Harris&Ewing House-Capitol tunnel (may get moving walk), Washington, DC 1939

• Cases 345,292 (+ 33,496 from yesterday’s 311,796)

• Deaths 14,925 (+ 1,854 from yesterday’s 13,071)

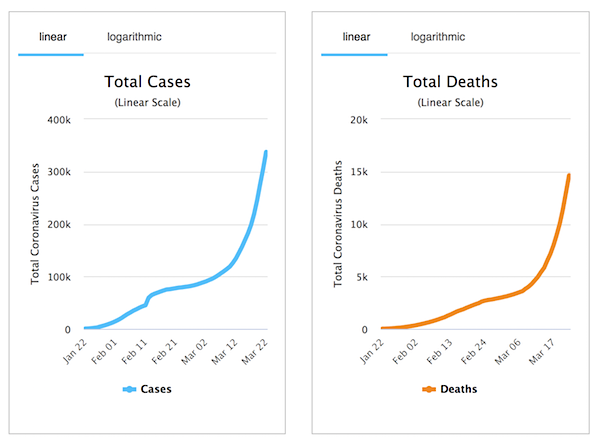

Haven’t shown these two graphs from Worldometer in a while. Obvious enough?!

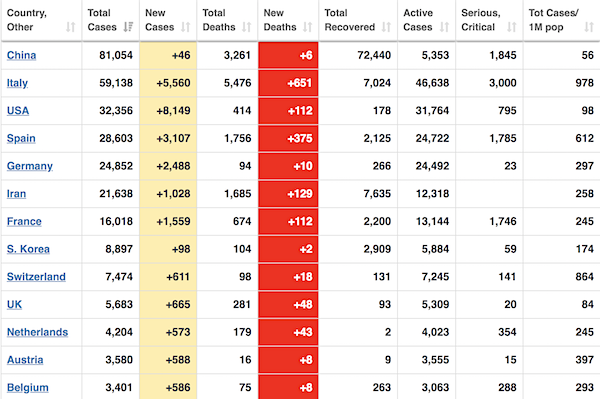

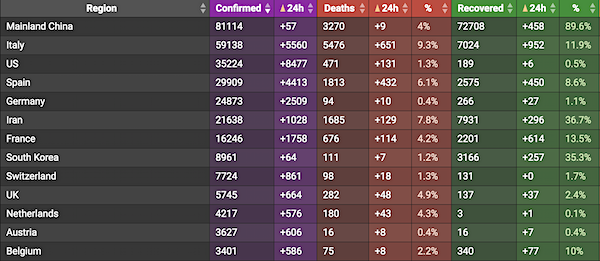

From Worldometer yesterday evening (before their day’s close)

One look at the US suffices:

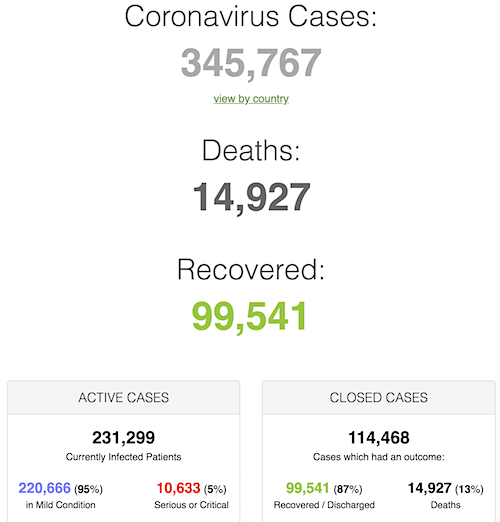

From Worldometer -NOTE: mortality rate for closed cases is at 13% !! –

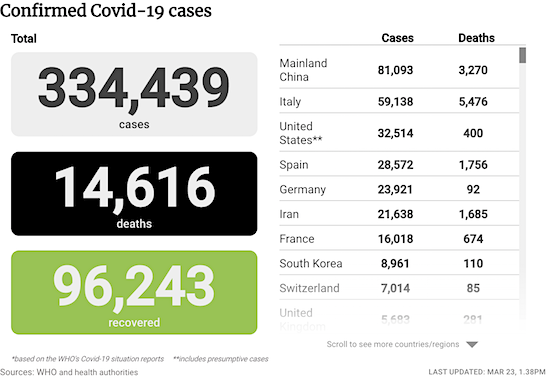

From SCMP: (SCMP appears to have given up on timely updating)

From COVID2019Live.info:

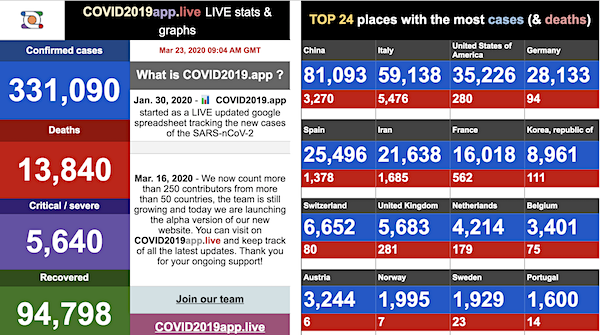

From COVID2019.app:

Reported US coronavirus cases via @CNN:

3/1: 89

3/2: 105

3/3: 125

3/4: 159

3/5: 227

3/6: 331

3/7: 444

3/8: 564

3/9: 728

3/10: 1,000

3/11: 1,267

3/12: 1,645

3/13: 2,204

3/14: 2,826

3/15: 3,505

3/16: 4,466

3/17: 6,135

3/18: 8,760

3/19: 13,229

3/20: 18,763

3/21: 25,740

Now: 35,070

Note: unlike many other nations, US numbers are updated several times a day.

Note 2: about half of US cases are in New York State. It it were a country, it would be in 7th place in the world.

The US would have to pass China in total infections by Thursday, 35,000 vs 81,000 now. Almost tripling in 3 days. I don’t know, and I’m not the biggest optimist around here.

• How Long to 1 Million US Cases? (Mish)

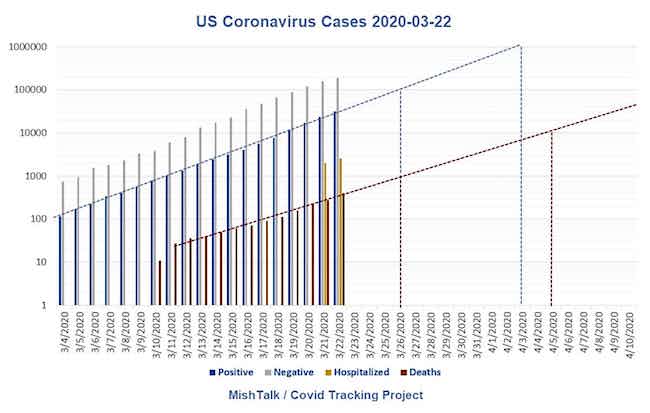

Inquiring minds are investigating a relatively new data feed from the Covid Tracking Project. I plot four data series for the US: Negative tests, positive tests, hospitalized, and deaths. Arguably, hospitalizations are the most significant column but the project only has two days worth of data. Once I have another dfats point or two, I will plot a trendline manually.

Trendlines At the current pace, the number of positive coronavirus cases would hit 100,000 on March 26, and 1,000,000 on April 3. At the current pace, the number of coronavirus deaths would hit 1,000 on March 26, and 10,000 on April 5. Those are not my projections, those are observations of what would happen if the current trends last that long at the same pace.

Your good news of the day. Based on new deaths levelling off.

• Nobel Laureate Predicts A Quicker Coronavirus Recovery (LAT)

Michael Levitt, a Nobel laureate and Stanford biophysicist, began analyzing the number of COVID-19 cases worldwide in January and correctly calculated that China would get through the worst of its coronavirus outbreak long before many health experts had predicted. Now he foresees a similar outcome in the United States and the rest of the world. While many epidemiologists are warning of months, or even years, of massive social disruption and millions of deaths, Levitt says the data simply don’t support such a dire scenario — especially in areas where reasonable social distancing measures are in place. “What we need is to control the panic,” he said. In the grand scheme, “we’re going to be fine.”

Here’s what Levitt noticed in China: On Jan. 31, the country had 46 new deaths due to the novel coronavirus, compared with 42 new deaths the day before. Although the number of daily deaths had increased, the rate of that increase had begun to ease off. Essentially, although the car was still speeding up, it was not accelerating as rapidly as before. “This suggests that the rate of increase in number of the deaths will slow down even more over the next week,” Levitt wrote in a report he sent to friends Feb. 1 that was widely shared on Chinese social media. And soon, he predicted, the number of deaths would be decreasing every day.

Three weeks later, Levitt told the China Daily News that the virus’ rate of growth had peaked. He predicted that the total number of confirmed COVID-19 cases in China would end up around 80,000, with about 3,250 deaths. This forecast turned out to be remarkably accurate: As of March 16, China had counted a total of 80,298 cases and 3,245 deaths — in a nation of nearly 1.4 billion people where roughly 10 million die every year. The number of newly diagnosed patients has dropped to around 25 a day, with no cases of community spread reported since Wednesday. Now Levitt, who received the 2013 Nobel Prize in chemistry for developing complex models of chemical systems, is seeing similar turning points in other nations, even ones that did not instill the draconian isolation measures that China did.

He analyzed 78 countries with more than 50 reported cases of COVID-19 every day and sees “signs of recovery.” He’s not looking at cumulative cases, but the number of new cases every day — and the percentage growth in that number from one day to the next. [..] Based on the experience of the Diamond Princess, he estimates that being exposed to the new coronavirus doubles a person’s risk of dying in the next two months. However, most people have an extremely low risk of death in a two-month period, and that risk remains extremely low even when doubled.

More good news. He can do it in 10 minutes.

• Canadian Doctor Rigs Ventilator to Treat 9 Patients Instead of One (IE)

As hospitals scramble to secure more ventilators, some doctors are getting creative in order to help their patients. Such is the case with Canadian doctor Dr. Alain Gauthier, an anesthetist at the Perth and Smiths Falls District Hospital in Ontario. Gauthier, who has a Ph.D. in respiratory mechanics, turned one hospital ventilator into a machine that can serve nine clients using do-it-yourself mechanics. The process was so brilliant that some have even called him an “evil genius.” Gauthier was inspired by YouTube videos created by two Detroit doctors in 2006, according to CBC News. He said he created a complex ventilator to offer people the best chance at survival. “At one point we may not have other options,” Gauthier told CBC News. “The option could be well, we let people die or we give that a chance.”

So in ten minutes the evil genius who is one of our GP anaesthetists (with a PhD in diaphragmatic mechanics) increased our rural hospitals ventilator capacity from one to nine!!! pic.twitter.com/yNmuCCDbWd

— alan drummond (@alandrummond2) March 17, 2020

I would lend much more credence to this if it didn’t come from the state-run China Global Television Network. It feels like they want to plant the narrative out there that it didn’t start in China at all.

• Coronavirus May Have Existed In Italy Since November: Local Researcher (CGTN)

As COVID-19 spreads across the world, many are interested in the origin of the virus behind this deadly disease. Fingers have been pointed at China, the U.S. and other places. Recently, a pharmacological researcher provided another possible lead to National Public Radio (NPR), a U.S. media outlet. Dr. Giuseppe Remuzzi, director of the Mario Negri Institute for Pharmacological Research in Italy, said he heard from general practitioners in the country’s Lombardy region that “they remember having seen very strange pneumonia, very severe, particularly in old people in December and even November.” “This means that the virus was circulating, at least in [the northern region of Lombardy and before we were aware of this outbreak occurring in China,” he told NPR.

Though Dr. Remuzzi originally used these words to answer a different question – why Italy acted later than expected on COVID-19 – NPR singled out this particular information in a tweet because it may relate to the origin of the novel coronavirus. China’s CCTV did the same thing by putting it on the headline of their report, though Dr. Remuzzi’s latest research mainly concerns how dire the situation is for Italy rather than the origin of the disease. What’s more interesting is that the English-language comments under the NPR tweet seem to completely differ from the Chinese-language ones under the CCTV Weibo. Many English comments suspect that China hid the situation from the world for a long time and that’s why similar symptoms showed up in Italy before the outbreak.

“China lied, people died” was most liked comment under NPR’s tweet. “So the Chinese government covered it up for even longer than we thought,” another comment said. A lot of Chinese comments, on the other hand, concluded that the virus originated in the U.S., so both China and Italy are victims. “Go to Trump for answers,” said a Weibo comment with more than 2,500 likes. “COVID-19 is a U.S. virus,” said another comment.

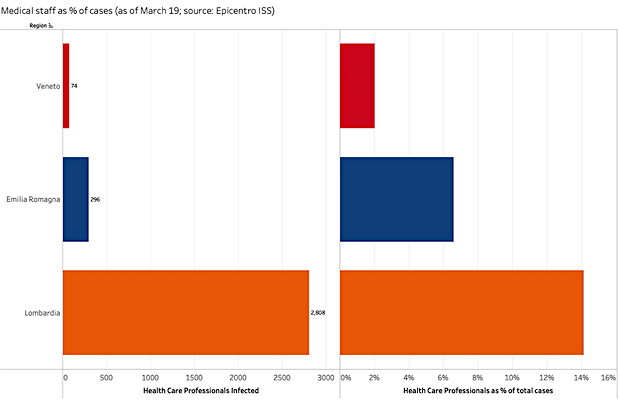

When hospitals become super-spreaders. All it takes is enough sick people.

“Lombardy’s health care workers have been badly hit w/ infections–the differences with other regions are staggering. A recent paper by local docs argues that hospitals might be a key source of transmission there.”

• The Epicenter of the COVID-19 Pandemic and Humanitarian Crises in Italy (NEJM)

In a pandemic, patient-centered care is inadequate and must be replaced by community-centered care. Solutions for Covid-19 are required for the entire population, not only for hospitals. The catastrophe unfolding in wealthy Lombardy could happen anywhere. Clinicians at a hospital at the epicenter call for a long-term plan for the next pandemic. We work at the Papa Giovanni XXIII Hospital in Bergamo, a brand-new state-of-the-art facility with 48 intensive-care beds. Despite being a relatively small city, this is the epicenter of the Italian epidemic, listing 4,305 cases at this moment — more than Milan or anywhere else in the country. Lombardy is one of the richest and most densely populated regions in Europe and is now the most severely affected one. The WHO reported 74,346 laboratory-confirmed cases in Europe on March 18 — 35,713 of them in Italy.

Our own hospital is highly contaminated, and we are far beyond the tipping point: 300 beds out of 900 are occupied by Covid-19 patients. Fully 70% of ICU beds in our hospital are reserved for critically ill Covid-19 patients with a reasonable chance to survive. The situation here is dismal as we operate well below our normal standard of care. Wait times for an intensive care bed are hours long. Older patients are not being resuscitated and die alone without appropriate palliative care, while the family is notified over the phone, often by a well-intentioned, exhausted, and emotionally depleted physician with no prior contact. But the situation in the surrounding area is even worse. Most hospitals are overcrowded, nearing collapse while medications, mechanical ventilators, oxygen, and personal protective equipment are not available.

Patients lay on floor mattresses. The health care system struggles to deliver regular services — even pregnancy care and child delivery — while cemeteries are overwhelmed, which will create another public health problem. In hospitals, health care workers and ancillary staff are alone, trying to keep the system operational. Outside the hospitals, communities are neglected, vaccination programs are on standby, and the situation in prisons is becoming explosive with no social distancing. We have been in quarantine since March 10. Unfortunately, the outside world seems unaware that in Bergamo, this outbreak is out of control.

Western health care systems have been built around the concept of patient-centered care, but an epidemic requires a change of perspective toward a concept of community-centered care. What we are painfully learning is that we need experts in public health and epidemics, yet this has not been the focus of decision makers at the national, regional, and hospital levels. We lack expertise on epidemic conditions, guiding us to adopt special measures to reduce epidemiologically negative behaviors. For example, we are learning that hospitals might be the main Covid-19 carriers, as they are rapidly populated by infected patients, facilitating transmission to uninfected patients. Patients are transported by our regional system,1 which also contributes to spreading the disease as its ambulances and personnel rapidly become vectors. Health workers are asymptomatic carriers or sick without surveillance; some might die, including young people, which increases the stress of those on the front line.

#Cuba's medical team given standing ovation as they arrive in #Italy to assist with COVID19 pandemic ravaging the country's population. pic.twitter.com/yGBmyYQauu

— Kevin Pina (@AcrossMediums) March 23, 2020

“It’s truly a bridge to the other side of an act of God…”

• The Government Budget Deficit Is About To Explode (CNBC)

Remember when people were all worked up over trillion-dollar government budget deficits? Those might seem like the good old days, once Congress and the White House finish up the coronavirus rescue package expected to be approved in the next few days. Estimates of just how big the final bill would be vary, but it’s assured that it will be a historic moment for sheer fiscal force being exerted at a time of economic duress. Administration statements over the past few days point to something on the order of $2 trillion in economic juice. By contrast, then-President Barack Obama ushered an $831 billion package through during the financial crisis.

That type of fiscal burden comes as the government already has chalked up $624.5 billion in red ink through just the first five months of the fiscal year, which started in October. That spending pace extrapolated through the full fiscal year would lead to a $1.5 trillion deficit, and that’s aside from any of the spending to combat the coronavirus. Already, the national debt stands at more than $23.5 trillion and will be on track to eclipse $25 trillion. Taxpayers shelled out $574.6 billion in fiscal 2019 on interest payments for the debt and another $229.1 billion in fiscal 2020. In short, the shock from the COVID-19 spread will blow a fiscal hole through Washington, D.C., that could take years if not decades to patch.

Hand-wringing over what this will all do to the debt and deficit situation, however, will have to wait for another day. In times of crisis, there is little patience for fiscal austerity, only a sense of urgency that while government spending can’t stop the virus from spreading, it can mitigate what will be profound economic damage. “It’s truly a bridge to the other side of an act of God,” economist Paul McCulley told CNBC.com. “We’ll deal down the road with the impacts on so many fronts of society with the whole thing. Right now, worrying about fiscal incontinence is the exact opposite of where we should be. We should have fiscal robustness implemented through effectively a joint venture between fiscal and monetary policy.”

Romney to Senate Dems: “Keep this up a little longer and we will go from social distancing to social destruction.”

• Senate Democrats Block Mammoth Coronavirus Stimulus Package (Hill)

Senate Democrats on Sunday blocked a coronavirus stimulus package from moving forward as talks on several key provisions remain stalled. Senators voted 47-47 on advancing a “shell” bill, a placeholder that the text of the stimulus legislation would have been swapped into, falling short of the three-fifths threshold needed to advance the proposal. Hopes of a quick stimulus deal quickly unraveled on Sunday as the four congressional leaders and Treasury Secretary Steven Mnuchin failed to break the impasse. Senate Majority Leader Mitch McConnell (R-Ky.) also delayed the procedural vote for three hours as they tried to get a deal. Democratic senators argue that the GOP bill includes several “non-starters” and walks back areas of agreement, such as expanding unemployment insurance, they thought they had reached with Republicans.

They emerged from a closed-door lunch fuming over the bill circulated by Republicans and called for McConnell to hold off on the 3 p.m. cloture vote. “We are pleading with McConnell not to call this vote,” Sen. Dick Durbin (Ill.), the No. 2 Senate Democrat, said after the lunch. “It’s a serious mistake. We have not negotiated this to the point of agreement yet.” Sen. Doug Jones (D-Ala.), who is up for reelection in a deeply red state, said that the Senate needed to be “as unified as possible.” “We don’t need split votes,” he said. Sen. Ed Markey (D-Mass.) added that the proposal put forward by Republicans was “totally inadequate.” That resulted in McConnell delaying the vote to 6 p.m.

Nothing in the Senate has shocked me, until today. Standing in the way of a critically needed rescue package is irresponsible and reckless. Dems say not enough money to states: nearly $200 billion isn’t chump change. Hospitals get at least $75 billion.

— Mitt Romney (@MittRomney) March 23, 2020

.@VP @Mike_Pence highlights USA has a system of federalism & this is functioning & supporting states in time of national crisis.@realDonaldTrump’s critics called him a dictator & Hitler for 3 years, yet now is NOT power-grabbing, but SUPPORTING federalism.

Will MSM apologize?? pic.twitter.com/Jmyp2Z2gaj

— Jenna Ellis (@JennaEllisEsq) March 22, 2020

I vote against all politicians.

• Blame Game Heats Up As Senate Motion Fails (Hill)

The finger-pointing on Capitol Hill reached a fever pitch Sunday evening, as both sides rushed to blame the other after a Senate motion to move a mammoth coronavirus relief bill failed on the chamber floor. Senate Majority Leader Mitch McConnell (R-Ky.) quickly took to the floor to hammer Democratic leaders, particularly Speaker Nancy Pelosi (D-Calif.), for what he characterized as petty obstruction that ignores the urgency of the crisis. “We were doing a good job of coming together until this morning, when the Speaker showed up — we don’t have a Speaker in the Senate, that’s in the House — and when the leader [Sen. Charles Schumer (D-N.Y.)] and the speaker came in [they] blew everything up,” an agitated McConnell, his face flushed, said walking off the Senate floor.

Democrats quickly countered with accusations that it was McConnell who had abandoned the negotiations the night before, when the Senate leader announced that Republicans would begin drafting the massive stimulus package before Democrats had endorsed it. “There was a good spirit of negotiation into early last night. And right about 8 o’clock, our side sensed a sort of change in attitude, an unwillingness to give and negotiate, for reasons we don’t fully understand,” said Sen. Tom Carper (D-Del.). The tense back-and-forth came moments after Democrats blocked a procedural motion to advance Congress’s third round of emergency relief — a package approaching $2 trillion — in response to the global coronavirus pandemic, which has devastated markets, sparked mass layoffs and ravaged businesses large and small across the country.

Democrats have raised a long list of objections to the Republicans’ proposal, saying the bill does too little to protect the unemployed, feed the hungry, subsidize states and cushion students facing mounds of debt. They’re also up in arms over language to provide up to $500 billion in loans and guarantees for corporations, at the sole discretion of the administration.

HUGELY IMPORTANT: Accounting standard setter just loosened standard for banks who provide loan modifications for borrowers (up to 6 months) due to #COVID19. Will *not* have to classify as "Troubled Debt Restructuring" providing capital relief. Agreed by Fed, FDIC, OCC, CFPB, NCUA https://t.co/txwKm9Lg8A

— Cate Long (@cate_long) March 23, 2020

The single best fan-made Joe Biden video. pic.twitter.com/EHYDGFMrk8

— Matt Orfalea (@0rf) March 23, 2020

And she was lucky enough to get tested.

• Total Cost of Her COVID-19 Treatment: $34,927.43 (Time)

When Danni Askini started feeling chest pain, shortness of breath and a migraine all at once on a Saturday in late February, she called the oncologist who had been treating her lymphoma. Her doctor thought she might be reacting poorly to a new medication, so she sent Askini to a Boston-area emergency room. There, doctors told her it was likely pneumonia and sent her home. Over the next several days, Askini saw her temperature spike and drop dangerously, and she developed a cough that gurgled because of all the liquid in her lungs. After two more trips to the ER that week, Askini was given a final test on the seventh day of her illness, and once doctors helped manage her flu and pneumonia symptoms, they again sent her home to recover. She waited another three days for a lab to process her test, and at last she had a diagnosis: COVID-19.

A few days later, Askini got the bills for her testing and treatment: $34,927.43. “I was pretty sticker-shocked,” she says. “I personally don’t know anybody who has that kind of money.” Like 27 million other Americans, Askini was uninsured when she first entered the hospital. She and her husband had been planning to move to Washington, D.C. this month so she could take a new job, but she hadn’t started yet. Now that those plans are on hold, Askini applied for Medicaid and is hoping the program will retroactively cover her bills. If not, she’ll be on the hook. She’ll be in good company. Public health experts predict that tens of thousands and possibly millions of people across the United States will likely need to be hospitalized for COVID-19 in the foreseeable future.

And Congress has yet to address the problem. On March 18, it passed the Families First Coronavirus Response Act, which covers testing costs going forward, but it doesn’t do anything to address the cost of treatment. While most people infected with COVID-19 will not need to be hospitalized and can recover at home, according to the World Health Organization, those who do need to go to the ICU can likely expect big bills, regardless of what insurance they have. As the U.S. government works on another stimulus package, future relief is likely to help ease some economic problems caused by the coronavirus pandemic, but gaps remain.

Of course there are Americans who borrow and spend too much. But how for the love of God is that a licence to even risk labeling people working 3 jobs and still not making ends meet, as irresponsible idiots who should save more? Who is irresponsible around here?

• Coronavirus Reveals Financial Irresponsibility Of Americans (Hill)

How long could you sustain your household if you were to stop earning income? If you are like most Americans, the answer is not for long. Only 40 percent of Americans can afford an unexpected $1,000 expense with their savings. In fact, nearly 80 percent of workers are living paycheck to paycheck. It is no surprise that the probability of an economic recession brought on by the coronavirus pandemic caused many to worry. In major cities such as Boston, New York, Los Angeles, and San Francisco, restaurants and businesses have been ordered to close. For many hourly workers, this means no paychecks in the coming weeks. Almost one in five Americans have already lost their jobs or have reduced hours.

At the same time, salaried workers are concerned about job security, as mass layoffs at numerous companies loom. While the situation is understandably stressful for every person affected, it serves as a sobering reminder that Americans must learn to live within their means and regularly save money. The need for all Americans to be able to sustain themselves for at least a few months on savings is accentuated during a time of crisis. This means planning ahead when times are good. Financial planners suggest saving at least 20 percent of take home income, while spending at most 30 percent on discretionary items. Yet too many workers still fail to think twice about spending entire paychecks for things they want but do not need.

Recent decades have offered us relative luxury. More than 80 percent of Americans own smartphones. The same portion of households own one high definition flat screen television, while over half of households own more than one. Over 60 percent of Americans dine out at least once a week, while nearly 20 percent dine out three or more times a week. The current panic is refocusing us on what is important. We now stockpile the things necessary for our health. Smartphones, fancy televisions, and restaurant meals are usually luxuries rather than necessities. Living within our means is not just rhetoric. It is a means of guarding ourselves during times like these. We have so much to learn from those who came before us. How many of our grandparents fared the austerity of the World Wars and the Great Depression, discovering to save, mend, and repair?

The richer suffer more, they’ll have you know. What pricks this dick’s balloon, though, is suggesting that prior to corona, there was a “normal chain of revenue generation etc.” and “solid economic fundamentals”. There haven’t been any normal markets, and that includes commercial mortgages, since Alan Greenspan. You may like to disagree, but just wait till the Fed folds.

• Preventing COVID-19 From Infecting the Commercial Mortgage Market (Barrack)

As a major participant in the non-bank real estate lending industry, I am fully supportive of the nation’s extraordinary response to contain COVID-19. The profound impact of the COVID-19 pandemic on the public health and safety of all Americans is unprecedented and the response measures being taken by federal, state, and local government agencies are essential and critical. One aspect of this all-out assault on an invisible enemy — in the effort to suppress the contagion and manage the precious resources of our medical community and first responders — has been the unfortunate but necessary cessation of general commerce nationwide.

Now everyone, from corporations and small and mid-sized businesses to employees and laborers from all walks of life, has been displaced from the normal chain of revenue generation, cash flow, and income necessary to meet their obligations, from payment of salaries, rent payments, mortgage payments, and all other debts and bills required in the daily life of every business and every American. As a direct consequence of the necessary response measures to COVID-19, high performing mortgage loans across the entire commercial real estate sector (approximately $16 trillion in aggregate), which had previously been grounded in solid economic fundamentals, are suddenly experiencing a temporary meltdown in cash flows.

We are seeing the beginning of a second crisis that will occur in the financial markets that underpin the lifeblood of these employees, workers, and businesses. Based on my own personal past experiences I would like to share with you some thoughts on how to alleviate the potential blockage in the commercial mortgage market which is beginning to raise its perilous head. Addressing this major looming crisis in liquidity in a coordinated manner will be essential in averting a crisis in credit and a long term economic recession.

This is just one of many such reports, of course. What I found interesting is that just 5 days ago, Singapore Airlines said it would cut flight capacity by 50%. And you wonder: what happened since Wednesday?

Emirates announced yesterday they would cut all flights, only to be told some flights are essential to services. Those are reinstated.

• Singapore Airlines Slashes 96% Of Capacity, Grounds Most Planes (CNA)

Singapore Airlines (SIA) will cut 96 per cent of its capacity that had been scheduled up to the end of April, said the airline on Monday (Mar 23). The decision was made after the further tightening of border controls around the world over the last week to stem the COVID-19 outbreak, SIA said in a news release. About 138 SIA and SilkAir planes, out of a total fleet of 147, will be grounded as a result. Scoot, the company’s low-cost unit, will suspend “most of its network” and will ground all but two of its 49 planes. This comes amid the “greatest challenge that the SIA Group has faced in its existence”, the company said.

“It is unclear when the SIA Group can begin to resume normal services, given the uncertainty as to when the stringent border controls will be lifted,” it said. “The resultant collapse in the demand for air travel has led to a significant decline in SIA’s passenger revenues.” Over the last few days, the SIA Group has drawn on its lines of credits to meet its immediate cash flow requirements, it said, adding that it is in discussions with several financial institutions on its future funding requirements. “The company is actively taking steps to build up its liquidity, and to reduce capital expenditure and operating costs,” it added. SIA said it is in talks with aircraft manufacturers to defer upcoming deliveries, in the hopes of delaying payment for those deliveries.

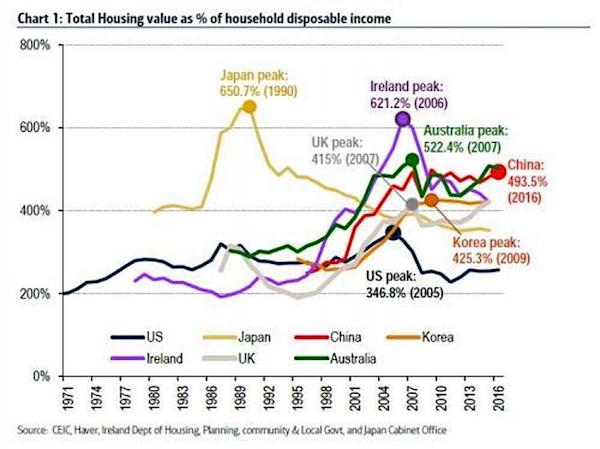

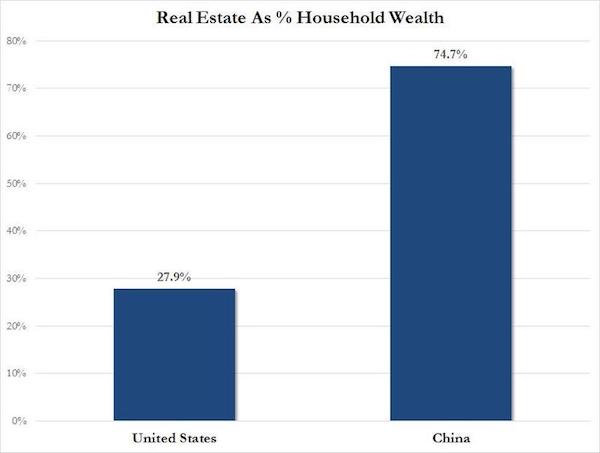

This is a bigger threat to Xi than the coronavirus. And why does it happen? Because China’s second-largest property developer wants to be the world’s biggest maker of electric cars…

• China’s Housing Bubble Bursts (ZH)

Now that the world is firmly focusing on apocalyptic forecasts about the state of the US and global economy, with St Louis Fed president James Bullard the latest to pour gasoline into the fire with his worst-case prediction of a 50% GDP drop and 30% surge in unemployment in Q2, it is easy to forget that China, which started this whole pandemic, is still in economic lockdown. And while Beijing is pretending that the Shanghai Sniffles are now firmly behind it, and forcing people back to work while openly fabricating disease numbers – because like Lloyd Blankfein it has realized that an economic depression is an even worse outcome than millions infected – the reality is that China’s economy is facing an unprecedented crisis of its own.

Today we got a stark reminder of that, when Evergrande Group – China’s second-largest property developer by sales – tumbled in early trading Monday after saying it expects full-year earnings to fall by half. As Bloomberg first reported, the residential property developer said in an exchange filing Sunday that net profit for 2019 is expected to come in it around 33.5 billion yuan ($4.7 billion), a drop of about 50% from the previous year. “The decrease in profit is mainly attributable to the delivery and settlement of the lower-priced clearance stock properties in 2019, which drove down the unit price of the property delivered,” Evergrande said. That sent the firm’s Hong Kong-traded shares down as much as 17.4% on Monday, the biggest intraday drop since July 2015.

And with the stock tumbling by more than two-thirds since its late 2017 highs, Citigroup downgraded the stock to “sell” and slashed its price target by 56%, as the expected decline in core profit was far below Citigroup’s estimate of a 27% year-on-year drop. To be sure, there are plenty of reasons to dump the stock: Evergrande is one of China’s most-indebted developers with net debt of $88.5 billion as of June. As Bloomberg reminds us, the company has been pouring billions of dollars into acquisitions as its Chairman and major shareholder Hui Ka Yan pursues an ambition to make Evergrande the world’s biggest maker of electric cars in the next three to five years.

Ardern sounds a bit too convinced. It’s still just one view.

• New Zealand To Go Into Month-Long Lockdown (G.)

New Zealand is preparing to enter a month-long nationwide lockdown from Wednesday night, with the entire country ordered to stay home apart from those in essential services. On Monday the nation was given two days to prepare for schools, businesses and community services to turn off the lights in a desperate bid to stem the spread of the coronavirus. The move came after the number of cases of Covid-19 in New Zealand rose past 100. In an address to the nation, the prime minister, Jacinda Ardern, said she was not willing to put the lives of her citizens in danger. “The worst-case scenario is simply intolerable, it would represent the greatest loss of New Zealanders’ lives in our history and I will not take that chance.”

Ardern announced the country would move to level three measures immediately, and then to four – the highest level – on Wednesday from 11.59pm. “I say to all New Zealanders: the government will do all it can to protect you. Now I’m asking you to do everything you can to protect all of us. Kiwis – go home.” The lockdown will last a month, and if the trend of cases slowed, could be partially eased in specific areas after that. Ardern said it was now established that community transmission was happening in New Zealand and that, if it took off, the number of cases would double every five days, with modelling advising the government that tens of thousands of New Zealanders could die.

[..] Ardern said if the country did not lock down it would face a death toll beyond anything ever experienced before, and she wanted to give health services “a fighting chance”. Thirty-six new cases of the coronavirus were confirmed on Monday, bringing the nationwide total to 102, spread across the North and South islands. Ardern said she knew the measures would be anxiety-inducing for many New Zealanders and they needed to be “strong and kind” to each other during the unprecedented crisis. “Today, get your neighbour’s phone number, set up a community group chat, get your gear to work from home, cancel social gatherings of any size or shape, prepare to walk around the block while keeping a two-metre distance between you.

No-Discrimination- Covid-19!! #quarantine #covid_19 #staysafe #becreative #brianeno pic.twitter.com/tvdzeJ7vv9

— Madonna (@Madonna) March 22, 2020

Oddly appropriate:

I haven’t smiled so hard all week. pic.twitter.com/3bugLnLdAr

— 39, 5’9” (@huegolden) March 22, 2020

Next years school pictures. pic.twitter.com/tuGddr6lbG

— You Had One Job (@_youhadonejob1) March 23, 2020

If you read us, support us.