Rembrandt van Rijn Saskia en profil in expensive attire 1640-45

Rogan Maajid Nawaz

https://twitter.com/i/status/1495280535207555079

Ha ha ha ha!

“..such a meeting “can only be held at the condition that Russia does not invade Ukraine,” the Elysee palace added”

• Biden And Putin Accept Macron’s Proposal (RT)

Russian President Vladimir Putin and his American counterpart Joe Biden have both agreed in “principle” to hold a meeting to halt escalation of conflict in Ukraine, the Elysee Palace said in a statement on Sunday night. Emmanuel Macron “proposed a summit to be held between President Biden and President Putin and then with relevant stakeholders to discuss security and strategic stability in Europe,” according to the statement. “Presidents Biden and Putin have both accepted the principle of such a summit,” it added. However, such a meeting “can only be held at the condition that Russia does not invade Ukraine,” the Elysee palace added. The “substance” of the summit, should it take place, will be prepared by Russia’s Foreign Minister Sergey Lavrov and US Secretary of State Antony Blinken during their meeting expected on Thursday, February 24.

While the Kremlin has yet to issue a comment, White House Press Secretary Jen Psaki confirmed that President Biden “accepted in principle a meeting with President Putin following [Blinken-Lavrov] engagement, again, if an invasion hasn’t happened.” French President briefed his US counterpart on Sunday evening on his talks with Vladimir Putin of Russia and Volodymyr Zelensky of Ukraine, in a call that reportedly lasted only 15 minutes on Sunday evening. In a call with Putin earlier on Sunday, Macron offered to mediate talks in the so-called Normandy Format “in the next few hours” to secure a ceasefire along the line of contact in the disputed region of Donbass in eastern Ukraine. The Kremlin confirmed that “the two leaders agreed to maintain contact at various levels,” but did not provide any specific details on such plans.

“..they must take the manufactured crisis to the brink of thermonuclear war, so that Joe Biden can save the world and be seen as this legendary diplomat.”

• Biden-Putin Peace Summit Certain to Bring Nobel Peace Nomination (CTH)

To understand why there has been so much escalating rhetoric about Russia going to invade Ukraine at any moment, you must realize the intent. The motives of the crisis narrative are crystal clear. Everything about the Russia invasion of Ukraine has to be increasingly imminent, horrible and loomingly catastrophic for the planet, so that when it doesn’t happen the glorious victory for Dear Leader Biden can be proclaimed and amplified from the mountaintops. Russia has absolutely no plan to invade Ukraine and doesn’t even have a role in this theatrical production from the White House. The way the game is played; and believe me, everything about this is a game; they must take the manufactured crisis to the brink of thermonuclear war, so that Joe Biden can save the world and be seen as this legendary diplomat.

In the annals of U.S. historym there has never been such an important summit. The nomination for the Nobel Peace Prize, that Ron Klain wants in this mid-term election year, is dependent on magnanimous and strategic Biden overcoming all geopolitical odds to save the world. Everything is carefully planned and scripted with a ‘this’, then ‘that‘ approach toward sequencing. Earlier today, the Sunday news talk shows were filled with pending invasion rhetoric. Putin was mere moments away from a massive army entering Ukraine. The smells of heavy diesel loomed in the valleys as the thundering sound of tank tracks approached ever closer. Dark men with black weapons were beating drums and carrying the flag of Mother Russia, as millions were seen marching by U.S. spy satellites in the region.

The birds all fled as the sounds of the battle groups began converging on the Ukraine border. “The Russians are coming; The Russians are coming” one lad shouted to the CNN crew as he whizzed by on his bicycle, trying to peddle fast while carrying a bag of sausages for his sullen and sickly grandparents in eastern Ukraine. CBS David Martin and Margaret Brennan reported {link} the Russian generals were informing their troop commanders of the invasion plans. CNN then broke into the news cycle quoting three sources {link} “saying that the US has intelligence indicating that orders have been sent to Russian commanders to proceed with an attack on Ukraine.” Things looked really bad just before noon…

Everything within the game needs to be looming on the precipice of crisis in order for it to have maximum impact when it doesn’t happen. However, it was always never going to happen, because it is pretend. It is all a big performance, a ruse, built on a completely manufactured scenario they know will never happen… because the White House is making it up.

“Ukraine’s own assessment is clearly far afield of America’s.”

• Ukraine DM: Low Probability of Major Escalation With Russia (Antiwar)

Ukraine DM Oleksii Reznikov told parliament on Friday that there is a low probability of any major escalation with Russia. He added that Ukraine intelligence sees every move made in the area. Tensions at the Russia-Ukraine border have been ongoing, with several Western nations repeatedly predicting a huge war. Ukraine has chided those nations for causing a panic. Predictions of such a conflict go back years, and while previous Ukraine officials had similar pessimism about it, more recently officials see a lot more chance for diplomacy. President Biden again predicted a Russian invasion Friday, noting a Russian offer to talk later this month and suggesting there’d be no point if invasion happens first. Ukraine’s own assessment is clearly far afield of America’s.

Gazprom has honored all contracts.

• Europe Has Next To No Gas Left – Gazprom (RT)

Underground gas storage facilities (UGS) in Europe were 95.3% empty as of February 17, Russia’s state energy giant and major gas exporter Gazprom said on Saturday, citing data from Gas Infrastructure Europe. This means that Europe now has only 4.7% of its gas reserves left for the remainder of the winter season. The volume of active gas in storage facilities is 21% or 8.3 billion cubic meters less compared to the same time last year. In total, 44.8 billion cubic meters have already been withdrawn from Europe’s UGS this winter. According to Gazprom, gas reserves in underground storage facilities in Ukraine are also at a minimum, having dropped to 10.6 billion cubic meters, which is 45% less than last year. Also, earlier this week, authorities in Germany, which has one of the largest underground storage capacities in Europe, reported a plunge in storage volumes to historically low levels compared to previous years.

The European Union, however, this week claimed that its supplies were sufficient to last several more weeks in the event that Russia stops its gas flow to the bloc amid tensions over Ukraine. Russian gas supplies to European countries had already started to fall in mid-2021, and the decline accelerated at the beginning of 2022. Gazprom, however, repeatedly insisted that it is still supplying Europe with gas in strict accordance with existing contracts. Despite this, the president of the European Commission, Ursula von der Leyen, on Saturday called Gazprom’s supply policy intentionally harmful. “Gazprom is consciously trying to store and deliver as little as possible while prices and demand are skyrocketing,” she said in a speech at the Munich Security Conference, as quoted by Anadolu news agency.

“The financial system has come to an end.”

• New World Order Desperate as Plan Falls Apart – Martin Armstrong (USAW)

Legendary financial and geopolitical cycle analyst Martin Armstrong thinks the New World Order’s so-called “Great Reset” plan for humanity is falling apart, and the globalists are becoming increasingly “desperate.” Armstrong explains, “They are basically desperate at this stage. I don’t think they anticipate the amount of resistance that they are getting. It’s not just with the truckers in Canada, but this is starting everywhere. There has been an awful lot of resistance consistently that the press does not cover in virtually every city throughout Europe. . . . . They never step out and talk to the people because we are too stupid to actually have an opinion. They know better. This is what Klause Schwab does. He is far more sophisticated than people realize.

He has methodically gone out and created his young global leaders. He is basically sticking people in government positions that are loyal to him. Canadian Prime Minister Trudeau is one of them. . . . They think communism is a step up, and the last time this was attempted, it led to the death of 200 million people. This is absurd. . . . You are not allowed to think freely. That’s what communism really is. . . . You don’t realize this whole thing we are going through right now is the same thing. This is cancel culture. Someone said something I don’t like, and that was 20 years ago, so cancel them. This is exactly what took place in communism. You are destroying the right to speak freely.” The so-called “Great Reset” is all about control and tyranny. Armstrong says, “Just look at Canada. Trudeau is one of Klaus Schwab’s young global leaders. The worst countries have leaders that have graduated from his school. Make everybody comply, and if they don’t, crush them to the ground.”

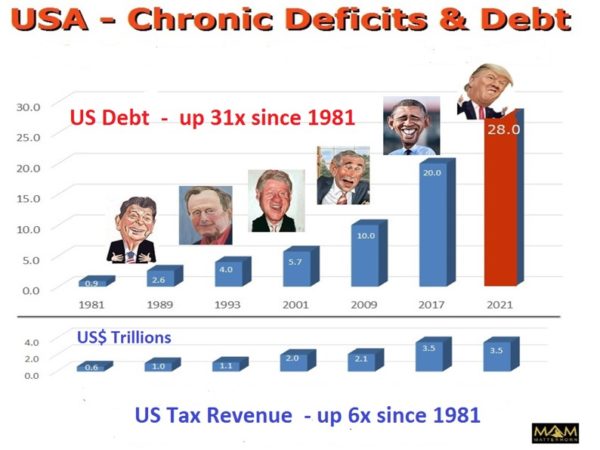

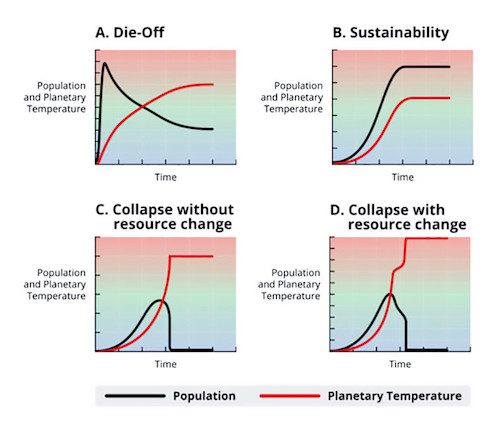

The only good news is, according to Armstrong and his “Socrates” computer analysis, this is “not going to work out well for the globalists pushing communism.” Armstrong says, “With Karl Marx, at the time, people owned nothing. Schwab is saying, ‘You will own nothing and you will be happy.’ This is absurd because what you are doing is creating a fake image. Schwab is saying I am going to relieve you of all your debt. . . . That is a front because the government has gone to the point of no return. What you have to understand here is it is really the government that has to default. What I have said is, look, governments are going to have to default because this is no longer sustainable.” Armstrong predicted last year, “The financial system has come to an end.”

A WEF overview. Can you still get elected anywhere without being a member?

• The Next Step for the World Economic Forum (Koops)

If I give you the names of the following people – Biden, Trudeau, Ardern, Merkel, Macron, Draghi, Morrison, Xi Jinping – what do you think that they have in common? Yes, they are all pampered and stumble over themselves, but that is also not the connection. One can see very quickly that these names certainly connect to lockdown countries and individuals who have ignored their own laws and/or tried in some way to usurp them. But, there is more to it than that and I will give a hint by providing a link with each name. Joseph Biden, President, United States Boris Johnson, PM of United Kingdom Jacinda Ardern, PM of New Zealand Angela Merkel, Former PM of Germany Emmanuel Macron, President of France Justin Trudeau, PM of Canada Xi Jinping, CCP Leader, China Mario Draghi, PM of Italy Scott Morrison, PM of Australia

They are all associated with the World Economic Forum (WEF), a “nonprofit” private organization started (in 1971) and headed by Klaus “You will own nothing and be happy” Schwab and his family. This is a private organization that has no official bearing with any world governance body, despite the implication of the name. It could just as well have been called the “Church of Schwabies.” The WEF was the origin of the “Great Reset” and I would guess that it was the origin of “Build Back Better” (since most of the above names have used that term recently). If you think that the WEF membership ends with just leaders of countries, here are a few more names: Gavin Newsom, Governor of California Jay Inslee, Governor of Washington State Anthony Fauci, Director NIAID Nancy Pelosi, Speaker of the House .

Allow me to introduce more of the WEF by giving a list of names for the Board of Trustees. Al Gore, Former VP of the US Mark Carney, UN Special Envoy for Climate Action T. Shanmugaratnam, Seminar Minister Singapore Christine Lagarde, President, European Central Bank Ngozi Okonja-Iweala, Director General, WTO Kristalian Georggieva, Managing Director, IMF Chrystia Freeland, Deputy Minister of Canada Laurence Fink, CEO, BlackRock

You can see a cross section of political and economic leaders on the board. The leader of the organization, that is the leader of the Board, is still Klaus Schwab. He has built an impressive array of followers. If you want to really see the extent of influence, go to the website and pick out the corporate name of your choice; there are many to choose from: Abbott Laboratories, Astra-Zeneca, Biogen, Johnson & Johnson, Moderna, Merck, Novartis, Pfizer, Serum Institute of India, BASF, Mayo Clinic, Kaiser Permanente, Bill and Melinda Gates Foundation, Wellcome Trust, Blackrock, CISCO, Dell, Google, Huawei, IBM, Intel, Microsoft, Zoom, Yahoo, Amazon, Airbus, Boeing, Honda, Rakuten, Walmart, UPS, Coca-Cola, UBER, Bank of China. Bank of America. Deutsche Bank, State Bank of India, Royal Bank of Canada, Lloyds Banking, JP Morgan-Chase, Equifax, Goldman-Sachs, Hong Kong Exchanges, Bloomberg, VISA, New York Times, Ontario (Canada) Teacher’s Pension Plan

“That’s what the State is folks, violence. Always has been. This is why Klaus Schwab and his minions like Trudeau, Arden and others will fail.”

• The Great Reset Becomes The Great Awakening (Luongo)

The reality is that Arden and Trudeau are both hanging on by a thread because public opinion already turned against them. The only thing propping Trudeau up at this point is the shock at the speed he has escalated events. That shock will wear off very soon. If parliament doesn’t act to limit/censure or simply get rid of this guy, Canadians will have a much bigger problem on their hands. Too many Canadians are still asking, “Is this Canada?” When they should be stating, “This is not Canada.” Stop asking for permission to feel outraged and feel the outrage.

In New Zealand, the veil of authority for Arden is thinner thanks to Trudeau’s mistakes in Ottawa. No doubt they are seeing the same things we are and want no part of it. The knives will come out for Arden quickly if she doesn’t back down. I say all the time, spooks start civil wars, militaries end them. In Canada, the civil war there is just beginning. What we’ve not seen in New Zealand means it’s likely over before anyone even realized they were in one. The Great Reset rests on tyrants like Justin Trudeau to win through fear, intimidation and the banal corruption of weak people to support them. With each image of peaceful people being trampled under the bootheel of Canadian stormtroopers, more people awaken from the slumber of the comfortable lie the government protects us from chaos.

That’s what the State is folks, violence. Always has been. This is why Klaus Schwab and his minions like Trudeau, Arden and others will fail. There is no law these people recognize. There is no restraint on their behavior they feel is justified for their holy cause. The sooner we accept that, like many of the truckers who organized this protest, the sooner we can all begin bridging the divide.

Schwab

https://twitter.com/i/status/1487922335864741890

“The problems we have go a lot deeper than the World Economic Forum and Bill Gates.”

• Why People Believe Wrong Things: A Response to Reader Critiques (Eugyp)

People on the establishment side of the debate mainly argue that Corona is an unprecedented and unusual virus, and that the scientific response has been totally reasonable and justified. People on our side of the discussion tend to see Corona as nothing special, but the scientific and political response as something new and unusual. I suggest that it helps to see the virus, despite its laboratory origins, as a biological threat of the kind we’ve lived with for millennia; and that it likewise helps to see our unbalanced reaction to this virus as an expression of our own declining society and institutions. That’s a big reason why fixing this has proven to be so hard.

The problems we have go a lot deeper than the World Economic Forum and Bill Gates. In many ways, those guys are just the surface manifestations of this much deeper rot. I know a lot of you conceive of what happened in 2020 as a kind of mass hysteria or hypnosis, or compare our current policies to National Socialism in the 1930s. I think there can be polemical value in both points, but I also think the most important thing, is to recognise that containment is a characteristic policy not of Nazi Germany, but of western liberal democracies. These regimes have enthusiastically embraced lockdowns, compulsory vaccination, and widespread restrictions. For two years, our governments pursued containment as their highest and most central political goal; it became a kind of ideological system unto itself, and persists as one. These are western, liberal, democratic policies by definition, and they show that something is terribly wrong with our political order.

I think it is important to come to terms with these simple facts, because these dangerous crazy lunatics are still running everything. The pandemicists have come out of the past two years more entrenched and powerful than ever before. Our public health bureaucracies have learned what they can do now, and with what little pretence. SARS-2 research will receive tidal waves of funding for decades to come; even people who study elephants or soil fungi will now find incentives to make their work at least a little bit about Corona. The SARS-related virus research will also continue, there will be more lab leaks, and the vaccinators will show up every fall with their mRNA snake oil. It would be better, if all of this nonsense were directed, or the result of some unusual passing madness. It’s not; it is the way things are. This is the nature of the political and social institutions that govern us.

What’s more striking, that the NYT goes after the CDC, or that they do it only now?

• The CDC Isn’t Publishing Large Portions of the Covid Data It Collects (NYT)

For more than a year, the Centers for Disease Control and Prevention has collected data on hospitalizations for Covid-19 in the United States and broken it down by age, race and vaccination status. But it has not made most of the information public. When the C.D.C. published the first significant data on the effectiveness of boosters in adults younger than 65 two weeks ago, it left out the numbers for a huge portion of that population: 18- to 49-year-olds, the group least likely to benefit from extra shots, because the first two doses already left them well-protected. The agency recently debuted a dashboard of wastewater data on its website that will be updated daily and might provide early signals of an oncoming surge of Covid cases. Some states and localities had been sharing wastewater information with the agency since the start of the pandemic, but it had never before released those findings.

Two full years into the pandemic, the agency leading the country’s response to the public health emergency has published only a tiny fraction of the data it has collected, several people familiar with the data said. Much of the withheld information could help state and local health officials better target their efforts to bring the virus under control. Detailed, timely data on hospitalizations by age and race would help health officials identify and help the populations at highest risk. Information on hospitalizations and death by age and vaccination status would have helped inform whether healthy adults needed booster shots. And wastewater surveillance across the nation would spot outbreaks and emerging variants early.

Without the booster data for 18- to 49-year-olds, the outside experts whom federal health agencies look to for advice had to rely on numbers from Israel to make their recommendations on the shots. Kristen Nordlund, a spokeswoman for the C.D.C., said the agency has been slow to release the different streams of data “because basically, at the end of the day, it’s not yet ready for prime time.” She said the agency’s “priority when gathering any data is to ensure that it’s accurate and actionable.” Another reason is fear that the information might be misinterpreted, Ms. Nordlund said.

[..] Last year, the agency repeatedly came under fire for not tracking so-called breakthrough infections in vaccinated Americans, and focusing only on individuals who became ill enough to be hospitalized or die. The agency presented that information as risk comparisons with unvaccinated adults, rather than provide timely snapshots of hospitalized patients stratified by age, sex, race and vaccination status. But the C.D.C. has been routinely collecting information since the Covid vaccines were first rolled out last year, according to a federal official familiar with the effort. The agency has been reluctant to make those figures public, the official said, because they might be misinterpreted as the vaccines being ineffective.

Ms. Nordlund confirmed that as one of the reasons. Another reason, she said, is that the data represents only 10 percent of the population of the United States. But the C.D.C. has relied on the same level of sampling to track influenza for years. Some outside public health experts were stunned to hear that information exists. “We have been begging for that sort of granularity of data for two years,” said Jessica Malaty Rivera, an epidemiologist and part of the team that ran Covid Tracking Project, an independent effort that compiled data on the pandemic till March 2021. A detailed analysis, she said, “builds public trust, and it paints a much clearer picture of what’s actually going on.”

CDC doesn’t publish, and scientists don’t research.

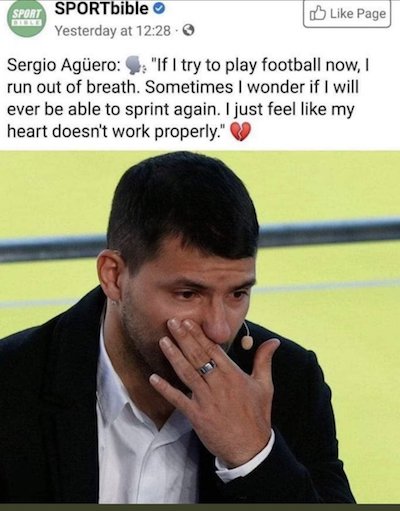

• Scientists Reluctant to Study Vaccine Side Effects, Notes Top Journal (DS)

While current evidence suggests that serious side effects are rare, the same is true of Covid itself when we’re talking about healthy, young people or those with a prior infection. Hence it’s by no means clear that vaccination actually makes sense for these people – especially if you factor in the possibility of unknown, long-term effects. So far, there’s evidence of an increased risk of blood clots following the Johnson & Johnson and AstraZeneca vaccines, and an increased risk of heart inflammation following the Moderna and Pfizer vaccines. While the absolute risks are still low, any side effects – however rare – have to be taken seriously. What’s more, there’s evidence that side effects are more common in young people and those who’ve already had Covid – two groups that face very little risk from the disease itself.

However, we still don’t know exactly what the risk of side effects is for specific subgroups, such as ‘people aged 18–30 with a prior infection’. In addition, some conditions that have been linked to the vaccines (including one that resembles long Covid) are not yet well-understood. Shouldn’t scientists be rushing to answer these and other unanswered questions about vaccine side effects? You’d certainly think so. But unfortunately, that isn’t the way science works in our current, politicised era. As this surprisingly candid report in the journal Science notes, scientists have other things to consider aside from how pressing certain questions might be:

“Probing possible side effects presents a dilemma to researchers: They risk fomenting rejection of vaccines that are generally safe, effective, and crucial to saving lives. “You have to be very careful” before tying COVID-19 vaccines to complications, Nath cautions. “You can make the wrong conclusion. … The implications are huge.” [Avindra Nath is clinical director at the National Institute of Neurological Disorders and Stroke]” Researchers are reluctant to work on vaccine side effects for fear of causing, or being accused of causing, ‘vaccine hesitancy’. The Science report goes on: “Other researchers note the scientific community is uneasy about studying such effects. “Everyone is tiptoeing around it,” Pretorius says. “I’ve talked to a lot of clinicians and researchers at various universities, and they don’t want to touch it.” [Resia Pretorius is a physiologist at Stellenbosch University in South Africa]”

Needless to say, this does not bode well for science. Nor does it bode well for vaccine uptake in the long term. After all, people will only take vaccines – whether for Covid or anything else – if they trust the medical establishment. And ignoring side effects, even rare ones, isn’t the way to build trust.

Wednesday.

• American Truckers Are Launching The People’s Convoy (Malone)

American truckers are launching The People’s Convoy, a peaceful and unified transcontinental movement, on Wednesday, February 23, 2022, from the Adelanto Stadium in Southern California. Starting at 10:00 a.m., hundreds of truckers will hear words of encouragement and blessings from a group of speakers including FLCCC President Dr. Pierre Kory and Godspeak Church Pastor Rob McCoy. The truckers and blue-collar workers of the United States will be joined by freedom-loving supporters from all walks of life – frontline doctors, lawyers, first- responders, former military servicemen and women, students, retirees, mothers, fathers and children – on this peaceful and law-abiding transcontinental journey toward the east coast. The truckers encourage one and all to come out to the stadium in the heart of Adelanto, California to wish them well, see them off and join in the journey.

This convoy is about freedom and unity: the truckers are riding unified across party and state lines and with people of all colors and creeds – Christians, Muslims, Sikhs, Mormons, Agnostics, Blacks, Hispanics, Asians, Native Americans, Republican, Democrats. All individuals are welcome to participate by either attending the launch gathering – at 10:00 a.m. on Wednesday February 23, at Adelanto Stadium – or by getting in their own vehicles and following the big rigs from Adelanto toward the east coast! The message of The People’s Convoy is simple. The last 23 months of the COVID-19 pandemic have been a rough road for all Americans to travel: spiritually, emotionally, physically, and – not least – financially.

With the advent of the vaccine and workable therapeutic agents, along with the hard work of so many sectors that contributed to declining COVID-19 cases and severity of illness, it is now time to re-open the country. The average American worker needs to be able to end-run the economic hardships of the last two years, and get back to the business of making bread – so they can pay their rents and mortgages and help jumpstart this economy. To that end, it’s time for elected officials to work with the blue collar and white-collar workers of America and restore accountability and liberty – by lifting all mandates and ending the state of emergency – as COVID is well-in-hand now, and Americans need to get back to work in a free and unrestricted manner.

“Watson said that officers had “done a remarkable job,” and were “very measured in their response.“

• Ottawa Mayor Wants To Sell Confiscated Freedom Convoy Trucks (RT)

Ottawa Mayor Jim Watson has praised the police crackdown on anti-mandate Freedom Convoy protesters in the Canadian capital. With the demonstrations cleared, he told state media that trucks, campers, and vehicles seized from the protesters should be sold off, claiming Prime Minister Justin Trudeau’s controversial emergency powers allow him to do so. Speaking to CBC on Saturday, Watson commended police officers for clearing protesters from downtown Ottawa, where they had been camped for three weeks protesting vaccine mandates. The demonstrations were broken by city and federal police officers between Friday and Saturday after Trudeau invoked the never-before-used Emergencies Act on Monday.

Despite video footage showing shocking scenes of police brutality, Watson said that officers had “done a remarkable job,” and were “very measured in their response.” At least 170 protesters have been arrested, more than 50 vehicles have been seized, and the government has frozen the bank accounts of at least 76 protest participants and supporters. “Under the Emergencies Act I’ve asked our solicitor and our city manager, ‘how can we keep the tow trucks and the campers and the vans and everything else that we’ve confiscated, and sell those pieces of equipment to help recoup some of the costs that our taxpayers are absorbing?’” Watson told CBC.

[..] It is unclear whether Watson’s plan will go ahead, and whether the Emergencies Act actually allows the city to auction off seized vehicles. Ottawa Police have previously stated that seized vehicles will be held for seven days, after which time they can be retrieved. Likewise the Emergencies Act is currently being enforced despite not being debated in Parliament, and could end up amended significantly. While some of Canada’s provincial premiers have relaxed their rules on masking and vaccination since the protest began, Trudeau’s nationwide vaccine mandate for cross-border truckers and a rule requiring Canadians be vaccinated to leave the country remain in effect.

Ha! Yeah, that’ll work…

• US Congresswoman Proposes Asylum For Canadian Protesters (RT)

A US congresswoman has promised to introduce legislation to grant asylum to Canadian truckers facing persecution from their government for being involved in the recent ‘Freedom Convoy’ protests against Covid-19 restrictions. Republican New Mexico Congresswoman Yvette Herrell announced her campaign to provide refuge to dissident Canadians on Saturday, comparing Canadian Prime Minister Justin Trudeau’s “heavy-handed crackdown against peaceful protesters” to that of “an authoritarian regime like Venezuela.”

Arguing that Canada’s treatment of protesters “is not the action of a Western Democracy,” Herrell said the US should provide asylum for protesters “who have been subjected to violence, had their property confiscated, and their bank accounts frozen by a government that is quickly becoming the embarrassment of the free world.” “I am introducing legislation that would temporarily grant asylum to innocent Canadian protesters who are being persecuted by their own government,” she said. “We cannot be silent as our neighbors to the north are treated so badly “

“When these protestors or those that supported them end up in financial hardship because they lose their job, business, or bank account, what will happen to those who try to help them?”

• A Social Credit System Arrives in Canada (Sacks)

On Monday, the rhetoric turned to action when Trudeau invoked the Emergencies Act. This heretofore-unused 1988 law gives the government virtually unlimited power for 30 days to deal with a crisis. Invoking the law under the present circumstance would require the threat or use of “serious violence,” yet the vast majority of protesters have been entirely peaceful—playing “We Are the World” and waving Maple Leaf flags. Indeed, the government has made little attempt to justify the need for emergency powers beyond Trudeau’s frequent bemoaning of the truckers’ alleged “hateful rhetoric.” His public safety minister Marco Mendocino stated that such extraordinary measures were necessary due to “intimidation, harassment, and expressions of hate.” Perhaps he doesn’t realize that none of these are listed in the law as valid reasons to invoke it.

Trudeau escalated things further on Tuesday night, when he issued a new directive called the Emergency Economic Measures Order. Invoking a War on Terror law called the Proceeds of Crime and Terrorist Financing Act, the order requires financial institutions—including banks, credit unions, co-ops, loan companies, trusts, and even cryptocurrency wallets—to stop “providing any financial or related services” to anyone associated with the protests (a “designated person”). This has resulted, according to the CBC, in “frozen accounts, stranded money and canceled credit cards.” Banks, according to this new order, have a “duty to determine” if one of their customers is a “designated person.” A “designated person” can refer to anyone who “directly or indirectly” participates in the protest, including donors who “provide property to facilitate” the protests through crowdfunding sites.

In other words, a designated person can just as easily be a grandmother who donated $25 to support the truckers as one of the organizers of the convoy. Because the donor data to the crowdfunding site GiveSendGo was hacked—and the leaked data shows that Canadians donated most of the $8 million raised—many thousands of law-abiding Canadians now face the prospect of financial retaliation and ruin merely for supporting an anti-government protest. Already, a low-level government official in Ontario was fired after her $100 donation came to light. A gelato shop was forced to close when it received threats after its owner was revealed to have donated to the protest. On Wednesday, Justice Minister David Lametti went on Canadian television to say the quiet part aloud, namely that anyone contributing to “a pro-Trump movement” should be “worried” about their bank accounts and other financial assets being frozen.

When these protestors or those that supported them end up in financial hardship because they lose their job, business, or bank account, what will happen to those who try to help them? Will Canadian financial institutions be forced to play Six Degrees of Deplorables? The fear of being ensnared in the dragnet will surely have a chilling effect on the commercial prospects of those suspected of “unacceptable views,” creating a caste of untouchables whom no one will dare to transact with or help. B.J. Dichter, one of the protest organizers who has had all of his bank accounts and credit cards frozen, expressed the sense of desperation: “It feels like being banished from the medieval village left to die.”

Make sure you have cash.

• Trudeau to Make Surveillance Powers over Financial Transactions Permanent (NR)

As all eyes were trained on the aggressive police sweep of the Ottawa trucker convoy this week, Canadian prime minister Justin Trudeau’s administration was quietly moving to implement a sweeping expansion of surveillance power at the federal level. The Trudeau government’s financial war against the truckers has been covered at length. But one underreported aspect of this broader assault on Canadian civil liberties is the effort to bring crowdfunding and payment service providers — two of the most prominent routes for financial transactions on the Internet — under the permanent control of a centralized government authority.

In a February 14 news conference, Canadian finance minister Chrystia Freeland said that the government was using the Emergencies Act to broaden “the scope of Canada’s anti-money-laundering and terrorist financing rules so that they cover crowdfunding platforms and the payment service providers they use.” That broadened power requires all forms of digital transactions, including cryptocurrencies, to be reported to the Financial Transactions and Reports Analysis Center of Canada. (I.e., “Fintrac”). “As of today, all crowdfunding platforms and the payment service providers they use must register with Fintrac, and they must report large and suspicious transactions to Fintrac,” Freeland said. She justified the move as a way to “mitigate the risk” of “illicit funds” and “increase the quality and quantity of intelligence received by Fintrac and make more information available to support investigations by law enforcement.” Trudeau, standing behind Freeland at the press conference, nodded his head in agreement.

Freeland said the trucker convoy, which had assembled to protest coronavirus restrictions, had “highlighted the fact” that digital assets and funding mechanisms “weren’t captured” by the Canadian government’s pre-existing surveillance powers. As a result, she said, “the government will also bring forward legislation to provide these authorities to FinTrac on a permanent basis.” Freeland reiterated that point in a subsequent press conference this past Friday. “We reviewed very, very carefully the tools at the disposal of the federal government, and we used all the tools that we had prior to the invocation of the Emergencies Act, and we determined that we needed some additional tools,” she said. “Now some of those tools, we will be putting forward measures to put those tools permanently in place. The authorities of FinTrac, I believe, do need to be expanded to cover crowdsourcing platforms and their payment providers.”

New York can’t pick a decent mayor, can it?

• Eric Adams Admits That Vax Mandates Don’t Work, But Won’t Change Them (NYP)

Mayor Eric Adams admitted Wednesday that vaccine mandates don’t work — yet he’s still going ahead with firing city workers who refuse to show proof they got their shots. “The rule was put in place; to start changing it now would send mixed messages,” he said while lamenting the fact that un-jabbed Brooklyn Nets point guard Kyrie Irving can’t play at his home arena even though unvaxxed out-of-towners can. Mixed messages? We’ve heard time and again that vax mandates are a life-and-death question of public health, fending off some new COVID surge. That’s plainly no longer true, if it ever was. So what’s the point now? New York City’s positivity rate is below 2%, down from an Omicron peak of near 23%. It’s clearly time to rethink draconian COVID approaches

The disconnect between policy and reality here is so glaring that the best Adams can offer in defense is a lukewarm worry that changing it might scramble political messaging. But at least he’s finally, albeit inadvertently, come clean about mandates: They’ve become pure hygiene theater. As we’ve said before: The vaccines are safe and effective and almost everybody should get them. But the data reveal that mandates have near-zero effect on COVID outcomes. Look at Florida, where Gov. Ron DeSantis actively restricted vaccine mandates. Per Mayo Clinic data, the Sunshine State saw about 347 average daily cases per 100,000 people at its Omicron peak. New York, with vastly stricter policies, saw 366. Florida’s fatality rate at the peak was 1.2% vs. New York’s 1.4%. And those outcomes were this similar even before Delta hit.

But even if you don’t want to “follow the science,” what about basic logic? You are allowed to play ball at Barclays Center or the Garden if you’re not vaccinated; you just can’t play for a New York team. Guess we missed that epidemiological principle: Away players are never disease vectors. A rule so self-contradictory has nothing to do with health. It’s pure power politics. Kyrie Irving is lucky. He earns many multiples of what average Americans will see in a lifetime even with his haircut for missed home games. But what of the hundreds of teachers, cops, firefighters and so on Adams just axed for refusing a vaccine? If the mandate’s main purpose is now literally rhetorical, it’s indefensible.

Police in Paris have joined the march against Covid mandates.

For the 32nd Saturday in a row, Paris protests to end COVID law today. pic.twitter.com/4aWM5ZFXJn

— Aaron Ginn (@aginnt) February 20, 2022

Support the Automatic Earth in virustime with Paypal, Bitcoin and Patreon.