduction for COVID-19 hospitalization relative to the placebo group (2.3 per 10,000 participants),” the study added.

The study was published on ScienceDirect on August 31, 2022. The authors include researchers from Stanford University, the University of Maryland, and UCLA. The study provides the following list of confirmed adverse events (or side effects) of the respective mRNA vaccines. It also provides the risk ratios versus Covid-19 (over 1 is a factor increase, under 1 is a factor decrease). The study also provided known complications for Covid-19. “Although the randomized trials offer high level evidence for evaluating causal effects, the sparsity of their data necessitates that harm-benefit analyses also consider observational studies,” the authors state. “Since their emergency authorization in December 2020, hundreds of millions of doses of Pfizer and Moderna COVID-19 vaccines have been administered and post-authorization observational data offer a complementary opportunity to study AESIs. Post-authorization observational safety studies include cohort studies (which make use of medical claims or electronic health records) and disproportionality analyses (which use spontaneous adverse event reporting systems).”

“In July 2021, the FDA reported detecting four potential adverse events of interest: pulmonary embolism, acute myocardial infarction, immune thrombocytopenia, and disseminated intravascular coagulation following Pfizer’s vaccine based on medical claims data in older Americans.” the researchers add. “Three of these four serious adverse event types would be categorized as coagulation disorders, which is the Brighton AESI category that exhibited the largest excess risk in the vaccine group in both the Pfizer and Moderna trials. FDA stated it would further investigate the findings but at the time of our writing has not issued an update.”

Joseph Fraiman announced the study results on Twitter: “Our study examining mRNA vaccine serious adverse events study is now peer-reviewed in the Journal Vaccine,” Fraiman wrote. “Serious adverse events of special interest following mRNA COVID-19 vaccination in randomized trials in adults.” Thus, the objection to Americans’ concerns that the mRNA vaccines may have adverse side effects has come to a close, despite the initial advertisements that the vaccines were “100% safe and effective,” prevented infection and transmission, and had no known serious side effects.

“We have been brainwashed to believe anything other than the New York Times, The Washington Post, CNN, or other puppets of the system, is pure hogwash. It is now the other way around.”

• Vaccine Vultures (Todd Hayen)

Vultures are birds that seek out wounded animals about to die and then swoop down on them when they are dead (or close to death) and devour them—apocryphally starting with gouging out the eyes. Vultures are typically not classed in the “warm and fuzzy” anthropomorphic grouping, although they accomplish a great service to the ecology of the planet, such as other animals thrown in the “yuck” bucket of human perception such as flies, spiders, laughing hyenas, and carrion beetles (who knows what a carrion beetle is?—they ARE pretty, so before you know what they do for a living, you might like them). So are we human vultures when we swoop down on dead or dying people we have heard about to see if they are vaxxed or not and if what they are suffering or dying from is due to the jab? Two? Three, god forbid four?

At the beginning of the vaccine madness, I was quite brazen and would unashamedly blurt out when hearing of someone’s misfortune, “were they vaccinated???!!!” I never got brazen enough to ask this to the person suffering (obviously if dead), but did to their friends, or whoever was explaining what was happening. I eventually backed off of the personal incidents I was experiencing as it did seem a bit too vulture-like, but I still would ask sheep in my company what they thought of dozens of athletes dropping in the fields, now extended out to just average Joe’s not waking up or doctors way too young to be experiencing such severe cardiac issues. Now I don’t even do that. I just listen. It seems this particular vulture just enjoys the shock of seeing no one (sheep) realizing the secret. “You’ll see,” I say to myself, in my evil vulture voice. “You’ll see.”

Now, isn’t that sick? Maybe. But what else is this experience going to drive us to if not un-empathetic lunacy. Think of Lord of the Rings’ Gollum. Isn’t that what did him in? We have been put into this untenable position of finding “joy” or at least “satisfaction” in the trauma of another. At its worse it is a form of schadenfreude, pleasure derived from another’s misfortune. But I would argue this is not really the case. I do not think what we are feeling (assuming others are fellow vaccine vultures) is “pleasure” and whatever it is that we are feeling is not due to someone else’s health misfortune. Of course the definition does include “self satisfaction from another’s failures”—maybe that is the closest schadenfreude comes to defining vaccine vultures.

[..] I have recently decided that the number one culprit for keeping sheep asleep is the media. The media has always played the role of the unbiased family member that will let you in on any corruption it saw in our leaders or other groups trying to get our attention. I think that is still true (that people rely on media for that reason) but the corruption is now in the media, at least the mainstream media. We have been brainwashed to believe anything other than the New York Times, The Washington Post, CNN, or other puppets of the system, is pure hogwash. It is now the other way around. I do believe that if any of these “gods of media” ran a story like we see day in and day out in the alternate media, many sheep heads would turn regardless what the venerated talking heads of government and power had to say.

“An observational study with the size and level of analysis as ours is hardly achieved and infeasible to be conducted as a randomised clinical trial. Conclusions are hard to be refuted. Data is data, regardless of your beliefs.”

• Ivermectin Reduces Covid Death Risk By 92% (Blaze)

A new peer-reviewed study found that regular use of ivermectin reduced the risk of dying from COVID-19 by 92%. The large study was conducted by Flávio A. Cadegiani, MD, MSc, PhD. Cadegiani is a board-certified endocrinologist with a master’s degree and doctorate degree in clinical endocrinology. The peer-reviewed study was published on Wednesday by the online medical journal Cureus. The study was conducted on a strictly controlled population of 88,012 people from the city of Itajaí in Brazil. Individuals who used ivermectin as prophylaxis or took the medication before being infected by COVID experienced significant reductions in death and hospitalization.

According to the study, those who took ivermectin regularly had a 92% reduction in their COVID death risk compared to non-users and 84% less than irregular users. “The hospitalization rate was reduced by 100% in regular users compared to both irregular users and non-users,” the study stated. The impressive reduction for regular ivermectin users was evident despite the regular users being at a higher risk for COVID deaths. The regular users were older and had a higher prevalence of type 2 diabetes and hypertension than irregular and non-users. Irregular users of ivermectin had a 37% lower mortality rate reduction than non-users. The study defined regular users as those who used more than 30 tablets of ivermectin over five months.

The dosage of ivermectin was determined by body weight, but “most of the population used between two and three tablets daily for two days, every 15 days.” “Non-use of ivermectin was associated with a 12.5-fold increase in mortality rate and a seven-fold increased risk of dying from COVID-19 compared to the regular use of ivermectin,” the study read. “This dose-response efficacy reinforces the prophylactic effects of ivermectin against COVID-19.” Cadegiani believes the study showed a “dose-response effect” – which means that increasing levels of ivermectin decreased the risk of hospitalization and death from COVID-19. Cadegiani wrote on Twitter, “An observational study with the size and level of analysis as ours is hardly achieved and infeasible to be conducted as a randomised clinical trial. Conclusions are hard to be refuted. Data is data, regardless of your beliefs.”

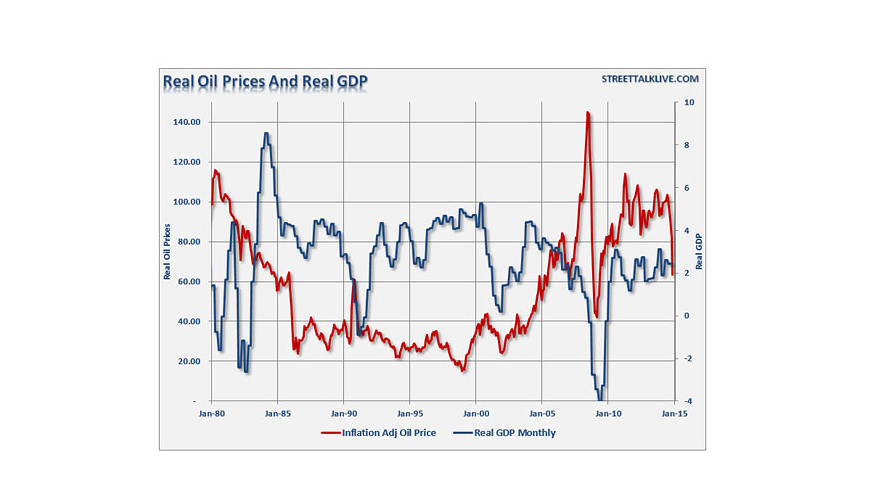

Sanctions make Russia rich

Check out this analysis of how the sanctions have benefited Russia, with hard numbers.

The French mainstream is (finally!) realizing that the sanctions they imposed are hurting the French people far more than Putin.pic.twitter.com/69lxcdrwNb

— Gonzalo Lira (@GonzaloLira1968) September 3, 2022

Buttigieg

https://twitter.com/i/status/1565941643869577217

Support the Automatic Earth in virustime with Paypal, Bitcoin and Patreon.