P�a�b�l�o� �P�i�c�a�s�s�o� Seated woman� �1903

Watters SS

The @SecretService admitted today that Trump wasn’t given counter-sniper teams at his campaign rallies for the last two years. Why after years of no Secret Service counter-snipers, did they show up in Butler? When he finally was given counter-snipers in Butler, the snipers only… pic.twitter.com/1P6SP2N9jp

— Jesse Watters (@JesseBWatters) August 3, 2024

Bidenomics

NEW: Trump campaign just released this Kamala Attack Ad.

It would be a shame if this was shared far and wide…pic.twitter.com/iykHWc3lLg

— Ryan Fournier (@RyanAFournier) August 2, 2024

Shapiro

https://twitter.com/i/status/1819409849694015608

Lemon

Remember that time that Don Lemon argued Kamala isn't African American? pic.twitter.com/JfMDBeeJGf

— Tim Young (@TimRunsHisMouth) August 2, 2024

Elon Matrix

"I have discussed with Trump the idea of a government efficiency commission"

-Elon Musk on garbage collection for rules and regulations pic.twitter.com/RjBF1mASYU

— Adrian Dittmann (@AdrianDittmann) August 2, 2024

Maduro

“Elon Musk is nothing but a PRODUCT of the PENTAGON!”

“The story about how he is intelligent, and how he created the rocket technology, they can tell that tale to SOMEONE ELSE!”

– Venezuelan President Maduro speaks to Jackson Hinkle on the TRUTH about Elon Musk!… pic.twitter.com/TokV52Ozn9

— The Saviour (@stairwayto3dom) August 3, 2024

Disturbed yet?

Hahaha. What a surprise. They want control.

• Harris Refuses Fox News Debate With Trump (RT)

US Vice President Kamala Harris has declined former President Donald Trump’s invitation to take part in a televised debate on Fox News next month, insisting that her presidential opponent stick to a previously agreed showdown on ABC News. In a post on his Truth Social platform on Friday, Trump accepted Fox’s proposal that he debate Harris on September 4 in the battleground state of Pennsylvania. Trump was scheduled to debate President Joe Biden on ABC News on September 10, before Biden suspended his reelection campaign and endorsed Harris to run in his place late last month. The ABC debate has been “terminated,” Trump explained, citing Biden’s decision to step down, and his pending litigation against ABC host George Stephanopoulos, which he claimed created “a conflict of interest.”

In a statement on Saturday, Harris’ campaign accused Trump of “running scared and trying to back out of the debate he already agreed to.” “He needs to stop playing games and show up to the debate he already committed to,” the statement continued. “The vice-president will be there one way or the other to take the opportunity to speak to a prime-time national audience. We’re happy to discuss further debates after the one both campaigns have already agreed to.” Fox News is generally seen as more sympathetic to Trump, while ABC is perceived as more sympathetic to Harris. Trump debated Biden in June, in a CNN-hosted faceoff in Atlanta, Georgia. Biden appeared frail during the debate and lost his train of thought on multiple occasions, and his lackluster performance set off a crisis within the Democratic Party that ultimately concluded with him suspending his campaign.

Trump maintains that senior Democrats staged a “coup” against Biden, and that former President Barack Obama was instrumental in forcing the president to step aside. “They all dumped him, and they said, ‘Either you get out nice or we’re going to go after you.’ And that’s what happened. And he had no choice. There’s no question about it,” he told the New York Post last month. Writing on Truth Social, Trump explained that he prefers Fox News’ chosen date of September 4, as early voting begins in some states two days later. “I spent hundreds of millions of dollars, time, and effort fighting Joe, and when I won the debate, they threw a new candidate into the ring,” he declared. “Nevertheless, different candidate or not, their bad policies are the same, and this will be strongly revealed at the September 4th debate.”

I love how the new MSM narrative is that Trump is “afraid to debate Kamala”.

Meanwhile, in reality, the last time Trump debated, he ended Biden’s career, and sparked the implosion of the Democrat Party…

And Trump did it while hosted by hostile Dem outlet CNN, with no crowd.… pic.twitter.com/VELxZnmpkh

— Clandestine (@WarClandestine) August 3, 2024

3 months before the election, she tries to restart the whole thing. A joint status report by Aug. 9, status conference set for Aug. 13. Next she’ll demand he shows up in person?

• Judge Chutkan Denies Trump’s Motion to Dismiss Election Case (ET)

U.S. District Judge Tanya Chutkan has scheduled a mid-August status conference in the classified documents case against former President Donald Trump, while denying his legal team’s motion to dismiss the indictment. The status conference, set for Aug. 13 in a Washington, D.C., federal courthouse, will address procedural matters and help determine the next steps in the proceeding, reads an order signed by Chutkan on Aug. 3. Chutkan ordered both the prosecution and the defense to submit a joint status report by Aug. 9, which will update the court on the progress of the case and can include such information as any agreements or disputes between the parties, as well as completed tasks and upcoming deadlines.

In the same order, Chutkan granted a brief stay on the briefing deadlines for special counsel Jack Smith’s motion seeking to limit the evidence and arguments that Trump’s legal team can introduce during the trial, particularly those that prosecutors argue are irrelevant or prejudicial. Specifically, the government’s motion seeks to exclude evidence related to Trump’s claims of selective prosecution, alleged investigative misconduct, and speculative theories about foreign influence or undercover agents during the Jan. 6, 2021 breach of the U.S. Capitol. Smith has also asked the judge to disallow arguments meant to sway the jury with political rhetoric or potential consequences of a conviction, and to impose limits on cross-examination by the defense, including potential testimony on Trump’s state of mind or belief that the 2020 election was stolen.

Chutkan’s order also denied without prejudice Trump’s motion to dismiss the indictment, which was filed on statutory grounds. Trump attorneys claim in their motion that Smith’s indictment improperly applied legal statutes, while arguing that the charges filed failed to demonstrate any acts of deceit or trickery necessary to establish conspiracy to defraud the United States, a key charge leveled against the former president in the case. Smith’s team charged Trump with four counts, including conspiracy to defraud the United States and to obstruct an official proceeding, in a case that centers on the former president’s actions after the 2020 election. Trump has pleaded not guilty, arguing that the case is motivated by political animus against him and is designed to thwart his 2024 presidential campaign.

Trump counsel also argued in the motion to dismiss that Trump’s public comments and actions to contest the results of the 2020 election were lawful exercises of his First Amendment rights and do not amount to obstruction of a government function. They also claimed that the indictment lacked the specificity required to support claims of corrupt intent, while arguing that the legal statutes cited by Smith’s team in the indictment should be interpreted more narrowly to avoid criminalizing legitimate political activity. A request for comment sent to Trump counsel regarding Chutkan’s rejection of the motion to dismiss was not immediately returned.

The renewed activity in the case, which had been put on hold pending Trump’s appeal to the U.S. Supreme Court on arguments he was immune from prosecution, occurred after the case was returned to Chutkan on Aug. 2, paving the way for further motions and hearings. The Supreme Court ruled on July 1 that Trump is entitled to some immunity, based on the high court’s finding that presidents have absolute immunity for actions within their “conclusive and preclusive constitutional authority,” presumptive immunity for official acts, and no immunity for unofficial acts. The Supreme Court justices sent the case back to district court, leaving it up to Chutkan to decide how to apply the ruling to the case.

“When people see that there is no limit on the power of corrupt prosecutors, they fear to go against the system.”

• Are Americans a Totally Conquered People? (Paul Craig Roberts)

The various “investigations” of the Secret Service’s failure to protect Trump are focused on operational and communication failures. The fact that the Secret Service did hardly anything normal procedures required has not yet raised the question whether elements of the Secret Service were involved. The failure is too large to be dismissed without investigation as nothing but a result of a collection of mistakes. The investigation that is needed is one that investigates whether elements in the Secret Service were involved in an assassination attempt on Trump, who is considered to be an existential threat to the ruling establishment. The investigation cannot be conducted by the Secret Service, Homeland Security, and the FBI, because if the assassination attempt was a deep state plot, all else against Trump having failed, these three agencies are the likely ones involved in the plot. A real investigation would have to answer these questions:

1. Was the acoustic evidence examined? 2. Were the fired bullets collected? Did they all come from the same rifle and was it the rifle found 7 feet away from Crooks dead body? Why was the rifle 7 feet away from the person alleged to have shot at Trump? 3. Why was Trump allowed to go on stage when the Secret Service knew Crooks was positioned on the building? 4. Why was the urgent information sent by the Pennsylvania police on the scene to the Secret Service not acted on and shared with Trump’s security detail? 5. Do such unprecedented operational and communicative failures of this magnitude suggest Secret Service complicity in an attempt on Trump’s life? 6. Was Crooks just a patsy whose presence was ignored because the plotters needed a patsy in place? It is unclear that the investigation can be conducted by a Congressional committee as members are dependent on ruling elites for campaign contributions and are vulnerable to threats from executive branch agencies.

The Founding Fathers made Congress weak because they feared “mob democracy.” But the consequence was to leave Congress too weak to hold the executive branch accountable. A real investigation would have to be conducted by credentialed independent experts, but even here independence can be hard to find. So many people rely on government contracts that it is difficult for many to speak freely. The fact that physics departments and universities are dependent on federal money explains why academic physicists avoided taking issue with the 9/11 narrative. Money speaks, and in the corrupt America of the 21st century, money is all that speaks. To understand the difficulty of private expert examination, consider the fate of the experts who proved beyond all doubt that the 2020 presidential election was stolen. That the election was stolen is as clear as day, but those who brought forward the evidence have been ridiculed as “conspiracy theorists,” sued, prosecuted or threatened with prosecution, and some sentenced, if memory serves, to prison for “interfering with an election.”

Even those who merely protested the stolen election were arrested, indicted, and imprisoned as “insurrectionists.” Any who survived the vendetta were bankrupted by their legal bills. Some of Trump’s lawyers were indicted along with him in a RICO indictment by a corrupt black female Atlanta prosecutor, apparently put in office with George Soros’ money and currently under investigation herself for going on vacations with money she paid her lover who she paid $700,000 to prosecute Trump. When people see that there is no limit on the power of corrupt prosecutors, they fear to go against the system.

Even if somehow an objective investigation could be conducted, if the conclusion was unacceptable to the ruling elite, the media would discredit it. The proven charges would lead nowhere. Look how long the US Department of Justice has been able to protect Hunter Biden from the perfectly clear evidence he provided on his laptop. In America today the main result achieved by the enormous sums poured into universities and public schools by taxpayers, corporations, philanthropic foundations such as the Ford and Rockefeller foundations, and by ego-driven businessmen, who want their name to live on forever on a university building, is to teach guilt to white students and to teach hatred of “white racist scum,” one of the most common terms used in American university classes.

The position of white people in American Society today is such that whatever they say, even if fact-based, is dismissed as “white supremacy speaking.” In other words, as white people are “aversive racists,” nothing they say, despite the evidence, can be believed. So, the conclusion in front of our face is that the ruling elite can do whatever it wants, because any challenge to it is impotent and results in the destruction of the challenger by the media, rejection by his family and friends, and if he is a business person the withdrawal of his financing, or his financial destruction by a Democrat prosecutor bankrupting him with the cost of endless producing of documents, as the corrupt NY prosecutor did to the website Vdare. It seems that what we are confronted with is the American people are whatever the ruling elite want them to be, which is insouciant sheep, totally incapable of protecting their freedom and independence. In effect, a totally conquered people.

“I don’t think US-Russia relations are going to be in a position where such a prisoner swap could have occurred in the next year, maybe the next two years..”

• Scott Ritter: Some Swapped Prisoners Were Likely ‘On CIA Payroll’ (Sp.)

The operation to swap 26 prisoners from seven countries took place in Ankara (Turkiye) on Thursday. As a result, eight Russian citizens, detained and imprisoned in several NATO countries, along with their minor children, were returned to their homeland. All implications are that some of the people involved in the recent prisoner swap between Moscow and several Western countries were CIA espionage assets, Scott Ritter has told Sputnik. The exchange that occurred on August 1 appears to have been “a deal hashed out between the Russian secret services and the American CIA,” noted the former US Marine Corps intelligence officer and ex-UN weapons inspector. Commenting on what is being called the biggest such swap since the Cold War, Ritter pointed out that among the 16 prisoners released by Russia was Evan Gershkovich, “caught red-handed receiving Russian secrets.” The Wall Street Journal reporter was subsequently charged with espionage, found guilty at trial, and meted out a lengthy sentence.

US Marine veteran Paul Whelan was likewise charged with espionage, while self-described Russian political figure Vladimir Kara-Murza, as it turns out, had a US green card. “This implies there was a special relationship between him [Kara-Murza] and the US government that maybe the US government doesn’t want to talk about in public,” Ritter said. Kara-Murza “appears to have been on the CIA payroll as well,” he noted. As for the Russian side, among the eight people released by the US in Thursday’s prisoner swap was Vadim Krasikov, recalled Scott Ritter. The former Russian intelligence officer was arrested in Germany in 2019 and accused by Berlin of terminating Chechen terrorist Zelimkhan Khangoshvili on German soil.

Krasikov was given a life-sentence in German prison for wiping out a warlord, “somebody who had butchered, murdered Russian prisoners of war during the Chechen conflict and, accordingly, was hunted down and killed in Berlin,” Ritter underscored. Looking ahead, the pundit suggested that the latest prisoner exchange taking place in the twilight of Joe Biden’s presidency “may be the best that US-Russian relations are gonna be for some time now.” “I don’t think US-Russia relations are going to be in a position where such a prisoner swap could have occurred in the next year, maybe the next two years. So it needed to happen now, and that’s why it did. The largest prisoner swap since the end of the Cold War. Who knows what the future will hold… Hopefully this is the beginning of a trend of good relations, but probably not,” Ritter concluded.

The Russian Federal Security Service (FSB) stated on Thursday that eight Russian citizens, who were detained and imprisoned in several NATO countries, have been returned to Russia. The exchange took place at Ankara airport (Turkiye) on August 1, 2024, and also included the repatriation of minor children. The security service added that the recently returned Russians were exchanged for a group of individuals who had been acting on behalf of foreign states, compromising Russia’s security.

“..Today, it is the unifying, pro-resistance qualities of leaders like Haniyeh and Arouri that pose a far bigger threat to Israel.”

• Israel Assassinates Chief Negotiator Across The Table (Cradle)

The assassination of Hamas Political Bureau leader Ismail Haniyeh has killed any chance for a lasting ceasefire in Gaza – on terms favorable to Palestinians – and leaves a huge political vacuum within the resistance movement. The assassination, which took place during an official visit to Tehran for the inauguration of Iranian President Masoud Pezeshkian, coincided with 300 days of Israel’s genocidal war on the Gaza Strip. Haniyeh was the chief Palestinian negotiator in indirect months-long ceasefire talks with the Israeli delegation, among them Mossad Chief David Barnea, whose organization reportedly executed the shocking kill operation. This targeting of the head of the political movement reflects Israel’s systematic policy of assassinating leaders who can unify ranks and deepen relations with regional and international powers. This also explains the reasoning behind Israel’s 2 January assassination of Saleh al-Arouri in Beirut, the key Hamas figure managing relations between Tehran, Ankara, Lebanon, and Doha.

Haniyeh, too, was distinguished not only by his ability to bridge the vision gap between Hamas’ military and political wings but also by successfully liaising with various regional and international powers and playing a major role advancing the interests of the resistance group in its three target regions – Gaza, the occupied West Bank, and abroad. Haniyeh’s assassination has created an urgent need to reorganize Hamas’ internal house – particularly urgent given Israel’s ongoing genocidal war on Gaza – and reconcile the disparate views of its leaders, such as Yahya Sinwar in Gaza and Khaled Meshaal abroad. Today, nothing would suit Israel more than seeing Meshaal, in particular, regain the reins at Hamas. The former Hamas politburo chief, after all, controversially split up Tel Aviv’s biggest regional adversaries – the Resistance Axis – at the start of the Syrian war by turning his back on the only Arab state member of the Axis, Syria.

It has taken Hamas years to fully reintegrate into the Axis after that betrayal, which is often blamed on Meshaal and his cohorts who decamped from Damascus to Doha. It was only through tireless efforts by leaders like Haniyeh and Arouri that Hamas’ relations with the regional resistance were publicly mended. Meshaal has since suffered the indignity of being spurned by Syrian, Iranian, and Hezbollah leaders, so his return to the top would be manna to Israeli ears – even though Israeli Prime Minister Benjamin Netanyahu had, almost successfully, undertaken to kill Meshaal in 1997. Those were different times, though, and alliances and interests in the region have shifted many times since. Today, it is the unifying, pro-resistance qualities of leaders like Haniyeh and Arouri that pose a far bigger threat to Israel.

“Today, Israel employs the full spectrum of its MAD strategy in its attacks on Palestinians in Gaza and across the West Bank – rape, murder, amputations, beheadings, torture – with impunity..”

• Israel Isn’t Crazy, It’s Just MAD (Cradle)

During the night hours between 30 and 31 July, Israel targeted two top Resistance Axis officials for assassination, both unprecedented in seniority during this round of conflict. First, top Hezbollah war commander Fuad Shukr was killed in an Israeli air attack on his residential building in the densely populated Beirut suburb of Dahiyeh, leaving several civilians dead and over 70 injured. The second target, at 2 am on 31 July, was Hamas political bureau leader Ismail Haniyeh – a central figure in ceasefire negotiations – who was in Tehran to attend the inauguration ceremony of Iran’s incoming President Masoud Pezeshkian. Within the course of a few hours, Israel managed to strike at three Resistance Axis members: Lebanon, Palestine, and Iran. In doing so, Tel Aviv violated a whole slew of international laws, diplomatic conventions, and customary practices that prohibit political assassinations while glaringly violating the territorial integrity of two UN member states.

Since its war on Gaza, Israel has rapidly gained global pariah status, not just because of its live-streamed genocide that has killed at least 39,000 Palestinian civilians – over 16,000 of them children – but also because of the unprecedented rulings and deliberations still underway at the International Criminal Court (ICC) and the International Court of Justice (ICJ) over Israel’s war crimes. Thus, Tel Aviv’s incendiary actions last night beg the question, is Israel just crazy? Does it not see the global censure brewing, the boycotts expanding, its alliances dwindling, the social media rage, and its growing and glaring isolation? The simple answer is no. Successive Israeli governments have been entirely rational, depending on a single overriding strategy from which the state has not veered. Recognizing its geographic, population, political, and economic shortcomings from the get-go, the Zionist project – very calculatingly – implemented something we can call the ‘MAD strategy’ to attain its objectives and then punch well above its geopolitical weight class.

A weird but effective strategy, MAD actually derives from textbook deterrence theory: Creating a threatening presence by having an aggressive reputation with the touch of madness will prevent your enemies from attacking you. They would not attack a person who takes his enemy with him if he falls. This is the essence of Israel’s strategy with friends and foes alike, and once understood, it is hard to unsee these tactics in all the state’s dealings.After the Palestinian resistance’s 7 October military operation last year – and just as US President Joe Biden was en route to Tel Aviv to lend his support to Israel – the occupation army struck Gaza’s Al-Shifa Hospital, killing hundreds of civilians seeking shelter and medical attention. The hit was by no accident. Israeli Prime Minister Benjamin Netanyahu deliberately sought those optics. He wanted to corner the US president into displaying support for his policies, no matter how awful the atrocity.

This is a long-practiced Zionist tactic to tame and groom targets to accept and expect Israeli bad behavior. Netanyahu also played this dangerous game with Russian President Vladimir Putin during the Syrian war. After every meeting with the powerful Russian head of state, the Israeli premier would launch hard strikes against Syria – again, to tame and groom the Russians to accept and expect Israeli bad behavior. Today, Israel employs the full spectrum of its MAD strategy in its attacks on Palestinians in Gaza and across the West Bank – rape, murder, amputations, beheadings, torture – with impunity. Allies, foes, and global populations are expected to accept the images and data and be ready for even worse scenarios. It is untrue that Tel Aviv acts irrationally. Implementing the MAD strategy is a rational decision for a small entity that needs to impose its oversized will on not only its neighbors but on global powers and international institutions, too.

“By refusing on principle ever to govern with real right-wing parties, the center-right guarantees that the left remains forever in power..”

• Europe’s Recipe for Disaster: The Von der Leyen Program (Godefridi)

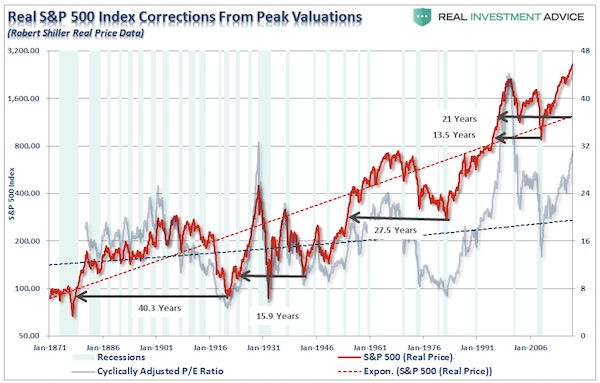

Calculated in terms of purchasing power parity – meaning disregarding the strength of the dollar — the average GDP per capita in the EU as of 2022 is 72% of the average GDP per American. Given that economic growth is higher every year in the United States than in the EU, this gap will only widen. This backwardness is confirmed by the innovation vitality of the American economy. In just one example, compare artificial intelligence, essentially an American innovation, to the lack of creativity in the European economy. NVIDIA’s success is unthinkable in Europe.

Three factors might help to explain Europe’s economic backwardness compared to the United States: the cost of energy, which is five to ten times higher in Europe than in the US; the greater difficulty in Europe of concentrating private capital to invest in R&D and finally, the pull of the “mad legislator”, which is even worse in Europe than in the US. For example, Apple recently settled an EU investigation regarding its restriction on third-party developers accessing its payment technology, which could have led to a fine of 10% of its annual revenue for non-compliance. Apple’s total net sales in 2023 were $383.3 billion, so a 10% fine would amount to $38.3 billion. Given Apple’s operating income in Europe is $36.1 billion, non-compliance with EU regulations could result in fines exceeding its regional earnings.

How is it, when all these facts are known, that von der Leyen was reappointed to her post, while the Greens lost the European Parliament elections, and the right-wing parties of all persuasions won them by a wide margin? Perhaps this seeming paradox can be explained by the fact that the center-right, the largest party bloc in the European Parliament, is ideologically subservient to the left, on two levels: 1) by adhering to most of the dogmas of the left, starting with environmentalism, and 2) by refusing on principle any coalition with real right-wing parties such as Prime Minister Giorgia Meloni’s Brothers of Italy or, in France, Marine Le Pen’s National Rally (RN).

This ensures that, while losing elections, the left can stay in power. The new von der Leyen majority consists of four parliamentary groups: the center-right, the socialists, the left-wing liberals and the far-left environmentalists. Of these groups, the center-right is by far the largest. It would therefore be logical for them to dominate von der Leyen’s program. But that is not what takes place. It is the demands of the smallest group — environmentalists — that dominate: continuation of the Green Deal, total decarbonization by 2050.

European power is a mirror image of its two driving forces — France and Germany — where the center-right parties behave in the same way: ideological submission to the left and a ban on the right governing. In Germany, the right-wing political party Alternative for Germany (AfD), finds itself in a position to govern several regions with the center-right. But everywhere in Germany, the center-right prefers to ally with the left, the environmentalists, sometimes even the communists, than to govern with the AfD. In France, Le Pen’s RN clearly won the European elections, then the first round of legislative elections. The center-right immediately announced that it preferred a victory for the far left and the communists to a victory for Le Pen.

The post-war European citizen has never voted so far to the right. He is harvesting a program that has never been so extremely left-wing. The von der Leyen program owes more to the Greens (53 MEPs) than to the center-right (188 MEPs). By refusing on principle ever to govern with real right-wing parties, the center-right guarantees that the left remains forever in power. When voting no longer serves any purpose, democracy dies.

“The proportion of electricity coming through Hungary in terms of Ukrainian imports exceeded 40-42 percent during several periods..”

• Hungary and Slovakia Consider Cutting Electricity Supply To Ukraine (RMX)

Roughly 40 percent of Ukraine’s electricity imports pass through the Ukrainian-Hungarian border, which means Hungary is not entirely powerless in the face of a Ukrainian blockade on oil supplies. In fact, Hungary may be forced to cut electricity to its neighbor if push comes to shove. Olivér Hortay, head of Századvég’s climate and energy policy department, noted that Ukraine’s biggest energy problem is the electricity system. Since the start of the war, the country has lost three-quarters of its own electricity generation capacity, leading to Ukrainians having to deal with prolonged blackouts and cuts to production due to a lack of electricity. To deal with Ukraine’s faltering electricity network, the country has been importing energy from neighboring countries. “The proportion of electricity coming through Hungary in terms of Ukrainian imports exceeded 40-42 percent during several periods,” said Hortay, while speaking to Hungarian television channel M1.

As a result, Ukraine may suffer “serious consequences” due to its oil blockade. He notes that the MAVIR station in Szabolcsbáka is one of the main hubs of the European and Ukrainian electricity systems. This is the only Hungarian and EU substation with 750 kV system components. Roughly 40 percent of Ukraine’s electricity imports pass through here. Hungary and Slovakia have both sounded the alarm to Brussels about Ukraine’s action of cutting oil supplies from Russia, which flow through the Friendship pipeline. However, the EU, which is well known for its opposition to the governments in Hungary and Slovakia, has responded cooly to the complaints, saying that Ukraine does not endanger the energy supplies of the two countries. Hungarian Minister of Foreign Affairs and Trade Péter Szijjártó has rejected the EU’s argument and called Croatia, which is supposed to increase supplies in response to the Ukrainian blockade, an unreliable transit country.

Both Hungary and Slovakia rely on Russia for up to 80 percent of their oil supply, underlining the threat to both economies. Olivér Hortay explained that Russia’s Lukoil provides a third of the oil demand of the Hungarian Száhahalombatta refinery and 45 percent of the demand of the Bratislava refinery in Slovakia. Gergely Gulyás, the minister in charge of the Prime Minister’s Office, called it unfair and contrary to EU agreements that Ukraine is blackmailing Hungary and Slovakia because of its pro-peace stance. Hortay points to an existing association agreement, based on which Hungary and Slovakia initiated proceedings at the European Commission , where “literally it is stated that the parties cannot limit each other’s imports, exports and transit.”

“..theoretically we can assume that this is the beginning of the process of realigning relations between Russia and the West..”

• A New Détente: Can Putin and Biden Make A Deal? (Drize)

Russia is delighted with Thursday’s prisoner exchange in Ankara, Western media outlets report, citing sources in their countries’ respective agencies. Meanwhile, in Washington and in Western European capitals, the event is being presented as a major diplomatic breakthrough. It may even be a prelude to further talks between Moscow and Washington. It was the largest swap in modern Russian history, not only in terms of the number of people involved, but also in their status. This time, not only foreigners convicted in our country, but also Russian citizens – let’s say critics of the existing state system and its leadership – were released from prison. We don’t need to list them all again. That information is everywhere in news stories and has been repeated many times.

It’s worth repeating that the last time anything like this happened was during the Cold War. So we have yet another indication that history is repeating itself more or less: missiles being placed in Western Europe, nuclear exercises in Russia, the decline in diplomatic relations….. all the signs are there. Nevertheless, this event is positive in terms of the prospect of defusing international tensions and perhaps encouraging a detente. Incidentally, this was a buzz word in the 1970s. Top US officials were in a festive mood. Joe Biden spoke at the White House, surrounded by the families of those transferred. The Democratic presidential candidate, Kamala Harris, flew from Houston to Washington to meet them. So, they were received at the highest level.

It also seems that the Kremlin has a lot of doubts about Donald Trump’s chances of victory. That’s the first thing. And secondly, it is no big secret that it’s much easier to come to an agreement with the Democratic Party in general and the Biden-Obama-Harris faction in particular. This is what we are witnessing. We can also recall that one of Biden’s first executive orders after taking office in 2021 was to extend the START treaty. As we know, ‘dear Donald’ refused to sign the document. But ‘Bad Joe’ took it and approved it, and immediately at that. So betting on this team seems quite logical. By the way, it’s also believed that both Iran and China believe it’s better to deal with bad than “very bad,” and they also don’t want Trump to return. But let’s not get sidetracked.

Anyway, an unprecedented agreement has been reached. And often when you manage to make one, it’s followed by a second. That is to say, theoretically we can assume that this is the beginning of the process of realigning relations between Russia and the West. Of course, the main stumbling block here is Ukraine, but it’s not the only one. And this process should take place before the election in the US, i.e. in the shortest possible time frame. The reason is obvious: Trump could win and then we’ll have to start all over again. Some will say: but what about all the hopes and assumptions pinned on him, and why are they being forgotten? Yes, we should not be naive. But events are moving, and moving fast. And time is running out. So what can we do? We can hope for the best, or rather, hope for the prudence of all parties. We don’t want the planet to burn in a fiery hell. So it makes sense to try to somehow avoid that scenario.

Do it quickly.

• Venezuela Could Hand Energy Rights To BRICS – Maduro (RT)

Venezuela could transfer the development rights to its vast oil and gas fields that are currently operated by American energy companies to entities from BRICS nations, President Nicolas Maduro warned on Friday during a press conference in Caracas. BRICS originally comprised Brazil, Russia, India, and China before subsequently adding South Africa and, at the beginning of this year, Egypt, Ethiopia, Iran, and the United Arab Emirates. Numerous other countries, including Venezuela, have expressed interest in joining the group. “If these people up north and their partners in the world make the mistake of their lives, then those oil blocks and those gas blocks that were already signed up [for US companies] will go to our BRICS allies,” Maduro said, adding that Washington was at the forefront of plans to destabilize his country.

With an estimated 303 billion barrels, Venezuela accounts for approximately 17% of global reserves of crude oil, according to the International Energy Agency (IEA), which lists the Bolivarian republic as having the world’s largest proven oil reserves. Chevron, the only American energy major still operating in Venezuela, scored a license to pump oil in the country in November 2022, a month after a sanctions waiver was implemented. This came in exchange for the unblocking of some of Caracas’ oil proceeds that had been frozen by US sanctions. Chevron is currently involved in four onshore and offshore projects in Venezuela through a partnership with state-controlled oil giant Petroleos de Venezuela (PDVSA). Earlier this year, the US company announced the goal of increasing output by 35% year-on-year by bringing new wells online.

Earlier this week, the White House recognized Western-backed opposition figure Edmundo Gonzalez Urrutia as the winner of Venezuela’s presidential election on Sunday, despite the official results showing incumbent Maduro having won. The Venezuelan leader has urged Washington to “keep its nose out of Venezuela,” saying that the protests that erupted in the country after the results were announced were an attempted “coup.” Russian President Vladimir Putin congratulated Maduro earlier this week on being reelected. Kremlin spokesman Dmitry Peskov said on Thursday that Venezuela’s opposition should admit defeat and congratulate the winner. He added that it is important for Venezuela to avoid attempts at destabilization orchestrated by third countries, and to remain free of outside meddling. Earlier this week, Venezuelan Foreign Minister Yvan Gil Pinto confirmed that Maduro had received an invitation to take part in the BRICS summit scheduled for October in the Russian city of Kazan.

“Boeing is not allowed to ask Elon to save them in an election year.”

“..stranded in space for 2 months, on what was supposed to be a 1 week trip. They were not allowed to take any luggage or change of clothes or personal items, since it was such a short stay.”

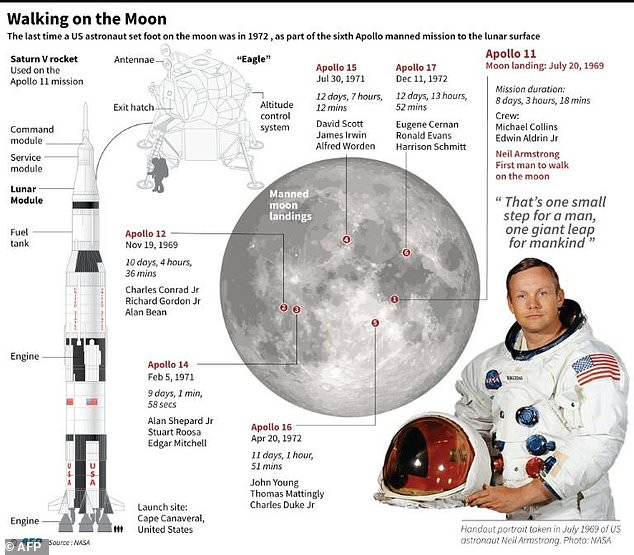

• SpaceX May Save Stranded Boeing Starliner Crew At ISS (ZH)

Boeing’s crewed Starliner spacecraft mission to the International Space Station was initially expected to last just a few days, but it has stretched into weeks and now two months. The two astronauts, Butch Wilmore and Suni Williams, have been stranded on the ISS following Starliner’s helium leaks and failing thrusters in early June. NASA and Boeing have been working to resolve Starliner’s issues, but progress has been limited. The big story here is that, after two months, Boeing has yet to publicly ask Elon Musk’s SpaceX for help. Optically, this would be a major blow to Boeing’s image, especially considering the series of mid-air mishaps involving its 737Max commercial jets. Additionally, it’s an election year for the Biden administration, which has been on a crusade against Trump and his supporters, but also is very anti-Musk. Any rescue mission by SpaceX’s Dragon spacecraft is undesirable news flow for Democrats.

However, a new report from Ars Technica, citing various sources, indicates SpaceX could be publicly called up to save the day. Here’s more from Ars Technica: “For a long time, it seemed almost certain that the astronauts would return to Earth inside Starliner. However, there has been a lot of recent activity at NASA, Boeing, and SpaceX that suggests that Wilmore and Williams could come home aboard a Crew Dragon spacecraft rather than Starliner.” The report continued: “One informed source said it was greater than a 50-50 chance that the crew would come back on Dragon. Another source said it was significantly more likely than not they would. To be clear, NASA has not made a final decision. This probably will not happen until at least next week. It is likely that Jim Free, NASA’s associate administrator, will make the call.”

On Thursday evening, NASA spokesperson Josh Finch told Ars, “NASA is evaluating all options for the return of agency astronauts Butch Wilmore and Suni Williams from the International Space Station as safely as possible. No decisions have been made and the agency will continue to provide updates on its planning.” X users are wondering why the stranded Starliner story is not huge news.

“..there are at least two countries already – Canada and the US – that permit anyone to freely decide the gender that gets listed on their passport.|”

• Gender-Bending Is The New Doping (Marsden)

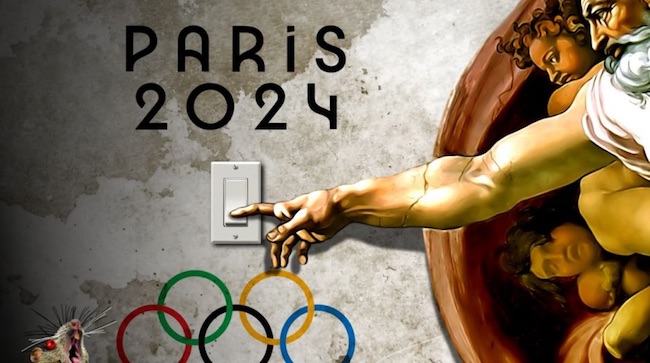

Ever since the Paris Olympics triggered culture warriors by dumping drag queens all over the opening ceremony like fleur de sel with a faulty cap, they’ve been on high alert for any perceived attempts by the organizers to further a woke, gender-bending agenda. When Algerian boxer Imane Khelif defeated Italian Angela Carini in a fight that lasted just 46 seconds, with Carini taking a punch to the head and reeling from a suspected broken nose, it didn’t take long for social media to pick up on Carini’s cry that the match wasn’t fair. Nor would it take long for a debate to emerge along the usual fault lines around Khelif’s gender and for Khelif to become a Rorschach test. Former competitive swimmer Riley Gaines tweeted that “men don’t belong in women’s sports,” to which X (formerly Twitter) owner Elon Musk replied, “Absolutely.”

Gaines has become an activist against men competing in women’s sports as a result of having to face off against transsexual swimmer Lia Thomas in the NCAA college swimming championships. And Musk has recently expressed upset over one of his children’s own gender transitioning. “The idea that those objecting to a male punching a female in the name of sport are objecting because they believe Khelif to be ‘trans’ is a joke. We object because we saw a male punching a female,” ‘Harry Potter’ author and frequent transsexual issue commentator J.K. Rowling wrote. Yet there isn’t any credible evidence that Khelif has ever undergone any kind of gender transitioning – something that would be unheard of in Khelif’s native Algeria. “This is the purest form of evil unfolding right before our eyes,” boxer and influencer Logan Paul said. “A man was allowed to beat up a woman on a global stage, crushing her life’s dream while fighting for her deceased father. This delusion must end.”

But then Paul deleted the posts. “OOPSIES,” he wrote. “I might be guilty of spreading misinformation along with the entirety of this app.” It’s no wonder everyone’s confused. Two sports governing bodies have faced off over Khelif and another athlete competing in women’s boxing, China’s Lin Yu-Ting. According to the International Boxing Association, the worldwide match sanctioning entity which disqualified both athletes in the 2023 World Championships where they won bronze and gold respectively, “the athletes did not undergo a testosterone examination but were subject to a separate and recognized test, whereby the specifics remain confidential. This test conclusively indicated that both athletes did not meet the required necessary eligibility criteria and were found to have competitive advantages over other female competitors.” Regulations stipulate that proof could be in the form of a DNA test, but no further evidence has been provided to confirm the results – perhaps due to concerns around privacy violations.

In the other corner, the International Olympic Committee calls the IBA’s ruling “sudden and arbitrary,” which can also be true without the results themselves being illegitimate. Accusing its CEO, Chris Roberts (an Officer of the Order of the British Empire for services to British army boxing), of a unilateral decision, the IOC issued a statement related to the latest controversy, stipulating that “as with previous Olympic boxing competitions, the gender and age of the athletes are based on their passport.” That’s hardly a rigorous test, particularly when there are at least two countries already – Canada and the US – that permit anyone to freely decide the gender that gets listed on their passport.

Arguably, the most levelheaded take came from transsexual former Olympic decathlon champion Caitlyn Jenner, who explained in a recent Netflix documentary about Jenner’s sporting career and life that it was Bruce Jenner who won those accolades, not Caitlyn. Bruce also had the integrity to keep the dresses at home and not show up in one to compete in the women’s decathlon – and Jenner does not now support any man who would. Jenner has described Khelif as “the Algerian competitor with XY chromosomes,” referencing the IBA test results, and has argued that the IOC has a duty to protect the integrity of women’s sports. The IOC doesn’t seem too interested in actively doing so, however, preferring instead to just take participants’ and countries’ word for it.

“.. financial commentators have put it as high as $2.3 quadrillion or even $3.7 quadrillion, far exceeding global GDP, which was about $100 trillion in 2022..”

• How Unelected Regulators Unleashed the Derivatives Monster (Ellen Brown)

“It was not the highly visible acts of Congress but the seemingly mundane and often nontransparent actions of regulatory agencies that empowered the great transformation of the U.S. commercial banks from traditionally conservative deposit-taking and lending businesses into providers of wholesale financial risk management and intermediation services.” – Professor Saule Omarova, “The Quiet Metamorphosis, How Derivatives Changed the Business of Banking” University of Miami Law Review, 2009

While the world is absorbed in the U.S. election drama, the derivatives time bomb continues to tick menacingly backstage. No one knows the actual size of the derivatives market, since a major portion of it is traded over-the-counter, hidden in off-balance-sheet special purpose vehicles. However, when Warren Buffet famously labeled derivatives “financial weapons of mass destruction” in 2002, its “notional value” was estimated at $56 trillion. Twenty years later, the Bank for International Settlements estimated that value at $610 trillion. And financial commentators have put it as high as $2.3 quadrillion or even $3.7 quadrillion, far exceeding global GDP, which was about $100 trillion in 2022. A quadrillion is 1,000 trillion. Most of this casino is run through the same banks that hold our deposits for safekeeping. Derivatives are sold as “insurance” against risk, but they actually add a heavy layer of risk because the market is so interconnected that any failure can have a domino effect. Most of the banks involved are also designated “too big to fail,” which means we the people will be bailing them out if they do fail.

Derivatives are considered so risky that the Bankruptcy Act of 2005 and the Uniform Commercial Code grant them (along with repo trades) “super-priority” in bankruptcy. That means if a bank goes bankrupt, derivative and repo claims are settled first, drawing from the same pool of liquidity that holds our deposits. A derivatives crisis could easily vacuum up that pool, leaving nothing for us as depositors — or for the “secured” creditors who are junior to derivative and repo claimants in bankruptcy, including state and local governments. As detailed by Pam and Russ Martens, publisher and editor, respectively of Wall Street on Parade, as of Dec. 31, 2023, Goldman Sachs Bank USA, JPMorgan Chase Bank N.A., Citigroup’s Citibank and Bank of America held a total of $168.26 trillion in derivatives out of a total of $192.46 trillion at all U.S. banks, savings associations and trust companies. That’s four banks holding 87 percent of all derivatives at all 4,587 federally-insured institutions then in the U.S.

In June 2024, the Federal Deposit Insurance Corporation (FDIC) and the Federal Reserve Board jointly released their findings on the eight U.S. megabanks’ “living wills” – their resolution or wind-down plans in the event of bankruptcy. The Fed and FDIC faulted all of the four largest derivative banks on shortcomings in how they planned to wind down their derivatives. Banks are not just middlemen in the derivatives market. They are active players taking speculative positions. In this century, writes Professor Omarova, the largest U.S. commercial banks have emerged “as a new breed of financial super-intermediary—a wholesale dealer in financial risk, conducting a wide variety of capital markets and derivatives activities, trading physical commodities, and even marketing electricity.” She notes that the Federal Reserve has allowed several financial holding companies to purchase and sell physical commodities (including oil, natural gas, agricultural products and electricity) in the spot market to hedge their commodity derivative activities, and to take or make delivery of those commodities to settle the transactions.

It was not Congress that authorized that expansive definition of permitted banking activities. It was the Office of the Comptroller of the Currency (OCC), part of the “administrative deep state,” that permanent body of unelected regulators who carry on while politicians come and go. As Omarova explains: Through seemingly routine and often nontransparent administrative actions, the OCC effectively enabled large U.S. commercial banks to transform themselves from the traditionally conservative deposit-taking and lending institutions, whose safety and soundness were guarded through statutory and regulatory restrictions on potentially risky activities, into a new breed of financial “super-intermediaries,” or wholesale dealers in pure financial risk. … Moreover, some of the most influential of those decisions escaped public scrutiny because they were made in the subterranean world of administrative action invisible to the public, through agency interpretation and policy guidance.

Love ya, but

“Babe, love ya, but I’m working right now”

pic.twitter.com/HXwFZtEZ2E— Science girl (@gunsnrosesgirl3) August 2, 2024

Baby+dog

https://twitter.com/i/status/1819336132997664797

Sport

https://twitter.com/i/status/1819484638953529696

Toy fix

https://twitter.com/i/status/1819646410620280877

Ref

https://twitter.com/i/status/1819276069972635674

Support the Automatic Earth in wartime with Paypal, Bitcoin and Patreon.