Arthur Rothstein Migratory fruit pickers’ camp in Yakima, Washington Jul 1936

“The first reason to worry is the curiously juxtaposed state of asset prices, with generally buoyant equities but falling sovereign bond yields and commodity prices. They cannot both be right. High equity prices are – or at least, should be – indicative of investor confidence and optimism. Low bond yields and falling commodity prices point to the very reverse.”

• Five Reasons Why Markets Are Heading For A Crash (Telegraph)

Many stock markets are close to their all-time highs, the oil price is plummeting, delivering a significant boost to Western and Asian economies, the European Central Bank is getting ready for full-scale sovereign QE – or so everyone seems to believe – the American recovery is gaining momentum, Britain is experiencing the highest rate of growth in the G7, God is in his heaven and all’s right with the world. All good, then? No, not good at all. I don’t want to put a dampener on the festive cheer, but here are five reasons to think things are not quite the unadulterated picture of harmony and advancement many stock market pundits would have you believe.

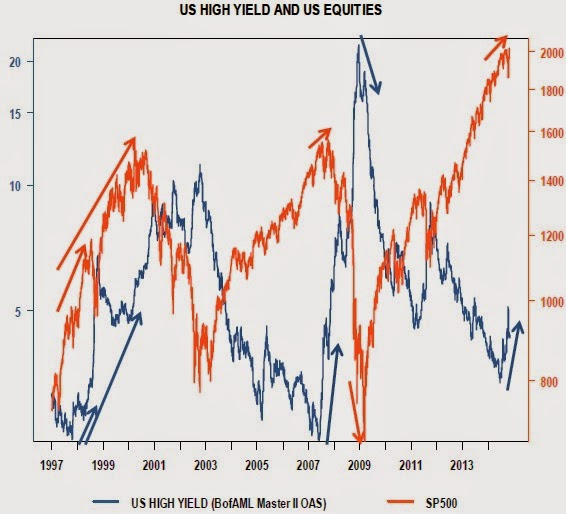

The first reason to worry is the curiously juxtaposed state of asset prices, with generally buoyant equities but falling sovereign bond yields and commodity prices. They cannot both be right. High equity prices are – or at least, should be – indicative of investor confidence and optimism. Low bond yields and falling commodity prices point to the very reverse; they are basically a sign of emerging deflationary pressures and a slowing economy. If demand was really about to roar away, both would be rising along with equities, not falling. The markets have become a kind of push-me-pull-you construct. They look both ways at the same time.

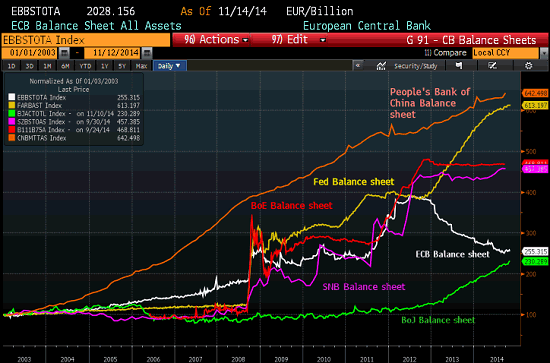

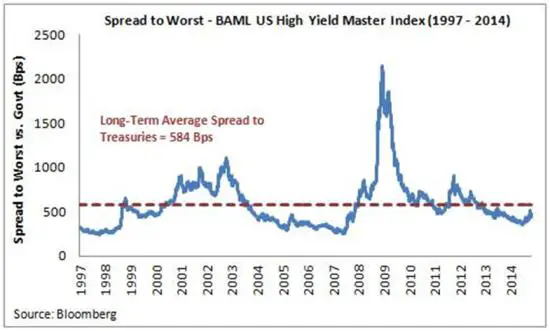

Yet this is no mere anomaly. There is a good reason for these divergent asset prices – pumped up by central bank money printing, abundant cash is desperate for fast vanishing yield, and is chasing it accordingly. Spanish sovereign debt might have looked a good buy a couple of years back, when the yield still factored in the possibility of default. But today, the yield on 10-year Spanish bonds is less than 2pc. In Germany, it’s just 0.7pc, not much more than Japan, which has had 20 years of stagnation and deflation to warp the traditional laws of investment. If it is yield you are after, sovereign debt markets are again exceptionally poor value, barely offering a real rate of return at all. Commodities were the next port of call, but that game too seems to be up.

“We all are in a Ponzi world right now. Hoping to be bailed out by the next person.”

• ‘The Minsky Moment Is The Crash’ (Zero Hedge)

BCG senior partner Daniel Stetler was recently interviewed by Portugal’s Janela na web magazine, his insights are significant and worrisome… Some key excerpts: “You have to think about a huge tower of debt on shaky foundations where central banks pump concrete in the foundations in an emergency effort to avoid the building from collapsing and at the same time builders are adding additional floors on top” [..] “Today central banks give money to institutions, which are not solvent, against doubtful collateral for zero interest. This is not capitalism.” [..] “It is the explicit goal of central banks to avoid the tower of debt to crash. Therefore they do everything to make money cheap and allow more speculation and even higher asset values. It is consistent with their thinking of the past 30 years. Unfortunately the debt levels are too high now and their instruments do not work anymore as good. They might bring up financial assets but they cannot revive the real economy.” [..]

“In my view [Piketty] overlook the fact that only growing debt levels make it possible to have such a growth in measured wealth. Summing up, Piketty looks at symptoms – wealth – and not on causes – debt.” “We need to limit credit growth and make it tax-attractive to invest in the real economy not in financial speculation. This will happen automatically if we return to normal interest rates. The key point is, that we as societies should reduce consumption which includes social welfare and rather invest more in the future.” [..] “”We all are in a Ponzi world right now. Hoping to be bailed out by the next person. The problem is that demographics alone have to tell us, that there are fewer people entering the scheme then leaving. More people get out than in. Which means, by definition, that the scheme is at an end. The Minsky moment is the crash. Like all crashes it is easier to explain it afterwards than to time it before. But I think it is obvious that the endgame is near.”

How ultra-low rates lets companies pretend they’re actually economically viable.

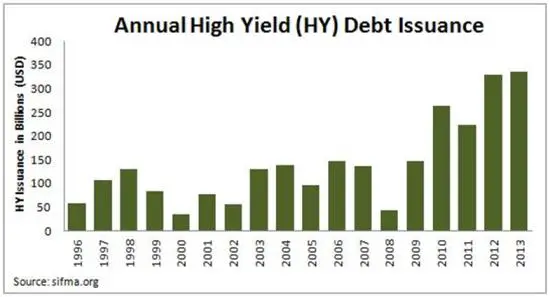

• Global Company Bond Sales Nearing $4 Trillion Set Annual Record (Bloomberg)

Global corporate bond sales set an annual record as companies lock in borrowing costs that forecasters say are bound to rise. SoftBank, Amazon.com and Medtronic were among borrowers that helped push issuance to $3.975 trillion, past the previous peak of $3.973 trillion in 2012, according to data compiled by Bloomberg. Sales in the U.S. have already reached an unprecedented $1.5 trillion. Issuance defied predictions of a slowdown made by underwriters from Bank of America Corp. to Barclays Plc as a decline in benchmark costs that no one foresaw pushed yields to record lows. While central banks in Europe and Japan have stepped up their own stimulus efforts, the likelihood the Federal Reserve will boost interest rates has fueled company borrowings worldwide.

“We’ve seen so much issuance just because everybody’s thinking that next year’s going to be the year when rates start rising,” Nathan Barnard, a fixed-income analyst at Portland, Oregon-based Leader Capital Corp., said today in a telephone interview. “It’s cheap financing still so why not do that.” Investors are poised to earn 7.01% on an annualized basis this year on debt from the most creditworthy to the riskiest borrowers worldwide, according to the Bank of America Merrill Lynch Global Corporate and High Yield Index. Those would be the largest gains since a 12.05% return in 2012, the index data show.

” ..because of how Saudi Arabia uses its oil well to support its entire economy, the country’s budget calls for $90 a barrel to break even, despite that the cost of production is closer to $30.”

• Collapse Of Oil Prices Leads World Economy Into Trouble (Guardian)

OPEC, the largest crude-oil cartel in the world, wanted others to feel its pain as oil prices collapsed. “OPEC wanted … to cut off production … and they wanted other non-OPEC [countries], especially in the US and Canada, to feel the pinch they are feeling,” says Abhishek Deshpande, lead oil analyst at Natixis. But in its rush to influence others, OPEC ended up hurting everyone in the process – including itself. Low oil prices, pushed down further by OPEC’s meeting last week,have impacted world economies, energy stocks, and several currencies. From the fate of the Russian rouble to Venezuelan deficits to American mutual funds full of Exxon or Chevron stock, OPEC’s decision was the shot heard round the world for troubled commodities.

So how low could oil go? Standard Chartered analysts expect a “chaotic” quarter ahead, saying OPEC’s decision to keep the production target unchanged is “extremely negative for oil prices for 2015”. The bank slashed its 2015 average price forecast for Brent crude oil by $16 a barrel to $85. Other forecasts are lower. Citi Research estimated an average 2015 price of $72 for WTI and $80 for ICE Brent. Natixis’s Deshpande said their average 2015 Brent forecast is around $74, with WTI around $69. These prices have real-world effects on world economies. Everyone in the sector is smarting. Deshpande said because of how Saudi Arabia uses its oil well to support its entire economy, the country’s budget calls for $90 a barrel to break even, despite that the cost of production is closer to $30.

Other OPEC members have even higher budgetary breakevens. Saudi Arabia is sitting on a “war chest” of money it stockpiled when prices were high, Deshpande said. Citi analysts said Saudi Arabia has about $800bn in cash reserves. Venezuela, on the other hand, is a prime example of a country squandering its riches. Citi said for every $10 drop in oil prices Venezuela loses about $7.5bn in revenues. “Already weak fiscally, this should call for reducing energy subsidies. But domestic politics including the 2015 election makes this nearly impossible,” they said. OPEC countries as a whole could lose $200bn in revenue if Brent prices stay at $80, which is about $600 per capita annually, Citi said.

“If you’re selling at the wellhead, you’re getting a very low number relative to WTI.”

• Sub-$50 Oil Surfaces in North Dakota As Regional Discounts Swell (Bloomberg)

Oil market analysts are debating if oil will fall to $50. In North Dakota, prices are already there. Crude sold at the wellhead in the Bakken shale region in North Dakota fell to $49.69 a barrel on Nov. 28, according to the marketing arm of Plains All American Pipeline LP. That’s down 47% from this year’s peak in June, and 29% less than the $70.15 paid for Brent, the global benchmark. The cheaper price for North Dakota crude underscores how geographic and logistical hurdles can amplify the stress that plunging futures prices have put on drillers in new shale plays that have helped push U.S. oil production to the highest level in 31 years. Other booming areas such as the Niobrara in Colorado and the Permian in Texas have also seen large discounts to Brent and U.S. benchmark West Texas Intermediate.

“You have gathering fees, trucking, terminaling, pipeline and rail fees,” Andy Lipow, president of Lipow Oil Associates LLC in Houston, said Dec. 2. “If you’re selling at the wellhead, you’re getting a very low number relative to WTI.” Discounted prices at the wellhead have been exacerbated by a 39% drop in Brent futures since June 19 to $69.92 a barrel yesterday. Prices have fallen as global demand growth fails to keep pace with surging oil production from the U.S. and Canada. Much of that new output is coming from areas that are facing steep discounts. Bakken crude was posted at $50.44 a barrel Dec. 2. Crude from Colorado’s Niobrara shale was priced at $54.55, according to Plains. Eagle Ford crude cost $63.25, and oil from the Oklahoma panhandle was $58.25.

Look for more of this too.

• First U.S. Gas Station Drops Below $2 a Gallon (Bloomberg)

$2 gasoline is back in the U.S. An Oncue Express station in Oklahoma City was selling the motor fuel for $1.99 a gallon today, becoming the first one to drop below $2 in the U.S. since July 30, 2010, Patrick DeHaan, a senior petroleum analyst at GasBuddy Organization Inc., said by e-mail from Chicago. “We knew when we saw crude oil prices drop last week that we’d break the $2 threshold pretty soon, but we didn’t know if it would happen in South Carolina, Texas, Missouri or Oklahoma,” said DeHaan, senior petroleum analyst for GasBuddy. “Today’s national average, $2.74, now makes the current price we pay a whopping 51 cents per gallon less than what we paid a year ago.”

Gasoline is sliding after OPEC decided last week not to cut production amid a global glut of oil that has already dragged international oil prices down by 37% in the past five months. Pump prices have fallen by almost a dollar since reaching this year’s high on April 26. 15% of the nation’s gas stations are selling fuel below $2.50 a gallon, “and it may not be long before others join OnCue Express in that exclusive club that’s below $2,” said Gregg Laskoski, another senior petroleum analyst with GasBuddy. Retail gasoline averaged $2.746 a gallon in the U.S. yesterday, data compiled by Florida-based motoring club AAA show. Stations will cut prices by another 15 to 20 cents a gallon as they catch up to the plunge in oil, Michael Green, a Washington-based spokesman for AAA, said by e-mail today.

“In a global market that neighboring Kuwait estimates is facing a daily oversupply of 1.8 million barrels, the accord stands to deepen crude’s 38% plunge since late June .. ”

• There Are 550,000 Iraqi Barrels Signaling Oil Glut Will Deepen (Bloomberg)

Not only is OPEC refraining from cutting oil output to stem the five-month plunge in prices, it’s adding to the supply glut. Just five days after OPEC decided to maintain production levels, Iraq, the group’s second-biggest member, inked an export deal with the Kurds that may add about 300,000 barrels a day to world supplies. In a global market that neighboring Kuwait estimates is facing a daily oversupply of 1.8 million barrels, the accord stands to deepen crude’s 38% plunge since late June. Or as Carsten Fritsch, a Frankfurt-based analyst at Commerzbank AG, put it: There’ll be “even more oil flooding the market that nobody needs.”

Benchmark Brent crude slumped immediately after the deal was signed Dec. 2 in Baghdad, dropping 2.8% to $70.54 a barrel. Prices, which slipped 0.9% yesterday to reach the lowest since 2010, were at $70.38 at 1:30 p.m. Singapore time today. Futures are down about 10% since OPEC’s Nov. 27 decision. The agreement seeks to end months of feuding between the Kurds and officials in Iraq over the right to crude proceeds, a dispute that has hindered their joint effort to push back Islamic State militants. The deal allows for as much as 550,000 barrels a day of crude to be shipped by pipeline from northern Iraq to the Mediterranean port of Ceyhan in Turkey, according to the regional government. The Kurds were already exporting about 220,000 barrels daily, according to data compiled by Bloomberg.

The Kurdish Regional Government expanded its control of Iraq’s oil resources in June when it deployed forces to defend Kirkuk, the largest field in the north of the country, from Islamic militants. The Kurds have been shipping crude through Turkey in defiance of the central government, which took legal action to block the sales, leaving some tankers loaded with Kurdish oil stranded at sea. As much as 300,000 barrels a day of Kirkuk blend will be shipped through the Turkish pipeline under the terms of the deal, according to the KRG. Another 250,000 barrels daily of oil produced in the Kurdish region will be exported through the same route, according to the government in Baghdad.

“.. if the consumer is struggling to go out and spend on goods and services, or if Americans are simply hesitant to ramp up spending, it could be a very un-merry holiday season for retailers. ..”

• Crushing The “Lower Gas Price = More Spending” Fiction (Zero Hedge)

With uncertainty lingering and patience wearing thin after five+ years of still lackluster wage growth, consumers are increasing saving for the future, hedging against a continuation of “more of the same.” Thus, for many, extra savings at the pump as a result of lower gas prices are simply being stored away to help supplement spending needs in the future, ramping up savings, not spending. As of September, consumers increased savings from 5.4% to a 5.6% pace, up from a recent low of 4.3% in November of last year. [..]

Against the backdrop of three consecutive months of aggressive energy price reprieve, retail sales have fallen short. With more than a $0.50 drop in the average cost of a gallon of gasoline, anything less than a minimal 0.5% increase in monthly retail sales highlights just how fragile the U.S. economy remains, particularly the consumer sector. While the weakness in October was dominated by a few categories, there was insufficient demand elsewhere to compensate. Consumers continue to spend, but at a modest level with no sign of further momentum in sight with income growth stubbornly limited, and consumers opting to use savings from lower gas prices to offset rising healthcare and utilities costs.

We are, after all, a consumer based economy, and if the consumer is struggling to go out and spend on goods and services, or if Americans are simply hesitant to ramp up spending, it could be a very un-merry holiday season for retailers. From the Fed’s perspective, if consumer spending continues to disappoint, headline activity is likely to significantly underperform monetary policy officials’ optimistic forecast of +2% in 2014 and circa 3% in 2015.

Expect a lot of this.

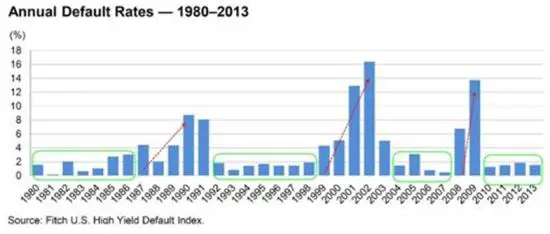

• Energy Junk-Debt Deals Postponed as Falling Oil Saps Demand (Bloomberg)

Two energy-related companies are postponing financings after a plunge in oil prices made their high-yield, high-risk debt more difficult to sell. New Atlas, a newly formed unit of oil and gas producer Atlas Energy Group, put on hold a $155 million loan it was seeking to refinance debt, according to five people with knowledge of the deal, who asked not be identified because the decision is private. EnTrans International, a manufacturer of equipment used in fracking, delayed selling a $250 million bond, according to three other people with knowledge of that transaction. Investors in bonds of junk-rated energy companies are facing losses of more than $11 billion as oil prices dropped to a five-year-low of $63.72 a barrel this week. This is deepening concern that the riskiest oil explorers won’t be able to meet their obligations, and sending their borrowing costs to the highest since 2010.

More than half of Cleveland, Tennessee-based EnTrans’s revenue comes from equipment sales to the hydraulic fracturing and the energy industry, Moody’s Investors Service said in a Nov. 17 report. The notes, which were being arranged by Credit Suisse, would have been used to refinance debt. Gary Riley, chief executive officer at EnTrans International, said yesterday in an e-mail commenting on the deal status that “the decision to defer or go forward has not been made.” Riley didn’t respond to questions seeking comment today. Deutsche Bank and Citigroup were managing New Atlas’s financing and had scheduled a meeting with lenders for this morning, according to data compiled by Bloomberg.

Blowing LNG out of the water.

• Canada Gas Project Delay Highlights Oil Plunge’s Wider Risk (Bloomberg)

Petroliam Nasional’s decision to postpone its C$36 billion ($32 billion) liquefied natural gas project in Canada highlights the risks for energy developments around the world from oil’s plunge. Woodside Petroleum’s Browse gas project in Australia and an oil project planned by Santos in Indonesia are among others seen as facing delays with oil trading at the lowest in more than four years. “Unless there is compelling reason to move ahead with approvals, we do expect significant deferrals of capex across the board,” Nik Burns, an analyst at UBS AG, said by phone from Melbourne. “Most investors are looking for greater financial discipline with commodity prices falling.” Oil’s slump threatens to hurt LNG contracts tied to crude prices for suppliers already coping with rising costs and competition from Russian gas commitments to China.

Costs at the Canadian project need to be cut before a decision is made, the Malaysian state-owned company known as Petronas said yesterday. Petronas announced the delay less than a week after Chief Executive Officer Shamsul Azhar Abbas told reporters there were a few “loose ends” to sort out before a final investment decision would be made. Oil fell almost 8% in the days between Shamsul’s comments in Kuala Lumpur and yesterday’s announcement. With BG Group saying in November that it would slow its proposed $16 billion LNG project in Prince Rupert, British Columbia, on concern about competing sources of supply from proposed projects in the U.S., the prospects for the 18 LNG developments on the drawing board in Canada are dimming.

Lower prices are killing jobs in producer nations. Next up: US.

• Norway Seeks to Temper Its Oil Addiction After OPEC Price Shock (Bloomberg)

After the biggest slump in oil prices since the start of the global financial crisis, the prime minister of Norway says western Europe’s largest crude producer must become less reliant on its fossil fuels. “We need new industries, a new tax system and a better climate for investment in Norway,” Prime Minister Erna Solberg said yesterday in an interview in Oslo. The comments follow threats from SAFE, one of Norway’s three main oil unions, which warned this week it will respond with industrial action unless the government acts to stem job losses. Solberg said that far from triggering government support, plunging oil prices should be used by the industry as an opportunity to improve competitiveness.

A 39% slump in oil prices since June is killing jobs in Norway, which relies on fossil fuels to generate more than one-fifth of its gross domestic product. In the past few months, Norway has lost about 7,000 oil jobs and SAFE said this week it was up to the government to reverse that trend. Solberg says protecting oil jobs will ultimately make it harder for the economy to wean itself off its commodities reliance. “We need to lower our cost of production in the development of new fields,” she said. “Oil production is not going to rise, it will slowly fall in Norway.”

I don’t think people understand the size of the China shadow banks, nor the scale of the risk linked to them, or the prominent position they have in the country.

• China Shadow Bank Collapse Exposes Grey-Market Lending Risk (FT)

A sign in parchment above the locked door of Shanxi Platinum Assemblage Investment, written in calligraphy, reads “Honesty is fundamental”. Until recently a police notice below it directed investors to report to the local station to submit evidence against the company. In Taiyuan, capital of the central Chinese province of Shanxi, investors have rushed to branches of Platinum Assemblage in recent days as word spread that the company was unable to meet payouts on maturing investment products that had offered annual interest rates of 14-18%. Meanwhile, rumors swirled that executives had fled and branches in some cities had shut their doors. The incident highlights financial risks lurking in the outer margins of China’s shadow banking system, where high-yielding wealth management products blur into grey-market lending. A financial system in which the government refuses to tolerate defaults has also encouraged moral hazard among investors by creating an expectation that even risky credit carries an implicit guarantee.

“I have no idea where they put the money. I’m not really clear on the guarantee businesses. But they had a business licence on the wall,” said an elderly man surnamed Wang wearing a mechanic’s jacket and knit cap outside the company’s locked doors. State media estimates that more than Rmb100 million ($16 million) may be at risk in the collapse of Platinum Assemblage, a relatively tiny sum. But a series of similar incidents this year suggests China’s slowing economy has created fertile ground for hucksters, as companies become increasingly desperate for funds amid a pullback in lending from banks as well as more mainstream non-bank lenders such as trust companies. In March, depositors in Yancheng city, Jiangsu province, rushed to withdraw funds from rural co-operatives and were told that the institutions — which operate like banks but whose legal status exempt them from liquidity regulations – had lent out all the money. Analysts said many co-ops, which were created to lend to farmers, had in fact been investing in real estate.

It is not known how Platinum Assemblage invested clients’ funds, but a large share of shadow banking funding flows into real estate, one of the few industries that, until recently at least, could deliver rates of return high enough to service loans at interest rates often exceeding 20%. Local media reported that wealth management clients of another guarantee company, Henan Swiftly Soaring Investment, blocked a road in Xinxiang city, Henan province, on Sunday to protest against the lack of payout on similarly structured wealth management products. China Business News, a national newspaper, reported that much of that money was also used for property purchases. Late last year eight government agencies including the banking regulator, the central bank and the commerce ministry released a notice warning of rampant irregularities among non-financial guarantee companies.

More funds that don’t deliver.

• BlackRock China ETF’s Derivatives Strategy Faltering (Bloomberg)

BlackRock’s pioneering China exchange-traded fund is at risk of losing its market-leading status as returns trail its benchmark index and competitors take advantage of reduced government curbs on foreign investors. The $10.1 billion iShares FTSE A50 China Index ETF, the first to track mainland shares when they were inaccessible to most foreigners in 2004, has underperformed its target by 4.6 percentage points this year. The Hong Kong-listed fund is lagging behind as its decade-long strategy of using derivatives proves more expensive for investors than buying shares directly. The fund’s diminished appeal reflects how China’s efforts to remove barriers on its $4.6 trillion stock market are changing the way international investors gain exposure to the world’s second-largest economy. Derivative products are getting replaced by funds that access the Chinese market through the nation’s quota system for foreign institutions and the Shanghai-Hong Kong exchange link that started last month.

“The playing field is changing,” Brendan Ahern, managing director at Krane Fund Advisors in New York, which oversees four Chinese ETFs, said by phone. “The market is gravitating to direct products. Managers have to think about how to adapt to the changes.” Investors are weighing the most efficient ways to access China’s stock market as it rallies from the cheapest levels on record versus global peers. The Shanghai Composite Index has advanced 31% in 2014 and reached a three-year high yesterday amid speculation the nation’s central bank will increase monetary stimulus. The BlackRock fund’s net asset value has climbed 26% this year, versus a 30% gain in the gauge it’s designed to mimic. Shareholder returns have been just 18%, reflecting both the cost of using derivatives and investors’ unwillingness to keep valuing the ETF at a premium to its underlying securities.

Draghi won’t move.

• What The Dollar May Be Saying About Europe (CNBC)

The dollar has been riding high and is looking for another boost Thursday from a dovish European Central Bank. The greenback made new multiyear highs against the yen and euro Wednesday, ahead of the ECB meeting. The dollar has been rising as U.S. monetary policy diverges from that of Japan and the eurozone. The U.S. economy is also stronger, and that is expected to show up in another 200,000 plus jobs report Friday. While the ECB is not expected to take any new steps at its rate meeting Thursday, traders have been anticipating a dovish ECB President Mario Draghi, who holds a briefing after the meeting. “The gist of it is I think Draghi will leave the door wide open for sovereign QE in the first quarter,” said Alan Ruskin, head of G-10 foreign exchange strategy at Deutsche Bank. “I think you’ve heard a number of comments from ECB officials suggesting December is too early, and they want to let some of their past decisions work their way through.”

The ECB has embarked on asset purchases as the Fed ended its quantitative easing bond buying, or QE, in October. The ECB is now expected to expand its asset buying with a program to buy sovereign debt. The dollar index, at 89.005 was at the highest level since March, 2009 and the dollar was at a seven-year high against the yen. “There’s this kind of fear that the dollar’s traded very, very well going into this meeting, and that maybe there’s some expectation he will deliver more than he actually will,” said Ruskin. He said even though Draghi is expected to be dovish, if nothing more is announced there’s a chance the dollar could selloff.

” .. could require cuts in non-protected departments such as police, local government and justice ..”

• UK Moves To Cut Spending To 1930s Levels (Guardian)

The chancellor, George Osborne, set out dramatic plans to move Britain from the red into the black that will see public spending as a percentage of GDP fall to its lowest level since the 1930s and could require cuts in non-protected departments such as police, local government and justice amounting to a further £60bn by 2019-20. The plans, according to the Treasury spending watchdog, the Office for Budget Responsibility, also presume the loss of a further one million public sector jobs by 2020, a renewed public sector pay squeeze and a further freeze on tax credits. The scale of the implied spending cuts required to drive the country into a surplus of £23bn by 2019-20 in part prompted the Liberal Democrat business secretary, Vince Cable, to write two weeks ago to ask the OBR to distinguish in its forecasts between the spending plans agreed by the coalition up to 2015-16 and any spending projections after that date which could only be an assumption about tax and spending policy.

Cable described the Osborne plans to bring public spending down to 35 % of GDP as “wholly unrealistic”. Among the measures in a politically-dominated autumn statement was a surprise shakeup of stamp duty, with an increase in rates levied on the most expensive properties designed to trump Labour’s plans for a mansion tax six months before the general election. Osborne claimed 98% of home-buyers would pay less stamp duty as a result of the changes, which, from midnight on Wednesday night, axed the big jumps in tax currently triggered when the cost of a home moves into a higher band. Under the new system, based on income tax bands, home buyers will pay no stamp duty on the first £125,000 of a purchase, then 2% up to £250,000, 5% up to £925,000, 10% up to £1.5m and 12% on everything above £1.5m. Anyone buying an “averagely priced” home worth £275,000 would pay £4,500 less in tax.

“Real growth is weak; nominal growth is pathetic .. ”

• Australia’s Dreadful GDP Figures – Six Things You Need To Know (Guardian)

Well, what a dreadful set of numbers. The September quarter GDP figures released on Wednesday unfortunately confirmed other economic data that shows Australia’s economy is growing at barely walking pace. Let’s break down the figures and to see if there is any sunshine amid the gloom.

1. Real growth is weak; nominal growth is pathetic – In seasonally adjusted terms, the economy grew by just 0.3% in the September quarter, and by 2.7% in the past year. Given average annual growth is around 3.1%, the 0.3% growth is particularly dreadful given that it would annualise to just 1.2%. As you would expect, the news was even more depressing for GDP per capita growth. In trend terms, it didn’t grow at all in the September quarter and, in seasonally adjusted terms, it actually fell 0.13%. Thus any growth we achieved this last quarter came about through population increase. For the budget numbers, the focus always goes onto nominal growth. Measured in current dollars, it gives a better link to taxation revenue than real GDP.

The May budget forecast nominal GDP in 2014-15 to grow by 3%. In the past 12 months it has grown by 2.7%, but most of that growth came in the December 2013 quarter and thus will not be counted from the next quarter onwards. Nominal GDP in the past quarter grew by just 0.2% in trend terms and actually fell by 0.1% in seasonally adjusted terms. All in all this suggests a fairly big hit to the budget bottom line. So yeah, all gloom.

I’d say that’s putting it mildly.

• Putin Accuses West Of ‘Pure Cynicism’ Over Ukraine (CNBC)

Russian President Vladimir Putin accused Western powers of “pure cynicism” over the situation in Ukraine, in a key speech to his country as its economic prospects worsens. The ruble looked set for another record low against the dollar as his speech unfolded on Thursday. With a plummeting ruble and oil price, spiraling inflation, and the prospect of more stringent sanctions from Western powers, Russia’s short-term economic prospects are falling faster than the temperature during a Siberian winter. Putin previously served as Russia’s Prime Minister, and this term coincided with relative economic prosperity for the country, as rising oil and gas prices helped boost Russia’s biggest exports. In 2015, however, the average Russian household’s disposable income will shrink by 2.8%, according to official Russian figures – the first fall since Putin came to power.

As President, his recent focus on defence and nationalism seems to have boosted his approval ratings, but it’s far from clear that this can continue if all Russians – from street-cleaners to oligarchs – feel worse off. “The market will be looking for the new ideas which are going to pull Russia out of the economic stagnation and looming decline which was already evident prior to the crisis in Ukraine and the more recent drop in oil prices,” Timothy Ash, head of emerging markets research at Standard Bank, wrote in a research note. “The pressure is now on Putin to offer a rival vision for a successful economic model for Russia.”

But who’s going to listen? Think these fold care about a million signatures? Once signed, we won’t get rid of these Frankensteins anymore.

• One Million Europeans Sign Petition Against EU-US TTIP Talks (BBC)

A campaign group website says over a million people in the European Union have signed a petition against trade negotiations with the United States. The petition calls on the EU and its member states to stop the talks on the Transatlantic Trade and Investment Partnership or TTIP. It also says they should not ratify a similar deal that has already been done between the EU and Canada. It says some aspects pose a threat to democracy and the rule of law. One of the concerns mentioned in the petition is the idea of tribunals that foreign investors would be able to use in some circumstances to sue governments.

There is a great deal of controversy over exactly what this system, known as Investor State Dispute Settlement, would enable companies to do, but campaigners see it as an opportunity for international business to get compensation for government policy changes that adversely affect them. This kind of provision exists in many bilateral trade and investment agreements. Friends of the Earth have published new research on the impact they have had on EU countries. Information about these cases is not always made public, but the group says that going back to 1994, foreign investors have sought compensation of almost €30bn (£24bn) from 20 states. Where the results are known (a small minority of the total), the tribunals have awarded total compensation of €3.5bn (about £2.8bn).

In Britain, the possible implications of this provision for the National Health Service have been especially controversial. Campaigners believe that the investor tribunals would make it harder to reverse any decisions to contract services out to international healthcare firms. John Hilary of War on Want said: TTIP “will make it impossible for any future government to repeal the Health & Social Care Act and bring the NHS back into public hands”. The petition lists a number of other areas where its signatories believes European standards would suffer if the TTIP negotiations are completed and the Canada deal is ratified: employment, social, environmental, privacy and consumer protection.

Feels like Mao never left.

• Xi’s Cultural Revolution Is Doomed to Fail (Bloomberg)

As Japan and South Korea have shown, the best way for governments to encourage pop culture with global appeal is probably to stay out of the way. China’s President Xi Jinping disagrees. Take Monday’s announcement by China’s top media watchdog. Effective immediately, the government has reserved the right to send film and television actors, directors, writers and producers on all-expenses-paid, involuntary, 30-day sabbaticals to rural mining sites, border areas, and other remote locations. The purpose, according to the directive, is to help Chinese artists “form a correct view of art and create more masterpieces.” The measure is extreme – reminiscent of “sending down” students to the countryside for reeducation during China’s mad Cultural Revolution. But it’s by no means an isolated case. Over the last few months, Xi’s government has issued several directives designed to control the country’s entertainment industries.

They include new restrictions on the streaming of foreign programs, bans on specific types of plots (adulterous affairs, for example, can no longer be portrayed in dramas), shutdowns of independent sites that subtitle foreign programs for Chinese viewers, and even a prohibition on punning. These directives sit awkwardly with Xi’s very public ambition to expand China’s “soft power” – a term that embodies everything from movies to bugle-playing – beyond its borders. The Chinese president is a child of Communist royalty; his formative years were during the Cultural Revolution, when entertainment was viewed as an ideological pursuit whose role was to propagandize. In Xi’s worldview, artists who don’t produce “correct” movies are doing a disservice to the nation and need to be reminded of their duty — say, by spending more time with the hardworking peasants they’re supposed to be championing in their works.

Farrell again looks beyond the narrow world of investors.

• The 8th, And Final, Deadly Sin: Exploiting The Earth (Paul B. Farrell)

“When I look at America,” said Pope Francis during a recent address at a university in Southern Italy, also looking at his “own homeland in South America, so many forests, all cut, have become land … can no longer give life.” “This is our sin, exploiting the Earth and not allowing her to her give us what she has within her. This is one of the greatest challenges of our time: to convert ourselves to a type of development that knows how to respect creation,” the pope told an audience of “students, struggling farmers and laid-off workers.” Challenge? Much worse. The relentless “destruction of nature is a modern sin.” says Pope Francis. Destruction of the planet’s great rain forests is the new sin of today’s humans.

Capitalism has already converted half the world’s original rain forests and natural habitats into urban developments. Another quarter will be rapidly converted by 2050. But for Pope Francis, the real sin is consumerism. In a recent ThinkProgress summary of Pope Francis’s annual letter to the G-20 leaders meeting in Australia, Katie Valentine put it this way: “Pope Francis to World Leaders: Consumerism Represents a ‘Constant Assault’ on the Environment.” The pope relied on several studies, including a Worldwatch report commented on in National Geographic by Gary Gardner: “Most of the environmental issues we see today can be linked to consumption,” warning us that for “humanity to thrive long into the future we’ll need to transform our cultures intentionally and proactively away from consumerism towards sustainability.”

Failure to do so means that “unbridled consumerism will have serious consequences for the world economy.” Pope Francis has called consumerism a “poison.” Earlier this year he warned that “Christians should safeguard Creation,” for if humanity destroys the planet, humans themselves will ultimately be destroyed. He added” ‘Creation is not a property, which we can rule over at will; or, even less, is the property of only a few” capitalists. “Creation is a gift, a wonderful gift that God has given us, so that we care for it and we use it for the benefit of all, with great respect and gratitude.” For exploiting the Earth by destroying forests, especially Amazonian rain forests, is a sin.”