Winslow Homer Cloud shadows 1890

The actual headline of this Guardian piece is “Stop Biodiversity Loss Or We Could Face Our Own Extinction”. Mine is better, because it illustrates, providing it’s accurate, how hopeless the situation is. If only because of what’s already in the pipeline. The prospect of 2 more years of meetings doesn’t change a thing.

• The World Has Two Years To Secure A Deal To Halt Species Extinction – UN (G.)

The world has two years to secure a deal for nature to halt a ‘silent killer’ as dangerous as climate change, says biodiversity chief

The world must thrash out a new deal for nature in the next two years or humanity could be the first species to document our own extinction, warns the United Nation’s biodiversity chief. Ahead of a key international conference to discuss the collapse of ecosystems, Cristiana Pasca Palmer said people in all countries need to put pressure on their governments to draw up ambitious global targets by 2020 to protect the insects, birds, plants and mammals that are vital for global food production, clean water and carbon sequestration.

“The loss of biodiversity is a silent killer,” she told the Guardian. “It’s different from climate change, where people feel the impact in everyday life. With biodiversity, it is not so clear but by the time you feel what is happening, it may be too late.” Pasca Palmer is executive director of the UN Convention on Biological Diversity – the world body responsible for maintaining the natural life support systems on which humanity depends. Its 196 member states will meet in Sharm el Sheikh, Egypt, this month to start discussions on a new framework for managing the world’s ecosystems and wildlife. This will kick off two years of frenetic negotiations, which Pasca Palmer hopes will culminate in an ambitious new global deal at the next conference in Beijing in 2020.

Conservationists are desperate for a biodiversity accord that will carry the same weight as the Paris climate agreement. But so far, this subject has received miserably little attention even though many scientists say it poses at least an equal threat to humanity. The last two major biodiversity agreements – in 2002 and 2010 – have failed to stem the worst loss of life on Earth since the demise of the dinosaurs. Eight years ago, under the Aichi Protocol, nations promised to at least halve the loss of natural habitats, ensure sustainable fishing in all waters, and expand nature reserves from 10% to 17% of the world’s land by 2020. But many nations have fallen behind, and those that have created more protected areas have done little to police them. “Paper reserves” can now be found from Brazil to China.

3 days to midterms.

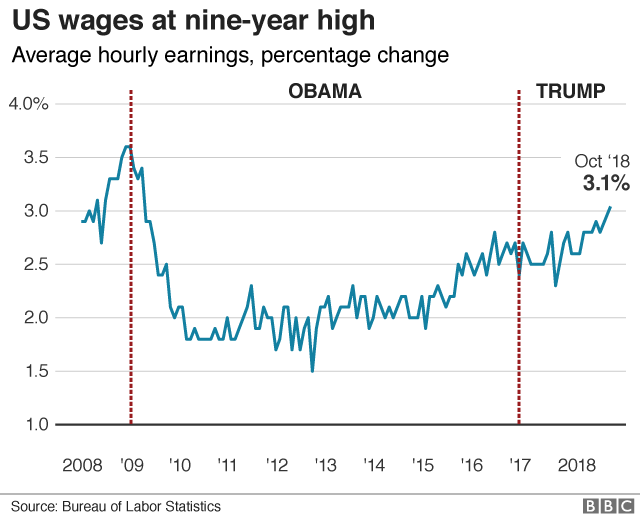

• US Wage Growth Hits Nine-Year High (BBC)

Wages in the US grew at their fastest pace for nine years last month, the latest official figures show. The US Labor Department said wages grew at an annual rate of 3.1% in October, accelerating from a rate of 2.8% the month before. The economy also added 250,000 jobs last month, beating expectations, while the jobless rate remained at 3.7%. The report quickly became fodder for political debate ahead of next week’s high stakes congressional election. President Donald Trump celebrated the figures on Twitter as “incredible” and urged his followers to “Vote Republican”. In an unusual move, the White House also organised a briefing call for reporters to promote the gains.

The top Senate Democrat, Chuck Schumer of New York, issued a statement of his own, aiming to redirect voter attention. The latest numbers “may look good” but should be considered alongside other economic policies, he said. “When the average family sees their health care costs go up because of Republican actions, these numbers will mean little,” he said. Among economists, there was wider agreement that the jobs report pointed to strength in the US economy, despite recent worries that weakness may be emerging in some sectors such as housing and trade.

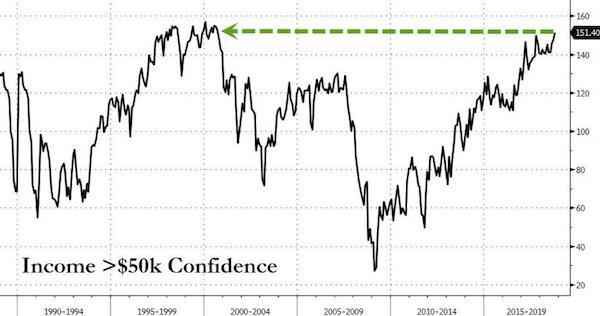

There’s something wonderfully ironic in this. Getting your confidence from hot air.

• America’s Wealth Bubble Is Boosting Consumer Confidence (Colombo)

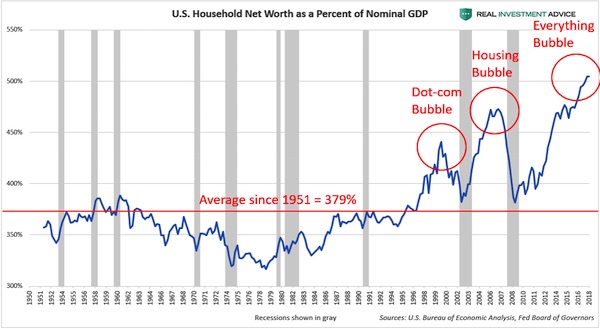

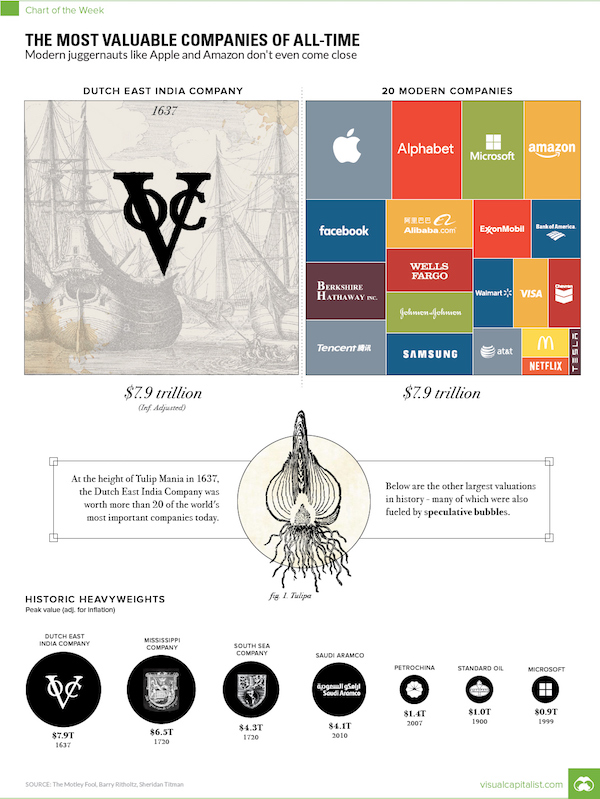

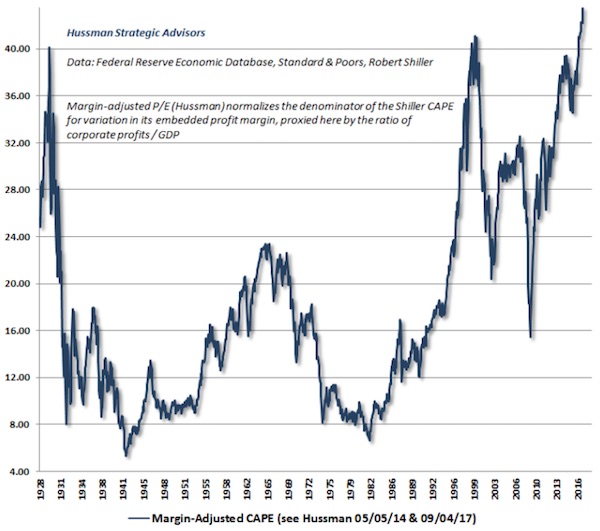

ZeroHedge posted an interesting chart a few days ago showing how affluent Americans (those making over $50,000 a year) have not been more confident since the dot com bubble. While strong consumer confidence may seem like a good thing when taken at face value, the contrarian in me sees it as a warning of the kind of over-exuberance seen during bubbles like the dot-com bubble and housing bubble.

Unfortunately, I believe that the U.S. is experiencing an unsustainable, artificial household wealth bubble that is causing affluent consumers to be over-optimistic despite the fact that our economic boom is largely driven by cheap credit and is going to end in a painful bust. As I explained in a recent presentation, U.S. household wealth has surged by approximately $46 trillion or 83% since 2009 to an all-time high of $100.8 trillion. Since 1951, household wealth has averaged 379% of the GDP, while the Dot-com bubble peaked at 429%, the housing bubble topped out at 473%, and the current bubble has inflated household wealth to a record 505% of GDP (see the chart below):

As I’ve said numerous times, Trump sells better than sex, and he’s keeping CNN alive. The suggestion that CNN allows both sides into teh debate is ludicrous, though.

• Inside The Trump Gold Rush At CNN (VF)

Zucker was on the phone talking about why Trump sucks up so much of CNN’s oxygen. “People say all the time, ‘Oh, I don’t want to talk about Trump. I’ve had too much Trump,’ ” he told me. “And yet at the end of the day, all they want to do is talk about Trump. We’ve seen that, anytime you break away from the Trump story and cover other events in this era, the audience goes away. So we know that, right now, Donald Trump dominates.” Zucker, the guy who first brought our president to the small screen when he green-lighted The Apprentice in 2004 while running NBC, had arguably schooled Trump in the art of reality television.

Halfway through Trump’s first term, his instincts remain just as acute. If Fox News represents Trump’s base and MSNBC has become a friendly platform for the resistance, CNN is the arena where both sides show up for cantankerous battle. “On Fox, you rarely hear from people who don’t support Trump,” Zucker told me. “On MSNBC, you rarely hear from people who do support Trump. We want to be home to both those points of view.” He continued, as if rebuking a common critique of the network. “It is true some of these folks are not very good with the facts, but that’s O.K. in the sense that it’s our job then to call them out.”

[..] Even though CNN still trails Fox News and MSNBC in prime-time audience size, its ratings have never been better. The average number of people watching on a given day has been above 700,000 each year since 2016, compared to around 400,000 in the pre-Trump news cycle. That’s also considerably larger than any other time over the past 25 years, an astonishing feat given the ubiquity of news and the decline of cable.

https://twitter.com/i/status/1058528086680051712

Russiagate undermines democracy.

• Who’s Really ‘Undermining’ US Democracy? (Stephen Cohen)

Even though still unproven, charges that the Kremlin put Trump in the White House have cast a large shadow of illegitimacy over his presidency and thus over the institution of the presidency itself. This is unlikely to end entirely with Trump. If the Kremlin had the power to affect the outcome of one presidential election, why not another one, whether won by a Republican or a Democrat? The 2016 presidential election was the first time such an allegation became widespread in American political history, but it may not be the last. Now the same shadow looms over the November 6 elections and thus over the next Congress. If so, in barely two years, the legitimacy of two fundamental institutions of American representative democracy will have been challenged, also for the first time in history.

And if US elections are really so vulnerable to Russian “meddling,” what does this say about faith in American elections more generally? How many losing candidates on November 6 will resist blaming the Kremlin? Two years after the last presidential election, Hillary Clinton and her adamant supporters still have not been able to do so. We know from critical reporting and from recent opinion surveys that the origins and continuing fixation on the Russiagate scandal since 2016 have been primarily a product of US political-intelligence-media elites. It did not spring from the American people – from voters themselves. Thus a Gallup poll recently showed that 58 percent of those surveyed wanted improved relations with Russia. And other surveys have shown that Russiagate is scarcely an issue at all for likely voters on November 6. Nonetheless, it remains a front-page issue for US elites.

Indeed, Russiagate has revealed the low esteem that many US political-media elites have for American voters – for their ability to make discerning, rational electoral decisions, which is the bedrock assumption of representative democracy. It is worth noting that this disdain for rank-and-file citizens echoes a longstanding attitude of the Russian political intelligentsia, as recently expressed in the argument by a prominent Moscow policy intellectual that Russian authoritarianism springs not from the nation’s elites but from the “genetic code” of its people.

Certainly looks like the Democrats need to hit some kind of bottom before they can rise again. If that ever happens.

• Perpetual Hysteria ( Kunstler)

Back in the last century, when this was a different country, the Democrats were the “smart” party and the Republicans were the “stupid” party. How did that work? Well, back then the Democrats represented a broad middle class, with a base of factory workers, many of them unionized, and the party had to be smart, especially in the courts, to overcome the natural advantages of the owner class. In contrast, the Republicans looked like a claque of country club drunks who staggered home at night to sleep on their moneybags. Bad optics, as we say nowadays. [..] The Republican Party has, at least, sobered up some after getting blindsided by Trump and Trumpism. Like a drunk out of rehab, it’s attempting to get a life.

Two years in, the party marvels at Mr. Trump’s audacity, despite his obvious lack of savoir faire. And despite a longstanding lack of political will to face the country’s problems, the Republicans are being forced to engage on some real issues, such as the need for a coherent and effective immigration policy and the need to redefine formal trade relations. Meanwhile, the Democratic Party has become the party of bad ideas and bad faith, starting with the position that “diversity and inclusion” means shutting down free speech, an unforgivable transgression against common sense and common decency. It’s a party that lies even more systematically than Mr. Trump, and does so knowingly (as when Google execs say they “Do no Evil”).

[..] I hope that Democrats lose as many congressional and senate seats as possible. I hope that the party is shoved into an existential crisis and is forced to confront its astounding dishonesty. I hope that the process prompts them to purge their leadership across the board. If there is anything to salvage in this organization, I hope it discovers aims and principles that are unrecognizable from its current agenda of perpetual hysteria.

Overreach. America’s anti-Iran stance hinges to a large extent on Saudi interests. Which have taken a huge hit.

• Trump Will Grant 8 Waivers To Buy Iranian Oil (CNBC)

The Trump administration will grant eight jurisdictions special exceptions to continue importing oil from Iran after U.S. sanctions on the country snap back into place on Monday, according to cabinet members. President Donald Trump gave oil buyers 180 days to wind down purchases of Iranian crude when he pulled out of the Iran nuclear deal in May. The eight waivers will allow the jurisdictions to more gradually reduce their purchases after the Nov. 4 deadline. Oil market watchers have been closely monitoring the situation to determine how forcefully the Trump administration will enforce the sanctions.

State Department officials initially said importers must cut their purchases to zero by November, but administration officials subsequently telegraphed that some exceptions would be made. Secretary of State Mike Pompeo and Treasury Secretary Steven Mnuchin on Friday declined to name the eight jurisdictions during a conference call with reporters. The officials said all of the countries or territories have significantly reduced their purchases and will be given more time to further reduce their imports. [..] Japan, India and South Korea are among the countries, and China is still negotiating a waiver, Bloomberg News reported earlier on Friday, citing a senior administration official. Pompeo confirmed on Friday that the EU is not one of the jurisdictions that will receive a waiver.

Russia and China will stand by Iran. Europe may as well.

• Europe Vows To Defy US Sanctions Against Iran (RT)

European countries have vowed to maintain “effective financial channels” and to keep trading with Tehran after the US announced that the EU is not among those spared from its sweeping sanctions against Iran. European countries suddenly discovered that they were not on the list of the ‘lucky ones’ that their ally, the US, decided to exempt from the new wave of all-encompassing sanctions it plans to unleash on Iran. The sanctions, targeting Iran’s shipping, finance and energy sectors, which come into force on November 5, are also designed to punish those countries that dared to do business with the Islamic Republic in defiance of the US pressure.

Only eight nations were graciously granted exemptions by the US, according to Secretary of State Mike Pompeo. However, Pompeo made it clear that the EU as a single entity is not on the list, sparking an angry reaction from the US’ western allies. Washington also specifically mentioned that it plans to target the special mechanism the EU has been creating to circumvent the restrictions, prompting its allies to fight back.

In response, the EU foreign policy chief Federica Mogherini, together with the foreign and finance ministers of Germany, France and the UK, vowed to maintain “effective financial channels with Iran” and in particular to continue buying the Islamic Republic’s oil and gas. They also said that despite Washington’s pressure the EU is still committed to establishing a “Special Purpose Vehicle” for Iran-EU trade. The European nations will seek to protect its companies engaged in “legitimate business with Iran,” the statement said, adding that the EU will cooperate with Russia and China in particular to achieve these goals.

Central banks are incapable of doing stress tests that matter.

• Europe’s Top Banks Ease Past ECB’s Latest Stress Tests (CNBC)

Results of the stress test of Europe’s bigger banks released Friday revealed that all of the financial institutions in the EU wide examination passed the European Central Bank’s “adverse scenario”. The stress tests were carried out by the European Banking Authority (EBA) and the Single Supervisory Mechanism (SSM) to gauge the health of the European banking system. The EBA said in findings published on their website that all 48 banks beat the common tier ratio of 5.5 percent under adverse stress. British bank Barclays ranked lowest in the test, scoring a common tier ratio of just 6.37 percent in the adverse scenario. Fellow U.K. bank Lloyds also performed poorly with a score of 6.8 percent.

Commenting after the results, the Bank Of England said the results showed that U.K. banks could absorb the effect of the EBA’s worst scenario. Europe’s biggest bank, Deutsche Bank, performed better than some forecasters had predicted, registering a core tier of 8.14 percent, again in an adverse scenario. EBA said under their adverse scenario, the capital depletion across the banks at the end of 2020 was 236 billion euros ($268 billion) and 226 billion euros on a “transitional and fully loaded basis respectively.” The ECB added that the EBA test showed that banks in Europe were now “more resilient to financial shocks.”

Italian banks were also under scrutiny but managed to record satisfactory scores according to banking regulators. Unicredit, Italy’s largest lender, scored a common tier ratio of 9.34 while UBI Banca scored 7.42 percent. The lowest score among Italian banks was for Banco BPM which registered 6.67 percent.

Erdogan was insulted by the Saudi chief prosecutor visiting Ankara/Istanbul.

• Erdogan Says ‘Highest Level’ Saudi Officials Ordered Khashoggi Murder (RT)

The killing of journalist Jamal Khashoggi was sanctioned at the “highest levels” of the Saudi government, Turkey’s President Recep Tayyip Erdogan said, trying to play kingmaker in Riyadh and bolster his credentials in the West. “We know that the order to kill Khashoggi came from the highest levels of the Saudi government,” the Turkish leader wrote in a surprise contribution to Friday’s Washington Post, vowing to “reveal the identities of the puppet masters” behind the murder. “No one should dare to commit such acts on the soil of a NATO ally again,” Erdogan wrote dramatically. “Had this atrocity taken place in the United States or elsewhere, authorities in those countries would have gotten to the bottom of what happened.”

“It would be out of the question for us to act any other way,” he added, noting that Ankara has already “moved heaven and earth to shed light on all aspects of this case.” The Turkish leader also used the opportunity to burnish his credentials in the West, saying that as a responsible NATO member, Turkey will not just leave this case uninvestigated and will act in exactly the same way as the US or any of its allies would in its place. Erdogan openly accused Riyadh of “trying to cover up the murder” by stalling the investigation and refusing to cooperate with the Turkish authorities, singling out the Saudi chief prosecutor Saud Al Mojeb, who visited Turkey earlier this week. “The refusal of the Saudi public prosecutor… to cooperate with the investigation and answer even simple questions is very frustrating,” he wrote, adding that Al Mojeb’s “invitation for Turkish investigators to Saudi Arabia … felt like a desperate and deliberate stalling tactic.”

Franco’s still alive and kicking.

• Public Prosecutors Charge Catalan Independence Leaders With Rebellion

The public prosecution on Friday morning filed its written accusation against Catalan secessionist leaders who are in pretrial detention for their role in the unauthorized referendum of October 1, 2017 and the unilateral independence declaration that followed. As expected, prosecutors are seeking a 25-year prison term for ex-deputy premier Oriol Junqueras for rebellion and misuse of public funds, and they also want the Catalan Republican Party (ERC) leader barred from holding public office for the next 25 years. Prosecutors are also seeking 17-year jail terms for Jordi Sànchez and Jordi Cuixart, the former heads of civic associations that campaigned actively for independence, and for Carme Forcadell, the former speaker of the Catalan parliament.

Other defendants in the upcoming trial face penalties ranging from economic fines to prison terms of 16 years. Meanwhile, Spain’s Solicitor General, who represents the Spanish state in the courts, has not accused Catalan secessionist leaders of rebellion. Instead, the written accusation focuses on the crimes of sedition and misuse of public funds in connection with the referendum and unilateral independence declaration. In its written accusation, the Solicitor General’s Office has called for Junqueras to be sentenced to 12 years in prison and a 12-year ban on holding public office.

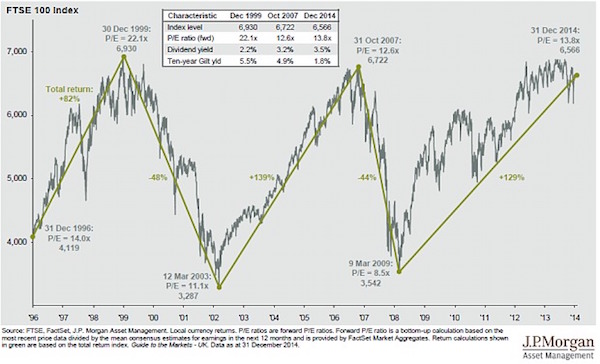

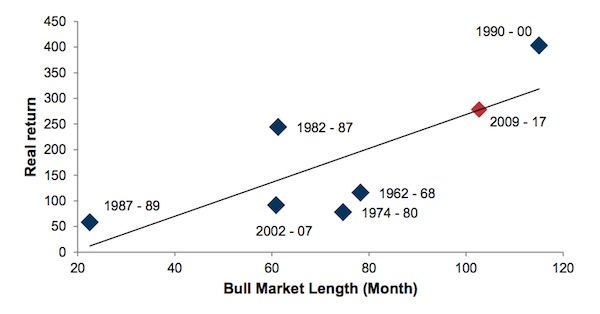

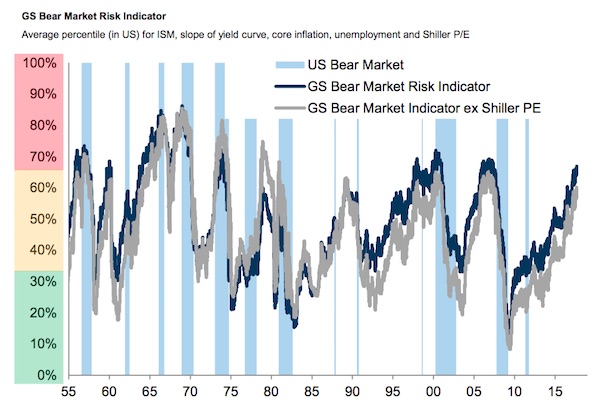

Historically, when the indicator is at 67%, there is an 88% chance of stocks falling into a bear market in two years’ time, the Goldman analysts say:

Historically, when the indicator is at 67%, there is an 88% chance of stocks falling into a bear market in two years’ time, the Goldman analysts say: