Wassily Kandinsky Clear connection 1925

“If the average interest rate on this debt is 20%, credit-cart interest payments alone add $233 a month to their household expenditures.”

• How Fed Rate Hikes Impact US Debt Slaves (WS)

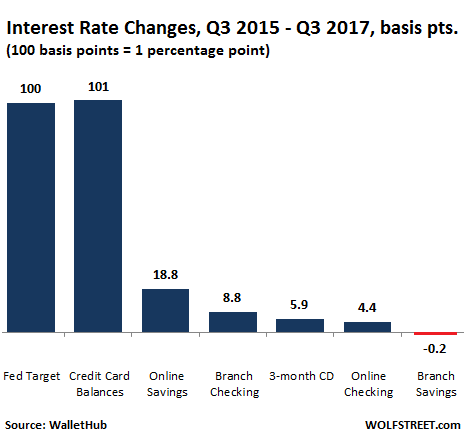

Revolving credit outstanding of $1 trillion, spread over 117.72 million households, would amount to $8,300 per household. But many households do not carry interest-bearing credit card debt; they pay their cards off in full every month. Finance charges are concentrated on households that use this form of debt to finance their spending and that cannot pay off their balances every month. Many of these households are already strung out and are among the least able to afford higher interest payments. Consumer credit bureau TransUnion shed some light on this in its Q3 2017 Industry Insights Report, according to which 195.9 million consumers had a revolving credit balance at the end of Q3, with total account balances of $1.35 trillion. This equals $6,892 per person with revolving credit balances.

If there are two people with balances in a household, this would amount to nearly $14,000 of this high-cost debt. If the average interest rate on this debt is 20%, credit-cart interest payments alone add $233 a month to their household expenditures. What is next for these folks? For now, the Fed has penciled in, and economists expect, three hikes next year. But recent developments – particularly the expected tax cuts and what the Fed calls “elevated asset prices” – suggest that the Fed might “surprise” the markets with its hawkishness in 2018. The Fed is currently pegging the “neutral” rate – the rate at which the federal funds rate is neither stimulating nor slowing the economy – at somewhere near 2.5% to 2.75%, so about five or six more rates hikes from today’s target range.

Interest rates on credit cards would follow in lockstep. These rate hikes to “neutral” would extract another $8 billion or so a year, on top of the additional $7.5 billion from the prior rate hikes. But that’s not all. Credit card balances continue to rise as our brave consumers are trying to prop up US consumer spending and thus the global economy by borrowing more and more. Thus, rising credit card balances combined with rising interest rates on those balances conspire to produce sharply higher interest costs. Since consumers with high-interest credit-card balances already don’t have enough money to pay off their costly debt, these additional interest payments will further curtail their efforts at making principal payments and thus inflate their credit card balances further.

And if/when you manage to pay off your credit cards, there’s the next challenge…

• Why Obamacare Is Locked In An Inescapable Death Spiral (ZH)

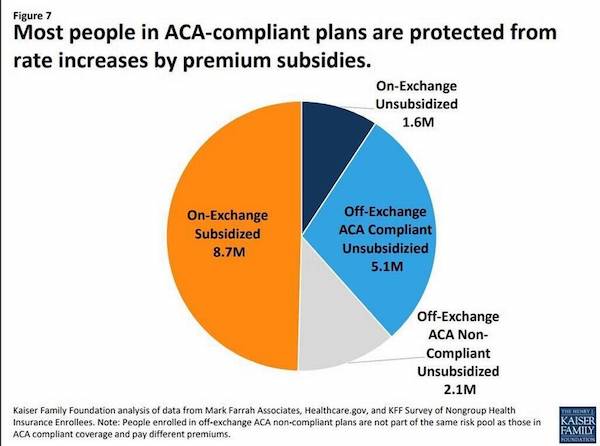

Ever since it was signed into law in 2010, defenders of Obamacare have dismissed staggering surges in annual premiums by highlighting only the rates paid by those fortunate enough to receive subsidies. In fact, last year we wrote about Marjorie Connolly’s, from Obama’s Department of Health and Human Services, response to the Tennessee insurance commissioner’s fear that the exchanges in his state were “very near collapse” after a staggering 59% premium surge: “Consumers in Tennessee will continue to have affordable coverage options in 2017. Last year, the average monthly premium for people with Marketplace coverage getting tax credits increased just $2, from $102 to $104 per month, despite headlines suggesting double digit increases,” said Marjorie Connolly, HHS spokeswoman, in a statement.

We’re unsure whether Connolly’s comment was just propaganda intended to defend a failing piece of legislation or an intentional, blatant admission that the Department of Health and Human Services just doesn’t care about the majority of Americans, the so-called 1%’ers, who are facing debilitating increases in healthcare costs simply because they manage to live above the poverty line. We’ll let you decide on that one. Be that as it may, as the Miami Herald points out this morning, roughly half of all Obamacare participants, nearly 9 million people in aggregate, don’t qualify for the subsidies that Connolly praised and have been forced to absorb debilitating premium increases for the past several years.

[..] As open enrollment for Affordable Care Act coverage nears the deadline of Dec. 15, and Florida once again leads all states using the federal exchange at healthcare.gov, Heidi and Richard Reiter sit at the kitchen table at their Davie home and struggle to piece together the family’s health insurance for 2018. The Reiters buy their own coverage, but they earn too much to qualify for financial aid to lower their monthly premiums. For 2017, they bought a plan off the exchange and paid $26,000 in premiums for family coverage, including their two sons, ages 21 and 17. Keeping the same coverage for 2018 would have cost the Reiters $40,000 in premiums, a 54% increase. So they selected a lower-priced plan that covers less but costs $29,000 in premiums. “That’s more than a lot of people’s mortgage payments,” Richard Reiter said. “For me, it’s a crisis situation.”

The odds of a correction (reversion).

• Sitting Closer To The Exit (Roberts)

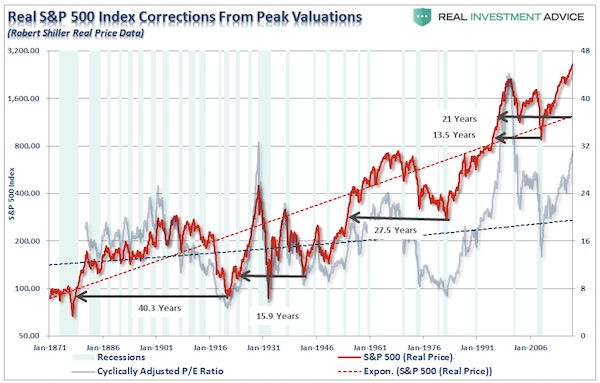

While valuation risk is certainly concerning, it is the extreme deviations of other measures to which attention should be paid. When long-term indicators have previously been this overbought, further gains in the market have been hard to achieve. However, the problem comes, as identified by the vertical lines, is understanding when these indicators reverse course. The subsequent “reversions” have not been forgiving. The chart below brings this idea of reversion into a bit clearer focus. I have overlaid the real, inflation-adjusted, S&P 500 index over the cyclically-adjusted P/E ratio. Historically, we find that when both valuations and prices have extended well beyond their intrinsic long-term trendlines, subsequent reversions beyond those trend lines have ensued. Every. Single. Time.

Importantly, these reversions have wiped out a decade, or more, in investor gains. As noted, if the next correction began in 2018, and ONLY reverts back to the long-term trendline, which historically has never been the case, investors would reset portfolios back to levels not seen since 1997. Two decades of gains lost. With everyone crowded into the “ETF Theater,” the “exit” problem should be of serious concern. “Over the next several weeks, or even months, the markets can certainly extend the current deviations from long-term mean even further. But that is the nature of every bull market peak, and bubble, throughout history as the seeming impervious advance lures the last of the stock market ‘holdouts’ back into the markets.”

“..the petrodollar is not the source of the U.S. dollar’s power around the world, but rather the U.S.’s main fulcrum by which to keep competition out of the markets..”

• Oil Producers Turning to Crypto to Solve Sanctions Problems (Luongo)

Last week, Venezuela announced it would develop a national cryptocurrency backed by its oil reserves, the Petro. Now there is a report that Russia is considering the same thing. Iran will likely follow suit. As of right now this is just a rumor, but it makes some sense. So, let’s treat this rumor as fact for the sake of argument and see where it leads us. The U.S. continues to sanction and threaten all of these countries for daring to challenge the global status quo. There is no denying this. [..] at the heart of this is the petrodollar. Contrary to what many believe, the petrodollar is not the source of the U.S. dollar’s power around the world, but rather the U.S.’s main fulcrum by which to keep competition out of the markets. It is a secondary effect of the dollar’s dominance in global finance today. But it is not the main driver.

Financial market are simply too big relative to the size any one commodity market for it to be the fulcrum on which everything hinges. It was that way in the past. But it is not now. That said, however, getting out from underneath the petrodollar gives a country independence to begin building financial architecture that can be levered up over time to threaten the institutional control it helped create. U.S. foreign policy defends the petrodollar along with other systems in place – the IMF, the World Bank, SWIFT, LIBOR and the central banks themselves – to maintain its control. The main oil producers, however, can escape this control simply by selling their oil in currencies other than the U.S. dollar. That’s not enough to dethrone the dollar, but, like I just said, it is where the process has to start. Therefore, any and all means must be employed to defend the dollar empire by keeping everyone inside that system.

[..] The problem with backing any currency with physical reserves is the fluctuations in value of those reserves. It’s not like oil is a low-beta commodity or anything. But, like everything else in the commodity space, price movements are supposed to be smoothed out by the futures markets helping to coordinate price with time. But the bigger problem is the estimation of those reserves the coin’s value is based on. First, how do you accurately quantify them? Can holders of Petro or Neft-coin trust the Russian or Venezuelan governments to provide accurate assessments of their reserves? Second, there is the ability of the country to pull it out of the ground and sell it into the market at anything close to a fair price. This isn’t a concern for Russia, the world’s 2nd largest supplier of oil and very stable government but Venezuela is the opposite. And, its “Petro” would probably trade at quite a discount early on to the dollar price of oil.

I doubt it. If only because as Taleb said, you can’t actually short BTC, and they should have introduced options along with futures. They didn’t. This story is far from over.

• Peak Bitcoin Media Mania Yet? (WS)

Bitcoin mania is now everywhere. It’s hard to have a conversation with regular people without sooner or later getting into bitcoin. Some of this is just for fun. Manias breed amazement. Miracles are wonderful to behold. But some of it is pretty serious. “We’ve seen mortgages being taken out to buy bitcoin,” said Joseph Borg, president of the North American Securities Administrators Association and director of the Alabama Securities Commission, on CNBC’s Power Lunch today. “People do credit cards, equity lines,” he said. Bitcoin futures trading started Sunday night on the Cboe futures exchange. Next week, the CME will offer trading in bitcoin futures.

This way, speculators can bet with unlimited derivatives on an unregulated digital entity that is backed by nothing and whose cash trading takes place in unregulated opaque and easily hacked exchanges around the world. But Borg doesn’t think that futures contracts legitimize bitcoin. Innovation and technology always outrun regulation, he said. “You’re on this mania curve. At some point in time there’s got to be a leveling off,” he said. “Cryptocurrency is here to stay. Blockchain is here to stay. Whether it is bitcoin or not, I don’t know.” And so the media mania over bitcoin has become deafening.

But there’s definitely a media bubble, even if there’s no BTC one yet.

• Bitcoin – Millennials’ “Fake Gold” (Katsenelson)

If you cannot value an asset you cannot be rational. With Bitcoin at $11,000 today, it is crystal clear to me, with the benefit of hindsight, that I should have bought Bitcoin at 28 cents. But you only get hindsight in hindsight. Let’s mentally (only mentally) buy Bitcoin today at $11,000. If it goes up 5% a day like a clock and gets to $110,000 – you don’t need rationality. Just buy and gloat. But what do you do if the price goes down to $8,000? You’ll probably say, “No big deal, I believe in cryptocurrencies.” What if it then goes to $5,500? Half of your hard-earned money is gone. Do you buy more? Trust me, at that point in time the celebratory articles you are reading today will have vanished. The awesome stories of a plumber becoming an overnight millionaire with the help of Bitcoin will not be gracing the social media.

The moral support – which is really peer pressure – that drives you to own Bitcoin will be gone, too. Then you’ll be reading stories about other suckers like you who bought it at what – in hindsight – turned out to be the all-time high and who got sucked into the potential for future riches. And then Bitcoin will tumble to $2,000 and then to $100. Since you have no idea what this crypto thing is worth, there is no center of gravity to guide you or anyone else to make rational decisions. With Coke or another real business that generates actual cash flows, we can at least have an intelligent conversation about what the company is worth. We can’t have one with Bitcoin. The X times Y = Z math will be reapplied by Wall Street as it moves on to something else.

People who are buying Bitcoin today are doing it for one simple reason: FOMO – fear of missing out. Yes, this behavior is so predominant in our society that we even have an acronym for it. Bitcoin is priced today at $11,000 because the fool who bought it for $11,000 is hoping that there is another, greater fool who will pay $12,000 for it tomorrow. This game of greater fools is not new. The Dutch played it with tulips in the 1600s– it did not end well. Americans took the game to a new level with dotcoms in the late 1990s – that round ended in tears, too. And now millennials and millennial-wannabes are playing it with Bitcoin and few hundred other competing cryptocurrencies.

The counterargument to everything I have said so far is that those dollar bills you have in your wallet or that digitally reside in your bank account are as fictional as Bitcoin. True. Currencies, like most things in our lives, are stories that we all have (mostly) unconsciously bought into. Of course, society and, even more importantly, governments have agreed that these fiat currencies are going to be the means of exchange. Also, taxation by the government turns the dollar bill “story” into a very physical reality: If you don’t pay taxes in dollars, you go to jail. (The US government will not accept Bitcoins, gold, chunks of granite, or even British pounds).

Compared to Japan, all other central banks are wimps and pussies.

• Next Bank of Japan Governor Faces a ‘Job From Hell’ (BBG)

The next governor of the Bank of Japan faces a “job from hell.” That’s according to Takeshi Fujimaki, a banker-turned-lawmaker who sees any attempt by Japan’s central bank to exit its program of unprecedented easing as triggering a Greek-like debt crisis. “This is the calm before the battle,” Fujimaki, an opposition Japan Innovation Party politician who once served briefly as an adviser to George Soros, said in an interview at his Tokyo office on Monday. BOJ Governor Haruhiko Kuroda’s five-year term runs out in April, with recent praise from Prime Minister Shinzo Abe strengthening expectations that the 73-year-old will stay on for a second stint. His massive easing program has weakened the yen, bolstered exports and helped stock prices to more than double. But inflation is still short of the government’s 2% target, and critics say the BOJ’s swollen balance sheet is unsustainable.

Fujimaki, 67, said he agreed with the view expressed by Kuroda’s predecessor Masaaki Shirakawa in his 2013 resignation press conference, when he said no judgment could be made on non-traditional monetary easing in Japan and in other developed economies until exits had been completed. Last week, Kuroda said the BOJ can take the appropriate steps to exit when the time comes, but talking specifics of an exit now would end up confusing markets. Even so, Fujimaki said Kuroda should stay on to oversee an exit from the policies he introduced. “Because Mr. Kuroda has taken it this far, he should carry on until the end,” Fujimaki said. “Just taking the good part and running away would be unfair.”

“(SEB) says 63% of households in Stockholm now expect prices to decline in the coming year while only 21% expect an increase; that’s “a dramatic shift compared with only two months’ ago..”

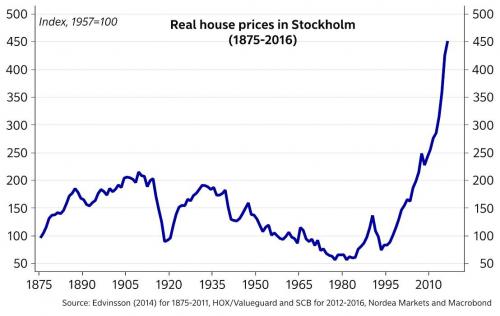

• Sweden: More Signs The World’s Biggest Housing Bubble Is Cracking (ZH)

We like to highlight that although Sweden’s property bubble is not the longest running (that accolade goes to Australia at 55 years), it is probably the world’s biggest, even though it gets relatively little coverage in the mainstream financial media. A month ago, we noted that SEB’s housing price indicator suffered its second biggest ever drop, falling by 39 points, only lagging a steeper fall from ten years earlier. This month the indicator, which shows the balance between households forecasting rising or falling prices, fell into negative territory, dropping to -5 from +11 in November. Households expecting prices to rise has almost halved from 66% In October, to 43% in November and 36% this month. The percentage of households expecting prices to fall has risen from 16% in October, to 32% in November and 41% this month.

After the housing price indicator was published, the Swedish krona fell as much as 0.7% versus the Euro to 10.0118, its lowest level since 5 December 2017. Not surprisingly, the focal point of Sweden’s property boom has been Stockholm, where the decline in the housing price indicator in December 2017 was precipitous. According to Bloomberg. “SEB says sharp drop in home-price expectations in Stockholm was main culprit behind the decline in its Swedish home-price indicator, with the indicator falling to -42 in the Swedish capital in Dec. from -6 in Nov. That means the Stockholm indicator is now close to the record low of -47 that was reached in Dec. 2008, at the height of the global financial crisis. (SEB) says 63% of households in Stockholm now expect prices to decline in the coming year while only 21% expect an increase; that’s “a dramatic shift compared with only two months’ ago..”

Given the disproportionate rate of decline in December in Stockholm, SEB was minded to ask whether special factors are at work “rather than general drivers such as fears over rising interest rates or a weak business cycle”. Indeed, aside from south-eastern Sweden, the outlook in all other regions remains positive. With regard to Stockholm, the bank notes that a large increase in new supply of expensive residential property and what it terms “very negative media reporting” have had an impact. Whether that’s a fair assessment, or whether it’s realist reporting of a monumental asset bubble is a moot point. What is indisputable is that the number of Swedish homes for sale has surged in November 2017 compared with the same month last year.

After talking to Musk and Bezos. Who target billions in profits from the bridges to nowhere on steroids.

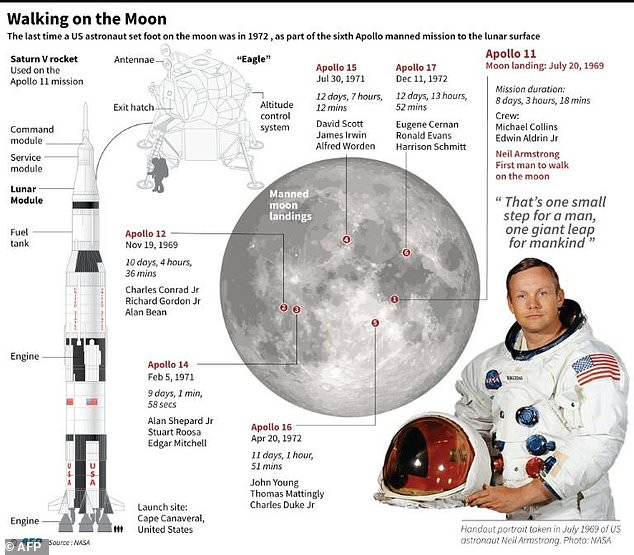

• Trump Tells NASA to Send Americans to the Moon (AFP)

US President Donald Trump directed NASA on Monday to send Americans to the Moon for the first time since 1972, in order to prepare for future trips to Mars. “This time we will not only plant our flag and leave our footprint,” Trump said at a White House ceremony as he signed the new space policy directive. “We will establish a foundation for an eventual mission to Mars and perhaps someday to many worlds beyond.” The directive calls on NASA to ramp up its efforts to send people to deep space, a policy that unites politicians on both sides of the aisle in the United States. However, it steered clear of the most divisive and thorny issues in space exploration: budgets and timelines.

Space policy experts agree that any attempt to send people to Mars, which lies an average of 140 million miles (225 million kilometers) from Earth, would require immense technical prowess and a massive wallet. The last time US astronauts visited the Moon was during the Apollo missions of the 1960s and 1970s. Trump, who signed the directive in the presence of Harrison Schmitt, one of the last Americans to walk on the Moon 45 years ago, said “today, we pledge that he will not be the last.” The better known Buzz Aldrin, the second man on the Moon after Armstrong and a fervent advocate of future space missions, was also present at the ceremony but not mentioned by Trump during his speech.

[..] Trump vowed his new directive “will refocus the space program on human exploration and discovery,” and “marks an important step in returning American astronauts to the Moon for the first time since 1972.” The goal of the new Moon missions would include “long-term exploration and use” of its surface. “We’re dreaming big,” Trump said. His administration has previously held several meetings with SpaceX boss Elon Musk and Amazon owner Jeff Bezos, who also owns Blue Origin.

The article has two authors, and at least one editor (Reuters), and still it says this: “world temperatures are likely to rise by more than 2 degrees Celsius (35.6°F) this century..

• Exxon To Provide Details On Climate Change Impact To Its Business (R.)

Exxon Mobil on Monday said it would publish new details about how climate change could affect its business in a move aimed at appeasing critics and forestalling another proxy fight next year. The largest U.S. oil and gas producer said in a filing to U.S. securities regulators that its board agreed to provide shareholders with information on “energy demand sensitivities, implications of two degree Celsius scenarios, and positioning for a lower-carbon future.” Scientists have warned that world temperatures are likely to rise by more than 2 degrees Celsius (35.6°F) this century, surpassing a “tipping point” that a global climate deal aims to avert. Exxon’s statement, which came three days before the deadline for its 2018 annual meeting resolution submissions, said additional information would be released in the near future, but did not provide details.

The company’s board originally opposed providing shareholders with a report outlining the potential impact of global warming on Exxon’s long-term outlook. Thomas P. DiNapoli, New York state’s comptroller, heads one the two lead sponsors of a shareholder resolution calling for Exxon to issue a climate-impact report. He called Monday’s decision “a win for shareholders and for the company’s ability to manage risk.” However, another sponsor noted the lack of specificity in the company’s statement. “This is giving no detail,” said Tim Smith, who leads shareholder engagement efforts at Walden Asset Management, a co-filer of last spring’s resolution. He said Exxon’s statement “needs to be expanded to assure shareowners that they’re responsive to last year’s request.”

Apple, Exxon, everybody seeks to escape their own shareholders.

• Apple Aims To Block Climate, Rights Using SEC Guidance (R.)

Apple is pushing back on shareholder proposals on climate issue and human rights concerns, an effort activists worry could sharply restrict investor rights. In letters to the U.S. Securities and Exchange Commission last month, an attorney for the California computer maker argued at least four shareholder proposals relate to “ordinary business” and therefore can be left off the proxy Apple is expected to publish early next year, ahead of its annual meeting. The attorney, Gene Levoff, cited guidance issued by the SEC on Nov. 1 saying that company boards are generally best positioned to decide if a resolution raises significant policy issues worth putting to a vote.

While companies routinely seek permission to skip shareholder proposals, Apple’s application of the new SEC guidance shows how it could be used to ignore many investor proposals by claiming boards routinely review those areas, said Sanford Lewis, a Massachusetts attorney representing Apple shareholders who had filed two of the resolutions. Were the SEC to side with Apple, “this would be an incredibly dangerous precedent that would essentially say a great many proposals could be omitted,” Lewis said. [..] Often seen as distractions in the past, shareholder measures have taken on new significance as big asset managers increasingly back those on areas like climate change or board diversity.

Apple cited the SEC’s new guidance among other things in seeking to omit the shareholder measures from its proxy, according to letters Apple sent to the SEC. These include calls for Apple to take steps such as establishing a “human rights committee” to address concerns on topics like censorship, and for Apple to report on its ability to cut greenhouse gas emissions.

Tusk against the rest. Couldn’t be because he’s Polish, could it? And looking at big jobs back home?!

• EU Could ‘Scrap Refugee Quota Scheme’ (G.)

The EU could scrap a divisive scheme that compels member states to accept quotas of refugees, one of the bloc’s most senior leaders will say this week. The president of the European council, Donald Tusk, will tell EU leaders at a summit on Thursday that mandatory quotas have been divisive and ineffective, in a clear sign that he is ready to abandon the policy that has created bitter splits across the continent. Tusk will set a six-month deadline for EU leaders to reach unanimous agreement on reforms to the European asylum system, but will propose alternatives if there is no consensus. “If there is no solution … including on the issue of mandatory quotas, the president of the European council will present a way forward,” states a draft letter from Tusk to national capitals, seen by the Guardian.

In effect this means scrapping mandatory quotas, because Hungary, Poland and Czech Republic are fiercely opposed to the idea of dispersing refugees around the bloc based on a formula drawn up in Brussels. Tusk is likely to face opposition, however, from other EU bodies, including the European commission. EU leaders introduced compulsory quotas in 2015 at the height of the migration crisis, as thousands of people arrived daily on Europe’s shores, many of whom were refugees from Syria, Iraq and Eritrea. Hungary, Slovakia, Romania and the Czech Republic voted against the move, but the policy was forced through by a majority vote. Hungary and Poland have defied the rest of the EU by not taking a single refugee under the scheme, which aimed to relocate about 120,000 refugees, mainly Syrians. The Czech republic has taken in only 12. All three countries were referred to the European court of justice last week for failing to implement the policy, the usual procedure for flouting EU rules.

All refugees living on Lesbos should be evacuated.

• Lesvos Authorities Block Ship With Container Homes For Refugees (AP)

Authorities on the Greek island of Lesvos say they have blocked a ship carrying container homes for refugees and other migrants in protest at the refusal of the government and the European Union to move more people to Greece’s mainland. A government-chartered ship carrying the containers remained anchored at Mytilene, the island’s main town, on Monday after municipal vehicles were used to block port facilities. The island’s municipal board was due to meet later on Monday to decide on whether to lift the blockade following talks with the government, state-run TV ERT said. The mayors of five Greek islands facing the coast of Turkey are demanding that the government and EU end a policy of containment for migrants – introduced last year as a deterrent against illegal migration – because living facilities are severely overcrowded.

Merkel, the story of a great and bitter failure.

• Germany Rejects Additional Winter Aid For Refugees On Greek Islands (KTG)

The German Foreign Ministry has made it clear that it will not provide additional winter assistance to refugees on the Aegean islands. In a related question from German newspapers, the foreign ministry replied that “responsibility for accommodating and feeding refugees falls under the jurisdiction of each country.” According to dpa, the Foreign Ministry recalled that Berlin recently funded the installation of 135 heated containers for a total of 800 people in two camps in the Thessaloniki region and that the EU has allocated up to now 1.4 billion euros to tackle the refugee crisis in Greece.

Meanwhile, there is media report that Greece has persuaded Turkey to accept migrant returns from the mainland in order to reduce critical overcrowding in its refugee camps. The Kathimerini daily said the agreement came during a strained two-day state visit by Turkish President Recep Tayyip Erdogan this week, during which he angered his hosts with talk of revising borders and complaints about Greece’s treatment of its Muslim minority. The deal is in addition to Turkey’s existing agreement to take back migrants from Aegean island camps, under the terms of an EU-Turkey pact.