Georges Seurat A Sunday Afternoon on the Island of La Grande Jatte 1884

“..those expensive bases of aggression around the world will begin to cost more than they bring in profit.”

• Angst and Madness at the End of Empire (Orphan)

[..] the angst of the American bourgeoisie is demonstrated more by what it doesn’t speak about than what it does. It is a disquiet which is at once terrified of the collapse that looms ahead and horrified at the idea of losing the status quo arrangement, even though that status quo is benefiting fewer and fewer people. It stands simultaneously aghast and paralyzed before the obvious madness of its rulers, and yet continually grasps at failed “lesser evilism” as a solution. And it largely still buys into the noxious mythology of it being the “greatest country on earth.” The corporate elite, having stripped down civic education over decades, robbed them of their political agency and resistance and replaced it with a sanitized history and demoralizing optimism, or “positive thinking,” which places all blame for their collective state and its inadequacies on the individual.

That it has been so lauded by Wall Street should cause anyone to wonder why it has been so internalized by the disenfranchised masses. To be sure, this arrangement is rapidly meeting its end. Banking and corporate corruption, never really having been dealt with in the last “Great Recession” or its notorious state funded “bailout,” has only become more blind and reckless. The membrane of the bubble created after that fiasco, born in avarice, is thinning in plain sight. It is about to burst again, and this time it will be far more catastrophic. The endless imperialistic wars that the US has engaged in for the last decades are also creating a financial strain.

Coupled with climate breakdown those expensive bases of aggression around the world will begin to cost more than they bring in profit. In the US itself biblical floods are wiping clean the soil graded for agriculture throughout the Midwest and causing tremendous economic hardship for scores of rural and commercial farmers. Droughts offer a grim alternative to this increasingly chaotic climate pattern. Food prices will undoubtedly rise in the future thanks to a capitalist system which creates artificial shortages and surpluses.

“..our so called leaders are devoid of principle, immune to responsibility and seem only to prioritise their own interests, power and most importantly private profit above all. Theresa May is exhibit one. ”

• Theresa May: The Total Decay Of Political Integrity And Vision (Ind.)

As an NHS doctor, making a diagnosis is quite an important part of my job. Central to it in fact. One has to process and put together information while providing care to your patients. Attention to detail is critical. For many of us working within the NHS therefore, it has been abundantly clear that the diagnosis for Theresa May has been terminal for some time. But where did it all go wrong? Was it always destined to end like this? What could have been done? Watching her face crumple and tears fall as she defended her claim to have “tackled Britain’s burning injustices”, as well as saying she had proudly served the country she loved, surely only the coldest of hearts could not have pity for a woman who had done her very best at the worst of times?

Well let me answer in the only way I know how: honestly, Theresa May is a mere symptom of the problem. The diagnosis is much greater and much more devastating than this one tragic figure. What we appear to be all bearing witness to is the total decay of political integrity and vision. We now live in a world where our so called leaders are devoid of principle, immune to responsibility and seem only to prioritise their own interests, power and most importantly private profit above all. Theresa May is exhibit one.

The woman who has supposedly tackled “burning injustices” has consciously implemented measures to ensure inequality has soared, overseen childhood and old-age poverty skyrocket, had life expectancy fall under her watch, ordered the Home Office to send out racist, xenophobic anti-immigration “Go Home” vans, and who oversaw a “hostile environment” policy that led to the deportation of many of the Windrush generation.

Hollowness echoes with the people.

• Boris Johnson Threatens To Withhold $50 Billion Brexit Payment (R.)

Boris Johnson, the leading candidate to succeed Theresa May as Britain’s next prime minister, said he would withhold a previously agreed 39 billion pound ($50 billion) Brexit payment until the European Union gives Britain better exit terms. The EU has repeatedly said it will not reopen discussion of the Brexit transition deal it reached with May last year, which British lawmakers have rejected three times, prompting May to announce her resignation earlier this month. May stepped down as leader of the governing Conservatives on Friday. Johnson, a former foreign secretary in May’s cabinet, is popular with ordinary Conservative Party members, who will decide between the two candidates who come top in a series of votes by Conservative lawmakers over the coming weeks.

“I always thought it was extraordinary that we should agree to write that entire cheque before having a final deal. In getting a good deal, money is a great solvent and a great lubricant,” Johnson told the Sunday Times. Britain is due to leave the EU on Oct. 31. If Parliament does not approve a deal – and the government does not ask the EU for another delay – there risks being major economic disruption from a disorderly departure. The 39 billion pounds represents outstanding British liabilities to the EU, which would be paid over a number of years according to the withdrawal agreement negotiated by May. Johnson also said border arrangements with Ireland should be settled only as part of a long-term agreement, rejecting a “backstop” which would avoid checks on Northern Ireland’s border but which Conservative lawmakers fear is a backdoor way of requiring Britain to continue to follow EU rules after Brexit.

Record loans for clunkers.

• US Auto Loans Hit Record (CNBC)

People buying a new vehicle are borrowing more and paying more each month for their auto loan. Experian, which tracks millions of auto loans each month, said the average amount borrowed to buy a new vehicle hit a record $32,187 in the first quarter. The average used-vehicle loan also hit a record, $20,137. “We have not seen a slowdown in loan demand. In fact, volume for new and used loans is up from previous years,” said Melinda Zabritski, senior director of automotive financial solutions for Experian. With sales of new vehicles moderating slightly after the four best years the industry has ever seen in the U.S., dealers and auto executives are watching whether consumers will be more resistant to the steady increase in new car prices.

That is not happening. In fact, the average amount borrowed topped $32,000 for the first time ever. As a result, the average monthly payment for a new vehicle continued to climb to a new high of $554 and to a record $391 for used vehicles, according to Experian. While new car sales and loans are still strong, people with the best credit scores are increasingly buying a used model instead of new. Experian says 61.8% of those with a prime credit rating and 44.7% of those with a super prime credit rating took out loans to buy a used vehicle in the first quarter. Those are the highest percentages Experian has ever recorded for prime and super prime used vehicle borrowing.

There’s something very ironic hidden in here.

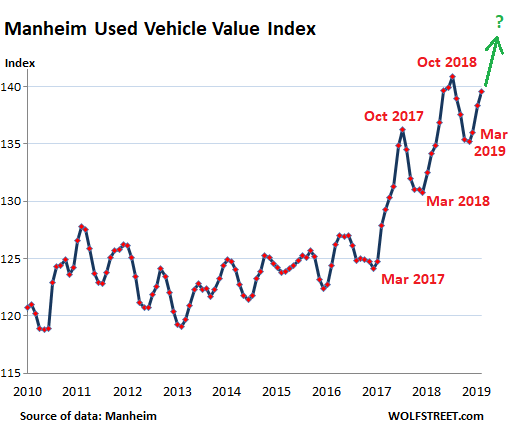

• Used-Car Wholesale Prices Surge (WS)

Prices of used vehicle that were sold in May at wholesale auctions rose 4.0% compared to May last year, according to Manheim, the largest auto-auction house in the US, running about 8 million vehicles through its venues a year. The chart of the Manheim Used Vehicle Value Index, which is adjusted for mix, mileage, and seasonality, shows the two price surges from end of March 2017 and March 2018 that were subsequently only partially unwound. And the 2019 selling season is beginning likewise. The last time there was such an extended period of year-over-year price gains was from the trough of the Financial Crisis. After prices had collapsed in 2008, they started bouncing off sharply in January 2009.

By the time the “Cash for Clunkers” program started officially on July 1, 2009, used vehicle prices had already recovered to their prior pre-crisis levels (see chart below). But “cash for clunkers” boosted prices further. Congress had appropriated $1 billion that was supposed to last through November. But by July 30, it was gone. Congress appropriated another $2 billion, which was soon gone too. Car buyers were handed this $3 billion to trade in their “clunkers” and buy a new vehicle. Cash for clunkers was designed to boost new-vehicle sales. The engines of these trade-ins under the program were destroyed and the vehicle was then towed to the salvage yard for parts.

As a side effect, the program destroyed a portion of the most affordable vehicles – another devastating blow to lower-income car buyers in subsequent years. Not only were the most affordable vehicles gone; but by removing this supply from the market, Cash for Clunkers caused the prices up the entire scale of used cars to surge. This included my three-year-old car. Its book value rose month after month, even as the car got older and accumulated miles, something I’d never seen before, and I’d spent many years in the car business.

So Europeans can buy clunkers too?!

• ECB Policymakers Open To Cut Rates If Growth Weakens (R.)

European Central Bank policymakers are open to cutting the ECB’s policy rate again if economic growth weakens in the remainder of the year and a strong euro hurts a bloc already bearing the brunt of a global trade war, two sources said. The ECB said on Thursday that its interest rates would stay “at their present levels” until mid-2020 but President Mario Draghi added rate setters had started a discussion about a possible cut or fresh bond purchases to stimulate inflation. The apparently mixed message failed to convince some investors, who saw it as too tenuous a commitment to more stimulus. This sent the euro rallying to a 2-1/2 month high of $1.1347 against the U.S. dollar.

But two sources familiar to the ECB’s policy discussions said a rate cut was firmly in play if the bloc’s economy was to stagnate again after expanding by 0.4% in the first quarter of the year. “If inflation and growth slow, then a rate cut is warranted,” said one of the sources, who requested anonymity because the ECB’s deliberations are confidential. The ECB’s deposit rate is already 40 basis points below zero and the bloc’s top-rated governments, such as Germany’s, can borrow at negative rates for up to a decade. In this context, countering the euro’s strength, rather than lowering already rock-bottom borrowing costs, would be the main reason for a further cut to that deposit rate, one of the sources said.

What else are they going to say?

• China Banking Regulator Says Small Bank Risks Manageable (R.)

China’s banking regulator says risks at small and mid-sized banks are manageable, a central bank publication reported on Sunday, in the latest move to soothe investors’ concerns after the government took over a troubled regional lender last month. The China Banking and Insurance Regulatory Commission (CBIRC) took control of Inner Mongolia’s Baoshang Bank due to “serious” credit risks on May 24, rattling Chinese markets and prompting the People’s Bank of China (PBOC) to inject cash into the banking system. While authorities said it was a standalone case, the seizure comes as Beijing is urging banks to boost lending to help cushion an economic slowdown, fuelling concerns about rising debt and more bad loans.

“At present, small and mid-sized banks are operating smoothly, liquidity is relatively ample, and overall risks are fully manageable,” the CBIRC said in a Q&A interview with the Financial News. The regulator also said big banks are willing to continue interbank business with small banks to safeguard the stability of financial markets. Some small banks rely heavily on short-term borrowing from the interbank market, leaving other banks at risk if they run into trouble. A Reuters analysis showed at least 18 smaller institutions have not published up-to-date financial reports, and in some of those cases senior regulatory officials have been appointed for bank management oversight.

Can I add a warning about IMF dominance?

• IMF Warns Of Giant Tech Firms’ Dominance (BBC)

Giant technology companies might cause significant disruption to the world’s financial system, the head of the International Monetary Fund has warned. Christine Lagarde said just a few firms with big data access and artificial intelligence could run the global payment and settlement arrangements. Her warning came as the G20 finance ministers met in Japan. The summit is also discussing the need to close tax loopholes for internet giants like Facebook and Google. One of the options being considered is to tax such companies where they make their profits – rather than where they base their headquarters.

“A significant disruption to the financial landscape is likely to come from the big tech firms,” Ms Lagarde said in Japan’s south-western city of Fukuoka. She said such firms “will use their enormous customer bases and deep pockets to offer financial products based on big data and artificial intelligence”.”This presents a unique systemic challenge to financial stability and efficiency,” she added. She cited China as a most recent example. “Over the last five years, technology growth in China has been extremely successful and allowed millions of new entrants to benefit from access to financial products and the creation of high-quality jobs,” Ms Lagarde said. “But it has also led to two firms controlling more than 90% of the mobile payments market.”

Can Bezos buy FedEx?

• Amazon Gets Booted by FedEx (WS)

Amazon is aggressively butting in on freight carriers with its own planes, trucks, and delivery infrastructure, and is at the same time aggressively pushing for faster and cheaper service from freight carriers such as FedEx, UPS, and the US Postal Service. And FedEx has had it with Amazon, announcing today that it was dumping Amazon as customer of its FedEx Express division. “FedEx has made the strategic decision to not renew the FedEx Express U.S. domestic contract with Amazon.com, Inc. as we focus on serving the broader e-commerce market,” it said in a surprise statement. The current contract ends June 30.

Its other units that do business with Amazon and its international services with Amazon are not impacted by this decision, FedEx said. FedEx is not overly dependent on Amazon – unlike some other freight companies that now have come to grief under Amazon’s boots, including New England Motor Freight, a less-than-truckload carrier that “stunned” the transportation world when it filed for bankruptcy in February. Interestingly, FedEx chose to address this point explicitly in the statement: “Amazon.com is not FedEx’s largest customer. The percentage of total FedEx revenue attributable to Amazon.com represented less than 1.3 percent of total FedEx revenue for the 12-month period ended December 31, 2018.”

“It will go when stratification breaks down completely and the Atlantic takes over the whole region.”

• The End Of The Arctic As We Know It (G.)

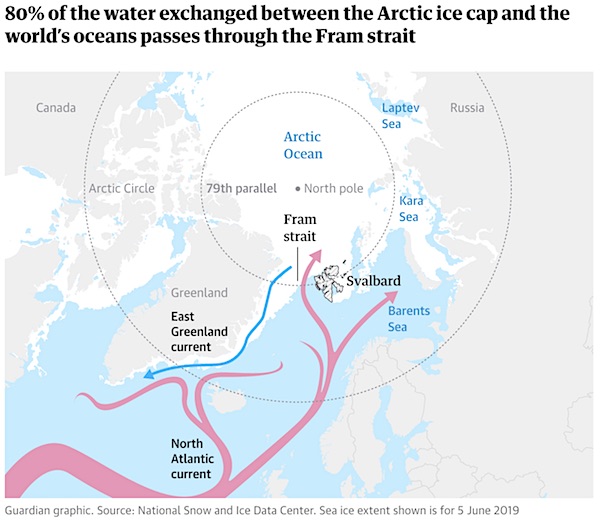

If the Arctic were a patient, doctors would be alarmed by its vital signs. As well as hot flushes, asthma and contamination (the researchers are following up on studies that suggest the Fram strait has one of the highest levels of microplastics in the world), the ocean has also been diagnosed with a weakening of its immune system. For centuries, the Arctic’s distinctive character has been shaped by a layer of cold, relatively fresh water just below the surface, produced by melting ice and glaciers. This has insulated the sea ice from the warmer, denser, saltier waters of the Atlantic currents that flow in the depth. But this stratification is collapsing as temperatures rise.

The oceanic shift was outlined in a landmark study published last year in Science, which found that the water density and temperature of the Fram strait and Barents Sea were increasingly like those of the Atlantic, while further east, Russia’s Laptev sea was starting to resemble what the Barents used to be. “The polar front is shifting,” the lead author, Dr Sigrid Lind, of the Institute of Marine Science and the University of Bergen, told the Guardian this year. “The Arctic as we know it is about to become history. It will go when stratification breaks down completely and the Atlantic takes over the whole region.”

This has not happened for more than 12,000 years, but the shift is well under way. First to succumb, according to Lind, will be the Barents Sea, which will have no fresh water by 2040, then the Kara sea. The consequences will be far-reaching. The food chain is already affected. Atlantic species of cod, herring and mackerel are moving northwards. For the next 20 to 30 years this could boost fishing catches, but forecasts by Norway suggest boom will turn to bust later as the waters grow too warm for fish larvae.

Photograph: Denis Sinyakov/Greenpeace

Home › Forums › Debt Rattle June 9 2019