Pierre Bonnard Nude in an Interior c1935

And the longer re-pricing is postponed, through QE etc., the steeper the fall will be.

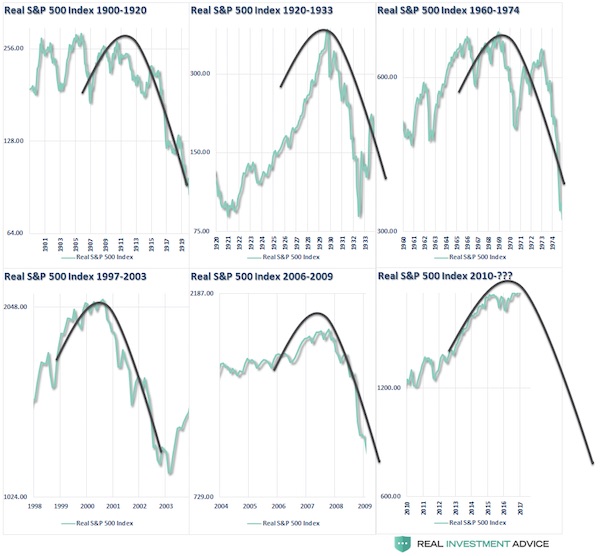

• Periods Of Re-Pricing Are Usually Quick And Brutal (Roberts)

1. Stock prices run in cycles. Periods of re-pricing are usually quick and powerful.

7. Your first loss will often be your best loss. No one is right all the time and you don’t have to be. There are market participants that are immensely profitable by being right only 30% of the time. It is good to have conviction in your investment thesis, but discipline should always trump conviction.

8. Optimism and pessimism in the stock market are contagious. Investor psychology often loses its logic and become emotional. The news media and the most recent price action play a particularly important role in developing moods of mass optimism or pessimism.

Debt slaves.

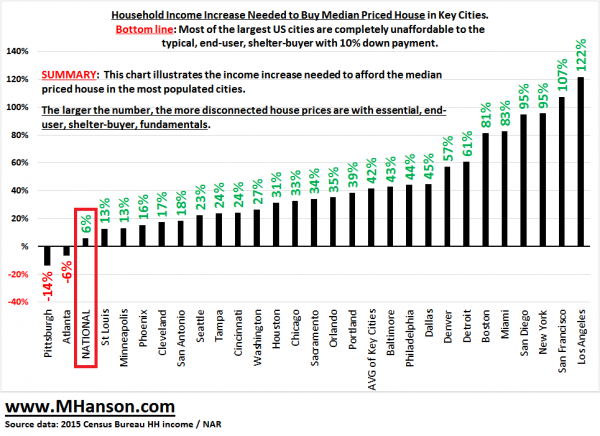

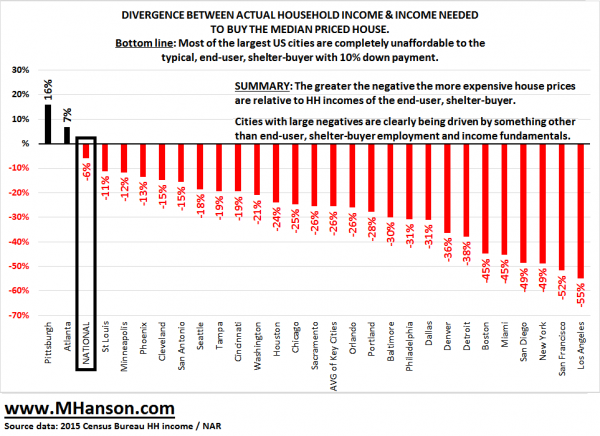

• US House Price Bubbles 2.0 (Hanson)

A big problem with house prices experiencing even a “moderate” correction of 10% to 20% — already underway in many of the most over-priced regions — is with between 40% and 50% of all house purchases for years being of the “less than 10% down” variety — and because it takes 8% to 10% equity to sell plus the 3% to 10% down payment on the new house — it doesn’t take much downside to swamp the nation in “NEGATIVE EQUITY” once again. And we know for certain that many homeowners rather pay their credit cards and car payments before their mortgage when they are underwater.

ITEM 1) Household income INCREASE needed to Buy the Median Priced House in Key Cities. Bottom Line: On a “national” basis the divergence isn’t too bad…6%. But, in the key cities that drive the US economy, Bubble 2.0 has blown large. This represents significant downside, especially in the sand states, just like in Bubble 1.0.

ITEM 2) DIVERGENCE between Actual Household Income & Income Needed to Buy the Median Priced House. Bottom Line: Here too, on a “national” basis the divergence isn’t too bad…-6%. But, in the key cities that drive the US economy, Bubble 2.0 has blown large.

It’s worse, actually. Heroin cold turkey is doable though hard. QE cold turkey is definitely not.

• QE Is Like Heroin, Says Former UK Treasury Official (G.)

A former senior Treasury mandarin has compared quantitative easing to heroin and called for an end to almost a decade of electronic money printing by central banks. Nick Macpherson was permanent secretary to the Treasury when Bank of England officials started buying UK government bonds to stimulate the economy following the financial crisis. On Monday, he said it was “time to move on” from QE, which is credited with helping Britain into recovery but remains in use nine years later amid concerns over Brexit. Threadneedle Street initially began pumping £200bn into the gilt market in 2009 to boost the economy, before expanding the programme to £435bn, including an extra £60bn following the EU referendum. The bond buying scheme is similar to massive stimulus packages used by other countries, such as the Fed’s $4.5tn of asset purchases (£3.5tn) and the ECB ’s €2.3tn (£2.1tn) plan.

Lord Macpherson’s call comes as pressure mounts on the world’s central bankers to give more clues about how they intend to exit QE in a process known as “normalisation” almost a decade on from the crash. Some indications could be given at a meeting of senior officials at Jackson Hole in the US later this week. Mario Draghi, the ECB governor, is expected to be the star turn at the event watched by global investors, although he is not thought to be preparing to announce the end of QE just yet. While QE is credited with lowering borrowing costs and helping banks to lend more to consumers and businesses, critics say such schemes inflate assets owned by the richest in society, while punishing savers without large amounts of wealth. Macpherson did not single out the specific bond-buying programme of a particular central bank. “QE like heroin: need ever increasing fixes to create a high. Meanwhile, negative side effects increase. Time to move on,” he wrote on Twitter.

And after all the QE, people are poorer than before.

• UK Credit Card Lending Booms As Real Wages Fall (Ind.)

UK consumers are increasingly purchasing goods on plastic with the number of transactions on credit and debit cards jumping 12% in the last year. The increase was the fastest annual rise in the number of card transactions since 2008 and comes after warnings from the Bank of England about the growth of personal debt. Shoppers spent 7.2% more on all types of cards in the year to the end of June, despite real wages falling over the period, data from industry body UK Finance showed. The total value of credit and charge card purchases increased 6.9% over the 12 months with credit card lending accelerating in April, May and June to an annual growth rate of 9%. During those three months, the number of people defaulting on their credit card bills and personal loans “increased significantly”, the Bank of England said in a recent report.

The rise comes as official figures show real earnings have declined. Average pay rose at an annual rate of 2.1% in the three months to June – well below the inflation rate of 2.6% in the year to the end of June. Overall consumer spending was up 1.3% in the year to July, the Office for National Statistics said in a separate release this month. Peter Tutton, head of policy at StepChange debt charity, expressed concern at the findings. “With our research estimating 3.2 million people are using credit cards to pay for everyday household expenses, the growing stock of credit card debt should focus attention on households in financial difficulties,” he said. Mr Tutton said the growth in credit card cash advances was particularly worrying. This type of borrowing is expensive and can be a warning sign that borrowers are facing financial difficulty.

More on Ken Rogoff and Larry Summers’ crazy ideas of power over people’s money.

• Cash is Not The Curse (Mark GB)

There’s a pub in the Welsh hills, not far from where I live, called ‘The Tylers Arms’ – pronounced ‘tillers’. The name originated, I believe, in the 18th century. The local villagers, who all worked on the land, would go there to pick up their wages in the form of ‘tyles’ – some of which would be immediately exchanged for beer, and thus returned to the landowner…who also owned the pub…and the local store. Thus, the ‘tyles’ circulated regularly, providing employment & cheap produce for the villagers, a steady and almost ‘captive’ profit for the landowner, and stability for the community. As the industrial revolution progressed some of the larger UK manufacturers adopted a similar system, but using fiat currency – e.g. there is a ‘village’ in Birmingham known as Bourneville, which was built by the Cadbury family.

Now before anyone thinks I’ve got unresolved baggage on feudalism, a ‘downer’ on capitalism, or a yearning for socialism…hold your horses please…this is about something far more serious than the ‘isms’. This is about who controls the money. The folks who do that…can, and do, call the tune for the rest of us. And that’s what I want to talk about here.

These days our monetary masters are much more sophisticated – our ‘tyles’ are pieces of paper backed by government fiat. You can work for pretty much whomever you like, and you can buy from whomever you like, but one way or another the government will take a cut of everything you earn and everything you spend. You can do the odd ‘swapsie’ with your pals but you can’t pay taxes with home grown tomatoes – the IRS don’t do vegetables – they can’t digitise them or create them with a keystroke so veggies would confuse the poor dears.

What happens next is technical and varies between territories, so let’s just deal with the ‘myth’: The taxman’s ‘cut’ is used to boost the economy on your behalf by spending it on useful things like building roads and bridges. It also includes an ever-growing list of things that you didn’t even realise you need, like cruise missiles & other stuff that goes ‘BANG’, along with other seemingly ‘essential’ services like bribing foreign governments and funding ‘moderate rebels’ to remove the foreign governments that can’t be bribed. Clearly we’ve come a long way from tyles, especially in the case of the dollar, which can used to bribe governments on seven continents. The chap who owned the Tillers never dreamt of such power – this is considered to be progress…

Now that Goldman rules the White House, default risk is definitely down.

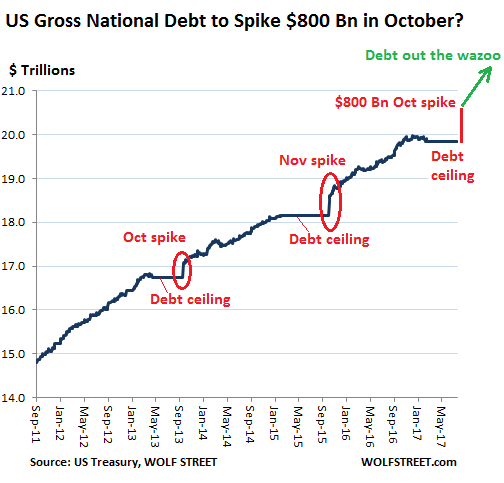

• US Gross National Debt to Spike by $800 Billion in October? (WS)

“There is zero chance, no chance we won’t raise the debt ceiling,” swore Senate Majority Leader Mitch McConnell (R., Ky.) at an event in Louisville, Kentucky, on Monday. He who couldn’t get his Republican ducks all lined up in a row to get any major legislation passed this year was confident that the Senate would pass a bill that would raise the debt ceiling so that the government could continue to pay for things that Congress told the Government to pay for, and so that the government could service its debts, rather than default on them. Treasury Secretary Steven Mnuchin was there with him, pleading once again for a “clean” debt-ceiling increase, according to the Wall Street Journal. His “magic super Treasury powers” that allow the government to conserve cash to avoid having to issue more debt will expire at the end of September, he said.

“This is not about spending money,” he said. “This is about paying for what we’ve spent, and we cannot put the credit of the United States on the line.” The debt ceiling is just under $20 trillion. While the government can issue bonds to redeem maturing bonds – and it does this all the time – it cannot allow the gross national debt to go beyond the debt ceiling. But because it has to continue to pay for things that Congress mandated in its various spending bills over the years, the Treasury scrounges up the money from other government accounts, robbing Peter to pay Paul, so to speak. For example it temporarily short-changes the Civil Service Retirement and Disability Fund. These “extraordinary measures,” as they’re called, or the “magic super Treasury powers,” as Mnuchin called it, run out after a while.

Mnuchin said in his last letter to Congress that the out-of-money-date is September 29. But as in the past, the real out-of-money date can probably be stretched into October. These shenanigans make the entire world shake its collective head and pray that Congress, after going through its charade, will for the umpteenth time raise the debt limit. The other option is a US default. Its global consequences are too ugly to even imagine. But this charade has some peculiar effects, beyond its entertainment value: for months on end, it covers up the true extent of US government debt, and the current surge of this debt. This chart shows the gross national debt going back to 2011, including the last two debt-ceiling fights. Note the long flat lines leading into October or November, followed each time by an enormous spike:

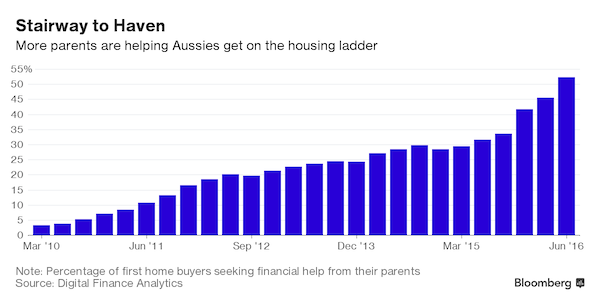

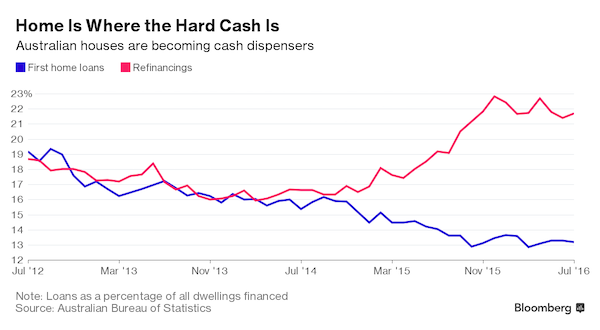

A good example of exatly how stuck governments and central banks are after blowing housing bubbles. There was an Australian tycoon this week who said the Oz bubble won’t pop because people are too heavily invested in property…

• Why Peter Costello Is Not Even Half Right On Housing (ND)

When former treasurer Peter Costello called on Monday for interest rates to be ‘normalised’ upwards to stop Australia’s credit bubble getting any larger, he was very nearly half right. As long as the Reserve Bank keeps the official cash rate at the record low of 1.5%, the economy will become increasingly “unbalanced”, as he put it. And although struggling families will protest that they can’t afford higher mortgage repayments, the other side of that coin is that each successive wave of first home owners is taking on even higher debts. The longer that super-low rates persist, the more debt the banks will be able to balance on the shoulders of new home buyers. That has already created huge property-based inequality. But Mr Costello’s comments weren’t focused on that imbalance – he’s worried about the impact that unstable house prices or teetering banks could have on economic growth more generally.

He told The Australian that “once [the price of] money returns to more normal levels” Australia could face a “big problem” with asset prices and the housing market. Quite right, but what could prevent that? A gradual increase in rates will not, in itself, ‘fix’ the housing market. To do that, two other abnormalities need to be addressed. The one mentioned most by Mr Costello’s side of politics is the availability of suitable dwellings – the ‘supply problem’. That is a wildly misunderstood problem, so I will look at it separately in coming days. But bigger than either low rates or the supposed ‘supply problem’ is the abnormality that Mr Costello himself created – tax laws that reward investors for making annual losses in the housing market, so as to reap lightly-taxed capital gains years down the track.

“..an impenetrable smokescreen of legal blather in the service of racketeering.”

• Diminishing Returns (Jim Kunstler)

These two words are the hinge that is swinging American life — and the advanced techno-industrial world, for that matter — toward darkness. They represent an infection in the critical operations of daily life, like a metabolic disease, driving us into disorder and failure. And they are so omnipresent that we’ve failed to even notice the growing failure all around us. Mostly, these diminishing returns are the results of our over-investments in making complex systems more complex, for instance the replacement of the 37-page Glass-Steagall Act that regulated American banking, with the 848 page Dodd-Frank Act, which was only an outline for over 22,000 pages of subsequent regulatory content — all of it cooked up by banking lobbyists, and none of which replaced the single most important rule in Glass-Steagall, which required the separation of commercial banking from trafficking in securities.

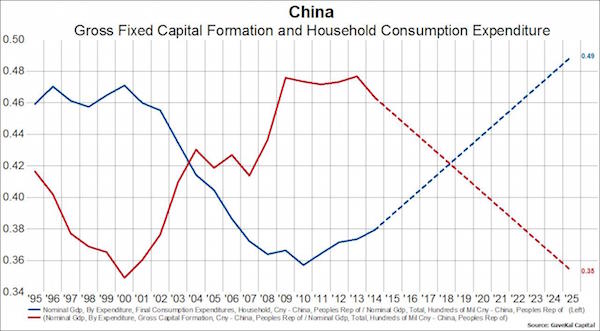

Dodd-Frank was a colossal act of misdirection of the public’s attention, an impenetrable smokescreen of legal blather in the service of racketeering. For Wall Street, Dodd-Frank aggravated the conditions that allow stock indexes to only move in one direction, up, for nine years. During the same period, the American economy of real people and real stuff only went steadily down, including the number of people out of the work force, the incomes of those who still had jobs, the number of people with full-time jobs, the number of people who were able to buy food without government help, or pay for a place to live, or send a kid to college. When that morbid tension finally snaps, as it must, it won’t only be the Hedge Funders of the Hamptons who get hurt. It will be the entire global financial system, especially currencies (dollars, Euros, Yen, Pounds, Renminbi) that undergo a swift and dire re-pricing, and all the other things of this world priced in them.

And when that happens, the world will awake to a new reality of steeply reduced possibilities for supporting 7-plus billion people. The same over-investments in complexity have produced the racketeering colossus of so-called health care (formerly “medicine”), in case you’re wondering why the waiting room of your doctor’s office now looks exactly like the motor vehicle bureau. Meanwhile, it’s safe to say that the citizens of this land have never been so uniformly unhealthy, even as they’re being swindled and blackmailed by their “providers.” The eventual result will be a chaotic process of simplification, as giant hospital corporations, insurance companies, and overgrown doctors’ practices collapse, and the braver practitioners coalesce into something resembling Third World clinics.

“..such a conflict – physical or political – could, equally, lead to a victory for nationalism over globalism, and to the protection of currencies and values.”

• What Would A US Civil War Look Like? (Copley)

There is little doubt that the US, despite the evidence that economic recovery is at hand, could spiral into a self-destructive descent of dysfunction, dystopia, and anomie. The path toward a “second civil war” has significant parallels with the causes of the first US Civil War (1861-65). Both events — the 19th Century event and a possible 21st Century one — saw the polarization of a fundamentally urban, abstract society against a fundamentally regional, traditional society. In some respects, it is a conflict between people with long memories (even if those memories are flawed and selective) and people to whom memories and history are irrelevant. Equally, it is a conflict between identity and materialism, with the abstract social groups (the urban populations) the most preoccupied with short-term material gain.

I have covered the US for 50 years, and my earliest view of it was, a half century ago, that its populations would inevitably polarize into protective islands of self-interest, surrounded by seas of unthinking locusts. What is ironic is that the present islands of wealth and power — the cities — have come to represent short-term materialism, as cities have throughout history. But what is interesting is that, despite the global attention on the political/geographic polarizations occurring in the US and other parts of the Western world, there has been a reversion in other parts of the world to a sense of Westphalian or pre-Westphalian nationalism. The fact that “the West” may have ring-fenced Iran, Russia, and so on, with sanctions and other forms of isolation may well be what ensures their enduring status.

They have avoided the contagion of globalism. Russia, indeed, recovered from the Soviet form of globalism in 1991. An urban globalist “victory” over Trump and Brexit would trigger that meltdown toward a form of civil societal collapse – civil war in some form or other – as the regions disavow the diktats of the cities. That would, in turn, bring about the global economic uncertainty which could impact the PRC and then the en-tire world. But such a conflict – physical or political – could, equally, lead to a victory for nationalism over globalism, and to the protection of currencies and values. We have seen this cycle repeated for millennia. It is the eternal battle.

The Archdruid from a few weeks ago.

It occurred to me the other day that there’s a curious disconnect between one of the most common assumptions most of us make about how to make the world better, on the one hand, and the results that this assumption has had when put into practice, on the other. It’s reminiscent of the realization that led James Hillman and Michael Ventura to title a once-notorious book of theirs We’ve Had A Hundred Years Of Psychotherapy And The World’s Getting Worse. In this case as in that one, something that’s supposed to make things better doesn’t seem to be doing the trick—in fact, quite the opposite—and it’s time that we talked about that. You know the assumption I have in mind, dear reader. It’s the conviction that certain common human emotions are evil and harmful and wrong, and the way to make a better world is to get rid of them in one way or another.

That belief is taken for granted throughout the industrial societies of the modern West, and it’s been welded in place for a very long time, though—as we’ll see in a moment—the particular emotions so labeled have varied from time to time. Just now, of course, the emotion at the center of this particular rogue’s gallery is hate. These days hate has roughly the same role in popular culture that original sin has in traditional Christian theology. If you want to slap the worst imaginable label on an organization, you call it a hate group. If you want to push a category of discourse straight into the realm of the utterly unacceptable, you call it hate speech. If you’re speaking in public and you want to be sure that everyone in the crowd will beam approval at you, all you have to do is denounce hate.

At the far end of this sort of rhetoric, you get the meretricious slogan used by Hillary Clinton’s unsuccessful presidential campaign last year: LOVE TRUMPS HATE. I hope that none of my readers are under the illusion that Clinton’s partisans were primarily motivated by love, except in the sense of Clinton’s love for power and the Democrats’ love for the privileges and payouts they could expect from four more years of control of the White House; and of course Trump and the Republicans were head over heels in love with the same things. The fact that Clinton’s marketing flacks and focus groups thought that the slogan just quoted would have an impact on the election, though, shows just how pervasive the assumption I’m discussing has become in our culture.

Now of course most people these days, when confronted with the sort of things I’ve just written, are likely to respond, “Wait, are you saying that hate is good?”—as though the only alternatives available are condemning something as absolutely bad or praising it as absolutely good. Let’s set that simplistic reaction to one side for the moment, and ask a different question: what happens when people decide that some common human emotion is evil and harmful and wrong, and decide that the way to make a better world is to get rid of it?

Watch Erdogan. German elections coming up.

• Greece Concerns Peak Amid Sudden Spike In Refugee Arrivals (K.)

A sudden spike in the number of undocumented migrants arriving from neighboring Turkey has led to concern on the part of Greek authorities, who expect the next few days to reveal whether the rapid increase is a random occurence or the beginning of a new trend. A total of 643 migrants who had set out from the Turkish coast landed on the islands of the eastern Aegean between Friday and Monday morning, according to government figures. Another 114 people arrived in two separate smuggling boats later on Monday, putting authorities on alert.

Early on Monday, a vessel belonging to the European Union’s border monitoring agency Frontex spotted a smuggling boat off the coast of Chios and intercepted the 53 migrants who had been aboard. Later in the day another 61 migrants were found in a boat that had reached Samos and were also detained. Tensions are already high in reception centers on several Aegean islands. Most of the facilities are at around twice their capacity as hundreds of migrants and refugees await the outcome of asylum applications or deportation orders. Tolerance has been tested in several island communities as dozens of migrants continue to arrive daily from nearby Turkish shores. There are currently more than 14,400 migrants living on camps on Lesvos, Chios, Samos, Kos and Leros.

Confused? The instructions are impossible to follow, not confusing.

• US Farmers Confused By Monsanto Weed Killer’s Complex Instructions (R.)

With Monsanto’s latest flagship weed killer, dicamba, banned in Arkansas and under review by U.S. regulators over concerns it can drift in the wind, farmers and weed scientists are also complaining that confusing directions on the label make the product hard to use safely. Dicamba, sold under different brand names by BASF and DuPont, can vaporize under certain conditions and the wind can blow it into nearby crops and other plants. The herbicide can damage or even kill crops that have not been genetically engineered to resist it. To prevent that from happening, Monsanto created a 4,550-word label with detailed instructions. Its complexity is now being cited by farmers and critics of the product. It was even singled out in a lawsuit as evidence that Monsanto’s product may be virtually impossible to use properly.

At stake for Monsanto is the fate of Xtend soybeans, it largest ever biotech seed launch. Monsanto’s label, which the U.S. Environmental Protection Agency (EPA) reviewed and approved, instructs farmers to apply the company’s XtendiMax with VaporGrip on its latest genetically engineered soybeans only when winds are blowing at least 3 miles per hour, but not more than 15 mph. Growers must also spray it from no higher than 24 inches above the crops. They must adjust spraying equipment to produce larger droplets of the herbicide when temperatures creep above 91 degrees Fahrenheit. After using the product, they must rinse out spraying equipment. Three times. “The restriction on these labels is unlike anything that’s ever been seen before,” said Bob Hartzler, an agronomy professor and weed specialist at Iowa State University. The label instructions are also of interest to lawyers for farmers suing Monsanto, BASF and DuPont over damage they attribute to the potent weed killer moving off-target to nearby plants.

It’s not ‘shocking’, it’s criminal.

• UK Blasted Over ‘Shocking’ Export Of Deadly Weedkiller To Poorer Countries (G.)

Paraquat, a pesticide so lethal that a single sip can be fatal, has caused thousands of accidental deaths and suicides globally, and was outlawed by EU states in 2007. But Swiss pesticide manufacturer Syngenta is exporting thousands of tonnes of the substance to other parts of the world from an industrial plant in Huddersfield. Campaigners have condemned the practice as an “astonishing double standard”, while a UN expert said it was deeply disquieting that the human rights implications of producing a substance for export that is not authorised in the EU were being ignored. “The fact that the EU has decided to ban the pesticide for health and environmental reasons, but they still export it to countries with far weaker regulation and far weaker controls, is shocking to me,” said Baskut Tuncak, the UN special rapporteur on toxic wastes.

Syngenta is responsible for 95% of Europe’s exports of paraquat, which it sells under the brand name Gramoxone. The substance can be absorbed through the skin and has been linked with Parkinson’s disease. Syngenta has exported 122,831 tonnes of paraquat from the UK since 2015, an average of 41,000 tonnes a year, according to export licensing data analysed by the Swiss NGO Public Eye and shared with the Guardian. Since 2015, when a facility in Belgium stopped exporting paraquat, all EU exports of the pesticide have come from Syngenta’s UK base, according to Public Eye. Almost two-thirds of these exports by volume – 62% – go to poor countries, including Brazil, Mexico, Indonesia, Guatemala, Venezuela and India. A further 35% is exported to the US, where paraquat can only be applied by licensed users.

We are a brilliant species.

• The Blue Dogs of Mumbai (G.)

Authorities in Mumbai have shut down a manufacturing company after it was accused of dumping untreated industrial waste and dyes into a local river that resulted in 11 dogs turning blue. The group of strangely coloured canines was first spotted on 11 August, according to the Hindustan Times, prompting locals to complain to the Maharashtra Pollution Control Board about dyes being dumped in the Kasadi river, where the animals often swim. Footage shows the animals roaming the streets with bright blue fur. “It was shocking to see how the dog’s white fur had turned completely blue,” said Arati Chauhan, head of the Navi Mumbai Animal Protection Cell, told the Times. “We have spotted almost five such dogs here and have asked the pollution control board to act against such industries.”

Chauhan had posted images of the blue dogs on the group’s Facebook page, saying the “pollutants from Taloja Industrial area not only ruining the water bodies affecting humans there but also affecting animals, birds, reptiles”. The board investigated, shutting down the company on Wednesday after confirming that canines were turning blue due to air and water pollution linked to the plant. An animal welfare agency managed to capture one of the dogs and wash some of the blue dye off. The group concluded that animal seemed unharmed in all other ways. The Kasadi River flows through an area with hundreds of factories.