DPC Steamer Tashmoo leaving wharf in Detroit 1901

Today is The Automatic Earth’s 7th anniversary!

Incredible.

• China’s Millions Of Government Workers To Get Huge 60% Pay Raise (Caixin)

China’s 39 million civil servants and public workers will get a pay raise of at least 60% of their base salaries as part of pension plan overhaul. Hu Xiaoyi, a vice minister of human resources and social security, said at a press conference Tuesday that government agencies and public institutions have been notified of detailed plans for the salary increase. The pay raise “will make sure that the overall incomes for most of these workers will not decrease after the reform, and some of them could actually earn a bit more,” he said. Hu did not provide details of the plan, which will cover civil servants and public workers, such as teachers and doctors. Copies of documents obtained by Caixin show that top civil servants, including President Xi Jinping and Premier Li Keqiang, will see their monthly base salaries rise to 11,385 yuan from 7,020 yuan (to $1,833 from $1,130), starting in October.

The base salaries of the lowest civil servants would more than double to 1,320 yuan. It is unclear if the plans Caixin saw are final. Data from the State Administration of Civil Service show that China had nearly 7.2 million civil servants and more than 31.5 million public-sector workers employed by institutions such as schools and hospitals at the end of 2013. Those workers do not contribute to their pension fund, meaning taxpayers fund their retirements. A reform announced on Jan. 14 by the State Council, China’s cabinet, will see civil servants and public workers start to contribute to the pension program in October. They will make contributions similar to those private-sectors workers, who have been paying in since the late 1990s. Government agencies and public institutions will pay 20% of their workers’ base salaries to the pension fund on behalf of their employees. The employees will contribute 8% of their salary.

The reform plan says government agencies and public institutions should also introduce an income annuity program for employees. That change will see employers contribute 8% of their employees’ salaries to an annuity fund, while employees pay 4%. The annuity program will provide retirees with another monthly payment. Hu Jiye, a professor in Beijing, said the annuity program and pension scheme will ensure government employees and public workers enjoy the same level of benefits after the reform. That assurance will help the reform make smooth progress, Hu said. Data from the China Statistical Yearbook show that in 2011 the average government pension paid 2,175 yuan a month per retiree. A private-sector pension paid 1,508 per month.

Read more …

Forecasts are all over the place.

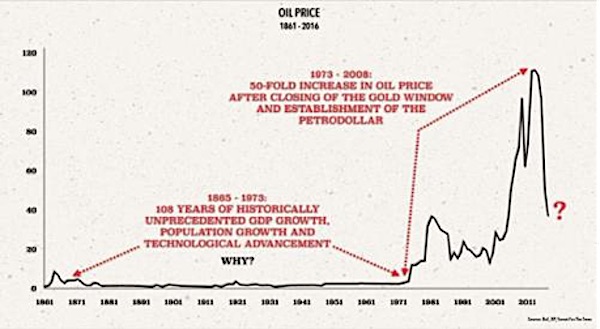

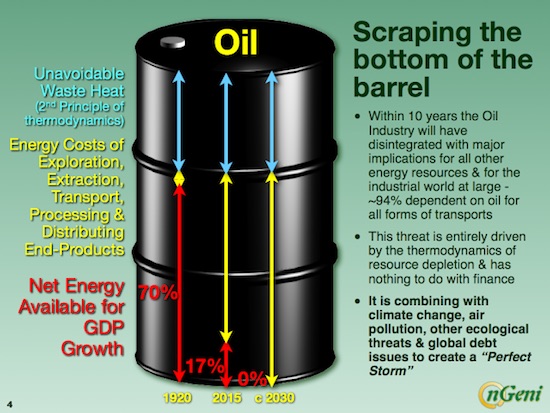

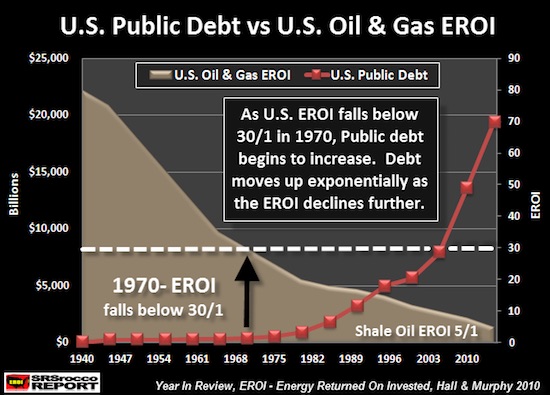

• Oil Interests Clash Over Price Collapse (Reuters)

OPEC defended on Wednesday its decision not to intervene to halt the oil price collapse, shrugging off warnings by top energy firms that the cartel’s policy could lead to a huge supply shortage as investments dry up. The strain the halving of oil prices since June is putting on producers was laid bare when non-member Oman voiced its first direct, public criticism of the Organization of the Petroleum Exporting Countries’ November decision not to cut production but instead to focus on market share. Oil prices have collapsed to below $50 a barrel as a result of a large supply glut, due mostly to a sharp rise in U.S. shale production as well as weaker global demand. The rapid decline has left several smaller oil producing countries reeling and has forced oil companies to slash budgets.

Speaking at the World Economic Forum in Davos, Switzerland, the heads of two of the world’s largest oil firms warned that the decline in investments in future production could lead to a supply shortage and a dramatic price increase. Claudio Descalzi, the head of Italian energy company Eni Spa, said that unless OPEC acts to restore stability in oil prices, these could overshoot to $200 per barrel several years down the line. “What we need is stability… OPEC is like the central bank for oil which must give stability to the oil prices to be able to invest in a regular way,” Descalzi told Reuters Television. He expected prices to stay low for 12-18 months but then start a gradual recovery as U.S. shale oil production began falling. But both OPEC and Saudi Arabia, the group’s largest producer, stuck to their guns.

“If we had cut in November we would have to cut again and again as non-OPEC would be increasing production,” OPEC Secretary General Abdullah al-Badri said in Davos. “Everyone tells us to cut. But I want to ask you, do we produce at higher cost or lower costs? Let’s produce the lower cost oil first and then produce the higher cost,” Badri said. “Prices will rebound. I saw this 3-4 times in my life.” Al-Badri said the policy was not directed at Russia, Iran or the United States.

Read more …

Talking one’s book.

• Davos Oil Barons Eye $150 Oil As Investment Slump Incubates Future Crunch (AEP)

Rampant speculation by hedge funds and a rare confluence of short-term shocks have driven the price of oil far below its natural clearing level, coiling the springs for a fresh spike this year that may catch markets badly off-guard once again. “The price will rebound and we will go back to normal very soon,” said Abdullah Al-Badri, OPEC’s veteran secretary-general. “Yes, there is an over-supply, but fundamentals don’t justify this 50pc fall in price.” xperts from across the world – from both the West and the petro-powers – said the slump in fresh investment in 2015 is setting the stage for a much tighter balance of supply and demand, and possibly a fresh oil crunch. Mr Al-Badri said he had been through price swings before but recovery may be swifter today than in past cyclical troughs. “This time we have to be very careful to handle this crisis right. We must keep investing, and not lay off experienced people as we did last time,” he told the World Economic Forum in Davos.

Claudio Descalzi, chief executive of Italy’s oil giant ENI, said the last phase of the price crash from $75 a barrel to around $45 was driven by wild moves on the derivatives markets. Traders with “long” positions effectively capitulated once it became clear that OPEC was not going to cut output to shore up prices. This led to abrupt switch to massive “short” positions instead. “These contracts are 15 or 20 times the physical market,” he said. Mr Descalzi said the roller coaster move in prices is destructive for the oil industry and is leading to investment cuts that may store up serious trouble for the future. “What we need is stability: a central bank for oil. Prices could jump to $150 or even $200 over the next four or five years,” he said. Khalid Al Falih, president of Saudi Aramco, the world’s biggest oil producer, said the mix of financial leverage and the end of quantitative easing had “accelerated” the collapse in prices but the slide has lost touch with reality.

“We’re going to see higher demand this year. Investors are shaken and will now be more careful about committing money to mega-projects in the oil and gas industry,” he said. Fatih Birol, the chief economist for the International Energy Agency, said the dramatic crash since June has been caused by a unique set of events. Supply surged by 2m barrels a day (b/d) last year – the highest in 30 years – at exactly the same moment that China slowed sharply, Japan fell back into recession and Europe’s recovery stalled. “Oil at $45 is a temporary phenomenon, so don’t get too relaxed. We see upward pressures on prices by the end of this year. Oil investments are going to fall by 15pc or about $100bn dollars this year,” he said.

Read more …

Sure.

• OPEC Secretary General: Oil To Remain At Low Levels For A Month (CNBC)

The secretary general of OPEC told CNBC on Wednesday that oil prices were likely to remain around their current levels for around a month before rebounding. Speaking at the World Economic Forum in Davos, Abdullah al-Badri said it was hard to predict oil price movements given the ongoing fluctuations. “It will stay for another month at this low price, but I’m sure the price will rebound,” he told CNBC. Brent crude oil prices have dropped almost 50% since last year in the biggest annual fall since 2008, amid weakening demand and a refusal by OPEC to cut production in November. But al-Badri insisted that the group, which provides about a third of the world’s supply, “knew what it was doing.” “We know that there is over-supply in the market, that there is a lower demand—and we decided to keep production as it is,” he said.

If OPEC was going to reduce supply, it had to be alongside production cuts by non-OPEC members, such as U.S. shale producers, al-Badri said. If OPEC was going to reduce supply, it had to be alongside production cuts by non-OPEC members, such as U.S. shale producers, al-Badri said. He insisted that the group was not playing a “game of chicken” with its rivals, as some analysts have claimed, over who can absorb the dip in prices and not cut back on production. “This is a collective decision. It is agreed by all the ministers. … There is a pure economic decision. It is not targeted at anybody. … Whatever you hear is nonsense,” he said. “We are more united than ever. … We are a very strong group.”

Read more …

“Companies like us, at BP, we’re going to need to rebase the company based on no guarantees at all that the price will come back up..”

• BP Boss Bob Dudley: Oil Prices ‘Low For Up To 3 Years’ (BBC)

The boss of oil giant BP Bob Dudley has said that oil prices could remain low for up to three years. He added that could send UK petrol prices below £1 per litre. He told BBC Business editor Kamal Ahmed in Davos BP was planning for low oil prices for years to come. That is expected to lead to job losses and falling investment in the North Sea oil industry and elsewhere, curbing supply and eventually forcing the price back up. Italian oil group Eni has said the next spike could be around $200 a barrel. Eni’s chief executive, Claudio Descalzi, said the oil industry would cut capital spending by 10-13% this year because of slumping prices. He said that would create longer-term shortages and sharp price rises in four to five years’ time, if the OPEC cartel fails to cut supplies.

Mr Dudley said historically world oil prices have fluctuated, and sometimes have remained low for a number of years. He expects to see current low prices for at least a year, and that BP has to plan for that. “Companies like us, at BP, we’re going to need to rebase the company based on no guarantees at all that the price will come back up,” he said. “We have go to plan on this [price] being down, and we don’t know exactly what level, but certainly a year, I think probably two and maybe three years.” From 2010 until mid-2014, oil prices around the world were fairly stable, at around $110 a barrel. However, since June prices have more than halved. Brent crude oil is around $48 a barrel, and US crude is around $47 a barrel. Mr Dudley said lower oil prices could mean UK petrol could fall below £1 per litre. This kind of petrol price was “not far off”, despite taxation forming a part of the fuel price. “If prices keep going down, I’m sure you will [see £1 per litre],” he added.

Read more …

Oil service companies are also expanding.

• An Oilfield Turf War for Market Share Is Brewing (Bloomberg)

An oilfield brawl is taking shape between Halliburton and Schlumberger as the world’s two biggest energy service companies vie to grab more market share during a prolonged industry slump. Both companies have chosen to expand operations with an eye toward emerging from the downturn bigger and stronger than before. Schlumberger agreed Tuesday to pay $1.7 billion for a stake in a Russian drilling business, and Halliburton reaffirmed its commitment to buying rival Baker Hughes Inc. for $34.6 billion. The combined companies will be about half the size of Schlumberger. “There’s going to be some market share battles between the two of them,” James West, an analyst at Evercore ISI, said in a phone interview. “Both will attempt to take market share from companies that can’t provide very high efficiency, very high technology products and services.”

A backlog of work provided Halliburton, Baker Hughes and Schlumberger with one last growth spurt in the fourth quarter as the companies turned the corner into a year where they’re expected to have to cut prices for their work by as much as 20%. Amid tens of thousands of industry job cuts, some oil producers have already slashed budgets by as much as 30%, Dave Lesar, chief executive officer at Halliburton, said on a conference call with analysts. The three oilfield service giants are taking their own steps to conserve cash as they brace to weather one of the deepest industry slumps since the 1980s oil bust. U.S. Crude prices have collapsed more than 55% since last year’s high of $107.26 in June.

Fourth-quarter earnings, excluding certain items, exceeded analysts’ expectations for each of the big three service companies. Schlumberger, excluding a $1.77 billion one-time charge that included severance costs, reported a profit of $1.94 billion. Halliburton boosted profit 14% to $901 million, while Baker Hughes more than doubled earnings to $663 million. Schlumberger is buying a stake in Eurasia Drilling, with an option to purchase the rest of the Russian rig contractor’s shares three years after the deal closes. The world’s largest oilfield contractor is betting that economic sanctions in the country will be lifted “sooner or later” in order to gain from a growing Russian oil services market, Alexander Kornilov, an analyst at Alfa Bank, said in an e-mail.

Read more …

We’ll see later today.

• ECB to Inject Up to €1.1 Trillion Into Economy in Deflation Fight (Bloomberg)

Mario Draghi called on the European Central Bank to make its biggest push yet to fend off deflation and revive the economy by unleashing a debt-buying spree of €1.1 trillion ($1.3 trillion). The ECB president and his Executive Board proposed spending €50 billion a month through December 2016, two euro-area central-bank officials said. The plan still faces a tense debate in the Governing Council and may change before the final decision on Thursday, the people said, asking not to be identified as the talks are private. An ECB spokesman declined to comment. By urging Fed-style quantitative easing, Draghi is remodeling the ECB as an aggressive central bank that will take risks even against the wishes of Germany, the region’s biggest economy.

Bundesbank President Jens Weidmann and Executive Board member Sabine Lautenschlaeger have argued QE isn’t needed and reduces the incentive of governments to make structural reforms. The proposal “looks larger than implied by the ECB’s previous comments about the size of its balance sheet,” said Riccardo Barbieri Hermitte, chief European economist at Mizuho in London. “A lot will depend on the risk-sharing features of the program.” Draghi’s intention is to expand the ECB’s balance sheet to the level seen in early 2012, or about €3 trillion. While the central bank has assets of about €2.2 trillion currently, that may shrink as €200 billion of outstanding long-term loans mature in coming weeks.

The ECB chief is scheduled to hold a press conference at 2:30 p.m. in Frankfurt on Thursday to announce the Governing Council’s decision. The council’s debate will be complicated by arguments over whether the risks incurred in the new bond-buying plan should be shared across the region’s 19 central banks or kept within national boundaries. Dutch central-bank Governor Klaas Knot has said any decision to mutualize risk should be taken by elected politicians, not unelected central bankers. The tension over that issue surfaced this week at a conference in Dublin. Irish Finance Minister Michael Noonan said having national central banks buy government bonds would be “ineffective” – drawing a response from ECB Executive Board member Benoit Coeure.

Read more …

As goal-seeked as you can get.

• Lagarde On European QE: It’s Already Working (CNBC)

The World Economic Forum in Davos has many different topics on the agenda but this year it coincides with an hotly anticipated announcement by Mario Draghi, the president of the EC). As part of the ECB’s attempts to stimulate the deflation-hit euro zone, Draghi’s press conference at 13:30 GMT, with a rate decision due at 12:45 GMT, is widely expected to be the moment the Governing Council launches some form of government bond-buying. And with the some of the most powerful people on the planet all meeting in a conference center in Switzerland, QE was the hottest topic of the week Christine Lagarde, managing director of the International Monetary Fund (IMF), said on Wednesday that expectations of a bond-buying program in Europe had already had an effect.

“To a point you can say that it has already worked,” Lagarde said on a panel in Davos. “If you look at currency variation and where the euro is at the moment, you can’t deny that there is expectations there that QE is about to come and is announced and will be significant.” European laggard economies were poised to benefit from the higher inflation expectations which would come with quantitative easing, Lagarde added. Official figures released earlier this month revealed that the euro zone slipped into deflation in December for the first time since 2009. “If there is some re-anchoring of inflation in the euro area, those emerging European markets, which are pegged to the euro, will have the benefit of that,” she said.

“Those that are at the moment, importing the inflation so to speak from the euro area will also benefit from that. If there is more growth, more jobs in the euro area, the emerging markets in Europe will benefit from that, because half of their trade actually goes to the euro area.” Speaking on the same panel as Lagarde, Larry Summers, the former U.S. Treasury Secretary, added: “I am all for European QE.”

Read more …

The big issue is whether Draghi can find enough bonds to purchase – by no means a given – and what their emptying the market of available bonds will do to bond markets.

• Mario Draghi May Need To Get A Bigger (QE) Boat (CNBC)

If Mario Draghi wants to have a significant market impact after Thursday’s European Central Bank meeting, he better not think small. The financial world’s collective gaze will be focused on the ECB president after the session, during which policymakers are expected to launch a U.S.-style quantitative easing program aimed at injecting liquidity into the sputtering euro zone economy, and goosing asset prices in the process. History, at least that generated by the Federal Reserve’s historically ambitious three rounds of QE, would suggest that the initiative would boost stocks, commodities and bond yields and, hopefully, generate some real economic growth.

However, that’s likely dependent upon how aggressive Draghi wants to get with the ECB’s version of QE, and specifically whether it can shock a market that already is well aware of the plan. “Our view is that the extent to which the ECB will surprise markets depends on size (well above market expectation of €500 billion) and the extent to which markets will perceive QE as being open-ended,” Gilles Moec, European economist at Bank of America Merrill Lynch, wrote in a report for clients. “ECB communication will be the key.” The latter part of the remark refers to the post-meeting news conference Draghi will hold.

Indications from him that the ECB continues to plan a “whatever it takes” approach to easing could spark markets, while anything less would be a disappointment. Moec figures the program will entail government bond buying of between €500 billion and €700 billion ($580 billion and $810 billion) over the span of 18 months, a close-to-consensus expectation that likely already is priced in. When headlines leaked of what the ECB was considering, the euro briefly sold, then rebounded and eventually settled slightly higher against the dollar. The trading action was an indication of “how baked-in expectations are to current market prices,” said Christopher Vecchio, currency analyst at DailyFX.

Read more …

“..investors’ willingness to buy government debt without expecting any profit is indicative of how little they trust corporate lenders.”

• Watch Europe Fumble QE (Bloomberg)

Tomorrow, the European Central Bank is almost certainly going to start a quantitative easing program, buying up government debt to provide money to banks so they plow it into European economies and thus boost demand and growth. So the theory goes, but the practice of European QE will probably prove it wrong. ECB President Mario Draghi has no other option after months of political pressure fueled by the panicky fear of deflation. In a way, the ECB painted itself into a corner by targeting headline inflation, not core inflation, which excludes food and energy. When the oil price halved in the last months of 2014, there was no way for the ECB to fulfill its mandate of keeping price growth close to 2% a year. My Bloomberg View colleague Mark Gilbert has pointed out that deflation hasn’t undermined consumer confidence in Europe as economists warned it would, and people haven’t really been delaying purchases. Yet, according to Jacob Funk Kirkegaard of the Peterson Institute for International Economics, a different danger still exists:

In general, falling prices of specific goods or services do not deter economic activity. The prospect of lower prices of computers does not, for example, keep consumers from purchasing them now. A greater risk to economic growth is that euro area employers, suspecting that deflation will boost real wages, may insist on minimum or even zero nominal wage increases in upcoming negotiations, reducing their purchasing power and dampening growth prospects.

The question is whether the injection of freshly minted euros from the ECB’s government-debt purchases will somehow make employers more amenable to raising wages and stimulating demand. For that to happen, the new euros first need to filter down to businesses. There are two ways that can happen: through the capital markets and through banks. The first path depends on driving down interest rates on sovereign debt so that lenders become more interested in other types of bonds, generated by businesses, and borrowing costs fall. Sovereign debt, however, already yields next to nothing. Germany today sold €4 billion ($4.7 billion) of zero% five-year bonds. Unless the QE drives yields on European sovereign debt deep into negative territory, it’s hard to see how the relative attractiveness of corporate bonds could increase by much. In fact, investors’ willingness to buy government debt without expecting any profit is indicative of how little they trust corporate lenders.

Read more …

“The ability of Jens Weidmann, the Bundesbank president, to promote his well-known concerns about risk-sharing into powerful conditions for a sovereign-bond program will astonish many who believed Mario Draghi could push through full-scale QE..”

• German Opt-Out Could Fatally Weaken Eurozone QE (MarketWatch)

In the shadowy world of European Central Bank decision-making, all central banks are equal — but some are more equal than others. Important concessions have been offered to the German Bundesbank to facilitate an announcement on sovereign-debt purchases after the ECB’s meeting on Thursday. But those concessions could open further divisions within the 19-member economic and monetary union, without guaranteeing the effectiveness of the attempt to overcome the eurozone’s low inflation and rebuild political cohesiveness. The QE program that ensues looks set to fall well short of the across-the-board quantitative easing that many financial-markets practitioners had been expecting. A significant additional factor in the complex ECB discussions on full-scale quantitative easing is last week’s Swiss National Bank decision to end its unilateral peg, in force since September 2011, between the Swiss franc and the euro.

That decision led to a sharp revaluation of the Swiss currency. The revoking of the earlier Swiss pledge to buy unlimited amounts of foreign currency to depress the Swiss franc has lowered the general credibility of central-bank statements on exchange rates and removed a major source of euro support. It exposes the SNB to heavy currency write-downs on its end-2014 foreign-exchange holdings of more than 475 billion francs, built up through unprecedented intervention to hold down the franc. Switzerland’s official reserves, up 10-fold since 2008, are now among the highest in the world. However, they will almost certainly be a major loss-maker for the Swiss state in 2015, with big political repercussions in Switzerland that will have an influence in Germany too. Further, the Swiss climb-down revealed the full extent of euro-bloc strains.

The mechanism of the single currency has depressed the real (inflation-adjusted) value of the “German euro” by at least 20%, compared with its theoretical level outside EMU. Whatever happens on Thursday, the fragility, hesitancy and politicization of the ECB’s decision-making are likely to drive the euro still weaker, without necessarily helping equity markets. The ability of Jens Weidmann, the Bundesbank president, to promote his well-known concerns about risk-sharing into powerful conditions for a sovereign-bond program will astonish many who believed Mario Draghi, the ECB president, could push through full-scale QE without accepting German strictures. The effective German opt-out from comprehensive support for other EMU countries rekindles memories of the Bundesbank’s surprise revelation in September 1992, when it said it would no longer intervene to shore up the Italian lira in the exchange-rate mechanism of the European Monetary System, the EMU’s forerunner.

Read more …

“..at least let’s say he’ll give it a good college try..”

• Market Will Be Disappointed By Draghi: Dennis Gartman (CNBC)

The market will likely be a bit disappointed by whatever economic stimulus European Central Bank President Mario Draghi announces Thursday, noted investor Dennis Gartman told CNBC on Wednesday. The ECB is expected to start a quantitative easing program it hopes will provide a boost to the European economy. “We’re going to end up seeing that Mr. Draghi will not be able to do what the market really wants him to do. He needs to get the balance sheet of the ECB back to $3 trillion, where it was several years ago. The problem that he has is that he doesn’t have the ammunition or he doesn’t have the capability to get it there,” the editor and publisher of The Gartman Letter said in an interview with “Closing Bell.”

While the U.S. has broad federal debt securities, the ECB has 19 different treasury securities from which to buy. “He would like to get it done. Size counts. Size matters. But I’m not sure he can get the size accomplished. So it will probably be a bit of a disappointment but at least let’s say he’ll give it a good college try,” Gartman said. The markets are anticipating about 500 billion euros ($580 billion) in bond purchases, but some economists think it could be higher. On Wednesday, sources confirmed to CNBC that the central bank is planning to announce it will purchase 50 billion euros of bonds a month. The Wall Street Journal first reported that figure.

“Let’s give him credit for being able to accomplish anything. This is a very tendentious group of people, of countries, that he has to try to get together,” Gartman said. Whatever Draghi can get done will help the European economy, he said, and will also put downward pressure upon the euro two to three weeks from now. “But you’re likely to get a small bounce. Any bounce that you get on the euro predicated upon disappointment … in tomorrow’s action … should be sold into,” Gartman added.

Read more …

“Europe can’t afford a Greek exit.”

• The Eurozone Can’t Afford A Greek Exit (Guardian)

Eurozone officials have spent the last four years building a financial buffer big enough to cope with a Greek exit. Ever since 2010 when Athens found itself unable to refinance its foreign loans and asked for a €120bn bailout, Brussels has sought to prevent another collapse and repeat of the crisis that swamped all ideas of recovery. Today a Grexit would weaken German and French banks, and cost the German government up to €77bn and the International Monetary Fund a slug of its loans, but would be unlikely to frighten global markets or undermine the 14-year-old currency bloc. In the last few weeks eurozone government bonds, which reflect the stability of a country’s finances, have remained steady while the leftist Syriza party’s polling has jumped.

In part, analysts say the €440bn European Financial Stability Facility (EFSF) amassed by Brussels is a big enough buffer. They have also scrutinised Syriza’s stance and reasoned that leader, Alex Tsipras, has given himself enough wriggle room to soften his previously hardline stance. Still, there are fears that the binding that holds the eurozone together will be loosened, especially if Greece is allowed to default while remaining inside the zone. The Bruegel Institute in Brussels is not the only thinktank to believe the estimated €250bn cost of a Grexit, while covered by the bailout funds, would cripple the eurozone and delay recovery for a decade. Zsolt Darvas, one of the institute’s economists said: “I am convinced that Greece will need new funding from European partners, but its volume should be a few dozen billion euros, say €20bn-€30bn.

“Compare the inconveniences of these additional funds to the losses on the existing approximate €250bn share of official lenders in Greek public debt (Greek Loan Facility, EFSF loans, IMF loans, money owed to the ECB and national central bank holdings of Greek bonds) and on various kinds of European Central Bank claims on Greece in the case of a Grexit.” Darvas said Greek loans can be extended to help Athens delay payments and use the money for reconstruction. Joachim Poss, the German Social Democratic party’s deputy finance spokesman in the German parliament, said earlier this month the total was unaffordable. “Europe as a whole would pick up a very, very large bill and Germany the biggest part – let there be no mistake,” he said, concluding: “Europe can’t afford a Greek exit.”

Read more …

“Syriza could embolden other anti-establishment parties challenging the mainstream political elite and their policies.”

• Populist Parties: Kryptonite For Europe’s Leaders? (CNBC)

Elections in Greece this weekend could prove a test bed for anti-establishment, populist parties throughout Europe which continue to make their plague mainstream parties in the opinion polls, general elections and on the streets. If Greek opinion polls are anything to go by, the Sunday’s snap election could be a nasty shock for Europe as the anti-establishment, anti-bailout party Syriza looks poised to win. Apart from concerns that Syriza would try to renegotiate Greece’s bailout terms with international lenders, reverse austerity measures and seek debt forgiveness – reasons enough to destabilize markets within the euro zone’s fragile, inter-connected economy – Syriza could embolden other anti-establishment parties challenging the mainstream political elite and their policies.

Among those that could stand to gain the most is Spain’s anti-establishment party “Podemos” (We Can). Despite being set up only one year ago, Podemos is leading opinion polls ahead of Prime Minister Mariano Rajoy’s People’s Party. Crucially, a general elections are due in Spain later this year — giving Podemos a real shot at power. “The rise of Syriza to power will represent an important test for the ability of an anti-establishment party to secure a better deal from Greece’s international creditors that will be closely watched by similar political movements, like Podemos,” Wolfango Piccoli, managing director of risk consultancy Teneo Intelligence told CNBC.

Anti-establishment movements such as the U.K. Independence Party (UKIP) and the Alternative for Germany (AfD) have spread throughout Europe over the last few years, accompanying a period of economic stress and unpopular austerity programs that have led voters to seek an alternative to the old political elite. “Behind the success of anti-establishment parties across Europe these days is the economic vulnerability in a growing subset of national electorates. From Syriza to UKIP, populist forces try to cash in on this insider-outsider politics, but each in their own national contexts,” Piccoli added.

Read more …

“Our homeland unfortunately is taking us backwards – paltry wages, miserable pensions – and we’re looking for something better.”

• Revenge of Disaffected Europe Risks Crisis Sparked in Greece (Bloomberg)

They speak different languages, they come from different backgrounds, yet all have the same message of frustration that’s threatening to redraw the European political map over the next year. Starting with elections this Sunday in Greece and heading west to Ireland via Britain and Spain, polls show Europeans will vent their anger over issues from widening income disparities and record unemployment to unprecedented immigration. For Athens pensioner Irini Smyrni, the moment she’d had enough was when her younger daughter lost her job with the government last year. For Dublin florist Nicola Johns, it was when her business fell behind on rent. “We pay, we pay, we pay,” said Smyrni, 73. “Our homeland unfortunately is taking us backwards – paltry wages, miserable pensions – and we’re looking for something better.”

English electrical technician David Liddle wants someone to stick up for people like him rather than immigrants and “scroungers.” Virginia Sanchez, an unpaid university researcher in Madrid, said she just grew tired of being failed by the usual politicians unable to improve her prospects. “I keep going because there’s nothing else to do,” said Sanchez, 23, who graduated in biology last year. Disaffection with what is seen as a ruling elite and a sense of being left behind in an increasingly globalized world are complaints heard across Europe on varying points of the political spectrum as the continent struggles to recover from successive waves of financial and economic crises.

European Central Bank President Mario Draghi today is expected to announce the latest efforts by his monetary policy makers to foster economic growth in the euro region by injecting money into the financial system. It’s unlikely to make enough of a difference to deter people from protesting at the ballot box. “Political elites have lost track of their citizens, who feel insecure amid all the economic and social pressures,” said Daniela Schwarzer, director of the German Marshall Fund’s Europe program in Berlin. “There’s a growing questioning of the political establishment across Europe.” The result is that people are abandoning parties used to being in government, those deemed safe to lead by creditors, investors and European bureaucrats.

Read more …

My bet is still they won’t.

• As Central Banks Surprise, Fed May Have To Throw In The Towel (MarketWatch)

The surprises coming out of the Swiss National Bank, the European Central Bank, the Bank of England and the Bank of Canada spell tectonic shifts occurring in the global economy that inevitably will hit these shores. The Swiss of course unearthed the biggest surprise last week, by ending their policy of buying up euros, but on Wednesday there were at least three further surprises as well. The surprises started as Bank of England minutes revealed that two hawks no longer supported rate hikes. That’s particularly newsworthy as the U.K. economy, along with the U.S., has been one of the strongest performers of industrialized nations. Then came news leaks on the European Central Bank’s quantitative easing plans.

That the ECB is about to start buying bonds is not a surprise, but the reports that they’ll do so each month is. While some in the market may be disappointed the headline size of 50 billion euros per month is not blockbuster, an open-ended campaign makes it easier for the ECB to continue the purchases and ramp them up. The Bank of Canada then shocked the market with a quarter-point rate cut, to 0.75%. The Bank of Canada is concerned that the sharp drop in oil prices will not just mute inflation but dampen growth in the export-intensive economy. The central bank even reported concerns that the oil-price collapse will have on foreign demand, exports, investment and jobs growth. With this backdrop, it seems almost ludicrous that the Fed will just stick to the plan it had in the fall, to start a rate-hike campaign in the middle of 2015.

In order for the Fed to do so, the U.S. economy will not only have to be resilient to some of the overseas pain, and its own domestic energy sector, but the inflows into government bonds and the dollar will have to slow. St. Louis Fed President James Bullard says the reason yields on U.S. Treasurys are so low is due to overseas investment and not fears over weak domestic growth. But even if right, that’s almost irrelevant. If the Fed starts hiking in this turbulent global environment, it will only accelerate overseas investment here — further dampening already-muted inflationary pressure and making life difficult for exporters, and possibly furthering risky behavior that some on the Fed want to clamp.

Read more …

Why the question mark?

• Is Canada’s Rate Cut A Race For The Bottom? (CNBC)

Commodity currencies may face a race to the bottom as the Bank of Canada’s surprise rate cut sent the Canadian dollar to five-year lows and could pressure Australia’s central bank to follow suit. “The reason [the Bank of Canada] cut rates is largely weaker oil prices. Australia is also a commodity exporter. The market could be excused for anticipating the RBA (Reserve Bank of Australia) would adopt a similar viewpoint,” said Greg Gibbs, senior foreign-exchange strategist at RBS. Discussions among market participants of whether successive rounds of central bank easing are making for a “tacit currency war” are increasing, he said.

On Wednesday, the Bank of Canada (BOC) cut its benchmark rate to 0.75% from 1%, its first rate change since late 2010, and cut its inflation and growth forecasts, citing the more than 50% decline in oil prices since mid-2014. The Canadian dollar, also known as the loonie, tanked, shedding as much as 4% against the dollar compared with Tuesday’s levels. The U.S. dollar was fetching levels not seen since 2009, during the Global Financial Crisis. Other central banks have also moved to weaken their currencies, with the Bank of Japan’s quantitative easing partly aiming for a weaker yen and Australia’s central bank trying to talk down its dollar.

The ECB’s likely move to announce plans Thursday to start buying assets set to further dent the euro, already at its weakest against the U.S. dollar since 2003. “Every central bank is trying to get rates down to zero, if not lower than zero,” Kumar Palghat at bond manager Kapstream told CNBC. “The only question is, you take rates down to zero, you depreciate your currency, you buy as much bonds as you want, if it doesn’t work, then what else are they going to do?” Energy and commodity exporters have particularly felt the heat. “Oil extraction now comprises roughly 3% of Canadian gross domestic product (GDP) and crude oil about 14% of Canadian exports,” Wells Fargo Securities said in a note Wednesday.

Read more …

“My only hope is that you understand that I acted in an attempt—however misguided—to generate higher returns for the fund and its investors..”

• Manager ‘Truly Sorry’ For Blowing Up $100 Million Hedge Fund (CNBC)

A hedge fund manager told clients he is “truly sorry” for losing virtually all their money. Owen Li, the founder of Canarsie Capital in New York, said Tuesday he had lost all but $200,000 of the firm’s capital—down from the roughly it ran as of late March. “I take responsibility for this terrible outcome,” Li wrote in a letter to investors, which was obtained by CNBC.com. “My only hope is that you understand that I acted in an attempt—however misguided—to generate higher returns for the fund and its investors. But even so, I acted overzealously, causing you devastating losses for which there is no excuse,” he added.

Li is a former trader at Raj Rajaratnam’s Galleon Group, which collapsed amid insider trading charges. Rajaratnam is now in prison for the illegal activity, but Li was never accused of wrongdoing. Li’s lieutenant at Canarsie is Ken deRegt, who joined in 2013 after retiring as the global head of fixed income sales and trading at Morgan Stanley. His son Eric deRegt also worked at Canarsie, according to filings with the SEC as of March 2014. Li said in the letter that he made a series of “aggressive transactions” over the last three weeks to make up for poor returns in December. He said he bet on stock price options, predicated on the broader market rising. But stock indexes fell, causing the huge losses along with several undisclosed direct investments, according to the note.

Read more …

“Just 80 individuals now have the same net wealth as 3.5 billion people – half the entire global population.”

• The Davos Oligarchs Are Right To Fear The World They’ve Made (Guardian)

The billionaires and corporate oligarchs meeting in Davos this week are getting worried about inequality. It might be hard to stomach that the overlords of a system that has delivered the widest global economic gulf in human history should be handwringing about the consequences of their own actions. But even the architects of the crisis-ridden international economic order are starting to see the dangers. It’s not just the maverick hedge-funder George Soros, who likes to describe himself as a class traitor. Paul Polman, Unilever chief executive, frets about the “capitalist threat to capitalism”. Christine Lagarde, the IMF managing director, fears capitalism might indeed carry Marx’s “seeds of its own destruction” and warns that something needs to be done. The scale of the crisis has been laid out for them by the charity Oxfam.

Just 80 individuals now have the same net wealth as 3.5 billion people – half the entire global population. Last year, the best-off 1% owned 48% of the world’s wealth, up from 44% five years ago. On current trends, the richest 1% will have pocketed more than the other 99% put together next year. The 0.1% have been doing even better, quadrupling their share of US income since the 1980s. This is a wealth grab on a grotesque scale. For 30 years, under the rule of what Mark Carney, the Bank of England governor, calls “market fundamentalism”, inequality in income and wealth has ballooned, both between and within the large majority of countries. In Africa, the absolute number living on less than $2 a day has doubled since 1981 as the rollcall of billionaires has swelled.

In most of the world, labour’s share of national income has fallen continuously and wages have stagnated under this regime of privatisation, deregulation and low taxes on the rich. At the same time finance has sucked wealth from the public realm into the hands of a small minority, even as it has laid waste the rest of the economy. Now the evidence has piled up that not only is such appropriation of wealth a moral and social outrage, but it is fuelling social and climate conflict, wars, mass migration and political corruption, stunting health and life chances, increasing poverty, and widening gender and ethnic divides. Escalating inequality has also been a crucial factor in the economic crisis of the past seven years, squeezing demand and fuelling the credit boom.

Read more …

It would still mean Monsanto et al own the rights and patents on our food, and that is as wrong as it can be.

• ‘Safer GMOs’ Made By US Scientists (BBC)

US scientists say they have taken the first step towards making “safer” GMOs that cannot spread in the wild, using synthetic biology. They have re-written the genetic code of bacteria to use only synthetic chemicals to grow. The GM bacteria would die if they escaped into nature. The research, published in Nature, is proof of concept for a new generation of GMOs, including plants, say Harvard and Yale university experts. Genetically engineered micro-organisms are used in Europe, the US and China to produce drugs or fuels under contained industrial conditions. Scientists want to build in safety measures so that their spread could be controlled if they were ever used in the outside world, perhaps to mop up oil spills or to improve human health.

“What we’ve done is engineered organisms so that they require synthetic amino acids for survival or for life,” Prof Farren Isaacs of Yale University, who led one of two studies, told BBC News. He said the future challenge was to re-engineer the code of other lifeforms. “What we’re seeing here is an important proof of concept that re-coding genomes and engineering dependence on synthetic amino acids is technically feasible in not just E coli but other micro-organisms and multicellular organisms such as plants.” GMOs have a number of potential practical uses, including the production of drugs and fuels, and removing pollutants from contaminated areas. However, strict containment measures would be needed to use them in open spaces to stop them spreading in the wild.

The US researchers describe their research, published in Nature journal, as a “milestone” in synthetic biology. Prof George Church of Harvard Medical School, who led the other study, said in order to protect natural ecosystems and address public concern the scientific community needed to develop robust biocontainment mechanisms for GMOs. “This work provides a foundation for safer GMOs that are isolated from natural ecosystems by a reliance on synthetic metabolites.”

Read more …