Fred Stein Americans All 1943

The whole thing oozes cynicism.

• “We Have Enough Votes”: House To Vote Thursday To Repeal Obamacare (ZH)

The Republicans are giving Obamacare repeal another try, and this time they may succeed. Just a few hours after we reported that “Obamacare repeal suddenly looks possible” when two key Republicans – Fred Upton and Billy Long – flipped and decided to support the GOP healthcare bill, leading to immediate speculation the bill has enough support, the WSJ reported that House Majority Leader Kevin McCarthy told reporters Wednesday evening the House will vote on Thursday on the Republican bill to replace most of Obamacare: “we will be voting on the health-care bill tomorrow because we have enough votes.” When asked by a reporter about whether the bill would have to be pulled from the floor again for lack of support, McCarthy replied: “Would you have confidence? We’re going to pass it. We’re going to pass it. Let’s be optimistic about life.”

McCarthy also cited an insurer pulling out of the ObamaCare exchanges in Iowa Wednesday as a reason the law needs to be quickly repealed. “That’s why we have to make sure this passes. To save these people from ObamaCare, which continues to collapse.” And so just like at the end of March, when the GOP was confident it had whipped enough names, only to pull the vote in the last moment, the announcement once again sets up a high-stakes vote that is expected to come down to the wire. The House GOP bill, if passed, would roll back much of the 2010 health-care law, replacing its subsidies with a system of tax credits largely tied to age. Until Wednesday, Republican leaders had struggled to secure the 216 votes they need to pass the bill, which is expected to receive no Democratic support.

They pulled the bill from the floor in late March, when conservatives and centrists defected and it became clear the legislation didn’t have the support to pass. Last week, GOP leaders also opted not to vote on the bill ahead of Trump’s first 100 days in office. [..] in pulling yet another page from the Democrats’ playbook, the House will pass the vote first before finding out what’s in it: the vote will take place without waiting for a new Congressional Budget Office analysis of Upton’s changes or the amendment from Rep. Tom MacArthur that won over the House Freedom Caucus. That analysis will eventually provide the details of the bill’s effects on coverage and its cost. For now however, Republicans are just scrambling to take advantage of this rare moment of agreement and get something finally done.

What’s so cynical: trying to break Democrats’ power by pushing through a half-baked bill.

• Democrats, Not Trump, Are Driving Policy (BBG)

Enough about Donald Trump’s first 100 days. On the 101st day, Congress came to a rare bipartisan agreement funding the federal government through September. This showed who really holds power in the Trump era: Democrats. After last November’s election, when Republicans had consolidated power and held both chambers of Congress as well as the White House, the question was who would be driving policy. Would it be the Trump administration, perhaps led by populist mastermind Steve Bannon? Would it be House Speaker Paul Ryan, a man with a reputation as a policy wonk with a vision for government? Would it be the ideological House Freedom Caucus, demanding that the new Republican-led government live up to the promises the party made to its base during the Obama years? All have tried to lead at some point this year, but the recently agreed-upon budget deal shows that instead, it’s Democrats who appear to be in charge.

Democrats have the leverage in Washington now because Republicans haven’t figured out how to govern on their own. The first Republican attempt at legislation was Paul Ryan’s American Health Care Act. That failed in part because it didn’t repeal Obamacare as the House Freedom Caucus insisted. The Trump administration tried to influence the legislative agenda by putting forth its budget blueprint in mid-March, which included draconian cuts to various departments. Yet the only parts of that budget that made it into the final agreement were modest spending increases for defense spending and border security, without any of the corresponding cuts. This happened because Republicans couldn’t come to an agreement on the budget on their own, meaning Democratic votes were needed for passage, and Democrats wouldn’t sign on to anything with big spending cuts.

[..]The emerging view may be that Trump just wants to sign legislation that he can take credit for, regardless of the substance of the bills. After all, he’s on the verge of signing a government funding bill that’s more in line with Democratic priorities than his own. Since he hasn’t been willing to stand up for any of his or his party’s policy priorities so far, should Democrats retake the House in 2018, there’s no reason to think he wouldn’t sign legislation passed by Democrats in the House if it makes it to his desk. On policy, the author of “The Art of the Deal” doesn’t seem to have any policy deal-breakers. A president without any fixed policy vision or breaking points is no authoritarian. He makes the legislature more powerful than it’s been in decades. If Republicans can’t come to internal agreement on major legislation, and Democrats are the ones with leverage, then complete inaction might become a best-case scenario for the GOP.

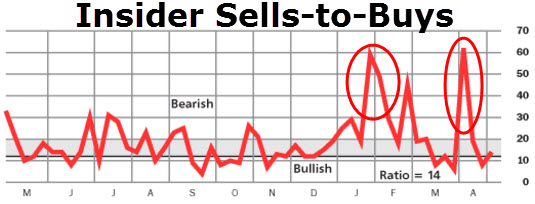

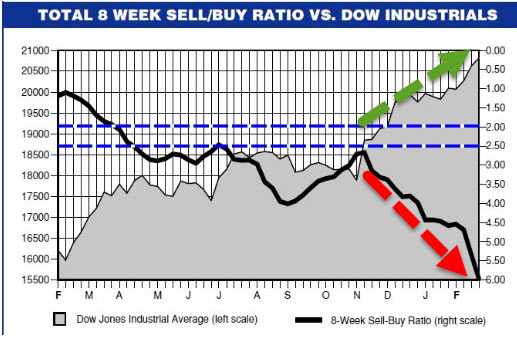

“The people who would stand to lose the most if the markets crashed [..] are all jumping ship and selling their stocks.”

• Corporate Insiders Are Unloading Their Stocks Like There’s No Tomorrow (Lang)

There aren’t any surefire ways to tell if the stock market, and perhaps the rest of the economy, is about to take a nosedive. That’s because millions of people with millions of ideas are involved, so it’s an inherently unpredictable system. However, there are certain players in our economy that have a lot more influence and insider knowledge than the rest of us. So when they make a move in unison, you know there’s a good chance that something is about to go down. And that’s exactly what’s going on with the stock market right now. The people who would stand to lose the most if the markets crashed; the corporate executives and insiders, are all jumping ship and selling their stocks.

“As the investing public has continued to devour stocks, sending all three major indexes to record highs in the last few months, corporate insiders have been offloading shares to an extent not seen in seven years.”Selling totaled $10 billion in March, according to data compiled by Trim Tabs. It’s a troubling trend facing an equity market that’s already grappling with its loftiest valuations since the 2000 tech bubble. If the people with the deepest knowledge of a company are cashing out, why should investors keep buying at current prices? The groundswell of insider selling has the attention of Brad Lamensdorf, portfolio manager at Ranger Alternative Management, and he doesn’t like what he sees. “This is definitely a negative sign,” Lamensdorf wrote in his April newsletter. “They do not see value in their own companies!”

And this isn’t a recent trend. While ordinary investors were optimistically diving into the stock market after Trump was elected, these people were dumping their stocks as far back as February. “Chief executives and other corporate insiders are selling stock hand over fist now that the quarterly earnings season is over, a report from Vickers Weekly Insider shows. Transactions by insiders are restricted around a company’s report. “Insider selling has jumped again, and this time to levels rarely seen,” analyst David Coleman wrote in Monday’s note.”

A useful term: “Pent Down Demand”

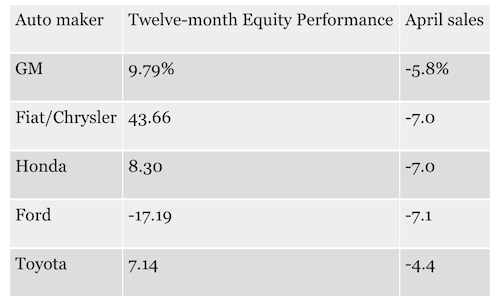

• The Coming Collapse In US Auto Sales (F.)

Automobiles are not moving off the parking lot. That’s according to an industry report that showed a sharp decline in auto sales across all auto makers—see table. Meanwhile industry inventories have been climbing up from an average of 55 days back in April of 2015 to 70 days last month. Coming after months of sluggish sales and generous incentives, the big drop in April sales could be a sign of an impending collapse which could parallel that of 2008-9. There’s a compelling reason for that: pent down demand, which for years has been “stealing” sales from the future. Now the future has arrived and pent down demand is bad for auto makers, their investors and the economy as a whole.

To get an idea how “pent down demand” (my own term) works, a good place to begin with is the more familiar concept of pent up demand, the lack of current demand for discretionary items like automobiles, home appliances, etc., which depresses sales of these items in the short run. Pent up demand usually appears before a period of consumer euphoria, when consumers choose to push spending on discretionary items to a future date, due to lower price expectations, depressed consumer confidence, or a credit crunch. And it disappears together with these conditions when that future day comes, and consumers rush to buy the items they put off in the past.

In contrast, pent down demand appears after a period of consumer euphoria when consumers choose to move spending on discretionary items from a future date into the present day, due to low cost of financing — which blurs the distinction between present and future. Why wait to buy a new car or a new home appliance next year when you can have it this year, paying a small penalty for this privilege? Simply put, ultra-low interest rates help “steal” sales from the future, creating market saturation, and eventually depress spending on “high ticket” items when the future becomes present. That’s what happened in the six years that preceded the 2008-9 collapse in US auto sales. Consumers rushed to take advantage of “zero percent” financing to purchase cars they would normally buy years later.

That’s how automobile sales grew from an average of 15 million in the 1980s and the 1990s to 17 million in the first six years of 2000s, before they tumbled during the Great Recession. Nonetheless, the Federal Reserve and other central bankers around the world didn’t take notice of the impact of pent down demand on future growth. They upped their ultra-low interest rate policies, refueling pent down demand again (automobile sales are above the pre-Great Recession levels). Compounding the problem, pent down demand is exacerbated by debt – a lot of debt – amassed on top of the old debt, which fueled the bubble that preceded the Great Recession. This was documented by a McKinsey report—US auto loans have crossed $1 trillion lately.

Locked in to their own fantasies.

• Fed to Markets: June Rate Hike Coming Your Way (CNBC)

As expected, the Fed gave a nod to a temporary weakness in the economy and signaled it is still moving ahead with policy tightening. “They’re looking past the first-quarter weakness. They are laying the groundwork for a June rate hike, in my opinion,” said Peter Boockvar, chief market analyst at Lindsey Group. Fed funds futures indicated just about a 75% chance of a June interest-rate hike, up about 5 percentage points after the announcement, according to Michael Schumacher, head of rates strategy at Wells Fargo Securities. “It seems pretty optimistic. … There’s no big difference between this statement and the last one. The comment that they are ignoring weak first-quarter growth is the big thing. There’s nothing really changed in their path,” Schumacher said.

First-quarter growth grew at a weak 0.7%, but economists expect a bounce back and some see growth over 3%. The Fed acknowledged the softness in its statement. “The Committee views the slowing in growth during the first quarter as likely to be transitory and continues to expect that, with gradual adjustments in the stance of monetary policy, economic activity will expand at a moderate pace, labor market conditions will strengthen somewhat further, and inflation will stabilize around 2% over the medium term,” they wrote. [..] The statement did not mention changes to the Fed’s balance sheet, which officials were expected to have discussed at length during the two-day meeting. That discussion should be revealed in the minutes of the meeting, expected to be released May 24.

Instead, the Fed noted in its statement that it was maintaining its strategy of balance sheet reinvestment, meaning it replaces securities as they roll down. The Fed has forecast two more rate hikes this year, and many strategists expect it to tackle its balance sheet after those moves. The Fed has said it would like to begin shrinking its balance sheet as early as this year. Many market pros expect some action on the balance sheet around the December meeting or in early 2018, after it raises interest rates in June and September.

Rickards’ been saying for a while that the Fed wouldn’t be able to help itself.

• Rickards Says Fed Raising Into Weakness, Recession Due By Summer (BBG)

A quarter are in mortgage stress already.

• 57% Of Australians Couldn’t Handle $100 A Month Rise In Mortgage Payments (G.)

The burden of housing costs is biting even in Australia’s wealthiest suburbs as an unprecedented one in four households nationally face mortgage stress, according to the latest in a 15-year series of analyses. Households in Toorak and Bondi, prestigious pockets of affluence in Australia’s biggest cities, have made the list of those struggling to meet repayments amid rising costs and stagnating wages, research firm Digital Finance Analytics has found. The firm’s principal, Martin North, said it was surprising new evidence showed that financial distress from property price surges reached beyond “the battlers and the mortgage belt” and was a “much broader and much more significant problem”. The survey, which analyses real cash flows against mortgage repayments, finds more than 767,000 households or 23.4% are now in mortgage stress, which means they have little or no spare cash after covering costs.

This includes 32,000 that are in severe stress, meaning they cannot cover repayments from current income. The firm predicts that almost 52,000 households will probably default on mortgages over the next year. Risk hotspots include Meadow Springs and Canning Vale in Western Australia, Derrimut and Cranbourne in Victoria, and Mackay and Pacific Pines in Queensland. Overall, New South Wales and Victoria, whose capital cities have seen a recent surge in home prices, accounted for more than half the probable defaults (270,000) and households in mortgage distress (420,000). North said the numbers were “an early indicator of risk in the system”. The underlying drivers were “flat or falling wage growth”, much faster rising living costs and the likelihood mortgage interest payments would only go up.

Widespread mortgage burdens were limiting spending elsewhere and “sucking the life out of the economy”, and the problem should be addressed to head off a housing crash and its repercussions, North said. North is not alone in highlighting household vulnerability. The Reserve Bank of Australia’s financial stability review last month observed one-third of Australian borrowers had little or no mortgage “buffer”, which North said was “the first time they’ve ever admitted it”. Finder.com last week found 57% of mortgagees could not handle a rise of $100 or more in monthly repayments. “The surprising thing is that people in Bondi in NSW, for example, or even young affluents who have bought down in Toorak in Victoria are actually on the list [of mortgage stressed],” North said.

“As soon as liabilities have problems – meaning the depositors decide to not roll their holdings – all hell breaks loose..”

• Kyle Bass Warns “All Hell Is About To Break Loose” In China (ZH)

China's credit system expanded "too recklessly and too quickly," and "it's beginning to unravel," warns Hayman Capital's Kyle Bass. Crucially, Bass notes that ballooning assets in Chinese wealth management products are another sign of a looming credit crisis in the nation.

"Some of the longer-term assets aren't doing very well," Bass said on Bloomberg TV from the annual Milken Institute Global Conference in Beverly Hills, California. "As soon as liabilities have problems – meaning the depositors decide to not roll their holdings – all hell breaks loose."

The wealth management products, or WMPs, have swelled to $4 trillion in assets in the last few years, he said., on a $34 trillion banking system…

"think about this – in the US, our asset-liability mismatch at the peak of our subprime greatness was around 2%! … China's mismatch is more than 10% of the system."

Must Watch simplification of the next stage of the credit cycle in China…

Timing the drop is hard, Bass notes, reminding Bloomberg's Erik Schatzker that "in the US, the first bumps in the road hit in early 2007, and we didn't start to really accelerate until mid 2008… even a large unraveling takes a while."Bass has been sounding the alarm for some time that debt-burdened Chinese banks need to be restructured…

"What you see when the liquidity dries up is people start going down… and this is the beginning of the Chinese credit crisis."

And judging by the collapse in both Chinese stocks and bonds, the deleveraging is accelerating…

And liquidity is getting desperate again…

China=Debt.

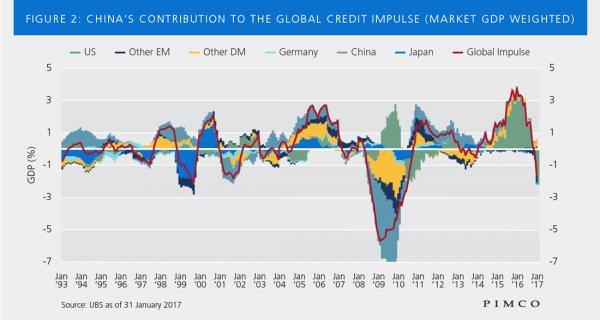

• PIMCO Warns “Brace For Lower Growth” From A Less ‘Impulsive’ China (ZH)

In the company’s blog, PIMCO’s Gene Fried echoes everything we have said and write that following the defeat of the new U.S. healthcare bill, investors have begun to rethink the likely time frame and extent of the Trump administration’s other top priorities, such as fiscal stimulus. Equity markets stalled and bonds rallied as investors toned down their expectations for global reflation recently. None of this is horribly surprising, but by focusing so intensely on U.S. political developments, investors risk missing a silent shift in what has arguably been the strongest driver of global reflation in the last five years: Chinese credit. This driver is now moving sharply in reverse. China’s “credit impulse,” the change in the growth rate of aggregate credit to GDP, bears close watching: It has tended to lead the Chinese manufacturing Purchasing Managers’ Index (PMI) by a year (see Figure 1) and the U.S. Institute for Supply Management’s (ISM) manufacturing index by 14 months.

The relevance of the Chinese credit impulse to global reflation cannot be overstated (see Figure 2). China’s massive credit stimulus starting in 2014 initially put a floor under commodity prices and emerging market (EM) growth. Then, the unexpected acceleration in Chinese real estate investment drove both commodity prices and volume demand higher. EM growth subsequently bounced, and with it, global trade volumes. The key driver of realized global reflation, then, has been China – not the promise of fiscal stimulus and deregulation that has helped boost confidence and other soft data in the U.S.

When will China’s credit drop affect growth? The sharp downturn in the Chinese credit impulse starting in 2016 portends a material drag on Chinese growth in the year ahead. Looking back on the past three years, the Chinese credit impulse turned positive sometime between late 2014 and mid-2015. Given China’s exchange rate volatility in August 2015, it took longer than normal for credit to gain traction. The Chinese credit impulse peaked in March 2016 and slowed sharply after the second quarter. It is only now that the impact of that reduced stimulus should be felt. PIMCO has already factored credit-related drag into its Chinese growth outlook, but the decline in the credit impulse has been sharper and more extreme than many expected.

Unanswerable question.

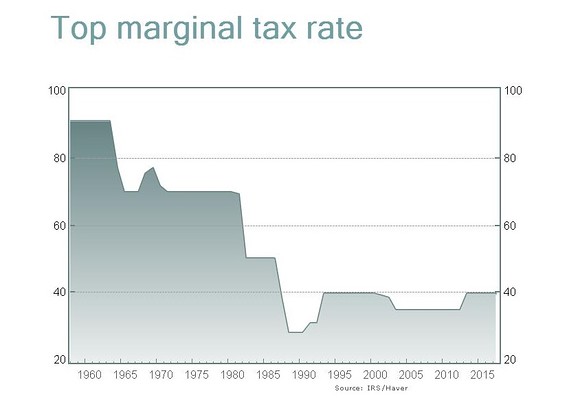

• Do Tax Cuts Pay For Themselves? (MW)

Forty-three years after economist Arthur Laffer sketched a pictorial representation of individuals’ response to changes in income tax rates, economists still can’t agree if tax cuts pay for themselves: entirely, in part, or not at all. In a capitalist system, a tax rate of 0% or a tax rate of 100% will yield no revenue for the government: in the first instance, because there is no tax levied on labor income; in the second, because there is no labor income to tax because most of us would refuse to work without compensation. The Laffer Curve is an attempt to describe the optimal tax rate, or the rate that maximizes revenue. As with most economic theories nowadays, the idea that tax cuts pay for themselves has been politicized. Many conservatives take an oath of fealty to supply-side economics, an offshoot of the Laffer Curve: the idea that lower tax rates act as an incentive to work and produce, lifting economic growth and tax revenue.

Supply-siders don’t differentiate between the potential effect of large reductions in the top marginal tax rate — from 91% (1950s) to 70% (1960s) to 28% (1980s) — and that of President Donald Trump’s proposed modest cut from 39.6% to 35% for top earners. Liberals, on the other hand, love to quote George H.W. Bush’s assessment of supply-side theory — at least until he became Ronald Reagan’s running mate — as “voodoo economics.” “Tax cuts for the rich” is another favorite derogatory moniker, which is an accurate description but one that is taboo for believers. The basic premise underlying supply-side economics is sound: Tax something less, and you will get more of it. Tax something more, and you will get less of it. Think hefty cigarette taxes, designed to deter cancer-causing tobacco use. It’s the application that goes astray.

The income tax is a tax on labor. According to supply-siders, if you raise marginal tax rates, individuals will work less. And if you cut rates, they will work more. Who except the rich is in a position to forgo take-home pay, even if it is taxed at a higher rate? Households with both parents working, struggling to make ends meet, can’t sacrifice one salary. That’s the dirty little secret of supply-side economics that its advocates never mention. It’s the rich who are able respond to changes in marginal tax rates. And yes, they are the ones likely to start a new business and create jobs. Theory aside, why don’t we know what the effect of tax cuts is on economic output and federal revenue? Economists of both political persuasions are eager to tout their findings, both in support of and as a challenge to supply-side economics.

Hopefully I should be getting Steve’s book today. Everyone should read it.

• The Economics of the Future (Michael Hudson)

At first glance Steve Keen’s new book Can We Avoid Another Financial Crisis? seems too small-sized at 147 pages. But like a well-made atom-bomb, it is compactly designed for maximum reverberation to blow up its intended target. Explaining why today’s debt residue has turned the United States, Britain and southern Europe into zombie economies, Steve Keen shows how ignoring debt is the blind spot of neoliberal economics – basically the old neoclassical just-pretend view of the world. Its glib mathiness is a gloss for its unscientific “don’t worry about debt” message. Blame for today’s U.S., British and southern European inability to achieve economic recovery thus rests on the economic mainstream and its refusal to recognize that debt matters.

Mainstream models are unable to forecast or explain a depression. That is because depressions are essentially financial in character. The business cycle itself is a financial cycle – that is, a cycle of the buildup and collapse of debt. Keen’s “Minsky” model traces this to what he has called “endogenous money creation,” that is, bank credit mainly to buyers of real estate, companies and other assets. He recently suggested a more catchy moniker: “Bank Originated Money and Debt” (BOMD). That seems easier to remember. The concept is more accessible than the dry academic terminology usually coined. It is simple enough to show that the mathematics of compound interest lead the volume of debt to exceed the rate of GDP growth, thereby diverting more and more income to the financial sector as debt service.

Keen traces this view back to Irving Fisher’s famous 1933 article on debt deflation – the residue from unpaid debt. Such payments to creditors leave less available to spend on goods and services. In explaining the mathematical dynamics underlying his “Minsky” model, Keen links financial dynamics to employment. If private debt grows faster than GDP, the debt/GDP ratio will rise. This stifles markets, and hence employment. Wages fall as a share of GDP. This is precisely what is happening. But mainstream models ignore the overgrowth of debt, as if the economy operates on a barter basis. Keen calls this “the barter illusion,” and reviews his wonderful exchange with Paul Krugman (who plays the role of an intellectual Bambi to Keen’s Godzilla), who insists that banks do not create credit but merely recycle savings – as if they are savings banks, not commercial banks. It is the old logic that debt doesn’t matter because “we” owe the debt to “ourselves.”

[..] By being so compact, this book is able to concentrate attention on the easy-to-understand mathematical principles that underlie the “junk economics” mainstream. Keen explains why, mathematically, the Great Moderation leading up to the 2008 crash was not an anomaly, but is inherent in a basic principle: Economies can prolong the debt-financed boom and delay a crash simply by providing more and more credit, Australia-style. The effect is to make the ensuing crash worse, more long-lasting and more difficult to extricate. For this, he blames mainly Margaret Thatcher and Alan Greenspan as, in effect, bank lobbyists. But behind them is the whole edifice of neoliberal economic brainwashing.

Keen attacks this “neoclassical” methodology by pointing at the logical fallacy of trying to explain society by looking only at “the individual.” That approach and its related “series of plausible but false propositions” blinds economics graduates from seeing the obvious. Their discipline is the product of ideological desire not to blame banks or creditors, wrapped in a libertarian antagonism toward government’s role as economic regulator, money creator, and financer of basic infrastructure.

The EU really cares.

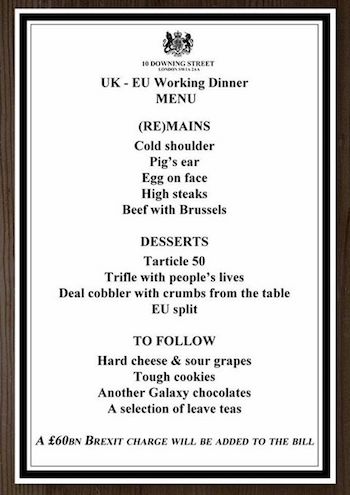

• UK PM May Accuses EU of Brexit Threats and Election Interference (CNBC)

U.K. Prime Minister Theresa May has accused the EU of not wanting Brexit negotiations to be a success, as tensions between both sides escalate ahead of official talks. “The events of the last few days have shown that – whatever our wishes, and however reasonable the positions of Europe’s other leaders – there are some in Brussels who do not want these talks to succeed,” May said Wednesday afternoon outside Downing Street. Her comments follow media reports that the EU’s Commission President Jean-Claude Juncker left London “10 times more skeptical” than he was before after a dinner with Prime Minister May last week. Their meeting has been described in the press as a disaster with both leaders clashing over key negotiating issues.

Earlier on Wednesday, Juncker described May as a “tough woman”. May has said that she will be a “bloody difficult woman” during Brexit talks. Speaking outside Downing Street, the head of the Conservative party went further and accused the European Union of wanting to interfere in the upcoming general election. “Britain’s negotiating position in Europe has been misrepresented in the continental press. The European Commission’s negotiating stance has hardened.Threats against Britain have been issued by European politicians and officials. All of these acts have been deliberately timed to affect the result of the general election that will take place on 8 June,” the prime minister said.

I watched parts of the debate, nothing brutal about it, just politics. Le Pen’s logic seems pretty solid: “France will be run by a woman whatever happens,” Le Pen said. “Either by me or by Mrs. Merkel.”

• Le Pen Tirade Meets Logic of Macron in Brutal French TV Duel

Marine Le Pen unleashed a barrage of attacks on her presidential rival Emmanuel Macron as she tried to close a gap of some 20 percentage points in the only head-to-head debate of the French election campaign. Le Pen, 48, said her centrist opponent was the candidate of the capitalist elite, and a friend to terrorists, who planned to shut down factories, schools and hospitals. Macron said Le Pen’s broadsides against state bodies meant she was unfit to lead the country as she struggled to defend her plans to leave the euro. “You have threatened public employees,” Macron, 39, said as his opponent chuckled on the other side of the table during the almost three-hour debate Wednesday night. “Your words show that you are not worthy to be the defender of our institutions.”

A snap survey of 1,314 likely voters by polling firm Elabe showed that 63 percent of respondents rated Macron as the winner and 34 percent picked Le Pen. With just three days to go before French voters settle the most turbulent election in the country’s modern history, Le Pen argued for new border restrictions to protect the French people from foreign competition and terrorism, and an exit from euro, reversing 60 years of European integration. The clash was brutal from the get-go, and the general consensus from commentators was that it wasn’t a particularly dignified debate. “It was like a schoolyard brawl,” said Emmanuel Riviere, managing director of pollster Kantar Public France. “The candidates went straight for the jugular. Le Pen started it. But Macron also played his part.”

Both candidates justified the nasty tone on Thursday. “It was severe, but that’s because for the first time ever the French have a real choice,” Le Pen said on RMC Radio. “Before, the candidates agreed on everything. I want to wake up the French people.” [..] She told him he’d traveled to Berlin to get the blessing of German Chancellor Angela Merkel for his policy plans, playing on French concerns that their country plays second fiddle within the European Union. “France will be run by a woman whatever happens,” Le Pen said. “Either by me or by Mrs. Merkel.”

“..your just and due compensation as part of this interdependent system we call society. We are all stakeholders in it.”

• Universal Basic Income is Not “Free Money” (Santens)

Let’s say the cost to produce a widget is $1. What’s the cost to produce 1 million widgets? This may sound like an extremely simple word problem that even some preschoolers could solve. However, if you think the answer is $1 million, you would be entirely wrong. The cost to produce 1 million widgets is far below $1 million thanks to the savings inherent in mass production. It’s a lot cheaper per something to make a lot of something, than it is to create one of it, or even a few. A couple secondary understandings extend themselves as a result of this primary understanding. First, it’s wrong to assume that providing people with more money will necessitate rising prices. Increased demand can lead to greatly increased production, which then leads to lower prices. Just how much production can be ramped up in response to increased demand is a key factor in price determination.

Where supply cannot be increased, and therefore more money is chasing the same amount of goods, price increases can be expected. Where supply can be greatly or even infinitely increased, lower prices can be expected, especially where true competition exists. Second, and I find this point extremely compelling and the real point of this post, is a recognition of our interdependence, and the collective debt we owe each other. Take whatever device you’re reading these words on as a prime example. Whatever its cost to you, it only cost that because millions of others like you expressed their demand for the same device. Without everyone else, that device would have cost you ten times, a hundred times, or even a thousand times more than it would have to create just one, just for you. In other words, we all subsidize each other.

[..] In Alaska, Alaskans are paid on average about $1000 per year for being an Alaskan. Why? Because the oil companies didn’t make the oil in Alaska. They’re merely bringing it up out of the ground and processing it. The oil is considered owned by all Alaskans, and so they should as owners see some of the revenue generated by its sale. Now apply this logic to the rest of what was not created by humankind. Apply it to what is not created by any one human individually, but everyone together, like for example land value. Take a million dollar mansion and swap it with an empty lot in the middle of the desert. The mansion becomes worth only the sum total of what its parts can sell for. The empty lot shoots up in value. Why? Because the unimproved value of land is socially created. That value exists because YOU exist.

Do you see now that basic income is not “free money” or “money for nothing?” You are owed it. It is your just and due compensation as part of this interdependent system we call society. We are all stakeholders in it. We are all owed a dividend as investors. No investor in Apple would ever be okay with being told that in return for their investment in Apple, they merely get the privilege of purchasing Apple products. Their reward is a return on their investment in the form of cash dividends. That’s fair and just. What is true for corporate stockholders should also be true for you. Don’t accept anything less than a cash dividend for your investments in this grand organization called human civilization. Claim what you are owed and demand unconditional basic income.

Key: “There is an effort by a coalition of interests: banks, financial funds, pro-bailout governments, and the international creditors. They want to grab people’s property by using the public debt as a lever..”

• The Brothers Fighting For Indebted Greek Homeowners (AP)

Leonidas Papadopoulos is a doctor, his brother Ilias an economist, and once a week they take a break from ordinary life to fight the government. They go to court every Wednesday, the day homeowners in default on mortgages lose their properties at auctions – the final step of foreclosure in a country where the government and its citizens are overwhelmed by debt. Auctions are supervised by a notary public, who faces a weekly hour of crowd harassment. At a lower court in Athens one Wednesday, the Papadopoulos brothers and about 30 protesters gather menacingly around the notary’s desk, shouting insults and chanting “Vultures out!” When the atmosphere gets heated, protesters clamber onto the empty judges’ benches. In the court halls outside the chamber, demonstrators unfurl large banners and set up loudspeakers to blast music normally associated with protest movements from the 1970s.

Police look on without intervening, and another auction is cancelled. The crowd celebrates with chants of “No Homes in Bankers’ Hands!” – and goes home. “We create a list of all the auctions that are due to take place and decide which cases require our intervention. When the notary enters the chamber, we eject them with our presence, and by shouting,” the 35-year-old Leonidas Papadopoulos says. Each postponement typically delays an auction by about two months. The bearded brothers have created a nationwide protest network of several hundred volunteers to disrupt the auctions across Greece and to help illegally reconnect homes of unemployed people who have had their electricity cut off. In its fourth year, the campaign is intensifying as the country faces pressure from its international bailout creditors to deal with a mountain of bad bank loans.

Greece owes a staggering 325 billion euros ($354 billion), most of it to bailout lenders, while annual economic output – hammered by austerity, political upheaval and years of recession – has withered to below 180 billion euros ($196 billion). The country’s key assets are locked up for 99 years under the control of a fund created by the creditors. The picture for the country’s 10 million citizens is equally grim: Some 4 million are in arrears on tax payments, while 2 million households and businesses are behind on their electricity bills. Nearly half of loans given by banks for businesses and property purchases are now officially listed as soured. Ilias Papadopoulos, 33, sees the problem differently, arguing that people’s property are being seized at fire-sale prices after tax collection has been exhausted, in a desperate effort to maintain bailout debt commitments.

“There is an effort by a coalition of interests: banks, financial funds, pro-bailout governments, and the international creditors. They want to grab people’s property by using the public debt as a lever,” he said. “That includes homes, small businesses, farm land, and industry. It’s wealth that was acquired with such great effort by the Greek people. It cannot be surrendered without a fight.” Ilias says he’s never been arrested or detained by police due to his activism, and predicts the fight against foreclosures will intensify after Greece and it’s bailout creditors reached a new austerity deal this week. “This will only make things worse for poor people. So we’ll have to step things up.”

Home › Forums › Debt Rattle May 4 2017