Vincenzo Camuccini La Morte Di Cesare 1804

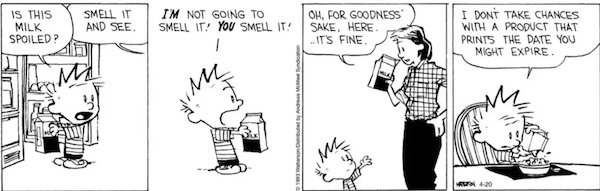

1997

Freak show

Here is the moment the Canadian Parliament gave not one, but TWO standing ovations to a Nazi soldier.

Never forget. pic.twitter.com/r4A6myWOWn

— Viva Frei (@thevivafrei) September 24, 2023

For the Russians, this is the same as supporting the Azov batallion.

“..it is impossible to do business with the current Trudeau cabinet, which is the personification of neoliberal fascism..”

“I believe that this is not a mistake. This is simply a consequence of the impunity of former Nazi criminals, the impunity of the activities of the Canadian Ukrainian Congress..”

• Russia Will Ask Canada to Explain Decision to Honor Nazi Veteran (Sp.)

Russian Ambassador to Canada Oleg Stepanov told Sputnik that on Monday he would request explanations from the Canadian Foreign Ministry and the Prime Minister’s office in connection with the invitation and honoring in the country’s parliament of Ukrainian Nazi veteran Yaroslav Hunka. On Friday, Hunka, a 98 years-old Ukrainian Nazi veteran who fought in the ranks of the 14th Waffen Grenadier Division of the Nazi SS during the Second World War, was given a standing ovation by the entire Canadian legislature. Hunka’s recognition happened as the Speaker of the House of Commons, Anthony Rota, was giving introductory remarks prior to Ukrainian President Volodymyr Zelensky’s address to the Canadian parliament.

“The embassy will take appropriate official steps. We will, of course, demand clarification from the Canadian government,” Stepanov said, adding that the notes would be sent on Monday to the Foreign Ministry and the office of the Prime Minister. At the same time, Stepanov noted that he has no illusions about the response of the Canadian government as it has become “a nest for Nazi criminals.” “We, of course, will make the necessary demarches, but I have no illusions because it is impossible to do business with the current Trudeau cabinet, which is the personification of neoliberal fascism,” Stepanov added. But Stepanov does not believe the invitation was the merely the result of negligence, but rather stems from Canada’s policy towards former Nazi party members.

“I believe that this is not a mistake. This is simply a consequence of the impunity of former Nazi criminals, the impunity of the activities of the Canadian Ukrainian Congress, which consists of children and grandchildren, who are mainly descendants of these Nazi henchmen, punishers, SS men,” Stepanov said. He also recalled the process of the extradition of Helmut Oberlander, which was dragged out until the death of this Nazi collaborator “in the comfort and care of Western medicine,” about the monuments to the punishers of the 14th SS-Volunteer Division “Galicia” and the Nachtigall Battalion in Canadian cemeteries, etc.

“The fact that in our time this is possible in a country that was a member of the anti-Hitler coalition, which is considered civilized, tolerant, and a supporter of respect for all human rights, the fact that neo-Nazism lives and flourishes here is simply unacceptable, but apparently Canada, under the auspices of the United States, is getting away with everything,” Stepanov added. On Sunday, Rota apologized for his decision to invite Hunka. Trudeau’s office said, in turn, that neither the Canadian prime minister nor Zelensky’s delegation were notified in advance of the invitation of Hunka.

“They’re trying to put Trump in prison for the crime of running against Joe Biden … That’s what this election’s about.”

• “They’re All Afraid” (WeltWoche.ch)

Tucker Carlson is unstoppable. Since his sudden departure from Fox News he scores record viewer ratings. In an exclusive interview with Weltwoche, the political media star demolishes the mainstream media’s manipulation machine, reveals his concerns about a potential Donald Trump Restoration, he speaks about the disturbing state of the Biden family and discusses what’s next for him in a Post-Fox News Order. When Tucker Carlson departed the Fox News Channel in April, his enemies cheered. But if they thought the happy warrior had finally been defeated, their judgment was as dismal as their approval ratings. With an assist from Elon Musk, Carlson is reaching an even larger, global audience with his new show, “Tucker Carlson on Twitter (now known as ‘X’).”

The veteran newscaster has expanded his mission: to defeat the mainstream media’s suffocating bias and incuriosity not just about critical events at home but in capitals around the world. When we reach him, Carlson has just returned from the United Arab Emirates where he met with its president, Mohamed bin Zayed. Carlson pronounces the sheikh “the most interesting, wisest leader I’ve ever spoken to” — a provocative assessment given that the talk show host sat across from Donald J. Trump last month. Of the Arab leader, Carlson enthuses, “I’ve never met a more humble leader, ever — and I believe humility is a prerequisite for wisdom.” Carlson is far less kind about his colleagues in the press. “They’re all fearful people,” the 54-year-old scoffs. Instead of holding the powerful to account, “they do exactly the opposite.” Indeed, “they do their bidding.”

Looking ahead to the Presidential elections in 2024, he says: “They’re trying to put Trump in prison for the crime of running against Joe Biden … That’s what this election’s about. Are we going to allow that, or aren’t we? And I just don’t think we can.”

Weltwoche: Since leaving Fox and going solo with your new show, “Tucker Carlson On Twitter (now known as ‘X’),” your posts have logged tens and sometimes hundreds of millions of views. You’re taking off like Buzz Lightyear. Are you feeling the freedom? To explore more topics and ideas? To express your views?” Tucker Carlson: “Well, definitely. If anything, I’ve expressed my views less. I haven’t done many straight-to-camera scripts where I write the script and give my opinion. I’ve done what I’ve wanted to do for a long time but couldn’t, which is get on an airplane and go see the rest of the world. I couldn’t because I had a daily show I had to do.

I’ve become convinced over the past several years — particularly since the war in Ukraine began — that the world is changing much more quickly than most Americans understand. And because there’s virtually no coverage of the rest of the world in American media, Americans don’t have a good sense of it. What we, in this country, refer to as the “Post-War Order” — the institutions set up in the wake of World War II to keep the world peaceful and prosperous and the United States at the top of the pyramid, and that would include the dominance of the dollar, the SWIFT system, NATO — all of that appears to me to be crumbling. That’s my view of it. I’ve wanted to travel and see if that is, in fact, happening — and it is.

“I’m a much more loyal American than, say, Joe Biden or Kamala Harris, who didn’t even grow up in this country; she grew up in Canada. And they’re telling me what it is to be a loyal American?”

• US Government Stopped Me From Interviewing Putin – Tucker Carlson (RT)

Former Fox News host Tucker Carlson has alleged in a recent interview that unnamed figures in Washington obstructed his attempts to interview Russian president Vladimir Putin. “I tried to interview Vladimir Putin, and the US government stopped me,” Carlson claimed in an interview with Swiss publication Die Weltwoche published on Thursday. He also explained that he felt let down by the lack of support for his situation that he says he received from US news media. He said: “I don’t think there was anybody who said ‘wait a second. I may not like this guy but he has a right to interview anyone he wants, and we have a right to hear what Putin says’.” The 54-year-old added: “You’re not allowed to hear Putin’s voice. Because why? There was no vote on it. No one asked me.”

The often-controversial media personality didn’t elaborate on the circumstances under which he says there was government intrusion into his plans to interview Putin but it appeared to suggest that it was the current Biden administration which was behind the meddling. Carlson also didn’t mention when the interview with the Russian leader was supposed to take place. “I’m an American citizen,” Carlson told Die Weltwoche. “I’m a much more loyal American than, say, Joe Biden or Kamala Harris, who didn’t even grow up in this country; she grew up in Canada. And they’re telling me what it is to be a loyal American?” Carlson –previously Fox News’ biggest star– parted ways with the broadcaster in April shortly after the news network settled for $787.5 million a lawsuit with voting-machine company Dominion Voting Systems. Fox News had regularly discussed claims on some of its shows that Dominion’s machines were involved in ‘rigging’ the 2020 US presidential election.

Carlson’s show Tucker Carlson Tonight, during which he frequently discussed issues like gender, race, sexuality and ‘woke’ ideology, was specifically referenced in the Dominion lawsuit. Since leaving Fox News, Carlson has broadcast abridged versions of his news show on X (formerly Twitter) which regularly draw tens of millions of views. Meanwhile, Russia TV news channel Rossiya 24 has aired a teaser trailer for a weekend show it says is to be hosted by Carlson. The promo was first broadcast earlier this month and again on September 22 along with the words “at the weekend.” It adds that the “high-profile American presenter is moving to another level. Here.” Rossiya 24 didn’t state when the show will debut or if it will be original content or translated versions of Carlson’s X broadcasts.

Shut up, Guardian.

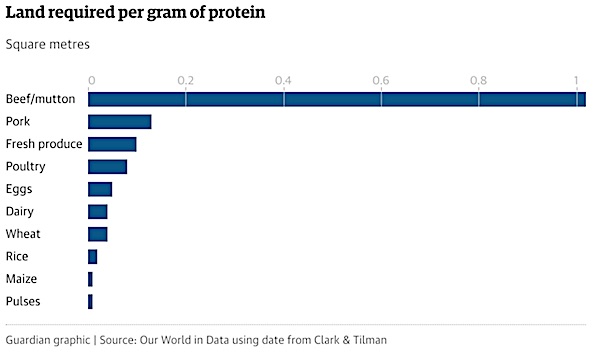

• Dossier To Accuse Russia Of Deliberately Causing Starvation In Ukraine (G.)

Human rights lawyers working with Ukraine’s public prosecutor are preparing a war crimes dossier to submit to the international criminal court (ICC) accusing Russia of deliberately causing starvation during the 18-month-long conflict. The aim is to document instances where the Russian invaders used hunger as a weapon of war, providing evidence for the ICC to launch the first prosecution of its kind that could indict the Russian president, Vladimir Putin. Yousuf Khan, a senior lawyer with law firm Global Rights Compliance, said “the weaponisation of food has taken place in three phases,” starting with the initial invasion where Ukrainian cities were besieged and food supplies cut.

Among the incidents documented was when 20 civilians were killed in Chernihiv in the early morning of 16 March 2022, when Russian fragmentation bombs exploded outside a supermarket in the city where Ukrainians were queueing for bread and food. Investigators are also focusing on the siege of Mariupol, Khan added. Food supplies were cut to the city and humanitarian relief corridors blocked or bombed, making it very difficult or impossible for desperate, starving civilians to escape. The second phase includes the destruction of food and water supplies as well as energy sources across Ukraine during the fighting, which the lawyer described as “objects indispensable to the survival of the civilian population”.

Such attacks, Khan argued, were “not crimes of result but crimes of intent” because “if you are taking out objects that civilians need, like energy infrastructure in the dead of winter, there is a foreseeability to your actions”. Cities such as Mykolaiv in the south were left without drinking water from early in the conflict after Russian forces captured the pumping station that supplied it. The remaining residents were forced to rely on water being driven in daily to ensure they could drink and wash safely. The third element is Russian attempts to prevent or restrict exports of Ukrainian food. “Then we’ve seen Russia attack grain facilities on the Danube and engage in muscle flexing on the Black Sea,” Khan said, citing reports from Ukrainian officials that 270,000 tonnes of the foodstuff were destroyed in late July and early August.

Fresh accusations that Russia sought to starve Ukrainians are particularly emotive in the light of the two countries’ history: in 1932-33, millions died of hunger in the Holodomor, an enforced famine engineered by Joseph Stalin’s Soviet government. But they have been given a renewed emphasis after the passage of a UN security council resolution in 2018 which condemned the use of starvation as a weapon of war, and revisions to the ICC’s governing Rome statute in 2019, to expand the type of cases that can be brought.

“Who will they send to the frontline? In reality, they can assemble a new army by spring, train it at the training grounds, teach it to shoot, teach it to use equipment..”

• Zelensky’s Vow to Continue Offensive Through Winter is Wishful Thinking (Sp.)

The Kiev regime is reportedly going to continue its “counteroffensive” in autumn and through winter, as per President Volodymyr Zelensky. But does Ukraine have enough resources for that? Ukraine’s president has argued that the country made a mistake by taking a pause last year after gaining some of the territory previously liberated by Russia. Speaking to the US press, after a day of meetings on Capitol Hill and the White House, Zelensky pledged to keep fighting through the autumn and winter this year. He also vowed to take Artemovsk (also known as Bakhmut) and a couple “more cities”. He said that US assistance should keep flowing to Ukraine, despite growing calls in the US Congress to reduce or halt the financial assistance altogether.

Zelensky’s vows appear to be nothing but wishful thinking: it’s unclear where he would get more troops and munitions for the protracted fighting according to Aleksey Borzenko, a military journalist and deputy chief editor of the “Literary Russia” newspaper. “Who will attack? Over the past two or three months, the Russian Army has crushed a large number of [Ukrainian] personnel, armored vehicles and howitzers. So who will attack? This question is very important. Who will they send to the frontline? In reality, they can assemble a new army by spring, train it at the training grounds, teach it to shoot, teach it to use equipment,” Borzenko told Sputnik. It’s unlikely that they would come with some sort of a sophisticated offensive strategy, according to the expert.

They have already used both Western and old Soviet tactics to attack Russia’s positions; they tried to push through Russia’s defenses in large groups and in small groups. However, they got bogged down, sustained heavy losses, and eventually failed to move through Russia’s multi-layered defenses, Borzenko noted. Likewise, they are unlikely to use NATO-grade heavy tanks during autumn and winter, since these heavy armored vehicles are not meant for dire weather conditions, the expert continued. He suggested that the Ukrainian military will use what it has left of its Soviet-era T-72 stash. “What other weapon [could be used]? They are waiting for aviation, but the F-16 will not change much,” he said. “[Russian forces] will hunt for them and shoot them down.

But they also need F-16s not so that they can organize air battles on the line of contact with [Russian] fighters, but in order to launch tactical missiles. These are all the latest missiles that they received in a few months, and they are waiting for ATACMS. Still, Zelensky specified during his recent interviews with US media that those long-range missiles would be used to “strike targets deeper” in Russia’s territory. This fits into Kiev’s terrorist tactics of launching strikes against civilian areas, nuclear power plants and infrastructure facilities in Russia. Yet this does not have anything to do with the balance of power on the battlefield. When it comes to the battleground, artillery duels and counter-battery combat, Ukrainians don’t have enough munitions, per the analyst. They are expecting to get more 155 mm shells from NATO but it will take time. Their 152 mm ammo stockpiles have been depleted too, he noted. “How many 152 mm shells do they have left? They receive them from the countries of the former Warsaw Pact. These are still old stock from the 1980s,” Borzenko said.

To show how popular he is? There’s nobody left to run against.

• Western Officials Pressuring Zelensky To Hold Elections – WaPo (RT)

Ukrainian officials are resisting calls from Kiev’s Western backers to hold parliamentary and presidential elections, even as martial law prohibits such processes, the Washington Post reported on Sunday. Several Western politicians, including Tiny Kox, head of the Council of Europe’s Parliamentary Assembly, and Democratic US Senators Richard Blumenthal and Elizabeth Warren, have urged Kiev to hold elections, the report says. Their efforts were also supported by Republican Senator Lindsey Graham, who described a ballot in Ukraine not only as “an act of defiance against the Russian invasion, but an embrace of democracy and freedom.” However, according to officials in Ukraine and experts interviewed by the Post, holding elections in a country embroiled in a major conflict “is virtually impossible and also ill-advised.”

The conundrum stems from the Russian military presence in regions that Ukraine claims as its own, as well as from the fact that millions have fled the country and tens of thousands of soldiers are deployed. Officials in Kiev reportedly believe that a major vote would require local authorities to overcome enormous financial, logistical, and legal hurdles. Some are said to be wary that Russia could exploit the elections by fomenting division, infiltrating its assets and weakening Ukraine from within. “The Russians are pushing for this through their secret channels,” an anonymous Ukrainian security official told the outlet. “There is no situation in which it is possible to have a democratic election during the war.” However, according to the Washington Post article, Kiev cannot dismiss out of hand the calls for elections without risking alienating its Western backers, who have emerged as crucial sources of financial and military support.

However, the Biden administration is said to be sympathetic to the obstacles facing Kiev and is not pushing for elections. Martial law, first imposed shortly after the start of Russia’s military campaign in February 2022 and repeatedly extended since then, prohibits the holding of presidential and parliamentary elections in Ukraine. In June, President Vladimir Zelenksy said that the vote could take place only after the end of hostilities. In August, however, he conceded that an election could take place but on condition that the parliament quickly change national legislation and the West provide an additional $135 million in funding. The latter statement was denounced by US Republican presidential hopeful Vivek Ramaswamy as a “ballot-box shakedown.”

Good idea.

• Brussels Should Buy Ukrainian Grain For Africa – Lavrov (RT)

The European Commission should buy the Ukrainian agricultural produce that the bloc says it doesn’t need and ship it to African countries, Russia’s foreign minister Sergey Lavrov has said at the UN General Assembly (UNGA). Western allies have repeatedly accused Moscow of trapping millions of tons of grain in Ukrainian Black Sea ports and of exacerbating a global food crisis, particularly across the African continent. “Since the European Commission is wasting tens of billions of dollars on Ukraine… it can buy the grain that Ukraine wants to sell and EU countries don’t want [to buy] for reasons of competitiveness, and send it to Africa,” Lavrov told the UNGA.

According to Russia’s top diplomat, Ukrainian agricultural produce is “being supplied to European countries in abundance” but many of them don’t want to buy it, because “they have their own farmers and don’t want them to go bust due to competition.” He also questioned the integrity of last year’s grain deal, pointing out during his speech at the UN that only 3% of the grain that was moved under this deal had reached the poorest countries in Africa. In addition, Lavrov said that some 260,000 metric tons of Russian fertilizers have been impounded in EU ports since 2022 and that Moscow was ready to ship these fertilizers to African nations for free. Russian fertilisers became the crucial point in talks over resuming the Black Sea Grain Deal that was clinched last year between Russia and Ukraine and brokered by the UN and Türkiye.

The deal was aimed at allowing Ukraine to export grain from its ports to countries in Asia, the Middle East and Africa, in exchange for lifting Western sanctions that prevented Russian agricultural exports. However, Moscow withdrew from the agreement in July, saying that the West was still making it impossible for Russia to ship food and fertilizer. Lavrov said that the Deputy Foreign Minister of Russia, Sergey Vershinin, is currently discussing the key issues related to the deal with UN representatives. He stressed also that Western states would be misleading UN Secretary-General Antonio Guterres by saying that the grain deal was about to resume. According to the minister, the deal can resume once Russia’s demands regarding its agricultural exports are fulfilled.

“It’s a sick reality, but that’s the depraved sort of ‘journalism’ Western audiences can expect to receive – until they demand better.”

• Russell Brand, Another Truth Warrior ‘Guilty Until Proven Innocent’ (Bridge)

Imagine what a wonderful world it would be if journalists dug into stories like ‘Russian election collusion’ and ‘Hunter Biden’s laptop’ with the same amount of gusto as they do with stories involving the sordid sex lives of celebrities. And not just any celebrities, but specifically those who have touched the third rail, so to speak, exposing the establishment for their egregious crimes against humanity. Russell Brand is/was that sort of spirited and fearless individual. While initially part of the Hollywood circuit, appearing in films and performing stand-up comedy, the loquacious Brit eventually found himself ostracized from tinsel town after pointing out during the 2013 GQ Awards that the sponsor of the event, Hugo Boss, manufactured uniforms for the Nazi Party during World War II.

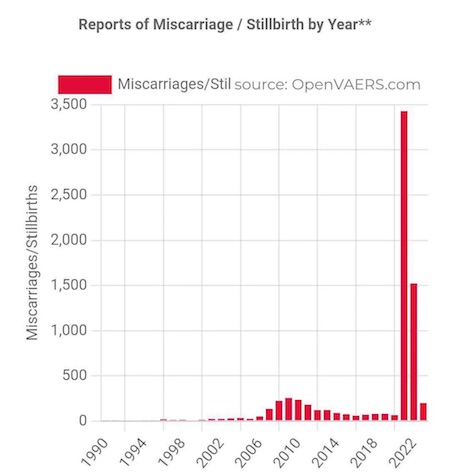

Having successfully torched his Hollywood career, Brand began to focus attention on his YouTube channel, where his fierce wit, intelligence and machine-gun-style delivery saw his number of subscribers climb to almost 7 million in 10 years. These are the sort of figures that land social media personalities on the ‘truth radar,’ a system backed by an army of left-wing fanatics and civil rights nut jobs devoted to enforcing ‘community standards’ with pure fascist fervor. Brand fell so far afoul of the mainstream media narrative that he was playing in an entirely differently stadium. It’s hard to say exactly when the powers-that-be decided to take down the YouTube sensation, but his March 2023 appearance on the Bill Maher show would be a safe bet. Appearing alongside John Heilemann, a national affairs analyst with MSNBC, and Democratic Senator Bernie Sanders, Brand went on a tangent about the Covid-19 pandemic and the pharmaceutical industry.

“The pandemic created at least 40 new Big Pharma billionaires; pharmaceutical corporations like Moderna and Pfizer made $1,000 in profit every second from the Covid-19 vaccines; more than two-thirds of Congress received campaign funding from pharmaceutical companies in the 2020 election; Pfizer Chairman Albert Bourla told Time magazine in July 202 that his company was developing a Covid vaccine for the good of humanity, not for money, and of course Pfizer made a $100 billion dollars in profit in 2022.” Maher, desperately trying to get a word in edgewise on his own show, reminded Brand that “a lot of people would be dead without the vaccine.” To which Brand snapped back: “If you have an economic system in which pharmaceutical companies benefit hugely from medical emergencies, where the military industrial complex benefits from war, where energy companies benefit from energy crisis, you are going to generate states of permanent crisis where the interests of ordinary people separate from the interests of the elite.”

Ever since the emergence of the #MeToo movement, the legacy media and social media have developed a mob justice mentality, refusing to allow for the possibility that the accused (male) may actually be innocent. In fact, that’s the agenda from the start. And it goes without saying that the media are in the extremely powerful position to mold public opinion to their will. This was evident in a Channel 4 video of the anonymous victims, some of them portrayed by actual actors, discussing their experiences. The production is complete with ominous background music and close-up silhouettes of the emotional women. This is cinematic manipulation that would certainly help to sway the public, not to mention some future jury, and not in a way favorable to Russell Brand’s defense team. Why is the media, which is supposed to take an unbiased approach to its reporting, resorting to manipulating the emotions of their audience? The answer is obvious.

Much like was the case with Julian Assange, who faced similar age-old charges after releasing information damning to the U.S. establishment, Brand is a very articulate individual who is not afraid of speaking truth to power. Much like Alex Jones, Tucker Carlson, and hundreds of other dissident voices, his anti-establishment opinions could not be tolerated, and once again the mainstream media was activated to do the dirty work of character assassination. It’s a sick reality, but that’s the depraved sort of ‘journalism’ Western audiences can expect to receive – until they demand better.

Fear of freedom.

• Is Censorship a Partisan Issue? (RCP)

[..] the most glaring gap is between conservatives and liberals, i.e., between Republicans and Democrats. On the issue of free expression, at least, Republicans are not the authoritarian party. That distinction belongs to the Democrats, the party launched by Thomas Jefferson — the Founding Father who famously said that if he were forced to choose between “a government without newspapers or newspapers without a government, I should not hesitate a moment to prefer the latter.” This is a relatively new development.

Traditionally, opposing censorship — whether imposed by government or corporations — was a bedrock principle of liberalism in this country. The American Civil Liberties Union was founded in 1920 to promote and defend free expression. And this ideal was at the heart of liberal thought, liberal lawmaking, and liberal jurisprudence during most of the 20th century. But times change. And notwithstanding the controversial current push by social conservatives to denude public school libraries of content they dislike, the new RealClear Opinion Research poll is the latest to document the gradual change that has taken place on the left when it comes to this free expression. Here are some of its findings:

• Republican voters (74%) and independents (61%) believe speech should be legal “under any circumstances, while Democrats are almost evenly divided. A bare majority of Democrats (53%) say speech should be legal under any circumstances, while 47% say it should be legal “only under certain circumstances.”

• Nearly one-third of Democratic voters (34%) say Americans have “too much freedom.” This compared to 14.6% of Republicans. Republicans were most likely to say Americans have too little freedom (46%), while only 22% of Democrats feel that way. Independents were in the middle in both categories.

• Although majorities of Democrats, Republicans, and independents agree the news media should be able to report stories they believe are in the national interest, this consensus shifts when it comes to social media censorship. A majority of Democrats (52%) approve of the government censoring social media content under the rubric of protecting national security. Among Republicans and independents, this percentage is only one-third.

• Poll respondents were read this statement: “I disapprove of what you say, but I will defend to the death your right to say it.” Only 31% of Democratic voters “strongly agreed” with that sentiment, compared to 51% of Republicans.

• Fully three-fourths of Democrats believe government has a responsibility to limit “hateful” social media posts, while Republicans are more split, with 50% believing the government has a responsibility to restrict hateful posts. (Independents, once again, are in the middle.)

• Democrats are significantly more likely than Republicans to favor stifling the free speech rights of political extremists. Also, Republicans don’t vary by the group: Only about half of GOP voters favor censorship — whether asked about the Ku Klux Klan, Nazis, or the Communist Party.

WaPo doesn’t like its own poll.

• Trump Leading Biden By Double Digits – Poll (RT)

If an election were held today, former US President Donald Trump would defeat President Joe Biden by a 10% margin of the popular vote, a Washington Post/ABC News poll has found. The result shows the strongest lead for Trump since both men declared their candidacy for the 2024 election. Published on Saturday, the poll found that 52% of respondents would choose Trump and 42% would side with Biden, while the remainder are either undecided or would not vote. When the Post/ABC pollsters asked the same question in February, Trump led Biden by four points, at 48% to 44%. The result is at odds with a slew of recent polls, all of which placed Trump and Biden in or near a statistical dead heat.

An NBC News poll, also published on Saturday, showed Trump and Biden tied at 46%, while a Fox News survey last week placed Trump ahead of Biden at 48%-46%, and a Quinnipiac University poll put Biden in the lead by 47%-46%. Before facing off against Biden for a second time, Trump will have to defeat an ever-expanding group of Republican challengers hoping to clinch the party’s nomination. However, every major poll shows the former president with a commanding lead over the pack, and Biden told donors on Wednesday that he thinks Trump “is destined to be the nominee again.” According to the Post/ABC survey, Trump has an almost 40-point lead over his nearest Republican rival, Florida Governor Ron DeSantis, at 54% to 15 %. No other GOP challenger managed to break double digits in the survey.

Biden and Trump both face significant obstacles in their respective bids for the White House. Trump will enter election season next year fighting more than 90 felony charges in four separate cases, stemming from his alleged attempts to overturn the results of the 2020 election, mishandling of classified documents, and improper reporting of ‘hush-money’ payments to porn star Stormy Daniels. Trump maintains that the indictments against him are politically-motivated, and that Biden’s Justice Department is engaged in a “Stalinist” attempt to take him out of the 2024 race.

For Biden, a key concern will be convincing voters that he is fit for office. According to the latest poll, three quarters of respondents, regardless of political persuasion, said that Biden is too old to serve a second term. Biden has long been attacked by Republicans for his apparent cognitive decline, but concerns over the president’s mental fitness have surfaced in most recent polls. According to a a CBS News poll published last Sunday, 34% of US voters believe that the 80-year-old president would finish a second term in office, while the same number believe that Biden lacks the mental and cognitive health necessary for the job.

Just separate Ukraine from the main budget. Problem solved.

• Biden Scapegoats ‘Extreme’ Republicans For Looming Government Shutdown (Sp.)

US President Joe Biden said that all citizens of the country would “pay the price” if “extreme” members of the Republican Party do not vote on the new budget and allow the federal government to shut down. “Just a few months ago, after long negotiations between myself and the new [House of Representatives] speaker [Kevin McCarthy], we agreed the spending level of government will fund essential domestic and national security priorities while still cutting the deficit by $1 trillion over the next decade. Now, a small group of extreme Republicans don’t want to live up to the deal, so now everyone in America could be forced to pay the price,” Biden said addressing the Congressional Black Caucus Foundation.

He warned that the government shutdown will affect “everything from food security to cancer research.” “It’s time for the Republicans to start doing the job America elected them to do,” he added. The inclusion of funds intended for Ukraine in the US defense budget faced strong opposition from a number of members of the House of Representatives and became a stumbling block to its adoption. Republican Congresswoman Marjorie Taylor Greene said earlier this week that she would vote against Pentagon bill as long as it includes Ukraine aid funds. The US Congress needs to adopt a full or short-term budget before October 1, the end of the current fiscal year, in order to avoid a government shutdown.

Sort of Ritter’s diary. Good read.

• My Addiction: A Playlist in Three Acts (Scott Ritter)

On April 23, 1910, Theodore Roosevelt, less than a year removed from serving as the President of the United States, delivered a speech at the Sorbonne in Paris, France. Entitled “Citizenship in a Republic,” the speech has gone down in history as “The Man in the Arena speech,” largely on the weight of the words contained in the following passage: “It is not the critic who counts, not the one who points out how the strong man stumbled or how the doer of deeds might have done them better. The credit belongs to the man who is actually in the arena, whose face is marred with sweat and dust and blood; who strives valiantly; who errs and comes short again and again; who knows the great enthusiasms, the great devotions, and spends himself in a worthy cause; who, if he wins, knows the triumph of high achievement; and who, if he fails, at least fails while daring greatly, so that his place shall never be with those cold and timid souls who know neither victory nor defeat.”

I have often drawn upon this passage when reflecting upon my own life, especially when trying to come to grips with my failure to prevent the US invasion of Iraq in 2003. I still struggle with the fact that, despite being empowered with the experienced-based knowledge that there were no viable weapons of mass destruction in Iraq. (I had served as a weapons inspector with the United Nation in Iraq from 1991 until 1998, where I participated in more than 45 inspections—14 as Chief Inspector—involved in accounting for Iraq’s chemical, biological, nuclear, and long-range ballistic missile weapons—collectively referred to as “weapons of mass destruction”, or WMD.) Roosevelt’s words helped bring me some solace—at least I had stood in the arena in pursuit of a worthy cause.

In 2008, I was asked to participate in a panel of military veterans who would provide commentary and take questions from the audience in response to a theatrical adaptation of Tim O’Brien’s classic war novel, The Things They Carried. As I watched the play, I became increasingly agitated. This was a story about war, and the cost of war. Looking around me, I saw a theater full of people who knew nothing about war, and the cost it took on those who waged it. I resented the fact that I had agreed to allow myself to be put on display as some sort of zoo exhibit—“Here is a veteran; let’s ask him about the emotional trauma of war.” When the play ended, I took my place on stage, flanked by several other veterans of America’s many wars. I was well known at the time, and so I was picked to answer the first question, “Did the play trigger any memories for you of war?”

My response stunned even me. “As I look out among the audience, I see people who lack any military experience. People who know nothing of war. This play talks about the most intimate aspects of a soldier’s life—the things he carried at the time of his death. This is a conversation I can have with the men sitting here with me on stage. But it’s not a conversation I’m going to have with you. You haven’t earned that right.” I got up and left. I justified my actions by reflecting on Roosevelt’s speech. I had spent my time in the arena of conflict. They had not. They did not have a right to peer into my soul about issues of this emotional magnitude.

Octopus

When octopuses are stressed, they generally don't want to be seen much. pic.twitter.com/qqH9NrjcdT

— Nature is Amazing ☘️ (@AMAZlNGNATURE) September 24, 2023

Support the Automatic Earth in wartime with Paypal, Bitcoin and Patreon.