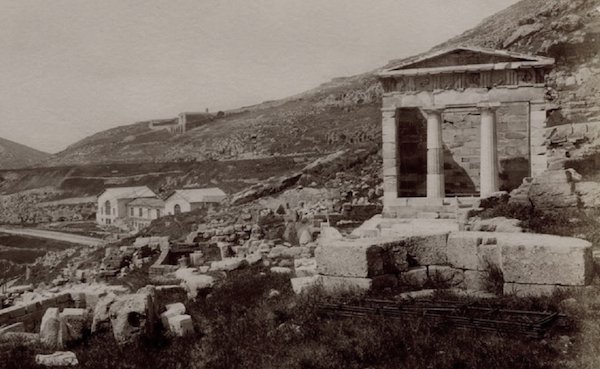

Fratelli Alinari Delphi c1920

They get together to set up a testing group, but carefully far enough removed from their structures to deny any responsibility. “We paid millions into it, but we have no idea what they do”. And they will escape any real punishment. TBTF. Testing carcinogenics on people. In the past 10 years.

• German Carmakers Take Another Hit With Diesel Testing on Monkeys, Humans (BBG)

The reputation of Germany’s auto industry took a fresh hit from revelations it sponsored tests that exposed humans as well as monkeys to diesel exhaust fumes, which can cause respiratory illness and cancer. The study, supported by a little-known group founded by Volkswagen, Daimler and BMW in 2007, had 25 people breathe in diesel exhaust at a clinic used by the University of Aachen, Stuttgarter Zeitung reported Monday. The story, citing annual reports from the European Research Group on Environment and Health in the Transport Sector, or EUGT, which closed last year, followed a New York Times report earlier that the organization also conducted tests using monkeys. Germany’s auto industry, which is still reeling from Volkswagen’s diesel-cheating scandal where the company rigged emissions tests, distanced itself from the organization.

“We are appalled by the extent of the studies and their implementation,” Daimler said Monday in an emailed statement, adding it didn’t have any influence over the study and promised an investigation. “We condemn the experiments in the strongest terms.” The revelations are another bombshell undermining diesel’s image. The technology remains a key profit driver for German automakers, even as demand gradually slips in Europe, the main market for the diesel models. The reports also weaken the carmakers’ position in its efforts to counter criticism of the technology as cities mull bans and German politicians weigh more stringent upgrades to lower pollution levels. In an additional twist, the VW Beetle model used in the test with animals was among the vehicles rigged to cheat on emissions tests, the New York Times reported. Volkswagen apologized for the misconduct and lack of judgment of some individuals, calling the trials a mistake. VW on Monday again distanced itself from the activities of the group.

That rumbling roar in the distance.

• The Risks Facing Global Stocks As Money Printing Comes To An End (BI)

“Correlation does not imply causation” is a vital principle of statistics and numerical models which reminds us that just because two things correlate doesn’t mean one causes the other. For many investors, they’ll be hoping that the correlation shown in the chart below is not a sign for things to come for stock market returns. Because if this correlation holds, things could be about to get nasty. The chart, from Citi, shows the rolling annual change in central bank asset purchases overlaid against annual returns for the MSCI World Stock Market Index since the depths of the global financial crisis back in early 2009. Clearly, as asset purchase levels have changed, so too has the performance of global stocks, tending to rise when asset purchases increase and fall when asset purchases decline.

Until recently that is. As shown in the red circle on the chart, despite a recent deceleration in central bank purchases, stock market returns have actually increased recently, bucking the trend seen over much of the past nine years. “In a world where the global CB taper is well underway — and in any case largely announced — stocks are seemingly starting to decouple from the bearish implication of [the chart],” says Citi. “As we had hoped, in a strong cyclical backdrop, with earnings coming in strong, markets can focus on underlying fundamentals rather than the reduction in central bank accommodation.” Central bank asset purchases set to slow sharply over the next year, as seen in the dotted black line in the chart. If the relationship between asset purchases and stock market returns were to snap back into place, it suggests that stocks could fall by close to 50% over the next year or so. 50%!

To be clear, Citi isn’t saying that’s going to happen, but it is a reminder that we’re entering uncharted territory for financial markets. Ultra-easy monetary policy settings are slowly being reversed, and no one is really certain as to how it will all play out. Adding to the intrigue, it’s clear from this other chart from Citi that while stocks recently disconnected from central bank asset purchases, corporate credit markets have not, with spread compression in investment grade debt starting to reverse in line with lower asset purchases.

Bond yields are already soaring. Does the Fed have any control left, or is this it?

• Fire Sale By The Treasury Could Send Shock Waves Through Bond Market (CNBC)

Wells Fargo’s head of interest rate strategy is detecting a major trouble spot in the bond market. Michael Schumacher’s chief concern right now: Who’s going to buy all those extra Treasury notes? “They [people] are worried about Treasury issuance going up, up, up. You could see an increase in 2018 of 50% — maybe more versus last year. That’s got a lot of people very concerned, myself included,” he said recently on CNBC’s “Futures Now.” He anticipates the Treasury Department will likely announce within days a “pretty significant change” in the way it issues bonds. It comes just as the Fed is shrinking its balance sheet. With less demand coming from the Fed, a fire sale of sorts would increase supply and emerge as the major catalyst causing yields to jump.

“You could see a pretty significant sell-off not just in the 10-year, which people focus on quite a bit, but also on 30-year bonds. We’re very concerned about that,” Schumacher said. “Being the bond nerd that I am, I’d say the market wants to climb a wall of worry like it does in stocks.” Right now, 10-year Treasury yields are bouncing around 2.6% — up nearly 40 basis points during the past six months. Schumacher’s year-end forecast on the note is 2.95%. But he believes it’s not unreasonable to expect rates to push 3.25%. “Something around that level probably does get people pretty worked up. And, it’s such a contrast versus last year when bonds did very, very little,” he said. Yields for 30-year Treasurys, essentially flat for the past six months, appear to be waking up. They’re up about 17 basis points this year.

Too much swamp to be drained.

• The Donald’s Davos Delusions (David Stockman)

[..] above all else, the Donald has whiffed entirely on what is really killing the American economy. That is, the nation’s out-of-control central bank. Via its massive falsification of financial asset prices, the Fed has turned Wall Street into a gambling casino, the corporate C-suites into financial engineering joints and Washington into a profligate den of debt addicts. Likewise, its idiotic pursuit of more inflation (2%) through 100 straight months of ZIRP (or near zero interest rates) has savaged retirees and savers, enriched gamblers and leverage artists, eroded the purchasing power of stagnant worker paychecks and unleashed virulent speculation and malinvestment throughout the warp and woof of the financial system.

Of course, we did not really expect the Donald to take on the money printers – notwithstanding his campaign rhetoric about “one big, fat, ugly bubble”. After all, Trump has always claimed to be a “low interest man” and he did spend 40 years getting the worst financial education possible. To wit, he rode the Fed’s easy money fueled real estate bubble to a multi-billion net worth, or so he claims, and pronounced himself a business genius – mostly by virtue of piling cheap debt upon his properties and reaping the windfall gains. Stated differently, the Donald came to office wholly unacquainted with any notion of sound money and free market financial discipline. And now he has spent a year proving he is completely clueless as to why Flyover America has been shafted economically.

Rather than the top-to-bottom housecleaning that the Eccles Building desperately needed, Trump actually appointed a pedigreed Keynesian crony capitalist Washington lifer, Jerome Powell, to chair the Fed. Then and there, and whether he understood it or not (he didn’t), the Donald surrendered to the permanent rulers of the Imperial City. That’s because at the end of the day, it was the Fed’s serial financial bubbles and massive monetization of the public debt that has enabled Washington’s imperial hegemony abroad, welfare state largesse at home and the egregious inflation of financial asset prices for the rich and the bicoastal elites coupled to them.

Knot is from Holland, an export-dependent country that suffers from a strong euro.

• ECB’s Knot Says QE Must End ‘As Soon As Possible’ (BBG)

The European Central Bank has to end its quantitative easing as soon as possible, according to ECB Governing Council member Klaas Knot, who said there’s not a single reason anymore to continue with the program. “The program has done what could realistically be expected of it,” Knot, who also heads the Dutch Central Bank, said in an interview on the television talk show Buitenhof on Sunday. The ECB is inching closer to unwinding unprecedented stimulus. At their December meeting, officials held out the prospect of a change in policy language early in the year, and some governors have since expressed their favor for taking a first step in March. While President Mario Draghi said Thursday that confidence in a sustained pickup in inflation has increased, patience and persistence are still warranted as progress so far remains muted.

“The program is fixed until September,” Knot said, with Draghi’s reasoning being that the central bank doesn’t have to commit yet to what will happen after that month. “We don’t have to communicate yet that it will be over after September, but I think that’s where we’re headed.” He said there is enough proof to make that clear. [..] Knot said the lack of commitment to any communication by the ECB as to what might happen to the QE program beyond September could have a dampening affect on the euro. A 6% surge in the euro since mid-December is threatening to become a thorn in the economy’s side if it curbs exports and damps prices.

And that’s definitely not enough.

• The ECB And The Euro Are The Only Glue Holding Parts Of Europe Together (CNBC)

Many German political observers estimate that, under the best circumstances, their country is unlikely to have a new three-party coalition government before Easter — April 1. They realize that this might be an optimistic forecast given the fundamental differences separating those who want a status quo stability (two right-wing parties) and a radical change of “governing culture” (the left-wing Social Democratic Party of Germany). Expectations are so dire, and so low, that the unfolding political events in Germany could mean the end of stability in the entire EU. In spite of that, the euro was soaring last Thursday to $1.2537 during the press conference at the European Central Bank. That was the highest reading since the middle of December 2014. And that had little to do with the talking down of the dollar by a U.S. delegation having fun in the Alps.

As of last Friday, the euro was up 16% against the dollar and 5.4% in trade-weighted terms since the Trump administration came to power a year ago. That puzzling paradox of a strong currency in a politically disintegrating economic system owes mainly to the euro area’s improving cyclical growth dynamics, engineered by a supportive monetary policy, and to trading bets ignoring the convulsions of the European project. The project in question has been a difficult work-in-progress for the past 59 years, as the relentless French-German rivalry failed to define mutually acceptable terms for a fairy tale called the European economic and political union. The euro is a result of such a political struggle between the two nations: Fearful of an overwhelming power of a reunited Germany, France insisted on a monetary union to dilute the influence of its erstwhile arch-enemy across the Rhine.

Reluctantly, Germany accepted to part with the Deutsche mark while imposing a legal and institutional infrastructure that would make the euro a clone of it. And to make sure that happened, Germany dictated the rules for the ECB — a supra-national institution and the world’s only genuinely independent monetary authority. Born out of fear of German domination, the euro is, arguably, the only major achievement of a project that was supposed to make another French-German war an impossibility. Still, a war by other means did happen, and France, Italy, Spain, Portugal, Ireland and Greece – 54% of the euro area GDP – have only the ECB to thank for rescuing them from an assault of disastrous German-imposed austerity policies.

When will we talk about making Facebook a public utility?

• Trump Administration Ponders Nationalizing 5G Mobile Network (CNBC)

National security officials in the Trump administration are looking at options where the U.S. government could take over a part of the country’s mobile network as a way of guarding against China, news outlet Axios reported. Axios, citing sensitive documents it obtained, said there are two options up for consideration: First, the U.S. government could pay for and build a single, super-fast mobile network and could then rent access to national carriers. The move, according to Axios, could see an unprecedented nationalization of infrastructure that has historically been privately-owned. But, the news outlet reported, a source familiar with the matter said a newer version of the document is neutral about whether the government should build and own such a network.

The alternative, according to Axios, is that wireless providers in the U.S. build their own 5G networks that would compete with one another — an option the document said could be costly and more time-consuming, but would be less commercially disruptive to the industry. The reason for even considering nationalization of part of the system is that China “has achieved a dominant position in the manufacture and operation of network infrastructure” and it’s “the dominant malicious actor in the Information Domain,” the document said, according to Axios. Reuters reported that a senior administration official on Sunday said that the government wants to build a secure 5G network and it’ll have to work with the industry to figure out the best way to do it. “We want to build a network so the Chinese can’t listen to your calls,” the official told Reuters.

“We have to have a secure network that doesn’t allow bad actors to get in. We also have to ensure the Chinese don’t take over the market and put every non-5G network out of business.” The matter was being debated at a lower level, the official said to Reuters, adding that it would take between six to eight months before it reaches President Donald Trump for consideration. The fifth generation (hence the 5G name) of mobile networks aims to provide faster data speeds and more bandwidth to carry ever-growing levels of web traffic. Late last year, the first specification for 5G was completed, which was considered a huge step toward commercializing the technology. Market watchers have predicted the technology will have more than one billion users by 2023, with more than half based in China. U.S. carriers are already working on deploying 5G networks.

Facebook gets nervous.

• Facebook Makes Privacy Push Ahead Of Strict EU Law (R.)

Facebook said on Monday it was publishing its privacy principles for the first time and rolling out educational videos to help users control who has access to their information, as it prepares for the start of a tough new EU data protection law. The videos will show users how to manage the data that Facebook uses to show them ads, how to delete old posts, and what happens to the data when they delete their account, Erin Egan, chief privacy officer at Facebook, said in a blog post. Facebook, which has more than 2 billion users worldwide, said it had never before published the principles, which are its rules on how the company handles users’ information.

Monday’s announcements are a sign of its efforts to get ready before the European Union’s General Data Protection Regulation (GDPR) enters into force on May 25, marking the biggest overhaul of personal data privacy rules since the birth of the internet. Under GDPR, companies will be required to report data breaches within 72 hours, as well as to allow customers to export their data and delete it. Facebook’s privacy principles, which are separate from the user terms and conditions that are agreed when someone opens an account, range from giving users control of their privacy, to building privacy features into Facebook products from the outset, to users owning the information they share. “We recognize that people use Facebook to connect, but not everyone wants to share everything with everyone – including with us. It’s important that you have choices when it comes to how your data is used,” Egan wrote.

No-one can be surprised by this anymore: “..Rats, mouldy walls, exposed electrical wiring, leaking roofs and broken locks ..” and “..holes in external walls, insect-infested beds, water pouring through ceilings and mould-covered kitchens ..”

• Hundreds Of Thousands Living In Squalid Rented Homes In England (G.)

Rented housing so squalid it is likely to leave tenants requiring medical attention is being endured by hundreds of thousands of young adults in England, an analysis of government figures has revealed. Rats, mouldy walls, exposed electrical wiring, leaking roofs and broken locks are among problems blighting an estimated 338,000 homes rented by people under 35 that have been deemed so hazardous they are likely to cause harm. It is likely to mean that over half a million people are starting their adult lives in such conditions, amid a worsening housing shortage and rising rents, which are up 15% across the UK in the last seven years. Visits by the Guardian to properties where tenants are paying private landlords up to £1,100 a month have revealed holes in external walls, insect-infested beds, water pouring through ceilings and mould-covered kitchens.

A 30-year-old mother near Bristol said her home is so damp that her child’s cot rotted. A 34-year-old woman in Luton told of living with no heating and infestations of rats and cockroaches, while a 24-year-old mother from Kent said she lived in a damp flat with no heating and defective wiring for a year before it was condemned. “Young adults have very little option but to rent from a private landlord, so we should at least expect a decent home in return for what we pay,” said Dan Wilson Craw, director of the Generation Rent campaign group. “Relying on cash-strapped councils to enforce our rights means that too many of us are stuck with unsafe housing.” The extent of the impact on young people emerged as a cross-party bid to give tenants new powers to hit back against rogue landlords gathers strength.

And the House of Commons passed the bill without noticing?!

• UK Brexit Bill ‘Constitutionally Unacceptable’ – House of Lords (Ind.)

An influential group of peers have warned Theresa May’s flagship Brexit legislation is “constitutionally unacceptable” and will need to be substantially rewritten. The stark warning comes as peers in the upper chamber gear up to begin the lengthy process of debating the legislation – passed with a seal of approval from the Commons earlier this month. The EU (Withdrawal) Bill seeks to transpose all existing EU law onto the UK statue book in time for Britain formally leaving the bloc in March 2019. More than 180 members are already lined up to speak during the two-day debate accompanying the legislation’s second reading this Tuesday and Wednesday, and there are likely to be impassioned interventions from both prominent Leave and Remain voices.

But peers on the Lords Constitution Committee warn in a report to be released on Monday that, while the legislation is necessary to ensure legal continuity after Brexit, it has “fundamental flaws” in its current state. The committee claims that at present the bill risks “undermining the legal certainty it seeks to provide” and gives “overly broad” powers to government ministers. Baroness Taylor of Bolton, who chairs the committee, said: “We acknowledge the scale, challenge and unprecedented nature of the task of converting existing EU law into UK law, but as it stands this bill is constitutionally unacceptable. “In our two previous reports we highlighted the issues this raised and we are disappointed that the Government has not acted on a number of our recommendations.

Words fail.

• Australia Unveils Plan To Become One Of World’s Top 10 Arms Exporters (G.)

Australia is set to become one of the world’s largest arms exporters under a controversial Turnbull government plan. The prime minister, Malcolm Turnbull, has unveiled a new “defence export strategy” setting out the policy and strategy to make Australia one of the world’s top 10 weapons exporters within the next decade. Hailing it a job-creating plan for local manufacturers, the Coalition says Australia only sells about $1.5bn to $2.5bn in “defence exports” a year and it wants the value of those exports to increase significantly. It has identified a number of “priority markets”: the Middle East, the Indo-Pacific region, Europe, the United States, the United Kingdom, Canada and New Zealand. It will set up a new Defence Export Office to work hand in hand with Austrade and the Centre for Defence Industry Capability to coordinate the commonwealth’s whole-of-government export efforts and provide a focal point for more arms exports.

A $3.8bn Defence Export Facility, to be administered by the Export Finance and Insurance Corporation, will provide the finance local companies need to help them sell their defence equipment overseas. A new Australian Defence Export Advocate position, set up to support the Australian Defence Export Office, will provide industry with the constant high-level advocacy needed to promote Australian-made weapons overseas. “It is an ambitious, positive plan to boost Australian industry, increase investment, and create more jobs for Australian businesses,” Turnbull said. “A strong, exporting defence industry in Australia will provide greater certainty of investment, support high-end manufacturing jobs and support the capability of the Australian defence force.”

Them’s fighting words. Greece needs debt relief no matter what. Blackmailing the country with it is amoral.

• Greek Debt Relief Will Depend On Continued Reforms – Regling (K.)

If Greece wants to see its debt burden lightened further it must ensure that it enacts agreed-to reforms and be prepared for the supervision of its foreign creditors to continue, European Stability Mechanism (ESM) Managing Director Klaus Regling told Sunday’s Kathimerini in an interview in which he also stressed that markets would like to see the IMF join the country’s third bailout. “If Greece wants additional debt relief, which means for creditor countries to grant something extra, there is the legitimate question that creditor countries would want to make sure that agreed policies are implemented and that there is no backtracking, on promises in relation to the primary surplus for instance, on future tax policies and on privatizations, or on the reduction of non-performing loans,” Regling said.

He added that there would be no additional conditions for further debt relief but that reforms must be fully implemented, noting that greater “ownership” of the bailout program will help achieve this. “Ownership has improved,” he said, adding however that, “sometimes there are still signals that it’s not fully there the way we would like. For example, on privatizations there are different voices.” As for continued foreign supervision of Greece after its scheduled exit from the third bailout in August, Regling said this was “normal,” noting that there is “post-program surveillance” in other countries that borrowed from the ESM. He added that “markets are always happy if a country is under the surveillance of its creditors.”

As for the potential participation of the IMF in Greece’s third bailout, Regling said it was “one of the elements that could play a positive role to further strengthen the good impression that the markets have.” He added, however, that the markets will also “look for statements by the Greek government that show there is real ownership of the program.”