NPC George W. Cochran & Co., 709 14th Street NW, Washington DC 1920

Biggest economic failure in European history.

• Stop Lying To The Greeks — Life Without The Euro Is Great (MarketWatch)

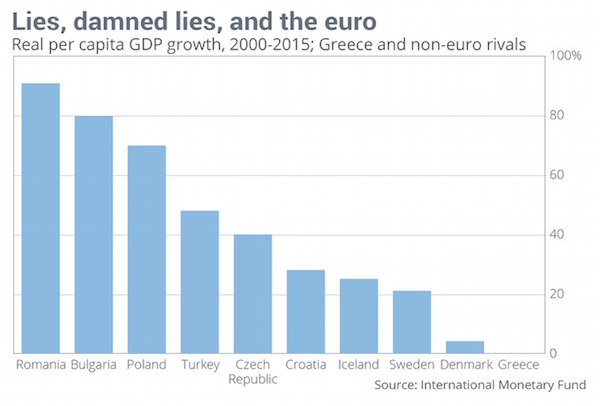

Will the euro-fanatics please stop lying to the people of Greece? And while they’re at it, will they please stop lying to the rest of us as well? Can they stop pretending that life outside the euro — for the Greeks or any other European country — would be a fate worse than death? Can they stop claiming that if the Greeks go back to the drachma, they will be condemned to a miserable existence on the dark backwaters of European life, a small, forgotten and isolated country with no factories, no inward investment and no hope? Those dishonest threats are being leveled this week at the people of Greece, as they gear up for the weekend’s big referendum on more austerity.

The bully boys of Brussels, Frankfurt and elsewhere are warning the Greek people that if they don’t do as they’re told, and submit to yet more economic leeches, they may end up outside the euro … at which point, of course, life would stop. Bah. Take a look at the chart. It compares the economic performance of Greece inside the euro with European rivals that don’t use the euro. Those other countries cover a wide range of situations, of course — from rich and stable Denmark, to former Soviet Union countries, to Greece’s neighbor Turkey, which isn’t even in the EU. But they all have one thing in common.

During the past 15 years, while Greece has been enjoying the “benefits” of having Brussels run their monetary policies, those poor suckers have all been stuck running their own affairs and managing their own currencies (if you can imagine). And you can see just how badly they’ve suffered as a result. They’ve crushed it. Romania, Turkey, Poland, Sweden, Croatia — you name it, they’ve all posted vastly better growth rates than Greece. The data come from the International Monetary Fund itself. It measures growth in gross domestic product, per person, in constant prices (in other words, with price inflation stripped out). Greece adopted the euro in 2001.

And after 14 years in the same club as the big boys, they are back right where they started. Real per-person economic growth over that time: Zero. Meanwhile Romania, with the leu, has only … er … doubled. Everyone else is up. The Icelanders, who suffered the worst financial catastrophe on the planet in 2008, have nonetheless managed to grow. Yes, all data points have caveats. Each country has its own story and its own advantages and disadvantages. But the overall picture is clear: The euro has either caused Greece’s disastrous economic performance, or at least failed to prevent it.

Amen.

• This Euro Is Destroying The European Dream (Guardian)

On Sunday the Greeks vote while the rest of Europe holds its breath. No matter how clunky the wording on the ballot paper, everyone knows what’s at stake. This is a moment of great peril, not only for the euro but for the European project itself. If Greece votes no, it’s hard to see how it can stay in the euro, which will represent the most grievous blow in the 16-year history of a currency whose momentum was always meant to be irreversible. If yes wins, and Syriza duly falls, the victory for the European powers could prove to be pyrrhic. Too many will believe that Brussels, and more pointedly Berlin, engineered the toppling of a democratically elected government.

Once Alexis Tzipras had, admittedly, put a gun to his own head by calling Sunday’s vote, the EU in effect told the Greek nation that the leaders they had chosen just six months ago were unacceptable and had to be removed. The moment will be cited ever after as proof that the EU’s approach to democracy is akin to Henry Ford’s view of consumer choice: you can have whatever colour you like, “so long as it is black”. For things to have reached such a pass – in which Greeks are being asked to select yes for organised penury or no for the chaotic variety – is surely an indictment of the single currency. Any scheme that can result in such a crisis – to say nothing of the stagnant growth, unemployment and poverty that have plagued much of the eurozone since the crash – is bound to be branded an unambiguous failure.

What’s more, it is now acting as a repellent for the European idea itself: witness the rise of populist anti-EU parties in Spain, Italy and beyond. That prompts a question, one that will only get sharper whether the Greeks leave the euro and descend into economic mayhem or stay and suffer back-breaking debt repayments. Is the disaster of the euro strangling the larger European project it was meant to serve? Could it be time to kill off the euro in order to save the European Union?

It’s dead in the water.

• Whatever Happens To Greece, The Euro Is Unsustainable (Kohler)

The latest Greek crisis should end next week after the people surrender this weekend, but Europe’s foundations will continue to weaken: this won’t be the last existential crisis for the euro. Unless greater fiscal and political union accompanies the monetary union, it will eventually, noisily, fall apart. But this crisis, at least, is almost over. The Greeks would vote ‘yes’ on Sunday to almost any question they are asked to get access to what’s left of their euros. Prime Minister Alexis Tsipras will then agree to Germany’s demands for reform against the overruled objections from his party, German cash will start flowing again through the ECB, and Greece’s banks will reopen to sighs of relief all round. Most importantly, funds will be released to repay the IMF.

The eurozone’s mistake was letting the IMF get involved in 2010. The incompetence, or negligence, of its then managing director Dominique Strauss-Kahn, who acted against the advice of many of his member countries (including Australia) and half of its staff, set up Greece for failure. The IMF’s refusal to restructure Greece’s debt in 2010, and instead to insist on crushing austerity in return for more cash, was a terrible mistake. The Eurogroup attempted to repair the situation in 2012 with the restructure that replaced almost all of the private lenders, but the damage to the Greek economy had been done. Ironically, the IMF has changed its mind and is now arguing that Greece needs some debt relief.

Greek Finance Minister Yanis Varoufakis declared this week that he would rather cut off his arm than sign another “pretend and extend” agreement that did not include debt relief, and that he’d resign if the people voted ‘Yes’. Meanwhile the IMF issued this review of Greece’s debt and commented that it needs €60 billion over three years, plus debt relief. The IMF’s central position in the 2010 bailout inserted a hard-line outsider into what had been a cosy arrangement — the 15-year-old European Monetary Union, in which Germany props up the southern countries with loans and they stagger on, burdened with debt, propping up Germany’s export machine. Greece’s failure to make its IMF loan repayment on Tuesday was a disaster for everyone: the IMF, Greece, Germany and the ECB. It is a mistake that should never have happened.

The IMF now has the largest and most prominent delinquent debtor in its history; Greece sits on the edge of catastrophe and Germany, the ECB and the EU are complicit in the threat to the euro itself. They accepted the IMF’s money and conditions in 2010 and now, in reality, it is they who are refusing to repay.

“..why is Syriza getting hell for pushing what both Germany in 2011 and the IMF now admit has to happen in order to have a viable Greek nation>”

• NSA Leak: Both Merkel And Schauble Saw Greek Debt As Unsustainable in 2011 (ZH)

Several days ago, we posted a NSA cable leaked by Wikileaks, in which then French finance minister Moscovici (currently a European commissioner) was admitted that the French economic situation was “worse than anyone [could] imagine and drastic measures [would] have to be taken in the next two years.” It has not improved since then. Overnight, in another perhaps even more relevant to the current quagmire in Greece leak, Wikileaks has released another intercepted NSA communication between German Chancellor Angela Merkel and her personal assistant which reveals that not only Merkel, but Schauble, were well aware that even with a debt haircut (which took place in 2012 but only for private creditors and whose impact was promptly countered with the debt from the second bailout) Greek debt would be unsustainable.

Technically, she did not use that word: she said that “Athens would be unable to overcome its problems even with an additional haircut, since it would not be able to handle the remaining debt.” She was right. And yet here she is, telling Tsipras and the Greek people that all Greece needs is to comply with the existing program when she knows well by her own admission that Greece is insolvent in its current state – precisely what Syriza is arguing and demanding be part of any deal. Because why bother making a deal if Greece will once again be in default a few months down the line, just as Varoufakis said earlier today. But where it gets really humorous is where the cable notes that even “Finance Minister Wolfgang Schaeuble alone continued to strongly back another haircut, despite Merkel’s efforts to rein him in… with IMF Managing Director Christine Lagarde described as undecided on the issue.”

Fast forward to today and now Lagarde is decided, and the IMF admits a 30% Greek haircut is necessary. So, one wonders, why is Syriza getting hell for pushing what both Germany in 2011 and the IMF now admit has to happen in order to have a viable Greek nation. Unless, of course, they don’t want a viable Greek nation, and instead want a vassal state that is constantly on the brink of collapse and thus creating enough systemic risk to constantly push the EUR lower. Because, just in case anyone has forgotten, the real issue here is not the fate of Greece or even the rest of the PIIGS, but how can Germany continue enjoying a currency that is substantially weaker than what a far stronger, and export-crushing Deutsche Mark would be at this very moment.

Ambrose’s bromance with V. grows.

• Varoufakis Prepares For Economic Siege As Companies Issue Private Currencies (AEP)

Greece has stockpiled enough reserves of fuel and pharmaceutical supplies to withstand a long siege, and has set aside emergency funding to cover all the country’s vitally-needed food imports. Yanis Varoufakis, the Greek finance minister, said the left-Wing Syriza government is still working on the assumption that Europe’s creditor powers will return to the negotiating table if the Greek people don’t agree to their austerity demands in a referendum on Sunday. “Luckily we have six months stocks of oil and four months stocks of pharmaceuticals,” he told The Telegraph. Mr Varoufakis said a special five-man committee from the Greek treasury, the Bank of Greece, the trade unions and the private banks is working feverishly in a “war room” near his office allocating precious reserves for top priorities.

Food has been exempted from an import freeze since capital controls were introduced last weekend. Grains, meats, dairy products, and other foodstuffs should be able to enter the country freely, averting a potential disaster as the full tourist season kicks off.

The cash reserves of the banks are dwindling fast as citizens pull the maximum €60 a day allowed under the emergency directive – already €50 at many banks. “We can last through to the weekend and probably to Monday,” Mr Varoufakis said. Despite assurances, the crisis is likely to escalate fast if there is no resolution early next week. Businesses in Thessaloniki and other parts of the country are already creating parallel private currencies to keep trade alive and alleviate an acute shortage of liquidity. [..]The Greek crisis is likely to come to a head one way or another soon after the referendum. The ECB is expected to restore emergency liquidity for the Greek banking system almost immediately if there is a “yes”, an outcome likely to trigger the downfall of the Syriza government and the creation of a national unity administration. The ECB has given strong hints that it will tighten the tourniquet yet further if there is a “no” vote – probably by raising collateral requirement – pushing Greek banks that it also regulates towards the abyss. This is a legal minefield since the ECB has a treaty duty to uphold financial stability. Syriza has said it will consider legal action at the European Court of Justice if this occurs.

Mr Varoufakis warned that the EU institutions are courting trouble if they respond to a democratic vote by the Greek people in such a way. “I find it hard to believe that Europe will continue to insist on an impasse because their own money will go up in smoke,” he said. The eurozone has well over €300bn of exposure in one form or another. Apart from normal bail-out loans, the ECB itself has €27bn of Greek bonds and has extended roughly €120bn in liquidity support through ELA funding for the banks and Target2 payments support. “They are very vulnerable. Target2 becomes a real loss if a country leaves the euro,” he said.

Mason tries to sound tough.

• Yanis Varoufakis, Are You Staying Put? ‘We Have A Duty To The People’ (Mason)

Greek Finance Minister Yanis Varoufakis tells Paul Mason that Syriza has been offered a deal from Greek creditors that the government would sign – but he won’t say where it is.

And he’s right.

• Yanis Varoufakis Accuses Creditors Of Terrorism Ahead Of Referendum (Guardian)

Yanis Varoufakis, the Greek finance minister, has accused the country’s creditors of terrorism, in an interview published on Saturday. “What they’re doing with Greece has a name: terrorism,” Varoufakis told Spain’s El Mundo. “What Brussels and the troika want today is for the yes [vote] to win so they could humiliate the Greeks. Why did they force us to close the banks? To instil fear in people. And spreading fear is called terrorism.” The escalation of his rhetoric comes as Greece prepares to vote on Sunday in the referendum that could decide the country’s continued membership of the eurozone.

The Greek economy is on the brink of collapse after the capital controls imposed before the referendum left the country with shortages of food and drugs, the tourist industry facing a wave of cancellations and banks with barely enough money to survive the weekend. Holding political rallies and publishing new opinion polls are banned 24 hours before the vote, the result of which remains too close to call. Polls have narrowed in recent days after warnings from the European commission and Greece’s eurozone partners that a no vote would lead to Greece’s ejection from the single currency. A GPO poll put the yes voters on 44.1% and no on 43.7%, while an Alco survey found 44.5% would vote yes, with 43.9% intending to vote no.

Many voters have switched to the yes camp since capital controls were imposed this week limiting daily cash machine withdrawals to just €60. Greeks queued once again on Saturday morning to make withdrawals as fears mounted about the state of the country’s economy. Banks said they had a €1bn cash buffer to see them through the weekend – equal to just €90 (£64) a head for Greece’s 11 million people. However, they will need immediate help from the European Central Bank on Monday whatever the result of the referendum.

Should have been done in 2010.

• IMF Backs (Ever So Peculiarly) Syriza Government’s Debt Assessment (Varoufakis)

Debt relief ought to be at the centre of negotiations over a New Deal for Greece. That has been our government’s mantra from 26th of January, our first day on the job. Exactly five months later, on 26th of June, the IMF has conceded the point (as evidenced earlier today by the NYT) – on the very day Prime Minister Alexis Tsipras called for a referendum so that the Greek people could reject an IMF-led proposal that offered no… debt relief. The IMF’s latest debt sustainability analysis (DSA) is a fascinating read. For the first time, the IMF recognised that, in its fifth review assessment, there was a low probability that Greece’s public debt would prove sustainable.

Here is an extract from the IMF’s own report confessing that, to portray Greek public debt as sustainable (without substantial debt relief), its researchers had to make the assumption that “…Greece would go from having the lowest average total factor productivity (TFP) growth in the euro area since it joined the EU in 1981 to having among the highest TFP growth, and that it would go to the highest labor force participation rates and to German employment rates.” Pigs would, of course, sooner fly!

When asked how productivity growth would do the ‘pole vault’ from the euro area’s lowest to the euro area’s highest levels, with employment recovering fully (and in the absence of credit and investment), the IMF’s standard answer is: “To achieve TFP growth that is similar to what has been achieved in other euro area countries, implementation of structural reforms is therefore critical.” But, Chapter 3 of the IMF’s April 2015 World Economic Outlook report tears this assumption to pieces. Indeed, the IMF’s own research shows that labour market reforms have a negative impact on total factor productivity while product market reform has a neutral one.

Damn right.

• The Real Losers From A Greek Exit Won’t Be In Greece (MarketWatch)

Another weekend, another Greek knife’s edge. As the markets close ahead of the weekend, they will be prepared for another couple of days of drama in the epic saga of the Greek debt crisis, looking to see whether the country will vote for or against the latest bailout package in a referendum scheduled for Sunday, and whether that in turn is the trigger its final exit from the euro. We will find out by Monday morning. One thing should be clear, however. Sooner or later, Greece is going to get out of the single currency. And there is a paradox in that which most commentators have so far missed. When the moment comes, the Greeks themselves will be just fine. But the collateral damage will be huge.

Most countries that tumble out of dysfunctional currency unions are back on their feet very quickly. Its victims? It will be a black day for the IMF, for the EU, for German Chancellor Angela Merkel, and for the gold bugs. Their standing may never recover from the blow that a “Grexit” will deliver. The situation in Greece has descended so deep into chaos that it is anyone’s guess what will happen next. It might still be in the euro next week. It might have re-launched the drachma, or a parallel euro. Heck, who knows, perhaps it will have adopted the dollar or the ruble as its currency? Everyone in Athens, Brussels and Berlin seems to be flying blind at this point, and if there is a plan somewhere no one can find it right now. Anything might happen.

Even so, if there is a Grexit, and that seems the most likely option with the banks already closed, and the country already in default, then in fact the country will recover fairly quickly. The Gr-covery will not be long in coming (after which, there should be a ban on smart-alec words starting with “Gr” — they are getting Gr-iresome). Most countries that tumble out of dysfunctional currency unions are back on their feet very quickly. Take Argentina for example. After the dollar peg ended in 2002, between 2003 and 2007 it averaged growth of 8.5% a year. Greece might not quite manage that, but with wage costs equal to Eastern Europe after devaluation, and with all the infrastructure that comes from being in the EU for 30 years, it should do just fine.

Nothing for Greece, but loans for Bulgaria, which is nowhere near the eurozone economically. Hmm…

• ECB Said to Extend Backstop to Bulgaria Amid Greek Fallout (Bloomberg)

The ECB is set to extend a backstop facility to Bulgaria and is ready to assist other nations in the region to ward off contagion from Greece, according to people familiar with the situation. The ECB would provide access to its refinancing operations, offering euros to the banking system against eligible collateral, the people said, asking to remain anonymous because the matter is confidential. The ECB and the Bulgarian central bank declined to comment. Eastern Europe is at risk of tremors from Greece via ties ranging from trade to finance, with lenders from the debt-ridden country owning almost a third of banking assets in Bulgaria. The possibility of Greece abandoning the euro after shutting banks and imposing capital controls has left eastern European currencies among this week’s worst emerging-market performers.

“The threat of ‘Grexit’ has understandably cast a dark cloud over the outlook” for the region, London-based Capital Economics Ltd. said last week in a note. “Ties with Greece are sizable in a few places, including Bulgaria and Romania.” Bulgaria and its banks have been a main focus of concern for European Union officials looking at potential fallout from the Greek crisis in the region, according to people familiar with their thinking. Yields on euro-denominated Bulgarian government debt due 2024 were little-changed at 3.14% Friday, having risen during the past week on Greek concerns.

Decent background.

• Hopeful Start to Greek Debt Negotiations Quickly Soured (NY Times)

Last Friday morning, the Greek prime minister, Alexis Tsipras, gathered his closest advisers in a Brussels hotel room for a meeting that was meant to be secret. All the participants had to leave their phones outside the door to prevent leaks. A week of tense negotiations between Greece and its creditors was coming to an end. And it was becoming increasingly clear to the left-leaning prime minister that he could not accept the tough economic terms that his lenders were demanding in exchange for new loans. As Mr. Tsipras paced and listened on the 25th floor of the hotel, his top aides argued that neither Germany nor the International Monetary Fund wanted an agreement and that they were instead pushing Greece into default and out of the euro.

The night before, at a meeting of eurozone leaders at the EU headquarters, Mr. Tsipras had asked Chancellor Angela Merkel of Germany about including debt relief with a deal, only to be rebuffed again. This is going nowhere, the 40-year-old Greek leader said in frustration, according to people who were in the room with him. The more we move toward them, the more they are moving away from us, Mr. Tsipras said. After hours of arguing back and forth about possible responses, Mr. Tsipras made a decision to get on a plane and go home to call a referendum, according to the people who were in the room. This decision by Mr. Tsipras to ask his people to back or reject, as he had recommended, the latest set of austerity measures for Greece sent shock waves through Europe.

Just days before the Sunday vote, the outcome remained too close to call. Many here, however, now think that a “no” vote would ultimately lead to Greece’s exit from the euro. This referendum will be one of the most important votes in Greece since it became an independent nation in 1830. Why Mr. Tsipras took such an extreme step remains puzzling. But a close look at the events of the last week — based on interviews with some of the participants and others briefed on the discussions — reveals an accumulation of slights, insults and missed opportunities between Greece and its creditors that led the prime minister to conclude that a deal was not possible, regardless of any concessions he might make.

Greece’s creditors see it differently, of course. In their view, Mr. Tsipras, who swept into power on a wave of anti-austerity support, was only interested in a deal that would go light on austerity measures and deliver maximum debt relief. He could not and would not comply with any agreement that required more sacrifices from the Greek people. Still, for a week that ended with so much enmity, its start was auspicious.

Logically, a NO vote in Athens July 5 should mean the end of Merkel, Hollande, Juncker, Dijsselbloem, Schultz, Schäuble, etc. But it won’t, will it?

• How Europe Played Greece (Alex Andreou)

Do these things, they said, for all our sakes and you will return to prosperity with our help. They lied. “They have decided to strangle us, whether we say yes or no”, said a Greek woman to me yesterday. “The only choice we have is to make it quick or slow. I will vote “oxi” (no). We are economically dead anyway. I might as well have my conscience clear and my pride intact.” Her view is not atypical among friends and relations I have canvassed in the last few days. Trust has evaporated. Faith in European Institutions is thin on the ground. Lines have been crossed. At times of financial strain, a country’s currency issuer, its central bank, should act as lender of last resort and prime technocratic negotiator. In Greece’s case, the European Central Bank, sits on the same side as the creditors; acts as their enforcer.

This is unprecedented. The ECB has acted to asphyxiate the Greek economy – the ultimate blackmail to force subordination. The money is there, in our accounts, but we cannot have access to it, because the overseers of our own banking system, the very people who some months ago issued guarantees of liquidity, have decided to deny liquidity. We have phantom money, but no real money. There is a terrifying poetry to that, since the entire crisis was caused by too much phantom money in the first place. EU Institutions are now openly admitting that their aim is regime change. A coup d’état in anything by name, using banks instead of tanks and a corrupt media as the occupiers’ broadcaster. The rest of Europe stands back and watches. Those leaders who promised the Syriza government support before the election, have ducked for cover.

I understand it. They sympathise, but they don’t want to be next. They are honourable cowards. They look at the punishment beating being meted out and their instinct is to protect their own. Many people within Greece have the same reaction. “[Tsipras] is an idealist”, a friend wrote, “but I don’t know whether idealism has the power to change reality. Life has shown me the opposite to be true. I will vote “yes”, with tears in my eyes. I will be another Brutus.” This tacit collusion, both within Greece and around Europe and the World, with the economic waterboarding being administered to a country on its knees, is made possible by a single politically expedient narrative: That Greece deserves to suffer and should just pay its debts. It is the single most common comment I have had on social media. And the most bitter to swallow.

Vehemently denied by V.

• Greek Banks Prepare Plan To Raid Deposits To Avert Collapse (FT)

Greek banks are preparing contingency plans for a possible “bail-in” of depositors amid fears the country is heading for financial collapse, bankers and businesspeople with knowledge of the measures said on Friday. The plans, which call for a “haircut” of at least 30 per cent on deposits above €8,000, sketch out an increasingly likely scenario for at least one bank, the sources said. A Greek bail-in could resemble the rescue plan agreed by Cyprus in 2013, when customers’ funds were seized to shore up the banks, with a haircut imposed on uninsured deposits over €100,000. It would be implemented as part of a recapitalisation of Greek banks that would be agreed with the country’s creditors — the EC,IMF and ECB.

“It [the haircut] would take place in the context of an overall restructuring of the bank sector once Greece is back in a bailout programme,” said one person following the issue. “This is not something that is going to happen immediately.” Eurozone officials said no decision had been taken to wind up any Greek banks or initiate a bail-in of depositors, a process that would be started by the ECB declaring the banks insolvent or pulling emergency loans. Greece’s banks have been closed since Monday, when capital controls were imposed to prevent a bank run following the leftwing Syriza-led government’s call for a referendum on a bailout plan it had earlier rejected. Greece’s highest court rejected an appeal by two citizens on Friday who had asked for the referendum to be declared unconstitutional.

Depositors can withdraw only €60 a day from bank ATM cash machines, while requests to transfer funds abroad have to be approved by a special finance ministry committee in co-operation with the Greek central bank. Two senior Athens bankers said the country had only enough cash to keep ATMs supplied until the middle of next week. This followed the ECB’s decision this week not to increase Greece’s allocation of emergency liquidity assistance after the bailout programme ended on June 30.

“..a dispute between Brussels and the IMF that has been simmering behind closed doors for months.” What’s Lagarde’s role in all this?

• Europeans Tried To Block IMF Debt Report On Greece (Reuters)

Euro zone countries tried in vain to stop the IMF publishing a gloomy analysis of Greece’s debt burden which the leftist government says vindicates its call to voters to reject bailout terms, sources familiar with the situation said on Friday. The document released in Washington on Thursday said Greece’s public finances will not be sustainable without substantial debt relief, possibly including write-offs by European partners of loans guaranteed by taxpayers. It also said Greece will need at least €50 billion in additional aid over the next three years to keep itself afloat. Publication of the draft Debt Sustainability Analysis laid bare a dispute between Brussels and the IMF that has been simmering behind closed doors for months.

Greek Prime Minister Alexis Tsipras cited the report in a televised appeal to voters on Friday to say ‘No’ to the proposed austerity terms, which have anyway expired since talks broke down and Athens defaulted on an IMF loan this week. It was not clear whether an arcane IMF document would influence a cliffhanger poll in which Greece’s future in the euro zone is at stake with banks closed, cash withdrawals rationed and commerce seizing up. “Yesterday an event of major political importance happened,” Tsipras said. “The IMF published a report on Greece’s economy which is a great vindication for the Greek government as it confirms the obvious – that Greek debt is not sustainable.”

At a meeting on the IMF’s board on Wednesday, European members questioned the timing of the report which IMF management proposed at short notice releasing three days before Sunday’s crucial referendum that may determine the country’s future in the euro zone, the sources said. There was no vote but the Europeans were heavily outnumbered and the United States, the strongest voice in the IMF, was in favor of publication, the sources said.

According to Der Spiegel, Merkel’s big mistake is not taking a harder line with Greece. Oh, and Tsipras is a radical idiot.

• Angela’s Ashes: How Merkel Failed Greece and Europe (Spiegel)

Angela Merkel relishes her reputation as queen of Europe. But she hasn’t learned how to use her power, instead allowing a bad situation to heat up to the boiling point. Her inability to take unpopular stances badly exacerbated the Greek crisis. Angela Merkel was already leaving for the weekend when she received the call that would change everything. The chancellor had just had a grueling day, spending all of it in meetings with Greek Prime Minister Alexis Tsipras – sometimes as part of a larger group, and others with only him and French President François Hollande. They discussed debt restructuring and billions of euros in additional investments. When it comes to issues important to him, Tsipras can be exhaustingly stubborn.

In the end, though, Merkel was left with the feeling the EU summit was the milestone that could quite possibly mark a turn for the better. Martin Schulz, president of the European Parliament, had pulled Merkel aside in Brussels and whispered to her that Tsipras was seeking allies in the opposition, with whom he could push a reform program through Greek parliament even without the consent of the radical wing of Syriza, if necessary. “Can you help me?” Tsipras had asked Schulz. Schulz has good connections in the Social Democratic PASOK Party. But when Merkel returned to Berlin, she received a call from Tsipras. He told her that he was not interested in a deal, but that he intended to hold a referendum in Greece first. A short time later, he tweeted: “With a clear ‘NO,’ we send a message that Greece is not going to surrender.”

Merkel is known for not being easily fazed. She has made it this far in part because she has firm control of her emotions. And she remained silent throughout the weekend. But at a Monday meeting of leading members of her Christian Democratic Union (CDU), she hinted at the depth of her disappointment in Tsipras. His policies are “hard and ideological,” she said, adding that he is steering his country into a brick wall “with his eyes wide open.” Merkel had always described Tsipras as a man who, while leading a crazy organization, was quite open and accommodating in person. She had hoped that Tsipras would ultimately help reason prevail. Now, though, it appears that he has handed Merkel the greatest debacle of her tenure as chancellor.

In the end, of course, it will primarily be the fault of the radical Greek government if the country is ejected from the euro zone. How should one deal with a prime minister who conducts negotiations using the language of military mobilization? “We have justice on our side. If we can overcome fear, then there is nothing left to fear,” Tsipras tweeted on Monday. But the divide that is now opening up in Europe also has something to do with Merkel’s leadership style – and with her idiosyncrasy of allowing things to drift for extended periods. This method works when it comes to negotiating a compromise, and when everyone involved is interested in a favorable outcome. But it reaches its limits when someone like Tsipras is determined to carry things to the extreme.

“Throughout the crisis, European elites have faced a simple choice: Acknowledge and explain to electorates their own mistakes, or revert to a much older playbook and manufacture scapegoats. Such tiny, tiny people.”

• Greece (Steve Randy Waldman)

The fact of the matter is no country, not Germany, not France, would voluntarily put up with the sort of “adjustment” that has been forced on Greece, for the good reason that gratuitous great depressions are not actually helpful to an economy. Creditors have had five years to mismanage Greece and they’ve done a startlingly effective job. Syriza has had five months to object. However much you may dislike their negotiating style, however little you think of their competence, Greece’s catastrophe was not Syriza’s work. If creditors respond to Syriza’s “intransigence” with maneuvers that cause yet more devastation, that will be on the creditors. Blaming victims for having insufficiently perfect leaders is standard fare for apologists of predation.

Unfortunately, understanding this may be of little comfort to the disemboweled prey. Europe’s creditors are behaving exactly as one might naively predict private creditors would behave, seeking to get as much blood from the stone as quickly as possible, indifferent to the cost in longer-term growth. And that, in fact, is a puzzle! Greece’s creditors are not nervous lenders panicked over their own financial situation, but public sector institutions representing primarily governments that are in no financial distress at all. They really shouldn’t be behaving like this.

I think the explanation is quite simple, though. Having recast a crisis caused by a combustible mix of regulatory failure and elite venality into a morality play about profligate Greeks who must be punished, Eurocrats are now engaged in what might be described as “loan-shark theater”. They are putting on a show for the electorates they inflamed in order to preserve their own prestige. The show must go on. Throughout the crisis, European elites have faced a simple choice: Acknowledge and explain to electorates their own mistakes, which do not line up along national borders of virtue and vice, or revert to a much older playbook and manufacture scapegoats. Such tiny, tiny people.

They’re really fed up with Europe.

• Greek Mass Psychology Of Revolt Will Survive Financial Carpet-Bombing (Mason)

When Times correspondent George Steer entered the city of Guernica in April 1937, what struck him were the incongruities. He noted precisely the bombing tactics “which may be of interest to students of the new military science”. But his report begins with a long paragraph describing the city’s ceremonial oak tree and its role in the Spanish feudal system. Sitting in Athens this week, I began to understand how Steer felt. Sunday’s referendum will take place under a kind of financial warfare not seen in the history of modern states. The Greek government was forced to close its banks after the European Central Bank, whose job is technically to keep them open, refused to do so. The never-taxed and never-registered broadcasters of Greece did the rest, spreading panic, and intensifying it where it had already taken hold.

When the prime minister made an urgent statement live on the state broadcaster, some rival, private news channels refused to cut to the live feed. Greek credit cards ceased to work abroad. Some airlines cancelled all ticketing arrangements with the country. Some employers laid off their staff. One told them they would be paid only if they turned up at an anti-government demonstration. Martin Schulz, the socialist president of the European parliament, called for the far-left government to be replaced by technocrats. And the Council of Europe declared the referendum undemocratic. With ATM cash limited to €60 a day, one shopkeeper described the effect on her customers: on day one, panic buying; day two, less buying; day three, terror; day four, frozen.

The words you find yourself using in reports, after looking into the eyes of pensioners and young mothers, make the parallel with conflict entirely justified: terror, fear, flight, panic, uncertainty, sleeplessness, anxiety, disorientation. If the effect was to terrorise the population, it has only half worked. The pollsters are simply finding what Greek political scientists already know: society is divided, deeply and psychologically, between left and right.

Draghi should be dragged before a court for this. How about The Hague?

• Greek Economy Close To Collapse As Food And Medicine Run Short (Guardian)

Greece’s economy is on the brink of collapse after the capital controls imposed ahead of Sunday’s referendum left the country with shortages of food and drugs, the tourist industry facing a wave of cancellations and banks with barely enough money to survive the weekend. Banks said they had a €1bn cash buffer to see them through the weekend – equal to just €90 (£64) a head for the 11 million-strong population – and would require immediate help from the ECB on Monday whatever the result of the referendum, in which the two sides are running neck and neck. Alexis Tsipras, Greece’s prime minister, was fighting for his political life on Friday night, using a rally to say that a no vote would enable him to negotiate a reform-for-debt-relief deal with the country’s creditors.

The survival of the Syriza coalition, formed just over five months ago to repudiate five years of austerity programmes, was in doubt as Greece started to suffer shortages of basic provisions, including the sale of vital drugs in pharmacies nationwide. Food staples, such as sugar and flour, were also fast running out on Friday as consumers started to feel the effect of the restrictions. “We have shortages,” said Mary Papadopoulou, who runs a pharmacy in the picturesque district of Plaka beneath the ancient Acropolis. “We’ve run out of thyroxine [thyroid treatment] and unless things change dramatically we’ll be having a lot more shortages next week.”

Greek islands, where thousands of holidaymakers headed this week, have also been hit, with popular Cycladic destinations such as Mykonos and Santorini reporting shortages of basic foodstuffs. More than half of Greece’s food supplies – and the vast majority of pharmaceuticals – are imported, but with bank transfers now banned, companies are unable to pay suppliers. Queues were reported at every cash machine in Athens on Friday night and business groups warned that the economic shutdown in the week since Tsipras called the referendum had already caused lasting damage to the economy. “Imports, exports, factories, firms, transport – everything is frozen,” said Vasilis Korkidis, who heads the national Confederation of Hellenic Commerce. “The only sectors in demand are food and fuel.”

Crazy that there still is one.

• US Shale Drillers’ Safety Net Is Vanishing (Bloomberg)

The insurance protecting shale drillers against plummeting prices has become so crucial that for one company, SandRidge Energy Inc., payments from the hedges accounted for a stunning 64% of first-quarter revenue. Now the safety net is going away.

The insurance that producers bought before the collapse in oil — much of which guaranteed minimum prices of $90 a barrel or more — is expiring. As they do, investors are left to wonder how these companies will make up the $3.7 billion the hedges earned them in the first quarter after crude sunk below $60 from a peak of $107 in mid-2014.“A year ago, you could hedge at $85 to $90, and now it’s in the low $60s,” said Chris Lang, a senior vice president with Asset Risk Management, a hedging adviser for more than 100 exploration and production companies. “Next year it’s really going to come to a head.” The hedges staved off an acute shortage of cash for shale companies and helped keep lenders from cutting credit lines, many of which are up for renewal in October. With drillers burdened by interest payments on $235 billion of debt, $89 billion of it high-yield, a U.S. regulator has warned banks to beware of the “emerging risk” of lending to energy companies.

Payments from hedges accounted for at least 15% of first-quarter revenue at 30 of the 62 oil and gas companies in the Bloomberg Intelligence North America Exploration and Production Index. Revenue, already down 37% in the last year, will fall further as drillers cash out contracts that paid $90 a barrel even when oil fell below $44. West Texas Intermediate for August delivery added 78 cents to $57.74 a barrel on the New York Mercantile Exchange at 10:45 a.m. New York time. Hedges purchased from banks or other traders allow drillers to lock in a sale price. Some guarantee a specific value. Others ensure a minimum payment regardless of how much the market moves, but require the oil company to pay some of it back if the price exceeds a certain threshold.

Home › Forums › Debt Rattle July 4 2015