Harris&Ewing Inauguration of air mail service, Washington, DC 1918

And why not?! If Abenomics’ 4th arrow is shopping vouchers, will the 5th be spoon feeding?

• Japan Government Weighs Shopping Vouchers, Promotions To Boost Consumption (R.)

Japan’s government might issue spending vouchers and promote national discount-sales events similar to Black Friday in the United States to boost its lackluster consumer spending and accelerate GDP growth. The government could decide the details as soon as next month as it finalizes the policies for its annual growth strategy, which could potentially help the Bank of Japan in its struggle to accelerate inflation. Authorities will also take steps to increase inbound tourism, raise the national minimum wage and encourage more IT investment, according to a draft approved on Monday by the government’s top advisory panel. The focus of this year’s growth strategy is meeting Prime Minister Shinzo Abe’s target of raising nominal GDP to 600 trillion yen ($5.40 trillion).

However, some economists have said sluggish growth in real wages and Japan’s shrinking workforce make it difficult to reach this target. At the end of 2015, nominal GDP was around 500 trillion yen. Consumer spending accounts for around 60% of Japan’s economy, and there is renewed focus on the household sector as consumption has struggled to gain momentum recently. There is also lingering speculation that Abe will cancel a nationwide sales tax increase scheduled for 2017 and focus more on fiscal spending to raise GDP and rebuild areas damaged by an earthquake in southern Japan earlier this month. Previously, Japan’s ruling Liberal Democratic Party has issued shopping vouchers, which economists say tends to only temporarily lift consumer spending and the broader economy.

These people are lost because they have no idea what inflation is: “..that could considerably affect the mindset” of the public and rejuvenate inflation expectations..”

• How Long Can the Bank of Japan Wait on Easing? (WSJ)

Officials and market participants agree that the Bank of Japan ought to do more to beat deflation, but they are split about whether it has to do so this week. Economic data offer plenty of reasons for easing at the central bank’s two-day meeting, which concludes Thursday. The economy is at risk of shrinking in second quarter because of big earthquakes that shook southern Japan recently. Inflation—including energy—is stuck near zero, while inflation expectations are by some measures the weakest in three years. Wage growth has slowed and the yen has strengthened. All of that runs counter to Bank of Japan Gov. Haruhiko Kuroda’s three-year-old campaign to deliver 2% inflation and put Japan on a steady growth path.

His latest gambit, a Jan. 29 decision to introduce negative interest rates on some commercial bank deposits at the central bank, hasn’t delivered results so far. Officials recognize the challenge. At least five of the BOJ’s nine policy-setting board members think that at the coming meeting, the bank should push back its forecast date for achieving its 2% inflation target, according to people close to the bank. The current forecast calls for 2% to be reached between April 2017 and September 2017. The target date has already been pushed back three times in the past year. “Risks to prices remain skewed to the downside,” one of the people said. The yen remains 8% higher than in late January, despite a modest pullback over the past week. That spells trouble for exporters that are already struggling with a global economic slowdown. It also saps inflation by making imports cheaper. In an interview earlier this month with The Wall Street Journal, Mr. Kuroda said about the yen: “If excessive appreciation continues, that could affect not just actual inflation but even the trend in inflation.” Private economists’ expectations for additional easing are the strongest in months. “We expect aggressive easing from the BOJ this week,” said Morgan Stanley MUFG Securities chief Japan economist Robert Feldman. Among other steps, Mr. Feldman believes the BOJ will cut its rate on excess commercial-bank deposits to at least minus 0.2% and perhaps to minus 0.3% from minus 0.1%. Others question that timing. Etsuro Honda, an economic adviser to Prime Minister Shinzo Abe, suggested this week in an interview that he wanted the BOJ to hold fire for now.

That is partly because global financial market turbulence has subsided, and partly because Mr. Honda hopes further BOJ easing could come as part of a coordinated action. Mr. Abe is looking into expanded government spending later this year and a possible delay in a sales-tax increase set to take effect in April 2017. “I know it’s hard to implement all three at the same time, but if we could do so with a relatively close timing…that could considerably affect the mindset” of the public and rejuvenate inflation expectations, Mr. Honda said. He said the prime minister’s Abenomics policy was in a “new phase” in which monetary policy alone was no longer sufficient to affect expectations.

It would be bad enough if it were ‘only’ commodities. But the actual scariest part is this: “Almost half of the world’s most active commodity derivatives are now traded on Chinese exchanges.”

• China Clamps Down On Commodities Frenzy (FT)

China moved to clamp down on excessive speculation in commodities on Monday after weeks of frenzied trading boosted prices and ignited fears of another bubble in its domestic markets. Activity on China’s largest commodity exchanges has surged in recent days with turnover in key steel contracts exceeding the combined volume of the Shanghai and Shenzhen stock exchanges on one day last week. Investors around the world have zeroed in on the latest trading binge as the prices of many commodities have risen sharply, with iron ore gaining almost a third in just two weeks. Cash has started to flow into raw materials in part because Chinese officials imposed curbs on equities trading last year. “China’s latest speculative spike has stunned global markets,” said Tom Price, a Morgan Stanley analyst.

Shanghai steel futures have risen more than 50% this year and more than a fifth this month. Iron ore traded on the Dalian Commodity Exchange hit its highest level since September 2014 last week. The surge led the country’s largest commodity trading venues — the Shanghai Futures Exchange, Dalian Commodity Exchange and Zhengzhou Commodities Exchange — to curb activity by lifting transaction costs, margins and daily trading limits on some contracts. Pricing power for the world’s most important raw materials has shifted east during a decade of economic growth that has transformed China into the largest importer of almost every major commodity. Almost half of the world’s most active commodity derivatives are now traded on Chinese exchanges.

Analysts said the trigger for increased speculative interest in commodities was a credit surge engineered by Chinese policymakers this year to prop up the economy and its currency. This led to a pick-up in construction activity and stoked investor appetite for ways to bet on the Chinese economy. Beijing imposed draconian rules on equities last year as fears of a slowing economy triggered a sell-off that threatened stability. “The Chinese speculative community seems to have decided the big credit figures that came out two weeks ago were a green light to get levered up,” Michael Coleman, co-founder of RCMA Asset Management in Singapore, “They don’t want to buy the stock market because of all the curbs that are in place and seem to have taken the view that commodities are really cheap.”

“There have been two days in the past month where futures volumes have been greater than the total amount of iron ore that China actually imported for the whole of 2015..”

• Goldman Says China’s Iron Speculation ‘Concerns Us the Most’ (BBG)

Goldman Sachs has expressed its concern about the surge in speculative trading in iron ore futures in China, saying that daily volumes are now so large that they sometimes exceed annual imports. The increase in futures trading in the world’s largest importer was among factors that have lifted prices, according to a report from analysts Matthew Ross and Jie Ma received on Tuesday. Iron ore volumes traded on the Dalian Commodity Exchange are up more than 400% from a year ago, they said. “While increased fixed-asset investment in China, a bring-forward of steel production (ahead of a government curtailment) and mining disruptions help to explain the strong rally in the iron ore price, the one driver that concerns us the most is the increased speculation in the Chinese iron ore futures market,” they wrote.

Iron ore has rallied in 2016, buttressed by the explosion in speculative trading in China’s commodity futures markets as mills boosted monthly output to a record. The spike in raw materials trading in China has stunned global markets, according to Morgan Stanley, which cited the jump in local activity in iron ore as well as steel. The increase has prompted exchange authorities in Asia’s top economy including Dalian to tighten rules on the trading of some contracts. “There have been two days in the past month where futures volumes have been greater than the total amount of iron ore that China actually imported for the whole of 2015 (950 million tons),” the Goldman analysts wrote. To slow trading activity, the Dalian exchange has announced it would be increasing margin requirements and transaction costs on iron ore futures, they said.

How much capital flees the country in these deals?

• “China Is Hoarding Crude At The Fastest Pace On Record” (ZH)

In the aftermath of China’s gargantuan, record new loan injection in Q1, which saw a whopping $1 trillion in new bank and shadow loans created in the first three months of the year, many were wondering where much of this newly created cash was ending up. We now know where most of it went: soaring imports of crude oil. We know this because as the chart below shows, Chinese crude imports via Qingdao port in Shandong province surged to record 9.86 million metric tons last month based on data from General Administration of Customs. As Energy Aspects pointed out in a report last week, “Imports through Qingdao surged to another record as teapot utilization picked up, leading to rising congestion at the Shandong ports.”

And sure enough, this kind of record surge in imports should promptly lead to another tanker “parking lot” by China’s most important port. This is precisely what happened when according to reports, some 21 crude oil tankers with ~33.6 million bbls of capacity signaled from around Qingdao last Monday, according to data compiled by Bloomberg. 12 of those vessels, with about 18 million bbls, were also there 10 days earlier, data show. As Bloomberg adds, port management had met to discuss measures to ease congestion, citing an official at Qingdao port’s general office, however for now it appears to not be doing a great job. Incidentally, putting Qingdao oil traffic in context, last year the port handled 69.9 million metric tons overseas oil shipments, or ~21% of nation’s total crude imports, more than any other Chinese port.

So what caused this surge in demand? The answer is China’s “teapot” refineries. According to Oilchem.net, the operating rate at small refineries in eastern Shandong province rose to 51.84% of capacity as of the week ended Apr. 22. The utilization rates climbed as various teapot refiners completed maintenance and restarted production. How much of a boost in oil demand did teapot refineries represent? Well, the current operating run rates is averaging 50.42% this tear compared to just 37.72% a year ago, Bloomberg calculated. Notably, this may be just the beginning of China’s. As Bloomberg adds today, China, the world’s second-biggest crude consumer, may be poised for another increase in imports after the number of supertankers bound for the Asian country’s ports rose to a 16-month high amid signs it’s stockpiling.

How about we double that number?

• China Expected To See $538 Billion Capital Exodus In 2016 (R.)

Global investors are expected to pull $538 billion out of China’s slowing economy in 2016, the Institute of International Finance (IIF) estimated on Monday, although the pace of outflows has dropped. That number would be down a fifth from the $674 billion pulled out last year, the industry association said, but could accelerate again if fears re-emerge of a “disorderly” drop in the yuan, or the renminbi, as the currency is also known. Capital exodus from China can influence emerging markets more generally, partly because of its sheer size and partly because sustained outflows can trigger more exchange rate volatility, which could then feed a fresh wave of outflows. “A sharp drop in the renminbi would likely spark a renewed sell-off of global risk assets and trigger a flight of portfolio capital from emerging markets,” the IIF said in a new report.

“Moreover, a sharp depreciation of the renminbi could lead to a round of competitive devaluation in other emerging markets, particularly in those with close trade linkages to China.” For now, though, outflows are slowing. Roughly $35 billion was pulled out in March, bringing the total since the start of the year to around $175 billion, well below the pace seen in the second half of 2015. The IIF cited progress Chinese authorities had made in easing worries about the yuan’s direction. They have emphasized there is more focus on its value against a basket of currencies, rather than just the U.S. dollar. One “important unknown”, however, is the threshold of currency reserves below which Chinese authorities would start to worry. They might then either allow the yuan to fall again or markedly tighten capital controls.

He sees failure on the horizon. Does it matter? Reality is that it won’t be ratified before the end of his term, so it’s all up for grabs no matter what.

• Obama Says TTiP Should Be Signed By The ‘End Of The Year’ (Ind.)

US President Barack Obama has said that the controversial Trans-Atlantic Trade and Investment Partnership should be signed “by the end of the year”. During a visit to an industrial trade fair in Hannover on Sunday, Obama warned that TTIP must be signed before it is derailed by political events, in what was likely a reference to the US election. “We’ve now been negotiating TTIP for three years. We have made important progress. But time is not on our side,” Obama said in the speech. “If we don’t complete negotiations this year, then upcoming political transitions – in the US and Europe – could mean this agreement won’t be finished for quite some time.” TTIP is the biggest transatlantic trade deal in history. Opponents say it would give corporations the power to sue governments when they pass regulation that could hit that corporation’s profits.

UNs figures have shown that that US companies have made billions of dollars by suing other governments nearly 130 times in the past 15 years under similar free-trade agreements. Details of the cases are often secret, but notorious precedents include Philip Morris suing Australia and Uruguay for putting health warnings on cigarette packets. Obama has described national laws and protections as “regulatory and bureaucratic irritants and blockages to trade.” In Hanover, he used a speech alongside the German Chancellor Angela Merkel to make a renewed push for the treaty to be signed. “Angela and I agree that the US and EU need to keep moving forward with the Transatlantic Trade and Investment Partnership negotiations,” he said. “I don’t anticipate that we will be able to have completed ratification of a deal by the end of the year, but I do anticipate that we can have completed the agreement.”

The Germans have turned really antagonistic.

• German Scorn Could Kill the TTiP (BBG)

In Hannover on Sunday, Barack Obama sought to convince a hostile German public of the merits of a transatlantic free-trade deal. Pitching EU membership in Britain was a walk in the park by comparison. It’s hard to overstate the level of opposition to the new deal in Germany. The Transatlantic Trade and Investment Partnership, or TTIP, is more unpopular in Germany these days than President Obama in a room full of Tory euroskeptics. Ask an American what they think about investor-state dispute settlement provisions and you are likely to get a blank face. Ask a German, and there’s a good chance you’ll get an earful. That wasn’t always the case. Two years ago, when negotiations for a new transatlantic trade deal were announced (it was Germany that pushed for an agreement then, by the way), more than half of Germans favored the deal.

A survey released last week showed only one in five Germans want it now. To Germans, TTIP reflects a capitalism that is too finance-driven, dominated by large multinationals, cavalier about privacy and not as serious about product standards. A new round of negotiations – the 13th, for anyone keeping track – started in New York Monday for a pact that would liberalize trade affecting 40% of the global economy. The key to a deal, as Obama’s Hannover visit suggested, rests with Germany. That a global exporting powerhouse and Europe’s biggest economy has become such a reluctant partner ought to be at least as worrying as the prospect of losing Britain’s voice in the EU. It’s unusual even in these highly charged times for a trade agreement to receive the kind of attention that TTIP has in parts of Europe.

But TTIP isn’t a typical free-trade agreement. For one thing, it’s much bigger than anything attempted before. It would create the world’s largest free market of some 800 million people. According to U.S. chamber of commerce estimates, it would add €119 billion to Europe’s economy and €95 billion to the U.S. economy, creating thousands of jobs in the process. But the real difference is qualitative. While tariffs are already low between the two economies (they would be reduced further under TTIP), the main thrust of the agreement is the removal of non-tariff barriers in agriculture, services, procurement and other areas. It is this large-scale regulatory liberalization that many Europeans, and principally Germans, find dangerous. Americans, too, are losing their appetite for free trade agreements, but their reasons are rather more prosaic.

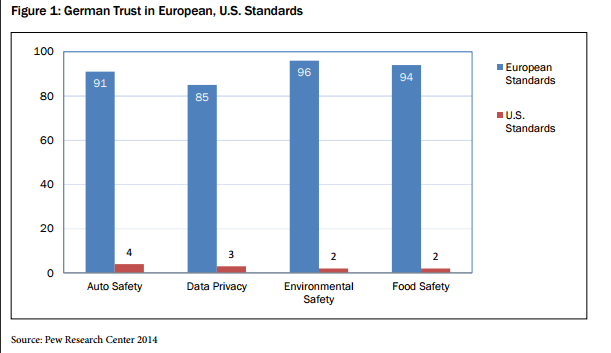

Among Americans opposed to the deal, half say they are worried about job losses and lower wages. Only 17% of Germans had those concerns. Germans, instead, are focused on what they see as inferior American standards (something that will strike many Americans as ironic after the Volkswagen emission scandal), concerns about privacy and also lack of transparency in the negotiations. These sentiments took American negotiators by surprise. America is the destination of over 8% of German exports; some 600,000 German jobs directly or indirectly depend on that trade, according to a 2013 study by the Cologne Institute for Economic Research. German trust for America’s business standards has been low for a while – there was near hysteria over chlorine-washed U.S. chickens, even though a German body declared them perfectly safe – but many figured France would present bigger obstacles to clinching an agreement.

These centralization attempts are dead in the water, and it’s hard to see what it would take to get them out of there.

• ECB Pushes For Eurozone Deposit Protection, At Odds With Germany (R.)

The ECB backed plans on Monday for a common means to protect savers, setting it on course for another collision with Germany over a scheme Berlin has so far blocked. After the financial crash, the ECB took charge of bank supervision across the 19 countries in the euro zone as part of wider reforms known as ‘banking union’ to make the sector safer. A parallel plan for pan-euro zone deposit protection, however, has yet to get off the ground, chiefly due to opposition from Germany, which does not want to be on the hook for bank failures elsewhere. On Monday, the ECB appealed for the introduction of common deposit protection as set out in plans from the EU’s executive European Commission. It would eventually replace the current country-by-country patchwork and help stop a repeat of the bank runs seen during the financial crisis.

In a legal opinion to European ministers signed by its President Mario Draghi, the ECB argued that “establishing a common safety net for depositors at the European level is the logical complement” to ECB supervision. “A European Deposit Insurance Scheme is the necessary third pillar to complete the Banking Union,” the letter said. The first ‘pillar’ is banking supervision and the second is resolution, a scheme for winding banks down. The call again puts the ECB at odds with Germany, where politicians including Finance Minister Wolfgang Schaeuble have stepped up criticism of its cheap money policy. Schaeuble was even reported as blaming the ECB’s stance in part for the rise of the right-wing, anti-immigration Alternative for Germany (AfD). Although influential, the ECB’s opinion is not binding and may be ignored by the ministers. Before it becomes law, such saver protection would require approval from euro zone countries, including Germany – unlikely for now.

“Surely Portugal can’t be a kind of simultaneously dead-and-alive-Schrodingers-cat?”

• The Euro’s Next Existential Crisis Might Arrive on Friday (BBG)

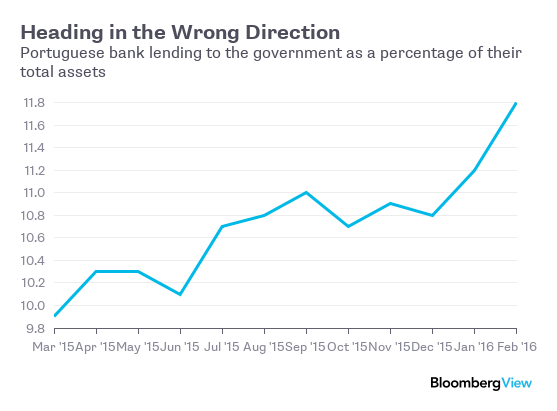

The euro’s future still looks far from secure. The ECB is defending its independence amid an attack on its negative interest-rate policies by Germany. European Commission President Jean-Claude Juncker admitted last week that “the European project has lost parts of its attractiveness.” Greece is still wrangling over the terms of its next bailout payment. And at the end of this week, a geeky decision in a corner of the bond market could send the bloc back into crisis mode. A credit-rating agency called Dominion Bond Rating Service is scheduled to complete its review of Portugal’s financial fitness on Friday. Moody’s, Standard & Poor’s and Fitch all view Portugal as undeserving of investment-grade status; put another way, Portugal is deemed a risky, junk-rated borrower. DBRS, though, has maintained its country classification at investment grade.

So long as at least one of the four rating agencies judges Portugal to be worthy, its government debt remains eligible to participate in the ECB’s bond-buying program. But if the country drops to sub-investment grade at all four, the ECB’s own rules forbid it from buying any more Portuguese government securities – purchases which have ballooned to almost €15 billion in the program’s one-year lifetime. So if DBRS lowers the nation’s grade – a distinct possibility, given the weakness of the Portuguese economy and the fact that the judgments of three other assayers of creditworthiness are all worse than DBRS’s – it could trigger a renewed crisis in the euro area. The ECB’s purchases are arguably responsible for keeping Portugal’s 10-year borrowing cost at an average of a bit less than 3% in the past six months.

Compare that with Greece, which doesn’t qualify for ECB assistance and has had an average yield of almost 9% since October, and it becomes clear how valuable ECB eligibility is – and how financially damaging it might be for Portugal if it was shut out after a downgrade. Surely Portugal can’t be a kind of simultaneously dead-and-alive-Schrodingers-cat? Surely it either is or isn’t investment grade, and therefore either should or shouldn’t qualify for the ECB program? Unfortunately, rating assessments are fraught with subjectivity and bias, as the world learned to its cost during the credit crisis. Where one analyst sees a life-threatening debt-to-gross-domestic-product ratio, another may see indebtedness that’s merely troubling.

Yeah, that’ll happen. Saudi as a tourism destination. Come watch the beheadings!

• Saudi Prince Vows Thatcherite Revolution And Escape From Oil (AEP)

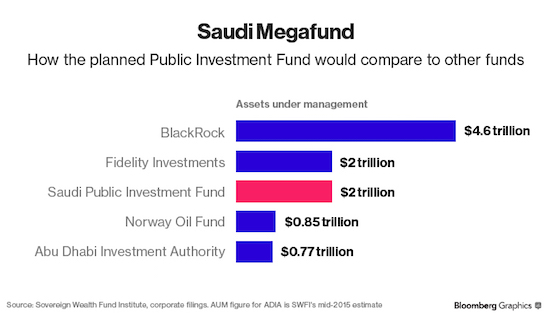

Saudi Arabia has launched a radical ‘Thatcherite’ shake-up to an avert economic crisis and prepare the kingdom for the post-carbon world, stunning analysts with claims that it could break reliance on oil within just four years. Prince Mohammad bin Salman, the country’s de facto ruler, vowed to build a $3 trillion wealth fund and break onto the world stage as an investment superpower, the spearhead of an historic package of measures intended to bring the deformed economy kicking and screaming into the 21st Century. “We have an addiction to oil. This is dangerous. I think that by 2020 we can live without it,” he told Al Arabiya television. It is an extraordinary claim for a government that has historically relied on oil exports for 90pc of its income and has yet to achieve much success in building alternative industries.

Gulf veterans say his words should be understood as poetic licence. Prince Mohammad, a 31 year-old tornado determined to smash the status quo, has amassed immense power over the economy and defence that belies his title as deputy crown prince, filling the cabinet with modern technocrats and startling his sinecure cousins from the Al Saud family with the unfamiliar prospect of hard work. The plan known as “Vision2030” aims to slash $80bn of wasteful spending each year and impose some degree of order on the kingdom’s chaotic finances with a consumption tax and fresh levies. Water prices have already risen tenfold as subsidies are paired back, though this prompted a protest storm on Twitter and is a warning of how hard it will be to dismantle the cradle-to-grave welfare system that keeps a lid on dissent.

Petrol has jumped 50pc, but it still costs just 16 pence a litre. Female participation in the workforce will rise from 22pc to 30pc. The share of non-oil exports is to jump from 16pc to 50pc. The country is to build its own defence industry. “We have the third or fourth-largest military spending in the world, yet our army is ranked in the twenties,” he said. “When I enter a Saudi military base, the floor is tiled with marble, and the finishing is five stars. Enter a base in the US, you can see the pipes in the ceiling. It’s made of cement. It is practical,” he said.

The reform blueprint is inspired by a McKinsey study – Beyond Oil – that laid out how the country can double GDP over the next fifteen years and reinvent itself with a $4 trillion of investment across eight industries, from electrical manufacturing, to cars, healthcare, metals, steel, aluminium smelting, solar power, and most surprisingly tourism. McKinsey warned that half-hearted reform risks disaster, and bankruptcy. There is some logic to the Vision2030 plan given Saudi Arabia’s access to cheap energy. Delivery is another matter. “We have seen these sorts of transition plans before and they never come to much,” said Patrick Dennis from Oxford Economics. “I don’t think they can pull this off. The riyal peg is grossly overvalued and that makes it even harder. We think market pressures will become overwhelming if there is little evidence of real reform by 2018.”

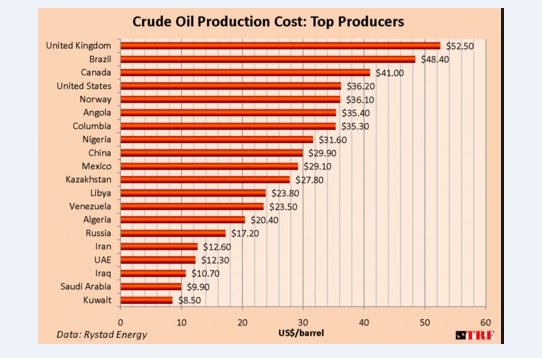

Saudi Arabia has one of the lowest production costs in the world

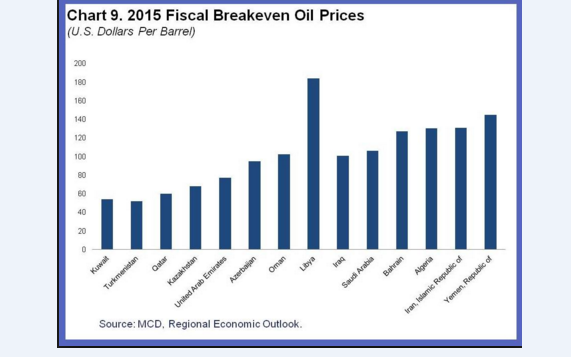

But Saudi Arabia needs $100 oil to balance the budget. That is its Achilles Heel

Pie in the sky.

• Saudi Arabia Puts Aramco Valuation Above $2 Trillion (BBG)

Saudi Arabia’s Deputy Crown Prince Mohammed bin Salman said he expects the value of Saudi Arabian Oil Co. to exceed $2 trillion as the kingdom prepares to sell part of the company in what could be the world’s largest initial public offering. The valuation of the oil producer known as Saudi Aramco hasn’t been completed, Prince Mohammed said in an interview with Saudi-owned Al Arabiya television. The government plans to turn Aramco into a holding company and will sell less than 5% of that entity, he said. Aramco units may be offered for sale at a second stage, he said. Prince Mohammed is leading the biggest economic shakeup since the founding of Saudi Arabia in 1932, with measures that represent a radical shift for a country built on petrodollars.

Saudi Aramco’s sale is a key part of the “Saudi 2030 Vision” announced Monday to overhaul the economy and reduce the kingdom’s reliance on oil, he said. It will help increase transparency, he said. “If Saudi Aramco is listed then it must announce its statements and it will do that every quarter,” he said. “It will be under the supervision of all Saudi banks, all analysts, all Saudi thinkers. Even more all international banks and research and planning centers in the world will monitor it intensively.” Aramco’s crude reserves of about 260 billion barrels are almost 10 times those of Exxon Mobil. Its daily production of more than 10 million barrels is more than the domestic output of every U.S. oil company combined.

“In 2020, I think we will be able to live without oil,” Prince Mohammed said. “We will need it but we can live without it.” Saudi Arabia has “huge” mining assets it can use to create jobs, according to the prince. The country has 6% of global uranium reserves, which is “another oil that we have not exploited,” he said. Saudi Arabia uses only 3 to 5% of its mining resources such as gold, silver and phosphate, he said.

“Romney defended his sons by declaring that they served their country by “helping me get elected”.

• How America’s Rich Betrayed Their Fellow Citizens (Gaughan)

[..] No single location encapsulates the worldview of “old money” families better than Harvard’s Memorial church, which stands in the center of Harvard Yard. The church’s walls list the Harvard students, alumni and faculty members who have perished in America’s wars since 1917. The numbers are breathtaking. During the world wars, thousands of Harvard students and alumni served in the US military. In all, about 400 died in WWI and nearly 700 in WWII. The ranks of Harvard fatalities included Quentin Roosevelt, the youngest son of Theodore Roosevelt, and Joseph Kennedy Jr, the older brother of John F Kennedy. Harvard’s military death toll is particularly staggering when one considers that in the early 20th century, Harvard’s student body was drawn primarily from America’s richest and most well-connected families.

Those families could have pulled strings to ensure their sons stayed out of combat. But they did not, as powerfully demonstrated by the list of names at Memorial church and similar memorials across the Ivy League. During the world wars, the upper classes did their part to defend the nation. Things could not be more different today. Only a small number of Harvard alumni serve in the military, and until recently, the university barred the military’s officer training programs from campus. Harvard is not unique. Military experience is rare among America’s political and economic elite. None of the current presidential candidates has served in the military, and only 18% of members of Congress are veterans, the lowest %age in generations.

As the children of elites have opted out of military service, middle-class and working-class families have taken up the slack, providing the vast majority of the nation’s service members. Mitt Romney, an immensely wealthy Harvard graduate, revealed the cavalier attitude of the rich toward military service during the 2008 presidential campaign. As the Iraq and Afghanistan wars raged, critics pointed out that none of Romney’s five sons had served in the military. In response, Romney defended his sons by declaring that they served their country by “helping me get elected”. The fact that Romney viewed working on a relative’s political campaign as the patriotic equivalent of battlefield service revealed just how tone-deaf many in America’s upper classes have become.

The military is only one example of how disconnected wealthy Americans are from their country. The extraordinarily low rate of charitable giving among the rich offers more evidence. Even though we live in a time of entrenched income inequality, poor Americans actually give a higher%age of their income to charity than the rich do. The lack of generosity among America’s upper classes shows no signs of abating. Although the overall wealth of the upper classes is growing, levels of charitable giving continue to fall among the rich.

No, the refugee flow will not stop.

• Syrian Food Crisis Deepens As War Chokes Farming (Reuters)

Syria’s war has destroyed agricultural infrastructure and fractured the state system that provides farmers with seeds and buys their crops, deepening a humanitarian crisis in a country struggling to produce enough grain to feed its people. The country’s shortage of its main staple wheat is worsening. The area of land sown with the cereal – used to make bread – and with barley has fallen again this year, the UN Food and Agriculture Organization (FAO) told Reuters. The northeast province of Hasaka, which accounts for almost half the country’s wheat production has seen heavy fighting between the Kurdish YPG militia, backed by the US-led air strikes, and Islamic State militants.

Farming infrastructure, including irrigation canals and grain depots, has been destroyed, according to the FAO. It said the storage facilities of the state seeds body across the country had also been damaged, so it had distributed just a tenth of the 450,000 tonnes of seeds that farmers needed to cultivate their land this season. Farmers are also struggling to get their produce to market so it can be sold and distributed to the population. The conflict has led to the number of state collection centers falling to 22 in 2015, from 31 the year before and about 140 before civil war broke out between government forces and rebels five years ago, according to the General Organisation for Cereal Processing and Trade (Hoboob), the state agency that runs them.

Many of those lost have been damaged or destroyed. The breakdown of the agricultural system means Syria could struggle to feed itself for many years after any end to the fighting, and need a significant level of international aid, the FAO says. It has had a major impact on plantings; the area of land sown with wheat and barley for the 2015-2016 season stood at 2.16 million hectares, down from 2.38 million hectares the previous season and 3.125 million in 2010 before the war, and only around two-thirds of the area targeted by the government, said the FAO.

Caveat: Merkel has not ‘raised charges’ against Böhmermann. Other than that, it’s about time more people speak out against her.

• Merkel’s Refugee Strategy – A Brown Nose Becomes the Chancellor (Rose)

It is a visit most Germans would like to forget – quickly. Their Chancellor Angela Merkel travelled to Turkey last Saturday, dropped in at what is termed a “sanitised” refugee camp for a well-orchestrated public relations exercise, and then held a press conference, effusing over Turkey’s exemplary treatment of refugees. It was “Brown Nose Tour The Second” to Turkey for Ms Merkel (the last in October, just before Turkish elections, in a veiled endorsement of Turkey’s dictator Recip Erdogan in return for a deal to stop the flow of refugees from Turkey to Greece). This spectacle was much more than a display of hypocrisy. Ms Merkel’s newest kowtow to Erdogan, following her recent decision to raise charges against the German satirist Jan Böhmermann for libelling Erdogan, demonstrated to the German people that they are not the generous, enlightened people they thought they were and the EU has nothing to do with Beethoven’s ode of joy, its unofficial anthem.

Still Ms Merkel hopes her brown nose may yet revive her failing political fortune. Ms Merkel has every reason to be thankful to Erdogan. Since the two completed their deal on 20 March the number of refugees crossing from Turkey has steadily declined. In the past five weeks a mere 113 refugees have purportedly been transferred from Turkey to the EU. That is not even 20 per week. Ms Merkel’s visit is however just one element in a vastly larger development. It is just eight months ago that the Germans were celebrating their Willkommenskultur, solidarity with refugees fleeing wars in Syria, Iraq and Afghanistan. At the forefront was Ms Merkel, nicking Barack Obama’s 2008 election motto “Yes we can!” (Wir schaffen das). Currently Willkommenskultur is being redefined in Germany: Bringing Arab and African dictators and war criminals out of the cold to support the EU’s anti-refugee policy.

The motivation for this generous gesture by Germany’s Chancellor and the German government is to dump Willkommenskultur I. Willkommenskultur II will furnish authoritarian leaders and warlords with cash, weapons, equipment to secure borders and other assistance to keep refugees from reaching Europe as well as repatriating those that manage to survive the journey and enter EU territory. This has become an integral aspect of Ms Merkel’s present policy of closing EU borders and deportation.

Wow. Just wow. Voting against defenseless children. What does that say about a person (294 of them, actually)?

• UK Government, Tories Vote Against Accepting 3,000 Child Refugees (G.)

A high-profile campaign for the UK to accept 3,000 child refugees stranded in Europe has failed after the government narrowly won a vote in the House of Commons rejecting the plan. MPs voted against the proposals by 294 to 276 on Monday after the Home Office persuaded most potential Tory rebels that it was doing enough to help child refugees in Syria and neighbouring countries. The amendment to the immigration bill would have forced the government to accept 3,000 unaccompanied refugee minors, mostly from Syria, who have made their way to mainland Europe. It originated in the House of Lords after being introduced by Alf Dubs, a Labour peer who was a beneficiary of the Kindertransport, the government-backed programme that took child refugees from Germany in the run-up to WWII.

Following the vote, Labour vowed to continue its efforts to make the government change its mind, tabling a new amendment in the House of Lords asking it to accept a specified number of child refugees from Europe after consultation with local councils. The Home Office successfully saw off the Dubs amendment in the Commons after arguing it would act as an incentive for refugees to make the dangerous Mediterranean crossing to Europe. James Brokenshire, a Home Office minister, said the government could not support a policy that would “inadvertently create a situation in which families see an advantage in sending children alone ahead and in the hands of traffickers, putting their lives at risk by attempting treacherous sea crossings to Europe which would be the worst of all outcomes”.

The amendment was backed by Labour, the SNP and Liberal Democrats. Keir Starmer, a shadow Home Office minister, said “history would judge” MPs for voting against the plan, saying it was the biggest refugee crisis in Europe since the second world war. “It is the challenge of our times and whether we rise to it or not will be the measure of us,” Starmer said. “We have the clear evidence of thousands of vulnerable children and we now need to act. This is the moment to do something about it, by voting with us this evening.”

Home › Forums › Debt Rattle April 26 2016