John Vachon Hull-Rust-Mahoning, largest open pit iron mine in the world, Hibbing, Minnesota 1941

Otherwise known as deflation.

• 4 Telltale Signs The Credit Cycle Is Turning Now (Zero Hedge)

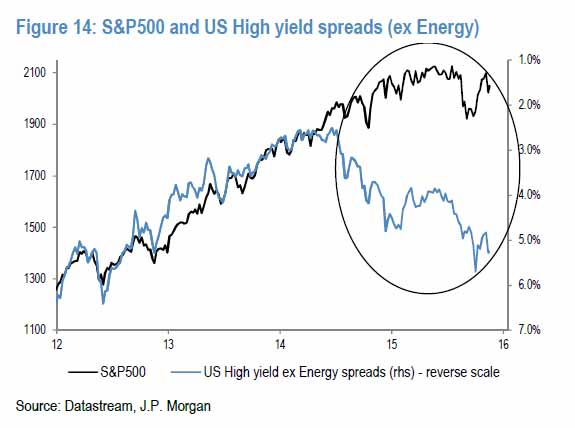

Earlier today, the FT wrote an article in which it found that “companies have defaulted on $78bn worth of debt so far this year, according to Standard & Poor’s, with 2015 set to finish with the highest number of worldwide defaults since 2009” which together with a chart we have been showing for the past year, namely the staggering disconnect between junk bond yields and the S&P500… has made many wonder if the credit cycle – a key leading indicator to economic inflection points and in the case of the last credit bubble, the Great Financial Crisis – has already turned. According to a recent analysis by Ellington Management, the answer is a resounding yes. [..] Ellington concludes: “once “fickle investors exit the market, high yield bonds and leveraged loan prices should settle at a supply/demand equilibrium well below today’s levels.”

Telltale Signs the Credit Cycle is Turning Now

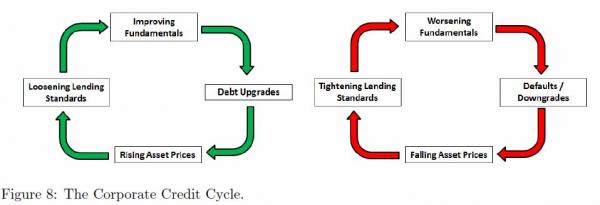

We believe that we are now at the end of the “over-investment” phase of the corporate credit cycle in the US that has been playing out since the depths of the GFC. This view is supported by a number of telltale signs of a reversal in the credit cycle:

Worsening Fundamentals – Declining corporate profits, record levels of corporate leverage, and an elevated high yield share of total corporate debt issuance

Defaults/Downgrades – Credit rating downgrades at a pace not seen since 2009

Falling Asset Prices – Price deterioration in the lowest quality loans and the most junior CLO tranches

Tightening Lending Standards – Weak investor appetite for new distressed debt issues, declines in CLO and CCC HY bond issuance, and tightening in domestic bank lending standards

Similar stocks vs junk bonds data. But do note the differences in the graphs too, in the 2012-14 period.

• This Chart Should Put Stock Investors On High Alert (MarketWatch)

The continued downtrend in the high-yield bond market is warning that liquidity is drying up, which could bode very badly for the stock market. When financial markets are flooded with liquidity, investors tend to feel safer about investing in riskier, higher-yielding assets, like noninvestment grade, or “junk,” bonds, and stocks. When the flow of money slows, the appetite for risk tends to decrease as well. That’s why many stock market watchers keep a close eye on the longer-term trends in the high-yield bond market. If money is flowing steadily into junk bonds, investors are likely to be just as willing, if not more willing, to buy equities.

When money is coming out of junk bonds, like the chart below shows, many see that as a warning that investors could start selling stocks. “High yield corporate bonds are thought by many to behave like the rest of the bond market, but they actually behave a lot more like the stock market,” Tom McClellan, publisher of the investment newsletter McClellan Market Report, wrote in a recent note to clients. “And when high-yield bonds start to suffer, that is usually a reliable sign that liquidity is drying up, and bad times are about to come for the stock market.”

Oh, well, they’ll have to buy the ones China will be selling.

• There’s a Big Drop in US Treasury Debt Supply Coming in 2016 (BBG)

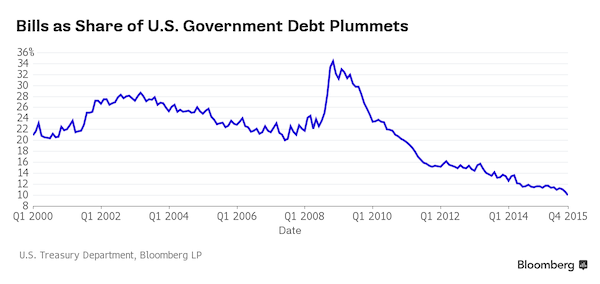

Lost in the debate over the U.S. Treasury market’s resilience as the Federal Reserve starts to raise interest rates is one simple fact: supply is falling – and fast. Net issuance of U.S. notes and bonds will tumble 27% next year, according to estimates by primary dealers that are obligated to bid at Treasury debt auctions. The $418 billion of new supply would be the least since 2008. While a narrowing budget deficit is reducing the U.S.’s funding needs, the Treasury has shifted its focus to T-bills as post-crisis regulations prompt investors to demand a larger stock of short-term debt instead. The drop-off in longer-term debt supply may keep a lid on yields, providing another reason to believe Fed Chair Janet Yellen can end an unprecedented era of easy money without causing a jump in borrowing costs that derails the economy.

“Longer-term yields will be slower to move up next year because the Treasury will be funding more with bills,” said Ward McCarthy, the chief financial economist at Jefferies, who has analyzed U.S. debt markets for over three decades and was a senior economist at the Richmond Fed. “There is also a global appetite for Treasuries as U.S. debt is one of the world’s highest-yielding and is among the most liquid markets.” Excluding bills, Jefferies forecasts net issuance of $404 billion in 2016, down from their $607 billion estimate for this year. Of the ten estimates compiled by Bloomberg, the Bank of Montreal was the lone primary dealer calling for an increase in 2016. Net issuance of interest-bearing securities, or those with maturities from two years to 30 years, has fallen every year since the U.S. borrowed a record $1.61 trillion in 2010, data compiled by the Securities Industry and Financial Markets Association show.

After the market for Treasuries more than doubled since the financial crisis to $12.8 trillion as the government ran deficits to bail out banks and support the economy, the U.S. has started to scale back supply. One reason is the narrowing budget gap. With the Fed holding its benchmark rate near zero since December 2008, the jobless rate has fallen by half from its post-crisis peak in 2009, to 5% today. As tax revenue increases, the Congressional Budget Office forecasts the shortfall will narrow to $414 billion in the fiscal year ending Sept. 30, 2016, from $439 billion in the previous 12 months and $483 billion in the prior annual period. To lock in record-low long-term borrowing costs, the government has also lengthened the average maturity of its debt to 5.8 years from 4.1 years at the end of 2008. One consequence is that the Treasury market’s share of bills has shrunk to about 10%, the smallest in Bloomberg data going back to 1996.

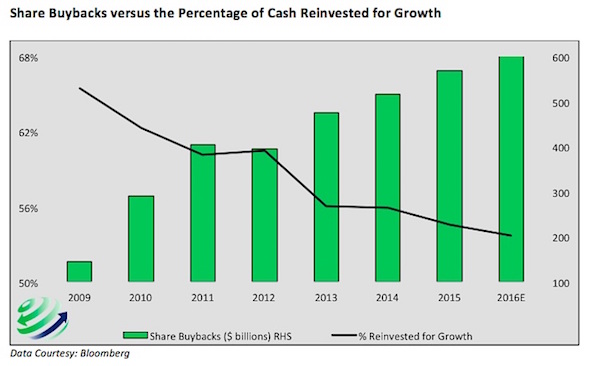

Perverse incentives 101. How corporate America blows itself up.

• Perverse Incentives : Stock Buybacks Blow Up Corporate America (Lebowitz)

Vast swaths of the population in the United States are not enjoying the benefits of the so-called post-crisis recovery. Meanwhile, the top executives of major corporations are prospering in a way never before seen. This contrast between the rich becoming ultra-rich and the rest of the population stagnating at best, was a characteristic of the pre-depression “Roaring 20’s” as well. A report issued by the Economic Policy Institute on CEO pay highlights that in 2014 the CEO-to-worker compensation ratio was 303X compared with 58x in 1989 and 20X in 1965. The exponential rise in executive compensation has occurred in both relative and absolute terms. From 1978 to 2014, inflation-adjusted CEO compensation increased 997%, almost double the rise in stock market value.

When compared with other highly paid workers (defined as those earning more than 99.9% of other wage earners), CEO compensation was 5.84 times greater. The rate at which CEO compensation outpaced the top 0.1% of wage earners reflects the power of CEO’s to extract “concessions” rather than an outsized contribution to productivity. The composition of executive pay has gone from one predominately salary based with less than 15% stock and option rewards in the mid-1960’s to one heavily dependent on stock and option rewards averaging well over 80% in 2013. These stock-based incentives make executives highly motivated to keep their stock price elevated at all costs.

The compensation structure in conjunction with the rise in pressure from Wall Street and investors to keep stock prices elevated arguably leads to short-term decision-making that ultimately does not afford proper consideration of the long-term problems those decisions create. One of the most prevalent ways in which executives can carry out such a compensation-maximizing scheme is through share buybacks. Share buybacks as a percentage of corporate use of cash are at near-record levels and rising rapidly. In a market where all major indices and the majority of publicly-traded company shares are near all-time highs, the proper question is, why? As Warren Buffett wrote in his 1999 letter to shareholders, “Managements, however, seem to follow this perverse activity (buy high, sell low) very cheerfully.”

It is vital to give proper consideration to the improper liberties that are being taken by those with “unwarranted influence” and “misplaced power”. Value extraction has replaced value creation in pursuit of short-term, self-serving benefits at the expense of long-term stability and durability of corporate America and therefore the country as a whole.

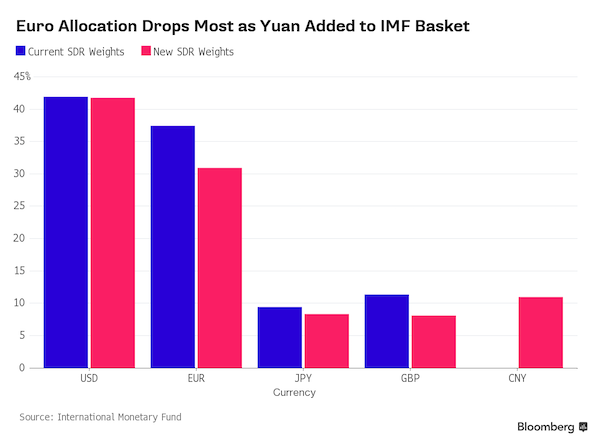

It’s going to be interesting to see what happens when China falls into recession. Will the IMF be inclined to pretend to believe Beijing’s ‘official’ numbers because otherwise it would look dumb? Or will it insist on real data and stifle Xi that way?

• IMF Approves Reserve-Currency Status for China’s Yuan (BBG)

The IMF will add the yuan to its basket of reserve currencies, an international stamp of approval of the strides China has made integrating into a global economic system dominated for decades by the U.S., Europe and Japan. The IMF’s executive board, which represents the fund’s 188 member nations, decided the yuan meets the standard of being “freely usable” and will join the dollar, euro, pound and yen in its Special Drawing Rights basket, the organization said Monday in a statement. Approval was expected after IMF Managing Director Christine Lagarde announced Nov. 13 that her staff recommended inclusion, a position she supported. It’s the first change in the SDR’s currency composition since 1999, when the euro replaced the deutsche mark and French franc.

It’s also a milestone in a decades-long ascent toward international credibility for the yuan, which was created after World War II and for years could be used only domestically in the Communist-controlled nation. The IMF reviews the composition of the basket every five years and rejected the yuan during the last review, in 2010, saying it didn’t meet the necessary criteria. “The renminbi’s inclusion in the SDR is a clear indication of the reforms that have been implemented and will continue to be implemented and is a clear, stronger representation of the global economy,” Lagarde said Monday during a press briefing at the IMF’s headquarters in Washington. Renminbi is the currency’s official name and means “the people’s currency” in Mandarin; yuan is the unit.

The addition will take effect Oct. 1, 2016, with the yuan having a 10.92% weighting in the basket, the IMF said. Weightings will be 41.73% for the dollar, 30.93% for the euro, 8.33% for the yen and 8.09% for the British pound. The dollar currently accounts for 41.9% of the basket, while the euro accounts for 37.4%, the pound 11.3% and the yen 9.4%.

Sorry, but that’s not quite true. Sterling loses more, percentage wise. It goes to 8.09% from 11.3%, while the euro moves to 30.93% from 37.4%.

• Euro to Bear Brunt of Yuan’s Inclusion in Reserve-Currency Club (BBG)

The euro’s worst year in a decade is looking even grimmer after the Chinese yuan’s inclusion in the IMF’s basket of reserve currencies. The 19-nation currency’s weighting in the IMF’s Special Drawing Rights basket will drop to 30.93%, from 37.4%, the organization said Monday. The yuan will join the dollar, euro, pound and yen in the SDR allocation from Oct. 1, 2016, at a 10.92% weighting. The euro has tumbled 13% against the dollar this year, the most in a decade, and central banks have reduced the proportion of the currency in their reserves to the lowest since 2002. ECB Mario Draghi signaled on Oct. 22 that policy makers are open to boosting stimulus, after embarking on a €1.1 trillion asset-purchase program in March. “The euro will get the most impact from this weight adjustment,” said Douglas Borthwick at New York-based brokerage Chapdelaine. “The IMF is taking from euro to give to China; the other rebalancing amounts are largely negligible.”

How you can write that without adding that this is true everywhere, I don’t get it. “..[a] yawning gap between capacity and demand is what’s driving the precipitous fall in prices..”

• No QE: Easy Money Is The Source Of China’s Problems, Not The Solution (Balding)

The first of the month means one thing in China: more gloomy numbers. On Tuesday, the official purchasing managers’ index fell to its weakest level in three years. If analysts aren’t panicking, that’s partly because the benchmark lending rate still stands at 4.35%. The central bank has plenty of room to juice the economy with rate cuts, as its counterparts in the U.S., Japan and Europe have done for years. That assumption, however, may be flawed. The People’s Bank of China has already slashed rates six times in a year, without producing any uptick in growth. To the contrary, deflationary pressures remain intense: Factory-gate prices have declined for four years running, falling 6% annually. Further easing might actually make the problem worse, not better.

This flies in the face of post-crisis orthodoxy. Since 2009, as inflation rates have converged to zero and growth slowed across the world, central bankers have almost uniformly sought to stimulate their economies using various loose-money policies. The Fed, Bank of Japan and ECB have all lowered interest rates and made more credit available in hopes of spurring investment and demand. Though inflation remains subdued in the major developed economies, the underlying logic behind quantitative easing hasn’t been seriously questioned. The consensus is that without these radical interventions, the world’s biggest economies would be in even worse shape than they are.

China is in a category of its own, however. Its reaction to the financial crisis – much praised at the time – was to launch a credit-fueled investment-and-construction binge. Using borrowed capital to build roads, airports, factories and homes at a frenzied pace has created massive overcapacity throughout the economy. To take just one example, China will install around 14 gigawatts of solar panels in 2015. Yet domestic panel-manufacturing capacity dwarfs this number: According to the Earth Policy Institute, in 2014 Chinese manufacturers produced 34.5 gigawatts of solar panels. The world as a whole only installed 38.7 gigawatts that year. In other words, Chinese manufacturers alone could meet nearly 90% of global demand.

This yawning gap between capacity and demand is what’s driving the precipitous fall in prices. A recent Macquarie report found that the Chinese steel industry is losing around 200 yuan ($31) per ton because its mills are churning out too much steel. One might think manufacturers would scale back production to bring things into balance. But as Macquarie notes, “mills are concerned about losing market share and having to spend fresh capital to resume operation if they stop producing now.” At the same time, Chinese “banks have been pushing mills to stay in the market so they don’t have to admit large bad loans.”

Not going well.

• China Manufacturing At Three-Year Low (AFP)

A key measure of China’s manufacturing activity dropped to its weakest level in more than three years in November, underlining weaknesses in the world’s second-largest economy. The official Purchasing Managers’ Index (PMI), which tracks activity in the crucial factories and workshops sector, fell to 49.6, the government statistics bureau said. It was the fourth consecutive month of decline and the lowest figure since August 2012. Investors closely watch the index as a barometer of the country’s economic health. A reading above 50 signals expanding activity while anything below indicates shrinkage. The statistics bureau blamed the disappointing figure on weak overseas and domestic demand, falling commodity prices and manufacturers’ reluctance to restock.

“Facing downward pressures on the economy, companies’ buying activities slowed and their will to restock was insufficient,” it said. China’s economy expanded 7.3% in 2014, the slowest pace since 1990, the government says, and at 7% in each of the first two quarters of this year. Officials say it decelerated further to 6.9% in the July-September period, its slowest rate since the aftermath of the financial crisis. But those statistics are widely doubted and many analysts believe the real rate of growth could be several percentage points lower. The government has depended on monetary loosening to stimulate growth. In October it cut interest rates for the sixth time in a year and abolished the official cap on interest rates for savers.

Can Beijing still bail them out now it’s in the SDR basket?

• The Debt Deadlines Faced By 5 Chinese Firms With Alarming Cash Problems (BBG)

A chemical producer, chicken processor, a sausage maker, a tin smelter and a coal miner have something in common. Surging losses and high leverage have prompted brokerages to put red flags on their debt. China International Capital, Guotai Junan Securities and Haitong Securities all flagged the five companies’ liquidity risks this month after China Shanshui Cement Group Co. became at least the sixth firm to default in the onshore bond market on Nov. 12. Corporate notes are suffering, with the yield premium for five-year AA- rated debentures over the sovereign widening 19.8 basis points this month, the most this year.

“One of the triggers for a financial crisis in China would be high-profile corporate defaults, which could change a deep-rooted mindset among investors that the government would always stand behind troubled companies,” said Xia Le at Banco Bilbao Vizcaya Argentaria“Then a panic would follow.” Premier Li Keqiang has pledged to weed out zombie companies to help restructure the economy while trying to prevent a hard landing amid the worst slowdown in a quarter century. A Chinese producer of pig iron, Sichuan Shengda Group said on Thursday it may not be able to repay bonds next month if investors demand their early redemption. Fertilizer maker Jiangsu Lvling Runfa Chemical is asking its guarantor to repay debt due Dec. 4. The following is a list of other companies wrestling with high debt and low liquidity, according to CICC, Guotai Junan and Haitong.

The madness is far from over, though. It could be in a split second, mind you.

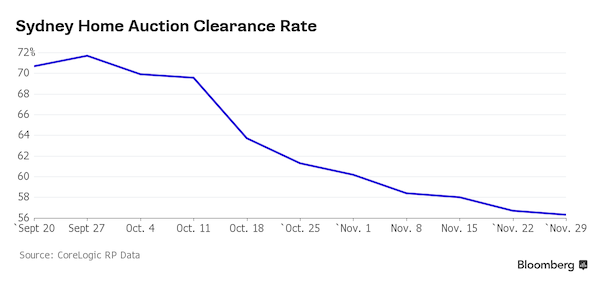

• Sydney Home Prices Drop Most in 5 Years (BBG)

Sydney home prices fell the most in five years in November as a regulatory crackdown forces banks to tighten lending and increase mortgage rates. Dwelling values in Australia’s largest city dropped 1.4% from a month earlier, data from property researcher CoreLogic Inc. showed on Tuesday. That was the biggest drop since December 2010 and the first decline since May. Prices across the nation’s capital cities declined 1.5%, with Melbourne leading with a 3.5% decrease. “The fact that mortgage rates have risen independently of the cash rate has, in all likelihood, become a contributor to the slowdown in housing market conditions,” Tim Lawless, head of research at the firm, said in an e-mailed statement. “Tighter mortgage servicing criteria across the board and affordability constraints in the Sydney and Melbourne markets are also having an impact on market demand.”

The drop in home prices is yet another indicator of the cooling Sydney property market after mortgage rates close to five-decade lows and buying by foreigners sent prices up 44% in the past three years. Sydney auction clearance rates, a measure of demand, have dropped for nine consecutive weeks and loans to investors climbed at the slowest pace in 14 months as banks raised interest rates to protect themselves from the risks of an overheated market. Buyers are hesitating after the price rise hurt affordability, and a regulatory clampdown prompted banks to raise rates for owner-occupiers for the first time in five years. Economists from Macquarie to Bank of America forecast a decline in prices over the next two years. Values in New South Wales state, where Sydney is the capital, are expected to climb 2.2% in 2016, a survey by National Australia Bank showed Monday.

“Supervisory measures are helping to contain risks that may arise from the housing market,” the Reserve Bank of Australia said Tuesday as it left its benchmark cash rate at a record-low 2%. “The pace of growth in dwelling prices has moderated in Melbourne and Sydney over recent months.” Still, Sydney home prices are up 12.8% in the past 12 months and Australia & New Zealand Banking Group Ltd. said in a note Monday “strong underlying demand” is likely to contain any price declines in the major capital cities to less that 10% in the absence of an economic downturn. On Saturday, 106 of 111 yet-to-be-built apartments worth about A$160 million ($116 million) in Chatswood, 10 kilometers north of Sydney’s business district, were sold in three hours, according to Domain, an online real estate website.

In other words: no real debt restructuring. But didn’t the IMF label that highly important?

• Greek Debt Relief Talks To Focus On Net Present Value (Reuters)

Future talks on debt relief for Greece will focus on the debt’s net present value, Greek deputy central bank governor Ioannis Mourmouras told a business conference on Tuesday. Eurozone governments believe that forgiving Greece part of its debt – a “nominal haircut” – is not necessary, because thanks to very low interest, long maturities and grace periods, the net present value of the debt is manageable. “I estimate that the basis of the discussion will be the net present value of the debt,” Mourmouras said. He also said that once Greece completes reforms agreed with creditors under the first review of its bailout program, it could benefit from the ECB’s bond-buying program. “The participation in the ECB’s QE, after the first review, will be a catalyst for the Greek economy,” he said. “In the beginning the amounts will be minor, something like €3 billion.”

Michael Moore had it oh-so right: “You can’t declare war on a noun”.

• The War on Terror is Creating More Terror (Ron Paul)

The interventionists will do anything to prevent Americans from seeing that their foreign policies are perpetuating terrorism and inspiring others to seek to harm us. The neocons know that when it is understood that blowback is real – that people seek to attack us not because we are good and free but because we bomb and occupy their countries – their stranglehold over foreign policy will begin to slip. That is why each time there is an event like the killings in Paris earlier this month, they rush to the television stations to terrify Americans into agreeing to even more bombing, more occupation, more surveillance at home, and more curtailment of our civil liberties. They tell us we have to do it in order to fight terrorism, but their policies actually increase terrorism. If that sounds harsh, consider the recently-released 2015 Global Terrorism Index report.

The report shows that deaths from terrorism have increased dramatically over the last 15 years – a period coinciding with the “war on terrorism” that was supposed to end terrorism. According to the latest report: “Terrorist activity increased by 80% in 2014 to its highest recorded level. …The number of people who have died from terrorist activity has increased nine-fold since the year 2000.” The world’s two most deadly terrorist organizations, ISIS and Boko Haram, have achieved their prominence as a direct consequence of US interventions. Former director of the Defense Intelligence Agency Michael Flynn was asked last week whether in light of the rise of ISIS he regrets the invasion of Iraq. He replied, “absolutely. …The historic lesson is that it was a strategic failure to go into Iraq.” He added, “instead of asking why they attacked us, we asked where they came from.”

Flynn is no non-interventionist. But he does make the connection between the US invasion of Iraq and the creation of ISIS and other terrorist organizations, and he at least urges us to consider why they seek to attack us. Likewise, the rise of Boko Haram in Africa is a direct result of a US intervention. Before the US-led “regime change” in Libya, they just were a poorly-armed gang. Once Gaddafi was overthrown by the US and its NATO allies, leaving the country in chaos, they helped themselves to all the advanced weaponry they could get their hands on. Instead of just a few rifles they found themselves armed with rocket-propelled grenades, machine guns with anti-aircraft visors, advanced explosives, and vehicle-mounted light anti-aircraft artillery. Then they started killing on a massive scale. Now, according to the Global Terrorism Index, Boko Haram has overtaken ISIS as the world’s most deadly terrorist organization.

Signing these deals is going to be far more expensive than any nation can afford.

• TPP Clauses That Let Australia Be Sued: Weapons Of Legal Destruction (Guardian)

Andrew Robb, the Australian trade minister, was quick to defend the agreement from its detractors. He lauded Australia’s efforts to secure significant exemptions, which he said would make it impossible for foreign corporations to sue the Australian government for enacting environmental policy. “It’s a trade agreement which looks at issues relating to trade that can affect public policy in the environmental area … It does provide safeguards, the best safeguards that have ever been provided in any agreement in this regard.” Robb said critics were just the usual suspects “jumping at shadows”, “peddling lines they’ve been peddling for years without having a decent look at what’s been negotiated”. But George Kahale III is not one of the usual suspects.

As chairman of the world’s leading legal arbitration firm – Curtis, Mallet-Prevost, Colt & Mosle – his core business is to defend governments being sued by foreign investors under ISDS. Some of his clients are included in the TPP, and he says the trade minister’s critics are right: “There are significant improvements in this treaty, but they do not immunise Australia from any of these claims. If the trade minister is saying, ‘We’re not at risk for regulating environmental matters’, then the trade minister is wrong.” Speaking via Skype from his office in New York, Kahale thumbs through the investment chapter, pointing out the critical loopholes that leave Australia wide open. “The one where all the discussion should be focused is 9.15,” he says, referring to one of the “safeguards”.

“That’s a very nice provision, which I imagine the trade minister points to as, ‘We’ve really protected ourselves on anything of social importance.’ I think that’s nonsense, frankly.” Here’s what 9.15 says: “Nothing in this chapter shall be construed to prevent a party from adopting, maintaining or enforcing any measure otherwise consistent with this chapter that it considers appropriate to ensure that investment activity in its territory is undertaken in a manner sensitive to environmental, health or other regulatory objectives.” This entire provision is negated, says Kahale, by five words in the middle: “unless otherwise consistent with this chapter”. “So at the end of the day, this provision, which really held out a lot of promise of being very protective, is actually much ado about nothing.”

“The U.S. is responsible for the majority of profits for most large pharmaceutical companies..”

• Why the US Pays More Than Other Countries for Drugs (WSJ)

Norway, an oil producer with one of the world’s richest economies, is an expensive place to live. A Big Mac costs $5.65. A gallon of gasoline costs $6. But one thing is far cheaper than in the U.S.: prescription drugs. A vial of the cancer drug Rituxan cost Norway’s taxpayer-funded health system $1,527 in the third quarter of 2015, while the U.S. Medicare program paid $3,678. An injection of the asthma drug Xolair cost Norway $463, which was 46% less than Medicare paid for it. Drug prices in the U.S. are shrouded in mystery, obscured by confidential rebates, multiple middlemen and the strict guarding of trade secrets. But for certain drugs—those paid for by Medicare Part B—prices are public. By stacking these against pricing in three foreign health systems, as discovered in nonpublic and public data, we were able to pinpoint international drug-cost differences and what lies behind them.

What we found, in the case of Norway, was that U.S. prices were higher for 93% of 40 top branded drugs available in both countries in the third quarter. Similar patterns appeared when U.S. prices were compared with those in England and Canada’s Ontario province. Throughout the developed world, branded prescription drugs are generally cheaper than in the U.S. The upshot is Americans fund much of the global drug industry’s earnings, and its efforts to find new medicines. “The U.S. is responsible for the majority of profits for most large pharmaceutical companies,” said Richard Evans, a health-care analyst at SSR LLC and a former pricing official at drug maker Roche. The reasons the U.S. pays more are rooted in philosophical and practical differences in the way its health system provides benefits, in the drug industry’s political clout and in many Americans’ deep aversion to the notion of rationing.

The state-run health systems in Norway and many other developed countries drive hard bargains with drug companies: setting price caps, demanding proof of new drugs’ value in comparison to existing ones and sometimes refusing to cover medicines they doubt are worth the cost. The government systems also are the only large drug buyers in most of these countries, giving them substantial negotiating power. The U.S. market, by contrast, is highly fragmented, with bill payers ranging from employers to insurance companies to federal and state governments. Medicare, the largest single U.S. payer for prescription drugs, is by law unable to negotiate pricing. For Medicare Part B, companies report the average price at which they sell medicines to doctors’ offices or to distributors that sell to doctors. By law, Medicare adds 6% to these prices before reimbursing the doctors. Beneficiaries are responsible for 20% of the cost.

The arrangement means Medicare is essentially forfeiting its buying power, leaving bargaining to doctors’ offices that have little negotiating heft, said Sean Sullivan, dean of the School of Pharmacy at the University of Washington.

“It all looks like a feckless slide provoked by our side into World War III, and for what? To make the world safe for the Kardashians?”

• The Story Line Dissolves (Jim Kunstler)

Sometimes societies just go crazy. Japan, 1931, Germany, 1933. China, 1966. Spain 1483, France, 1793, Russia, 1917, Cambodia, 1975, Iran, 1979, Rwanda, 1994, Congo, 1996, to name some. By “crazy” I mean a time when anything goes, especially mass killing. The wheels came off the USA in 1861, and though the organized slaughter developed an overlay of romantic historical mythos — especially after Ken Burns converted it into a TV show — the civilized world to that time had hardly ever seen such an epic orgy of death-dealing. I doubt that I’m I alone in worrying that America today is losing its collective mind. Our official relations with other countries seem perfectly designed to provoke chaos. The universities have melted into toxic sumps beyond even anti-intellectualism to a realm of hallucination.

Demented gunmen mow down total strangers weekly in what looks like a growing competition to end their miserable lives with the highest victim score. The financial engineers have done everything possible to pervert and undermine the operations of markets. The political parties are committing suicide by cluelessness and corruption. There is no narrative for our behavior toward Russia that makes sense anymore. Our campaign to destabilize Ukraine worked out nicely, didn’t it? And then we acted surprised when Russia reclaimed the traditionally Russian territory of Crimea, with its crucial warm-water naval ports. Who woulda thought? Then we attempted to antagonize them further with economic sanctions. The net effect is that Vladimir Putin ended up looking more rational and sane than any leader in the NATO coalition.

Lately, Russia has filled the vacuum of competence in Syria, cleaning up a mess that America left with its two-decade-long crusade to leave a train of broken governments everywhere in the region. A few weeks back, Mr. Putin made the point before the UN General Assembly that wrecking every national institution in sight among weak and unstable nations was probably not a recipe for world peace. President Obama never did formulate a coherent comeback to that. It’s a little terrifying to realize that the leader of our former arch-adversary is the only figure onstage who can come up with a credible story about what needs to happen there. And his restraint this week following what may have been a US-assisted shoot-down of a Russian bomber by idiots in Turkey is really estimable. It all looks like a feckless slide provoked by our side into World War III, and for what? To make the world safe for the Kardashians?

Yeah, Americans are your best friends…

• The Slow Death Of Hope For America’s Loyal Friends In Iraq (FT)

The phone calls in the past week were tearful. I spoke to two Iraqis, former colleagues who had risked their lives for Americans, to tell them I doubted they would ever be welcomed in my country. As France mourned murders by Islamist terrorists, and US politicians thousands of miles away spewed anti-refugee rhetoric, I realised my friends probably had no friends in Washington. For years after the 2003 invasion, Americans relied on Iraqis to navigate a country whose terrain we barely knew and whose sectarian loyalties it was vital to understand. Journalists could not have survived without them. Neither could the troops, aid workers or diplomats. The goodwill of those caught in the middle of these war zones — whether in Iraq or now perhaps in Syria — allowed us to stay safe and do our jobs.

The men I knew had been translators and drivers for the Chicago Tribune, then my employer. They reported through mortar attacks, even a car bomb. Then Sinan Adhem and Nadeem Majeed decided they wanted to live in the US. They applied 10 years ago for visas. As they waited, they became fathers, perfected their English and found better jobs. Sinan is now a security analyst for the UN. Nadeem works for Nissan Motors. Both live in Baghdad. Last year, both Sinan and Nadeem received emails from the US Citizenship and Immigration Services stating that they could not be trusted. No one disputed they had presented all the proper papers or that the visa applications were credible. Yet form letters dismissed Sinan, then Nadeem, with vague finality: “Denied as a matter of discretion for security-related reasons.”

“Are the Americans calling me a terrorist?” Sinan sputtered over the phone. I calmed him down; it had to be a clerical error by USCIS and the Department of Homeland Security. I was sure I could sort it and I knew we had to work fast. Neighbouring Syria was falling apart; my friends could soon be vying with thousands of desperate refugees. In the weeks that followed, though, I found few people in my government willing to help. No single bureaucrat wanted to accept responsibility.

Huh?: “..losses in excess of around €1.5 million.” Is that the same as around in excess of?

Other than that: hey, it works. Let the 1500 refugees go and you can ship your holiday rush gadgets and trinkets. Easy.

• Migrant Blockades Of Train Tracks In Northern Greece Hit Commerce (Kath.)

Trainose, the company that manages Greece’s state-owned railway system, has said that a blockade of the tracks at the country’s northern border has led to losses in excess of around €1.5 million. Speaking to Skai on Tuesday, Trainose CEO Thanasis Ziliaskopoulos said that about 1,800 cars waiting to cross the border between Greece and the Former Yugoslav Republic of Macedonia (FYROM) have been affected by protests as an estimated 1,500 refugees and migrants remain stuck at the crossing as they try to make their way deeper into Europe.

About a dozen or so protesters have been lying or camping out on the tracks since November 18 in demand that FYROM relax its border controls, following its decision in the wake of the Paris terror attacks to bar entry to what it deems are “economic migrants.” Ziliaskopoulos said that Trainose has been receiving complaints from some of its biggest clients – including Cosco, Hewelett Packard and Sony – over the delays in shipments, adding that contracts may be at stake unless the situation is resolved, particularly given the pre-holiday rush to meet orders.

Home › Forums › Debt Rattle December 1 2015